Market Overview:

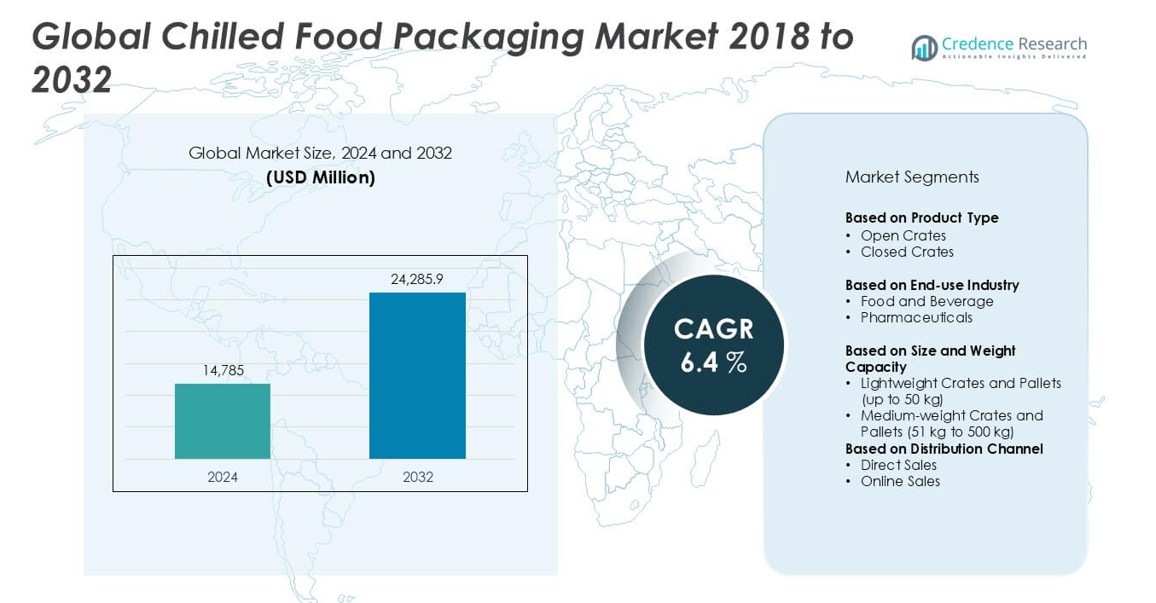

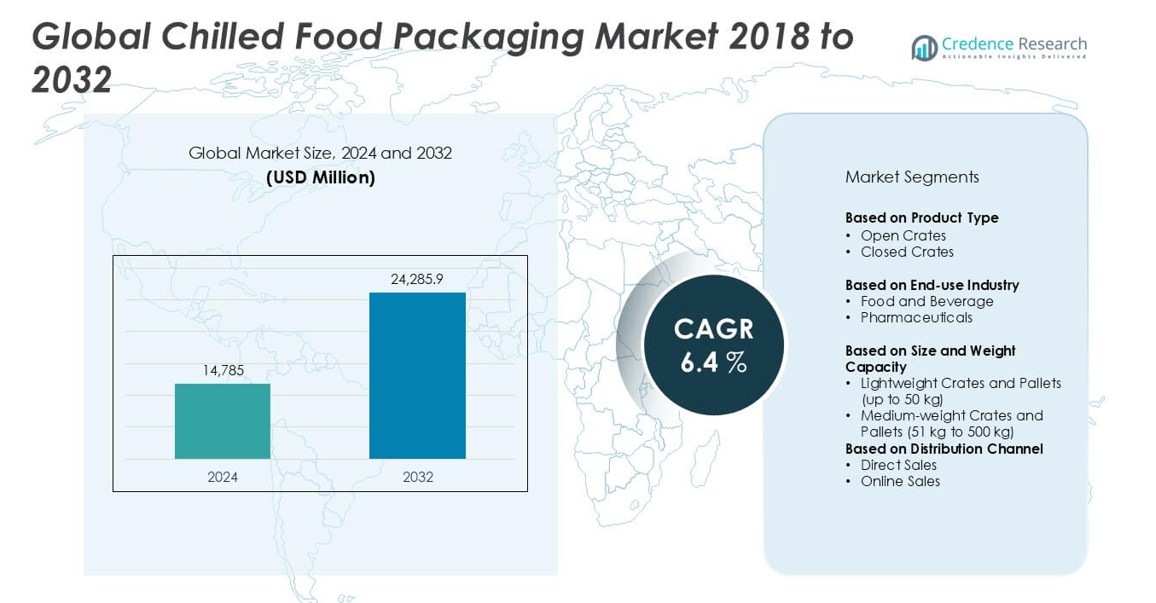

The Crates and Pallets Packaging market size was valued at USD 14,785 million in 2024 and is anticipated to reach USD 24,285.9 million by 2032, growing at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crates and Pallets Packaging Market Size 2024 |

USD 14,785 million |

| Crates and Pallets Packaging Market, CAGR |

6.4% |

| Crates and Pallets Packaging MarketSize 2032 |

USD 24,285.9 million |

The crates and pallets packaging market is led by top players such as Brambles Limited, Smurfit Kappa, DS Smith, Nilkamal, Georg Utz Holding, and PGS Group. These companies maintain a strong global presence through advanced manufacturing capabilities, wide distribution networks, and sustainable product innovations. Brambles Limited, with its CHEP brand, remains a dominant force in reusable pallet solutions. Smurfit Kappa and DS Smith lead in corrugated pallet offerings, particularly in Europe. Asia Pacific emerges as the leading region, accounting for 33% of the global market share in 2024, driven by rapid industrialization and strong growth in e-commerce and manufacturing sectors across China, India, and Southeast Asia.

Market Insights

- The Crates and Pallets Packaging market was valued at USD 14,785 million in 2024 and is expected to reach USD 24,285.9 million by 2032, growing at a CAGR of 6.4% during the forecast period.

- The market is primarily driven by growing demand from food and beverage and pharmaceutical industries, along with increased adoption of reusable and sustainable packaging solutions.

- Key trends include the integration of smart technologies such as RFID in pallets, and rising adoption of automation-compatible designs in warehousing and logistics operations.

- Major players like Brambles Limited, Smurfit Kappa, DS Smith, Nilkamal, and Georg Utz Holding focus on product innovation and sustainability to maintain competitive advantage in a fragmented market.

- Asia Pacific leads the global market with 33% share, followed by North America at 28% and Europe at 25%; among product types, closed crates dominate, while medium-weight crates and pallets (51–500 kg) hold the largest segment share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Crates and Pallets Packaging market is segmented into open crates and closed crates, with closed crates emerging as the dominant sub-segment, accounting for a significant market share in 2024. This dominance is driven by their enhanced protection capabilities, making them ideal for securing high-value or perishable goods during transit. Closed crates also offer better stacking strength and weather resistance, which is crucial in international shipping and warehousing. Additionally, industries such as pharmaceuticals and food and beverage increasingly prefer closed crates due to their hygienic enclosures and compliance with regulatory standards for safety and containment.

- For instance, Georg Utz Holding developed closed-loop hygienic containers used in pharmaceutical logistics, with over 1.5 million units deployed across Europe, ensuring compliance with GDP standards for medical shipments.

By End-use Industry

Among the end-use industries, the food and beverage segment holds the largest share of the Crates and Pallets Packaging market. This segment’s dominance stems from the high volume of packaged products requiring secure, sanitary, and reusable transportation solutions. The growing demand for efficient cold-chain logistics and increased exports of fresh produce, dairy, and beverages contribute significantly to the use of crates and pallets. Moreover, stringent food safety regulations have encouraged the adoption of durable and contamination-resistant packaging, making crates an essential element in maintaining product integrity across the supply chain.

- For instance, Brambles Limited, through its CHEP platform, facilitated over 345 million pallet and crate movements within the food and beverage sector globally in one year, improving safety and reducing product damage by 25%.

By Size and Weight Capacity

In terms of size and weight capacity, medium-weight crates and pallets (51 kg to 500 kg) represent the leading sub-segment with the highest market share. This is primarily due to their versatility and wide application across various industries, including logistics, manufacturing, and retail. These crates and pallets offer an optimal balance between load capacity and handling convenience, making them suitable for automated storage and transportation systems. The expansion of e-commerce and bulk distribution networks has further driven demand for medium-weight packaging solutions capable of efficiently handling larger product volumes without compromising durability or cost-effectiveness.

Market Overview

Expansion of Global Supply Chain Networks

he rapid globalization of supply chains has significantly increased the demand for reliable and durable packaging solutions such as crates and pallets. As companies expand their distribution operations across international markets, the need for standardized and reusable packaging formats grows. Crates and pallets ensure product safety during long-distance transit, reduce handling time, and support automation in warehouses. The increasing focus on efficient logistics, particularly in e-commerce, automotive, and industrial goods, continues to drive adoption and investment in robust crate and pallet packaging solutions.

- For instance, DS Smith operates over 250 sites globally and supplies more than 3 billion corrugated packaging units annually, supporting transcontinental logistics for clients across 34 countries.

Growth in the Food and Beverage Sector

The rising demand for packaged and processed food products, coupled with the expansion of cold chain logistics, is a major driver of the crates and pallets packaging market. These packaging solutions are essential for transporting perishable goods safely and efficiently, helping maintain product quality and compliance with food safety standards. The sector’s growth, particularly in emerging economies, is further propelled by increasing urbanization and changes in consumption patterns, which require scalable, sanitary, and durable packaging systems throughout the supply chain.

- For instance, Nilkamal Ltd. has supplied over 2.2 million food-grade plastic crates annually to leading Indian dairy and beverage companies, helping improve cold chain compliance and reducing product returns by 30%.

Increasing Preference for Reusable and Sustainable Packaging

Environmental concerns and regulatory pressures have led industries to shift toward sustainable and reusable packaging formats. Crates and pallets made from recyclable materials such as high-density polyethylene (HDPE) or engineered wood are gaining traction due to their long lifecycle and reduced environmental impact. Companies are adopting circular economy practices by implementing returnable packaging systems, which minimize single-use plastic waste and improve operational efficiency. This transition is fostering innovation in design and materials, further stimulating market growth and differentiation.

Key Trends & Opportunities

Adoption of Smart and IoT-Enabled Pallets

A notable trend in the market is the integration of smart technologies such as RFID tags and IoT sensors in pallets for real-time tracking and inventory management. These smart pallets provide enhanced visibility across supply chains, allowing companies to monitor temperature, humidity, and handling conditions during transit. The data-driven approach helps reduce losses, optimize logistics operations, and improve traceability. As companies prioritize supply chain intelligence and operational transparency, the demand for technology-integrated crates and pallets continues to rise.

- For instance, The Corrugated Pallets Company partnered with RFID Global Solution to integrate RFID-enabled tracking on 100,000 pallets annually, reducing asset loss rates by 40% and improving shipment accuracy by 18%.

Expansion of Automation in Warehousing and Logistics

With the rise of automated warehouses and robotic handling systems, there is increasing demand for standardized, automation-compatible crates and pallets. These packaging solutions are designed for easy stacking, swift mechanical handling, and space optimization. Automated guided vehicles (AGVs) and conveyor systems work seamlessly with crates and pallets, reducing labor costs and increasing efficiency. This trend presents a significant opportunity for manufacturers to innovate and develop packaging formats that align with the evolving logistics infrastructure globally.

- For instance, Smurfit Kappa has deployed over 1.1 million automation-compatible corrugated pallets in smart warehouses across Germany and the Netherlands, enabling a 35% improvement in loading/unloading cycle times.

Key Challenges

Volatility in Raw Material Costs

Fluctuations in the prices of raw materials such as plastic resins and wood significantly impact the production costs of crates and pallets. Geopolitical instability, supply chain disruptions, and rising energy costs can create uncertainty in raw material availability and pricing. These cost pressures challenge manufacturers to maintain profitability while meeting demand, especially in price-sensitive markets. Additionally, the need for cost-effective yet durable materials drives the search for alternatives, potentially affecting production timelines and product consistency.

Stringent Environmental Regulations

The crates and pallets packaging market faces increasing scrutiny under evolving environmental regulations, particularly those targeting plastic use and waste management. Manufacturers must comply with regional and international standards related to material recyclability, emissions, and waste disposal. Adapting to these regulations often requires investments in R&D and manufacturing upgrades. Smaller players may struggle to meet compliance requirements, limiting their market participation. Moreover, regulatory differences across countries add complexity to cross-border trade and production planning.

Limited Reusability in Certain Applications

While reusable crates and pallets offer environmental benefits, their adoption remains limited in sectors with strict hygiene standards or long return cycles, such as pharmaceuticals and certain food applications. In such cases, single-use packaging is preferred to ensure product safety and regulatory compliance. The logistics of returning and sanitizing reusable packaging also pose operational challenges, especially for companies operating in dispersed geographical locations. This limits the overall market penetration of reusable formats and may hinder sustainability goals.

Regional Analysis

North America

North America holds a significant share in the global crates and pallets packaging market, accounting for approximately 28% of the total market in 2024. The region’s dominance is driven by the presence of a well-established logistics and warehousing infrastructure, along with high demand from sectors like food and beverage, retail, and pharmaceuticals. The U.S. leads regional growth due to increased automation in supply chains and heightened emphasis on sustainability. Additionally, the widespread adoption of reusable plastic pallets and compliance with stringent regulatory frameworks further boost demand for durable and environmentally responsible packaging solutions across the region.

Europe

Europe captures around 25% of the global crates and pallets packaging market, supported by strong demand from the manufacturing, automotive, and FMCG sectors. Countries like Germany, France, and the UK are at the forefront due to their advanced industrial base and commitment to sustainable packaging practices. The EU’s regulations on plastic waste and circular economy initiatives have accelerated the shift toward recyclable and reusable crate and pallet solutions. Additionally, innovations in automation-compatible designs and the increasing use of RFID-enabled packaging are enhancing operational efficiency across European supply chains, reinforcing the region’s position in the global market.

Asia Pacific

Asia Pacific dominates the global crates and pallets packaging market with an estimated 33% market share in 2024. The region’s growth is primarily fueled by rapid industrialization, growing e-commerce activity, and expanding food and beverage sectors in countries such as China, India, and Southeast Asian nations. Rising demand for efficient logistics and cold-chain solutions further accelerates the use of durable crates and pallets. Additionally, increasing investments in infrastructure and manufacturing, coupled with a shift toward standardized packaging systems, support continued market expansion. The region presents strong growth potential due to its large population base and evolving consumer preferences.

Latin America

Latin America holds a moderate share of around 7% in the global crates and pallets packaging market. Growth in this region is supported by the expanding agricultural exports and food processing industries, particularly in Brazil, Mexico, and Argentina. These industries demand robust and cost-effective packaging solutions for transportation and storage. However, market development is somewhat constrained by limited access to automation and slower adoption of sustainable packaging alternatives. Despite these challenges, increasing trade activity and improvements in regional supply chain infrastructure are expected to create new opportunities for crates and pallets packaging providers.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region accounts for roughly 7% of the global crates and pallets packaging market. The market is growing steadily due to rising infrastructure development, industrial activity, and the growing demand for food and pharmaceutical products. Gulf countries such as the UAE and Saudi Arabia are investing in logistics and warehouse modernization, creating demand for efficient and reusable packaging formats. In Africa, agriculture and cross-border trade are key sectors supporting market growth. However, cost sensitivity and regulatory inconsistencies across countries may limit broader adoption, though emerging economies offer untapped potential for long-term expansion.

Market Segmentations:

By Product Type

- Open Crates

- Closed Crates

By End-use Industry

- Food and Beverage

- Pharmaceuticals

By Size and Weight Capacity

- Lightweight Crates and Pallets (up to 50 kg)

- Medium-weight Crates and Pallets (51 kg to 500 kg)

By Distribution Channel

- Direct Sales

- Online Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the crates and pallets packaging market is characterized by the presence of both global and regional players striving to enhance their market position through innovation, strategic partnerships, and sustainable practices. Key companies such as Brambles Limited, DS Smith, Smurfit Kappa, Georg Utz Holding, and Nilkamal dominate the market with extensive product portfolios and established distribution networks. These players are investing in advanced materials, automation-compatible designs, and RFID-enabled solutions to meet the evolving demands of logistics and supply chain operations. Sustainability is a central focus, with companies increasingly adopting recyclable and reusable materials to comply with environmental regulations and meet customer expectations. Regional players like Suzhou First Plastic, Jiangsu Yujia, and Milwood are expanding their footprint through cost-effective offerings tailored to local markets. The market is witnessing consolidation through mergers and acquisitions, enabling firms to scale operations and diversify product lines. Innovation, cost-efficiency, and sustainability remain the key differentiators in this competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Suzhou Dasen Plastic

- Delbrouck

- The Corrugated Pallets Company

- Smurfit Kappa

- Brambles Limited

- PGS Group

- Jiangsu Yujia

- Milwood

- Georg Utz Holding

- DS Smith

- Suzhou First Plastic

- Kamps Pallets

- Nilkamal

Recent Developments

- In February 2025, The Corrugated Pallets Company expanded its product line, focusing on corrugated pallets. The 2025 industry analysis hows strong growth in this sector, particularly in North America and Europe, driven by demand for sustainable, lightweight, and recyclable pallets. The company’s recent efforts involve enhancing their corrugated pallet product line for better performance and recyclability.

- In January 2025, Smurfit Westrock, the merged entity of Smurfit Kappa and WestRock, launched a 100% paper-based pallet stretch wrap, offering a sustainable alternative to traditional plastic. This innovation is fully recyclable and designed to reduce Scope 3 emissions, supporting circular supply chains. Collaborations with companies like Encirc demonstrate the potential for significant carbon footprint reduction in logistics and packaging.

Market Concentration & Characteristics

The Crates and Pallets Packaging Market exhibits moderate market concentration, with several global players maintaining strong positions alongside numerous regional manufacturers. It features a balanced mix of standardized and customized solutions tailored to diverse industry requirements, including food and beverage, pharmaceuticals, agriculture, and logistics. The market is characterized by high demand for durable, reusable, and sustainable packaging, which has led to increased use of materials such as high-density polyethylene and corrugated fiberboard. Large companies such as Brambles Limited, DS Smith, and Smurfit Kappa focus on scalable operations, efficient logistics support, and innovation in design to meet evolving supply chain needs. Regional players contribute through cost-effective production and localized services, especially in emerging markets. The market reflects steady growth in response to expanding global trade, automation in warehouses, and stricter regulations on packaging waste. Technological integration in tracking and handling also shapes its competitive environment, creating opportunities for differentiation and long-term supplier relationships.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-use Industry, Size and Weight Capacity, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by increasing demand for efficient supply chain and logistics solutions.

- Reusable and sustainable crates and pallets will gain more traction due to rising environmental concerns and regulatory pressure.

- Automation-friendly packaging formats will become more prominent as warehouses adopt robotics and smart systems.

- The food and beverage industry will continue to lead in demand for hygienic and durable packaging options.

- E-commerce growth will fuel the need for standardized pallet solutions to support fast and safe product delivery.

- Integration of tracking technologies like RFID and IoT will become common for improved inventory management.

- Emerging markets in Asia and Latin America will offer strong expansion opportunities for manufacturers.

- Customization and modular design features will rise to meet diverse industry-specific packaging requirements.

- Companies will invest in lightweight and cost-effective materials to reduce handling and shipping costs.

- Strategic collaborations and acquisitions will shape market consolidation and global supply capabilities.