Market Overview:

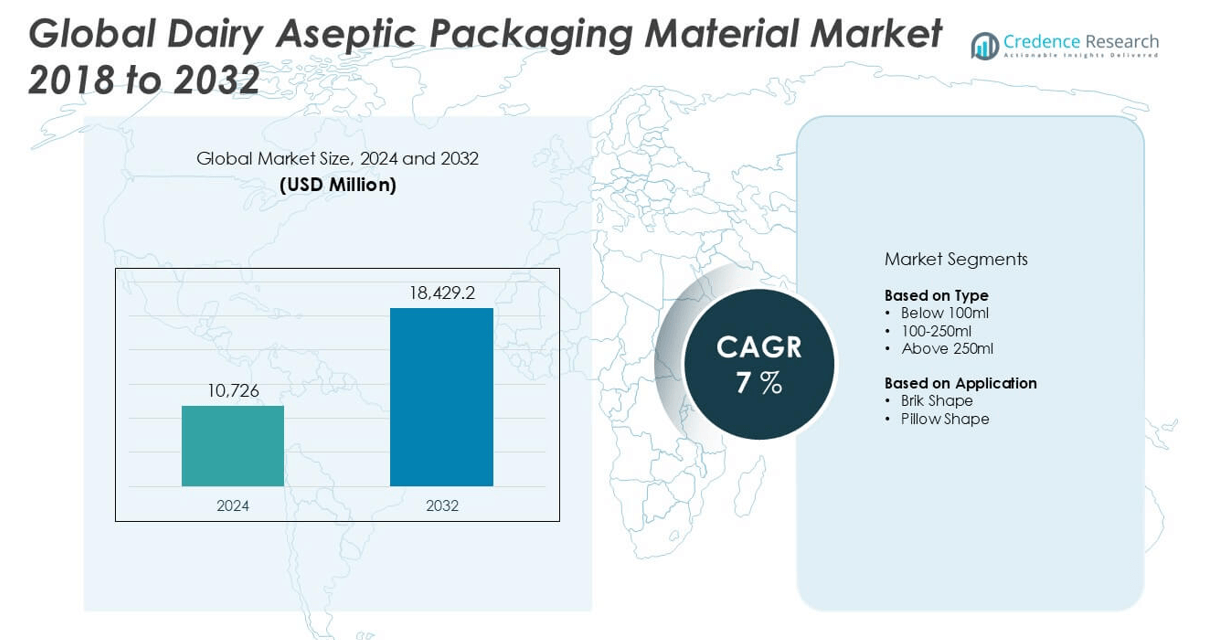

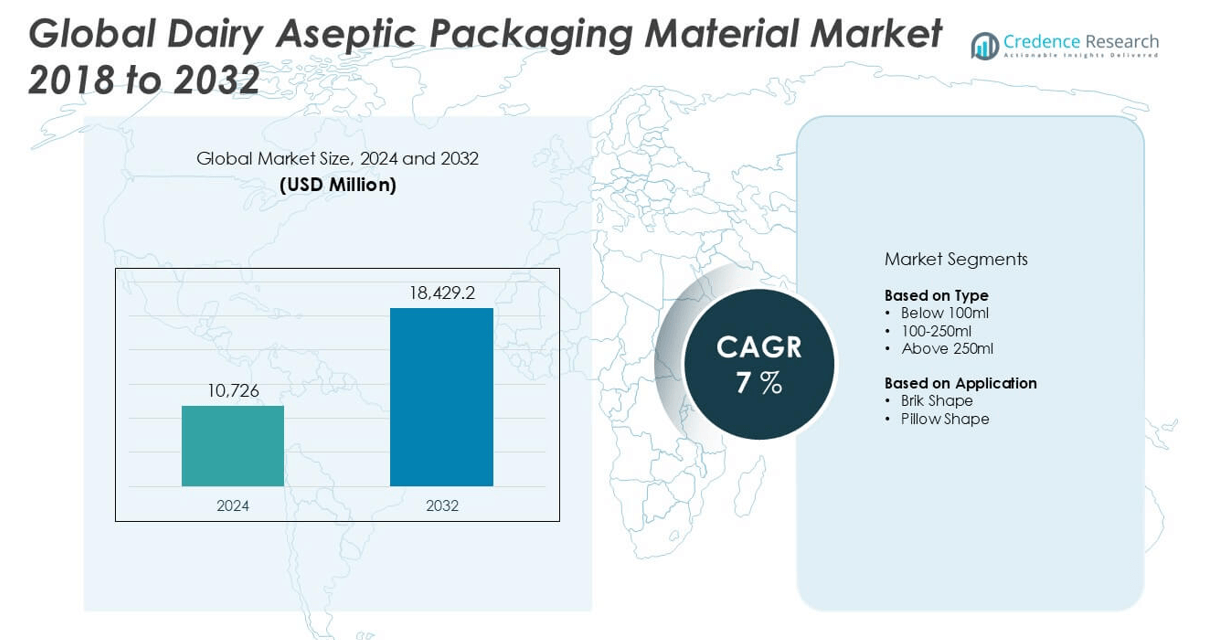

The Dairy Aseptic Packaging Material market size was valued at USD 10,726 million in 2024 and is anticipated to reach USD 18,429.2 million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dairy Aseptic Packaging Material Market Size 2024 |

USD 10,726 million |

| Dairy Aseptic Packaging Material Market, CAGR |

7% |

| Dairy Aseptic Packaging Material Market Size 2032 |

USD 18,429.2 million |

The Dairy Aseptic Packaging Material market is led by key players such as Tetra Pak, SIG, Elopak, Coesia IPI, Greatview, Skylong, Jielong Yongfa, Bihai, Xinjufeng Pack, and Likang. These companies dominate through advanced aseptic technologies, extensive global distribution networks, and strong partnerships with dairy producers. Tetra Pak and SIG hold significant market positions due to continuous innovations in sustainable and high-barrier packaging solutions. Regionally, Asia-Pacific stands as the leading market, accounting for 32% of the global share in 2024, driven by rising dairy consumption, limited cold chain infrastructure, and growing urban populations. Europe and North America follow with 28% and 24% market shares, respectively, supported by strong technological adoption and consumer demand for shelf-stable dairy formats.

Market Insights

- The Dairy Aseptic Packaging Material market was valued at USD 10,726 million in 2024 and is projected to reach USD 18,429.2 million by 2032, growing at a CAGR of 7% during the forecast period.

- Growth is driven by increasing demand for shelf-stable dairy products, expanding urban populations, and rising consumer preference for convenient, ready-to-drink dairy beverages.

- A key trend is the shift toward sustainable packaging materials, with major players investing in recyclable, bio-based, and lightweight aseptic solutions to meet environmental regulations and consumer expectations.

- The market is highly competitive, led by Tetra Pak, SIG, and Elopak, while regional players like Greatview and Skylong gain ground with cost-effective solutions in Asia-Pacific.

- Asia-Pacific holds the largest market share at 32%, followed by Europe at 28% and North America at 24%; the 100–250ml type segment leads the market due to its suitability for single-serve dairy products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The 100-250ml segment emerged as the dominant sub-segment in the Dairy Aseptic Packaging Material market, accounting for the largest market share in 2024. This segment’s prominence is driven by its optimal portion size, making it ideal for single-serve dairy products such as flavored milk and drinkable yogurt, which are gaining popularity among health-conscious consumers and children. Its lightweight, portable nature supports on-the-go consumption, particularly in urban markets with busy lifestyles. The rising demand for convenience-focused dairy packaging further strengthens the position of the 100-250ml format across both developed and developing regions.

- For instance, SIG’s combiblocMini 150ml and 250ml packs recorded over 6 billion units sold globally in single-serve beverage segments in 2023, highlighting strong adoption of mid-range aseptic formats.

By Application:

In terms of application, the Brik Shape segment held the highest market share in 2024, attributed to its widespread adoption for packaging milk, cream, and dairy-based beverages. Its uniform structure ensures efficient palletization, storage, and transport, making it cost-effective for manufacturers and retailers. The shape also enhances product visibility on shelves and allows for more detailed branding and labeling. Consumer preference for compact and easy-to-handle packaging, along with its compatibility with automated filling machines, continues to drive the demand for brik-shaped aseptic cartons in the global dairy packaging industry.

- For instance, Tetra Pak’s iconic Tetra Brik Aseptic line has achieved installation of over 8,600 filling machines globally, supporting large-scale production of brik-shaped dairy and beverage packages.

Market Overview

Rising Demand for Shelf-Stable Dairy Products

Consumers are increasingly opting for dairy products with longer shelf lives that require no refrigeration, particularly in regions with limited cold chain infrastructure. Aseptic packaging offers a solution by ensuring product safety and freshness without preservatives. This growing preference for ambient dairy products—like UHT milk, flavored milk, and lactose-free beverages—is driving the demand for aseptic packaging materials that support long-term storage while maintaining nutritional value and taste, particularly in Asia-Pacific, Latin America, and parts of Africa.

- For instance, Elopak’s Pure-Pak® Aseptic cartons are designed to preserve dairy products for up to 12 months without refrigeration, and were used in over 1.2 billion UHT milk packs globally in 2023.

Urbanization and On-the-Go Consumption

he global shift toward urban lifestyles has significantly influenced purchasing behavior, with consumers preferring convenient, ready-to-consume dairy formats. Aseptic packaging materials cater to this demand by enabling smaller, portable packs that suit modern, mobile lifestyles. The increasing penetration of single-serve dairy beverages in convenience stores, schools, and workplaces further accelerates the adoption of 100-250ml and below-100ml aseptic packaging formats. This trend is particularly strong among young adults and working professionals in metropolitan areas across North America and Europe.

- For instance, Greatview Aseptic sold over 23 billion packs in 2023, with more than 40% in the 100–250ml size category, largely distributed in urban consumption zones across China and Europe.

Technological Advancements in Packaging Materials

Innovations in multilayer barrier films, lightweight materials, and bio-based polymers are enhancing the performance and sustainability of aseptic packaging. These materials improve product safety, reduce environmental impact, and align with evolving regulatory and consumer demands for eco-friendly solutions. Additionally, the integration of digital printing and intelligent packaging technologies is enhancing product traceability and consumer engagement. These advancements not only boost product appeal but also provide a competitive edge for dairy producers investing in premium packaging solutions.

Key Trends & Opportunities

Growing Focus on Sustainable Packaging Solutions

With increasing awareness of environmental issues, dairy brands are investing in sustainable aseptic packaging materials such as recyclable cartons, plant-based laminates, and biodegradable layers. This shift is driven by both regulatory mandates and consumer demand for eco-conscious alternatives. Companies that adopt circular packaging systems and reduce plastic use in aseptic formats are likely to benefit from enhanced brand reputation and customer loyalty, presenting a key opportunity for differentiation in the competitive dairy packaging space.

- For instance, SIG has introduced SIGNATURE PACK, the world’s first aseptic carton linked to 100% renewable materials, and by 2023 had delivered over 1.5 billion packs made from responsibly sourced paper and polymers.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Africa, and Latin America are witnessing rapid growth in dairy consumption, driven by rising incomes, urbanization, and changing dietary preferences. These regions often face infrastructure challenges that limit refrigerated supply chains, making aseptic packaging an attractive option. Manufacturers are increasingly targeting these untapped markets with localized product offerings and smaller pack sizes. As a result, there is significant opportunity for aseptic packaging material suppliers to expand their footprint and establish long-term partnerships in high-growth regions.

- For instance, Tetra Pak commissioned three new packaging material plants between 2021 and 2023 in India, Vietnam, and Nigeria to meet surging regional demand for aseptic cartons in localized dairy distribution

Key Challenges

High Initial Investment in Aseptic Technology

Despite its advantages, aseptic packaging requires significant capital investment in specialized filling and sealing equipment. This poses a barrier, especially for small- and medium-sized dairy producers in developing regions. The cost of integrating aseptic systems into existing production lines can delay adoption and limit market penetration. Additionally, the complexity of the technology demands skilled labor and consistent maintenance, further increasing operational expenses for businesses with limited resources.

- For instance, the average cost of installing a Tetra Pak A3/Flex aseptic filling machine is around EUR 1.8 million, excluding operational and training expenditures required for long-term uptime.

Recycling Limitations of Multi-Layered Materials

Aseptic packaging materials typically consist of multiple layers including plastic, aluminum, and paperboard, which complicates recycling processes. While efforts are being made to improve recyclability, many regions still lack the infrastructure to efficiently separate and process these components. This challenge not only raises environmental concerns but also affects compliance with evolving packaging waste regulations. As governments implement stricter sustainability mandates, companies using non-recyclable aseptic materials may face increased pressure or penalties.

Volatility in Raw Material Prices

The aseptic packaging industry is vulnerable to fluctuations in the prices of key raw materials such as polymer resins, aluminum foils, and paperboard. Factors such as geopolitical tensions, supply chain disruptions, and shifts in oil prices can lead to unpredictable cost structures. These price volatilities can squeeze margins, especially for manufacturers operating in price-sensitive markets. Consequently, long-term supply contracts and alternative sourcing strategies are essential to mitigate financial risks.

Regional Analysis

North America:

North America accounted for approximately 24% of the global Dairy Aseptic Packaging Material market in 2024, driven by the strong presence of organized retail and rising demand for shelf-stable dairy beverages. The U.S. and Canada are key contributors, where consumers favor convenient, ready-to-drink dairy options such as flavored milk and protein-enriched beverages. Advanced packaging infrastructure and a growing preference for sustainable and recyclable materials also support market expansion. Additionally, increased investments in food safety and cold chain alternatives are propelling the adoption of aseptic packaging solutions among dairy manufacturers across the region.

Europe:

Europe held a 28% share of the global market in 2024, making it the leading region in the Dairy Aseptic Packaging Material market. The dominance stems from well-established dairy industries in countries like Germany, France, and the Netherlands. The region’s strong focus on food safety, environmental sustainability, and circular economy practices fuels the demand for recyclable and biodegradable aseptic packaging materials. Additionally, the high consumption of ambient dairy products and favorable regulatory frameworks encourage innovations in packaging formats and materials, solidifying Europe’s leadership in both technology adoption and market penetration.

Asia-Pacific:

Asia-Pacific represented around 32% of the global market share in 2024, making it the fastest-growing and most dynamic region in the Dairy Aseptic Packaging Material market. Rapid urbanization, rising disposable incomes, and shifting dietary habits in countries like China, India, and Indonesia are key growth drivers. The region experiences high demand for single-serve, portable dairy formats due to increasing young population and mobile lifestyles. Furthermore, limited refrigeration infrastructure in rural areas amplifies the need for aseptic solutions, particularly in UHT milk and yogurt products. Government support for packaging innovation also accelerates regional market expansion.

Latin America:

Latin America captured nearly 9% of the global Dairy Aseptic Packaging Material market in 2024. Brazil and Mexico lead the regional growth, supported by expanding dairy processing industries and consumer demand for affordable, long-life milk products. The market benefits from increasing investment in packaging infrastructure and the adoption of aseptic technologies to reduce spoilage and extend product shelf life in warm climates. Rising awareness about food hygiene and safety, along with growing urban consumption of value-added dairy beverages, contributes to the market’s gradual yet steady growth across the region.

Middle East & Africa (MEA):

The Middle East & Africa accounted for about 7% of the global market in 2024, driven by a growing dairy industry and the need for shelf-stable packaging due to high ambient temperatures and limited refrigeration. Countries like Saudi Arabia, South Africa, and the UAE are investing in modern dairy processing and aseptic filling technologies. Rising consumer demand for nutritious and convenient dairy options, especially in urban centers, is fueling demand for aseptic cartons and pouches. However, market growth remains modest due to infrastructure constraints and price sensitivity, although ongoing developments indicate future potential in this region.

Market Segmentations:

By Type

- Below 100ml

- 100-250ml

- Above 250ml

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dairy Aseptic Packaging Material market is characterized by the presence of several global and regional players focusing on innovation, sustainability, and cost efficiency. Key companies such as Tetra Pak, SIG, and Elopak dominate the market with their advanced aseptic technologies, extensive global reach, and strong partnerships with leading dairy brands. These players continue to invest in eco-friendly materials, recyclable solutions, and digital printing technologies to align with evolving consumer preferences and regulatory standards. Emerging companies like Greatview and Skylong are gaining traction, particularly in Asia, by offering cost-competitive solutions and flexible packaging formats. Strategic collaborations, product portfolio expansions, and regional manufacturing facilities remain common growth strategies. Market players are also emphasizing customer-centric approaches and after-sales support to strengthen long-term client relationships. As sustainability and operational efficiency become top priorities, the competition is expected to intensify, driving innovation and creating opportunities for differentiation across product design and material performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Skylong

- Elopak

- Jielong Yongfa

- Greatview

- Bihai

- Xinjufeng Pack

- Tetra Pak

- Coesia IPI

- SIG

- Likang

Recent Developments

- In September 2024, Tetra Pak collaborated with a leading company in the European juices, nectars, and soft drinks markets to launch the new Tetra Prisma Aseptic 300 Edge beverage carton. This innovative portion package stands out on the shelf, with its distinct look and ergonomic design catering to the preference of modern consumers for taller, slimmer packaging.

- In May 2024, ITO EN, beverage and dairy industry based in Japan, revealed the introduction of the SIG SmileSmall carton packs, manufactured by the SIG Drinksplus technology integrated in the SIG SmileSmall 24 Aseptic filling machine.

- In November 2023, Tetra Pak and Lactogal introduced an aseptic carton for milk containing a paper-based barrier. The new cartons are made of approximately 80% paperboard, reducing the carbon footprint by 33%.

- In October 2023, SIG, a packaging solution providing company, revealed that the company supplies Milky Mist Dairy Food Private Limited with advanced aseptic filling technology. Three high-speed SIG filling machines for aseptic carton packs will be installed, enabling the dairy product company situated in South India to boost production, broaden its product line, and give Indian consumers cutting-edge packaging options.

Market Concentration & Characteristics

The Dairy Aseptic Packaging Material market exhibits a moderately consolidated structure, with a few global players commanding significant market share through advanced technologies, established supply chains, and long-standing partnerships with leading dairy manufacturers. Companies such as Tetra Pak, SIG, and Elopak lead the industry by offering reliable, high-barrier packaging solutions that meet regulatory standards and sustainability goals. It maintains consistent growth due to rising demand for long-shelf-life dairy products and growing urbanization across emerging economies. Regional players, particularly in Asia-Pacific, contribute to competitive pricing and flexible supply, intensifying market dynamics. The market features high entry barriers due to capital-intensive aseptic technology and strict food safety regulations. Product innovation, cost optimization, and eco-friendly materials define key competitive characteristics. Demand for single-serve and on-the-go formats strengthens the position of specific packaging sizes such as 100–250ml. The market also responds quickly to evolving consumer preferences and regulatory requirements, making adaptability and innovation critical success factors.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, driven by increasing global demand for shelf-stable and ready-to-consume dairy products.

- Emerging economies in Asia-Pacific and Africa will present strong growth opportunities due to rising dairy consumption and limited cold chain infrastructure.

- Adoption of sustainable and recyclable aseptic packaging materials will become a key focus for manufacturers and brands.

- Technological advancements will improve the efficiency, barrier properties, and shelf life of aseptic packaging solutions.

- The 100–250ml segment will maintain dominance as single-serve dairy formats gain popularity among urban consumers.

- Brik-shaped packaging will remain preferred due to ease of stacking, transportation, and high visibility in retail spaces.

- Strategic partnerships between packaging suppliers and dairy producers will drive product innovation and regional market penetration.

- Digital printing and smart labeling on aseptic packages will enhance product traceability and consumer engagement.

- Regulatory pressure will encourage the use of biodegradable and low-carbon footprint materials.

- The competitive landscape will intensify as new players enter with cost-effective and localized packaging solutions.