Market Overview:

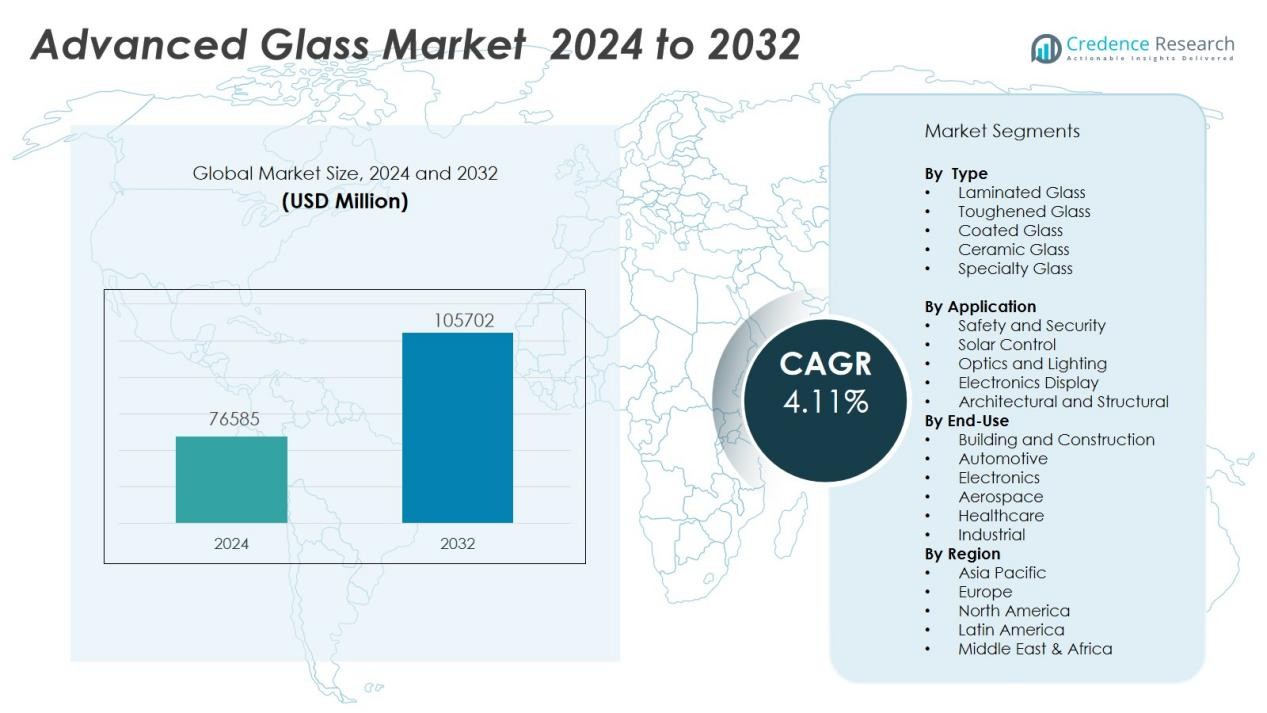

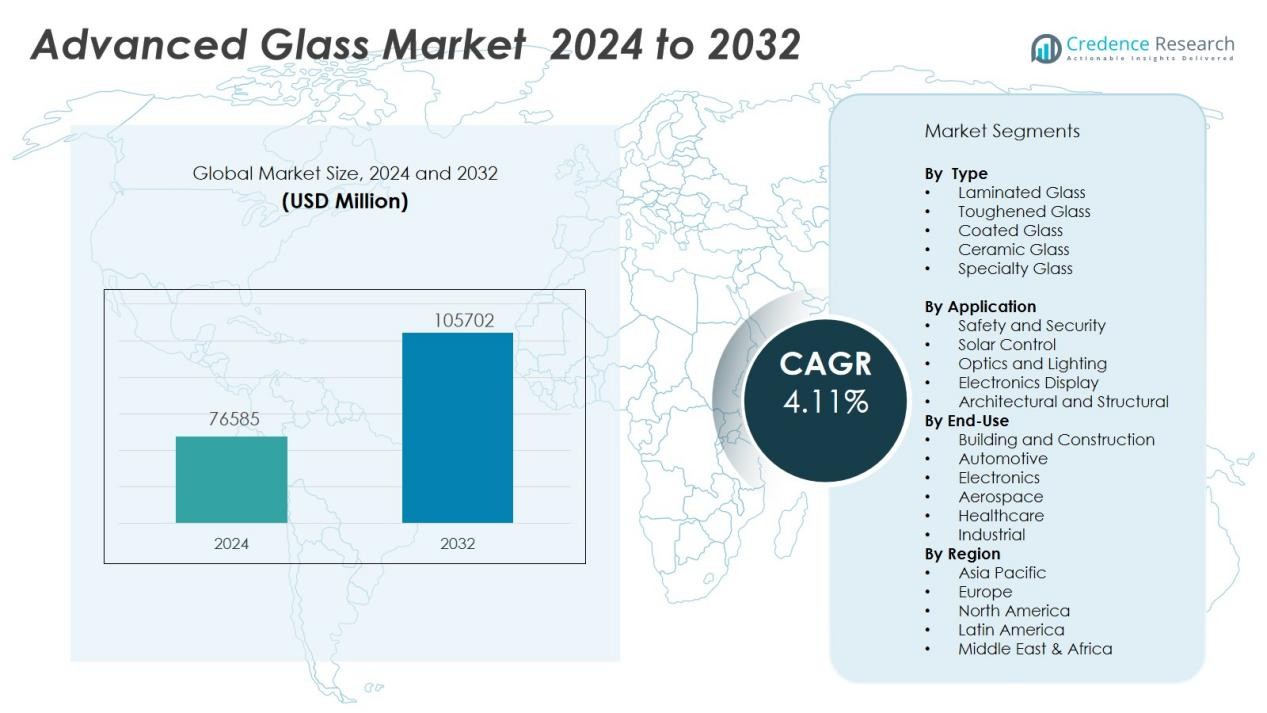

The advanced glass market size was valued at USD 76585 million in 2024 and is anticipated to reach USD 105702 million by 2032, at a CAGR of 4.11 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Glass Market Size 2024 |

USD 76585Million |

| Advanced Glass Market, CAGR |

4.11 % |

| Advanced Glass Market Size 2032 |

USD 105702 Million |

Key market drivers include the rising demand for energy-efficient building solutions, advancements in smart glass technologies, and growing use of advanced glass in high-performance automotive and consumer electronics. Increasing focus on sustainability and safety standards fuels the adoption of laminated and tempered glass, while ongoing research in lightweight and multifunctional glass products further strengthens market momentum.

Regionally, North America and Europe represent leading markets for advanced glass due to strong regulatory frameworks, established construction sectors, and significant investments in research and development. The Asia-Pacific region is witnessing the fastest growth, propelled by rapid urbanization, infrastructure development, and the expansion of electronics and automotive manufacturing in countries such as China, India, Japan, and South Korea. This regional diversification supports the advanced glass market’s sustained growth trajectory worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The advanced glass market was valued at USD 76,585 million in 2024 and is expected to reach USD 105,702 million by 2032, growing at a CAGR of 4.11%.

- Rising demand for energy-efficient building materials and regulatory focus on green construction drive market expansion, especially in the construction sector.

- Rapid advancements in smart glass technologies and IoT integration strengthen adoption in residential, commercial, and automotive applications.

- High-performance glass solutions gain momentum in electronics and automotive sectors, offering scratch resistance, impact durability, and superior optical clarity.

- The market faces challenges from high production costs, complex manufacturing, and supply chain disruptions, which limit broad adoption among smaller enterprises.

- Technical barriers, such as integration with digital systems and lack of standardization, restrict large-scale deployment across diverse industries.

- Asia-Pacific leads with a 36.1% share, while North America and Europe together account for 52%, with Middle East & Africa and Latin America emerging as new growth frontiers.

Market Drivers:

Surging Demand for Energy-Efficient and Sustainable Solutions in Construction:

The advanced glass market benefits from strong momentum in the construction sector, where demand for energy-efficient and sustainable building materials continues to intensify. Governments and regulatory agencies enforce stringent energy codes, compelling developers to adopt advanced glass for improved insulation and solar control. It enables architects to design structures that reduce energy consumption while meeting environmental certification standards. The market’s growth is reinforced by green building initiatives and a global shift toward net-zero emissions.

- For instance: AGC Stopray Ultra-60T triple-silver coated insulating glass unit delivers an industry-leading centre-pane U-value of 1.0 W/(m²·K), enabling architects to cut heating and cooling loads by over 20 percent while maintaining 60 percent visible light transmission.

Technological Advancements and Adoption of Smart Glass Applications:

Rapid innovation in glass technologies drives the advanced glass market, with smart glass solutions gaining significant traction in residential, commercial, and automotive applications. Smart glass enables dynamic control of light and heat, offering enhanced occupant comfort and operational efficiency. It supports the integration of IoT and automated building management systems, further amplifying its appeal in modern infrastructure. These technological advancements stimulate ongoing investments and diversify end-use opportunities.

- For instance, View, Inc. has deployed its View Dynamic Glass across over 90 million square feet of commercial and institutional buildings, with each pane featuring an electrochromic coating that can switch from 62 percent to 2 percent visible light transmission—completing the full tint cycle in under 45 seconds—to actively manage glare and solar heat gain.

Expansion of Electronics and Automotive Sectors Fuels Product Penetration:

The advanced glass market draws strength from robust growth in electronics and automotive manufacturing. High-performance glass provides essential properties such as scratch resistance, impact durability, and high optical clarity, supporting its adoption in touchscreens, displays, and vehicle glazing. It meets the rigorous quality and safety standards required by these sectors, positioning advanced glass as a preferred material in next-generation devices and automobiles. The increasing popularity of electric vehicles and smart devices further expands the addressable market.

Heightened Focus on Safety, Security, and Specialty Applications:

Demand for advanced glass with superior safety, security, and specialty attributes underpins market expansion across sectors such as defense, healthcare, and transportation. The advanced glass market addresses requirements for bulletproof, fire-resistant, and chemically durable glass solutions. It supports the development of critical infrastructure and sensitive environments where conventional materials fall short. This trend highlights the pivotal role of advanced glass in enabling safer, more resilient applications worldwide.

Market Trends:

Rising Integration of Smart and Functional Glass Technologies Across Industries:

The advanced glass market reflects a clear trend toward the adoption of smart and functional glass solutions in multiple industries. Smart glass technologies, such as electrochromic, photochromic, and thermochromic glass, enable dynamic control of light and heat within buildings and vehicles. Manufacturers focus on developing glass products with embedded sensors, coatings, and connectivity features to address the demand for adaptive and automated environments. It supports energy savings, privacy, and enhanced occupant experience in residential and commercial spaces. Growth in digital displays and interactive panels in public infrastructure further drives demand for advanced glass with high optical clarity and touchscreen capabilities. The expanding use of functional coatings, including self-cleaning and anti-reflective layers, underscores the market’s transition toward value-added, multipurpose glass products.

- For instance, View Inc.’s Smart Building Cloud platform—integrated with its electrochromic View Dynamic Glass—has been deployed across more than 100 million square feet of commercial building space, automatically blocking up to 90 percent of solar radiation while delivering high optical clarity and over-the-air updates for enhanced performance.

Emphasis on Lightweight, Durable, and Sustainable Materials in Product Innovation:

Manufacturers in the advanced glass market prioritize research into lightweight and high-strength glass compositions to meet evolving industry requirements. The drive toward lightweight automotive and aerospace components elevates demand for glass with improved durability, impact resistance, and reduced thickness. It enables the production of larger, more complex architectural glass panels while maintaining performance and safety standards. Strong industry focus on recyclability and reduced environmental impact encourages the development of glass products with lower embodied carbon and higher use of recycled content. Innovations in production processes, such as low-emission melting technologies and modular manufacturing, accelerate the market’s progress toward sustainable practices. This trend highlights the growing importance of balancing performance, durability, and eco-friendly attributes in advanced glass solutions.

- For instance, Corning® Gorilla® Glass Victus offers 2 m drop protection and 2× higher scratch resistance versus prior generations, ensuring superior impact resilience for next-generation mobile and cockpit displays.

Market Challenges Analysis:

High Production Costs and Supply Chain Vulnerabilities Restrain Market Expansion:

The advanced glass market faces significant challenges due to high production costs linked to specialized raw materials, precision manufacturing, and stringent quality controls. Manufacturers encounter fluctuating prices for inputs such as high-purity silica, rare earth elements, and advanced coatings, creating pressure on profit margins. Complex production processes and energy-intensive operations further elevate operational expenses. Supply chain disruptions and limited availability of certain raw materials disrupt timely production and delivery. It struggles to maintain consistent cost competitiveness, especially in price-sensitive regions. These factors limit broader adoption, particularly among small- and medium-scale enterprises.

Technical Barriers and Standardization Issues Hinder Widespread Adoption:

Widespread adoption of advanced glass technologies faces technical challenges related to product integration, compatibility, and durability. The advanced glass market contends with the need to meet diverse regulatory requirements and performance standards across different regions and industries. Technical barriers, such as thermal stress, long-term reliability, and integration with digital systems, impede seamless deployment. It requires continuous investment in research and skilled labor to address evolving application demands. Slow standardization and lack of universal guidelines hinder large-scale project adoption. These challenges restrict market growth and delay advanced glass’s entry into new application areas.

Market Opportunities:

Rising Adoption in Renewable Energy and Smart Infrastructure Projects:

Expanding investment in renewable energy and smart infrastructure creates substantial growth opportunities for the advanced glass market. Demand for high-performance glass in solar panels, building-integrated photovoltaics, and energy-efficient facades continues to rise as governments and industries pursue clean energy targets. It offers unique properties such as high transparency, low emissivity, and durability, supporting the design of advanced solar modules and intelligent building envelopes. Integration of smart glass into infrastructure projects enables energy savings, daylight management, and enhanced occupant comfort. The shift toward smart cities and sustainable urbanization further amplifies the need for innovative glass solutions.

Emergence of Next-Generation Applications and Customization Potential:

Innovations in advanced glass manufacturing enable tailored solutions for emerging sectors such as healthcare, defense, and consumer electronics. The advanced glass market benefits from opportunities to develop antimicrobial, bioactive, and specialty-coated glass for medical devices and sensitive environments. It can address growing demand for lightweight, ultra-thin, and flexible glass in foldable displays and wearable electronics. Expansion into niche markets, such as aerospace glazing and protective glass for critical infrastructure, broadens its commercial scope. Ongoing research into multifunctional and adaptive glass unlocks new applications and accelerates product differentiation across industries.

Market Segmentation Analysis:

By Type:

The advanced glass market comprises segments such as laminated glass, toughened glass, coated glass, and ceramic glass. Laminated glass leads due to its superior safety and security features, finding extensive use in automotive windshields and architectural facades. Toughened glass stands out for its strength and thermal resistance, supporting applications in electronics, transportation, and construction. Coated glass, including low-emissivity and solar control variants, grows in demand for energy-efficient buildings and smart glazing solutions. Ceramic glass caters to specialized requirements in high-temperature environments, such as cooktops and industrial applications.

By Application:

Key application segments include safety and security, solar control, optics and lighting, and electronics display. Safety and security applications drive strong adoption in commercial buildings, automotive glazing, and infrastructure, reflecting increasing emphasis on occupant protection. Solar control glass supports energy-saving initiatives in modern construction by minimizing heat gain and glare. Optics and lighting utilize advanced glass for precision lenses, fiber optics, and specialty illumination. Electronics display applications leverage high-performance glass for touchscreens, smartphones, and display panels, contributing to significant volume growth.

- For instance, SCHOTT’s Advanced Optics portfolio comprises over 120 distinct optical glass types, each manufactured with refractive-index homogeneity below one part per million, enabling ultra-precise lenses for scientific instruments and AR devices.

By End-Use:

Major end-use sectors include building and construction, automotive, electronics, and aerospace. The advanced glass market serves the construction industry with solutions for facades, windows, and skylights that combine aesthetics, safety, and efficiency. Automotive manufacturers rely on advanced glass for lightweight, durable, and intelligent vehicle glazing. Electronics companies utilize specialty glass in smartphones, tablets, and wearable devices. Aerospace applications demand glass that delivers high reliability, impact resistance, and advanced optical properties.

- For instance, AGC Automotive reported shipments exceeding 25 million units of chemically strengthened laminated and tempered windshields, enabling lightweight yet durable vehicle glazing with integrated functionalities such as heads-up display compatibility.

Segmentations:

By Type:

- Laminated Glass

- Toughened Glass

- Coated Glass

- Ceramic Glass

- Specialty Glass

By Application:

- Safety and Security

- Solar Control

- Optics and Lighting

- Electronics Display

- Architectural and Structural

By End-Use:

- Building and Construction

- Automotive

- Electronics

- Aerospace

- Healthcare

- Industrial

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe :

North America accounts for 27.4% of the advanced glass market, while Europe holds 24.6% of the global share, driven by robust manufacturing capabilities and advanced research ecosystems. Both regions benefit from stringent building codes, energy efficiency regulations, and aggressive targets for carbon reduction. High demand from the automotive, construction, and electronics sectors supports steady consumption of advanced glass products. Market players in these regions invest heavily in R&D to introduce new functionalities and improve product performance. Strong collaboration between industry and academic institutions accelerates innovation. Favorable policy frameworks and government incentives encourage sustainable construction and renewable energy projects, further supporting market expansion.

Asia-Pacific :

Asia-Pacific holds 36.1% of the advanced glass market, establishing itself as the fastest-growing region globally. The region’s strong market position is supported by large-scale infrastructure development, expanding automotive manufacturing, and significant growth in consumer electronics production. China, India, Japan, and South Korea remain central to regional demand, with ongoing investments in smart city initiatives and green building projects. Manufacturers benefit from lower production costs, growing skilled labor, and rising domestic consumption. The region’s dynamic economic landscape attracts global players seeking high-growth opportunities. Strategic focus on renewable energy deployment and urbanization ensures continued momentum in the coming years.

Middle East & Africa and Latin America :

The Middle East & Africa represents 6.1% of the advanced glass market, while Latin America accounts for 5.8%, reflecting emerging but expanding opportunities. Urban development projects, infrastructure modernization, and increased attention to energy-efficient solutions drive steady adoption. Governments in both regions support market growth through updated building codes, investment incentives, and renewable energy targets. Multinational companies enter these regions to tap into untapped demand and foster local partnerships. The advanced glass market capitalizes on new infrastructure projects, commercial buildings, and the introduction of high-performance glass in the automotive and electronics sectors. These trends position both regions as strategic growth frontiers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Saint-Gobain

- CoorsTek Inc.

- AGC Inc.

- SCHOTT AG

- Nippon Sheet Glass Co. Ltd

- Packerland Glass Products

- Atheer Inc.

- American Precision Glass Corp.

- Thermoseal

- Vuzix

- Murata Manufacturing Co. Ltd

Competitive Analysis:

The advanced glass market features intense competition among global leaders and specialized regional players. Key companies such as AGC Inc., SCHOTT AG, Saint-Gobain, CoorsTek Inc., Nippon Sheet Glass Co. Ltd, Packerland Glass Products, and Thermoseal hold significant market positions through innovation, product diversification, and broad distribution networks. Leading manufacturers invest heavily in research and development to deliver advanced functionalities, such as smart glass, energy-efficient coatings, and specialty compositions. It focuses on continuous improvement in product quality, performance, and compliance with global standards. Strategic collaborations, acquisitions, and expansion into emerging markets help leading firms strengthen their market footprint and respond to changing customer needs. Competitive pricing and tailored solutions for high-growth sectors such as construction, automotive, and electronics further define the market’s dynamic landscape.

Recent Developments:

- In July 2025, Qosina announced an expansion of its distribution partnership with Saint-Gobain Bioprocess Solutions to offer more advanced tubing and polymer solutions for bioprocessing applications.

- In July 2024, Saint-Gobain announced a strategic partnership with Akila to reduce carbon emissions at APAC sites by 33% by 2030, supporting its sustainability roadmap.

- In January 2025, CoorsTek announced its partnership with Aramco (CoorsTek Membrane Sciences) to commercialize advanced metal-ceramic membrane technology for carbon capture and hydrogen production projects.

Market Concentration & Characteristics:

The advanced glass market demonstrates a moderate to high level of market concentration, with leading global players holding significant shares due to established manufacturing capabilities, technological expertise, and broad distribution networks. It features a mix of multinational corporations and specialized regional manufacturers, creating a competitive landscape focused on continuous innovation and product differentiation. Major companies invest in research and development to introduce value-added solutions, expand smart glass portfolios, and meet evolving industry standards. The market is characterized by strong emphasis on quality, performance, and regulatory compliance, while ongoing consolidation and strategic partnerships shape the competitive dynamics.

Report Coverage:

The research report offers an in-depth analysis based on Segment 1, Segment 2, Segment 3, and Segment 3. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Leading firms will expand smart glass integration across buildings and vehicles, enhancing shading, transparency, and energy performance.

- Designers will increasingly adopt adaptive glazing in smart infrastructure to support responsive climate control and occupant comfort.

- Manufacturers will invest in antimicrobial and specialty coatings to support usage in healthcare, laboratories, and public environments.

- Suppliers will advance lightweight and ultra-thin glass variants for foldable electronics, wearables, and next-generation displays.

- Developers will integrate advanced glass in building-integrated photovoltaics and solar modules to support renewable energy applications.

- Producers will strengthen supply chain resilience and streamline production to control high costs and meet delivery timelines.

- Companies will establish regional partnerships and joint ventures to enter emerging markets in Latin America, Africa, and Southeast Asia.

- Innovators will combine advanced glass with IoT connectivity to enable automated maintenance, sensor integration, and smart surface functionality.

- Sustainability will play a central role, driving demand for low-emission manufacturing, recycled content, and circular life-cycle strategies.

- Standardization bodies and industry associations will develop guidelines and certifications to support large-scale adoption and performance assurance.