Market Overview

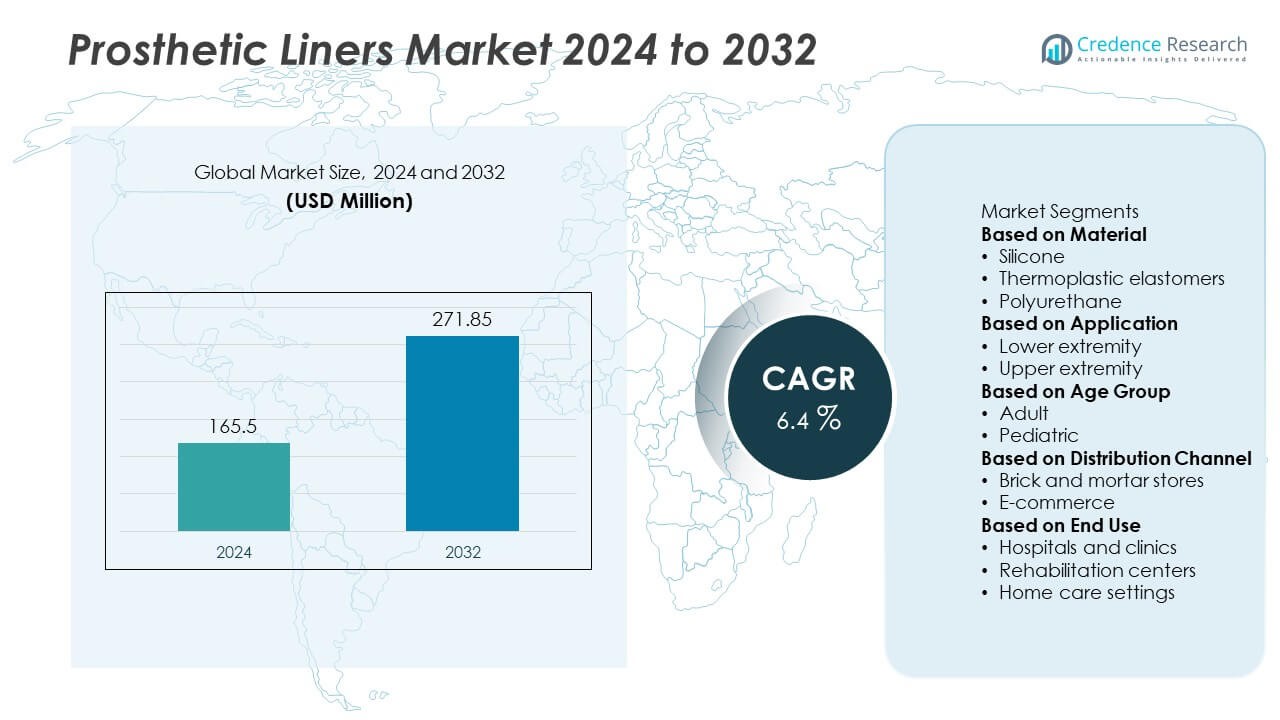

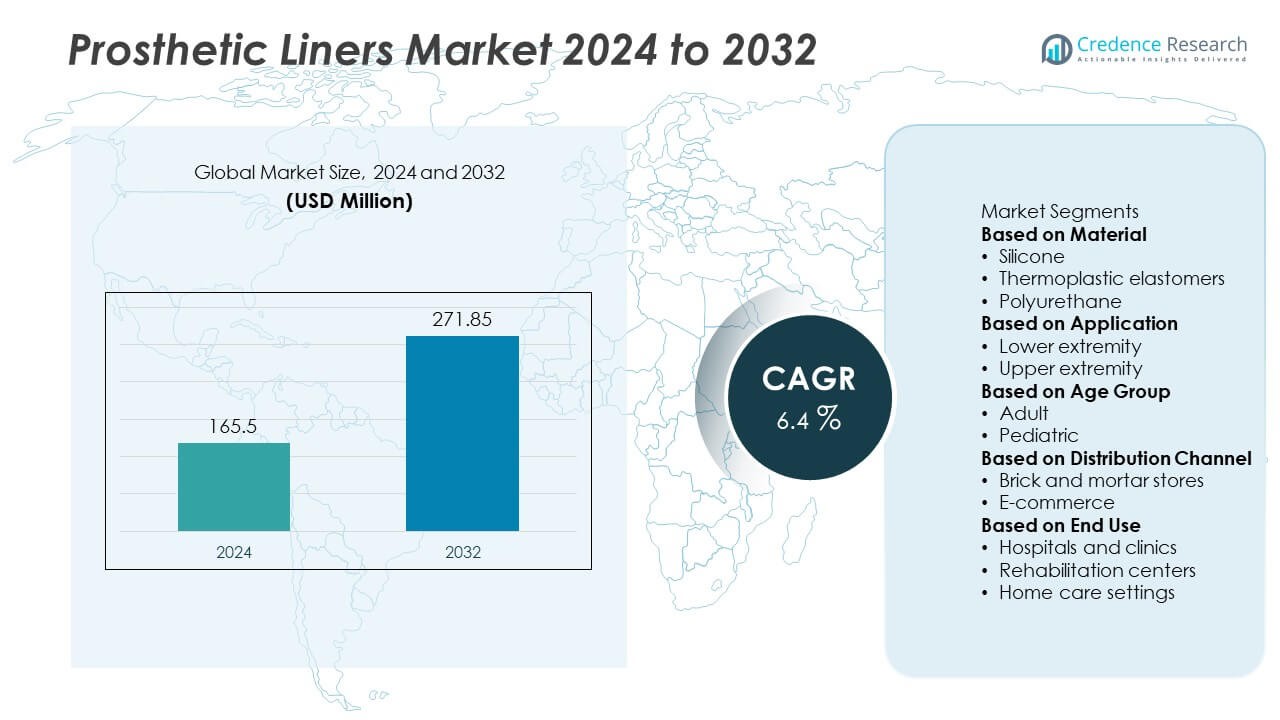

The Prosthetic Liners market was valued at USD 165.5 million in 2024 and is projected to reach USD 271.85 million by 2032, growing at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prosthetic Liners Market Size 2024 |

USD 165.5 Million |

| Prosthetic Liners Market, CAGR |

6.4% |

| Prosthetic Liners Market Size 2032 |

USD 271.85 Million |

The prosthetic liners market features prominent players including ÖSSUR, Ottobock, ALPS, Blatchford, Fillauer, Ortho Europe, ORLIMAN, KARE Prosthetics and Orthotics, SILIPOS, and College Park. These companies drive competition through product innovation, advanced material use, and strong partnerships with rehabilitation centers. North America leads the global market with a 38% share in 2024, supported by advanced healthcare infrastructure, reimbursement coverage, and early adoption of custom-fit silicone liners. Europe follows with 28% share, benefiting from strong healthcare systems and growing demand for eco-friendly solutions, while Asia-Pacific, holding 22% share, emerges as the fastest-growing region driven by rising diabetes prevalence, road accident cases, and expanding healthcare access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The prosthetic liners market was valued at USD 165.5 million in 2024 and is projected to reach USD 271.85 million by 2032, growing at a CAGR of 6.4% during the forecast period.

- Rising prevalence of diabetes-related and trauma-related amputations is driving demand, with the lower extremity application segment holding 70% share in 2024 due to its critical role in mobility and rehabilitation.

- Growing adoption of custom-fit and 3D-printed liners, along with innovations in hypoallergenic, breathable, and antimicrobial materials, is shaping market trends and improving patient comfort.

- The competitive landscape includes leading players such as ÖSSUR, Ottobock, ALPS, Blatchford, Fillauer, Ortho Europe, ORLIMAN, KARE Prosthetics and Orthotics, SILIPOS, and College Park, all focusing on innovation and global expansion.

- Regionally, North America led with 38% share, followed by Europe at 28%, while Asia-Pacific held 22% and emerged as the fastest-growing market, supported by healthcare access and rising amputation cases.

Market Segmentation Analysis:

By Material

The silicone segment dominated the prosthetic liners market in 2024 with over 45% share, owing to its comfort, durability, and biocompatibility. Silicone liners provide cushioning and reduce friction, making them the preferred choice for long-term prosthesis users. Their superior skin-friendly properties and compatibility with advanced suspension systems support wide adoption in both developed and emerging markets. Thermoplastic elastomers and polyurethane liners are growing steadily due to cost-effectiveness and adaptability, but silicone continues to lead as healthcare providers prioritize reliability, consistent performance, and patient satisfaction in prosthetic applications.

- For instance, Ottobock offers a variety of advanced silicone liners, such as the Skeo series, known for their durability and comfort. The silicone material is highly resistant, stabilizes soft tissue, and provides good adhesion, making it a superior choice for prosthetic users.

By Application

Lower extremity applications accounted for more than 70% share of the prosthetic liners market in 2024, establishing the segment as the clear leader. Rising cases of lower-limb amputations caused by diabetes, vascular diseases, and traumatic injuries drive strong demand for these liners. The high usage in above-knee and below-knee prosthetics underscores their necessity in daily mobility and rehabilitation. Upper extremity applications, though essential for functionality and quality of life, remain smaller in market share due to lower prevalence of upper-limb amputations compared to lower-limb conditions.

- For instance, Ottobock’s prosthetic liners for lower limbs are designed to provide cushioning and manage pressure, helping to improve comfort and stability for the wearer. The company offers a range of liners in materials like silicone, polyurethane, and copolymer, which are chosen and clinically adapted by a prosthetist to fit an individual’s needs.

By Age Group

The adult segment held a commanding 85% share of the prosthetic liners market in 2024, reflecting the high incidence of limb loss in adult populations globally. Diabetes-related amputations and road traffic injuries are major contributors to this dominance. Adults also benefit from greater access to advanced prosthetic solutions through healthcare coverage and rehabilitation programs. In contrast, the pediatric segment, while comparatively smaller, is gradually expanding due to improvements in liner designs that accommodate growth and enhance comfort for younger patients, addressing rising awareness in pediatric prosthetic care.

Key Growth Drivers

Rising Prevalence of Diabetes and Vascular Diseases

The increasing prevalence of diabetes and peripheral vascular diseases is a primary driver for prosthetic liners demand. Diabetes alone accounts for millions of amputations annually, particularly in lower limbs. As the global diabetic population continues to grow, healthcare systems are prioritizing advanced prosthetic solutions to improve quality of life for affected patients. Prosthetic liners play a critical role in enhancing comfort, reducing skin breakdown, and improving mobility, thereby fueling sustained adoption in hospitals, rehabilitation centers, and orthopedic clinics worldwide.

- For instance, Ossur utilizes its Iceross® prosthetic liners, made from medical-grade silicone, which has been an area of focus for the company’s innovation since the 1970s to provide cushioning and stability.

Advancements in Material Innovation

Continuous improvements in liner materials significantly support market growth. Silicone remains dominant due to durability and biocompatibility, while thermoplastic elastomers and polyurethane offer affordability and flexibility. Companies are investing in hypoallergenic, breathable, and lightweight materials to address user-specific needs. These advancements not only enhance comfort but also extend prosthetic life cycles, reducing replacement frequency. The integration of antimicrobial coatings and moisture-wicking technologies further strengthens patient compliance. As innovation accelerates, manufacturers gain opportunities to meet diverse requirements across adult and pediatric users.

- For instance, ALPS South, LLC introduced a silicone liner with a modified surface that reduces the coefficient of static friction by 80% under clinical testing.

Increasing Rehabilitation and Prosthetic Care Programs

Government and non-profit initiatives to improve access to prosthetic care are expanding market reach. Programs offering subsidized prosthetics and rehabilitation support help reduce financial barriers for amputees in developing regions. Advanced healthcare infrastructure in North America and Europe already ensures higher adoption, but similar efforts in Asia-Pacific and Latin America are driving faster uptake. Training programs for clinicians and technicians also increase liner awareness and usage rates. Such initiatives foster broader adoption across age groups, making rehabilitation programs a key catalyst for global market expansion.

Key Trends & Opportunities

Adoption of Custom-Fit and 3D-Printed Liners

Customization is emerging as a major trend in the prosthetic liners market. Advanced 3D-printing technologies enable liners tailored to patient anatomy, enhancing comfort and reducing skin irritation. Custom-fit liners also improve suspension and mobility, supporting long-term prosthetic use. This trend aligns with the broader movement toward patient-specific healthcare solutions. Companies offering on-demand and digitally designed liners are well-positioned to capture new opportunities as clinicians increasingly seek highly personalized solutions for amputees across varied demographic profiles.

- For instance, LIMBER Prosthetics & Orthotics, Inc. developed a 3D-printed custom prosthesis that is manufactured in 12 hours using digital scans, with materials capable of withstanding load testing for over 100,000 cycles, making it a rapidly deployable option for personalized prosthetic care.

Sustainability and Eco-Friendly Materials

Growing focus on sustainable healthcare solutions is creating opportunities for eco-friendly liner materials. Manufacturers are exploring recyclable thermoplastics, biodegradable polymers, and lower-energy production processes to align with environmental goals. As healthcare providers adopt sustainability frameworks, eco-friendly prosthetic liners can differentiate manufacturers in competitive markets. This trend is especially relevant in Europe, where stricter environmental regulations and consumer awareness drive adoption. Companies embracing sustainable designs not only meet compliance standards but also attract patients seeking environmentally responsible prosthetic care options.

- For instance, Open Bionics utilizes 3D printing technology with durable materials like Nylon PA12 for their Hero Arms, a medically certified device known for its reliability. This aligns with broader efforts in sustainable manufacturing to reduce waste and utilize materials efficiently.

Key Challenges

High Costs and Limited Reimbursement Coverage

The relatively high cost of advanced prosthetic liners poses a significant barrier, particularly in low- and middle-income countries. Many healthcare systems provide limited or no reimbursement for prosthetic devices, leaving patients to cover expenses out-of-pocket. This restricts access for a large portion of the amputee population, despite rising demand. Without improved insurance coverage and funding programs, affordability challenges may slow adoption, especially for innovative liners with premium materials and technologies designed to enhance patient outcomes.

Skin Compatibility and Durability Issues

Despite advancements, prosthetic liners still face challenges related to skin health and durability. Users often experience sweating, skin irritation, and breakdown due to prolonged use, which can reduce comfort and compliance. Frequent replacements are needed for liners exposed to heavy wear, adding to patient costs. Manufacturers continue to innovate with breathable and antimicrobial materials, yet ensuring long-term durability without compromising comfort remains a challenge. Addressing these issues is critical to improving patient satisfaction and broadening global adoption.

Regional Analysis

North America

North America held the largest share of the prosthetic liners market in 2024 with 38%, supported by advanced healthcare infrastructure, strong reimbursement policies, and high prevalence of diabetes-related amputations. The region benefits from robust adoption of technologically advanced liners, including silicone and custom-fit models, due to patient demand for comfort and long-term usability. The presence of leading prosthetic manufacturers and rehabilitation centers further drives growth. Rising investments in clinical training and early adoption of 3D printing also enhance regional dominance, positioning North America as the primary market hub for innovative prosthetic liner solutions.

Europe

Europe accounted for 28% share of the prosthetic liners market in 2024, driven by strong healthcare systems and widespread access to rehabilitation services. Countries such as Germany, the U.K., and France lead adoption due to supportive insurance frameworks and established prosthetics research centers. The region is also at the forefront of sustainable medical device adoption, favoring eco-friendly and recyclable liner materials. High demand for lower extremity prosthetics, coupled with a growing elderly population, strengthens market expansion. Increasing focus on customized solutions and advanced materials continues to drive growth across major European economies.

Asia-Pacific

Asia-Pacific captured 22% share of the prosthetic liners market in 2024, emerging as the fastest-growing region. Rising cases of diabetes and road traffic accidents drive significant demand for lower extremity prosthetics. Governments in countries like India, China, and Japan are improving healthcare access through prosthetic care programs and subsidies, which support greater affordability. Expanding local manufacturing and adoption of advanced materials also contribute to regional growth. Increasing awareness of rehabilitation services and investments in orthopedic clinics strengthen market opportunities. Asia-Pacific’s rapid expansion makes it a key growth frontier for global prosthetic liner manufacturers.

Latin America

Latin America represented 7% share of the prosthetic liners market in 2024, supported by gradual improvements in healthcare infrastructure and rehabilitation services. Countries such as Brazil and Mexico are leading adoption, driven by rising diabetes prevalence and trauma-related amputations. However, limited reimbursement policies and affordability challenges remain significant barriers, slowing wider adoption. Local NGOs and international aid programs are contributing to awareness and accessibility, particularly for lower-limb amputees. Growing investments in healthcare modernization and training initiatives are expected to improve regional adoption of advanced prosthetic liners over the forecast period.

Middle East & Africa

The Middle East & Africa region held 5% share of the prosthetic liners market in 2024, reflecting limited but growing adoption. Demand is primarily concentrated in urban centers of countries such as Saudi Arabia, South Africa, and the UAE, where healthcare facilities and rehabilitation services are more developed. Rising trauma-related amputations due to conflicts and accidents drive demand, but access remains uneven in rural areas. Limited reimbursement coverage and affordability constraints are key challenges. Nonetheless, ongoing government initiatives and collaborations with international organizations are gradually improving accessibility to modern prosthetic liners.

Market Segmentations:

By Material

- Silicone

- Thermoplastic elastomers

- Polyurethane

By Application

- Lower extremity

- Upper extremity

By Age Group

By Distribution Channel

- Brick and mortar stores

- E-commerce

By End Use

- Hospitals and clinics

- Rehabilitation centers

- Home care settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the prosthetic liners market is shaped by leading players such as ÖSSUR, Ottobock, ALPS, Blatchford, Fillauer, Ortho Europe, ORLIMAN, KARE Prosthetics and Orthotics, SILIPOS, and College Park. These companies compete through continuous product innovation, advanced material integration, and expansion into emerging markets. Silicone-based liners dominate product portfolios, with growing focus on custom-fit and breathable designs to enhance patient comfort and reduce skin complications. Leading firms invest in research and development to deliver hypoallergenic, antimicrobial, and durable solutions. Strategic partnerships with rehabilitation centers and healthcare providers strengthen their distribution networks and market reach. Companies are also expanding manufacturing capabilities in high-growth regions such as Asia-Pacific and Latin America, aiming to meet increasing demand from diabetic and trauma-related amputees. Sustainability initiatives, digital integration, and patient-specific customization are becoming central strategies, as market players seek to differentiate offerings and maintain strong positioning in a competitive global environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ÖSSUR

- Ortho Europe

- KARE Prosthetics and Orthotics

- Ottobock

- ALPS

- Blatchford

- SILIPOS

- ORLIMAN

- Fillauer

- college park

Recent Developments

- In May 2025, Ortho Europe released “The Overlay” from Ethnocare as a new offering.

- In October 2024, Ortho Europe launched “New Product Alert!” (likely in prosthetics / liners) on its news page.

- In 2024, Ottobock introduced its iFab / TransferScan digital process to better fabricate sockets and liners via 3D printing.

- In 2023, ALPS introduced a custom liner design method using a thermoformable gel (Thermoliner).

Report Coverage

The research report offers an in-depth analysis based on Material, Application, Age Group, Distribution Channel, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for advanced prosthetic care.

- Silicone liners will continue to dominate due to durability and skin compatibility.

- Thermoplastic elastomers and polyurethane liners will gain traction for cost-effective solutions.

- Lower extremity applications will remain the largest segment driven by diabetes-related amputations.

- Adult users will sustain majority share as prevalence of amputations is higher in this group.

- Custom-fit and 3D-printed liners will see wider adoption for personalized comfort.

- Eco-friendly and recyclable materials will create opportunities for sustainable product development.

- North America will maintain leadership supported by strong reimbursement systems.

- Asia-Pacific will grow fastest with rising healthcare investments and awareness programs.

- Competition will intensify as global players expand presence in emerging markets.