Market Overview:

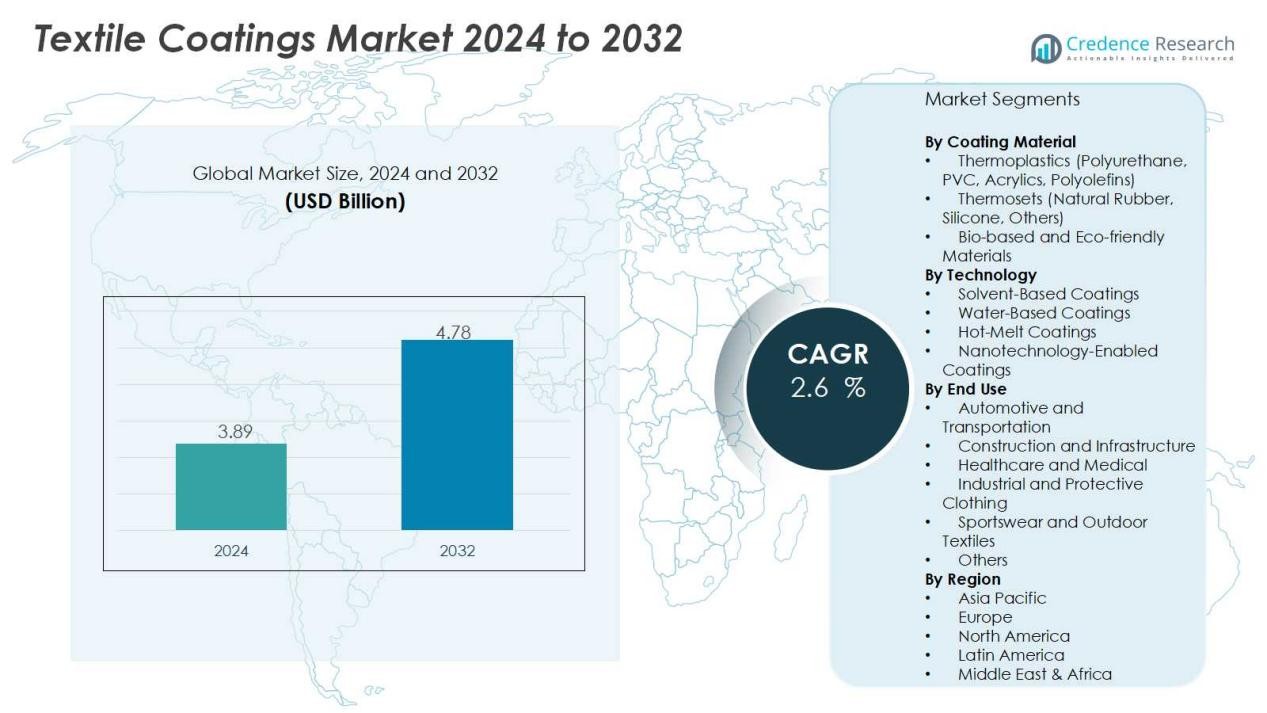

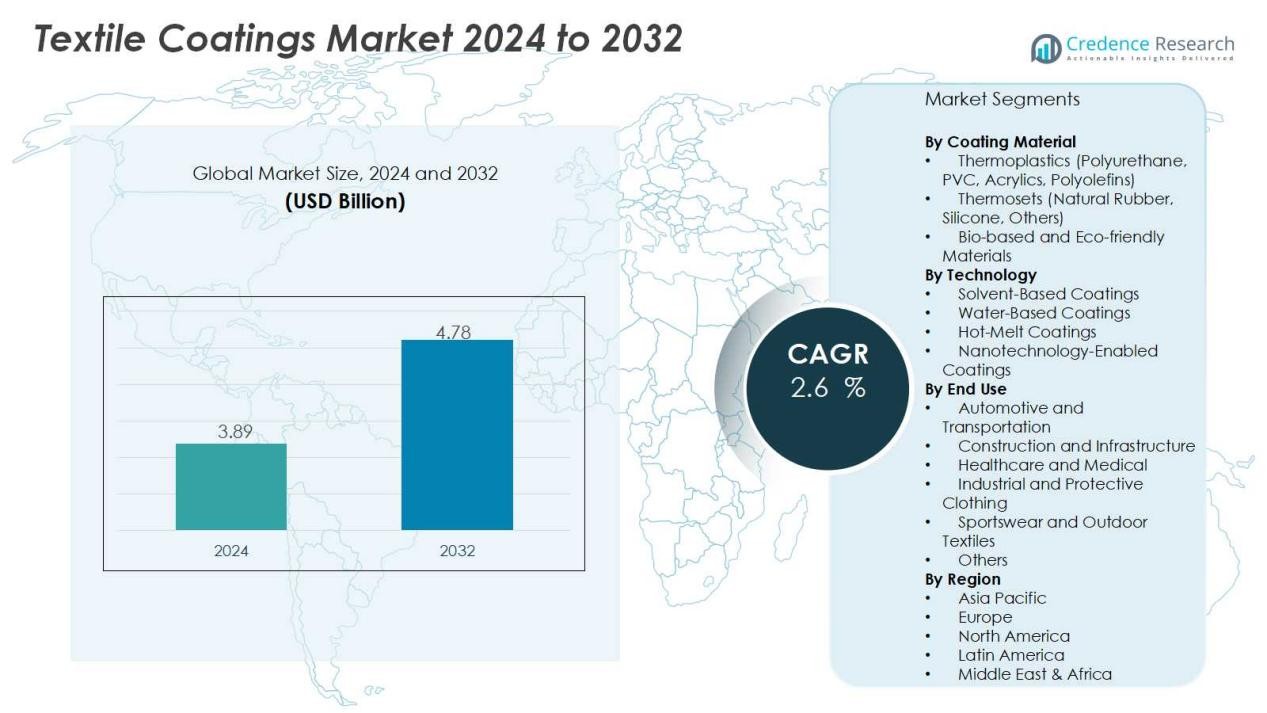

The textile coatings market size was valued at USD 3.89 billion in 2024 and is anticipated to reach USD 4.78 billion by 2032, at a CAGR of 2.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Textile Coatings Market Size 2024 |

USD 3.89 Billion |

| Textile Coatings Market, CAGR |

2.6 % |

| Textile Coatings Market Size 2032 |

USD 4.78 Billion |

Key market drivers include the growing need for water resistance, flame retardancy, and durability in textiles. Rising adoption of eco-friendly coatings and advanced polymer technologies further strengthens market expansion. The demand for protective clothing in industrial and healthcare sectors, combined with increasing use of coated fabrics in automotive interiors and construction materials, continues to create growth opportunities.

Regionally, Asia-Pacific dominates the textile coatings market due to its strong textile manufacturing base in China, India, and Southeast Asia. Europe follows, with high demand for advanced, sustainable coatings driven by stringent regulations. North America records stable growth supported by innovation in technical textiles and protective applications, while emerging regions in Latin America and the Middle East & Africa present untapped opportunities fueled by industrial expansion and growing infrastructure investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The textile coatings market was valued at USD 3.89 billion in 2024 and is projected to reach USD 4.78 billion by 2032 at a CAGR of 2.6%.

- Growing demand for water resistance, flame retardancy, and durability in textiles drives market expansion.

- Eco-friendly coatings and advanced polymer technologies strengthen growth opportunities across multiple industries.

- Protective clothing in healthcare and industrial sectors fuels demand for high-performance coated fabrics.

- Automotive interiors and construction applications such as seats, airbags, and roofing membranes support steady growth.

- Asia-Pacific held 46% share in 2024, led by China, India, and Southeast Asia’s strong manufacturing base.

- Europe recorded 27% share and North America 19% share, driven by innovation, regulations, and advanced technical textiles.

Market Drivers:

Rising Demand for Functional and Performance-Enhanced Textiles:

The textile coatings market benefits from the rising demand for fabrics with functional properties. Consumers and industries seek textiles that offer water resistance, flame retardancy, stain resistance, and durability. Coatings enhance the value of fabrics by improving performance across protective clothing, sportswear, and technical textiles. It is also essential in sectors where safety and reliability are non-negotiable, such as healthcare and defense.

- For instance, Stahl launched the non-fluorinated Integra® Dry 725 coating for technical textiles, which achieved water repellency ratings exceeding 80 on the AATCC TM22 spray test for camping gear in April 2024.

Expanding Applications in Automotive and Construction Sectors:

The market experiences strong growth from applications in automotive interiors and construction materials. Coated fabrics are widely used in seats, airbags, and headliners, supporting safety and comfort in vehicles. Construction applications include roofing membranes, awnings, and wall coverings, which require weather resistance and durability. It reinforces demand across both industries, driven by infrastructure development and rising vehicle production.

- For instance, Toray is a major producer of high-tenacity nylon fabrics used in airbags, which are tested against international standards like ISO 13937-4 to ensure they meet the rigorous requirements for tear resistance.

Advancements in Eco-Friendly and Sustainable Coating Technologies:

Sustainability acts as a major driver in the textile coatings market, with a shift toward water-based and bio-based coatings. Companies focus on reducing VOC emissions and adopting recyclable materials to meet regulatory standards. Eco-friendly solutions attract industries aiming to improve their environmental footprint while maintaining product quality. It ensures compliance with global sustainability goals and strengthens brand reputation.

Growth of Technical Textiles and Protective Applications:

The rapid expansion of technical textiles fuels steady demand for advanced coating solutions. Healthcare, industrial, and defense sectors require fabrics with high performance and protective features. The market benefits from rising adoption of coated fabrics in gloves, gowns, uniforms, and geotextiles. It highlights the importance of coatings in extending fabric life and enhancing safety across specialized applications.

Market Trends:

Increasing Adoption of Sustainable and Smart Coating Solutions:

The textile coatings market is shifting toward sustainable solutions driven by environmental regulations and consumer preferences. Water-based, bio-based, and solvent-free coatings are gaining prominence across industries. It helps manufacturers reduce VOC emissions while aligning with circular economy principles. Smart coatings that provide functionalities such as UV protection, antibacterial resistance, and self-cleaning surfaces are also seeing wider acceptance. This trend reflects the need for textiles that go beyond traditional uses and deliver advanced performance. Industries including healthcare, automotive, and sportswear lead adoption, ensuring steady growth in innovative coating solutions.

- For instance, researchers developed LED-embedded self-cleaning textile systems using nitrogen-doped titanium dioxide coatings that achieve 99% bacterial inactivation within 8 hours of exposure.

Rising Focus on High-Performance Applications Across End-Use Industries:

The market shows strong momentum from high-performance textile applications across diverse sectors. Demand for coated fabrics in automotive interiors, industrial safety gear, and technical textiles continues to rise. It enables manufacturers to deliver enhanced durability, weather resistance, and extended fabric life. Advanced nanotechnology-based coatings are being developed to improve breathability and strength. Growth in infrastructure, defense, and protective clothing applications further reinforces the need for specialized coatings. The textile coatings market is expected to see continuous product innovation, supporting long-term industry transformation.

- For instance, 3M Scotchlite™ Reflective Material – 8925 Silver Fabric retains full retroreflectivity after 75 domestic wash cycles at 60 °C.

Market Challenges Analysis:

Environmental Concerns and Stringent Regulatory Pressures:

The textile coatings market faces challenges due to rising environmental concerns and strict regulations. Many solvent-based coatings release VOCs that affect air quality and health. It forces manufacturers to adopt cleaner alternatives, which often involve higher costs and complex formulations. Compliance with regional and global sustainability standards adds pressure to invest in eco-friendly technologies. Transitioning to water-based or bio-based coatings requires significant R&D, which smaller players may struggle to fund. These challenges limit flexibility and increase operational costs for many producers.

High Raw Material Costs and Technical Limitations:

The market is also constrained by fluctuating raw material prices and technical performance issues. Petroleum-based raw materials used in coatings are vulnerable to supply chain disruptions and global price shifts. It creates uncertainty for manufacturers trying to manage costs while maintaining profit margins. Some eco-friendly coatings still fall short in durability or resistance compared to conventional options. Balancing sustainability with high performance continues to be a major obstacle. The textile coatings market must overcome these barriers to ensure long-term growth and competitiveness.

Market Opportunities:

Expansion of Technical Textiles and Specialized Applications:

The textile coatings market offers strong opportunities through the growing demand for technical textiles. Sectors such as healthcare, defense, and industrial safety require advanced fabrics with protective properties. It creates scope for coatings that deliver flame resistance, antibacterial protection, and enhanced durability. The rise of geotextiles in infrastructure and environmental projects further supports this demand. Sportswear and outdoor clothing brands also push for innovations that combine comfort with performance. This shift opens avenues for manufacturers to expand into niche, high-value applications.

Rising Demand for Sustainable and Smart Coating Technologies:

The transition toward sustainable materials and smart coatings presents another growth opportunity. Water-based and bio-based formulations align with global sustainability goals while appealing to eco-conscious consumers. It enables companies to differentiate themselves in competitive markets and meet regulatory standards. Smart coatings with features such as self-cleaning, UV protection, and energy efficiency are gaining interest. Demand from automotive interiors, protective clothing, and construction projects reinforces this trend. The textile coatings market can capitalize on these opportunities by advancing R&D and forming strategic collaborations.

Market Segmentation Analysis:

By Coating Material:

The textile coatings market is segmented by coating material into thermoplastics, thermosets, and others. Thermoplastics such as polyurethane and PVC dominate due to their durability, flexibility, and resistance to water and chemicals. It supports applications in automotive interiors, protective clothing, and construction textiles. Thermosets, including natural rubber and silicone, serve industries requiring heat and flame resistance. Growing demand for eco-friendly materials drives development of bio-based alternatives. Manufacturers focus on balancing performance and sustainability to remain competitive.

- For Instance, As a major supplier of airbag fabrics, Toray Industries regularly introduces advancements in materials, such as developing recycled nylon 66 derived from silicone-coated airbags to improve sustainability.

By Technology:

The market is divided by technology into traditional and advanced methods, including solvent-based, water-based, and hot-melt coatings. Water-based technology records strong growth, supported by stricter regulations and the need to reduce VOC emissions. It offers environmental compliance while maintaining functional performance. Solvent-based coatings still hold relevance in heavy-duty applications due to superior adhesion. Hot-melt coatings are gaining adoption in technical textiles requiring lightweight and durable finishes. Innovation in nanotechnology enhances efficiency and broadens application scope.

- For Instance, February 2024, BASF, in partnership with Inditex, announced the launch of loopamid®, a recycled polyamide 6 (nylon 6). This innovative material is derived entirely from textile waste.

By End-Use:

The textile coatings market is segmented by end-use into automotive, construction, healthcare, industrial, and others. Automotive and transportation lead due to coated fabrics used in seats, airbags, and headliners. It also grows in construction through demand for coated membranes, wall coverings, and roofing materials. Healthcare drives adoption with coated textiles in gowns, gloves, and protective fabrics. Industrial sectors rely on high-performance coatings for uniforms and safety equipment. Expanding applications across diverse industries continue to sustain long-term market potential.

Segmentations:

By Coating Material:

- Thermoplastics (Polyurethane, PVC, Acrylics, Polyolefins)

- Thermosets (Natural Rubber, Silicone, Others)

- Bio-based and Eco-friendly Materials

By Technology:

- Solvent-Based Coatings

- Water-Based Coatings

- Hot-Melt Coatings

- Nanotechnology-Enabled Coatings

By End-Use:

- Automotive and Transportation

- Construction and Infrastructure

- Healthcare and Medical

- Industrial and Protective Clothing

- Sportswear and Outdoor Textiles

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific held 46% share of the textile coatings market in 2024, leading globally. China, India, and Southeast Asia dominate due to large-scale textile production and export strength. It benefits from cost-effective labor, expanding infrastructure, and strong demand for technical textiles. Government initiatives promoting industrial development and sustainability further support market expansion. Growing demand for automotive, healthcare, and protective textiles accelerates adoption of advanced coatings. Regional suppliers invest in eco-friendly and high-performance solutions to meet global standards.

European:

Europe accounted for 27% share of the textile coatings market in 2024, supported by strong innovation. Countries such as Germany, Italy, and France focus on high-performance and sustainable coating solutions. It reflects the region’s strict environmental regulations and emphasis on quality standards. Demand from automotive, construction, and protective clothing sectors drives continuous R&D investments. The region benefits from advanced polymer technologies and adoption of bio-based coatings. Leading manufacturers enhance competitiveness through sustainability initiatives and premium product offerings.

North American:

North America held 19% share of the textile coatings market in 2024, driven by technical textiles. The United States leads with strong demand from defense, healthcare, and automotive industries. It records steady growth through innovation in nanotechnology and smart coatings. Construction and infrastructure projects create demand for coated fabrics with durability and weather resistance. The market benefits from established players focusing on product innovation and strategic partnerships. Regional emphasis on sustainability supports wider adoption of eco-friendly coatings across applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Arkema

- Clariant

- Covestro AG

- Huntsman International LLC

- Solvay

- OMNOVA North America Inc.

- The Lubrizol Corporation

- Sumitomo Chemical Co. Ltd.

- Tanatex Chemicals B.V.

- Formulated Polymer Products Ltd.

Competitive Analysis:

The textile coatings market is characterized by intense competition with global and regional players focusing on innovation and sustainability. Key participants include Arkema, Clariant, Covestro AG, Huntsman International LLC, Solvay, OMNOVA North America Inc., and The Lubrizol Corporation. It emphasizes advanced polymer technologies, eco-friendly formulations, and strong distribution networks to gain market presence. Companies invest in R&D to deliver coatings with enhanced performance, durability, and environmental compliance. Strategic collaborations with textile manufacturers strengthen product customization and expand industry reach. Sustainability initiatives and bio-based solutions remain central to competitive positioning. The market continues to evolve with firms leveraging technology leadership and customer-focused strategies to maintain long-term growth.

Recent Developments:

- In September 2025, Arkema announced a partnership with Catalyxx to develop a new value chain for low-carbon, bio-based acrylic resins utilizing proprietary technology targeted at coatings, adhesives, e-mobility, and sustainable infrastructure markets.

- In September 2025, Lucas Meyer Cosmetics by Clariant outlined ambitious new sustainability goals for its lecithin platform, aiming for 100% non-GMO soy sourcing and full traceability.

Report Coverage:

The research report offers an in-depth analysis based on Coating Material, Technology, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The textile coatings market will expand with increasing demand for functional fabrics in multiple sectors.

- Sustainability will remain central, driving adoption of water-based and bio-based coating technologies.

- It will see higher investment in smart coatings offering UV protection, antibacterial, and self-cleaning properties.

- Automotive interiors and construction materials will continue to create steady opportunities for coated textiles.

- Protective clothing and healthcare applications will fuel demand for coatings that enhance durability and safety.

- It will face rising pressure to balance performance with compliance to strict environmental standards.

- Nanotechnology and advanced polymers will shape innovations that deliver strength without compromising comfort.

- Regional growth in Asia-Pacific will accelerate due to strong textile manufacturing and export activities.

- Collaborations between coating producers and textile manufacturers will strengthen innovation pipelines and customization.

- The textile coatings market will evolve toward specialized, high-value applications, ensuring long-term competitiveness for leading players.