Market Overview

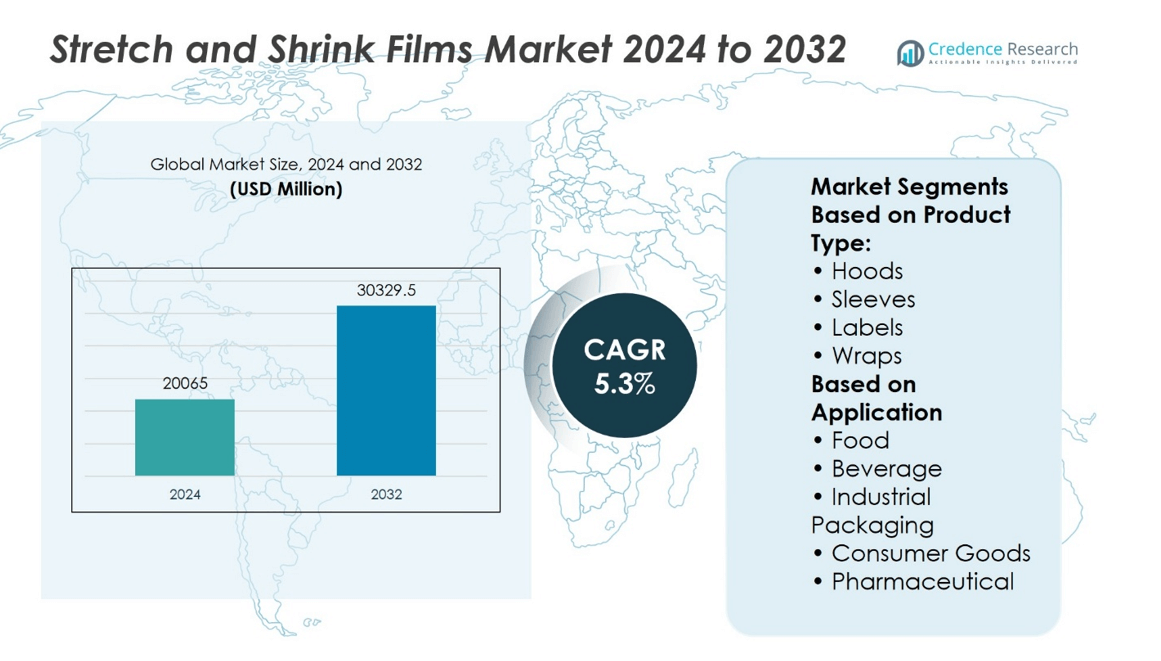

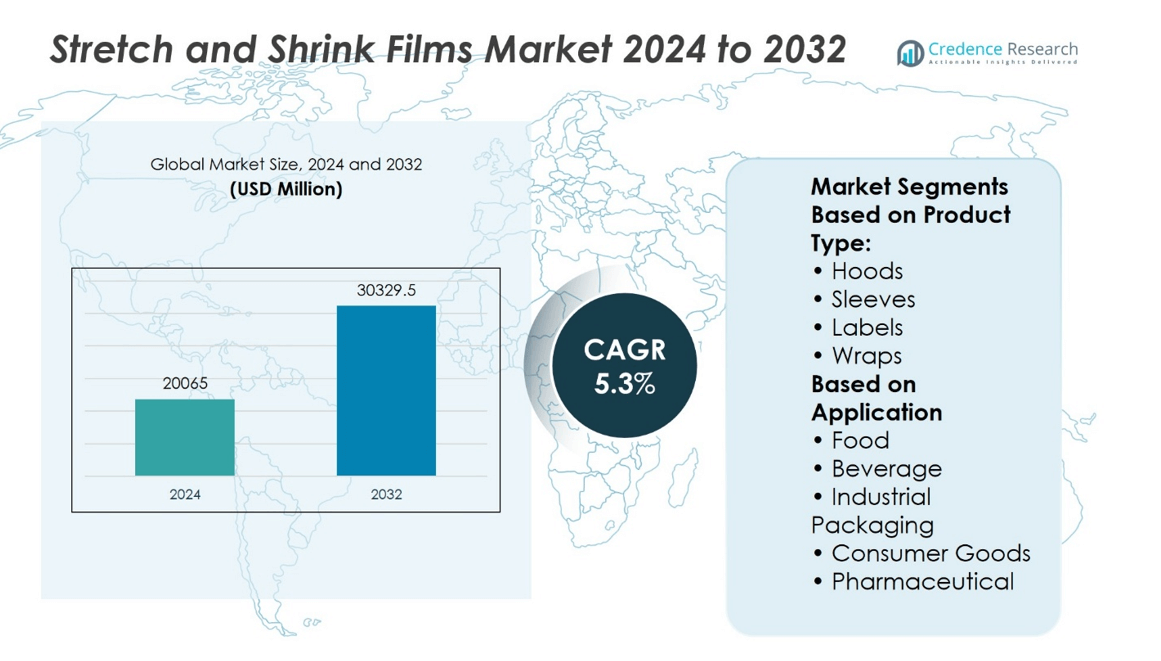

Stretch and Shrink Films Market size was valued at USD 20065 million in 2024 and is anticipated to reach USD 30329.5 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stretch and Shrink Films Market Size 2024 |

USD 20065 million |

| Stretch and Shrink Films Market, CAGR |

5.3% |

| Stretch and Shrink Films Market Size 2032 |

USD 30329.5 million |

The stretch and shrink films market grows steadily due to rising demand for secure and tamper-evident packaging across food, beverage, and logistics sectors. It benefits from strong adoption in e-commerce and retail supply chains where durability and product visibility matter. The market trends highlight a shift toward sustainable, recyclable films and innovations in multi-layer extrusion technologies that improve performance and reduce material use. Manufacturers focus on downgauging film thickness without compromising strength. Demand for automated packaging solutions also influences product development, prompting investments in high-efficiency films that support faster processing and reduced operational costs across various end-use industries.

The stretch and shrink films market shows strong regional presence across North America, Europe, and Asia-Pacific, with Asia-Pacific holding the largest market share due to its expanding manufacturing base and packaging demand. North America and Europe follow, driven by sustainability regulations and advanced packaging infrastructure. Key players such as Berry Global Inc., Sigma Plastics Group, Amcor plc, Sealed Air, Bollore Inc, Paragon Films, and HIPAC Spa compete through product innovation, regional expansion, and strategic acquisitions to strengthen their global market position.

Market Insights

- The stretch and shrink films market reached USD 20065 million in 2024 and is projected to grow at a CAGR of 5.3% through the forecast period.

- Increasing demand for efficient packaging in food, beverage, and logistics sectors drives market expansion.

- Rising focus on lightweight, cost-effective, and sustainable packaging solutions supports steady adoption.

- Key players focus on innovation, such as multi-layer film technologies and recyclable materials, to gain competitive advantage.

- Fluctuating raw material prices and environmental regulations challenge consistent profit margins.

- Asia-Pacific holds the largest regional share due to strong manufacturing activity and high demand for consumer goods.

- North America and Europe show moderate growth with emphasis on sustainable practices and automation in packaging lines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

E-commerce Expansion Increases Packaging Demand Across Distribution Channels

The rapid growth of e-commerce has created significant demand for efficient and secure packaging solutions, driving adoption of stretch and shrink films. These films ensure product stability and protection during transportation across complex distribution networks. With retailers shipping millions of parcels daily, manufacturers rely on these films to safeguard items from dust, moisture, and tampering. Stretch and shrink films enhance operational efficiency by minimizing packaging time and reducing material waste. Warehouses and fulfillment centers implement automated packaging lines that depend on these films for consistent wrapping and bundling. It supports the need for lightweight and cost-effective packaging that withstands long-distance shipment and high handling frequency.

- For instance, Berry Global reported an increase of 4,500 metric tons in its North American stretch film production capacity in 2023 to meet rising demand from online retail packaging applications.

Food and Beverage Sector Drives Adoption for Shelf-Life Extension and Hygiene

The food and beverage industry remains a key consumer of stretch and shrink films due to their role in product preservation and hygiene. These films create tight seals around packaged goods, preventing contamination and extending shelf life. Manufacturers of perishable products use it to maintain visual appeal and freshness throughout retail display. The films accommodate various shapes and sizes, making them suitable for multipacks and irregularly shaped containers. Fast-moving consumer goods rely on clear visibility and tamper evidence that these films provide. It also reduces packaging bulk while supporting compliance with food safety regulations.

- For instance, Amcor developed its shrink film solution for dairy products that extended shelf life by 15 days and reduced oxygen transmission to below 0.1 cc/m²/day, resulting in enhanced product safety and reduced food waste.

Industrial and Consumer Goods Manufacturers Focus on Cost-Efficient Load Stabilization

Stretch and shrink films contribute to secure palletization and load containment in industrial settings, supporting high-speed logistics and warehouse safety. Industries such as construction materials, electronics, and personal care products employ it to stabilize large or irregular shipments. The films offer high tensile strength and puncture resistance, minimizing the risk of damage during handling. Manufacturers choose these materials to lower packaging costs and streamline transportation. Integration with automated stretch wrapping machines improves throughput and reduces labor dependency. It plays a vital role in maintaining consistent packaging standards across diverse product lines.

Sustainability Requirements Influence Material Innovation and Recycling Efforts

Growing environmental awareness and stricter regulations have prompted producers to invest in recyclable and downgauged variants of stretch and shrink films. It now features higher performance with less material usage, supporting waste reduction targets. Many companies shift toward mono-material solutions to enhance recyclability and meet sustainability commitments. Development of bio-based and post-consumer recycled content films continues to gain traction across industries. Packaging teams evaluate it not only for strength and clarity but also for life cycle impact. This shift aligns with broader circular economy goals and reinforces brand accountability.

Market Trends

Growth in Flexible Packaging Adoption Influences Material Preference

Flexible packaging formats continue to replace rigid alternatives across various industries, prompting a shift in material selection within the stretch and shrink films market. Brands seek lightweight, durable solutions that improve shelf appeal and reduce shipping costs. It supports efficient space utilization during transportation and storage. The versatility of these films allows for their application across diverse shapes and sizes, from individual retail units to bulk shipments. Consumer goods and food sectors favor them for their tamper-resistance and transparency. Their compatibility with high-speed packaging lines further encourages widespread integration.

- For instance, Coveris increased its production of polyethylene-based shrink films by 2,800 metric tons in 2023 to support demand for lightweight, flexible packaging in the food and medical sectors.

Focus on Downgauging and High-Performance Film Formulations

Manufacturers emphasize downgauging to reduce film thickness while maintaining strength, improving material efficiency and sustainability. The stretch and shrink films market sees growing interest in multi-layered, high-performance films that offer superior load containment and clarity. It supports sustainability goals without compromising functionality. These developments help reduce resin consumption and lower operational costs for end-users. Companies invest in advanced extrusion technologies to produce films that meet evolving performance demands. The trend also supports compliance with emerging environmental standards.

- For instance, Sealed Air launched its Cryovac OptiDure 2050 shrink film with a down gauge thickness of 25 microns, offering puncture resistance of over 2.5 kg

Integration of Automation Technologies in Packaging Operations

The transition to automated packaging solutions in manufacturing and distribution sectors increases reliance on films compatible with machine applications. The stretch and shrink films market adapts to this trend by offering materials with uniform stretchability, consistent gauge, and smooth unwind characteristics. It improves wrapping speed and reduces material waste. Automated lines require films that deliver optimal tension control and minimize film breaks. Machine-grade films help optimize throughput in high-volume environments. The demand for compatibility with robotics and smart packaging systems continues to rise.

Circular Economy Principles Guide Innovation and Material Recovery Efforts

Sustainability trends influence product innovation, with brands adopting recyclable, compostable, and post-consumer recycled films. The stretch and shrink films market reflects this shift with expanded offerings that align with closed-loop systems and regulatory pressures. It promotes the use of mono-material structures to support recycling stream compatibility. Governments and industry groups advocate for greater traceability and responsible sourcing of raw materials. Brands prioritize environmental transparency and incorporate life-cycle assessments into packaging decisions. The trend encourages collaboration across the supply chain to reduce ecological impact.

Market Challenges Analysis

Rising Environmental Scrutiny and Regulatory Pressures Limit Material Use

The stretch and shrink films market faces challenges from mounting environmental concerns and tightening global regulations. Government agencies continue to impose restrictions on single-use plastics, urging companies to reduce polymer-based packaging. It complicates raw material sourcing and forces a shift toward recyclable or biodegradable alternatives, many of which lack equivalent performance or scalability. Compliance with extended producer responsibility (EPR) frameworks adds cost and operational complexity. Brands must reevaluate film compositions to meet recycling requirements without compromising product protection. These pressures reduce flexibility in design and often delay product innovation cycles.

Volatility in Raw Material Prices Disrupts Supply Chain Stability

Price fluctuations in petrochemical-derived resins, such as polyethylene and polypropylene, present a major obstacle for producers. The stretch and shrink films market depends heavily on stable feedstock supplies to maintain consistent pricing and profit margins. It suffers when geopolitical tensions, trade restrictions, or refinery disruptions limit resin availability. Procurement teams must manage cost unpredictability while meeting delivery schedules for high-volume applications. Smaller manufacturers face particular difficulty in absorbing price shocks, reducing their competitiveness. These supply-side constraints frequently hinder long-term planning and investment in new technologies.

Market Opportunities

Expansion of E-Commerce and Retail Logistics Opens New Avenues for Film Usage

The growth of online retail and direct-to-consumer distribution creates strong demand for secure and efficient packaging. The stretch and shrink films market benefits from increased use of pallet wraps and unit load protection across e-commerce supply chains. It enables retailers and fulfillment centers to reduce product damage during high-volume shipping operations. Film manufacturers can develop specialized formats tailored to automated wrapping systems, ensuring fast throughput and minimal waste. Custom films that support branding or tamper-evidence also find growing acceptance. These applications offer scalable, high-frequency use cases that reinforce recurring sales.

Shift Toward Bio-Based and Recyclable Films Spurs Innovation

Sustainability-driven innovation in materials presents a clear opportunity for forward-looking producers. The stretch and shrink films market gains momentum from growing investments in bio-based polymers and circular packaging solutions. It allows manufacturers to align with corporate ESG goals and regulatory expectations while offering performance-aligned alternatives. Advances in multilayer technology and post-consumer resin integration help maintain strength and flexibility in eco-friendly formats. Partnerships with recyclers and resin developers support the creation of closed-loop systems. These initiatives position film makers as responsible suppliers in a packaging landscape that prioritizes resource efficiency.

Market Segmentation Analysis:

By Product Type:

The stretch and shrink films market includes products such as hoods, sleeves and labels, wraps, and others. Wraps are widely used in securing pallet loads across warehouses and distribution centers, offering reliable load stability and minimizing movement during transit. It supports fast packaging speeds and cost efficiency in logistics. Sleeves and labels are important in industries like beverages and pharmaceuticals, where high-quality branding and tamper-evident packaging are essential. Shrink sleeves conform to complex container shapes and enable 360-degree design coverage, enhancing shelf appeal. Hoods, especially stretch hoods, have replaced traditional shrink covers in many industrial applications due to their strength and energy-saving characteristics. It eliminates the need for heat application while offering strong puncture resistance and waterproof sealing.

- For instance, Berry Global’s Stratos Stretch Film achieved a pre-stretch capability of 325%, allowing a single roll to wrap up to 15,000 linear feet of pallets, reducing film consumption by 1.2 kg per pallet load

By Application:

The stretch and shrink films market caters to applications in food and beverage, industrial packaging, consumer goods, and pharmaceuticals. Food and beverage lead in adoption due to the sector’s demand for hygienic, durable, and visually appealing packaging. It helps extend shelf life, protect against contamination, and support retail display readiness. Industrial packaging relies on stretch and shrink films to bundle large and heavy products like appliances, machinery, and construction materials. It ensures product stability and ease of transportation without needing additional protective layers. Consumer goods use these films for bundling and retail presentation, helping manufacturers reduce individual packaging costs while enhancing visual impact on shelves. In pharmaceuticals, the use of shrink labels and tamper-evident films ensures regulatory compliance and product integrity throughout the supply chain.

- For instance, according to the USDA Agricultural Research Service, the use of high-barrier shrinks films in beef packaging-maintained oxygen transmission rates at 0.04 cc/m²/day, extending product shelf life from 21 days to 42 days when stored at 1.7°C

Segments:

Based on Product Type:

- Hoods

- Sleeves

- Labels

- Wraps

Based on Application

- Food

- Beverage

- Industrial Packaging

- Consumer Goods

- Pharmaceutical

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounted for 28.5% of the global stretch and shrink films market share in 2024. The region benefits from mature packaging industries in the U.S. and Canada, where demand for flexible and sustainable packaging solutions remains consistent. High consumption of packaged food, beverages, and pharmaceuticals drives the uptake of shrink and stretch film packaging. The U.S. leads in demand due to its expansive retail and logistics sectors, which prioritize damage-free delivery and shelf-ready packaging formats. Growth in e-commerce and warehouse automation encourages the use of high-performance stretch films for pallet unitization. It supports operational efficiency while meeting sustainability goals with thinner films that use less plastic. North American manufacturers also invest in downgauged films and recyclable materials to align with government initiatives aimed at reducing plastic waste.

Europe

Europe captured a 24.2% share of the stretch and shrink films market in 2024. Strict environmental regulations and consumer demand for eco-friendly packaging solutions shape market trends across the region. Countries such as Germany, France, and the U.K. lead innovation in bio-based and recyclable film formulations. Stretch films with high tensile strength and lower material usage remain in focus among European packaging companies. The beverage and personal care sectors demand high-clarity shrink sleeves for premium branding and tamper-evident sealing. Automated packaging lines and integration of recyclable mono-materials continue to influence purchasing decisions across industrial users. It reflects the European Union’s sustainability goals and increasing demand for circular packaging solutions. Local players collaborate with retailers and recyclers to improve film recovery and reduce landfill dependency.

Asia Pacific

Asia Pacific led the global market with a 33.1% share in 2024. The region’s dominance stems from rapid industrialization, growth in manufacturing, and expanding retail sectors across China, India, Japan, and Southeast Asia. China alone contributes a major portion of regional revenue due to its role as a global manufacturing hub and exporter of packaged goods. Stretch and shrink films find widespread application in logistics, agriculture, electronics, and FMCG sectors. It supports efficient load containment and reduces product damage during long-distance transportation. Rising disposable income and urbanization drive consumption of packaged food and consumer goods, further accelerating packaging demand. Asia Pacific also sees increasing local investments in extrusion technologies, improving the availability of cost-effective, high-performance films tailored for varied climates and supply chain conditions.

Latin America

Latin America held a 7.8% share of the global stretch and shrink films market in 2024. Brazil and Mexico drive demand in the region through their growing beverage, dairy, and consumer goods industries. Local producers adopt stretch hoods and shrink wraps for both retail and industrial packaging applications. It enhances product stability during transport and meets branding requirements with custom-printed shrink sleeves. Growing logistics networks, particularly in urban areas, push manufacturers to adopt automated packaging technologies. Local challenges like limited recycling infrastructure create demand for biodegradable alternatives and thinner gauge films. Market players in Latin America also benefit from trade integration and manufacturing relocation from North America, expanding regional production capabilities.

Middle East and Africa (MEA)

The Middle East and Africa contributed 6.4% to the global market in 2024. Gulf countries, especially the UAE and Saudi Arabia, continue to invest in advanced retail and logistics infrastructure, creating sustained demand for high-performance stretch films. It plays a key role in food security by extending the shelf life of perishables through barrier shrink wraps. Industrial sectors in South Africa and the GCC utilize stretch films to secure machinery and heavy equipment for export and internal distribution. MEA faces challenges with film recycling, prompting efforts toward localizing biodegradable film production. Imports still dominate the market, but investments in flexible packaging plants are expected to strengthen regional supply. The region’s young consumer base and growing retail sector support long-term demand for visually appealing, protective shrink packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HIPAC Spa

- Millennium Packaging, Inc

- LUBAN PACK

- Amcor plc

- Paragon Films

- A-Z Packaging

- Italdibipack SpA

- Sigma Plastics Group

- Berry Global Inc.

- Sealed Air

- Bollore Inc

Competitive Analysis

The stretch and shrink films market include HIPAC Spa, Millennium Packaging, Inc, LUBAN PACK, Amcor plc, Paragon Films, A-Z Packaging. The stretch and shrink films market remains highly competitive, driven by rapid innovation in materials and packaging technologies. Companies are focusing on enhancing film strength, clarity, and sustainability to meet evolving industry requirements. Strategic investments in advanced extrusion technologies and multilayer film development help firms deliver high-performance solutions across diverse applications. Market participants prioritize strong supply chain integration and regional manufacturing footprints to ensure consistent product availability. Sustainability goals continue to influence operations, with players accelerating adoption of recyclable and bio-based films. Firms also emphasize tailored product offerings to meet sector-specific demands in food, pharmaceuticals, and consumer goods. The market’s dynamic nature demands continual innovation and operational efficiency to maintain competitive positioning.

Recent Developments

- In March 2024, Paragon launched “Beyond PCR,” the world’s first ultra-high performance, thin-gauge machine film with certified-pending, post-consumer recycled content, available nationwide in the United States.

- In February, 2024, Innovia Films launched floatable polyolefin shrink films. RayoFloat white APO is a low-density white polyolefin that maintains floatability when printed. Its opacity enhances light blocking, suitable for shrink sleeves for light-sensitive industries such as dairy, food supplements, nutritional products and cosmetics.

- In July 2023, Amcor invested in a new production line in Swansea, enabling the company to produce a new series of thinner, PVdC-free shrink bags and films that maintain high optical and protective qualities while reducing plastic usage.

- In May 2023, Innovia Films introduced APO 45, a floatable and sustainable shrink sleeve material developed to boost PET recycling rates and support a circular economy for packaging. The product is suitable for use in all shrink sleeve applications in the household, laundry, personal care, food, dairy, and beverage markets, states the company.

Market Concentration & Characteristics

The shrink films market exhibits moderate to high market concentration, with a mix of global manufacturers and regional players competing across application verticals. It operates in a technologically driven environment where product differentiation centers on film clarity, shrink ratio, and material composition. The market emphasizes cost efficiency, high-speed application compatibility, and consistent sealing performance to meet industrial packaging demands. It displays characteristics of scalability, with manufacturers expanding capacity through multilayer co-extrusion lines and automation. Regulatory compliance, especially regarding food contact safety and recyclability, influences product development and procurement strategies. The shrink films market shows a strong inclination toward sustainability, driving innovation in biodegradable and recyclable polyolefin formulations. Competitive intensity continues to shape market structure, supported by integrated value chains and growing end-user expectations for durability and aesthetics.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The stretch and shrink films market will experience rising demand due to increasing adoption of flexible packaging solutions across industries.

- Manufacturers will invest more in recyclable and biodegradable film technologies to meet sustainability regulations.

- E-commerce growth will push the need for strong, tamper-evident, and secure packaging formats.

- The market will benefit from automation in packaging lines, requiring consistent film thickness and high-speed compatibility.

- Demand for food-grade shrink films will grow, driven by increased consumption of packaged food and beverages.

- Stretch hood films will gain traction in industrial packaging due to their high load stability and moisture resistance.

- North America and Asia-Pacific will remain key contributors, supported by strong manufacturing and logistics sectors.

- Innovation in multilayer co-extruded films will continue, improving mechanical strength and visual appeal.

- Regulatory focus on plastic waste reduction will influence product development and raw material sourcing.

- The market will see increased consolidation, with key players expanding production capacity and geographic reach.