Market Overview

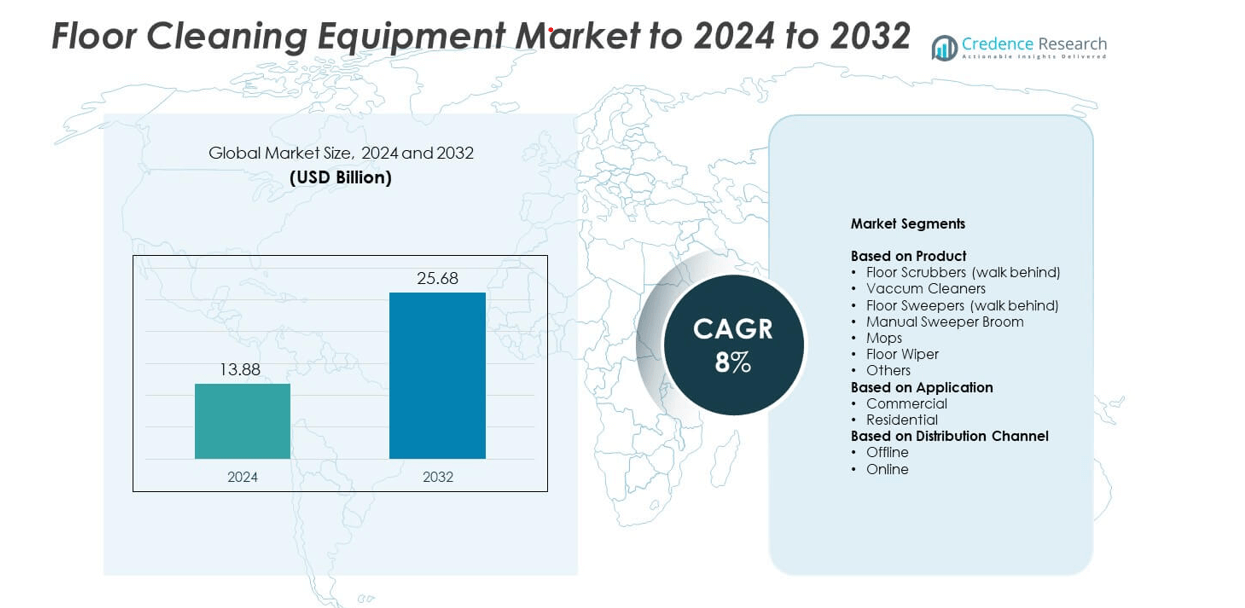

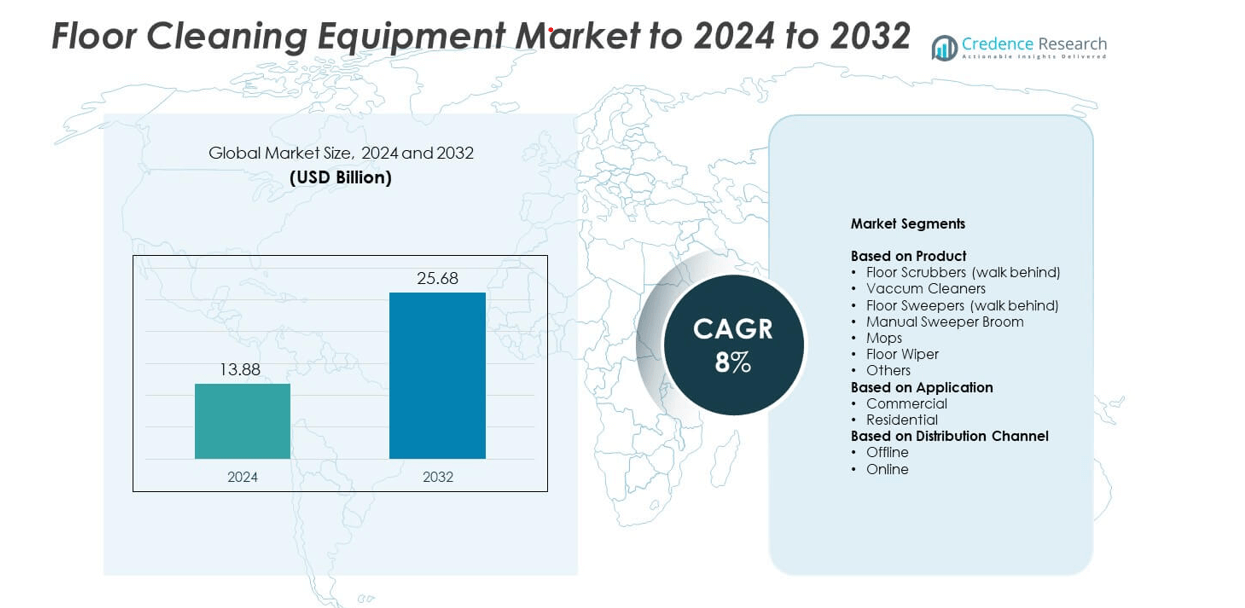

The Floor Cleaning Equipment market was valued at USD 13.88 billion in 2024 and is anticipated to reach USD 25.68 billion by 2032, growing at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floor Cleaning Equipment Market Size 2024 |

USD 13.88 billion |

| Floor Cleaning Equipment Market, CAGR |

8% |

| Floor Cleaning Equipment Market Size 2032 |

USD 25.68 billion |

The floor cleaning equipment market is dominated by leading players such as Dyson, Tennant Company, Nilfisk Group, Kärcher, and Comac S.p.A, which collectively maintain a strong global presence through innovation and strategic expansion. These companies focus on developing energy-efficient, automated, and sustainable cleaning solutions to meet growing hygiene standards across residential, commercial, and industrial sectors. North America leads the global market with a 36% share, supported by advanced technology adoption and robust infrastructure. Europe follows with 28%, emphasizing eco-friendly cleaning systems, while Asia Pacific holds 24%, driven by rapid urbanization and expanding commercial facilities.

Market Insights

- The floor cleaning equipment market was valued at USD 13.88 billion in 2024 and is projected to reach USD 25.68 billion by 2032, growing at a CAGR of 8%.

- Growth is driven by increasing demand for automated and robotic cleaning systems across commercial and residential sectors.

- Smart connectivity, IoT-enabled devices, and eco-friendly designs are emerging as key market trends shaping future innovation.

- The market is highly competitive, with global and regional manufacturers focusing on technological upgrades and sustainability-focused product launches.

- North America holds a 36% share, followed by Europe at 28% and Asia Pacific at 24%, while the vacuum cleaners segment dominates with 32% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Vacuum cleaners held the dominant share of 32% in the Floor Cleaning Equipment market in 2024. Their efficiency in removing dust and allergens from carpets and hard floors drives strong adoption across both residential and commercial spaces. Demand is also fueled by the rise of robotic and cordless vacuum technologies, offering greater convenience and time savings. Leading brands like Dyson, Kärcher, and iRobot continue to invest in smart and energy-efficient designs, further supporting growth. Floor scrubbers and sweepers also show steady adoption in industrial and institutional cleaning applications.

- For instance, Dyson’s 360 Vis Nav delivers 22,000 Pa suction pressure.

By Application

The commercial segment led the market with a 58% share in 2024, supported by growing demand from offices, retail stores, hospitals, and hospitality facilities. Increasing hygiene standards and the need for large-area cleaning drive the dominance of this segment. Automated cleaning systems, particularly robotic scrubbers, are gaining traction in commercial setups to reduce labor costs and enhance operational efficiency. The residential segment is also expanding rapidly due to the growing preference for compact, user-friendly vacuum cleaners and mops.

- For instance, Kärcher’s KIRA B 200 has a maximum theoretical area performance of up to 4,860 m² per hour (disc brushes), though the actual performance varies based on the environment.

By Distribution Channel

The offline segment accounted for 64% of the market share in 2024, as consumers continue to prefer in-store purchases for high-value cleaning equipment. Retail outlets, including specialty and hardware stores, allow product demonstrations and after-sales support, influencing buying decisions. However, the online segment is growing faster, driven by the rise of e-commerce platforms and digital marketing campaigns. Brands like Philips and Bissell are strengthening their online presence with virtual product showcases and doorstep delivery options, expanding customer reach in urban areas.

Key Growth Drivers

Rising Demand for Automated Cleaning Solutions

The growing need for convenience and time efficiency is driving the adoption of automated and robotic floor cleaning equipment. Commercial facilities such as airports, malls, and hospitals increasingly use robotic scrubbers and vacuum cleaners to enhance productivity and reduce labor costs. Technological advances in AI navigation and IoT integration further support this trend. Consumers also prefer smart home-compatible cleaning tools, leading to a wider product range from global manufacturers.

- For instance, Tennant’s T7AMR has a theoretical maximum productivity of 2,660 m² per hour in autonomous mode, though the actual performance varies based on the environment.

Expansion of Commercial Infrastructure

Rapid urbanization and growth in commercial infrastructure are major factors fueling market expansion. Offices, hospitality facilities, and healthcare centers require advanced cleaning systems to maintain hygiene standards. This expansion increases demand for large-capacity floor scrubbers and vacuum systems capable of operating in high-traffic zones. The trend aligns with corporate sustainability efforts, as modern cleaning devices integrate energy-efficient and water-saving technologies.

- For instance, in a case study at Norway’s TORP Sandefjord Airport, a Nilfisk Liberty SC50 saved the cleaning team approximately 3 hours every day.

Emphasis on Hygiene and Safety Standards

The post-pandemic focus on health and cleanliness continues to influence market growth. Governments and private organizations are enforcing stricter hygiene norms in public facilities and workplaces. As a result, commercial cleaning firms and institutional buyers invest more in efficient, high-performance cleaning equipment. Products with HEPA filters, antimicrobial materials, and touch-free operation are becoming essential to meet regulatory and consumer expectations.

Key Trends and Opportunities

Integration of Smart and Connected Technologies

Smart technologies such as IoT sensors, mobile app control, and AI-based route mapping are transforming floor cleaning equipment design. Manufacturers are developing devices that can monitor cleaning efficiency, detect dirt density, and schedule operations autonomously. These innovations enhance operational efficiency and reduce manual supervision, especially in large commercial areas. Growing adoption of connected systems creates new opportunities for premium and subscription-based maintenance services.

- For instance, iRobot has sold over 50 million consumer robots globally.

Sustainability and Eco-Friendly Equipment Design

Sustainability is becoming central to product innovation in the floor cleaning equipment industry. Companies are introducing energy-efficient motors, recyclable materials, and low-water-use technologies to reduce environmental impact. Consumers and corporations increasingly favor products that meet eco-certifications and green cleaning standards. This shift creates strong opportunities for brands investing in biodegradable consumables, battery-powered devices, and reusable cleaning accessories.

- For instance, Tennant ec-H2O NanoClean uses no detergent and enables up to 3 times longer scrubbing between refills.

Key Challenges

High Initial Cost of Advanced Equipment

The high upfront investment in automated and robotic cleaning systems remains a major restraint. Many small and medium enterprises prefer manual or semi-automatic alternatives due to cost concerns. While these devices offer long-term savings through reduced labor, budget limitations hinder adoption in developing regions. Manufacturers are responding by introducing financing options and mid-range models to improve accessibility.

Maintenance Complexity and Technical Issues

Complex maintenance requirements and system malfunctions pose challenges to market expansion. Advanced floor cleaning equipment often requires skilled technicians for repairs and periodic calibration. Downtime during servicing can affect operational continuity in commercial facilities. To address this, producers are focusing on modular component design, remote diagnostics, and predictive maintenance tools to ensure reliability and user convenience.

Regional Analysis

North America

North America held the largest share of 36% in the floor cleaning equipment market in 2024. The region’s growth is supported by the strong presence of commercial facilities such as airports, offices, and retail stores requiring advanced cleaning systems. High labor costs have driven the adoption of robotic and automated floor cleaners. Major manufacturers like Tennant, Nilfisk, and Kärcher maintain strong distribution networks across the United States and Canada. Continuous investment in AI-enabled and energy-efficient cleaning devices further boosts market expansion across the region.

Europe

Europe accounted for a 28% market share in 2024, driven by stringent hygiene regulations and sustainability goals across commercial sectors. The hospitality and healthcare industries are key contributors, supported by demand for eco-friendly and low-noise cleaning machines. Manufacturers in Germany, the UK, and France are introducing electric and battery-operated cleaning equipment to align with green building standards. Increasing awareness of workplace cleanliness and employee safety has also encouraged businesses to upgrade traditional cleaning systems with automated solutions.

Asia Pacific

Asia Pacific captured a 24% share of the global market in 2024, led by rapid urbanization and expansion of commercial infrastructure in China, India, and Japan. Rising disposable income and awareness of hygiene standards drive adoption in both residential and commercial applications. The region also benefits from the growing availability of low-cost and compact cleaning devices. Local manufacturers are enhancing production capacity to meet domestic demand, while international brands are investing in regional partnerships to expand market penetration.

Latin America

Latin America held an 8% share in 2024, with steady growth supported by increasing adoption of mechanized cleaning in hospitality, education, and healthcare facilities. Brazil and Mexico remain the leading markets due to growing awareness of hygiene standards and improved retail infrastructure. However, limited access to advanced equipment and higher import costs restrict faster adoption. Manufacturers are focusing on offering affordable and easy-to-maintain products suited for small businesses and residential users across urban centers.

Middle East and Africa

The Middle East and Africa accounted for a 4% market share in 2024, driven by infrastructure development and expansion of commercial buildings. Growing demand from sectors such as hospitality, healthcare, and retail supports market growth, particularly in the UAE, Saudi Arabia, and South Africa. Increasing emphasis on cleanliness and hygiene compliance in commercial establishments is fueling equipment adoption. Despite challenges related to high equipment costs, partnerships with international cleaning equipment suppliers are helping expand regional accessibility.

Market Segmentations:

By Product

- Floor Scrubbers (walk behind)

- Vaccum Cleaners

- Floor Sweepers (walk behind)

- Manual Sweeper Broom

- Mops

- Floor Wiper

- Others

By Application

By Distribution Channel

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The floor cleaning equipment market is highly competitive, with key players such as Dyson, Comac S.p.A, Tennant Company, Fimap S.p.A, Nilfisk Group, Hako GmbH, Kärcher, Rawlins, EUREKA S.p.A. Unipersonale, Minuteman Intl, Alfred Kärcher GmbH & Co. KG., and International Cleaning Equipment leading global operations. The industry is marked by continuous innovation in automation, energy efficiency, and sustainability to meet evolving cleaning standards. Companies are investing heavily in research and development to enhance performance, battery life, and connectivity features. Strategic mergers, product launches, and regional expansions are common to strengthen market presence. Increasing focus on eco-friendly technologies and smart integration, including AI-based navigation and IoT-enabled monitoring, has become central to competitive differentiation. The market also witnesses rising competition from regional manufacturers offering cost-effective solutions. Overall, technological innovation, strong distribution networks, and brand reputation remain critical to sustaining leadership in the global floor cleaning equipment market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dyson

- Comac S.p.A

- Tennant Company

- Fimap S.p.A.

- Nilfisk Group

- Hako GmbH

- Kärcher

- Rawlins

- EUREKA S.p.A. Unipersonale

- Minuteman Intl

- Alfred Kärcher GmbH & Co. KG.

- International Cleaning Equipment

Recent Developments

- In 2025, Kärcher Launched the KIRA B 200, an autonomous robot scrubber dryer for professional use.

- In 2024, Nilfisk Partnered with LionsBot, a robotics company, to co-develop robotic cleaning machines.

- In 2024, Dyson launched the WashG1 wet floor cleaner, designed for hygienic and effective cleaning

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with strong demand for robotic and automated cleaning systems.

- Manufacturers will focus on energy-efficient and low-noise designs to meet sustainability goals.

- Smart connectivity features such as app control and AI-based mapping will become standard.

- Growth in commercial construction will drive demand for large-capacity scrubbers and sweepers.

- Residential adoption will rise as compact and cordless cleaning devices gain popularity.

- Subscription-based maintenance and equipment leasing models will see wider acceptance.

- Eco-friendly materials and water-saving technologies will dominate product innovation.

- Manufacturers will strengthen e-commerce and digital sales channels to reach more users.

- Emerging markets in Asia and Latin America will show the fastest adoption growth.

- Partnerships between cleaning equipment makers and facility management firms will increase.