Market Overview

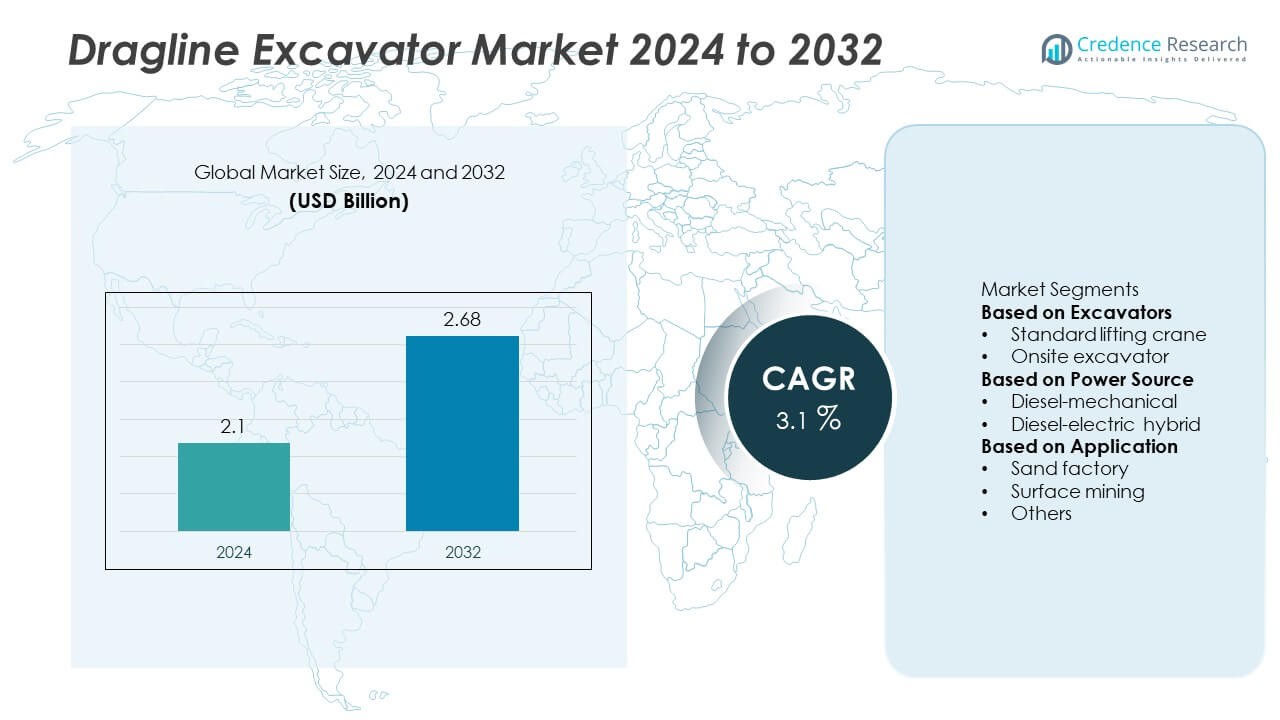

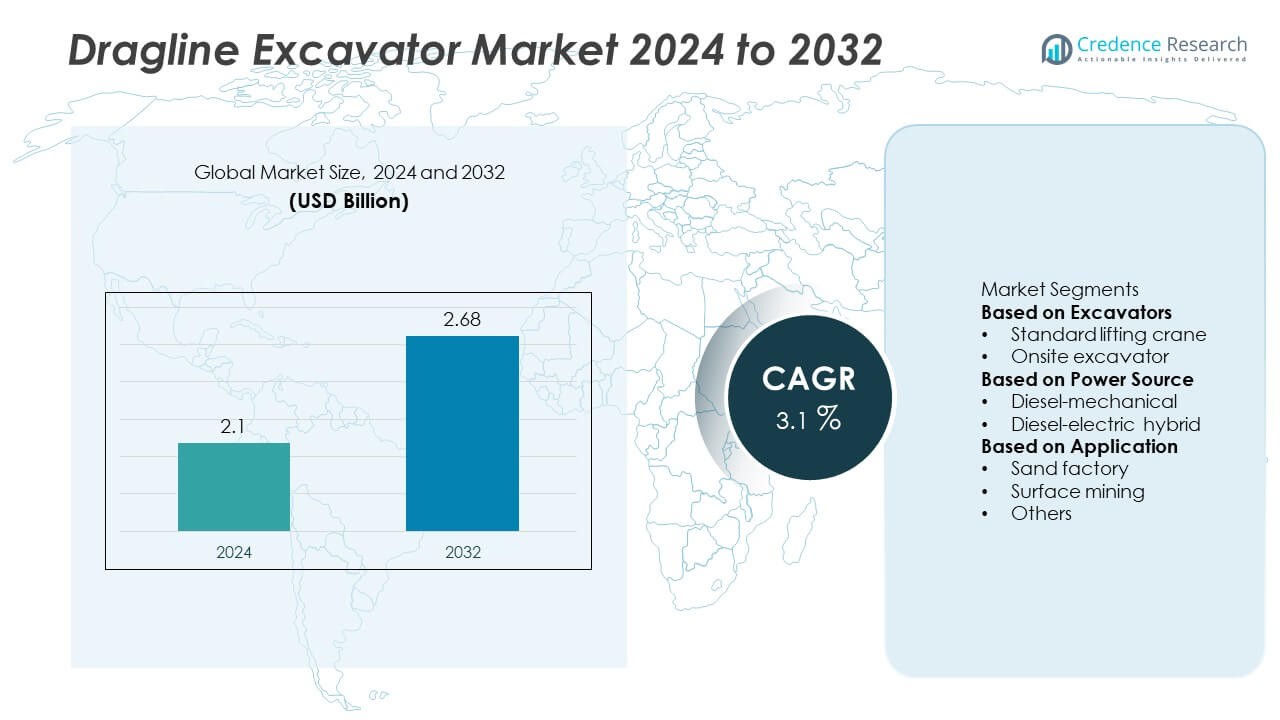

The Dragline Excavator market size was valued at USD 2.1 billion in 2024 and is anticipated to reach USD 2.68 billion by 2032, growing at a CAGR of 3.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dragline Excavator market Size 2024 |

USD 2.1 Billion |

| Dragline Excavator market, CAGR |

3.1% |

| Dragline Excavator market Size 2032 |

USD 2.68 Billion |

The Dragline Excavator market is led by key players including Komatsu Ltd., Doosan Bobcat Inc., Liebherr International Deutschland GmbH, Hitachi Construction Machinery Co. Ltd., AB Volvo, Heavy Engineering Corp. Ltd., Hyundai Construction Equipment Co. Ltd., Sumitomo Heavy Industries Ltd., Caterpillar Inc., and Deere & Co. These companies dominate through advanced product portfolios, strong distribution networks, and continuous investment in automation and hybrid technologies. North America emerged as the leading region in 2024 with a 33% market share, driven by extensive surface mining and infrastructure projects. Asia-Pacific followed with a 29% share, supported by rapid industrialization and large-scale mining operations in China, India, and Australia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dragline Excavator market was valued at USD 2.1 billion in 2024 and is projected to reach USD 2.68 billion by 2032, growing at a CAGR of 3.1% during the forecast period.

- Rising demand from surface mining and large infrastructure projects is driving market growth, supported by increasing investments in earthmoving and mineral extraction operations.

- The market is witnessing trends such as the integration of hybrid power systems, automation, and telematics for enhanced operational efficiency and reduced fuel consumption.

- Key players including Komatsu, Caterpillar, Liebherr, and Hitachi are focusing on R&D, expanding production capacities, and offering energy-efficient draglines to strengthen their global presence.

- North America leads the market with a 33% share, followed by Asia-Pacific at 29% and Europe at 27%; by application, the surface mining segment dominates with a 68% share, reflecting its critical role in coal and mineral extraction industries.

Market Segmentation Analysis:

By Excavators

The onsite excavator segment dominated the Dragline Excavator market in 2024, accounting for 61% of total revenue. These excavators are preferred for their high productivity and adaptability in large-scale mining and construction operations. Their ability to handle deep excavation and heavy overburden removal makes them ideal for open-pit mining and quarrying. Standard lifting cranes, while versatile, are mainly used for smaller-scale material handling tasks. The strong demand for onsite excavators is supported by rising investment in infrastructure and the growing need for efficient earthmoving equipment across emerging economies.

- For instance, the Caterpillar Cat 6040 Hydraulic Mining Shovel features a bucket capacity of 22 m³ and dual Cat C32 engines providing 1,516 kW of gross power, enabling high productivity in open-pit operations.

By Power Source

The diesel-electric hybrid segment held a leading 57% share of the Dragline Excavator market in 2024. These systems combine diesel power with electric drives to improve efficiency and reduce fuel consumption in heavy-duty applications. Hybrid excavators offer superior torque control and lower emissions, aligning with global sustainability targets. Manufacturers are increasingly adopting this configuration for large mining operations to cut operational costs. In contrast, diesel-mechanical excavators remain in use for smaller or remote projects. The shift toward hybrid models reflects the industry’s focus on performance optimization and environmental compliance.

- For instance, Hitachi Construction Machinery’s EX2000-7 large excavator (FCO version) uses a 12-cylinder, 30.5-liter diesel engine and offers up to a 19% reduction in fuel consumption, while the electric drive version of the EX2000-7 provides lower operating costs and zero emissions.

By Application

The surface mining segment accounted for the largest 68% share in 2024, driven by its extensive use in coal, iron ore, and mineral extraction. Dragline excavators are integral to surface mining operations due to their ability to move large volumes of material efficiently. Their long boom reach and high bucket capacity enable lower cost-per-ton excavation, which is critical for mining profitability. The sand factory segment follows, supported by construction material demand. The dominance of surface mining applications continues as global mineral production expands and large-scale mining projects adopt advanced dragline equipment.

Key Growth Drivers

Expansion of Surface Mining Operations

The rapid growth of surface mining projects is a key driver for the dragline excavator market. These machines are essential for large-scale earth removal in coal, iron ore, and phosphate mining. Their high bucket capacity and ability to handle deep overburden layers improve efficiency and reduce operational costs. Expanding mineral extraction activities in countries such as India, Australia, and China further strengthen demand. Growing investment in energy and raw material production supports the steady use of dragline excavators in open-pit mining operations.

- For instance, BEML Limited supplied a 24/96 dragline with a 24 m³ bucket capacity and a boom length of 96 meters to Coal India, increasing stripping performance at over 500,000 cubic meters per month. Similarly, Caterpillar’s 8750 dragline, equipped with a 109-meter boom and a 127-tonne bucket, delivers more than 7,000 tons of material moved per hour in surface mining operations.

Advancements in Hybrid Excavator Technology

Technological innovation is enhancing the performance and sustainability of dragline excavators. The adoption of diesel-electric hybrid systems improves energy efficiency, lowers emissions, and reduces fuel consumption. Manufacturers are investing in automation, digital controls, and remote operation features to increase productivity and safety. These advancements allow operators to manage large-scale mining sites more efficiently. The integration of hybrid technology also aligns with global initiatives promoting reduced carbon footprints across industrial machinery operations.

- For instance, the Komatsu PC3000-11 is available in a version with a single 900 kW electric motor or a 940 kW diesel engine, offering advanced technology to improve operating efficiency.

Growing Infrastructure and Construction Investments

Increasing public and private infrastructure development is driving demand for dragline excavators. These machines play a vital role in large-scale earthmoving, dredging, and foundation work. Governments are investing in roads, bridges, and mining infrastructure, particularly in developing economies. The rise in construction material extraction, including sand and aggregates, further supports demand. Equipment modernization programs and fleet expansions by contractors are also contributing to market growth, creating long-term opportunities for excavator manufacturers worldwide.

Key Trends & Opportunities

Integration of Automation and Remote Operations

Automation is transforming dragline excavator operations by improving accuracy, safety, and productivity. Remote-controlled and semi-autonomous systems allow operators to manage excavation in hazardous or hard-to-access mining environments. These systems reduce downtime and enhance precision in overburden removal. Manufacturers are investing in smart monitoring technologies that track machine performance and predictive maintenance needs. This trend is expected to accelerate as the mining sector embraces digitalization and data-driven operational efficiency.

- For instance, Develon (formerly Doosan Infracore) developed its Concept-X platform featuring 5G connectivity for remote equipment control and drone-assisted site mapping. This integrated control solution can analyze site data to plan and operate fleets of autonomous construction machinery.

Rising Demand for Electrification and Energy Efficiency

Energy efficiency and emission reduction are becoming major priorities in heavy equipment manufacturing. The market is shifting toward electrified and hybrid-powered dragline excavators to meet sustainability goals. Advancements in electric drives, regenerative braking, and energy recovery systems are improving operational efficiency. Mining companies adopting cleaner technologies are gaining regulatory advantages and cost benefits. The trend toward green mining practices will continue to open new opportunities for manufacturers focusing on electric-powered machinery.

- For instance, Liebherr’s R 9400 E electric excavator operates with dual 1,250 kW motors, reducing energy consumption by nearly 1,500 liters of diesel equivalent daily compared to mechanical systems.

Emergence of Equipment Rental and Leasing Models

The growing preference for equipment rental services offers new opportunities in the dragline excavator market. High initial costs often limit purchases, leading contractors and mining operators to opt for leasing options. Rental models provide flexibility, lower capital expenditure, and access to the latest technologies. Equipment manufacturers are partnering with leasing companies to expand their market reach. This trend is particularly strong in developing regions where infrastructure expansion and mining activity are accelerating.

Key Challenges

High Capital and Maintenance Costs

Dragline excavators involve substantial upfront investment and ongoing maintenance expenses. Their large size and complex mechanical systems require regular servicing and skilled operators. The high cost of parts replacement and downtime impacts profitability, particularly for small and mid-sized operators. Despite efficiency benefits, these financial challenges often limit adoption. Manufacturers are working to develop cost-effective and modular designs to reduce ownership costs and improve lifecycle performance for mining and construction applications.

Environmental and Regulatory Constraints

Strict environmental regulations on emissions and land disturbance present challenges for dragline excavator operations. Surface mining projects face growing scrutiny over ecological impact and carbon emissions. Governments are enforcing tougher standards on equipment performance, noise levels, and energy consumption. Compliance with these regulations increases production costs for manufacturers and operational costs for users. To remain competitive, industry players must focus on sustainable designs and cleaner technologies that align with global environmental targets.

Regional Analysis

North America

North America held a 33% share of the Dragline Excavator market in 2024, driven by large-scale surface mining projects and strong demand in the coal and metal extraction sectors. The United States leads the region with extensive use of high-capacity draglines in open-pit mines. Modernization of existing fleets and adoption of hybrid models are enhancing operational efficiency. Canada contributes through mining activities in oil sands and mineral deposits. Ongoing investments in automation and digital monitoring technologies further strengthen regional growth, supported by a well-established equipment supply network and service infrastructure.

Europe

Europe accounted for a 27% share of the Dragline Excavator market in 2024, supported by active mining operations and increasing infrastructure investments. Countries such as Germany, Poland, and Russia continue to rely on draglines for coal extraction and bulk earthmoving. The region’s focus on emission control and sustainability is driving the adoption of hybrid and electric-powered equipment. Advanced engineering capabilities and equipment refurbishment programs contribute to steady demand. Government-backed renewable energy and construction projects also create opportunities for dragline use in reclamation and dredging activities across European markets.

Asia-Pacific

Asia-Pacific captured a 29% share of the Dragline Excavator market in 2024, fueled by rapid industrialization and mining expansion in China, India, and Australia. Rising energy demand and large-scale coal and mineral extraction projects drive equipment utilization across the region. Government initiatives promoting infrastructure development and resource efficiency are also boosting adoption. Local manufacturers are introducing cost-effective and durable draglines to meet regional needs. The growing focus on automation, electric drive systems, and energy-efficient machinery further strengthens the market outlook, positioning Asia-Pacific as a key hub for future demand growth.

Latin America

Latin America held a 7% share of the Dragline Excavator market in 2024, supported by expanding mining and construction sectors. Brazil, Chile, and Peru remain key contributors due to extensive metal and mineral extraction activities. The region’s demand for efficient excavation machinery is rising with new mining concessions and infrastructure expansion. However, high equipment costs and limited access to advanced technologies pose challenges. Manufacturers are increasingly partnering with local distributors to improve service availability and affordability. Growing foreign investment in mining projects is expected to sustain moderate regional market growth.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the Dragline Excavator market in 2024. The region’s demand is primarily driven by the mining of minerals, construction materials, and oilfield development projects. South Africa leads the market with significant coal and metal mining operations, while the Gulf countries are investing in large infrastructure and quarrying projects. Ongoing industrialization, coupled with efforts to diversify economies beyond oil, supports equipment demand. Although technology adoption remains limited, investments in heavy machinery modernization are gradually improving regional market penetration.

Market Segmentations:

By Excavators

- Standard lifting crane

- Onsite excavator

By Power Source

- Diesel-mechanical

- Diesel-electric hybrid

By Application

- Sand factory

- Surface mining

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dragline Excavator market features leading players such as Komatsu Ltd., Doosan Bobcat Inc., Liebherr International Deutschland GmbH, Hitachi Construction Machinery Co. Ltd., AB Volvo, Heavy Engineering Corp. Ltd., Hyundai Construction Equipment Co. Ltd., Sumitomo Heavy Industries Ltd., Caterpillar Inc., and Deere & Co. These companies compete through advancements in design efficiency, automation, and hybrid power technologies to enhance productivity and reduce environmental impact. Manufacturers are focusing on developing large-capacity draglines with improved durability and lower operating costs for surface mining applications. Strategic collaborations, mergers, and investments in digital monitoring systems are expanding product portfolios and after-sales service capabilities. Companies are also emphasizing localized manufacturing and maintenance support to strengthen their regional presence. Continuous R&D efforts, integration of telematics, and the growing shift toward sustainable machinery solutions remain central strategies to maintaining a competitive edge in the evolving global dragline excavator market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Komatsu Ltd.

- Doosan Bobcat Inc.

- Liebherr International Deutschland GmbH

- Hitachi Construction Machinery Co. Ltd.

- AB Volvo

- Heavy Engineering Corp. Ltd.

- Hyundai Construction Equipment Co. Ltd.

- Sumitomo Heavy Industries, Ltd.

- Caterpillar Inc.

- Deere & Co.

Recent Developments

- In September 2025, Komatsu launched the PC220LC-12 / PC220LCi-12 excavators, with IMC 3.0 automation, 3D boundary control, larger cab, better efficiency.

- In January 2025, Caterpillar at CES 2025 unveiled its focus on autonomy, connectivity, electrification across heavy equipment lines, signaling direction for dragline tech too.

- In October 2024, Doosan Bobcat acquired Doosan Mottrol to internalize production of hydraulic components, which bolsters capabilities for large machines.

Report Coverage

The research report offers an in-depth analysis based on Excavators, Power Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dragline excavators will rise as surface mining projects expand globally.

- Manufacturers will focus on developing hybrid and electric-powered models to improve efficiency.

- Automation and remote operation technologies will enhance safety and precision in mining operations.

- Use of lightweight and durable materials will reduce maintenance costs and extend equipment lifespan.

- Digital monitoring and predictive maintenance will become standard features across new models.

- Emerging economies will drive future demand through increased mining and infrastructure investments.

- Sustainability goals will encourage adoption of energy-efficient and low-emission excavators.

- Equipment leasing and rental services will gain traction among small and mid-sized operators.

- Strategic collaborations between OEMs and mining companies will promote innovation and customization.

- Continuous R&D efforts in design optimization and fuel efficiency will strengthen long-term market competitiveness.