Market Overview

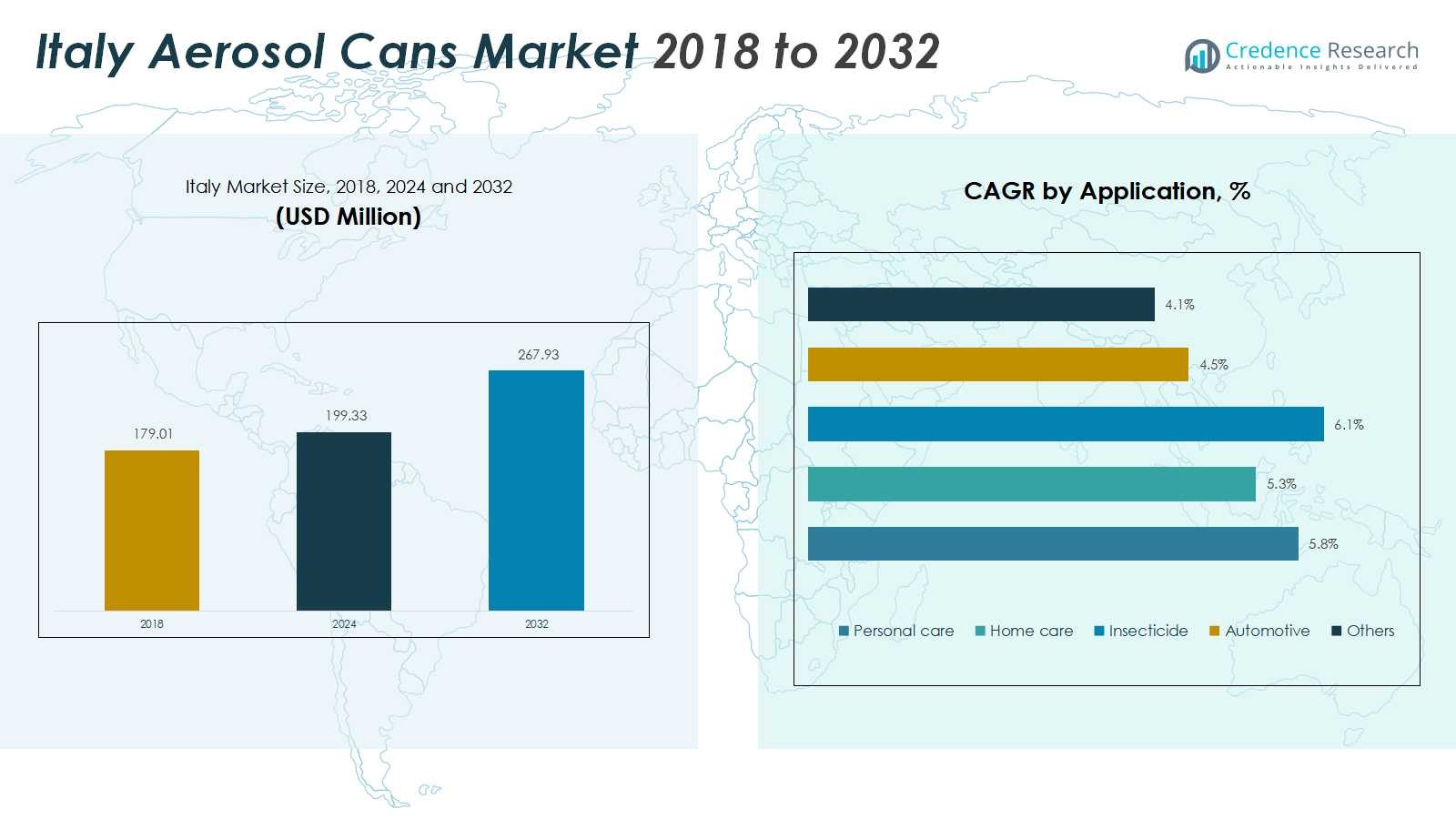

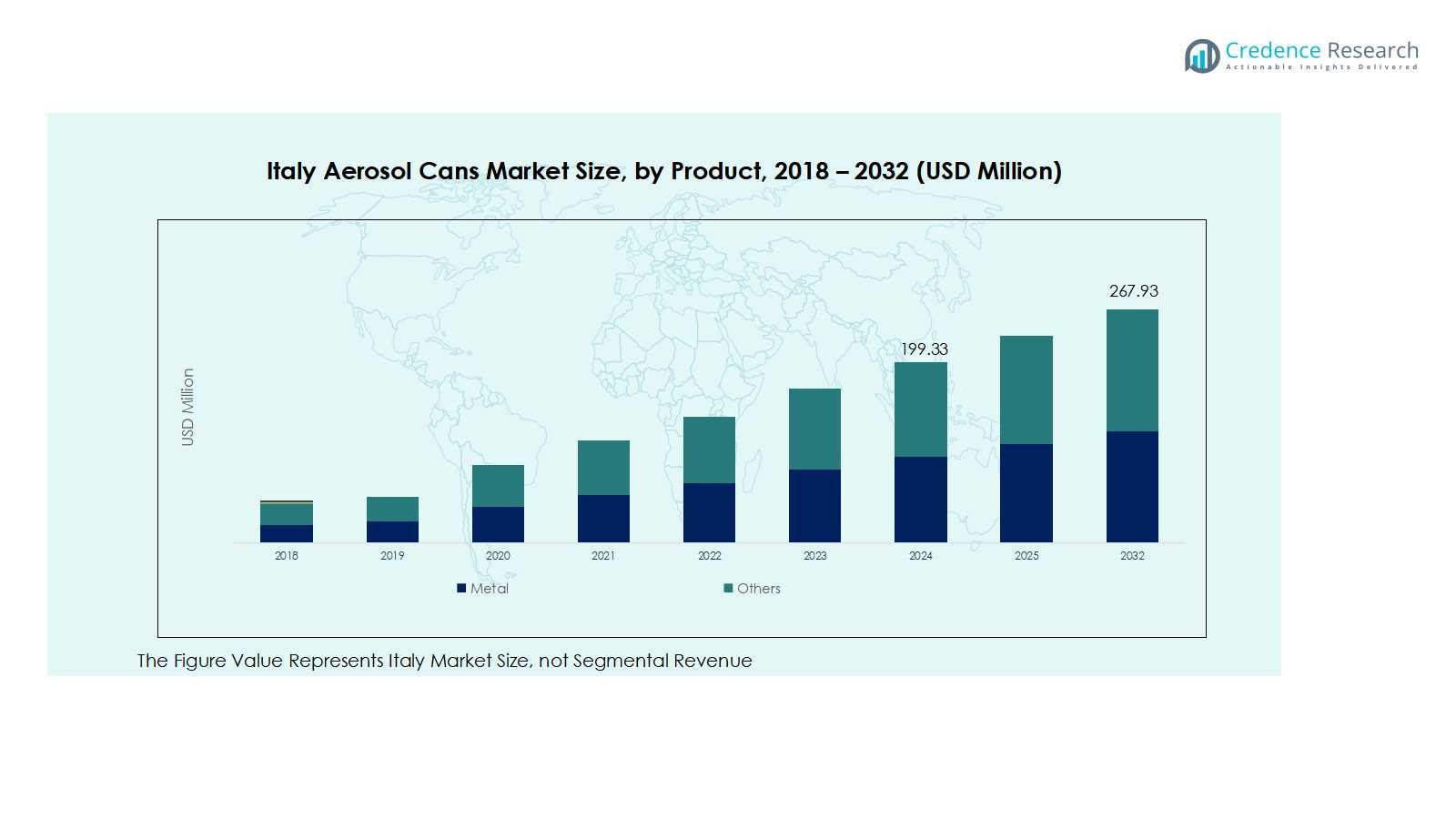

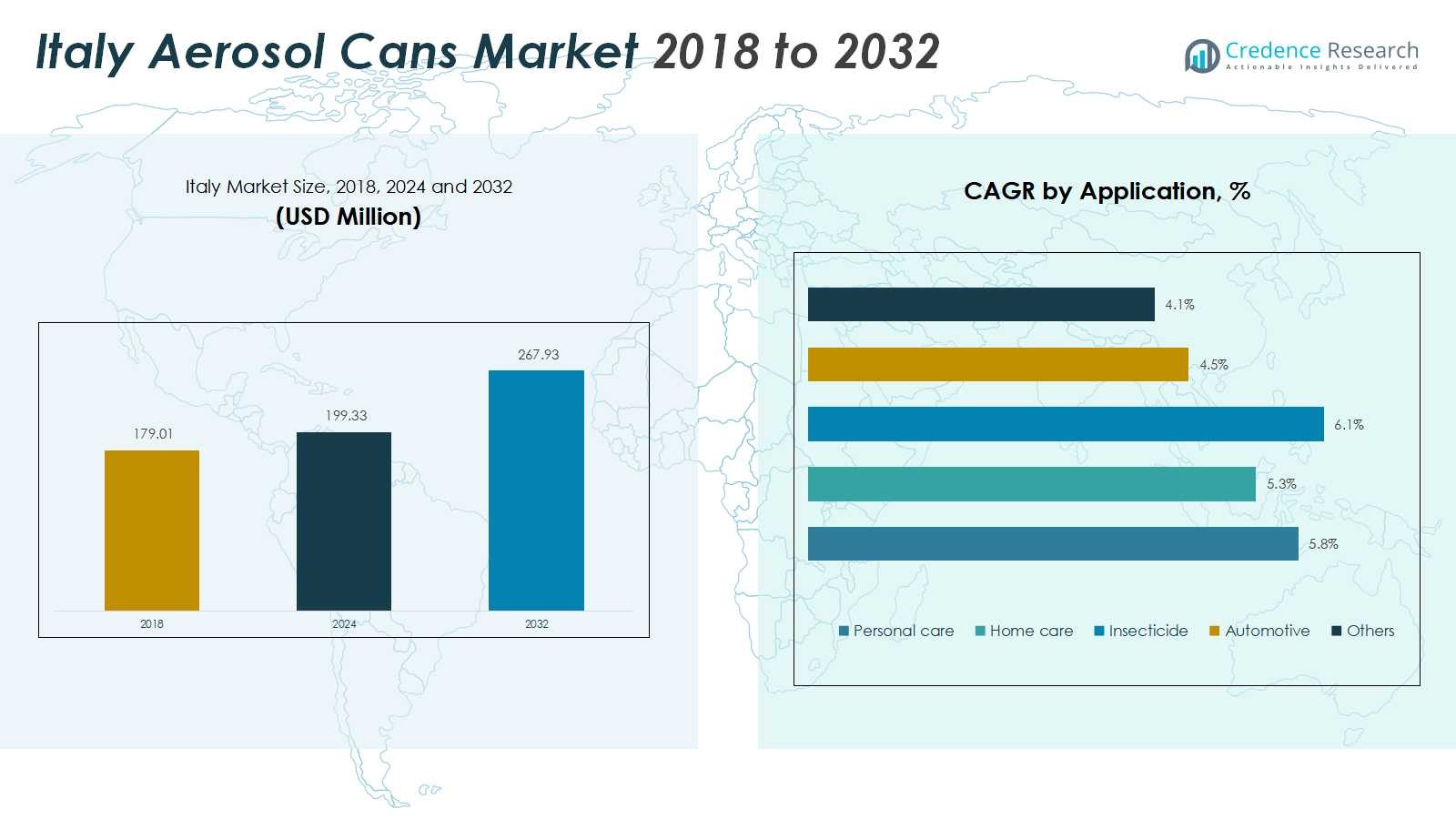

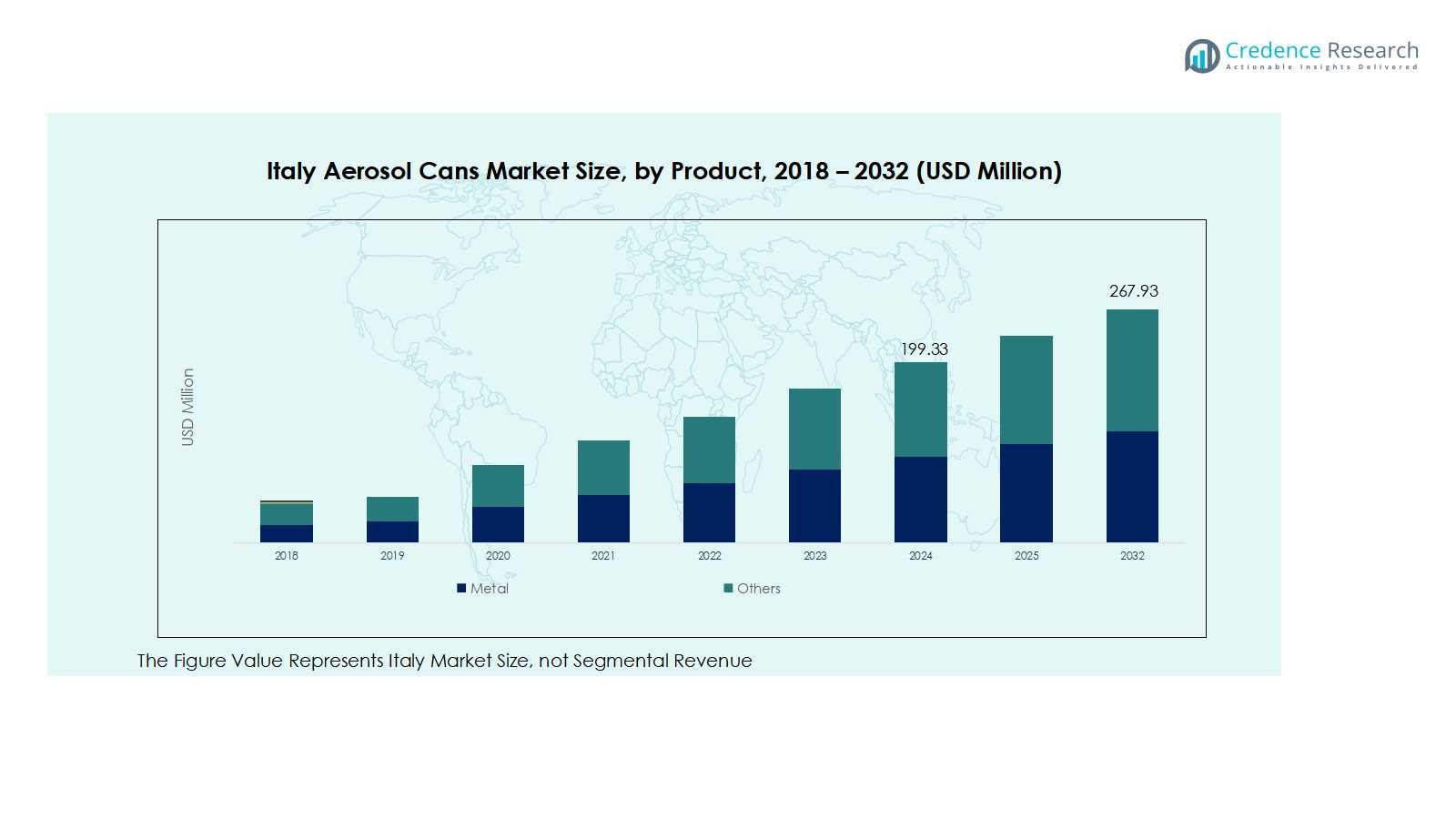

Italy Aerosol Cans Market size was valued at USD 179.01 million in 2018 and grew to USD 199.33 million in 2024. The market is anticipated to reach USD 267.93 million by 2032, registering a CAGR of 3.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Aerosol Cans Market Size 2024 |

USD 199.33 Million |

| Italy Aerosol Cans Market, CAGR |

3.77% |

| Italy Aerosol Cans Market Size 2032 |

USD 267.93 Million |

The Italy Aerosol Cans Market is highly competitive, with leading players such as Ardagh Metal Packaging, Trivium Packaging, Ball Corporation (Ball Packaging Europe), TUBEX GmbH, G. Staehle GmbH & Co. KG, TUNAP Group, Pirlo Group, and Nucan/Nussbaum driving innovation and market expansion. These companies focus on sustainable metal and composite cans, advanced formulations, and strategic partnerships to strengthen their regional presence. Northern Italy emerges as the dominant region, capturing 38% of the market, fueled by high industrial activity, urban consumer demand, and robust manufacturing infrastructure. Central Italy follows with 27% share, driven by growing personal care and home care product consumption, while Southern Italy and Insular Italy hold 20% and 15%, respectively, benefiting from expanding urbanization, retail networks, and adoption of eco-friendly aerosol packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Aerosol Cans Market was valued at USD 199.33 million in 2024 and is projected to reach USD 267.93 million by 2032, growing at a CAGR of 3.77%.

- Rising demand in personal care and home care products, including deodorants, hair sprays, and cleaning sprays, is driving market growth, supported by convenience, hygienic dispensing, and urban lifestyle trends.

- Market trends indicate increasing adoption of sustainable and recyclable metal cans, lightweight and refillable designs, and innovations in premium and specialty aerosol products across personal care, home care, and industrial applications.

- The competitive landscape is dominated by Ardagh Metal Packaging, Trivium Packaging, Ball Corporation, TUBEX GmbH, G. Staehle GmbH & Co. KG, TUNAP Group, Pirlo Group, and Nucan/Nussbaum, focusing on product innovation, partnerships, and sustainable packaging to maintain leadership.

- Northern Italy leads the regional market with 38% share, followed by Central Italy at 27%, Southern Italy at 20%, and Insular Italy at 15%, with metal cans dominating 72% of the product segment.

Market Segmentation Analysis:

By Product

In Italy, metal aerosol cans dominate the product segment, capturing approximately 72% of the market share due to their durability, recyclability, and ability to preserve high-pressure formulations. The segment benefits from rising demand across personal care, home care, and automotive industries, where product protection and precision dispensing are essential. The ‘Others’ segment, including plastic and composite cans, holds around 28% share, driven by lightweight design, cost-efficiency, and increasing adoption in personal care and household products. Innovations in sustainable composites and refillable solutions further support growth in this segment.

- For instance, Tecnocap, a leading European manufacturer, produces aluminum monobloc aerosol cans widely used across personal care, household, and industrial applications, emphasizing lightweight design and recyclability.

By Application

Personal care applications lead the market, contributing nearly 35% of revenue, driven by deodorants, hair sprays, and skincare products, where convenience and hygienic dispensing are key. Home care aerosols hold about 25% share, propelled by air fresheners and cleaning sprays amid growing hygiene awareness. Insecticide sprays account for 15%, fueled by pest control needs and eco-friendly formulations. Automotive aerosols contribute 12%, driven by lubricants, cleaners, and protective coatings, while other niche applications, including industrial coatings and adhesives, make up 13% of the market.

- For instance, BASF’s Intrepid insecticide, based on Chlorfenapyr, offers targeted pest control for crops like chili and cabbage with a novel mode of action disrupting insect energy production.

Key Growth Drivers

Rising Demand in Personal Care and Home Care Applications

The growing preference for convenient and hygienic personal care and home care products is a major driver for the Italy aerosol cans market. Consumers increasingly favor deodorants, hair sprays, air fresheners, and cleaning sprays in aerosol packaging due to precise dispensing, portability, and extended shelf life. Expanding urban populations and busy lifestyles further fuel demand. Manufacturers are responding with innovative formulations and sustainable packaging, ensuring product safety and durability. This trend strengthens adoption across both retail and professional sectors, supporting consistent market growth.

- For instance, major brands like L’Oréal and Schwarzkopf expand aerosol hairspray offerings with innovative, eco-conscious formulations that capture growing demand for strong hold and sustainable products in Europe.

Expanding Industrial and Automotive Applications

Industrial and automotive sectors are driving aerosol can usage in Italy, particularly for lubricants, protective coatings, and specialized sprays. Aerosol packaging offers precise application, contamination-free delivery, and durability for harsh environments, making it ideal for workshops and manufacturing units. Rising vehicle maintenance awareness, aftermarket activities, and demand for high-performance coatings contribute to market expansion. Innovations in eco-friendly formulations, corrosion protection, and multi-functional sprays further enhance adoption, making the industrial and automotive applications a key pillar of sustained market growth.

- For instance, Delta Protekt’s zinc flake spray provides a thin, electrochemical corrosion protection layer widely used in automotive and industrial applications to protect metal components against harsh environmental conditions.

Focus on Sustainable and Recyclable Packaging

Sustainability initiatives are significantly influencing the Italy aerosol cans market. Metal cans, which are highly recyclable, dominate the segment, while manufacturers are introducing composite and refillable options to reduce environmental impact. Regulatory support for eco-friendly packaging and growing consumer awareness of sustainable products are driving adoption. Companies are investing in lightweight, recyclable, and biodegradable solutions, aligning with circular economy practices. This focus on sustainability not only meets environmental compliance but also appeals to environmentally conscious consumers, boosting market demand across personal care, home care, and industrial sectors.

Key Trends & Opportunities

Innovation in Product Formulations

Manufacturers in Italy are increasingly focusing on innovative aerosol formulations to enhance product performance, safety, and user experience. From improved fragrance delivery in personal care to multi-purpose cleaning and protective sprays, innovation drives consumer adoption. Eco-friendly and bio-based formulations are gaining traction, opening new market opportunities. Additionally, lightweight and refillable designs create potential for cost savings and reduced environmental impact, offering companies a competitive edge and strengthening their position in both domestic and international markets.

- For instance, Unilever’s Cif Infinite Clean, a multi-purpose cleaning spray formulated with probiotics and a continuous mist delivery system, designed to provide longer-lasting cleaning even after application, while reducing plastic waste by 50% with a ‘Re-load’ pack design.

Growth in Premium and Specialty Applications

The Italian market is witnessing growth in premium and specialty aerosol products, including luxury personal care, professional cleaning solutions, and industrial specialty sprays. Consumers are willing to pay a premium for high-quality, convenient, and environmentally responsible aerosol products. This trend encourages manufacturers to explore niche applications, expand product portfolios, and differentiate offerings. The rising adoption of smart packaging, multifunctional sprays, and customizable solutions presents opportunities for innovation and increased market penetration, particularly in urban and high-income consumer segments.

- For instance, HSA Cosmetics in Varese specializes in luxury personal care aerosols, offering customized formulations and packaging to global brands, emphasizing Italian craftsmanship and sustainability.

Key Challenges

Regulatory Compliance and Environmental Concerns

Stringent regulations on volatile organic compounds (VOCs), propellants, and environmental safety pose challenges for aerosol can manufacturers in Italy. Compliance with EU standards requires investment in research and development, reformulation, and testing. Companies must balance regulatory adherence with cost efficiency while maintaining product performance. Additionally, environmental concerns regarding waste management and recyclability of composite cans increase operational complexity. Navigating these regulatory frameworks can limit production flexibility, slowing market expansion and requiring manufacturers to adopt sustainable practices proactively.

Rising Raw Material Costs

Fluctuating prices of aluminum, steel, plastics, and propellants impact the profitability of aerosol can manufacturers. Rising raw material costs create pressure on manufacturers to optimize production processes, manage supply chain efficiencies, and maintain competitive pricing. Cost increases may also affect smaller players disproportionately, limiting market entry and innovation. Companies are exploring alternative materials, lightweight designs, and efficient manufacturing technologies to mitigate these challenges, but market growth may still face headwinds in periods of sustained material price volatility.

Regional Analysis

Northern Italy

Northern Italy leads the aerosol cans market with a share of 38%, driven by high industrial activity and urban consumer demand. The region hosts major manufacturing hubs for personal care, home care, and automotive products, which rely heavily on durable metal and composite aerosol packaging. Strong distribution networks, rising disposable income, and awareness of sustainable packaging further fuel growth. Northern Italy also benefits from advanced logistics and proximity to export markets, allowing companies to efficiently serve both domestic and international customers. Innovation in premium and specialty aerosol products strengthens its dominance in the regional market.

Central Italy

Central Italy accounts for 27% of the market share, supported by a growing consumer base for personal care and home care aerosols. Urban centers like Rome and Florence drive demand for hygiene, cleaning, and cosmetic products packaged in metal and composite aerosol cans. The region benefits from a mix of established domestic manufacturers and emerging specialty players focusing on sustainable and refillable designs. Increasing disposable income, lifestyle-driven consumption, and the presence of research and development facilities contribute to regional growth. Central Italy also sees steady expansion in niche industrial aerosol applications, reinforcing market development.

Southern Italy

Southern Italy holds 20% of the aerosol cans market, propelled by expanding industrial and home care demand in urban and semi-urban areas. While the region lags slightly behind the north in industrial infrastructure, growing consumer awareness of convenience products and increased adoption of personal care aerosols are key growth drivers. Manufacturers are investing in distribution and localized production to capture this market. Demand for cost-efficient and eco-friendly packaging options is rising, encouraging companies to introduce lightweight metal and composite cans. The region is gradually emerging as an important contributor to Italy’s overall aerosol cans market growth.

Insular Italy (Sicily and Sardinia)

Insular Italy represents 15% of the market share, driven primarily by residential and small-scale industrial demand. Consumers increasingly adopt personal care, home care, and insecticide aerosols due to portability, convenience, and hygienic dispensing. The region benefits from expanding retail networks and seasonal tourism, which boosts temporary demand for personal care and insecticide products. Logistics challenges are being mitigated by localized warehousing and partnerships with national distributors. Manufacturers are also exploring lightweight and recyclable cans to meet sustainability expectations, enhancing adoption. Despite limited industrial density compared to the mainland, Insular Italy maintains steady market growth through targeted regional strategies.

Market Segmentations:

By Product:

By Application:

- Personal Care

- Home Care

- Insecticide

- Automotive

- Others

By Region

- Northern Italy

- Central Italy

- Southern Italy

- Insular Italy

Competitive Landscape

The competitive landscape of the Italy aerosol cans market is dominated by key players such as Ardagh Metal Packaging, Trivium Packaging, Ball Corporation (Ball Packaging Europe), TUBEX GmbH, G. Staehle GmbH & Co. KG, TUNAP Group, Pirlo Group, and Nucan/Nussbaum. These companies focus on innovation, product quality, and sustainable packaging solutions to maintain market leadership. Strategies such as mergers, acquisitions, partnerships, and technological advancements enable them to expand their regional presence and product portfolios. The market is characterized by high competition in personal care, home care, and industrial applications, with players investing in metal and composite cans to meet evolving consumer demand. Increasing emphasis on recyclable and eco-friendly packaging drives differentiation, while consistent R&D and strategic collaborations strengthen their position, ensuring responsiveness to regulatory changes and emerging market trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Ferrari Meccanica, a prominent Italian steel packaging manufacturer, acquired 100% of Metal Press S.p.A., a leading producer of aerosol cans and tinplate components. This strategic move aims to enhance production efficiencies and strengthen their market position within the aerosol sector.

- In December 2024, Sonoco Products Company finalized the acquisition of Eviosys, a leading European manufacturer of metal packaging, including aerosol cans. This $3.9 billion deal strengthens Sonoco’s capabilities in the aerosol sector and establishes a leading platform for metal food cans and aerosol packaging.

- In March 2025, Ferrari Meccanica, a division of the New Box Group, acquired Metal Press, a leading manufacturer of tinplate aerosol cans. This acquisition aims to enhance production efficiencies and strengthen Ferrari Meccanica’s position in the aerosol sector.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy aerosol cans market is expected to experience steady growth driven by rising demand across personal care and home care sectors.

- Increasing adoption of sustainable and recyclable metal packaging will remain a key growth factor.

- Manufacturers will continue to innovate with lightweight, eco-friendly, and refillable aerosol can designs.

- Expanding industrial and automotive applications will enhance the overall market potential.

- Rising consumer awareness of hygiene and convenience products will fuel aerosol-based product demand.

- Technological advancements in propellants and coatings will improve product efficiency and safety.

- Companies are likely to strengthen local production capacities to meet growing domestic demand.

- Strategic partnerships and mergers among leading players will enhance market competitiveness.

- Regulatory emphasis on environmental compliance will accelerate the transition to greener packaging solutions.

- Growth in premium and specialty aerosol products will open new opportunities in niche market segments.