Market Overview

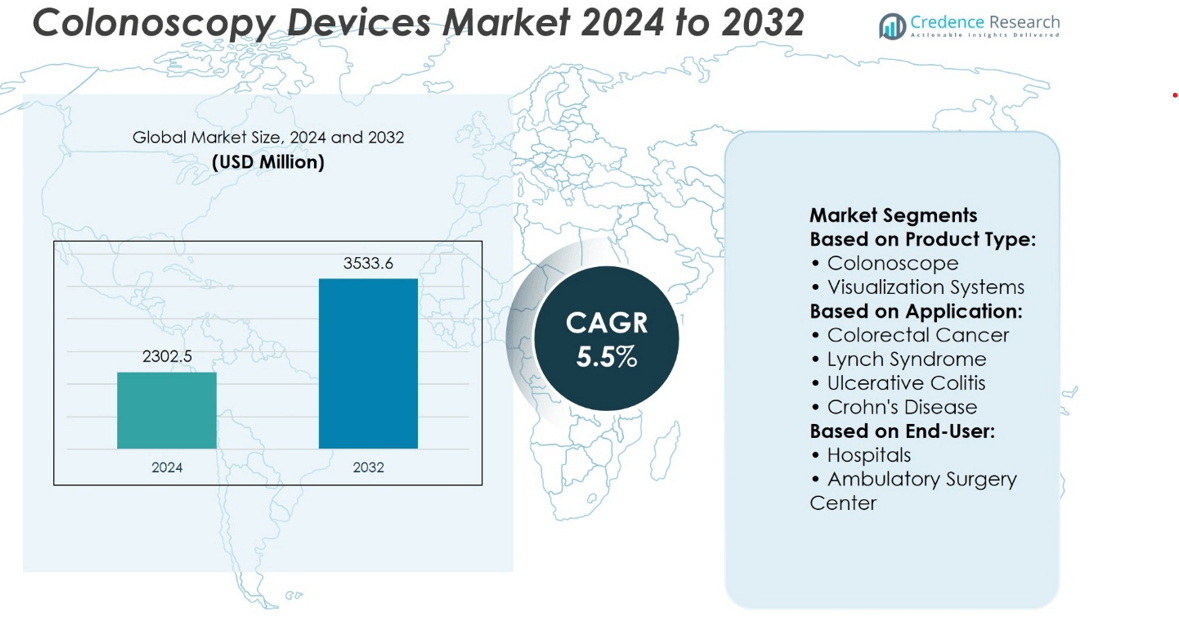

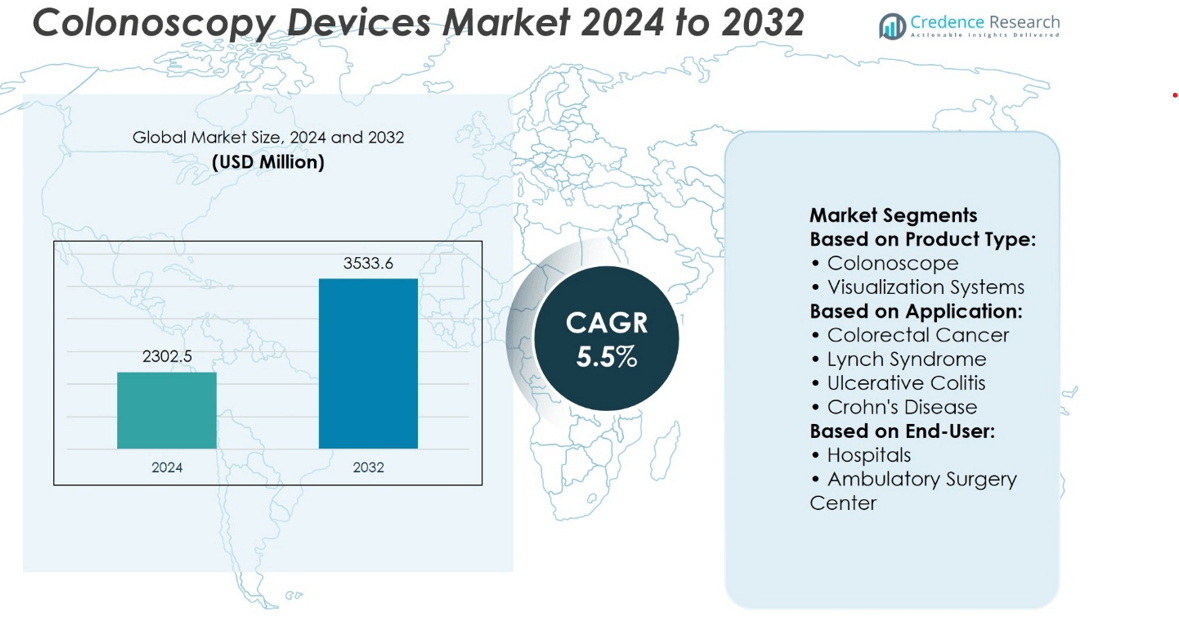

Colonoscopy Devices Market size was valued at USD 2302.5 million in 2024 and is anticipated to reach USD 3533.6 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Colonoscopy Devices Market Size 2024 |

USD 2302.5 million |

| Colonoscopy Devices Market, CAGR |

5.5% |

| Colonoscopy Devices Market Size 2032 |

USD 3533.6 million |

The Colonoscopy Devices Market is driven by rising colorectal cancer incidence, growing awareness of preventive screening, and expanding healthcare infrastructure across emerging economies. Demand for minimally invasive procedures and early diagnosis continues to grow, supported by favorable reimbursement policies. Technological advancements such as AI-integrated imaging, disposable colonoscopes, and robotic-assisted systems are reshaping clinical practices. The market also benefits from the shift toward outpatient care and increasing investments in endoscopic training and equipment upgrades. These trends reflect a broader move toward efficient, patient-centric diagnostics that prioritize safety, accuracy, and operational efficiency across both developed and developing healthcare systems.

North America leads the Colonoscopy Devices Market due to advanced healthcare infrastructure and high screening rates, followed by Europe with strong public health initiatives. Asia-Pacific shows rapid growth driven by increasing awareness and expanding medical access, while Latin America and the Middle East & Africa present emerging opportunities. Key players in the market include Boston Scientific Corp., FUJIFILM Holdings Corp., Ambu AS, Conmed Corp., Getinge AB, Cosmo Pharmaceuticals NV, Endomed Systems GmbH, Consis Medical, G.I. View Ltd., and Guangzhou MeCan Medical Ltd.

Market Insights

- Colonoscopy Devices Market size was valued at USD 2302.5 million in 2024 and is projected to reach USD 3533.6 million by 2032, growing at a CAGR of 5.5%.

- Rising cases of colorectal cancer and increasing awareness about early screening are major drivers of market growth.

- AI-integrated imaging systems, disposable colonoscopes, and robotic-assisted technologies are key trends reshaping clinical diagnostics.

- The market is competitive, with companies focusing on innovation, regional expansion, and strategic collaborations to strengthen market presence.

- High equipment costs and limited access in low-income regions remain significant restraints affecting market penetration.

- North America dominates the market due to strong healthcare infrastructure, while Asia-Pacific shows rapid growth with improved medical access.

- Key players include Boston Scientific Corp., FUJIFILM Holdings Corp., Ambu AS, Conmed Corp., Getinge AB, Cosmo Pharmaceuticals NV, Endomed Systems GmbH, Consis Medical, G.I. View Ltd., and Guangzhou MeCan Medical Ltd.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Incidence of Colorectal Cancer and Growing Awareness of Preventive Screening

The Colonoscopy Devices Market is experiencing growth due to the rising global prevalence of colorectal cancer. Governments and healthcare organizations are actively promoting early screening programs, encouraging more individuals to undergo colonoscopies. Public health campaigns have improved awareness of the importance of preventive diagnosis, contributing to increased procedure volumes. It benefits from the expanding aging population, which is more susceptible to colorectal diseases. Early detection remains a critical factor in reducing mortality rates, driving demand for advanced diagnostic tools. The growing acceptance of routine screening protocols strengthens the market’s position in both developed and emerging economies.

- For instance, Boston Scientific reported that its latest colonoscopy system achieved a withdrawal time reduction from 7.5 minutes to 6.1 minutes in clinical trials involving over 500 procedures.

Expansion of Healthcare Infrastructure and Increase in Procedure Volumes

The Colonoscopy Devices Market gains momentum from expanding healthcare infrastructure, especially in developing countries. Hospitals and diagnostic centers are investing in endoscopy suites and upgrading their equipment to support complex procedures. It sees strong demand from urban hospitals and outpatient clinics, where procedure volumes are steadily increasing. Government-backed healthcare reforms are helping boost accessibility and affordability of colonoscopy procedures. Private sector involvement in healthcare delivery is also expanding the availability of colonoscopy services. The broader reach of medical services enhances the adoption of advanced colonoscopy technologies.

- For instance, Medtronic reported that in 2023, its colonoscopy device installations increased by 350 units across Asia-Pacific hospitals, supporting over 20,000 additional procedures annually.

Technological Advancements in Visualization and Device Functionality

Innovations in imaging and device design are enhancing the efficiency and precision of colonoscopy procedures. The Colonoscopy Devices Market benefits from high-definition video systems, flexible endoscopes, and computer-aided detection technologies. These improvements support better polyp detection and reduce procedural complications, increasing physician confidence. It also sees growth from disposable colonoscopes that help prevent cross-contamination and lower infection risks. Integration of artificial intelligence and robotics is streamlining procedures and shortening recovery time. These advancements contribute to faster diagnostics and greater patient comfort.

Growing Preference for Minimally Invasive Procedures and Outpatient Care

The Colonoscopy Devices Market is supported by the rising demand for minimally invasive diagnostic techniques. Patients prefer colonoscopies over surgical alternatives due to lower risks, shorter hospital stays, and quicker recovery. It is further supported by the shift toward outpatient care, which reduces costs and improves scheduling flexibility. Healthcare providers are optimizing colonoscopy workflows to increase daily case volumes without compromising quality. Insurance coverage and reimbursement policies now favor routine colonoscopy, encouraging broader participation. The convenience and efficiency of the procedure continue to drive strong market demand.

Market Trends

Increased Adoption of Disposable Colonoscopes to Reduce Infection Risk

Hospitals and clinics are steadily shifting toward disposable colonoscopes to minimize cross-contamination and infection risks. This shift reflects a growing emphasis on patient safety and infection control protocols. The Colonoscopy Devices Market benefits from demand for single-use devices that eliminate the need for complex reprocessing. It supports operational efficiency by reducing downtime between procedures. Regulatory bodies are also encouraging adoption of disposable equipment to improve hygiene standards. The trend aligns with growing awareness about hospital-acquired infections and the need for sterile diagnostic environments.

- For instance, Ambu reported that its single-use colonoscope, the Ambu® aScope™ 4, was used in over 15,000 procedures worldwide in 2023, helping healthcare providers eliminate.

Integration of Artificial Intelligence to Enhance Diagnostic Accuracy

Artificial intelligence is gaining traction in endoscopic imaging and polyp detection. AI algorithms assist physicians by highlighting abnormal tissues in real time, improving diagnostic accuracy and procedure efficiency. The Colonoscopy Devices Market is seeing strong interest in AI-powered systems that support faster clinical decision-making. It helps reduce variability in results and supports standardized reporting. AI also contributes to reduced oversight and improved lesion detection rates. Technology developers are investing in software platforms that seamlessly integrate with existing colonoscopy systems.

- For instance, Medtronic’s GI Genius system demonstrated in clinical trials involving 1,058 patients that AI-assisted colonoscopy increased adenoma detection by 18 additional adenomas per 1,000 procedures compared to standard colonoscopy.

Rising Use of Robotic-Assisted Colonoscopy for Improved Maneuverability

Robotic-assisted colonoscopy is emerging as a promising technique for navigating the colon with enhanced precision and reduced discomfort. It is designed to improve scope control and minimize looping, a common source of patient pain. The Colonoscopy Devices Market is witnessing increasing investments in robotic platforms that combine automation with operator control. It allows smoother insertion, improved visualization, and potentially shorter procedure times. Hospitals are adopting robotic systems to improve both patient outcomes and physician workflow. This trend supports the evolution of colonoscopy from manual to precision-guided procedures.

Growing Emphasis on Outpatient Procedures and Ambulatory Settings

Healthcare providers are shifting colonoscopy procedures to outpatient centers to reduce costs and enhance convenience. The Colonoscopy Devices Market aligns with this trend by offering compact, portable, and easy-to-use systems. It enables high-throughput diagnostics in ambulatory surgical centers and standalone clinics. Demand for outpatient procedures is rising among patients seeking minimal disruption to daily life. Insurance coverage and healthcare reforms are supporting the growth of non-hospital-based care. The trend reflects a broader movement toward value-based healthcare delivery.

Market Challenges Analysis

High Cost of Devices and Limited Access in Low-Income Regions

The high cost of colonoscopy systems and related accessories remains a major barrier to widespread adoption, particularly in low- and middle-income countries. Advanced colonoscopy equipment involves significant capital investment, which many smaller hospitals and clinics cannot afford. The Colonoscopy Devices Market faces challenges in regions with underfunded healthcare infrastructure and limited reimbursement coverage. It struggles to expand in rural and remote areas where endoscopy services are scarce or nonexistent. Cost constraints also limit the adoption of newer technologies such as AI integration and robotic systems. Many facilities continue to rely on outdated equipment, which hampers diagnostic accuracy and patient outcomes.

Shortage of Trained Professionals and Procedure-Related Discomfort

A shortage of skilled gastroenterologists and trained technicians limits the scalability of colonoscopy services. It affects both developed and developing regions where demand for diagnostic procedures is increasing but workforce growth remains slow. The Colonoscopy Devices Market is impacted by this talent gap, which restricts procedure volumes and delays patient access to timely screening. Patient apprehension due to discomfort and preparation-related inconvenience also contributes to low participation rates. It faces resistance from individuals unwilling to undergo invasive procedures, despite rising awareness of preventive care. Improving training programs and enhancing patient education remain critical to overcoming these obstacles.

Market Opportunities

Expansion into Emerging Markets with Growing Healthcare Investments

Rising healthcare investments in emerging economies present strong growth potential for the Colonoscopy Devices Market. Governments in Asia, Latin America, and Africa are prioritizing cancer screening and early diagnostics through national health programs. It can benefit from increasing funding directed toward improving hospital infrastructure and equipping diagnostic centers. Rising disposable incomes and better healthcare access are encouraging more individuals to opt for preventive screenings. International manufacturers have an opportunity to establish local partnerships and distribution networks in these underserved markets. Launching cost-effective product lines tailored for budget-constrained regions can further enhance market penetration.

Development of Compact, Portable, and AI-Integrated Systems

There is growing demand for compact and AI-enabled colonoscopy devices that offer ease of use in outpatient and mobile care settings. It supports the need for flexible and efficient diagnostic tools that can operate in diverse clinical environments. The Colonoscopy Devices Market can tap into opportunities by designing equipment that reduces procedure time while maintaining accuracy. Integration of artificial intelligence, cloud connectivity, and automated reporting offers value to both clinicians and healthcare administrators. The shift toward remote diagnostics and tele-endoscopy platforms opens new avenues for innovation. Manufacturers that prioritize portability and smart features are well-positioned to gain a competitive edge.

Market Segmentation Analysis:

By Product Type

The product type segment includes colonoscopes, visualization systems, and other related devices. Colonoscopes dominate the market due to their essential role in direct examination of the colon and rectum. High demand for flexible and video colonoscopes drives growth in this category. Visualization systems also hold a significant share, as advanced imaging is critical for detecting small polyps and lesions with accuracy. It benefits from innovations such as high-definition imaging and narrow-band technology that enhance diagnostic precision. Other product types, including accessories and auxiliary tools, contribute to operational efficiency and procedural success.

- For instance, Olympus Corporation recorded sales of over 25,000 colonoscope units globally in 2023, highlighting strong demand for its EVIS X1 system, which features enhanced image clarity and advanced scope flexibility.

By Applications

Based on applications, the market is segmented into colorectal cancer, Lynch syndrome, ulcerative colitis, Crohn’s disease, and other gastrointestinal conditions. Colorectal cancer remains the leading application area, supported by growing awareness, rising screening rates, and government-led prevention initiatives. The Colonoscopy Devices Market continues to grow with increased early detection efforts aimed at reducing cancer mortality. Lynch syndrome and inflammatory bowel diseases such as ulcerative colitis and Crohn’s disease are also driving segmental growth. It supports long-term monitoring and diagnosis for patients requiring repeated evaluations. Broader clinical use for identifying gastrointestinal symptoms further extends the market’s relevance.

- For instance, Pentax Medical reported that its colonoscopy systems were used in over 12,000 colorectal cancer screening procedures in 2023, with advanced imaging technologies aiding in the early detection of lesions.

By End User

The end-user segment includes hospitals and ambulatory surgery centers. Hospitals account for the largest share due to high procedure volumes, access to advanced technologies, and availability of trained gastroenterologists. It sees strong equipment demand from multispecialty hospitals investing in endoscopy suites. Ambulatory surgery centers are emerging as a fast-growing segment, driven by the trend toward minimally invasive outpatient procedures. These centers offer lower operational costs and greater scheduling flexibility for both patients and clinicians. The shift toward decentralized diagnostic services strengthens the role of both end-user segments in supporting future market growth.

Segments:

Based on Product Type:

- Colonoscope

- Visualization Systems

Based on Application:

- Colorectal Cancer

- Lynch Syndrome

- Ulcerative Colitis

- Crohn’s Disease

Based on End-User:

- Hospitals

- Ambulatory Surgery Center

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share in the Colonoscopy Devices Market, accounting for 41.3% of the global revenue. The region benefits from well-established healthcare infrastructure, high awareness of colorectal screening, and strong reimbursement policies. The United States leads the region, supported by national screening programs such as those recommended by the U.S. Preventive Services Task Force (USPSTF). It also benefits from early adoption of advanced technologies, including AI-assisted colonoscopy and robotic endoscopy systems. High procedure volumes, particularly in outpatient settings, contribute to consistent device demand. Canada follows with significant investments in cancer screening programs and public healthcare support. The presence of major medical device manufacturers and continuous product innovation further strengthen the region’s dominance.

Europe

Europe captures a 26.7% share of the Colonoscopy Devices Market, supported by robust healthcare systems and increasing emphasis on early cancer detection. Countries such as Germany, France, and the United Kingdom have integrated colorectal cancer screening into national health agendas. It sees demand growth from an aging population and rising incidence of gastrointestinal disorders. European governments are investing in minimally invasive diagnostic technologies and expanding public awareness campaigns. Germany represents the largest market within the region due to high procedural volumes and infrastructure readiness. Innovation in visualization systems and compliance with strict regulatory standards push manufacturers toward continual device upgrades. Cross-border collaboration among EU countries in healthcare also supports market expansion.

Asia-Pacific

Asia-Pacific holds an 18.5% share and represents one of the fastest-growing regions in the Colonoscopy Devices Market. Rapid urbanization, growing healthcare expenditure, and increasing awareness of preventive diagnostics drive demand. Japan and China lead the region with large patient populations and ongoing technological adoption. It faces challenges from regional disparities in access, but government-led initiatives in cancer screening are improving early detection rates. India, South Korea, and Australia are also contributing to market growth through public-private healthcare partnerships and expanding endoscopy service capacity. Rising medical tourism and improved access to trained professionals support sustained development. Manufacturers have opportunities to provide cost-effective, portable solutions tailored for regional needs.

Latin America

Latin America accounts for 7.6% of the global market, with Brazil and Mexico leading in adoption of colonoscopy devices. Public health systems are increasing their focus on cancer screening and early diagnosis. It benefits from international collaborations aimed at enhancing endoscopic training and improving clinical capabilities. Infrastructure limitations and economic constraints continue to restrict widespread access, particularly in rural regions. However, private sector growth and increased availability of outpatient centers are supporting gradual improvement. Brazil’s national cancer plan and public investment in healthcare are expected to contribute to market expansion. Regional demand for less invasive and lower-cost technologies creates a favorable environment for new entrants.

Middle East & Africa

The Middle East and Africa hold the smallest share at 5.9%, primarily due to limited healthcare access and resource constraints in several countries. The Colonoscopy Devices Market in this region is gradually expanding with infrastructure development and increased public health funding. The Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, are investing in advanced diagnostic services. It faces barriers related to awareness, affordability, and trained personnel, especially in sub-Saharan Africa. International partnerships and mobile healthcare initiatives are helping bridge these gaps. The market has potential to grow with increased focus on preventive care and government-backed screening programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FUJIFILM Holdings Corp.

- Consis Medical

- Ambu AS

- Getinge AB

- Cosmo Pharmaceuticals NV

- Endomed Systems GmbH

- I. View Ltd.

- Guangzhou MeCan Medical Ltd.

- Boston Scientific Corp.

- Conmed Corp.

Competitive Analysis

The Colonoscopy Devices Market include Boston Scientific Corp., FUJIFILM Holdings Corp., Ambu AS, Conmed Corp., Getinge AB, Cosmo Pharmaceuticals NV, Endomed Systems GmbH, Consis Medical, G.I. View Ltd., and Guangzhou MeCan Medical Ltd. The Colonoscopy Devices Market remains highly competitive, driven by innovation, strategic partnerships, and expanding global healthcare demands. Companies focus on developing advanced technologies such as AI-integrated visualization systems, single-use endoscopes, and robotic-assisted colonoscopy platforms to enhance diagnostic accuracy and procedural efficiency. Rising demand for minimally invasive and outpatient procedures continues to influence product development and distribution strategies. Market participants actively invest in research and development to gain regulatory approvals and launch differentiated solutions. The competitive landscape is also shaped by efforts to expand into emerging markets through localized manufacturing, cost-effective product lines, and collaborative healthcare initiatives. Strong emphasis on infection control, patient comfort, and workflow optimization continues to drive product upgrades and competitive positioning across regions.

Recent Developments

- In April 2024, Medtronic introduced ColonPRO, its latest software for the AI-powered GI Genius system, representing a notable leap forward. The software aims to revolutionize GI screening by aiding gastroenterologists during colonoscopies.

- In March 2024, Endostart secured FDA 510(k) clearance for its leading product, Endorail. Endorail, a magnetic balloon solution, is designed to enhance the outcomes of colonoscopy procedures.

- In Jan 2023, Olympus Corporation and Fujifilm Corporation, two major players in the market, formed a strategic partnership to jointly develop and market advanced endoscopic technologies.

Market Concentration & Characteristics

The Colonoscopy Devices Market exhibits moderate to high market concentration, with a few global players holding significant shares due to their technological expertise, broad product portfolios, and established distribution networks. It is characterized by rapid innovation, with manufacturers focusing on developing advanced visualization systems, disposable devices, and AI-powered diagnostic tools to improve accuracy and reduce procedural risks. Regulatory compliance, clinical efficacy, and product reliability remain key factors influencing purchasing decisions among hospitals and outpatient centers. The market shows a strong preference for minimally invasive technologies that support shorter recovery times and enhanced patient comfort. It is driven by clinical demand for early detection of colorectal conditions and an aging global population requiring routine screening. While mature markets in North America and Europe dominate in revenue, emerging economies offer growth opportunities through expanding healthcare infrastructure and rising awareness of preventive diagnostics. Competitive dynamics favor companies that can adapt to regional needs with cost-effective and high-performance solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with rising global awareness about early colorectal cancer screening.

- Adoption of AI-assisted colonoscopy systems will increase diagnostic accuracy and efficiency.

- Demand for single-use colonoscopes will rise due to stricter infection control protocols.

- Portable and compact devices will gain popularity in outpatient and ambulatory settings.

- Emerging economies will offer strong growth potential through healthcare infrastructure expansion.

- Robotics and automation will improve procedure precision and reduce patient discomfort.

- Manufacturers will invest more in cloud-connected and data-driven diagnostic platforms.

- Training programs for endoscopy professionals will expand to address skill shortages.

- Reimbursement policies will evolve to support wider access to preventive colonoscopy services.

- Strategic partnerships and regional collaborations will drive product innovation and market penetration.