Market Overview

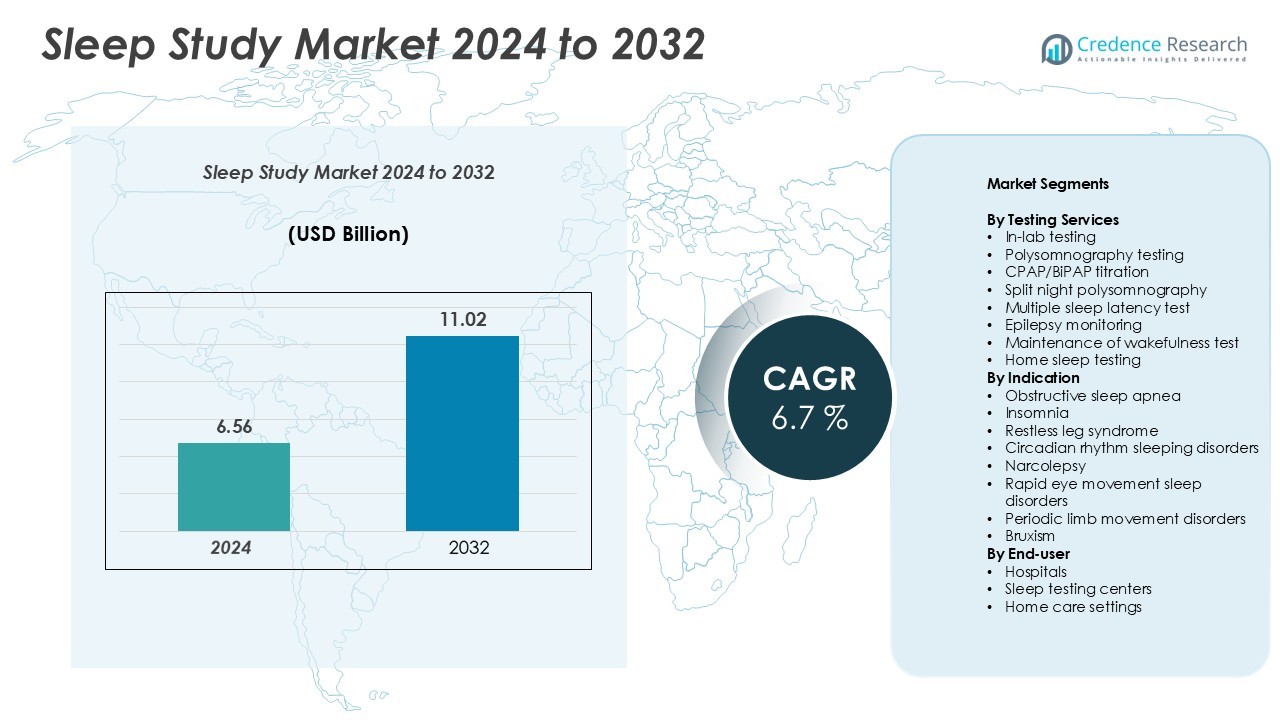

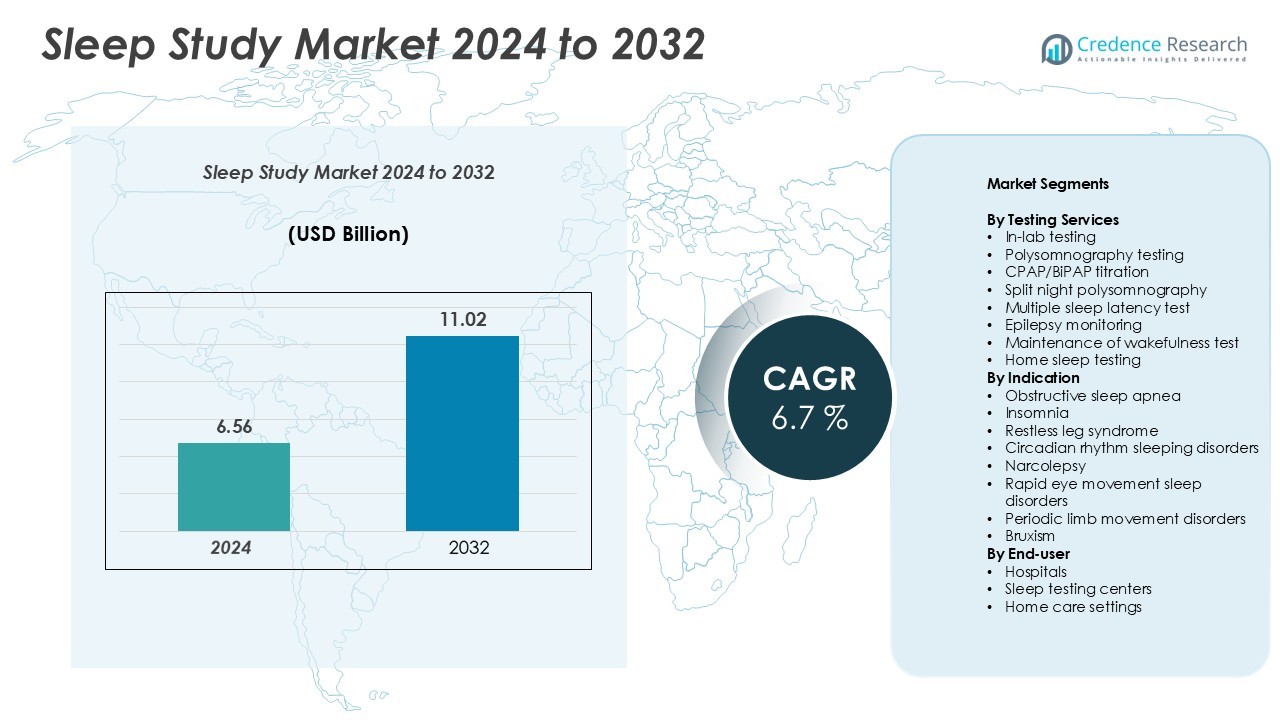

The Sleep Study Market size was valued at USD 6.56 billion in 2024 and is anticipated to reach USD 11.02 billion by 2032, growing at a CAGR of 6.7% during the forecast period

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sleep Study Market Size 2024 |

USD 6.56 Billion |

| Sleep Study Market , CAGR |

6.7% |

| Sleep Study Market Size 2032 |

USD 11.02 Billion |

The Sleep Study Market is led by major players including Koninklijke Philips N.V., Cleveland Clinic, Millennium Sleep Lab, MedStar Health, London Sleep Centre, and Circle Health Group. These companies dominate through advanced diagnostic technologies, AI-driven sleep monitoring, and integrated telehealth services. Philips leads global innovation with connected home sleep testing solutions, while Cleveland Clinic and MedStar Health enhance clinical accuracy through digital polysomnography systems. Academic centers such as Imperial College Healthcare NHS Trust and Korea University Medicine contribute to research-driven advancements. Regionally, North America holds the largest share at 38%, supported by strong healthcare infrastructure, reimbursement coverage, and widespread adoption of home-based sleep diagnostics, positioning it as the global hub for sleep study innovations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sleep Study Market was valued at USD 6.56 billion in 2024 and is projected to reach USD 11.02 billion by 2032, growing at a CAGR of 6.7%.

- Rising cases of sleep apnea, insomnia, and other disorders drive market growth, with in-lab testing holding a 56% share due to high diagnostic precision.

- Technological advancements such as AI-based scoring, wearable monitoring, and home sleep testing are shaping modern diagnostic approaches and expanding accessibility.

- Key players like Koninklijke Philips N.V., Cleveland Clinic, and MedStar Health are investing in connected systems and telehealth platforms, while high equipment costs and a shortage of skilled technologists restrain widespread adoption.

- Regionally, North America leads with a 38% market share, followed by Europe at 27% and Asia-Pacific at 22%, supported by healthcare infrastructure, insurance coverage, and increasing awareness of sleep health across major economies.

Market Segmentation Analysis:

By Testing Services

In-lab testing dominates the Sleep Study Market with a 56% share, driven by its high diagnostic accuracy and comprehensive patient monitoring capabilities. Polysomnography remains the most widely used in-lab method, offering multi-parameter evaluation of brain activity, breathing, and limb movement. For instance, Nox Medical’s Nox A1s PSG system enables real-time data capture with 99% signal fidelity, enhancing clinician decision-making. The increasing prevalence of sleep apnea and advancements in CPAP/BiPAP titration technologies are driving segment growth. Meanwhile, home sleep testing is gaining traction due to its convenience and cost-effectiveness for preliminary diagnosis.

- For instance, Nox Medical’s Nox A1s PSG system captures over 32 physiological parameters with high signal quality, ensuring reliable diagnostics, as demonstrated by clinical studies.

By Indication

Obstructive sleep apnea leads the market with a 48% share, supported by the growing elderly population and lifestyle-related disorders. Advanced diagnostic tools now integrate AI-driven analytics for precise apnea-hypopnea detection. For instance, ResMed’s AirView platform processes over 1 billion nights of sleep data, enabling clinicians to optimize therapy. Rising awareness campaigns and favorable insurance coverage for OSA diagnosis further strengthen segment dominance. Other key conditions, including insomnia and restless leg syndrome, are witnessing increased testing demand due to higher screening rates and mental health linkages.

- For instance, The Philips Alice NightOne was a valid home sleep apnea testing device with good diagnostic accuracy, especially for moderate-to-severe sleep apnea. However, the device was recalled and discontinued in the United States and other markets, and patients should now seek alternative testing methods.

By End-user

Hospitals account for the largest market share at 44%, attributed to their advanced infrastructure, specialized technicians, and access to multidisciplinary care teams. These facilities often utilize integrated sleep labs and continuous patient monitoring systems. For instance, Philips Healthcare’s Alice 6 system allows simultaneous monitoring of multiple patients, reducing test turnaround time by 30%. Sleep testing centers are expanding rapidly, offering dedicated facilities with faster diagnosis cycles. Home care settings are also growing as remote monitoring technologies and wearable sleep trackers enhance accessibility for patients preferring at-home assessments.

Key Growth Drivers

Rising Prevalence of Sleep Disorders

The increasing global incidence of sleep disorders such as obstructive sleep apnea, insomnia, and restless leg syndrome is a major growth driver for the Sleep Study Market. Sedentary lifestyles, obesity, and stress contribute significantly to this rise, leading to higher diagnosis and treatment demand. For instance, the American Academy of Sleep Medicine reports that nearly 30 million adults in the U.S. suffer from sleep apnea, yet only 20% receive treatment. This growing gap between diagnosis and care is encouraging healthcare institutions to expand sleep testing facilities. The growing awareness of sleep-related health risks, including cardiovascular diseases and cognitive impairments, further supports market expansion.

- For instance, ResMed’s cloud-connected devices, including the AirSense 11 system, support over 30 million connected devices globally and have amassed over 23 billion nights of clinical sleep data. This extensive data pool, accessible to clinicians through the AirView platform, helps them monitor patient adherence and more effectively manage sleep apnea.

Technological Advancements in Diagnostic Devices

Rapid innovations in diagnostic and monitoring technologies have transformed sleep testing accuracy and efficiency. Advanced wireless sensors, AI-based analytics, and cloud-connected platforms enable real-time data transmission and remote patient evaluation. For instance, Itamar Medical’s WatchPAT ONE device provides a disposable, Bluetooth-enabled home sleep apnea test that eliminates the need for in-lab testing. Such devices enhance patient comfort while maintaining clinical-grade precision. The integration of digital health ecosystems allows clinicians to manage and analyze large data sets, improving diagnostic outcomes. As healthcare systems embrace connected technologies, adoption of digital sleep diagnostics is expected to accelerate across both hospital and home settings.

- For instance, Itamar Medical’s WatchPAT ONE device provides a fully disposable, Bluetooth-enabled home sleep apnea test that records seven key parameters, including oxygen saturation, heart rate, and true sleep time, with over 89% diagnostic correlation to in-lab polysomnography.

Growing Preference for Home Sleep Testing

Home sleep testing (HST) has emerged as a significant growth driver due to its affordability, convenience, and increasing diagnostic accuracy. Technological advancements in portable devices have made home-based assessments a reliable alternative to laboratory testing. For instance, ResMed’s ApneaLink Air enables multi-night monitoring with automatic event detection, achieving up to 90% correlation with in-lab polysomnography. The growing acceptance of telemedicine and insurance reimbursement for HST procedures further fuels adoption. Rising patient preference for comfortable testing environments and minimal hospital visits also supports this shift, particularly in developed markets like North America and Europe.

Key Trends & Opportunities

Integration of Artificial Intelligence and Data Analytics

AI and machine learning are reshaping sleep diagnostics by improving accuracy, predictive analysis, and personalized treatment. Advanced algorithms analyze complex physiological data, identifying apnea events and sleep stages more precisely. For instance, EnsoData’s AI-powered platform analyzes over 87 million data points per study, reducing scoring time by 68% while enhancing reliability. The use of predictive analytics also helps clinicians identify at-risk patients early, enabling preventive care. As hospitals and sleep centers increasingly adopt AI-driven workflows, opportunities for data integration and cloud-based analytics are expanding rapidly.

- For instance, EnsoData’s EnsoSleep AI software evaluates more than 87 million data points per sleep study and automates scoring across over 500,000 tests annually, reducing manual review time by 68% while maintaining over 90% concordance with certified technologists.

Expansion of Telemedicine and Remote Monitoring

Telemedicine integration in sleep testing presents a major opportunity for patient engagement and market expansion. Remote monitoring allows clinicians to oversee therapy adherence and outcomes without in-person visits. For instance, Philips’ Care Orchestrator platform connects over 1 million sleep therapy devices, providing continuous remote care management. Such connectivity enables real-time insights into patient compliance, improving treatment success rates. The growing demand for remote diagnostics in rural areas and during post-pandemic care has positioned telehealth-enabled sleep testing as a key future growth avenue.

- For instance, The Philips Care Orchestrator is a legitimate cloud-based platform for managing sleep and respiratory patients, but the specific metrics regarding connected devices and nightly therapy sessions are outdated due to the widespread Philips Respironics recall initiated in 2021.

Rising Demand for Wearable Sleep Devices

Wearable sleep trackers and portable diagnostic tools are becoming mainstream for continuous monitoring and lifestyle management. Companies are introducing multi-sensor wearables capable of measuring heart rate, oxygen saturation, and sleep stages with medical-grade accuracy. For instance, Fitbit’s Sense 2 and Oura Ring Gen 3 integrate advanced SpO₂ and temperature sensors, providing users with daily sleep insights. These consumer-driven innovations are bridging preventive care and clinical diagnosis, creating new market opportunities for hybrid medical and wellness applications.

Key Challenges

High Cost of In-Lab Sleep Testing and Equipment

The high cost associated with traditional polysomnography testing and sleep lab setup remains a major barrier. Many hospitals and diagnostic centers face financial constraints due to expensive equipment, maintenance, and trained technician requirements. For instance, a single in-lab polysomnography test can cost between USD 800 to USD 3,000 per night, limiting accessibility in low- and middle-income countries. Limited reimbursement coverage in emerging markets further restricts adoption. This cost burden encourages healthcare providers to explore affordable home testing alternatives and digital diagnostic tools to enhance market reach.

Shortage of Skilled Sleep Technologists

A critical shortage of qualified sleep technologists and clinicians hampers diagnostic efficiency and service capacity. Training and certification requirements for sleep specialists are extensive, leading to workforce gaps, especially in developing regions. For instance, the American Board of Sleep Medicine notes a shortfall of over 4,000 registered sleep technologists in the U.S. alone. This shortage results in longer wait times and delays in treatment initiation. To address this challenge, healthcare systems are investing in automation, AI-assisted scoring, and remote data analysis platforms to optimize resource utilization and maintain diagnostic quality.

Regional Analysis

North America

North America dominates the Sleep Study Market with a 38% share, driven by high awareness of sleep disorders and advanced healthcare infrastructure. The U.S. leads the region due to the growing prevalence of obstructive sleep apnea and widespread adoption of home sleep testing. For instance, ResMed’s connected devices monitor over 20 million patients globally, with a strong concentration in the U.S. Supportive reimbursement policies and the presence of key players like Philips and Natus Medical further strengthen market penetration. Continuous innovation in diagnostic systems and AI integration sustains the region’s leadership.

Europe

Europe holds a 27% market share, supported by government-led initiatives promoting early diagnosis and treatment of sleep disorders. Countries such as Germany, France, and the U.K. have established advanced sleep laboratories and telehealth systems for remote monitoring. For instance, Löwenstein Medical’s SOMNOscreen Plus enables full polysomnography with 32 EEG channels, improving diagnostic precision. The rising prevalence of insomnia and lifestyle-related sleep disorders also fuels demand. Expanding collaborations between healthcare providers and research institutions continue to drive technological innovation and adoption across both hospital and home-based testing environments.

Asia-Pacific

Asia-Pacific accounts for 22% of the market and is the fastest-growing region, driven by rising urbanization, lifestyle stress, and improved healthcare access. China, Japan, and India lead in adoption due to growing awareness of sleep-related diseases. For instance, Nihon Kohden’s PSG-1100 system enhances accuracy through advanced digital amplifiers and signal processing capabilities. Expanding telehealth adoption and government efforts to integrate sleep diagnostics into primary care systems are key growth enablers. Increasing affordability of home sleep testing devices and the presence of regional manufacturers are accelerating market expansion in emerging economies.

Latin America

Latin America captures a 7% share of the Sleep Study Market, led by Brazil and Mexico, where healthcare modernization and sleep awareness programs are expanding. The growing burden of obesity-related sleep apnea drives demand for advanced diagnostic solutions. For instance, Embla Systems’ sleep monitoring solutions are gaining traction among private clinics across the region. Limited reimbursement coverage and uneven distribution of sleep labs remain challenges, but rising investments in portable diagnostic devices and telemedicine-based sleep services are improving accessibility and driving gradual regional growth.

Middle East & Africa

The Middle East & Africa region holds a 6% share, supported by increasing healthcare investments and growing recognition of sleep disorders as a public health concern. Gulf countries such as Saudi Arabia and the UAE are witnessing rapid establishment of sleep centers within hospitals. For instance, Cleveland Clinic Abu Dhabi’s Sleep Disorders Center conducts over 3,000 tests annually using advanced PSG systems. Despite limited awareness in some African nations, partnerships between healthcare providers and international device manufacturers are expanding diagnostic reach, gradually enhancing market penetration and sleep healthcare infrastructure.

Market Segmentations:

By Testing Services

- In-lab testing

- Polysomnography testing

- CPAP/BiPAP titration

- Split night polysomnography

- Multiple sleep latency test

- Epilepsy monitoring

- Maintenance of wakefulness test

- Home sleep testing

By Indication

- Obstructive sleep apnea

- Insomnia

- Restless leg syndrome

- Circadian rhythm sleeping disorders

- Narcolepsy

- Rapid eye movement sleep disorders

- Periodic limb movement disorders

- Bruxism

By End-user

- Hospitals

- Sleep testing centers

- Home care settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sleep Study Market is characterized by strong competition among key players such as Koninklijke Philips N.V., Cleveland Clinic, Millennium Sleep Lab, Interdisciplinary Center of Sleep Medicine, Circle Health Group, SOVA Sleep Services Inc., MedStar Health, London Sleep Centre, USA Sleep Diagnostic, Korea University Medicine, International Institute of Sleep, Imperial College Healthcare NHS Trust, SleepMedSite, Midwest Sleep Services Inc., and Medical Service Company. These organizations focus on advanced diagnostic systems, telehealth integration, and patient-centered sleep care. For instance, Philips’ Alice NightOne device provides accurate home-based sleep diagnostics through automated data transmission, reducing testing delays. Healthcare institutions like Cleveland Clinic and MedStar Health have expanded their digital monitoring networks, offering AI-based scoring and remote patient follow-up. Academic centers such as Imperial College and Korea University Medicine lead research in polysomnography innovations and multi-sensor data analytics. Strategic collaborations, technology upgrades, and AI-powered diagnostic advancements are driving intense competition and accelerating global market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Koninklijke Philips N.V.

- Cleveland Clinic

- Millennium Sleep Lab

- Interdisciplinary Center of Sleep Medicine

- Circle Health Group

- SOVA Sleep Services Inc.

- MedStar Health

- London Sleep Centre

- USA Sleep Diagnostic

- Korea University Medicine

- International Institute of Sleep

- Imperial College Healthcare NHS Trust

- SleepMedSite

- Midwest Sleep Services Inc.

- Medical Service Company

Recent Developments

- In April 2025, Fisher & Paykel Healthcare Corporation, a global medical device manufacturer, completed the acquisition of Compusult, a leading Canadian sleep diagnostics technology company, to expand its diagnostic capabilities and offerings.

- In May 2025, the U.S. Food and Drug Administration (FDA) granted clearance to ResMed for its new Adaptive Servo-Ventilator, a sleep apnea therapeutic device designed for patients with complex respiratory needs, marking a significant technological advancement in the market.

- In March 2024, Philips Respiratory Care and Royal Philips signed a strategic partnership with the American Sleep Apnea Association (ASAA) to improve sleep apnea awareness and access to diagnostic tools and therapies.

- In January 2024, ResMed, a leading medical device company, announced the launch of its new AirMini Autoset Travel CPAP Machine, a compact and lightweight sleep apnea therapy device, designed for users who travel frequently.

Report Coverage

The research report offers an in-depth analysis based on Testing Services, Indication, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered sleep analysis will enhance diagnostic speed and accuracy.

- Home sleep testing will expand as patients prefer cost-effective and convenient options.

- Integration of telemedicine will improve remote monitoring and follow-up care.

- Wearable sleep tracking devices will gain wider clinical acceptance.

- Cloud-based data management will streamline diagnosis and treatment planning.

- Hospitals and sleep centers will invest more in digital polysomnography systems.

- Awareness campaigns will increase early diagnosis of sleep-related disorders.

- Partnerships between device makers and healthcare providers will drive innovation.

- Emerging markets in Asia-Pacific and Latin America will witness strong growth.

- Regulatory support and reimbursement expansion will make sleep diagnostics more accessible.