Market Overview

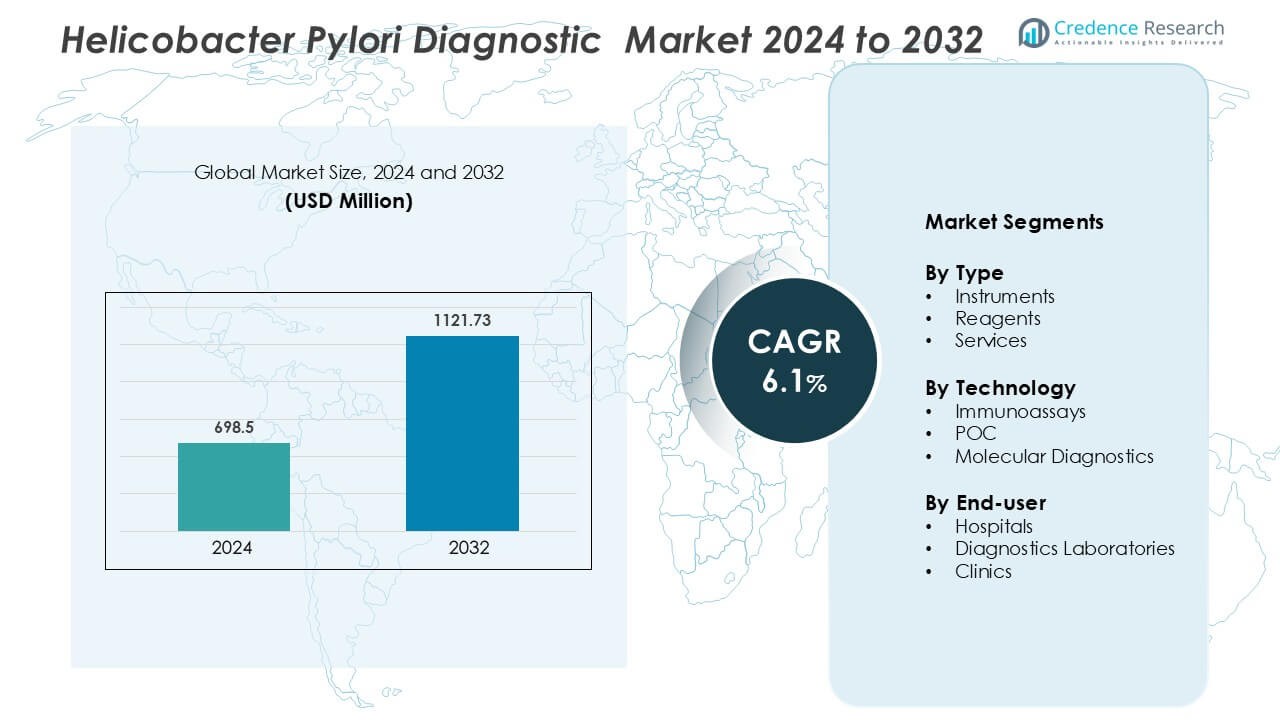

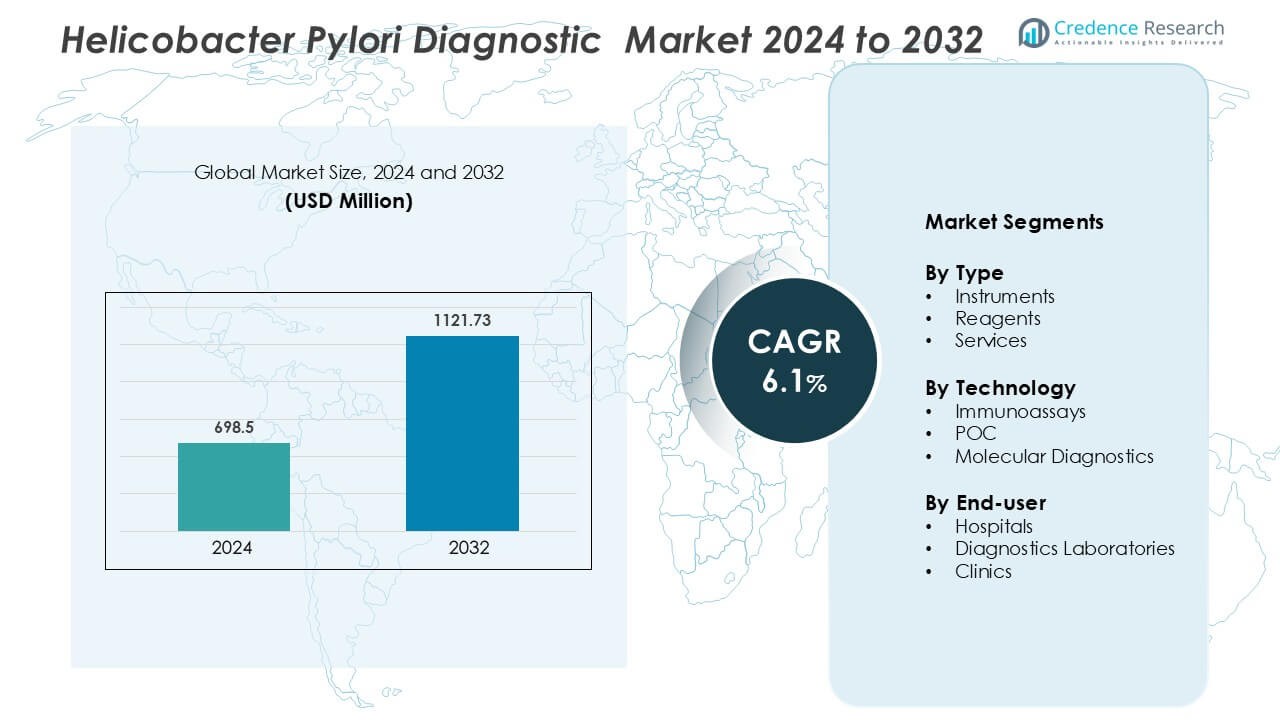

Helicobacter Pylori Diagnostic Market was valued at USD 698.5 million in 2024 and is anticipated to reach USD 1121.73 million by 2032, growing at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Helicobacter Pylori Diagnostic Market Size 2024 |

USD 698.5 Million |

| Helicobacter Pylori Diagnostic Market, CAGR |

6.1% |

| Helicobacter Pylori Diagnostic Market Size 2032 |

USD 1121.73 Million |

The Helicobacter pylori diagnostic market is moderately consolidated, with key players focusing on innovation, portfolio diversification, and regional expansion to strengthen their positions. Prominent companies include F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Thermo Fisher Scientific, Quest Diagnostics Incorporated, Meridian Bioscience, Biohit Oyj, Certest Biotec, Epitope Diagnostics Inc., Alpha Laboratories Ltd, and Coris BioConcept. These firms compete through advancements in immunoassay kits, molecular diagnostics, and point-of-care testing solutions aimed at improving detection accuracy and turnaround time. North America leads the global market, holding an estimated 38% share, driven by robust healthcare infrastructure, strong adoption of non-invasive tests, and consistent investments in diagnostic research and automation technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global market size for the Helicobacter pylori diagnostics sector reached USD 698.5 million in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2032.

- Market growth is driven by increasing prevalence of H. pylori infections, rising incidence of gastritis and peptic ulcers, and higher demand for non-invasive, rapid diagnostic tests across primary and tertiary care settings.

- A key trend in the market is the shift toward molecular diagnostics and resistance-profiling assays alongside widespread adoption of immunoassays and point-of-care testing, expanding segment shares and user access.

- Competitive analysis shows major companies expanding reagent and instrument portfolios; the reagents segment held a dominant share of 54.2% of the type category in 2023, underscoring focus on consistent consumable-based revenues.

- Regional analysis indicates that North America leads the market with approximately 46.7% share in 2024, supported by mature healthcare infrastructure, high test adoption and reimbursement coverage.

Market Segmentation Analysis:

By Type

In the diagnostics market for Helicobacter pylori, the reagents sub-segment emerged as the dominant component, capturing approximately 44.5% of the market in 2024. Reagents drive the market by enabling a broad range of assay formats antibody/antigen tests, urea-breath kits, stool antigen detection and molecular preparations which in turn respond to rising disease prevalence and demand for non-invasive testing. Secondary segments such as instruments and services support this expansion but grow more slowly, since instruments require higher capital and services often depend on lab infrastructure adoption. Regulatory approvals, technological enhancements in reagent sensitivity/specificity, and growing clinician awareness further stimulate reagent uptake.

- For instance, Meridian Bioscience’s Premier HpSA Flex assay achieved a limit of detection of 4.66 ng/mL in unpreserved stool and 12 ng/mL in preserved stool transport media, significantly improving non-invasive stool antigen testing.

By Technology

Within the technology segmentation, immunoassays led with the largest share, amounting to roughly 43.5% of market revenue in 2024. The dominance of immunoassays stems from their established use, operational familiarity in clinical labs, cost-effectiveness, and compatibility with high-volume workflows for H. pylori detection (especially antibody/antigen formats). While point-of-care (POC) and molecular diagnostics are gaining momentum, they currently trail due to higher cost, more complex validation requirements and slower adoption. Key drivers of the immunoassay segment include rising demand for early, non-invasive diagnosis of H. pylori-associated gastritis/ulcers, and continuous improvements in assay automation and kit throughput.

- For instance, the commercially available rapid whole-blood immunoassay gabControl® H. pylori immunoassay (gabmed GmbH) was evaluated in 108 outpatients and achieved a sensitivity of 91.4 % and a specificity of 76.7 % versus the ^13C-urea breath test.

By End-User

In the end-user category, hospitals hold the largest share of the H. pylori diagnostics market, accounting for approximately 44.6% in 2024. Hospitals dominate because they combine access to comprehensive diagnostic infrastructure, gastroenterology services, and inpatient/outpatient testing pathways for patients with suspected H. pylori-related conditions. Diagnostic laboratories follow as high-volume testing hubs, while clinics are gradually expanding but often depend on referrals or external labs. The main growth drivers for hospitals include increasing incidence of gastric disease, emphasis on early detection and treatment in tertiary centres, and adoption of integrated diagnostic solutions that streamline patient care pathways from testing to therapy.

Key Growth Drivers

Rising disease burden and screening demand

The expanding clinical and public-health recognition of Helicobacter pylori as a primary risk factor for gastritis, peptic ulcer disease and gastric cancer drives diagnostic demand across care settings. Increasing prevalence in many geographies and renewed calls for “screen-and-treat” strategies raise testing volumes for both symptomatic and population-level screening, prompting laboratories and hospitals to prioritize accessible, validated assays. This demand concentrates spend on non-invasive tests that support large-scale screening initiatives and surveillance programs, while also motivating procurement of complementary instruments and reagents for confirmatory testing. The result is steady market expansion as payers and health systems incorporate H. pylori detection into broader gastric-cancer prevention pathways and clinical guidelines.

- For instance, Biohit Oyj’s GastroPanel® test was validated in a cohort of 522 gastroscopy-referral patients, of whom 53 had biopsy-confirmed atrophic gastritis (10.2 %) and the overall agreement between the test and the updated Sydney System classification was 92.4%.

Technological innovation and assay diversification

Rapid improvements in assay platforms—higher-throughput immunoassays, streamlined urea-breath test systems, sensitive stool antigen kits and expanding molecular panels—fuel adoption by reducing turnaround time and improving diagnostic confidence. Manufacturers invest in reagent optimization, automation compatibility and multiplex molecular chemistries that identify infection and, increasingly, resistance markers, enabling clinicians to move from empirical therapy toward targeted regimens. Technology diffusion also lowers per-test costs in high-volume labs and supports point-of-care formats for primary care and clinic use. Together, these advances accelerate market uptake, broaden the addressable end-user base and create cross-sell opportunities for bundled instrument-plus-reagent offerings.

- For instance, Meridian Bioscience’s Urea Breath Test platform advertises a result in approximately 2 minutes from sample measurement stage for its H. pylori detection kit, enabling high-throughput and rapid patient workflow.

Antimicrobial resistance and demand for resistance-guided testing

Rising clarithromycin, metronidazole and other antibiotic resistances have reduced empirical eradication success and driven clinical demand for diagnostics that inform therapy choice. As resistance prevalence grows regionally, clinicians increasingly require molecular assays or culture-based methods that detect resistance-conferring mutations or phenotype, to guide tailored treatment and improve cure rates. This clinical imperative elevates spend on molecular reagents and specialized instruments, and encourages adoption of reflex testing algorithms (initial non-invasive screen, followed by resistance testing for failures). Consequently, diagnostics that combine detection with resistance markers command premium pricing and capture higher margins within the market.

Key Trend & Opportunity

Growth of molecular and resistance-targeted diagnostics

Molecular diagnostics represent a major growth vector as demand for rapid, sensitive detection and genotypic resistance information rises. PCR and sequencing-based assays that identify H. pylori and clarithromycin or other resistance mutations enable precision therapy and may shorten time to cure; these assays appeal to tertiary hospitals, reference labs and regions with high resistance burdens. Commercialization of simplified, automated molecular cartridges and integration with laboratory information systems lowers operational barriers and enables scaling. Manufacturers that offer validated resistance panels positioned alongside established non-invasive tests can capture both routine screening and stewardship-driven testing volumes, creating a durable revenue stream in markets prioritizing optimized eradication.

- For instance, the RIDA®GENE H. pylori Assay by r‑biopharm AG was tested on 436 gastric-biopsy samples; of those, 47 were PCR-positive, 42 culture-positive, 44 immunohistochemistry positive; qPCR achieved sensitivity of 100 % and specificity of 99 % versus culture, and 96 % and 99 % versus immunohistochemistry for H. pylori detection, and 92 % sensitivity / 97 % specificity for clarithromycin-resistance detection.

Point-of-care and decentralized testing expansion

Point-of-care (POC) antigen and rapid urea-breath readouts present opportunities to shift diagnosis closer to the patient, improving treatment timeliness in outpatient and primary-care settings. Advances in rapid stool antigen formats and compact breath-test analyzers reduce clinic referral rates, support “test-and-treat” workflows, and enable immediate management decisions. Decentralized testing also opens access in underserved regions and supports campaigns in high-prevalence areas. Companies that produce low-complexity, CLIA-waived or equivalent POC solutions and supply training/consumer-friendly collection kits can penetrate clinics and small hospitals, expanding the market beyond centralized laboratories and improving overall diagnostic coverage.

- For instance, Meridian’s ImmunoCard STAT! HpSA (CLIA-waived format) was evaluated in 227 consecutive dyspeptic-patient stool samples (85 positive, 142 negative) and showed 77 true positives and 130 true negatives, yielding a sensitivity of 90.6 and a specificity of 91.5 in that study.

Emerging-market expansion and population screening programs

Geographies with high H. pylori prevalence—particularly parts of Asia, Latin America and Africa—represent growth opportunities for scalable, cost-effective diagnostics and screening programs. Public-health initiatives that prioritize gastric cancer prevention encourage adoption of non-invasive, lab-scalable assays and create procurement demand from government and NGO channels. Local manufacturing partnerships, tiered pricing, and reagent formats tailored to constrained laboratory infrastructure can accelerate uptake. Additionally, integration of H. pylori testing into existing screening platforms (e.g., community health checks) and digital reporting systems further supports market penetration and long-term sustainable volumes in emerging markets.

Key Challenge

Variability in test performance and clinical pathway alignment

Heterogeneity in sensitivity and specificity among serology, stool antigen, breath and molecular tests complicates clinical decision-making and limits universal replacement of one method. Serology cannot reliably distinguish active from past infection; stool antigen and urea-breath tests vary by pre-analytical factors and kit quality; molecular assays require careful validation. Misalignment between available tests and established clinical pathways leads to inconsistent use, false negatives/positives, and unnecessary repeat testing. Addressing this challenge requires rigorous performance validation, consensus guideline updates, clinician education and harmonized reflex algorithms to ensure appropriate test selection and to protect test credibility in the marketplace.

Reimbursement, cost pressures and regulatory complexity

Cost sensitivity in public and private healthcare systems constrains uptake of higher-cost molecular and POC platforms, especially where standard, lower-cost assays remain available. Complex and variable reimbursement policies across regions delay commercialization and reduce margins for advanced diagnostics. Regulatory approval pathways for novel molecular resistance assays and POC formats add time and expense to market entry and require substantial clinical evidence. Manufacturers must therefore balance R&D investment with pragmatic pricing, generate robust health-economic data demonstrating improved outcomes and savings, and navigate diverse regulatory requirements to achieve sustainable reimbursement and broader market access.

Regional Analysis

North America

The North American region accounts for approximately 35-40% of the global Helicobacter pylori diagnostics market, driven by its well-established healthcare infrastructure, extensive use of non-invasive testing (such as urea breath and stool antigen tests), and high levels of end-user awareness. The United States leads this region, supported by favourable reimbursement frameworks and the presence of major diagnostic companies that supply both instruments and reagents. Advanced molecular diagnostics are increasingly deployed for resistance profiling, further boosting market value. Continued investment in preventive gastroenterology and screening programmes sustains the region’s dominant position.

Europe

Europe holds roughly 25-30% share of the global H. pylori diagnostics market, underpinned by mature healthcare systems, proactive screening initiatives and strong adoption of immunoassay- and molecular-based diagnostics. Countries such as Germany, the UK and France contribute substantially, with increasing uptake of non-invasive testing in outpatient and tertiary settings. Reimbursement policies and public health programmes targeting gastric disease prevention support diagnostic penetration. Growth in Eastern Europe is emerging, driven by improvements in infrastructure and rising awareness of infection-related gastric complications.

Asia-Pacific

The Asia-Pacific region represents approximately 20-30% of the H. pylori diagnostics market and is forecasted to exhibit the highest growth rate. High infection prevalence in countries like India and China, combined with rapid healthcare infrastructure expansion and increasing disposable incomes, propel demand for cost-effective non-invasive diagnostics and point-of-care solutions. Government health initiatives and rising gastroenterology care accessibility in urban centres further reinforce market volumes. The region thus offers substantial opportunity for manufacturers targeting volume growth and emerging-market penetration.

Latin America

Latin America contributes around 5-10% of the global market share for H. pylori diagnostics and is characterized by moderate growth opportunities. Brazil and Mexico are key markets, supported by expanding private healthcare services and rising awareness of gastrointestinal disorders. However, infrastructure limitations, cost sensitivities and variable reimbursement systems temper uptake of advanced molecular kits. Nevertheless, as clinics modernize and public-health screening efforts increase, the region’s diagnostic volumes are expected to rise steadily.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for roughly 5-10% of the global H. pylori diagnostics market share, with significant variation between advanced Gulf states and lower-income countries. Growth is driven by investment in healthcare infrastructure, increasing gastroenterology care capacity and rising incidence of infection-related gastric disorders. However, constraints such as limited laboratory penetration, low diagnostic technology adoption in rural areas and cost pressures continue to challenge deeper market expansion. Targeted partnerships and affordable test solutions are essential to accelerate growth in MEA.

Market Segmentations:

By Type

- Instruments

- Reagents

- Services

By Technology

- Immunoassays

- POC

- Molecular Diagnostics

By End-user

- Hospitals

- Diagnostics Laboratories

- Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Helicobacter pylori diagnostic market is characterized by the The Helicobacter pylori diagnostic market is moderately consolidated, with major players advancing assay accuracy, automation, and accessibility. F. Hoffmann-La Roche Ltd and Thermo Fisher Scientific lead through advanced molecular and immunoassay platforms that deliver high sensitivity and rapid turnaround for clinical diagnostics. Bio-Rad Laboratories and Meridian Bioscience focus on enzyme immunoassays and stool antigen tests, ensuring reliable detection across laboratory and point-of-care settings. Quest Diagnostics Incorporated leverages its extensive diagnostic network to provide large-scale testing and data-driven clinical insights. Certest Biotec and Coris BioConcept emphasize rapid diagnostic kits with simplified workflows suited for decentralized healthcare environments. Biohit Oyj and Epitope Diagnostics, Inc. strengthen their market presence with innovative ELISA-based solutions supporting early detection and screening programs. Alpha Laboratories Ltd supports distribution of specialized test kits across Europe. Continuous innovation in non-invasive testing and molecular diagnostics underpins competitive differentiation and broader adoption in global healthcare systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories

- Meridian Bioscience

- Quest Diagnostics Incorporated

- Certest Biotec

- Thermo Fisher Scientific

- Epitope Diagnostics, Inc.

- Biohit Oyj

- Alpha Laboratories Ltd

- Coris BioConcept

Recent Developments

- In December 2023, Biomerica, Inc. announced that it received U.S. Food and Drug Administration (FDA) 510(k) clearance for its Hp Detect Stool Antigen ELISA test, designed to detect H. pylori bacteria. This approval strengthened the company’s market position and enhanced its competitiveness.

- In July 2023, Meridian Bioscience, Inc. announced that the U.S. Food and Drug Administration (FDA) approved Premier HpSA FLEX for diagnosing H. pylori in both preserved and unpreserved stool samples. This approval broadened the company’s product portfolio and expanded its customer base.

- In July 2022, Bio-Rad launched Platelia H. Pylori IgG, an immuno-enzymatic assay for qualitative determination of IgG antibodies. Serology offers a non-invasive, simple, and reliable method for detecting H. pylori infection. The Platelia H. Pylori IgG assay is specifically used to assess the presence and quality of IgG antibodies.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand due to rising global prevalence of H. pylori infections and increasing screening programs.

- Adoption of non-invasive diagnostic methods such as urea breath and stool antigen tests will accelerate in both developed and emerging markets.

- Molecular diagnostic technologies will gain prominence for detecting antibiotic resistance and improving treatment precision.

- Point-of-care testing will grow as healthcare systems emphasize rapid, on-site diagnosis and immediate therapy initiation.

- Integration of automated and high-throughput platforms will enhance efficiency in hospital and laboratory settings.

- Strategic collaborations between diagnostic manufacturers and healthcare providers will support large-scale screening initiatives.

- Emerging economies will experience strong growth due to improved healthcare infrastructure and rising awareness of gastric health.

- Regulatory support for innovative diagnostic kits will boost commercialization and market entry of advanced products.

- Increasing focus on personalized medicine will drive demand for resistance-guided testing solutions.

- Continuous technological innovation and cost optimization will shape competitive dynamics and sustain long-term market growth.