Market Overview:

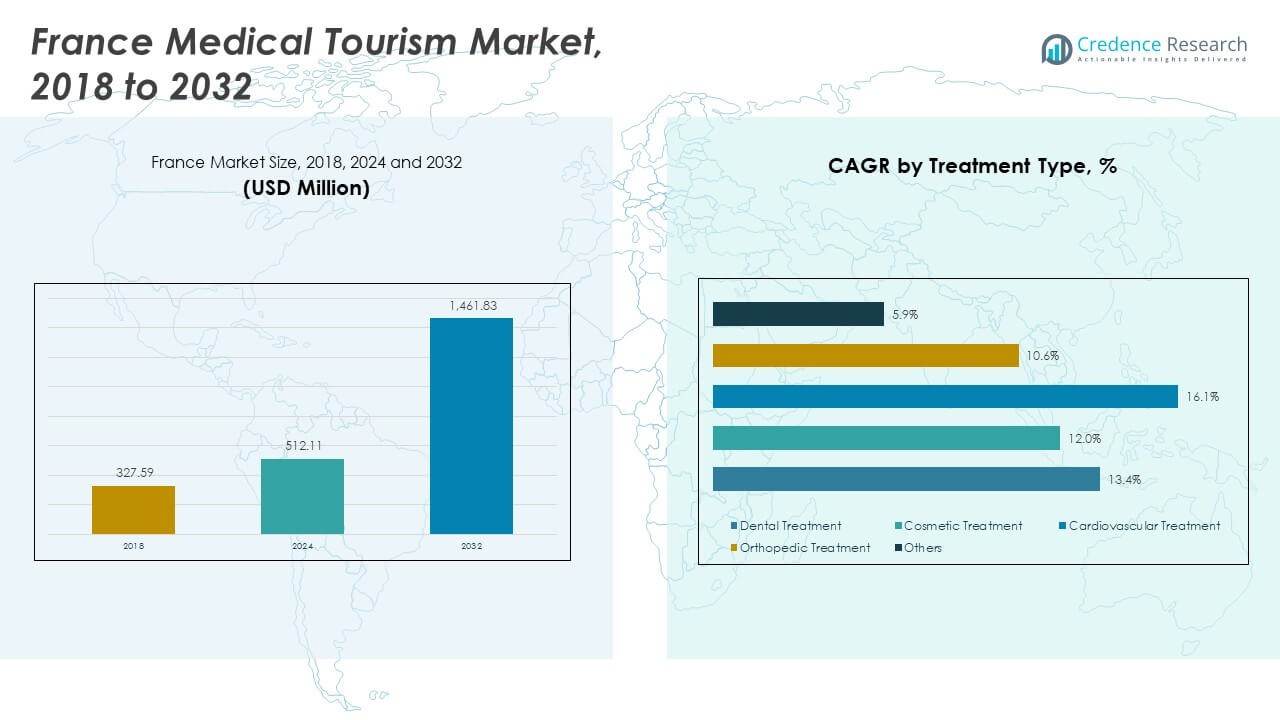

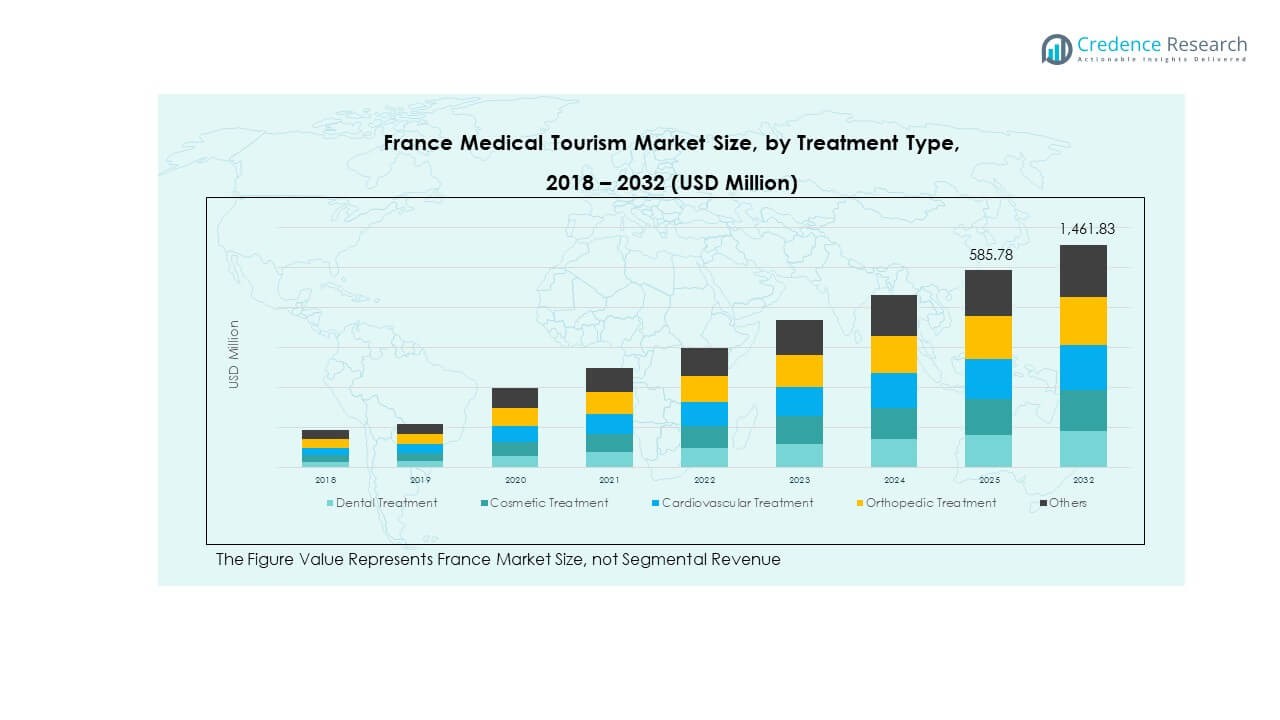

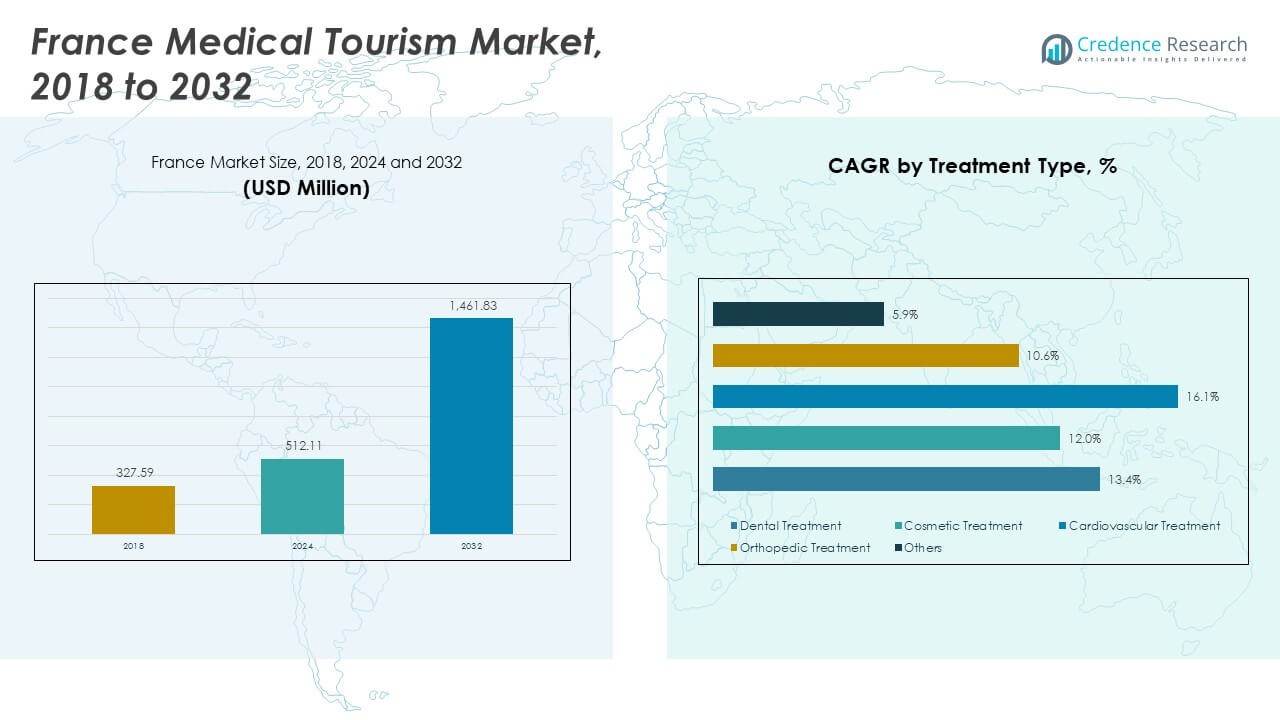

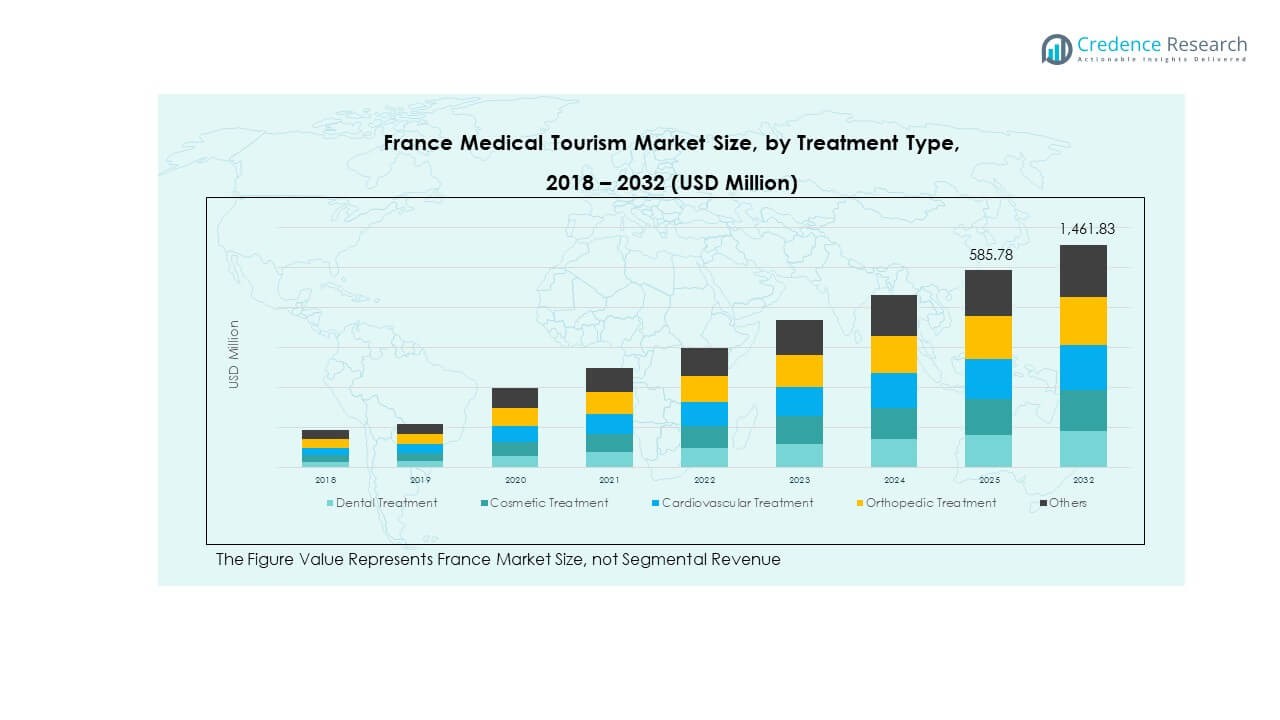

The France Medical Tourism Market size was valued at USD 327.59 million in 2018, increasing to USD 512.11 million in 2024, and is anticipated to reach USD 1,461.83 million by 2032, at a CAGR of 13.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Medical Tourism Market Size 2024 |

USD 512.11 Million |

| France Medical Tourism Market, CAGR |

13.96% |

| France Medical Tourism Market Size 2032 |

USD 1,461.83 Million |

The France Medical Tourism Market is expanding due to advanced healthcare infrastructure, skilled medical professionals, and competitive treatment costs. High demand for cosmetic surgery, dental care, and cardiac treatments attracts international patients. France’s reputation for medical innovation, supported by government quality regulations, boosts confidence among foreign travelers. Favorable visa policies, multilingual healthcare staff, and well-connected air transport systems enhance the overall patient experience and accessibility.

France serves as a hub for medical travelers from Europe, the Middle East, and Africa. Paris, Lyon, and Marseille lead due to their concentration of internationally accredited hospitals and clinics. Northern European patients prefer France for specialized procedures, while North African visitors seek affordability and quality. The growing partnerships between French hospitals and international travel facilitators are strengthening the country’s position in the regional medical tourism landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Medical Tourism Market was valued at USD 327.59 million in 2018, reached USD 512.11 million in 2024, and is projected to hit USD 1,461.83 million by 2032, expanding at a CAGR of 13.96% during 2024–2032.

- Western France leads with about 48% share, driven by world-class hospitals in Paris, Lyon, and Marseille. Northern and Central France follow with 32%, benefiting from cross-border accessibility and affordable procedures. Southern France holds around 20%, supported by its wellness and recovery tourism appeal.

- The fastest-growing region is Southern France, which combines high-end medical facilities with luxury wellness resorts and integrated rehabilitation services, attracting long-stay recovery patients.

- By treatment type, orthopedic and cosmetic treatments together account for nearly 45% of total revenue, supported by high international demand for reconstructive and aesthetic procedures.

- Dental treatments contribute roughly 25% share, sustained by affordability, advanced technology, and France’s strong reputation in oral and maxillofacial care.

Market Drivers:

Growing Preference for Advanced Medical Infrastructure and Clinical Excellence

France Medical Tourism Market benefits from its world-class healthcare infrastructure and globally recognized medical expertise. Hospitals like Institut Gustave Roussy and Pitié-Salpêtrière Hospital attract patients for oncology and cardiac procedures. Its healthcare system ranks among the top in Europe for quality and accessibility. High clinical success rates and advanced robotic surgery platforms enhance its appeal. Patients from the Middle East and Africa prefer France for specialized surgeries unavailable locally. Government investment in digital health records and patient safety boosts credibility. The combination of affordability and precision medicine positions France as a trusted medical destination. Its well-trained specialists continue to drive global patient inflow.

- For instance, at Institut Gustave Roussy in Villejuif, the centre treats nearly 50,000 patients annually—including around 3,500 paediatric cases—and registers about 40 % of its patients in clinical trials.

Expanding Demand for Cosmetic and Reconstructive Procedures

France remains a top destination for cosmetic and aesthetic surgery due to innovation and skilled surgeons. It leads in dermatology, reconstructive surgery, and anti-aging treatments backed by medical-grade technology. Patients from the UK, Spain, and Italy seek facial rejuvenation and body contouring services. The presence of certified aesthetic clinics with international standards improves patient satisfaction. Rising demand for post-surgery rehabilitation and aftercare enhances service quality. France’s regulatory framework ensures patient safety and transparency in cosmetic practices. Growing awareness of medical aesthetics supports procedural diversification. The market’s strong reputation for ethical cosmetic medicine attracts long-term clientele.

- For instance, French clinics deploy robotic and image-guided systems in reconstructive surgery, with leading centres achieving accreditation from international bodies like JCI and performing high volumes of body-contouring and aesthetic dentistry procedures.

Increasing Accessibility Through Streamlined Medical Tourism Infrastructure

The development of patient coordination services and medical travel facilitators strengthens cross-border access. France’s hospitals collaborate with travel agencies to create treatment-inclusive packages. The Schengen visa system simplifies travel for European patients seeking elective procedures. Its international airports connect major medical hubs to over 200 destinations. Healthcare interpreters and multilingual medical staff improve the overall experience. Digital teleconsultation platforms enable pre- and post-treatment communication with doctors abroad. The integration of transport, hospitality, and healthcare networks enhances operational efficiency. France continues to invest in seamless medical tourism infrastructure that ensures high patient turnover.

Rising Awareness of Affordable High-Quality Treatments Among International Patients

International patients view France as a cost-effective alternative to other Western nations. Treatments such as orthopedic surgery, dental implants, and fertility care are 20–40% cheaper than in the United States. Public-private partnerships have expanded service capacity in private clinics. Insurance collaborations support international billing and claims management. France’s transparent pricing and ethical medical practices create trust among patients. Strong marketing campaigns highlight affordability without compromising quality. It competes favorably against Spain and Germany in specialized care costs. This affordability-driven perception fuels sustained growth in medical travel inflow.

Market Trends:

Integration of Digital Health Technologies for Enhanced Patient Management

The France Medical Tourism Market adopts digital health tools to improve patient coordination and treatment outcomes. Hospitals are using AI-driven diagnostic systems to personalize care. Electronic health records simplify cross-border data sharing and post-surgical monitoring. Telemedicine helps patients consult doctors before and after their visit. Digital payments and scheduling systems enhance convenience and transparency. The rise of health-travel apps supports itinerary management and aftercare coordination. Integration with wearable health devices improves recovery tracking. Technology-driven healthcare delivery strengthens France’s competitiveness in the global medical tourism landscape.

- For instance, France’s AI diagnostics market supports nationwide deployment of AI-powered imaging and decision-support tools—some hospitals use systems trained on clinical-report datasets for improved diagnostic accuracy.

Growing Popularity of Wellness and Preventive Health Tourism

France’s wellness sector merges medical treatment with holistic recovery experiences. Patients seek spa therapy, nutrition counseling, and rehabilitation in scenic locations like Provence and the French Alps. Wellness retreats combine traditional medicine with physiotherapy and stress management. The government promotes preventive healthcare as part of its tourism strategy. Patients recovering from surgery often choose extended wellness packages. Partnerships between clinics and resorts create integrated healing experiences. The trend aligns with global demand for wellness-based medical travel. France’s natural spa heritage and luxury hospitality make it a preferred health retreat destination.

- For instance, clinics in regions like the French Alps and Provence may collaborate with resort hotels to privately offer postoperative rehabilitation alongside spa therapy, nutrition counselling, and physiotherapy in scenic settings.

Rise of Specialized Centers of Excellence for High-Demand Procedures

Specialized medical clusters are emerging in Paris, Lyon, and Bordeaux. These centers focus on orthopedics, oncology, and reproductive medicine. Hospitals are investing in robotic surgery systems and advanced imaging equipment. Accreditation by Joint Commission International (JCI) boosts credibility and attracts foreign patients. Collaborations between research institutions and clinics enhance innovation in treatment protocols. France’s focus on specialization ensures procedural accuracy and improved outcomes. Patients prefer these hubs for complex surgeries and long-term care programs. It is building a strong identity as a hub of specialized healthcare expertise.

Partnerships Between Healthcare Providers and Travel Facilitators

Hospitals partner with medical tourism facilitators to streamline patient journeys. These collaborations handle visa support, accommodation, and aftercare. Global insurance providers integrate France into international treatment networks. Travel agencies promote bundled health-tourism packages. This alliance improves transparency, logistics, and patient satisfaction. Airlines and hotel chains are launching loyalty programs for medical travelers. The ecosystem supports sustainable growth and long-term competitiveness. It demonstrates a coordinated national approach to attracting global patients.

Market Challenges Analysis:

Regulatory and Administrative Complexity Affecting Foreign Patient Access

The France Medical Tourism Market faces challenges due to strict regulations and administrative barriers. Complex visa processes can delay patient admission for elective surgeries. Health insurance claims for international patients often face documentation issues. Hospitals must adhere to EU medical directives, adding compliance costs. Language barriers and documentation requirements affect patient convenience. Coordination between private and public institutions remains limited. Reimbursement policies vary by country, making cost predictability difficult. These challenges reduce ease of access for short-term medical travelers and slow potential growth.

Rising Competition and Capacity Constraints in High-Demand Specialties

France faces increasing competition from European nations like Spain, Germany, and Turkey. These countries market aggressive pricing for similar procedures. High domestic patient loads in French hospitals restrict appointment availability. Limited capacity for elective treatments affects scheduling flexibility for foreign patients. Skilled physician shortages in rural regions reduce geographic reach. Marketing and international promotion budgets remain lower than global competitors. High infrastructure costs make it difficult for smaller clinics to sustain international operations. It must address these challenges to maintain its leadership in medical tourism quality.

Market Opportunities:

Expansion of Premium Healthcare Packages and Global Partnerships

France’s healthcare providers can expand by designing premium health packages combining luxury travel with specialized treatments. Collaborations with Middle Eastern and African hospitals can establish referral partnerships. High-value service bundles can target affluent medical travelers. Joint ventures with airlines and hospitality brands can enhance medical tourism visibility. The integration of wellness and rehabilitation services will improve patient satisfaction. Increasing adoption of AI-driven diagnostics presents opportunities for innovation-led differentiation. It can leverage its medical credibility to capture the growing segment of wellness-focused tourists.

Growing Demand for Geriatric and Fertility Treatments

An aging global population and rising infertility rates drive new demand sectors. France offers advanced geriatric care supported by rehabilitation centers and assisted living facilities. Fertility clinics equipped with modern IVF technologies attract patients from across Europe. Legal frameworks governing assisted reproduction enhance trust and safety. Hospitals can promote cross-border fertility programs through digital platforms. Targeting niche demographics creates sustainable growth potential. It can capitalize on this opportunity by enhancing international outreach and service capacity.

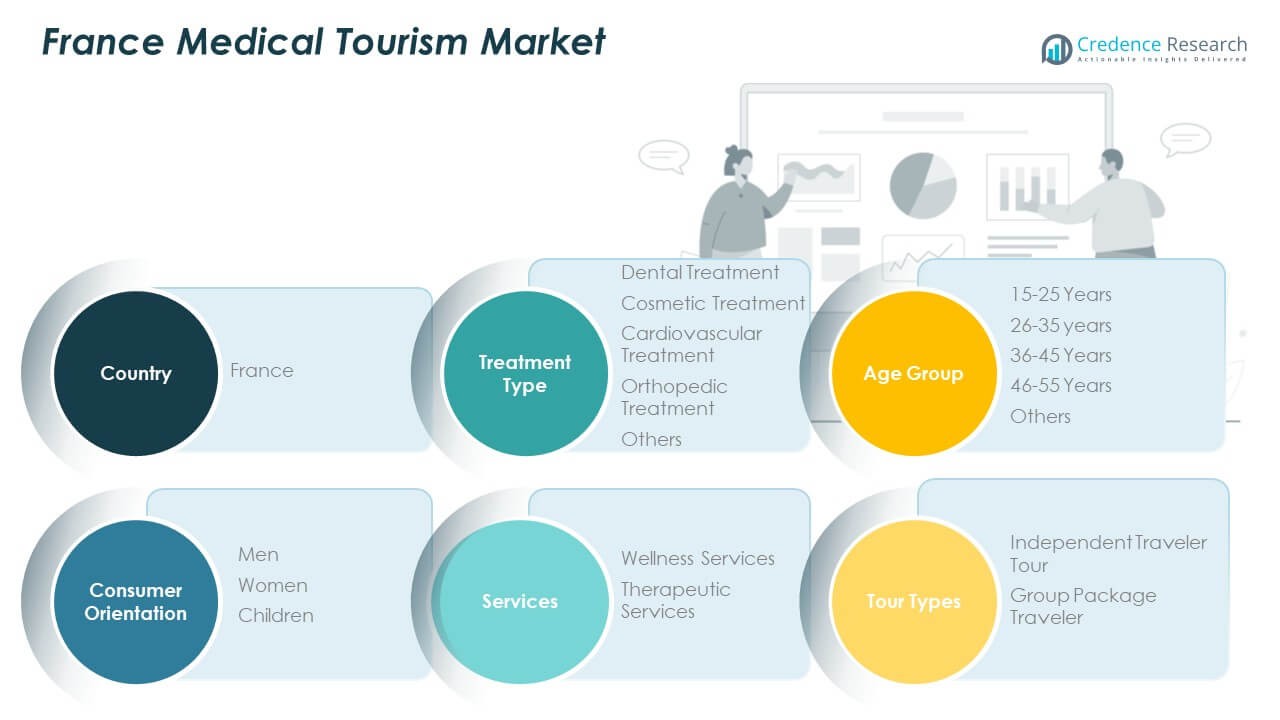

Market Segmentation Analysis:

By Treatment Type

The France Medical Tourism Market covers a wide range of treatment segments, including dental, cosmetic, cardiovascular, orthopedic, and other medical procedures. Dental and cosmetic treatments attract most foreign patients due to France’s excellence in aesthetic and restorative care. Cardiovascular and orthopedic treatments gain traction among aging populations seeking advanced surgical outcomes. Specialized hospitals in Paris and Lyon cater to high-complexity procedures using robotic and minimally invasive systems. It benefits from strong medical infrastructure and post-surgical rehabilitation support that enhances patient recovery and satisfaction.

- For example, French hospitals deployed more than 300 robotic surgical systems across public and private centres, improving precision and recovery for complex orthopedic and cardiovascular procedures. Specialized hospitals in Paris and Lyon cater to high-complexity procedures using robotic and minimally invasive systems.

By Age Group

Patients aged 26–45 years represent the core demographic, driven by demand for cosmetic enhancements, fertility care, and corrective dental procedures. The 46–55 years segment seeks cardiac and orthopedic treatments aligned with preventive and restorative goals. Younger travelers aged 15–25 often visit for minor dental or sports-related medical issues. It attracts a balanced age mix, reflecting both lifestyle-oriented and clinical medical needs.

- For instance, global aesthetic procedures reached 15.8 million surgical operations in 2023 according to ISAPS, with France being a strong participant via its cosmetic clinics. The 46–55 years segment seeks cardiac and orthopedic treatments aligned with preventive and restorative goals. Younger travelers aged 15–25 often visit for minor dental or sports-related medical issues.

By Consumer Orientation

Women dominate the consumer base due to higher demand for aesthetic, dermatological, and wellness services. Men increasingly opt for orthopedic and cardiovascular treatments. Children represent a smaller but consistent segment, often linked to specialized pediatric surgeries. Each group benefits from tailored care pathways supported by multilingual staff and family-friendly service models.

By Services and Tour Types

Wellness and therapeutic services strengthen France’s medical tourism value proposition. Independent travelers seek personalized care, while group package travelers prefer structured itineraries offering bundled healthcare and hospitality. It maintains an integrated approach that combines treatment precision with superior patient experience.

Segmentation:

By Treatment Type

- Dental Treatment

- Cosmetic Treatment

- Cardiovascular Treatment

- Orthopedic Treatment

- Others

By Age Group

- 15–25 Years

- 26–35 Years

- 36–45 Years

- 46–55 Years

- Others

By Consumer Orientation

By Services

- Wellness Services

- Therapeutic Services

By Tour Types

- Independent Traveler Tour

- Group Package Traveler

By Country Analysis (Geographic Scope)

- Country-wise Revenue

- Treatment Type Revenue

- Age Group Revenue

- Consumer Orientation Revenue

- Services Revenue

- Tour Type Revenue

Regional Analysis:

Dominance of Western Europe in Medical Tourism Revenue Share

Western Europe holds the largest share of the France Medical Tourism Market, accounting for nearly 48% of total revenue. Paris, Lyon, and Marseille serve as primary hubs due to their concentration of internationally accredited hospitals, research centers, and aesthetic clinics. High-quality healthcare infrastructure and specialized institutions attract patients from the UK, Germany, and Italy seeking complex surgeries and cosmetic procedures. Its established hospitality industry complements medical tourism by offering premium accommodations and rehabilitation services. Government initiatives supporting cross-border healthcare and simplified travel access strengthen regional leadership. Western France’s strong integration of wellness and medical care contributes further to this dominance.

Emergence of Northern and Central France as Specialized Medical Hubs

Northern and Central France collectively represent around 32% of the market share, with growing infrastructure and affordability driving their rise. Lille and Reims are emerging as preferred destinations for dental and orthopedic treatments. It benefits from proximity to Belgium, Luxembourg, and the Netherlands, attracting short-term medical travelers. Central France, particularly in regions like Tours, focuses on cardiology and rehabilitation services backed by public-private hospital partnerships. Competitive pricing, accessible transport links, and lower waiting times enhance appeal for international patients. These regions are expanding hospital capacities to manage increasing inflows while maintaining service quality and efficiency.

Rising Opportunities in Southern France and Overseas Territories

Southern France accounts for nearly 20% of the France Medical Tourism Market, supported by its strong wellness and recovery tourism base. Cities such as Nice, Toulouse, and Montpellier combine medical treatment with spa and post-operative recovery experiences. The Mediterranean climate and scenic environment make it a preferred choice for convalescence and wellness therapies. Its hospitals increasingly collaborate with hospitality partners to create integrated recovery packages for international visitors. French overseas territories, including Réunion and Guadeloupe, show growing potential in therapeutic and wellness tourism. These regions are leveraging natural resources, climate advantages, and government-backed infrastructure projects to expand their medical tourism footprint.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The France Medical Tourism Market features a competitive landscape dominated by specialised healthcare providers and patient-facilitation agencies. It attracts players that establish strong networks with international patients, efficient logistics, and premium care pathways. Many organisations emphasise multilingual support and concierge-style services that guide patients from overseas to French hospitals. Leading hospitals maintain JCI or equivalent accreditation, which sustains credibility among inbound patients. It benefits companies that excel in end-to-end travel, treatment and recovery coordination. Intense competition drives continuous service enhancement and value-based care offerings. Consolidation through partnerships and strategic alliances boosts reach into under-served geographic segments.

Report Coverage:

The research report offers an in-depth analysis based on Treatment Type, Age Group, Consumer Orientation, Services, and Tour Types. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Enhanced telemedicine pre-consultation services will fuel inbound patient coordination.

- Expansion of wellness-linked treatment packages will widen patient segments.

- Rising demand for fertility and geriatric care will diversify treatment offerings.

- Development of multilingual patient facilitation networks will improve service access.

- Strategic partnerships with travel and hospitality firms will boost holistic care travel experiences.

- Growth of insurance coverage for medical travel will lower barriers for patients.

- Investment in robotic surgery and minimally invasive treatments will improve outcomes.

- Emerging regions in France will host new premium clinics to widen geographic reach.

- Data-driven patient outcome tracking will raise treatment transparency and trust.

- Regulatory streamlining and visa support enhancements will shorten patient lead time.