Market Overview:

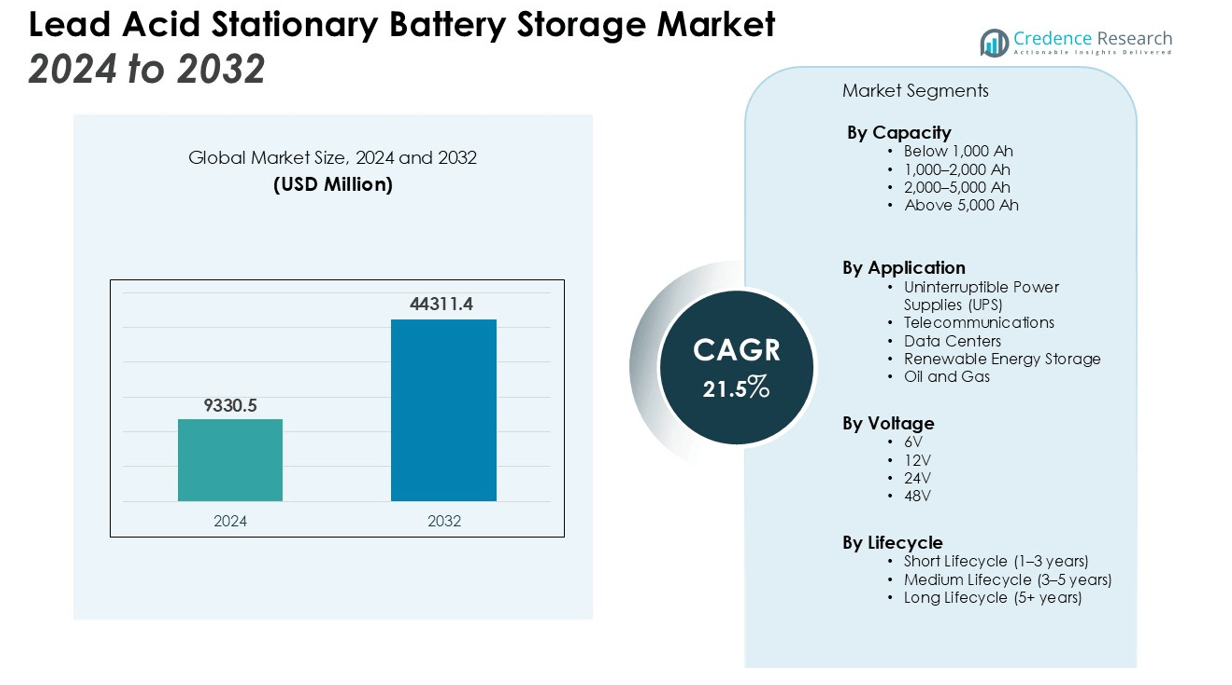

The Lead Acid Stationary Battery Storage Market size was valued at USD 9330.5 million in 2024 and is anticipated to reach USD 44311.4 million by 2032, at a CAGR of 21.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Lead Acid Stationary Battery Storage Market Size 2024 |

USD 9330.5 million |

| Lead Acid Stationary Battery Storage Market, CAGR |

21.5% |

| Lead Acid Stationary Battery Storage Market Size 2032 |

USD 44311.4 million |

Key drivers of this market include the rising adoption of renewable energy sources, which necessitate efficient storage systems to manage intermittent power generation. Lead acid batteries, particularly Valve-Regulated Lead-Acid (VRLA) types, offer a balance between cost and performance, making them suitable for applications such as uninterruptible power supplies (UPS), telecommunications, and data centers. Additionally, advancements in battery technology and recycling processes are enhancing the appeal of lead acid batteries in stationary applications. The cost-effectiveness and recyclability of lead acid batteries further contribute to their widespread adoption across various industries.

Regionally, North America held a significant market share in 2023, driven by industrial demand and supportive energy policies. Europe follows closely, with strong government incentives promoting energy storage systems. The Asia-Pacific region, particularly countries like China and India, is experiencing rapid growth due to industrialization, urbanization, and increasing energy storage requirements. This regional diversification underscores the global shift towards sustainable and resilient energy infrastructures. Furthermore, the ongoing investments in grid modernization and renewable energy projects globally are set to further propel the demand for stationary battery storage solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Lead Acid Stationary Battery Storage Market was valued at USD 9330.5 million in 2024 and is projected to reach USD 44311.4 million by 2032, growing at a CAGR of 21.5% during the forecast period.

- The rising adoption of renewable energy sources is driving the demand for efficient energy storage systems. Lead acid batteries, particularly Valve-Regulated Lead-Acid (VRLA) types, offer a balance of cost and performance, making them ideal for uninterruptible power supplies (UPS), telecommunications, and data centers.

- Governments worldwide are implementing policies and incentives to promote energy storage systems, further driving the adoption of lead acid stationary batteries, especially in regions with ambitious renewable energy targets.

- Lead acid stationary batteries are known for their cost-effectiveness and established technology. Their affordability and widespread availability make them a preferred choice for many industries, supported by a mature recycling infrastructure that enhances their economic viability.

- North America led the market in 2023, capturing 38% of the share, driven by industrial demand and energy policies that promote grid resilience and backup power solutions.

- Europe followed closely with 33% of the market share, with countries like Germany and Italy at the forefront of battery energy storage capacity, fueled by strong renewable energy integration and regulatory incentives.

- The Asia-Pacific region holds a 23% share, propelled by rapid industrialization, urbanization, and growing energy storage needs in countries like China and India, driving the demand for cost-effective energy storage solutions.

Market Drivers:

Integration of Renewable Energy Sources

The global transition to renewable energy sources, such as solar and wind, necessitates efficient energy storage solutions to manage their intermittent nature. Lead acid stationary battery storage systems offer a cost-effective and reliable means to store excess energy generated during peak production periods. This capability ensures a stable power supply during periods of low generation, facilitating the integration of renewable energy into the grid and supporting sustainability goals.

- For instance, Tesla advanced the integration of clean energy by deploying 31.4 GWh of battery storage worldwide in 2024, a figure that more than doubled its deployments from the previous year.

Demand for Uninterrupted Power Supply

Industries and critical infrastructure sectors require a consistent and reliable power supply to maintain operations. Lead acid stationary batteries provide an effective solution for uninterruptible power supply (UPS) systems, ensuring continuous power during outages. Their ability to deliver high surge currents makes them suitable for applications in telecommunications, data centers, and healthcare facilities, where power reliability is paramount.

Cost-Effectiveness and Established Technology

Lead acid batteries are among the most cost-effective energy storage solutions available, offering a balance between performance and affordability. Their well-established technology and widespread availability make them a preferred choice for many applications. The mature recycling infrastructure for lead acid batteries also contributes to their economic viability, supporting a circular economy and reducing environmental impact.

- For instance, thanks to a robust, coast-to-coast lead battery infrastructure in the U.S., the industry successfully keeps approximately 160 million used batteries out of landfills every year.

Government Incentives and Policy Support

Governments worldwide are implementing policies and providing incentives to promote the adoption of energy storage systems. These initiatives aim to enhance energy security, reduce carbon emissions, and support the transition to cleaner energy sources. Such policy support is driving the adoption of lead acid stationary battery storage systems, particularly in regions with ambitious renewable energy targets and grid modernization plans.

Market Trends:

Shift Towards Hybrid and Modular Energy Storage Systems

The stationary battery storage market is witnessing a significant shift towards hybrid and modular energy storage systems. These systems combine different battery technologies, such as lead-acid and lithium-ion, to optimize performance and cost-effectiveness. Hybrid systems offer enhanced flexibility, allowing users to tailor energy storage solutions to their specific needs. Modular designs facilitate scalability, enabling easy expansion as energy demands grow. This trend is driven by the increasing need for efficient and adaptable energy storage solutions across various sectors, including residential, commercial, and industrial applications.

- For instance, the Tesla Megapack, a large-scale modular battery system, has a storage capacity of up to 3.9 megawatt-hours (MWh) per unit.

Advancements in Battery Recycling and Sustainability Initiatives

Advancements in battery recycling technologies are playing a crucial role in enhancing the sustainability of lead acid stationary battery storage systems. Companies are investing in closed-loop recycling processes, recovering lead and other materials from used batteries to produce new ones. This not only reduces the environmental impact but also lowers the demand for raw materials. Additionally, sustainability initiatives are gaining momentum, with manufacturers focusing on improving battery lifespan and reducing energy consumption during production. These efforts contribute to the overall growth and acceptance of lead acid stationary battery storage systems as environmentally responsible energy solutions.

- For instance, San-Lan has developed recycling equipment technology that allows for the recovery of 998 kilograms of lead for every 1,000 kilograms of battery lead that is processed.

Market Challenges Analysis:

Environmental and Health Concerns

Lead acid stationary battery storage systems face significant environmental and health challenges due to the toxic nature of lead and sulfuric acid. Improper disposal and recycling of these batteries can lead to soil and water contamination, posing risks to human health and ecosystems. Additionally, the production and recycling processes can release harmful pollutants, contributing to air and water pollution. These issues have led to stricter regulations and increased scrutiny from environmental agencies, potentially increasing operational costs and affecting market growth.

Competition from Advanced Battery Technologies

The lead acid stationary battery storage market is experiencing intensified competition from advanced battery technologies, particularly lithium-ion batteries. Lithium-ion batteries offer higher energy density, longer cycle life, and reduced maintenance requirements compared to lead acid batteries. As a result, industries and consumers are increasingly opting for lithium-ion solutions, especially in applications where space, weight, and performance are critical. This shift poses a challenge for lead acid batteries to maintain their market share and necessitates innovation and adaptation within the industry.

Market Opportunities:

Expansion into Emerging Markets

The lead acid stationary battery storage market presents significant opportunities in emerging economies experiencing rapid industrialization and urbanization. Regions such as Asia, Africa, and South America are witnessing increased energy consumption due to growing middle classes and expanding industrial sectors. For instance, countries like India and Brazil are implementing aggressive renewable energy integration plans, which include substantial investments in solar and wind capacities. Governments in these regions are supporting the adoption of energy storage technologies through various incentives such as tax breaks, subsidies, and favorable regulations. This combination of increasing energy demand, favorable government policies, and the critical need for grid modernization positions lead acid stationary battery storage systems as a viable solution to meet these challenges.

Integration with Renewable Energy Sources

The global transition towards renewable energy sources, such as solar and wind, necessitates efficient energy storage solutions to manage their intermittent nature. Lead acid stationary batteries offer a cost-effective and reliable means to store excess energy generated during peak production periods. This capability ensures a stable power supply during periods of low generation, facilitating the integration of renewable energy into the grid. The growing adoption of renewable energy sources is driving the demand for stationary lead acid battery storage systems, particularly in applications like uninterruptible power supplies (UPS), telecommunications, and data centers. Additionally, advancements in battery technology and recycling processes are enhancing the appeal of lead acid batteries in stationary applications, further supporting their role in sustainable energy infrastructures.

Market Segmentation Analysis:

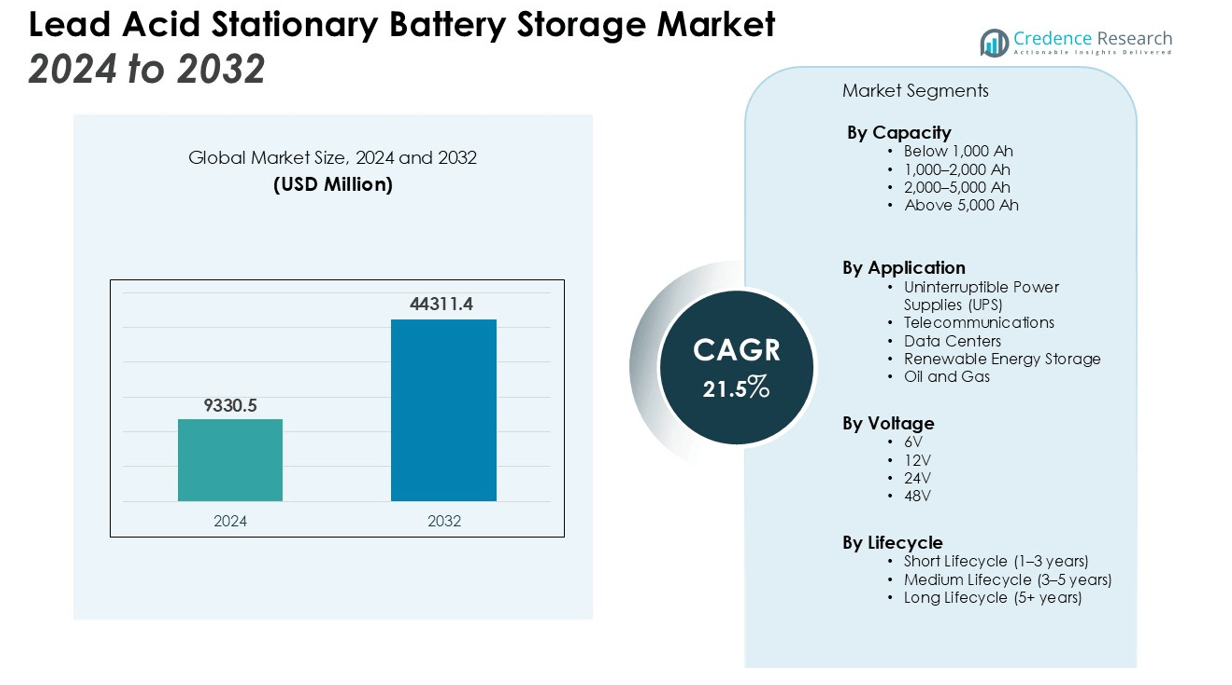

By Capacity

The market is segmented into four capacity ranges: Below 1,000 Ah, 1,000–2,000 Ah, 2,000–5,000 Ah, and Above 5,000 Ah. The 1,000–2,000 Ah segment holds the largest market share, driven by its widespread adoption in uninterruptible power supplies (UPS) and telecommunications. The Below 1,000 Ah segment is projected to witness the highest growth rate, fueled by increasing demand for small-scale energy storage solutions in residential and commercial sectors. The 2,000–5,000 Ah segment is significant in large-scale applications such as grid balancing and renewable energy integration. The Above 5,000 Ah segment is gaining traction due to the growing need for high-capacity energy storage solutions in industrial and utility applications.

- For instance, Aoke Epower Co., Ltd. manufactures the AK-EH04 solar storage system, which features LFP battery technology and has a nominal capacity of 300 Ah.

By Application

Key applications include UPS systems, telecommunications, data centers, renewable energy storage, and oil and gas sectors. The UPS segment is expected to dominate, driven by the need for reliable backup power in critical infrastructure. Telecommunications and data centers also represent substantial portions of the market, requiring uninterrupted power supply to maintain operations. Renewable energy storage is an emerging application, facilitating the integration of solar and wind energy into the grid. The oil and gas sector utilizes stationary lead acid batteries for backup power in remote locations and offshore platforms.

- For instance, Huawei’s FusionPower UPS5000-H series for data centers can achieve a power capacity of 1 megawatt in a single rack, a design that supports high-density deployments.

By Voltage

Voltage options in the market include 6V, 12V, 24V, and 48V. The 12V segment is anticipated to hold the largest market share, owing to its versatility and widespread use in various applications, including UPS systems, automotive batteries, and renewable energy storage. The 6V segment is expected to grow steadily, driven by its adoption in small-scale applications such as emergency lighting and portable devices. The 24V and 48V segments are projected to expand, particularly in industrial and commercial applications requiring higher power capacities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Capacity

- Below 1,000 Ah

- 1,000–2,000 Ah

- 2,000–5,000 Ah

- Above 5,000 Ah

By Application

- Uninterruptible Power Supplies (UPS)

- Telecommunications

- Data Centers

- Renewable Energy Storage

- Oil and Gas

By Voltage

By Lifecycle

- Short Lifecycle (1–3 years)

- Medium Lifecycle (3–5 years)

- Long Lifecycle (5+ years)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America held a significant share of 38% in the stationary lead acid battery storage market, driven by a strong industrial base and rising demand for reliable backup power. The United States, in particular, is projected to surpass substantial market value, fueled by applications in data centers, telecommunications, and utilities. The region’s established infrastructure and emphasis on energy resilience contribute to its market dominance. With increasing demand for grid stabilization and power backup solutions, North America remains a key player in the market.

Europe

Europe accounted for 33% of the market share, with countries like Germany and Italy leading in battery energy storage capacity. Germany has seen strong installations of home storage systems in recent years. The region’s commitment to renewable energy integration and stringent environmental regulations support the adoption of lead acid stationary battery storage systems for grid stabilization and backup power. As a major player in the renewable energy sector, Europe is well-positioned for continued growth in battery storage solutions.

Asia-Pacific

The Asia-Pacific region captured a market share of 23%, driven by rapid industrialization and growing energy demand in countries like China and India. These nations are focusing on expanding renewable energy capacity and improving grid infrastructure, creating a significant opportunity for lead acid battery storage solutions. The region’s emphasis on cost-effective and scalable energy storage systems is expected to drive its market share further, especially in emerging economies where energy demand is rapidly increasing.

Key Player Analysis:

- Exide Technologies

- Crown Battery Manufacturing Co.

- S. Battery Manufacturing Co.

- GNB Industrial Power

- Yuasa Battery Co. Ltd.

- Fiamm S.p.A.

- Trojan Battery Co.

- HBL Power Systems

- Enersys

- East Penn Manufacturing Co.

- Leoch Battery Group Co. Ltd.

- Johnson Controls Inc.

Competitive Analysis:

The Lead Acid Stationary Battery Storage Market is competitive, with key players like Exide Technologies, Crown Battery Manufacturing Co., HOPPECKE Batterien, and East Penn Manufacturing Co. dominating the landscape. Exide Technologies is notable for its broad range of products and strong R&D focus, continuously improving battery efficiency and performance. Crown Battery, known for long-lasting, durable batteries, and HOPPECKE, offering comprehensive industrial solutions, also hold significant positions in the market. East Penn’s extensive product portfolio and global presence further enhance its competitive edge. These companies differentiate themselves through technological advancements, high-quality products, and robust customer service. The rising demand for energy storage solutions, particularly driven by renewable energy integration and backup power needs, intensifies competition. Players are focusing on expanding their offerings, improving performance, and tapping into new markets to maintain their market leadership.

Recent Developments:

- In July 2025, Exide Technologies launched its new EZ800 Dual EFB battery, designed for marine and leisure applications.

- In July 2025, GS Yuasa launched its next-generation SWL+ series of Valve Regulated Lead Acid (VRLA) batteries for uninterruptible power supply (UPS) and other standby power applications.

- In March 2025, East Penn Manufacturing Co. launched its new Deka Ready Power product family, which includes both Lithium and Gel battery technologies, at the ProMat 2025 trade show.

Market Concentration & Characteristics:

The Lead Acid Stationary Battery Storage Market is moderately concentrated, with several key players holding substantial market shares. Leading companies, including Exide Technologies, Crown Battery, HOPPECKE, and East Penn Manufacturing, dominate the market by offering a wide range of reliable and cost-effective solutions for various applications. These companies leverage strong research and development capabilities to improve battery performance, efficiency, and lifespan. The market is characterized by high competition, as manufacturers focus on product innovation, technological advancements, and expanding their global presence. Despite this, there remains room for regional players to enter and establish a presence by offering tailored solutions and capitalizing on specific industry needs. The market’s characteristics include a steady demand for energy storage solutions driven by the adoption of renewable energy, growing industrial applications, and the increasing need for backup power systems in critical sectors.

Report Coverage:

The research report offers an in-depth analysis based on Capacity, Application, Voltage, Lifecycle and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Lead Acid Stationary Battery Storage Market will continue to benefit from the increasing adoption of renewable energy sources, requiring reliable energy storage solutions for grid integration.

- Technological advancements in battery design and recycling processes will enhance the efficiency and sustainability of lead acid batteries.

- The demand for uninterruptible power supply (UPS) systems, particularly in critical industries like telecommunications, data centers, and healthcare, will drive further growth.

- Government policies and incentives supporting renewable energy adoption and energy storage systems will provide a favorable environment for market expansion.

- The rise in industrialization and urbanization, especially in developing economies, will increase the need for energy storage solutions in commercial and residential sectors.

- Competition from advanced battery technologies, such as lithium-ion, will encourage continuous improvements in lead acid battery performance.

- Regional diversification will lead to increased market opportunities, especially in emerging markets like Asia-Pacific and Latin America.

- The growing focus on energy security and the need for reliable backup power will continue to drive demand in various applications, including oil and gas and large-scale energy storage.

- Manufacturers will invest more in expanding their product portfolios and entering new markets to maintain a competitive edge.

- The shift towards more sustainable and environmentally friendly solutions will drive innovation in lead acid battery recycling and lifespan improvements.