Market Overview:

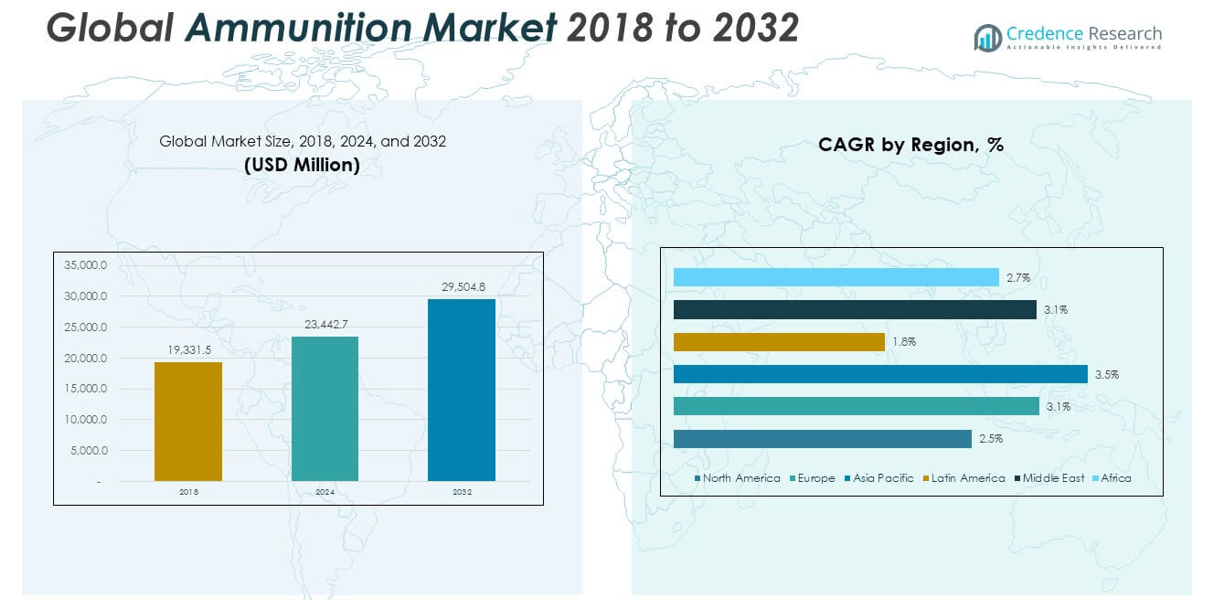

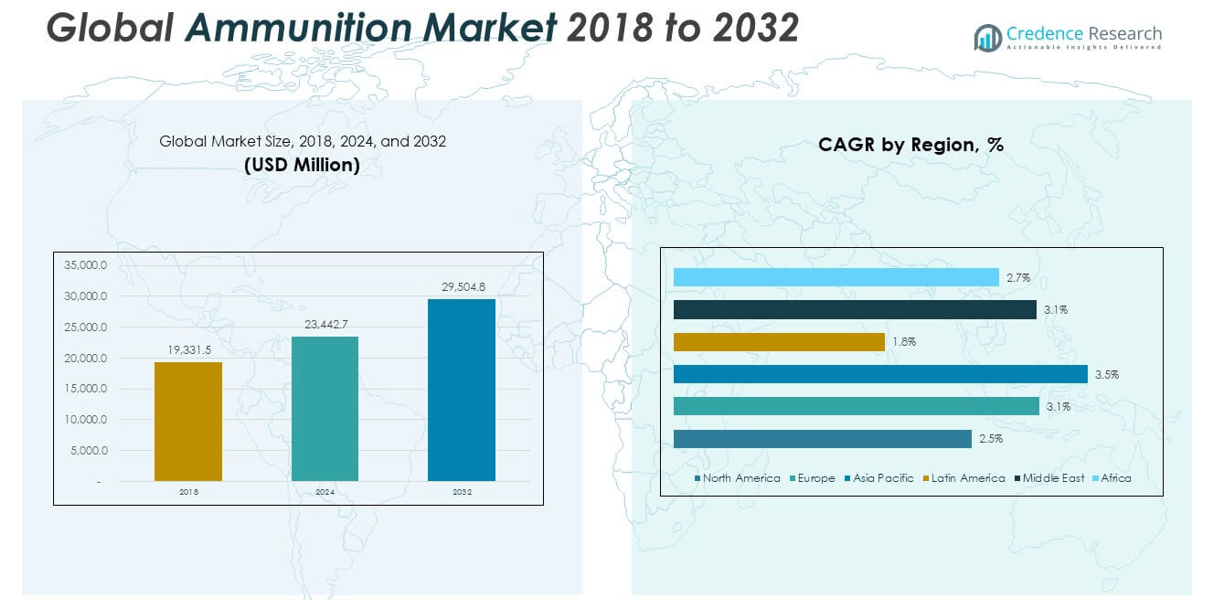

The Ammunition Market size was valued at USD 19,331.5 million in 2018 to USD 23,442.7 million in 2024 and is anticipated to reach USD 29,504.8 million by 2032, at a CAGR of 2.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ammunition Market Size 2024 |

USD 23,442.7 million |

| Ammunition Market, CAGR |

2.90% |

| Ammunition Market Size 2032 |

USD 29,504.8 million |

Key drivers fueling the growth of the ammunition market include rising geopolitical tensions, increased defense modernization programs, and a growing emphasis on border security. Military and paramilitary forces across the globe are expanding their inventories of both conventional and precision-guided munitions to enhance combat readiness and tactical superiority. Furthermore, advancements in ammunition technology—such as smart ammunition and lightweight alloys—are improving performance and attracting defense contracts. Civilian demand, especially in countries with liberal gun ownership laws, continues to rise for applications such as self-defense, hunting, and sports shooting. In addition, law enforcement agencies are upgrading their arsenals in response to evolving threats and crime rates, further supporting market demand.

Regionally, North America dominates the global ammunition market due to substantial military budgets, large-scale procurement initiatives, and a significant civilian firearms population—particularly in the United States. Europe holds the second-largest share, driven by NATO commitments and rising defense spending in response to regional conflicts, particularly the Russia–Ukraine war. Asia-Pacific represents the fastest-growing regional market, propelled by defense modernization in countries like China, India, South Korea, and Australia. These nations are increasingly focused on indigenous production and reducing import dependency. Latin America shows moderate growth, largely influenced by police modernization and civilian firearm use, especially in Brazil and Mexico. Meanwhile, the Middle East and Africa are witnessing consistent demand amid ongoing regional conflicts and rising investment in military infrastructure.

Market Insights:

- The Ammunition Market size was valued at USD 19,331.5 million in 2018 to USD 23,442.7 million in 2024 and is anticipated to reach USD 29,504.8 million by 2032, at a CAGR of 2.90% during the forecast period, supported by a CAGR of 2.90% and expanding global security requirements.

- Rising geopolitical tensions and strategic military modernization programs are boosting demand for both conventional and precision-guided ammunition across major economies.

- Technological advancements such as smart munitions, lightweight alloys, and environmentally safer rounds are reshaping tactical capabilities and product development priorities.

- Strong civilian interest in self-defense, sport shooting, and hunting is driving market diversification, especially in countries with liberal gun ownership laws.

- Regulatory complexity, export controls, and inconsistent standards across regions are restricting innovation and limiting global trade flexibility for manufacturers.

- Supply chain volatility and rising raw material costs are exerting financial pressure, particularly on smaller firms operating under fixed defense contracts.

- Regionally, North America leads the market in size, while Asia-Pacific emerges as the fastest-growing region, driven by defense spending and indigenous production efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increased Global Defense Spending and Strategic Military Modernization Are Accelerating Procurement Volumes

The sharp rise in defense budgets across key nations has directly influenced the growth of the Ammunition Market. Countries are allocating substantial resources to modernize military capabilities, leading to higher procurement of both conventional and precision-guided ammunition. Tensions in Eastern Europe, the Middle East, and the Indo-Pacific region have prompted several governments to reassess combat readiness and reinforce stockpiles. Military modernization programs often include a comprehensive overhaul of weapons systems and corresponding ammunition. It supports rapid acquisition cycles and multi-year contracts with global suppliers. Nations such as the United States, India, China, and Germany have prioritized ammunition replenishment to maintain operational preparedness.

- For example, in 2024 and 2025, the U.S. Army awarded over $961 million in contracts to boost 155mm artillery production, including procurement of 500,000 M119A2 propellant charges, 260,000 M231 Modular Artillery Charge Systems, and 16,900 M1128 High Explosive projectiles. The Army set a target of producing 100,000 shells per month by 2025, responding to increased demand from ongoing conflicts and modernization priorities.

Ongoing Border Conflicts and Security Threats Continue to Drive Demand Across Military and Law Enforcement Agencies

Persistent regional conflicts and internal security challenges have sustained the momentum of demand for ammunition. The market remains strongly influenced by the need for responsive tactical solutions to address insurgencies, terrorism, and organized crime. Law enforcement agencies are also enhancing their response capabilities with new ammunition types suited for urban operations and crowd control. Countries experiencing political unrest or territorial disputes are investing heavily in ammunition to support both deterrence and frontline deployments. The Ammunition Market has expanded its relevance beyond wartime usage into peacekeeping missions and civilian protection scenarios. It now serves a wider security apparatus that includes border forces, counter-terrorism units, and riot control teams.

- For instance, in 2024, Federal Premium launched the Hydra-Shok Deep 9mm round, featuring a redesigned core and center post for up to 50% deeper penetration than the original Hydra-Shok. It achieves 15 inches of penetration in bare ballistic gel, meeting FBI standards for law enforcement and self-defense applications.

Technological Innovation and Product Advancement Are Expanding Tactical Capabilities and Application Scope

Recent advancements in materials science, ballistics, and smart systems have transformed traditional ammunition into high-performance combat tools. Manufacturers are focusing on creating lighter, more durable, and environmentally safer ammunition without compromising lethality. The integration of electronics into guided munitions has improved accuracy, reducing collateral damage and enhancing mission success rates. Smart ammunition is seeing greater adoption in both training and combat environments, particularly by advanced military forces. The Ammunition Market now reflects a strategic shift from volume-based consumption to precision-based application. It supports agile warfare strategies that rely on real-time data, unmanned systems, and remote operations.

Civilian Demand for Personal Defense, Sport Shooting, and Hunting Is Supporting Market Diversification

Civilian use of firearms remains a strong contributor to overall market dynamics, especially in North America and parts of Europe. Rising interest in personal protection, recreational shooting, and regulated hunting has fueled demand for small-caliber ammunition. Several manufacturers are tailoring product lines to meet the preferences of sport shooters and licensed gun owners. Demand from private consumers has remained resilient, driven by lifestyle trends and concerns about personal safety. The Ammunition Market benefits from this stable civilian segment, which complements government procurement and sustains manufacturing cycles. It plays a key role in balancing military requirements with commercial opportunities

Market Trends:

Adoption of Lead-Free and Environmentally Friendly Ammunition Is Strengthening Compliance and Sustainability Goals

Environmental regulations are shaping new standards in ammunition production, pushing manufacturers toward non-toxic and biodegradable alternatives. Lead-free ammunition is gaining traction among military, law enforcement, and civilian users due to increasing concerns about soil and groundwater contamination. Several countries have enacted policies to phase out traditional lead-based rounds, especially in training ranges and hunting zones. This shift has encouraged the development of copper-based and polymer-composite projectiles. The Ammunition Market is now witnessing a surge in R&D investments aimed at balancing ballistic performance with ecological safety. It reinforces sustainability mandates without compromising operational requirements.

- For example, SIM-X’s DEFENSECORE bullets feature a patented synthetic polymer core combined with a precision alloy jacket, making them completely lead-free and suitable for indoor range use without requiring hazardous material cleanup. The core material exhibits non-Newtonian fluid properties, which enhance gas sealing and contribute to increased muzzle velocities. According to company data and independent testing, these rounds can achieve velocity improvements of up to 12% compared to traditional lead-core ammunition, depending on the caliber and conditions.

Integration of Advanced Manufacturing Technologies Is Streamlining Production and Enhancing Customization

Manufacturers are integrating automation, robotics, and additive manufacturing to improve efficiency and precision in ammunition production. These technologies enable faster prototyping, consistent quality control, and the ability to tailor products to specific mission profiles. Smart factories allow real-time monitoring of production metrics, helping to reduce material waste and downtime. Customization in bullet weight, shape, and coatings is also becoming more feasible with digital tooling. The Ammunition Market is responding to user demand for tailored solutions that meet modern tactical and recreational requirements. It supports more agile supply chains and scalable operations.

- For example, in 2025, BAE Systems announced a 16-fold increase in 155mm artillery shell production at its Glascoed, South Wales facility by implementing new production methods. This leap was achieved through innovations in propellant formulas and manufacturing processes, notably reducing the need for large-scale factories and operating costs.

Expansion of Virtual and Simulation-Based Training Is Driving Demand for Non-Lethal and Practice Ammunition

Armed forces and law enforcement agencies are expanding the use of simulation-based training to enhance combat readiness without incurring high operational costs. This trend has increased the demand for non-lethal rounds and low-cost practice ammunition. Simulated environments often require specialized rounds that replicate real ballistics while ensuring safety and reusability. Commercial shooting ranges are also incorporating these technologies to improve user engagement and reduce risk. The Ammunition Market is evolving to include training-grade products that mirror live-fire performance while maintaining cost-efficiency. It ensures readiness while minimizing live-fire wear and logistics burdens.

Growing Interest in Heritage and Collectible Ammunition Is Creating a Niche Premium Segment

Collectors and enthusiasts are driving demand for historically significant and limited-edition ammunition. This trend includes reproduction of vintage calibers, custom headstamps, and commemorative packaging. Manufacturers are catering to this audience through curated collections that emphasize authenticity and craftsmanship. Auctions and private sales of collectible rounds are becoming more visible through online platforms and trade shows. The Ammunition Market now includes a premium niche where value is defined by rarity and historical significance rather than just performance. It offers manufacturers a profitable avenue beyond traditional military or civilian supply chains.

Market Challenges Analysis:

Stringent Regulatory Frameworks and Export Restrictions Are Limiting Global Trade and Innovation

The ammunition industry operates under tight scrutiny, with strict regulations governing production, distribution, and export. Governments impose licensing requirements, safety protocols, and environmental standards that vary widely across regions. These inconsistent frameworks create delays, limit market entry, and restrict international supply chain flexibility. Export controls and embargoes on certain countries further complicate global sales, especially for small and mid-sized manufacturers. The Ammunition Market must navigate complex legal environments, which often slow innovation and raise operational costs. It requires companies to maintain compliance while adapting to shifting geopolitical and regulatory landscapes.

Volatility in Raw Material Supply and Rising Production Costs Are Pressuring Profit Margins

Raw materials such as brass, copper, steel, and chemical propellants are critical to ammunition manufacturing, yet their prices remain highly volatile. Supply disruptions caused by global trade tensions, mining restrictions, or transportation delays have raised costs and created procurement uncertainty. Manufacturers often face difficulty passing on these cost increases to end users, particularly in government contracts with fixed pricing terms. Energy costs and inflationary pressures have further inflated overall production expenses. The Ammunition Market must balance quality, affordability, and reliability in a volatile input environment. It places continuous pressure on margins and challenges long-term financial planning.

Market Opportunities:

Expansion of Domestic Manufacturing Capabilities Can Reduce Import Dependency and Strengthen Supply Chains

Several countries are investing in local ammunition production to achieve self-reliance and secure consistent supply. Government-backed initiatives and defense industrial policies are promoting the establishment of domestic manufacturing units. This shift reduces reliance on imports, shortens lead times, and improves inventory responsiveness. The Ammunition Market stands to benefit from public-private partnerships and technology transfers that enhance domestic capabilities. It enables tailored product development aligned with national defense needs. Local sourcing also helps mitigate geopolitical risks tied to global supply chain disruptions.

Rising Demand from Emerging Economies Offers Untapped Commercial and Defense Potential

Rapid economic development and growing security concerns in regions like Asia-Pacific, Latin America, and Africa are increasing ammunition demand. Governments in these areas are expanding military budgets and modernizing security forces. Civilian interest in sport shooting and personal defense is also on the rise, supported by changing regulatory landscapes. The Ammunition Market can tap into these emerging segments through affordable, adaptable product lines. It opens up growth channels beyond traditional markets dominated by North America and Europe. Localized marketing and distribution strategies can enhance brand visibility and capture long-term value.

Market Segmentation Analysis:

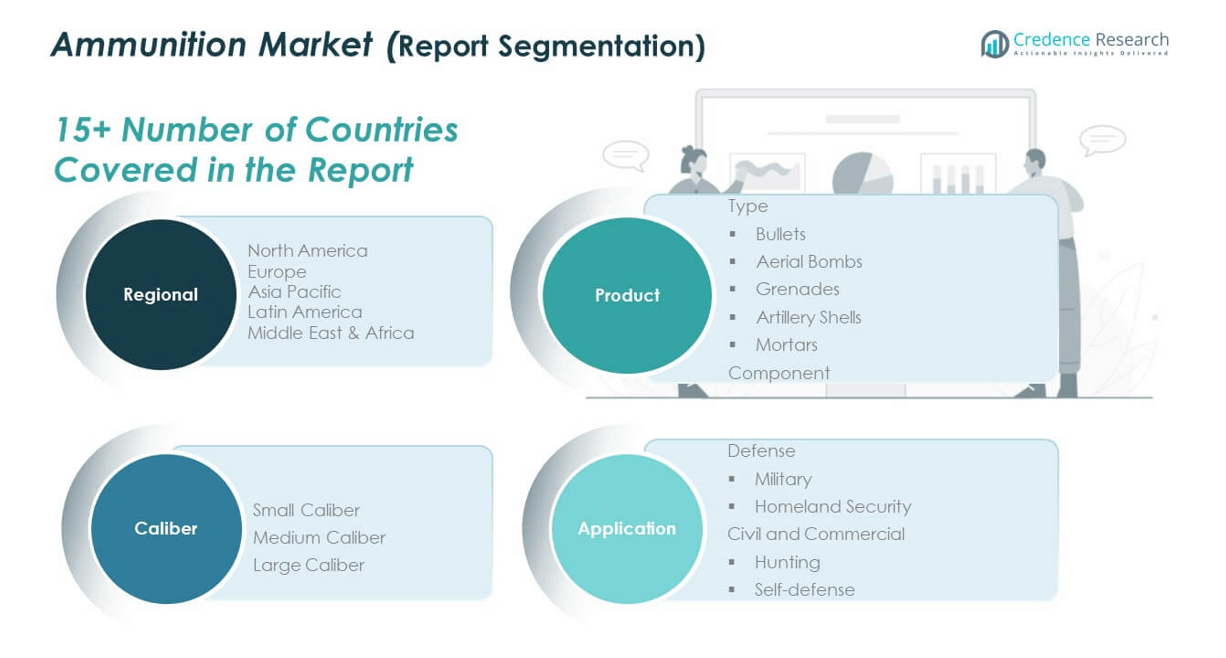

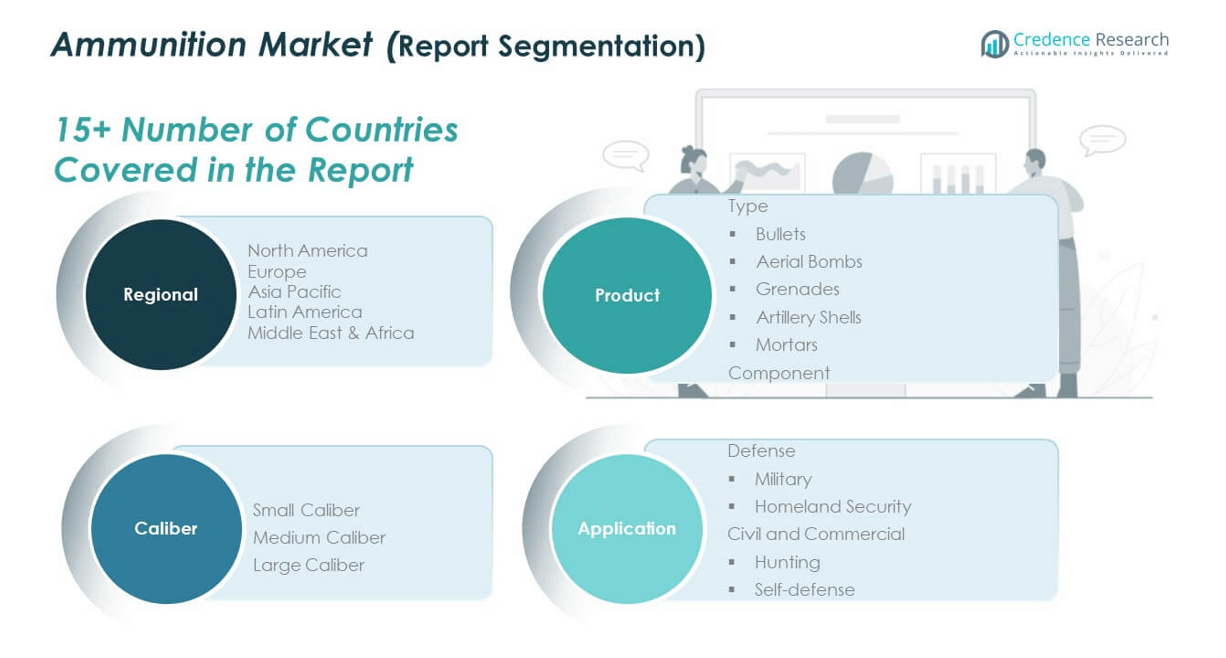

The Ammunition Market is segmented by product type, caliber, and application, each contributing to its overall growth and diversification.

By product, the market includes bullets, aerial bombs, grenades, artillery shells, and mortars. Bullets hold the largest share due to widespread military and civilian usage, while artillery shells and mortars gain traction through increasing demand in active conflict zones. Aerial bombs and grenades also register consistent growth driven by evolving combat strategies and tactical applications. By component, the market includes critical elements such as casings, primers, propellants, and projectiles, where innovation in materials and design continues to enhance performance.

- For example, Federal Premium and Winchester Ammunition play pivotal roles in bullet segment, spearheading product development and market expansion. Federal Premium markets the popular .308 Winchester, offering variants like Nosler AccuBond, Trophy Copper, and Sierra MatchKing tailored for hunting and target shooting.

By caliber, the market is categorized into small, medium, and large calibers. Small caliber ammunition dominates, supported by high consumption across infantry, law enforcement, and civilian sectors. Medium and large calibers are primarily used in armored and artillery systems, with rising procurement from defense forces worldwide.

- For example, carbon fiber-reinforced polymers offer high strength-to-weight ratios and corrosion resistance, while 3D printing enables the production of complex, lightweight components with tight tolerances.

By application, the market serves defense and civil-commercial sectors. Within defense, military and homeland security drive demand through modernization and tactical upgrades. In the civil and commercial segment, hunting leads growth, supported by legal firearm ownership and recreational shooting in North America and parts of Europe. The Ammunition Market reflects evolving end-user needs and varied operational scenarios across its core segments.

Segmentation:

By Product

· Type

- Bullets

- Aerial Bombs

- Grenades

- Artillery Shells

- Mortars

· Component

By Caliber

- Small Caliber

- Medium Caliber

- Large Caliber

By Application

- Defense

- Military

- Homeland Security

- Civil and Commercial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Ammunition Market size was valued at USD 6,315.61 million in 2018 to USD 7,490.95 million in 2024 and is anticipated to reach USD 9,146.49 million by 2032, at a CAGR of 2.5% during the forecast period. North America holds the largest share of the global Ammunition Market, accounting for nearly 36.5% of total revenue in 2024. The region benefits from high military expenditure, widespread civilian firearm ownership, and a strong domestic manufacturing base. The United States drives most of the demand, supported by defense modernization initiatives and a robust law enforcement sector. Canada contributes through recreational shooting and hunting applications. Government procurement contracts and private sales continue to fuel steady market expansion. It maintains a strategic edge through technological innovation and consistent investment in production capabilities.

The Europe Ammunition Market size was valued at USD 4,235.54 million in 2018 to USD 5,190.55 million in 2024 and is anticipated to reach USD 6,623.83 million by 2032, at a CAGR of 3.1% during the forecast period. Europe contributes around 25.3% of the global market share, driven by growing defense budgets and collaborative procurement among NATO member states. Countries such as Germany, France, and the United Kingdom are actively investing in smart ammunition and stockpile enhancement. The conflict in Ukraine has heightened regional defense preparedness, prompting accelerated spending across Eastern and Central Europe. The Ammunition Market in this region is characterized by partnerships between governments and domestic manufacturers. It is supported by strong regulatory frameworks and research programs that foster innovation and cross-border supply chains.

The Asia Pacific Ammunition Market size was valued at USD 5,113.19 million in 2018 to USD 6,423.64 million in 2024 and is anticipated to reach USD 8,459.03 million by 2032, at a CAGR of 3.5% during the forecast period. Asia Pacific holds around 31.4% of the global Ammunition Market share, making it the fastest-growing region. Key contributors include China, India, South Korea, Japan, and Australia, all of which are boosting defense production and procurement. Border tensions, territorial disputes, and rising domestic security concerns are driving continuous demand. Governments are emphasizing indigenous manufacturing to reduce dependency on imports and improve strategic autonomy. The region shows a high volume of military-grade ammunition usage alongside increasing civilian adoption. It reflects a diverse and rapidly evolving security environment.

The Latin America Ammunition Market size was valued at USD 1,569.72 million in 2018 to USD 1,791.02 million in 2024 and is anticipated to reach USD 2,065.34 million by 2032, at a CAGR of 1.8% during the forecast period. Latin America represents approximately 8.1% of the global market in 2024, led by Brazil, Mexico, and Argentina. Market growth is largely driven by law enforcement modernization, rising crime rates, and growing civilian interest in personal defense. Governments are focusing on strengthening national security infrastructure and tactical response units. The Ammunition Market in this region remains fragmented, with a mix of local production and foreign imports. Brazil stands out as a regional manufacturing hub with expanding export capabilities. It continues to gain relevance in both domestic and export markets.

The Middle East Ammunition Market size was valued at USD 1,192.76 million in 2018 to USD 1,459.48 million in 2024 and is anticipated to reach USD 1,858.80 million by 2032, at a CAGR of 3.1% during the forecast period. The Middle East accounts for 7.1% of global market share, driven by active conflicts, border tensions, and large-scale military investments. Countries such as Saudi Arabia, the United Arab Emirates, and Israel are expanding defense arsenals and upgrading ammunition stockpiles. Demand is supported by ongoing geopolitical instability and government priorities in counter-terrorism and regional deterrence. Domestic production is increasing through international partnerships and offset agreements. The Ammunition Market here reflects a high preference for technologically advanced and precision-guided rounds. It remains a key destination for global suppliers seeking long-term defense contracts.

The Africa Ammunition Market size was valued at USD 904.72 million in 2018 to USD 1,087.07 million in 2024 and is anticipated to reach USD 1,351.32 million by 2032, at a CAGR of 2.7% during the forecast period. Africa holds a 5.3% share of the global market, supported by rising regional security threats, military reforms, and peacekeeping deployments. Nations such as South Africa, Egypt, and Nigeria are leading demand, with emphasis on small- and medium-caliber ammunition. Armed forces and police units are expanding training programs and tactical capabilities. The Ammunition Market in Africa is shaped by growing reliance on foreign suppliers and limited domestic manufacturing infrastructure. It shows potential for growth through defense partnerships and international funding programs. Strategic focus remains on affordability, reliability, and consistent supply.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- General Dynamics Corporation

- Magtech Ammunition Company, Inc.

- Remington Arms Company, Inc.

- Denel PMP

- RUAG Ammotec

- Northrop Grumman Corporation

- Olin Corporation

- Nammo AS

- ST Engineering

- Elbit Systems

- Other Key Players

Competitive Analysis:

The Ammunition Market is characterized by intense competition among global defense contractors, specialized manufacturers, and emerging regional players. Leading companies such as Northrop Grumman, BAE Systems, General Dynamics, Rheinmetall AG, and CBC Global Ammunition maintain strong market positions through advanced product offerings, large-scale contracts, and integrated supply chains. It continues to attract investment in research and development, focusing on precision-guided munitions, eco-friendly materials, and enhanced ballistic performance. Strategic partnerships, government tie-ups, and expansion into emerging markets play a critical role in shaping competitive advantage. Regional players are gaining ground by meeting local procurement needs and offering cost-effective solutions. The Ammunition Market remains sensitive to geopolitical developments, regulatory approvals, and export restrictions, which influence production and trade strategies. Companies that can innovate, scale efficiently, and adapt to evolving defense priorities are expected to retain leadership in this dynamic environment.

Recent Developments:

- In early 2025, APEX Ammunition introduced a new 3-inch 20-gauge load to its popular TSS/S 3 family of blended waterfowl ammunition. This new load combines ⅞-ounce of premium No. 2 steel with ¼-ounce of No. 7.5 TSS, aiming to deliver enhanced performance for waterfowl hunters.

- In January 2025, Remington launched the Core-Lokt Tipped Lever Gun ammo, extending its traditional Core-Lokt hunting series to optimize performance for lever-action rifles. This new product promises improved downrange performance and is tailored for hunters seeking reliable expansion and penetration.

- In August 2023, Remington Ammunition expanded its partnership with Ganka Inc., a leading distributor of outdoor clothing and accessories. This collaboration broadens Remington’s product offerings to include a complete line of hunting apparel and footwear, enhancing its appeal to hunters and outdoor enthusiasts across North America.

Market Concentration & Characteristics:

The Ammunition Market displays a moderate to high level of concentration, with a few dominant players controlling a significant share of global production and distribution. It features a blend of multinational defense firms and regional manufacturers serving both military and civilian sectors. The market operates under stringent regulatory oversight and long procurement cycles, which favor established companies with proven capabilities and government relationships. It requires high capital investment, technological expertise, and compliance with international standards. Demand patterns are closely tied to defense budgets, security needs, and geopolitical events. While innovation drives differentiation, price sensitivity and reliability remain critical buying criteria across all segments.

Report Coverage:

The research report offers an in-depth analysis based on Product, Caliber and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The ammunition market is expected to grow steadily over the forecast period, supported by long-term defense and civilian demand.

- Heightened geopolitical tensions and national security concerns are increasing investments in military-grade ammunition.

- Advancements in smart munitions and innovative materials are enhancing battlefield effectiveness and product differentiation.

- Ongoing defense modernization programs across major economies are sustaining demand for advanced ammunition types.

- Civilian firearm usage for personal protection, sport shooting, and hunting continues to expand in key markets.

- Law enforcement agencies are upgrading equipment to respond more effectively to urban and cross-border threats.

- North America remains the leading regional market, supported by strong defense budgets and widespread firearm ownership.

- Europe is experiencing consistent growth due to rising defense cooperation and geopolitical instability.

- Asia-Pacific is emerging as the fastest-growing region, driven by domestic manufacturing and strategic defense priorities.

- Latin America, the Middle East, and Africa show increasing demand through internal security reforms and regional defense initiatives.