Market Overview

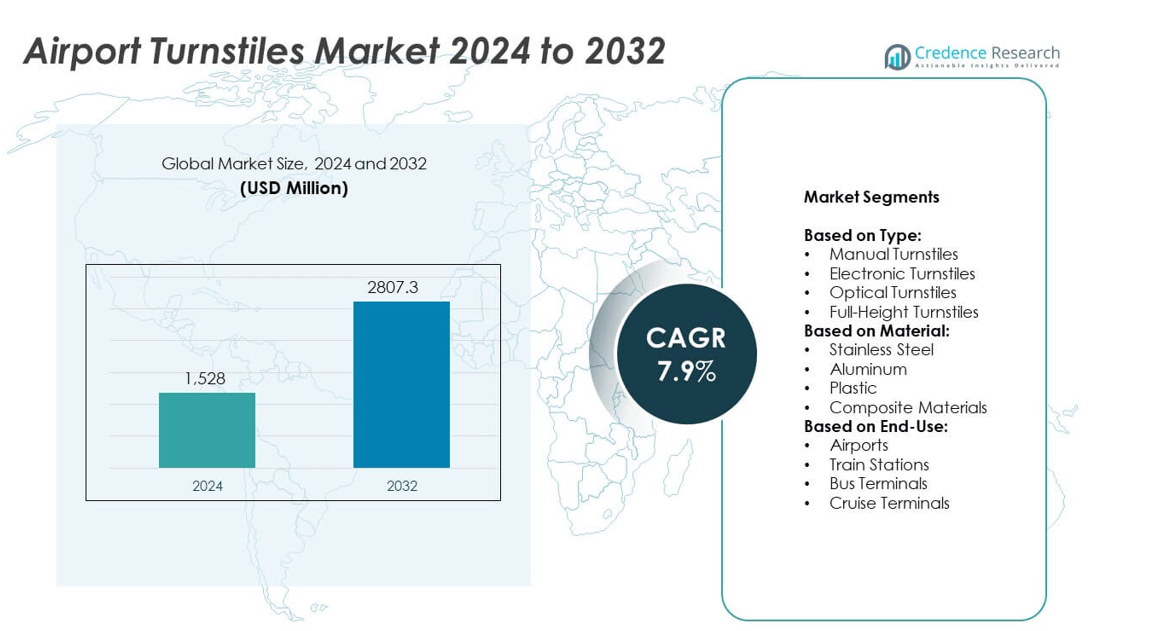

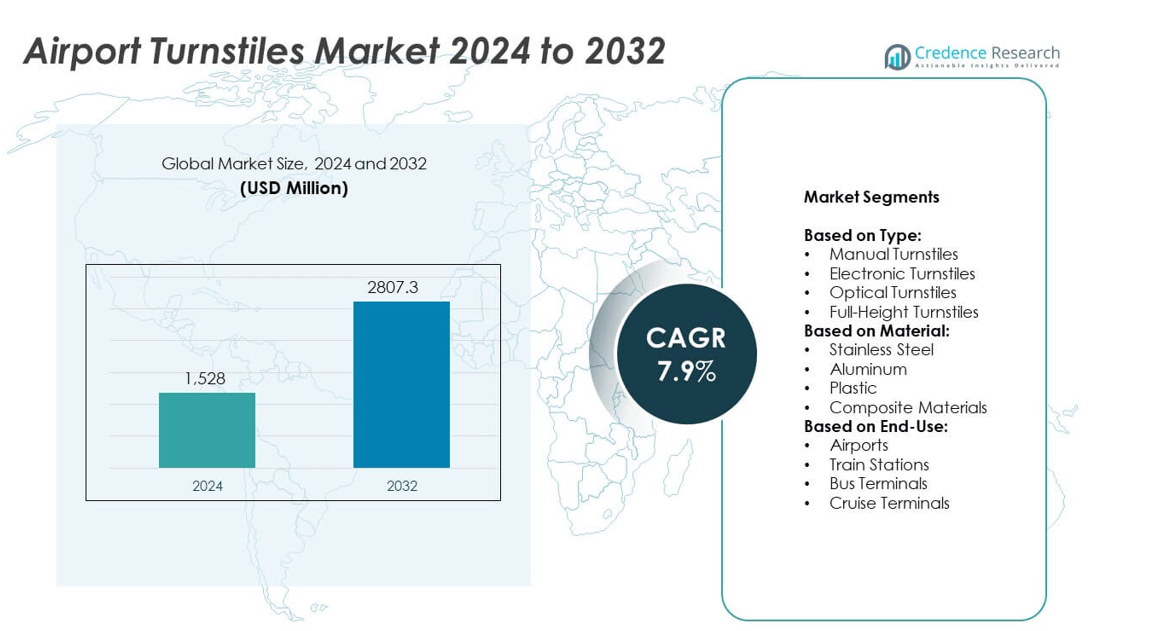

Airport Turnstiles Market size was valued at USD 1,528 Million in 2024 and is anticipated to reach USD 2,807.3 Million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport Turnstiles Market Size 2024 |

USD 1,528 Million |

| Airport Turnstiles Market, CAGR |

7.9% |

| Airport Turnstiles Market Size 2032 |

USD 2,807.3 Million |

Airport Turnstiles market grows with rising global passenger traffic and stricter airport security regulations. Demand for biometric-enabled, contactless, and automated access control systems is increasing to improve passenger throughput and reduce congestion. Airports invest in smart infrastructure that integrates turnstiles with IoT platforms and surveillance systems. Sustainability initiatives drive adoption of energy-efficient and durable designs. Focus on enhancing passenger experience and reducing manual intervention encourages airports to upgrade existing infrastructure with advanced, reliable, and digitally connected turnstile solutions.

North America leads the Airport Turnstiles market with strong investments in airport modernization and biometric systems. Europe follows with upgrades to meet strict aviation security regulations and enhance passenger flow. Asia-Pacific shows rapid growth driven by new airport construction and rising domestic travel demand. Middle East & Africa focus on large-scale airport expansions, while Latin America modernizes major hubs to improve efficiency. Key players include OTIS, Schneider Electric, Thales, Siemens, Zebra Technologies, and Fujitsu, offering advanced and scalable turnstile solutions.

Market Insights

- Airport Turnstiles market was valued at USD 1,528 million in 2024 and is projected to reach USD 2,807.3 million by 2032, growing at a CAGR of 7.9%.

- Rising air passenger traffic and stricter airport security regulations are key drivers boosting demand.

- Biometric-enabled, contactless, and IoT-integrated turnstiles are gaining adoption to enhance throughput and efficiency.

- Leading players such as OTIS, Schneider Electric, Thales, Siemens, Zebra Technologies, and Fujitsu focus on innovation and global expansion.

- High installation costs, retrofitting challenges, and maintenance complexity act as restraints, delaying adoption in smaller airports.

- North America leads with advanced airport modernization projects, Europe upgrades terminals under strict EASA regulations, and Asia-Pacific sees fastest growth with new airport construction.

- Middle East & Africa invest in large-scale hub developments, while Latin America accelerates adoption in major airports to improve passenger management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Passenger Traffic and Security Requirements

Airport Turnstiles market benefits from rising global air travel and stricter security standards. Increasing passenger volumes drive airports to adopt automated access control for smoother movement. It enhances security screening efficiency by restricting unauthorized entry. Turnstiles improve passenger flow during peak hours, reducing wait times. Airports deploy advanced biometric-enabled systems to meet regulatory compliance. This shift supports seamless travel experience and operational reliability.

- For instance, The Fast Track Immigration – Trusted Traveller Programme (FTI-TTP) has been rolled out at Trichy International Airport, along with four other airports, allowing registered passengers to clear immigration in under 30 seconds using biometric e-gates.

Rising Demand for Automation and Smart Infrastructure

Airports are investing in digital infrastructure to improve operational efficiency. Airport Turnstiles market grows as airports seek automated gates that integrate with smart systems. It supports contactless access, which reduces human intervention and improves hygiene. Turnstiles link with boarding pass scanners and biometric databases to verify identity in seconds. Automated systems help airports handle growing traffic with minimal staffing. This trend aligns with smart airport initiatives worldwide.

- For instance, As of November 2023, the Bureau of Immigration (BI) in the Philippines had 21 e-gates distributed across major international airports. According to statements from Commissioner Norman Tansingco, these biometric gates were expected to shorten the processing time for eligible passengers from the standard manual method’s 45 seconds to as low as 8 seconds. This was part of an initiative to increase efficiency and improve the passenger experience.

Focus on Passenger Experience and Convenience

Airports aim to deliver faster and smoother transit for travelers. Airport Turnstiles market supports self-service check-in and boarding solutions that enhance convenience. It reduces congestion by enabling faster throughput and minimizing manual checks. Automated access points improve passenger satisfaction and airport reputation. Airlines and airport operators favor technologies that provide real-time monitoring. This focus drives upgrades to modern, reliable turnstile systems.

Government Regulations and Infrastructure Investments

Authorities mandate strict access control and monitoring for aviation safety. Airport Turnstiles market gains traction with government-backed infrastructure expansion projects. It helps airports comply with international aviation security norms. Turnstiles support surveillance integration, providing data for security audits and investigations. Investment in airport modernization projects creates demand for durable and scalable systems. Public-private partnerships encourage adoption of advanced turnstile technology across regions.

Market Trends

Adoption of Biometric and Contactless Solutions

Airports are shifting toward biometric authentication to enhance security and efficiency. Airport Turnstiles market integrates facial recognition and fingerprint scanning technologies. It allows passengers to pass checkpoints without presenting documents manually. Contactless systems minimize physical touchpoints and support health safety protocols. Airlines and airports deploy these solutions to speed up boarding processes. This trend aligns with the global focus on touch-free travel experiences.

- For instance, IDEMIA does supply biometric e-gate systems for use at Singapore Changi Airport, with its technology playing a central role in the airport’s Fast and Seamless Travel (FAST) program. While IDEMIA’s solutions were initially deployed in Terminal 4, the technology has since been extended to Terminals 1 and 2 in March 2022.

Integration with Smart Airport Ecosystems

Turnstiles are becoming part of connected airport ecosystems. Airport Turnstiles market supports integration with IoT sensors and centralized control platforms. It enables real-time data collection and passenger flow monitoring. Operators use analytics to predict congestion and adjust staffing. Integration with baggage handling and boarding systems enhances efficiency. This development strengthens airport-wide automation strategies.

- For instance, COMINFO, a.s. has supplied turnstile and gate systems to more than 70 countries, with installation in Airport terminals, metro stations, academic campuses and other public transit hubs.

Rising Demand for Energy-Efficient and Durable Designs

Airports focus on sustainability while upgrading access control infrastructure. Airport Turnstiles market adopts energy-efficient motors and long-life components. It reduces maintenance needs and lowers operational costs. Manufacturers use stainless steel and composite materials for durability and weather resistance. Turnstiles are designed to withstand continuous operation in high-traffic environments. This trend reflects growing investment in sustainable airport infrastructure.

Increased Use of Customization and Modular Systems

Airports seek tailored solutions to match terminal layouts and passenger flow requirements. Airport Turnstiles market offers modular designs for flexible installation. It allows easy expansion or relocation during terminal upgrades. Customizable features include lane widths, barrier types, and aesthetic finishes. Operators demand systems that meet both security and architectural standards. This approach ensures optimal utilization of space and consistent passenger experience.

Market Challenges Analysis

High Installation Costs and Infrastructure Constraints

Airports face significant capital expenditure when deploying automated access systems. Airport Turnstiles market is challenged by high procurement, installation, and integration costs. It becomes more complex when airports operate in older terminals with limited space for upgrades. Retrofitting turnstiles requires redesigning entry points, which increases project timelines. Smaller airports may delay adoption due to budget restrictions. These financial and structural barriers slow the pace of modernization across some regions.

Maintenance Complexity and System Downtime

Turnstiles require regular servicing to ensure smooth operation and passenger safety. Airport Turnstiles market experiences disruptions when systems fail during peak traffic hours. It impacts passenger flow and creates operational delays. Airports need skilled technicians to manage software updates and mechanical repairs. Spare parts availability can be a challenge in remote locations. These factors increase lifecycle costs and make long-term maintenance planning critical.

Market Opportunities

Expansion of Global Airport Infrastructure and Modernization Projects

Governments are investing heavily in new airport construction and terminal expansions. Airport Turnstiles market stands to benefit from these large-scale projects. It creates opportunities for suppliers to provide advanced access control systems tailored to new layouts. Emerging markets in Asia-Pacific and the Middle East are leading new airport developments. Large hubs in Europe and North America are upgrading facilities to handle rising passenger volumes. These infrastructure investments drive long-term demand for automated turnstile solutions.

Growing Adoption of Digital and Biometric Technologies

Airports are rapidly embracing biometric-based access control and digital transformation initiatives. Airport Turnstiles market can capitalize on demand for seamless, touch-free passenger processing. It opens opportunities for integration with facial recognition, e-gates, and cloud-based control systems. Airports prefer solutions that enhance operational efficiency and improve traveler satisfaction. Vendors offering interoperable and scalable systems gain a competitive edge. This shift supports broader adoption of smart, connected turnstile systems worldwide.

Market Segmentation Analysis:

By Type:

Manual turnstiles hold steady demand in smaller airports and low-traffic zones. They offer a cost-effective solution for areas with limited automation requirements. Electronic turnstiles show strong growth with increasing preference for automated passenger control. Airport Turnstiles market benefits from optical turnstiles, which provide fast and contactless passage ideal for busy terminals. Full-height turnstiles gain traction in areas requiring maximum security and restricted access. It supports perimeter control and staff-only zones, reducing unauthorized entry risks.

- For instance, Gastop has equipped more than 100 stadiums and multiple airports with full-height turnstiles (including the BA3 and BL series), as well as other models likeoptical turnstiles from its SG and GT series.

By Material:

Stainless steel dominates due to its durability, corrosion resistance, and suitability for high-traffic environments. Aluminum turnstiles appeal to airports seeking lightweight yet sturdy solutions for easier installation. Plastic options serve niche applications where cost efficiency is a priority. Composite materials are gaining adoption for their strength-to-weight ratio and design flexibility. It allows manufacturers to produce turnstiles that meet aesthetic and functional needs. Airports increasingly choose materials that balance performance, maintenance, and long service life.

- For instance, dormakaba’s Kentaur full-height turnstile model handles up to 20 persons per minute while maintaining high security (4 cross‐bar level, steel construction) for restricted airport perimeter zones.

By End-Use:

Airports remain the largest segment, driven by global passenger traffic growth and security regulations. Train stations adopt turnstiles to manage fare collection and control platform access efficiently. Bus terminals deploy them for crowd management during peak travel times. Cruise terminals are gradually integrating automated systems to improve boarding processes and enhance passenger safety. It reflects growing adoption of controlled access solutions across multiple transportation hubs. This multi-sector demand strengthens the long-term growth outlook for automated turnstile systems.

Segments:

Based on Type:

- Manual Turnstiles

- Electronic Turnstiles

- Optical Turnstiles

- Full-Height Turnstiles

Based on Material:

- Stainless Steel

- Aluminum

- Plastic

- Composite Materials

Based on End-Use:

- Airports

- Train Stations

- Bus Terminals

- Cruise Terminals

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Airport Turnstiles market, accounting for 34% of global revenue. The region benefits from high air passenger traffic, strict security regulations, and extensive airport modernization programs. It invests heavily in biometric-enabled and contactless turnstiles to enhance passenger experience and meet TSA requirements. The United States leads with several major airport expansion projects, including upgrades at Atlanta, Dallas–Fort Worth, and Los Angeles airports. Canada follows with investments in automated boarding and access control systems across major hubs. It supports large-scale adoption of smart turnstiles integrated with surveillance and passenger flow management software. The region’s focus on safety, automation, and efficiency continues to drive demand for advanced systems.

Europe

Europe represents a significant share of the market, contributing 28% of global sales. The region is characterized by stringent aviation security regulations under the European Union Aviation Safety Agency (EASA). Airports across Germany, France, and the UK are replacing conventional gates with automated turnstiles. It improves throughput, reduces staffing needs, and supports Schengen zone border control standards. Projects such as Heathrow’s biometric boarding initiative and Paris Charles de Gaulle’s smart terminal upgrades stimulate growth. Sustainability is a key focus, with airports demanding energy-efficient, durable, and recyclable turnstile solutions. The market in Europe benefits from government funding programs supporting digital transformation and green infrastructure.

Asia-Pacific

Asia-Pacific accounts for 24% of the global market and is the fastest-growing region. Rising middle-class populations and expanding aviation infrastructure in China, India, and Southeast Asia drive significant demand. It benefits from numerous greenfield airport projects, including Beijing Daxing and Navi Mumbai International Airport. Airports in Japan and South Korea are early adopters of facial recognition turnstiles for seamless travel. Rapid urbanization and high domestic travel volumes push governments to expand capacity and improve passenger handling efficiency. Regional manufacturers also introduce cost-effective solutions to cater to local airports. This strong demand pipeline ensures sustained growth for turnstile installations in the coming years.

Middle East & Africa

Middle East & Africa together hold 8% of the global market share. The Middle East is investing in world-class airport infrastructure, with major projects in Saudi Arabia, UAE, and Qatar. It deploys advanced turnstile systems to manage growing international transit traffic. Dubai and Doha airports lead in adopting biometric solutions to streamline passenger flow. Africa’s market remains smaller but is expanding, with nations like South Africa and Kenya upgrading key airports. Investments from global operators and funding agencies improve airport safety infrastructure. The region shows rising interest in scalable, durable systems that can handle both local and international passenger growth.

Latin America

Latin America contributes 6% of the Airport Turnstiles market. Brazil and Mexico dominate due to high passenger volumes and modernization of major airports such as São Paulo-Guarulhos and Mexico City International. It focuses on improving efficiency in security checkpoints to handle rising tourism. Adoption of automated turnstiles remains gradual but is accelerating in major hubs. Regional governments support projects that integrate turnstiles with surveillance and passenger data systems. This growing demand creates opportunities for suppliers offering cost-effective and reliable systems. Latin America’s market potential strengthens with the region’s recovery in air travel and tourism infrastructure development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zebra Technologies

- Crisp Tech

- Fujitsu

- HID Global

- TSA Corporation

- Gates Corporation

- Schneider Electric

- OTIS

- RuggedCom

- Aerticket

- Datalogic

- Thales

- HID

- Siemens

- Norma Group

Competitive Analysis

The leading players in the Airport Turnstiles market include OTIS, Aerticket, HID, Datalogic, Schneider Electric, Gates Corporation, Crisp Tech, HID Global, Thales, RuggedCom, Zebra Technologies, Norma Group, Siemens, TSA Corporation, and Fujitsu. These companies compete by offering advanced turnstile solutions with high reliability, security, and integration capabilities. They focus on delivering biometric-enabled, contactless, and IoT-integrated systems to support smart airport initiatives. The players invest in R&D to develop energy-efficient motors, modular designs, and scalable solutions for various terminal sizes. Strategic collaborations with airport authorities and system integrators help them secure large installation contracts. Many companies strengthen their global presence by expanding distribution networks and providing end-to-end support, including installation and maintenance services. Competitive pressure drives continuous innovation, with emphasis on reducing downtime and improving passenger throughput. The market also sees mergers, acquisitions, and partnerships to enhance technological capabilities and regional reach. Companies differentiate through product durability, customization options, and compliance with international security standards. Growing demand for digital transformation in airports ensures long-term competition, encouraging suppliers to deliver cost-effective yet sophisticated systems. This dynamic environment fosters rapid technological upgrades and adoption of next-generation automated gate solutions.

Recent Developments

- In 2025, Thales offers a wide range of airport solutions addressing communication and surveillance, including airport security and traffic management, indirectly linked with turnstile and access control systems.

- In 2025, Siemens markets RUGGEDCOM communication equipment suitable for harsh industrial environments, which may include airport infrastructure.

- In 2025, HID released the BG100 Speedgate in partnership with Assa Abloy. This biometric eGate solution, which integrates HID’s “HID Facepod” facial recognition technology with a document reader, is designed for efficient passenger processing at airports and other high-security checkpoints.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Airport turnstiles market will grow with rising air passenger traffic worldwide.

- Biometric and contactless technologies will dominate new installations across major airports.

- Smart turnstiles will integrate with IoT platforms for real-time monitoring and analytics.

- Demand will increase for energy-efficient and low-maintenance turnstile systems.

- Emerging markets will drive growth through new airport construction and expansions.

- Vendors will focus on modular and customizable designs to suit terminal layouts.

- Governments will invest in airport security infrastructure to meet global compliance standards.

- Cloud-based access control systems will gain adoption for centralized management.

- Partnerships between technology providers and airport operators will accelerate innovation.

- Passenger experience enhancement will remain a primary focus for future turnstile upgrades.