Market Overview

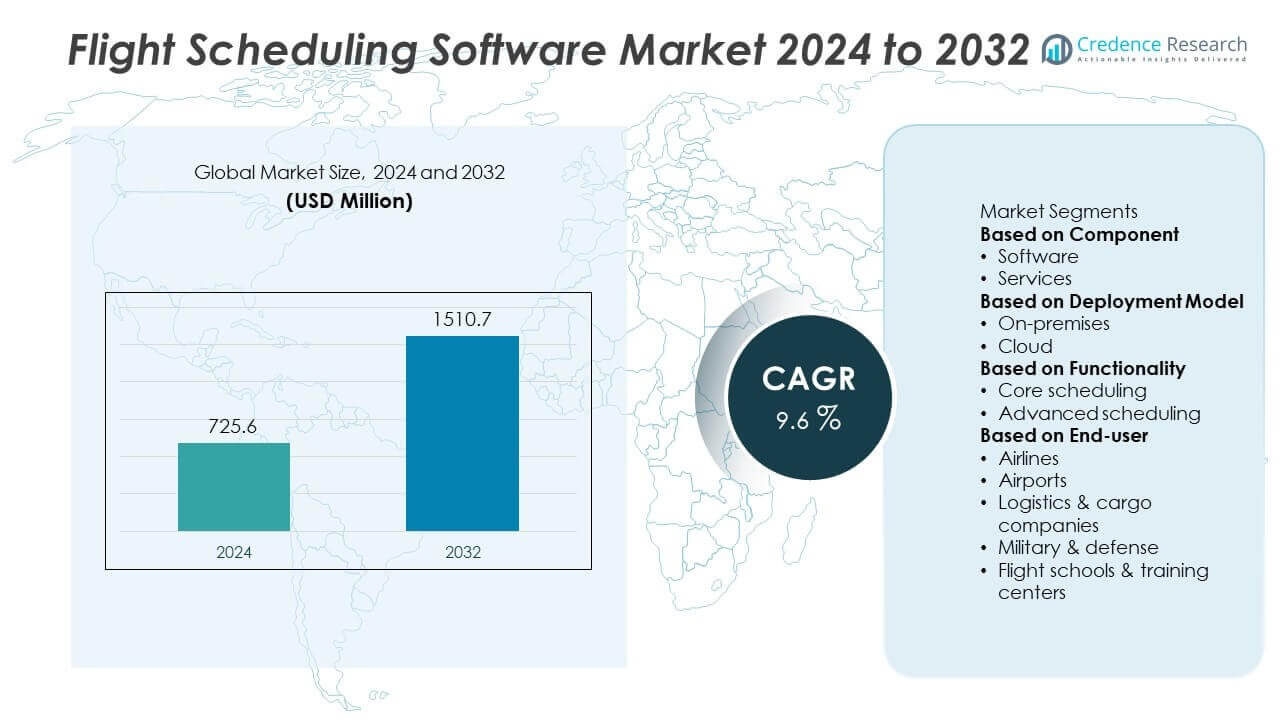

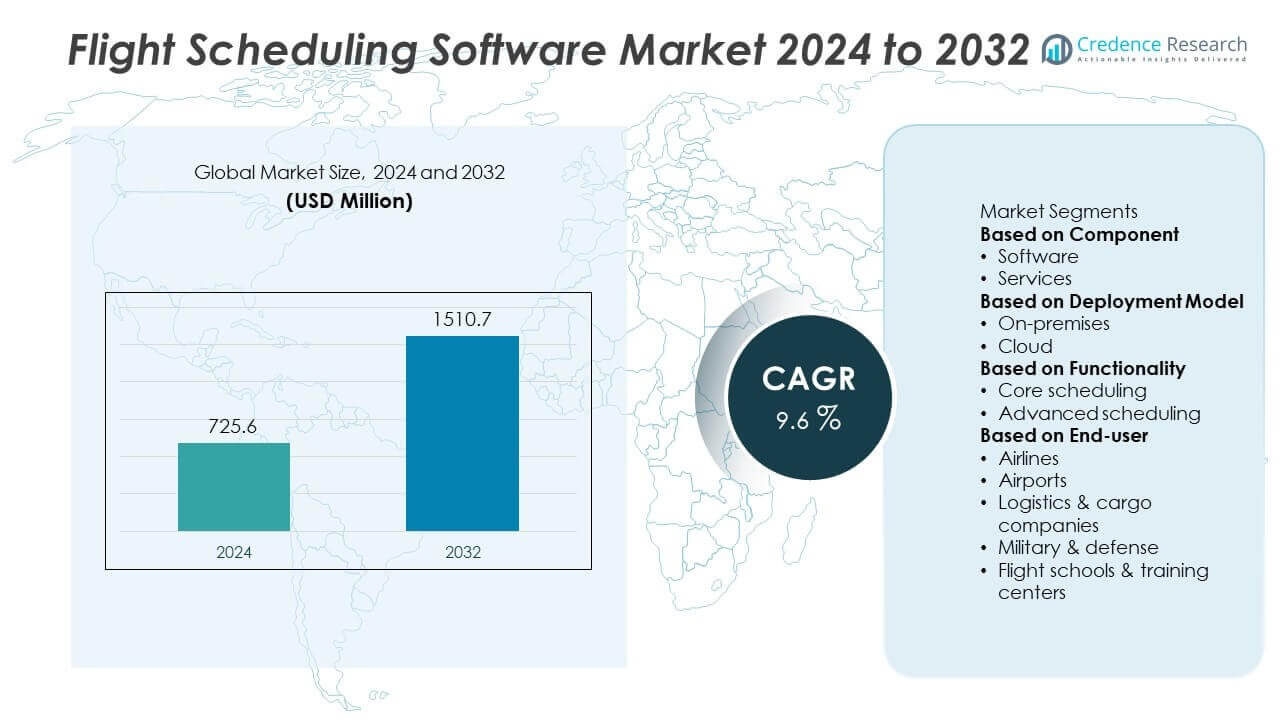

The Flight Scheduling Software Market size was valued at USD 725.6 million in 2024 and is projected to reach USD 1,510.7 million by 2032, growing at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flight Scheduling Software Market Size 2024 |

USD 725.6 Million |

| Flight Scheduling Software Market, CAGR |

9.6% |

| Flight Scheduling Software Market Size 2032 |

USD 1,510.7 Million |

The Flight Scheduling Software Market grows through rising demand for operational efficiency, safety, and real-time coordination in aviation. Airlines adopt advanced platforms to optimize crew allocation, reduce delays, and comply with strict regulatory standards. It benefits from increasing air traffic, where automation ensures resource utilization and punctuality.

The Flight Scheduling Software Market demonstrates strong global adoption across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with each region contributing unique drivers. North America leads with advanced aviation infrastructure and early adoption of digital scheduling solutions by major airlines. Europe emphasizes sustainability, regulatory compliance, and efficient operations, supported by widespread use of cloud-based platforms. Asia-Pacific records rapid growth due to rising air traffic, smart airport projects, and increasing investments in airline digitization across China, India, and Southeast Asia. Latin America and the Middle East & Africa gradually expand adoption, driven by infrastructure modernization and growing airline networks. Key players such as Amadeus IT Group, Lufthansa Systems, Sabre Corporation, and IBS Software strengthen competitiveness by integrating AI, predictive analytics, and cloud capabilities into scheduling platforms. Their focus on innovation and strategic partnerships positions them to address the evolving demands of global airline operations.

Market Insights

- The Flight Scheduling Software Market was valued at USD 725.6 million in 2024 and is projected to reach USD 1,510.7 million by 2032, growing at a CAGR of 9.6%.

- Rising demand for operational efficiency, safety, and real-time coordination in aviation drives adoption of flight scheduling solutions.

- Cloud-based deployment, AI-driven analytics, and IoT-enabled tools for predictive insights highlight strong market trends shaping future adoption.

- Competitive dynamics feature leading players such as Amadeus IT Group, Lufthansa Systems, Sabre Corporation, IBS Software, and GE Aviation, which invest in innovation and strategic partnerships to expand reach.

- High implementation costs, integration complexities with legacy systems, and data security concerns act as restraints, particularly for small and mid-sized carriers.

- North America leads with advanced digital adoption in airlines, Europe emphasizes regulatory compliance and sustainability, while Asia-Pacific records rapid growth driven by rising air traffic and infrastructure development.

- The overall market outlook remains positive as airlines prioritize digital transformation, improved passenger experiences, and cost reduction, ensuring long-term adoption across diverse aviation networks worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Operational Efficiency in Airlines

The Flight Scheduling Software Market grows with airlines focusing on operational efficiency and cost control. Airlines face rising passenger traffic and complex route networks, creating a need for automated scheduling tools. It helps carriers optimize aircraft usage, allocate crew effectively, and reduce turnaround times. Scheduling systems provide real-time visibility into operations, reducing delays and improving overall performance. Airlines benefit from improved fuel efficiency through route optimization. This focus on operational excellence drives strong adoption worldwide.

- For instance, Air Canada implemented Lufthansa Systems’ NetLine/Ops ++ in January 2025 and migrated to the Global Aviation Cloud. This platform supports operations across their multicloud environment, enhancing real-time decision-making capabilities.

Adoption of Cloud-Based and Digital Solutions

The shift toward cloud-based platforms supports growth in the Flight Scheduling Software Market. Cloud deployment offers scalability, cost savings, and easier integration across airline operations. It enables seamless collaboration between stakeholders, including crew, ground staff, and operations managers. Real-time access to schedules improves decision-making and enhances resilience during disruptions. Airlines value the flexibility of cloud systems to adapt to varying passenger demands. The adoption of digital technologies strengthens long-term demand for advanced scheduling platforms.

- For instance, Air France-KLM announced its partnership with IBS Software in May 2025 to integrate the iFlight platform across its fleet of over 500 aircraft. This enables real-time crew and schedule optimization to reduce delays and enhance operational efficiency.

Compliance with Aviation Regulations and Standards

Strict aviation regulations act as a strong driver for the Flight Scheduling Software Market. Airlines must comply with rules related to crew duty hours, aircraft maintenance, and flight safety. Scheduling systems ensure compliance by automating checks and preventing regulatory violations. It reduces risks of penalties, flight cancellations, and operational inefficiencies. Governments and aviation bodies emphasize digital tools to improve safety and accountability. Compliance-focused adoption strengthens reliance on advanced scheduling solutions across global carriers.

Growing Focus on Passenger Experience and Service Quality

Passenger expectations for reliability and seamless travel enhance demand for scheduling systems. The Flight Scheduling Software Market benefits from tools that minimize delays and ensure timely connections. It improves resource management, reducing flight disruptions and enhancing service quality. Airlines use data-driven scheduling to align capacity with passenger demand trends. Enhanced scheduling supports customer loyalty by improving on-time performance. This growing emphasis on customer satisfaction drives continuous adoption of advanced scheduling software.

Market Trends

Integration of Artificial Intelligence and Machine Learning

The Flight Scheduling Software Market reflects a strong trend toward AI and machine learning integration. Airlines adopt intelligent systems that predict disruptions and recommend optimal rescheduling options. It supports predictive maintenance by analyzing aircraft usage data and reducing downtime risks. Machine learning algorithms improve route planning and fuel efficiency through real-time analytics. Carriers benefit from enhanced decision-making capabilities that minimize costs and delays. This trend emphasizes a shift from reactive to predictive scheduling models.

- For instance, In December 2024, GE Aerospace officially announced its integration of Aireon’s space-based ADS-B data into its Airspace Insight platform. This was done to provide airlines with real-time, global aircraft tracking data, which enhances the platform’s ability to support AI-driven predictions and operational optimization.

Expansion of Cloud-Based and Mobile Platforms

Cloud-based deployment continues to reshape the Flight Scheduling Software Market. Airlines rely on cloud systems for scalability, accessibility, and seamless integration across global networks. It allows operators and crew members to access real-time updates via mobile devices. Cloud platforms enable faster response during flight disruptions and operational changes. Mobile-friendly solutions improve communication and collaboration between crew and ground staff. This expansion of cloud and mobile access strengthens scheduling efficiency and resilience.

- For instance, the Air France–KLM Group partnered with IBS Software to implement the iFlight cloud-native solution starting in May 2025 across its fleet of over 500 aircraft. This unified digital platform will streamline flight operations by enabling centralized decision-making and optimizing resources to minimize delays. The iFlight Crew Mobile Application offers crew members real-time access to their schedules, duty information, and other resources.

Adoption of Data Analytics for Operational Insights

Airlines increasingly use advanced analytics to enhance scheduling precision. The Flight Scheduling Software Market benefits from tools that process large datasets, including passenger demand, weather conditions, and traffic patterns. It helps optimize capacity allocation and align resources with demand fluctuations. Analytics-driven scheduling reduces overcapacity and underutilization, boosting profitability. Airlines leverage data for scenario modeling, improving resilience during peak travel periods. This trend highlights the rising importance of data-driven decision-making in flight operations.

Focus on Sustainability and Fuel Efficiency

Sustainability initiatives are shaping scheduling practices in the aviation sector. The Flight Scheduling Software Market adapts by integrating features that reduce fuel consumption and carbon emissions. It enables route optimization, minimizing unnecessary mileage and improving aircraft utilization. Airlines adopt eco-friendly scheduling models to meet regulatory targets and reduce environmental impact. Sustainable practices align with consumer expectations for greener air travel. This trend positions scheduling systems as essential tools for supporting aviation’s transition to sustainability.

Market Challenges Analysis

High Implementation Costs and Integration Complexities

The Flight Scheduling Software Market faces challenges from high upfront costs and complex integration requirements. Airlines often struggle with the expenses associated with licensing, customization, and employee training. It creates barriers for small and mid-sized carriers operating under strict budget constraints. Integration with legacy systems further complicates adoption, requiring additional technical expertise and time. Delays during deployment disrupt operational workflows, reducing efficiency gains in the short term. These cost and integration challenges slow down the pace of large-scale implementation across the industry.

Data Security Risks and Limited Skilled Workforce

Data security remains a critical concern in the Flight Scheduling Software Market. The reliance on cloud-based and digital platforms exposes sensitive operational and passenger data to potential cyber threats. It raises compliance concerns under strict aviation and data protection regulations worldwide. Airlines also face shortages of skilled professionals capable of managing advanced scheduling systems. Lack of expertise hinders effective use of features such as AI-driven analytics and predictive modeling. Continuous workforce training adds to operating costs while highlighting the need for specialized talent. These factors limit the full potential of advanced scheduling solutions in aviation.

Market Opportunities

Rising Demand for Digital Transformation in Aviation

The Flight Scheduling Software Market presents strong opportunities through rising adoption of digital transformation initiatives in aviation. Airlines increasingly prioritize automation to optimize crew assignments, manage irregular operations, and improve on-time performance. It enables seamless coordination between ground staff, pilots, and air traffic controllers, reducing delays and improving customer satisfaction. Government-backed programs promoting modernization of air transport infrastructure further accelerate adoption. Low-cost carriers and regional operators also recognize the benefits of streamlined scheduling systems for resource optimization. Growing reliance on digital platforms positions flight scheduling solutions as integral to operational efficiency worldwide.

Integration of AI, Predictive Analytics, and Cloud Platforms

The Flight Scheduling Software Market benefits from opportunities created by advancements in AI, predictive analytics, and cloud-based platforms. Airlines adopt intelligent scheduling tools that forecast demand, predict disruptions, and recommend efficient routes. It supports predictive maintenance by integrating aircraft health data, reducing downtime and operational risks. Cloud-based deployment allows airlines to access scalable solutions with lower infrastructure costs, improving flexibility. Partnerships between software providers and aviation operators enhance customized solutions for diverse needs. The expansion of smart airports and digital aviation ecosystems strengthens the long-term role of flight scheduling software.

Market Segmentation Analysis:

By Component

The Flight Scheduling Software Market segments by component into software and services. Software holds the largest share, driven by growing demand for platforms that automate flight planning, resource allocation, and real-time monitoring. It offers scalability and integrates with crew management and air traffic systems, enhancing operational efficiency. Services contribute significantly, with airlines seeking consulting, customization, and training support to ensure smooth implementation. Managed services also gain importance as operators outsource maintenance to reduce operational complexity. The balance of software innovation and service delivery supports broad adoption across airlines and airports.

- For instance, Lufthansa Systems’ NetLine/Plan software was adopted by China Airlines in August 2025 to manage scheduling for more than 80 aircraft and 140 global destinations, supporting automated planning and resource allocation across the fleet.

By Deployment Model

Deployment models in the Flight Scheduling Software Market include on-premises and cloud-based solutions. Cloud-based deployment records rapid growth, supported by flexibility, scalability, and lower upfront infrastructure costs. It enables real-time access across multiple locations and enhances collaboration among global stakeholders. On-premises solutions remain relevant for airlines with strict regulatory requirements or high-security needs. They provide greater control over data and customization but involve higher maintenance costs. The growing trend toward cloud adoption reflects aviation’s broader shift toward digital and connected ecosystems.

By Functionality

Segmentation by functionality highlights crew management, flight planning, fleet management, and real-time analytics. Crew management dominates due to the need for efficient scheduling, compliance with working hours, and resource optimization. It ensures airlines maintain safety and regulatory standards while reducing operational disruptions. Flight planning tools record steady demand by optimizing routes, reducing fuel consumption, and improving punctuality. Fleet management supports aircraft utilization and maintenance scheduling, minimizing downtime and costs. Real-time analytics gains traction as airlines adopt data-driven tools for predictive decision-making. The Flight Scheduling Software Market strengthens its value proposition by addressing diverse operational requirements across the aviation sector.

- For instance, Jeppesen (a Boeing subsidiary) has provided flight planning and optimization solutions that have resulted in fuel savings for various operators. For example, one customer, Virgin Atlantic, reported a 1.7% cruise fuel saving during a trial of Jeppesen’s FliteDeck Advisor solution.

Segments:

Based on Component

Based on Deployment Model

Based on Functionality

- Core scheduling

- Advanced scheduling

Based on End-user

- Airlines

- Airports

- Logistics & cargo companies

- Military & defense

- Flight schools & training centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Flight Scheduling Software Market with 34% in 2024. The region benefits from advanced aviation infrastructure, strong adoption of digital solutions, and a high concentration of airlines and airports modernizing their scheduling systems. The United States drives demand through major commercial carriers, regional airlines, and charter operators focusing on operational efficiency and regulatory compliance. Canada contributes with investments in fleet digitization and smart airport projects, while Mexico supports growth through expanding low-cost carriers and cross-border aviation activities. Strict regulations by the Federal Aviation Administration (FAA) also encourage the integration of advanced scheduling platforms to ensure safety and transparency. This environment positions North America as a leader in innovation and adoption of flight scheduling software.

Europe

Europe represents a 29% share of the Flight Scheduling Software Market in 2024, reflecting its emphasis on sustainability, compliance, and modernization of aviation systems. Germany, France, and the United Kingdom lead adoption, supported by high air traffic volumes and strong digital transformation initiatives among airlines. The region benefits from the European Union Aviation Safety Agency (EASA) regulations, which mandate strict standards for crew management, safety, and operational efficiency. Eastern Europe shows growing adoption as countries modernize aviation infrastructure and expand regional airline networks. Airlines in Europe focus heavily on reducing emissions, encouraging the use of software tools that optimize routes and improve fuel efficiency. This regulatory and environmental focus ensures consistent growth across the region.

Asia-Pacific

Asia-Pacific accounts for 23% of the Flight Scheduling Software Market in 2024, recording the fastest growth due to rising air traffic, rapid urbanization, and large-scale airport development projects. China dominates adoption with its expanding aviation industry, new airport infrastructure, and government-backed modernization programs. India contributes strongly with rising demand from low-cost carriers and regional connectivity initiatives under government schemes. Japan and South Korea emphasize technology integration, adopting advanced scheduling tools to support efficient fleet and crew management. Southeast Asian countries, including Indonesia, Thailand, and Vietnam, record steady adoption with growing tourism and e-commerce-driven air cargo services. The region’s scale, combined with government-backed aviation reforms, ensures long-term opportunities for software adoption.

Latin America

Latin America holds an 8% share of the Flight Scheduling Software Market in 2024. Brazil and Mexico dominate with strong airline networks and expanding regional connectivity across urban and tourism-driven routes. The region adopts scheduling solutions to improve punctuality, reduce delays, and optimize fleet management in competitive low-cost carrier markets. Argentina, Chile, and Colombia contribute with modernization programs in commercial aviation and airport systems. Challenges such as budget constraints and slower digital adoption in smaller markets limit broader penetration. However, rising passenger demand and international partnerships with technology providers encourage steady adoption of flight scheduling software across the region.

Middle East & Africa

The Middle East & Africa account for a 6% share of the Flight Scheduling Software Market in 2024, reflecting gradual adoption but significant long-term potential. Gulf countries, including the United Arab Emirates, Saudi Arabia, and Qatar, lead with strong investments in aviation hubs and smart airport projects. Airlines in these regions adopt advanced scheduling systems to support international connectivity and fleet expansion. Africa records slower adoption due to limited budgets and infrastructure gaps, but countries like South Africa and Nigeria are modernizing their aviation operations. Government diversification strategies and investments in tourism and logistics create favorable conditions for adoption. The region demonstrates growing opportunities as aviation expands and modernizes to meet rising passenger and cargo demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amadeus IT Group

- FLYHT Aerospace Solutions Ltd.

- Lufthansa Systems

- Jeppesen

- IBS Software

- Airline Software Applications

- GE Aviation

- AIMS International

- Sabre Corporation

- SITA

Competitive Analysis

The competitive landscape of the Flight Scheduling Software Market features key players such as Amadeus IT Group, Lufthansa Systems, Sabre Corporation, IBS Software, GE Aviation, Jeppesen, SITA, FLYHT Aerospace Solutions Ltd., Airline Software Applications, and AIMS International. These companies lead the market by providing advanced software platforms that optimize flight planning, crew scheduling, and operational efficiency while ensuring regulatory compliance. They focus on integrating AI-driven analytics, cloud-based deployment, and real-time data solutions to enhance decision-making and minimize delays. Strategic partnerships with airlines and aviation authorities expand their global presence and strengthen adoption across both full-service and low-cost carriers. Many players prioritize end-to-end digital ecosystems, offering modules for scheduling, passenger services, and predictive maintenance to deliver comprehensive solutions. Investments in R&D and innovation enable the development of user-friendly platforms that enhance passenger experience while lowering costs for operators. Intense competition drives continuous upgrades in automation, scalability, and security, ensuring sustained relevance in a rapidly evolving aviation landscape.

Recent Developments

- In August 2025, China Airlines adopted Lufthansa Systems’ network-planning solution NetLine/Plan to enhance strategic scheduling.

- In July 2025, Amadeus partnered with Google to integrate Google’s QPX flight-management system and Google Flights into Amadeus’ airline platform. This enhances scheduling capabilities and flight-search integration.

- In July 2025, ANA (All Nippon Airways) selected Lido Flight 4D for next-generation flight planning to boost operational efficiency.

- In May 2024, FLYHT teamed up with MBS Electronic Systems to develop a prototype for secure wireless avionics software vault and onboard data-loading. This enhances compliance and safety in-flight operations.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Functionality, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for digital transformation in airline operations.

- Cloud-based deployment will gain traction due to scalability and cost efficiency.

- AI-driven predictive analytics will enhance decision-making and operational accuracy.

- Integration with IoT and real-time data platforms will improve flight planning efficiency.

- Demand for crew scheduling and resource optimization tools will strengthen adoption.

- Growing passenger traffic will drive investment in automated scheduling solutions.

- Low-cost carriers will increase adoption to streamline costs and improve efficiency.

- Regional airlines will adopt modular solutions tailored to local requirements.

- Partnerships between software providers and airlines will accelerate technological innovation.

- Regulatory compliance and safety standards will continue to shape software development.