Market Overview:

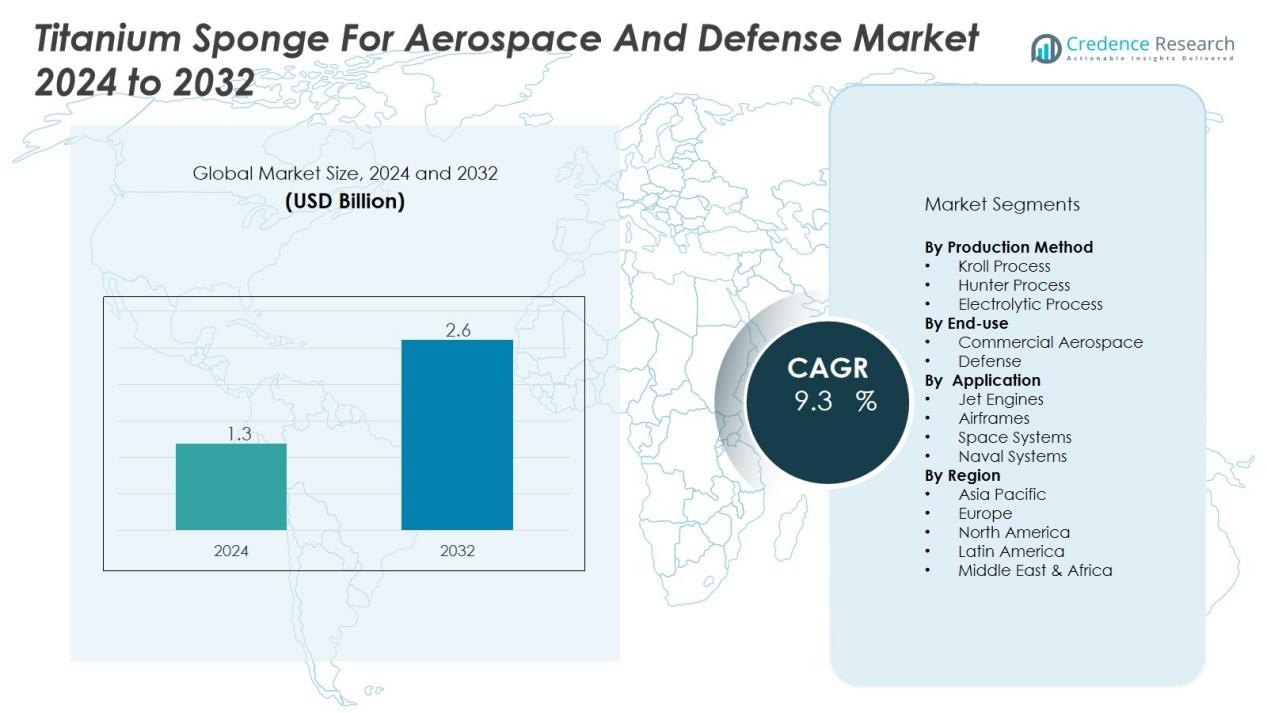

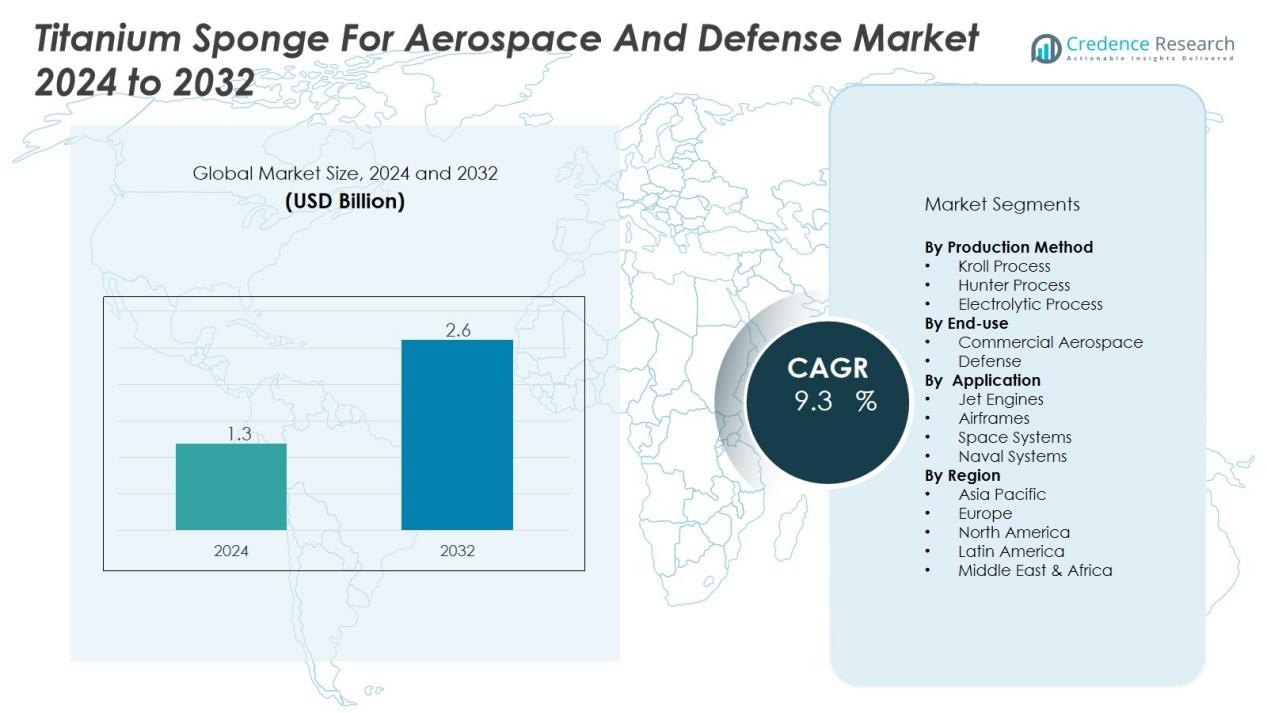

The titanium sponge for aerospace and defense market size was valued at USD 1.3 billion in 2024 and is anticipated to reach USD 2.6 billion by 2032, at a CAGR of 9.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Titanium Sponge for Aerospace and Defense Market Size 2024 |

USD 1.3 Billion |

| Titanium Sponge for Aerospace and Defense Market, CAGR |

9.3 % |

| Titanium Sponge for Aerospace and Defense Market Size 2032 |

USD 2.6 Billion |

Key market drivers include the material’s superior strength-to-weight ratio, corrosion resistance, and ability to withstand extreme temperatures, making it indispensable in aircraft frames, jet engines, and defense armor. Growing investments in space exploration, hypersonic weapons, and next-generation aircraft further accelerate demand. Strategic initiatives by aerospace companies to reduce carbon emissions through lighter materials also amplify the use of titanium sponge across commercial and military fleets.

Regionally, North America dominates the market due to strong aerospace manufacturing bases in the United States, supported by defense contracts and commercial aircraft production. Europe follows with robust demand from Airbus and defense collaborations across EU nations. Asia-Pacific is emerging rapidly, fueled by rising domestic aircraft manufacturing in China and India and expanding defense budgets. Latin America and the Middle East show gradual growth, linked to fleet expansions and modernization projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The titanium sponge for aerospace and defense market was valued at USD 1.3 billion in 2024 and is projected to reach USD 2.6 billion by 2032, expanding at a CAGR of 9.3%.

- Its growth is driven by superior strength-to-weight ratio, corrosion resistance, and ability to endure extreme temperatures.

- Rising demand from commercial aircraft production and global defense modernization programs continues to strengthen market expansion.

- Investments in space exploration, hypersonic weapons, and reusable launch vehicles are increasing titanium sponge adoption.

- High production costs, energy-intensive processing, and supply chain vulnerabilities pose significant challenges to manufacturers.

- North America leads with 42% share, supported by strong aerospace manufacturing in the United States and defense contracts.

- Europe accounts for 28% share, backed by Airbus production and defense collaborations, while Asia Pacific holds 22% share with rising aircraft programs in China and India.

Market Drivers:

Rising Demand for Lightweight and High-Strength Materials in Aerospace and Defense

The titanium sponge for aerospace and defense market benefits from the continuous push toward weight reduction in aircraft and defense equipment. Titanium sponge provides an unmatched strength-to-weight ratio, making it ideal for jet engines, aircraft structures, and armored vehicles. It helps improve fuel efficiency, payload capacity, and overall system performance. Defense forces and aerospace manufacturers are prioritizing lightweight materials to extend operational range and enhance maneuverability. This trend firmly positions titanium sponge as a critical material in advanced applications.

- For instance, Boeing uses approximately 50 tons of titanium in each 787 Dreamliner aircraft, where titanium constitutes about 15% of the airframe weight, providing essential weight reduction and strength for performance enhancement.

Expansion of Commercial Aircraft Production and Defense Modernization Programs

The titanium sponge for aerospace and defense market is fueled by increasing production rates of commercial aircraft and ongoing defense modernization programs. Boeing, Airbus, and regional aircraft manufacturers are boosting output to meet rising air travel demand. Simultaneously, governments are upgrading fleets with modern fighter jets, drones, and naval assets. Titanium sponge supports these efforts by providing durability and performance under demanding conditions. It remains an essential resource to meet evolving requirements in both civil and defense aviation.

- For instance, the F-35 Joint Strike Fighter incorporates titanium components constituting about 25% of its structural weight, emphasizing titanium’s critical role in defense aerospace.

Growing Investments in Space Exploration and Next-Generation Technologies

The titanium sponge for aerospace and defense market gains momentum from heightened investments in space exploration and next-generation aerospace technologies. Titanium sponge is widely used in spacecraft, satellites, and hypersonic vehicles due to its resistance to extreme temperatures. National space agencies and private firms are expanding satellite launches and space programs. Hypersonic defense systems and reusable launch vehicles also rely heavily on titanium sponge. It continues to be a material of choice for future-focused aerospace advancements.

Increasing Focus on Sustainability and Emission Reduction in Aviation

The titanium sponge for aerospace and defense market is shaped by industry efforts to reduce emissions and improve sustainability. Aerospace companies are investing in lighter materials to lower fuel consumption and meet strict environmental standards. Titanium sponge supports these goals by enabling efficient designs without compromising safety. It also extends the lifecycle of aircraft components through superior corrosion resistance. The shift toward sustainable aviation reinforces titanium sponge as a preferred material across the industry.

Market Trends:

Advancements in Aerospace Manufacturing and Supply Chain Integration:

The titanium sponge for aerospace and defense market is witnessing steady growth due to innovations in aerospace manufacturing processes and tighter supply chain integration. Aerospace companies are adopting advanced forging, machining, and additive manufacturing techniques that rely on high-quality titanium sponge to ensure precision and strength. It supports the production of lighter airframes and engine components, which are essential for efficiency in both commercial and defense aviation. Strategic collaborations between titanium producers and aircraft manufacturers are strengthening material availability and reducing cost volatility. Governments are also prioritizing domestic production of titanium sponge to secure supply chains and minimize reliance on imports. This trend highlights the strategic importance of titanium sponge as both a technological enabler and a resource tied to national security.

- For Instance, Titanium Metals Corporation (TIMET) supplies aerospace-grade titanium sponge and mill products that meet stringent AMS 4931 standards, producing over 3,000 metric tons annually for aircraft engine and airframe parts for companies including General Electric and Rolls-Royce.

Rising Demand from Space Exploration, Hypersonic Weapons, and Sustainable Aviation:

The titanium sponge for aerospace and defense market is experiencing increased demand from expanding space programs, hypersonic weapon development, and sustainability-driven aviation initiatives. Titanium sponge is critical in satellite structures, launch vehicles, and reusable spacecraft, where strength and heat resistance are non-negotiable. It is equally vital in hypersonic missile systems and advanced defense platforms requiring materials that endure extreme stress and temperature. Aerospace manufacturers are also aligning with global carbon reduction goals, accelerating the use of lightweight titanium-based components to improve fuel efficiency. Strategic investments by companies and governments are driving broader adoption of titanium sponge across next-generation technologies. These shifts mark a transition toward advanced, sustainable, and high-performance aerospace solutions where titanium sponge remains indispensable.

- For instance, SpaceX utilized titanium alloy Ti-6242 in the grid fins of its BulgariaSat-1 mission rockets, leveraging the material’s high-temperature strength up to around 1,100°F to withstand re-entry aerodynamic heating

Market Challenges Analysis:

High Production Costs and Supply Chain Vulnerabilities :

The titanium sponge for aerospace and defense market faces challenges from high production costs and supply chain vulnerabilities. Titanium extraction and processing require complex technologies, which significantly raise overall expenses. It also depends heavily on energy-intensive methods, making costs sensitive to energy price fluctuations. Limited availability of high-grade raw materials adds further strain to producers. Supply chain disruptions, trade restrictions, and geopolitical tensions threaten consistent material flow. These challenges force manufacturers and defense contractors to secure long-term supply agreements. The situation creates pressure on margins and raises concerns about affordability in large-scale aerospace projects.

Environmental Regulations and Recycling Limitations :

The titanium sponge for aerospace and defense market is also impacted by strict environmental regulations and recycling limitations. Production processes generate emissions and waste that are subject to tightening global sustainability standards. It compels manufacturers to invest in cleaner technologies, which further increases operational costs. Recycling of titanium remains limited due to technical challenges in maintaining purity for aerospace-grade applications. This gap restricts the circular use of titanium sponge and raises reliance on primary production. Compliance with regulatory frameworks requires ongoing investment in eco-friendly processes. These constraints highlight the need for sustainable innovation within titanium sponge manufacturing.

Market Opportunities:

Expansion of Space Exploration and Emerging Aerospace Programs:

The titanium sponge for aerospace and defense market holds strong opportunities in space exploration and emerging aerospace programs. Governments and private companies are investing heavily in satellite launches, reusable rockets, and deep-space missions. Titanium sponge is vital for spacecraft structures due to its ability to withstand extreme heat and pressure. It also plays a key role in reusable launch vehicles that demand lightweight, durable materials. Rapid advancements in private aerospace ventures create consistent demand for high-purity titanium sponge. Growing collaborations between titanium producers and space agencies strengthen supply security. These factors position titanium sponge as a central material for the next phase of space innovation.

Adoption of Sustainable Aviation and Defense Modernization Initiatives:

The titanium sponge for aerospace and defense market also benefits from opportunities linked to sustainable aviation and global defense modernization. Airlines and manufacturers are targeting lighter aircraft designs to reduce emissions and fuel use. Titanium sponge offers efficiency gains that align with international sustainability goals. Defense forces are modernizing fleets with advanced jets, drones, and naval systems, all of which rely on titanium components. It provides long-term durability and performance across these applications. Expanding investments in hypersonic systems and unmanned platforms further boost future demand. These developments create a favorable landscape for titanium sponge producers and aerospace stakeholders.

Market Segmentation Analysis:

By Production Method:

The titanium sponge for aerospace and defense market is segmented by production method into Kroll process and alternative emerging techniques. The Kroll process dominates due to its established reliability in producing high-purity titanium sponge suitable for aerospace standards. Emerging methods focus on cost reduction and environmental efficiency, gaining interest among producers seeking competitive advantages. It continues to be influenced by innovation in refining technologies aimed at minimizing waste and improving output quality.

- For instance, the Ukrainian company Velta Holdings developed the Velta Ti Process, an alternative method producing titanium powder directly from ilmenite with eight times less CO2 emissions and zero liquid waste compared to the Kroll method, aiming to produce 10,000 tons of titanium powder annually for aerospace and defense sectors.

By End Use:

The titanium sponge for aerospace and defense market serves commercial aviation, military aviation, naval defense, and space exploration. Commercial aviation accounts for significant demand, supported by aircraft manufacturers seeking lightweight, durable materials. Military aviation and naval defense programs rely on titanium sponge for engines, armor, and structural applications. Space exploration initiatives are expanding its use in satellites and launch systems. End-use diversification ensures consistent growth opportunities across both defense and civil aerospace sectors.

- For instance, Boeing, one of the world’s largest aircraft manufacturers, uses titanium sponge extensively in its 787 Dreamliner airframe, which contains approximately 15% titanium by weight to reduce overall aircraft weight and improve fuel efficiency.

By Application:

The titanium sponge for aerospace and defense market includes applications in airframes, jet engines, armor systems, and spacecraft components. Airframes and jet engines represent the largest share, with demand tied to fuel efficiency and performance. Armor systems benefit from titanium sponge’s high strength and corrosion resistance. Spacecraft and satellite applications continue to grow with increasing investments in global space programs. It remains indispensable in applications requiring durability, lightweight design, and resistance to extreme conditions.

Segmentations:

By Production Method

- Kroll Process

- Hunter Process

- Electrolytic Process

By End Use:

- Commercial Aerospace

- Defense

By Application:

- Jet Engines

- Airframes

- Space Systems

- Naval Systems

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America:

North America holds 42% market share in the titanium sponge for aerospace and defense market, driven by the United States’ robust aerospace sector. The region benefits from the presence of Boeing, Lockheed Martin, and other key defense contractors that secure long-term supply for titanium sponge. It is supported by significant government spending on defense modernization and advanced aerospace programs. The U.S. military demand for lightweight, durable materials continues to expand titanium use in fighter jets, naval assets, and space systems. Canada contributes through aerospace component manufacturing and specialized defense projects. Strong R&D infrastructure across the region ensures sustained demand for titanium sponge. This dominance highlights North America’s strategic role in titanium-based aerospace supply chains.

Europe:

Europe accounts for 28% market share in the titanium sponge for aerospace and defense market, supported by Airbus and cross-border defense initiatives. The region has strong demand from France, Germany, and the U.K., which maintain active aerospace and defense manufacturing clusters. It benefits from joint programs such as the Future Combat Air System (FCAS) and naval modernization projects. European aerospace companies focus on lightweight, sustainable materials to meet emission goals, boosting titanium sponge consumption. The presence of advanced machining and processing facilities further strengthens regional growth. Rising investment in space exploration programs, including ESA-led missions, adds to titanium demand. Europe’s integrated supply chain ensures steady reliance on titanium sponge for long-term projects.

Asia Pacific:

Asia Pacific holds 22% market share in the titanium sponge for aerospace and defense market, led by China and India’s growing aerospace capabilities. China’s domestic aircraft programs and military modernization create consistent demand for titanium sponge. India is expanding its defense sector with indigenous fighter jets, naval ships, and space missions. Japan and South Korea add momentum through advanced aerospace technologies and satellite launches. It benefits from government-backed investments in infrastructure and aerospace supply chain development. Regional players are increasing titanium sponge capacity to reduce dependency on imports. These developments position Asia Pacific as a fast-growing hub for aerospace-grade titanium sponge production and consumption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- VSMPOAVISMA

- International Titanium Association

- Haynes International

- Titanium Processing Center

- American Elements

- Alcoa

- Western Metallica

- China Rare Metal Material

- Kymera International

- RBC Bearings

- Precision Castparts Corp

- Allegheny Technologies

- Supra Alloys

Competitive Analysis:

The titanium sponge for aerospace and defense market is highly competitive, with leading players focusing on supply security, product quality, and long-term contracts. Key participants include VSMPO-AVISMA, International Titanium Association, Haynes International, Titanium Processing Center, American Elements, Alcoa, and Western Metallica. It is shaped by strategies such as capacity expansion, technological advancements, and partnerships with aerospace and defense contractors. Companies emphasize producing high-purity titanium sponge that meets stringent aviation and defense standards. Strategic alliances with aircraft manufacturers and defense agencies strengthen market positioning. Rising demand from commercial aviation, defense modernization, and space exploration pushes players to scale operations and invest in R&D. Competitive dynamics remain defined by the ability to ensure consistent quality, maintain global supply networks, and address sustainability requirements. This environment positions established players to retain dominance while creating opportunities for newer entrants to innovate in processing efficiency.

Recent Developments:

- In August 2025, VSMPO-AVISMA expressed readiness to return to cooperating with Boeing and to develop the partnership further.

- In August 2025, Haynes International announced the development of a new alloy, HASTELLOY® WR-66™, targeting wear and corrosion markets with upcoming product availability.

- In Aug 2025, The International Titanium Association is scheduled to hold its Titanium USA 2025 conference from September 28-30 in Boston, MA, continuing its role as a key industry platform.

Report Coverage:

The research report offers an in-depth analysis based on Production Method, End Use, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for titanium sponge will rise with growing adoption of lightweight materials in aviation and defense.

- Commercial aircraft production expansion will create sustained requirements for titanium sponge in engines and airframes.

- Defense modernization programs will continue to boost titanium sponge use in advanced jets, drones, and naval assets.

- Space exploration and satellite deployment will increase reliance on titanium sponge for heat-resistant and durable components.

- Hypersonic weapons development will strengthen the need for titanium sponge in high-temperature applications.

- Sustainability goals in aviation will accelerate titanium sponge use to reduce emissions and improve fuel efficiency.

- Recycling innovations will emerge to address environmental concerns and secure supply of aerospace-grade titanium sponge.

- Regional supply chain development will reduce dependency on imports and improve global titanium sponge availability.

- Collaborations between titanium producers and aerospace manufacturers will enhance long-term supply stability.

- Investment in advanced processing technologies will ensure higher quality titanium sponge suited for next-generation aerospace programs.