Market Overview

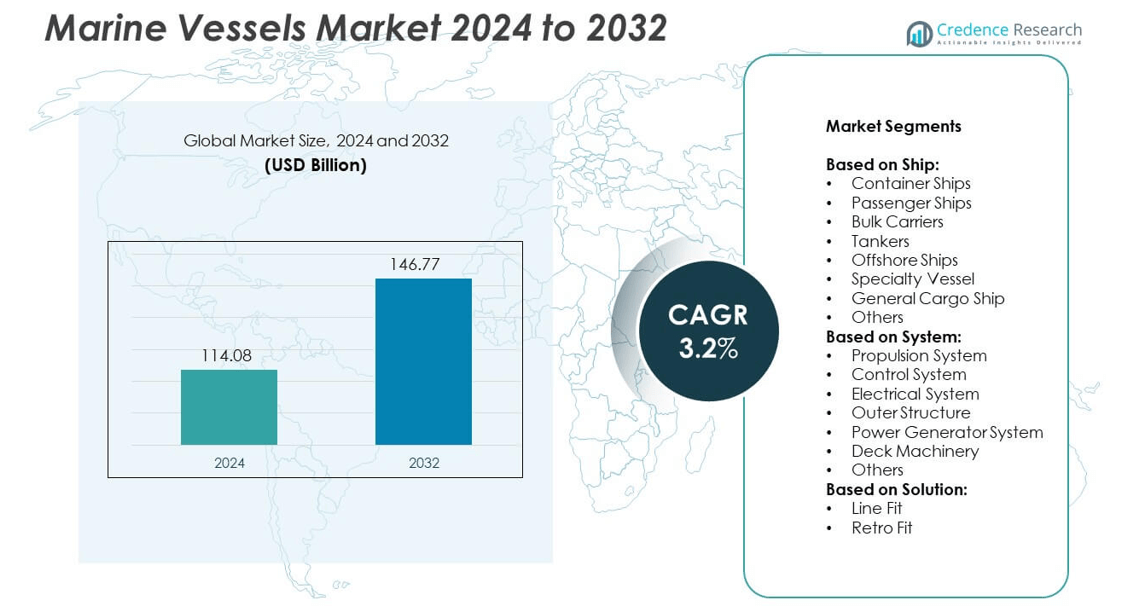

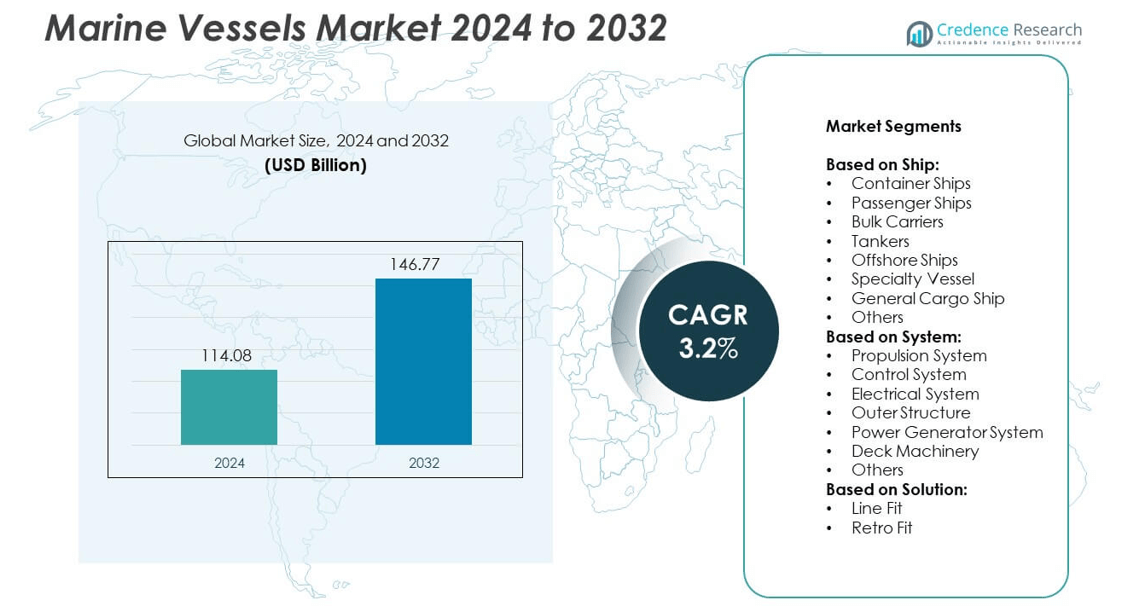

The Marine Vessels Market size was valued at USD 114.08 Billion in 2024 and is anticipated to reach USD 146.77 Billion by 2032, growing at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Vessels Market Size 2024 |

USD 114.08 Billion |

| Marine Vessels Market, CAGR |

3.2% |

| Marine Vessels Market Size 2032 |

USD 146.77 Billion |

The Marine Vessels market grows through rising global trade, offshore energy projects, and increasing passenger transport demand. Adoption of LNG, hybrid, and hydrogen propulsion systems supports compliance with strict environmental regulations. Digitalization and smart ship technologies improve fuel efficiency, navigation, and predictive maintenance capabilities. Offshore wind projects drive specialized vessel demand, while cruise and ferry segments expand with tourism recovery. It reflects a clear shift toward sustainable ship design, operational efficiency, and advanced technologies shaping the industry’s long-term direction.

North America and Europe lead through advanced shipbuilding, naval modernization, and strong focus on sustainable propulsion technologies. Asia-Pacific dominates global production with large-scale facilities in China, South Korea, and Japan, while Southeast Asia strengthens demand for passenger and cargo vessels. Latin America shows growth through offshore exploration, and the Middle East & Africa expand fleets to support energy exports. Key players shaping the industry include Hyundai Heavy Industries, Fincantieri, Damen Shipyards Group, and Mitsubishi Heavy Industries.

Market Insights

- The Marine Vessels market was valued at USD 114.08 Billion in 2024 and is projected to reach USD 146.77 Billion by 2032, growing at a CAGR of 3.2%.

- Growth is driven by increasing global trade, rising demand for cruise and passenger ships, and expansion of offshore energy projects.

- Market trends include adoption of LNG, hybrid, and hydrogen propulsion systems, smart ship technologies, and digitalization for predictive maintenance.

- Competitive analysis shows key players such as Austal, Babcock International Group, Hyundai Heavy Industries, Fincantieri, Damen Shipyards Group, and Mitsubishi Heavy Industries focusing on innovation, eco-friendly vessels, and modern shipyard expansion.

- Restraints include high capital expenditure for shipbuilding, volatile fuel prices, strict regulatory compliance costs, and economic uncertainties affecting shipping demand.

- Regional analysis indicates Asia-Pacific leads production with China, South Korea, and Japan as major hubs, while North America and Europe focus on advanced ship design and naval modernization.

- Opportunities exist in retrofitting existing fleets with eco-friendly technologies, offshore wind support vessels, and growth in cruise, ferry, and specialized cargo ships globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Trade and Seaborne Transportation

The Marine Vessels market benefits from rising global trade volumes and demand for seaborne transport. Containerized shipping continues to dominate cross-border commerce due to its cost efficiency and scalability. It supports the movement of raw materials, manufactured goods, and energy resources across major regions. Ports expand capacity to manage larger vessels, fueling demand for advanced fleets. The growth of e-commerce increases reliance on reliable shipping networks. Shipbuilders and operators invest in modern designs to handle rising cargo demand. This driver remains central to the industry’s steady expansion.

- For instance, In 2023, the Mediterranean Shipping Company (MSC) remained the world’s largest container fleet, surpassing 5 million TEU in May and introducing some of the world’s largest container ships, including the MSC Irinaclass, with capacities up to 24,346 TEU. The company’s fleet continued to expand, exceeding 6 million TEU by mid-2024 and officially reaching 900 vessels with a total capacity of 6.47 million TEU by April 2025. The new ultra-large vessels delivered in 2023 briefly held the title of the world’s largest container vessels by capacity.

Advancement in Propulsion and Energy Efficiency

The Marine Vessels market grows through innovation in propulsion systems and fuel efficiency technologies. Shipowners adopt dual-fuel engines and LNG propulsion to reduce emissions. It aligns with global regulations on sulfur oxide and carbon output. Advanced hull designs and hybrid power integration improve operational performance. Digital tools enhance fuel monitoring and optimize voyage planning. The drive for lower operating costs accelerates adoption of energy-efficient solutions. These factors reinforce competitiveness in a highly regulated market.

- For instance, Wärtsilä’s portfolio of dual-fuel engines can run on LNG, marine diesel, or other conventional or alternative fuels like biofuel. By November 2012, the company had already delivered over 2,000 gas-fueled engines to the marine industry

Strengthening Regulatory Compliance and Safety Standards

The Marine Vessels market evolves with stricter international regulations on environmental and safety performance. The International Maritime Organization enforces rules on emissions, ballast water, and fuel usage. It compels operators to upgrade or retrofit existing fleets. New shipbuilding projects focus on sustainable materials and advanced onboard safety systems. Enforcement of safety standards ensures reduced risk in passenger and cargo operations. Governments and port authorities support compliance through incentive programs. This environment drives continuous technological and operational improvements.

Expansion of Offshore and Passenger Segments

The Marine Vessels market gains momentum from offshore exploration and passenger transport growth. Offshore vessels remain vital for oil, gas, and wind energy projects. It drives demand for specialized ships with high endurance and advanced equipment. Passenger ships and cruise liners recover strongly with rising tourism activities. Emerging economies invest in coastal and inland water transport infrastructure. Ferry networks expand to support urban mobility and island connectivity. Both offshore and passenger categories contribute significantly to long-term industry demand.

Market Trends

Adoption of Green Propulsion Technologies

T

he Marine Vessels market reflects a strong shift toward green propulsion and alternative fuels. LNG, hydrogen, and biofuels gain traction as viable options for reducing emissions. It aligns with global decarbonization targets and regulatory frameworks. Hybrid and fully electric propulsion systems are under development for short-sea shipping and ferries. Shipbuilders focus on integrating low-carbon engines into new fleets. Operators prioritize vessels that can meet future environmental standards. This trend highlights sustainability as a key driver of ship design.

- For instance, Hyundai Heavy Industries (HHI), which is part of the HD Hyundai group, develops and manufactures ballast water treatment systems (BWTS) such as the HiBallast (electrolysis-based) and EcoBallast (UV-based) models to help ships comply with environmental standards. In 2011, HHI announced that it had received orders for BWTS installations on 30 ships. By 2023, HD Hyundai had cumulatively delivered over 2,300 ships to 335 clients across 51 countries since its inception. The company continues to offer its BWTS for both newbuilds and retrofits to meet international maritime regulations.

Integration of Smart and Digital Solutions

The Marine Vessels market advances with digitalization and smart shipping technologies. Fleet operators invest in IoT platforms, AI analytics, and predictive maintenance systems. It enhances fuel efficiency, safety, and voyage planning accuracy. Remote monitoring and automation reduce crew workload and operational risks. Cybersecurity measures gain importance to protect vessel data and navigation systems. Digital twins and simulation tools improve ship design and performance evaluation. This trend supports higher efficiency and competitiveness in global shipping operations.

- For instance, In 2023, Carnival Corporation operated a fleet of 93 cruise ships and carried approximately 12.5 million guests globally. The company’s 2023 Sustainability Report confirms it “delivered unforgettable happiness to 12.5 million guests”. Also during 2023, the company underwent a corporate restructuring in June while operating its combined fleet of 93 ships.

Growth of Autonomous and Unmanned Vessels

The Marine Vessels market experiences rising investment in autonomous ship technologies. Companies explore fully unmanned cargo ships for specific trade routes. It improves operational safety and reduces crew-related costs. Sensor-based navigation and advanced control systems enable safer long-distance voyages. Pilot projects test autonomous vessels across Europe, Asia, and North America. Regulators evaluate frameworks to integrate unmanned ships into existing maritime law. This trend points toward a gradual but impactful industry transformation.

Expansion in Offshore Renewable Support Vessels

The Marine Vessels market grows with offshore renewable energy developments, especially wind power. Demand rises for service operation vessels and cable-laying ships. It supports large-scale offshore wind projects in Europe, China, and the United States. Shipbuilders design specialized vessels equipped with dynamic positioning and heavy-lift capacity. The offshore renewable sector strengthens ties between shipbuilding and energy industries. Governments encourage investment in green maritime infrastructure. This trend underlines the strategic role of vessels in clean energy transition.

Market Challenges Analysis

High Operating Costs and Fuel Price Volatility

The Marine Vessels market faces challenges from high operating expenses and volatile fuel prices. Shipowners manage costs linked to crew, port charges, and insurance while addressing maintenance needs. It becomes more complex with global fluctuations in bunker fuel prices. The transition to cleaner fuels such as LNG and hydrogen demands major capital investment. Smaller operators struggle to compete with large fleets that benefit from economies of scale. Rising costs place pressure on freight rates and profitability. This challenge forces companies to seek efficiency through technology and optimized operations.

Regulatory Pressure and Environmental Compliance

The Marine Vessels market encounters strong pressure from evolving environmental regulations. The International Maritime Organization enforces stricter emission rules, driving costly fleet upgrades and retrofits. It creates uncertainty for operators unsure of future fuel adoption pathways. Non-compliance risks heavy fines, restricted port access, and reputational damage. Developing countries find compliance especially difficult due to limited access to advanced shipbuilding technologies. Continuous investment in research, design, and retrofitting remains necessary to meet international standards. This regulatory challenge reshapes long-term strategies across the global maritime industry.

Market Opportunities

Rising Demand for Energy-Efficient and Eco-Friendly Vessels

The Marine Vessels market creates opportunities through the rising demand for energy-efficient ships. Shipowners prioritize vessels with hybrid propulsion, LNG systems, and optimized hull designs. It positions companies to align with global carbon reduction mandates. Eco-friendly designs gain preference in procurement decisions from governments and commercial operators. Shipyards capable of delivering low-emission fleets secure long-term contracts. Growing interest in green shipping corridors further boosts demand for sustainable vessels. This opportunity favors firms investing in innovation and compliance-ready solutions.

Expansion in Offshore Energy and Passenger Transport

The Marine Vessels market benefits from opportunities in offshore exploration and renewable energy. Service vessels, cable layers, and heavy-lift ships are critical for offshore wind development. It strengthens collaboration between the maritime and energy industries. Cruise liners and passenger ferries also experience renewed demand with increasing tourism. Governments in emerging economies invest in ferry systems to improve coastal transport. Advanced passenger vessels with safety and digital features meet evolving traveler expectations. This opportunity expands growth across both energy and passenger transport segments.

Market Segmentation Analysis:

By Ship:

Ship type, covering container ships, passenger ships, bulk carriers, tankers, offshore ships, specialty vessels, general cargo ships, and others. Container ships remain dominant due to their critical role in global trade and e-commerce logistics. It supports large cargo volumes with efficiency, making them essential for cross-border commerce. Passenger ships, including ferries and cruise liners, show steady recovery with growing tourism and rising demand for urban water transport. Bulk carriers and tankers serve resource and energy supply chains, while offshore ships expand in support of oil, gas, and renewable projects. Specialty vessels and general cargo ships fulfill niche demands across defense, research, and regional trade, broadening the segment scope.

- For instance, In 2020, NYK Line introduced Japan’s first LNG-fueled car carrier, the Sakura Leader, with a capacity of approximately 7,000 vehicles. The vessel was named in September and officially delivered to NYK in October of the same year. Built by Shin Kurushima Dockyard, the Sakura Leader was the first large LNG-fueled PCTC constructed in Japan.

By System:

The Marine Vessels market includes propulsion, control, electrical, outer structure, power generator, deck machinery, and others. Propulsion systems lead the segment with strong adoption of LNG, hybrid, and dual-fuel engines to meet emission rules. It ensures compliance while lowering operating costs for shipowners. Control systems and electrical systems advance with automation, digital monitoring, and IoT-enabled solutions that improve navigation and efficiency. Outer structures emphasize lightweight, durable materials to boost fuel economy and performance. Power generators adapt to hybrid and renewable integration, while deck machinery evolves for safer and faster operations. Each system plays a critical role in modernizing fleets and ensuring compliance with global standards.

- For instance, Maersk deployed its Remote Container Management (RCM) system across over 380,000 of its refrigerated containers by December 2019, covering 99% of its reefer fleet.

By Solution:

The Marine Vessels market is classified into line fit and retrofit. Line fit dominates as shipbuilders integrate advanced propulsion, automation, and energy-saving systems into new vessels. It reflects the demand for future-ready fleets designed for efficiency and compliance. Retrofit solutions gain importance as existing ships adapt to new environmental and safety regulations. Operators invest in upgrades to extend vessel lifecycles and meet stricter emission norms. This balance between line fit and retrofit ensures both new construction and existing fleet modernization remain essential growth avenues. Together, these segments shape the industry’s long-term transformation.

Segments:

Based on Ship:

- Container Ships

- Passenger Ships

- Bulk Carriers

- Tankers

- Offshore Ships

- Specialty Vessel

- General Cargo Ship

- Others

Based on System:

- Propulsion System

- Control System

- Electrical System

- Outer Structure

- Power Generator System

- Deck Machinery

- Others

Based on Solution:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 27% in the Marine Vessels market. The region benefits from strong demand in commercial shipping, defense modernization, and offshore energy support. It invests heavily in modern shipbuilding facilities and advanced propulsion systems to meet international environmental compliance. The United States drives regional growth with its naval expansion and continuous focus on LNG-powered vessels. Canada strengthens the segment through investments in Arctic-capable vessels, icebreakers, and port infrastructure upgrades. It also benefits from rising demand for cruise ships along the East and West Coasts, with Alaska routes gaining popularity. North America demonstrates steady growth through integration of smart ship technologies and government-backed modernization programs, keeping the fleet competitive on a global scale.

Europe

Europe accounts for 31% of the Marine Vessels market, reflecting its strong role in commercial and passenger shipping. The region leads in green shipbuilding, with widespread adoption of LNG, hybrid, and hydrogen-fueled vessels. It benefits from a strong network of ports and shipyards in countries like Germany, Norway, Denmark, and Italy. The cruise sector plays a major role, as European operators invest in next-generation cruise liners with digital and sustainable systems. Offshore wind expansion also supports demand for specialized vessels, including service operation ships and cable layers. It aligns with strict European Union maritime emission targets, pushing faster adoption of green technologies. Europe’s focus on digital monitoring, automation, and compliance ensures its fleets remain technologically advanced and environmentally sustainable.

Asia-Pacific

Asia-Pacific holds the largest market share of 34% in the Marine Vessels market. The region dominates shipbuilding, with China, South Korea, and Japan accounting for a majority of global vessel construction. China expands rapidly with new shipyards and large-scale container ship production, while South Korea specializes in LNG carriers and advanced tankers. Japan emphasizes innovation in fuel-efficient and autonomous ships. It benefits from strong export activities, manufacturing hubs, and increasing seaborne trade routes. Growing demand for passenger ferries and inland water transport in Southeast Asia further supports the segment. The region invests significantly in next-generation propulsion and automation systems, consolidating its leadership in both volume and technology adoption across global shipping markets.

Latin America

Latin America secures a market share of 5% in the Marine Vessels market. The region focuses on commercial shipping, offshore oil exploration, and port modernization projects. Brazil plays a leading role with investments in offshore vessels to support pre-salt oilfield activities. Mexico advances with upgrades in its naval and commercial fleets. It also witnesses growth in regional passenger transport systems, supported by government initiatives to improve connectivity. The region adopts modernization programs, though at a slower pace compared to Asia-Pacific and Europe. Limited shipbuilding capacity challenges expansion, yet offshore exploration and rising trade volumes continue to create steady demand. Latin America’s reliance on imports and energy shipping highlights its growing importance in the industry.

Middle East & Africa

The Middle East & Africa holds a market share of 3% in the Marine Vessels market. The region demonstrates steady demand driven by energy exports, offshore exploration, and naval expansion. Gulf nations like Saudi Arabia and the UAE invest in port infrastructure and modern fleets to support growing oil and gas shipments. Africa strengthens its shipping sector through government-backed projects to modernize ports and improve regional connectivity. It faces challenges of limited shipbuilding capacity, relying heavily on imports of advanced vessels. Offshore oil exploration and emerging renewable energy projects increase the need for specialized vessels. It highlights opportunities for international shipbuilders to expand their footprint through partnerships and investments in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Meyer Werft

- Austal

- Navantia

- Damen Shipyards Group

- HII

- Mitsubishi Heavy Industries

- General Dynamics NASSCO

- Lurssen

- Garden Reach Shipbuilders and Engineers

- Cochin Shipyard

- SHI-MCI

- Babcock International Group

- Fincantieri

- China Shipbuilding Industry Corporation

- Hyundai Heavy Industries

- Meyer Turku

- Japan Marine United Corporation

Competitive Analysis

The Marine Vessels market features strong competition among leading players such as Austal, Babcock International Group, China Shipbuilding Industry Corporation, Cochin Shipyard, Damen Shipyards Group, Fincantieri, Garden Reach Shipbuilders and Engineers, General Dynamics NASSCO, HII, Hyundai Heavy Industries, Japan Marine United Corporation, Lurssen, Meyer Turku, Meyer Werft, Mitsubishi Heavy Industries, Navantia, and SHI-MCI. Competition is shaped by advanced shipbuilding capabilities, innovation in propulsion systems, and compliance with international emission standards. Companies emphasize LNG, hybrid, and hydrogen-fueled vessel development to strengthen their market positioning. It creates opportunities to secure contracts with both commercial and naval sectors. The focus on digitalization, smart ship solutions, and predictive maintenance platforms enhances operational reliability and efficiency. Shipyards invest in modern facilities and R&D to remain competitive in specialized segments such as offshore support, cruise liners, and naval vessels. The market shows increasing preference for eco-friendly ships and advanced designs, which drives heavy investment in research and retrofitting. Established companies with global shipyard networks and diversified portfolios maintain a strong advantage, while regional players strengthen presence through government-backed programs. The competitive landscape highlights a balance between large-scale global players and regional builders focused on specialized needs. This dynamic fosters continuous innovation and capacity expansion across the industry.

Recent Developments

- In August 2025, Austal was approved as Australia’s Strategic Shipbuilder under a Strategic Shipbuilding Agreement with the Commonwealth of Australia, a major milestone supporting long-term orderbooks for facilities in Western Australia. Austal is now the prime contractor for the Landing Craft Medium and Landing Craft Heavy programs under this agreement.

- In April 2025, Fincantieri launched Fincantieri Ingenium with Accenture to accelerate digital transformation in cruise, defense, and port infrastructure sectors

- In June 2024, RightShip joined forces with Green Marine, an environmental certification program for the North American and European maritime industries.

Report Coverage

The research report offers an in-depth analysis based on Ship, System, Solution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for efficient container shipping.

- Adoption of LNG, hydrogen, and hybrid propulsion systems will accelerate across fleets.

- Cruise and passenger ship orders will grow with recovery in global tourism.

- Offshore wind projects will create steady demand for service operation vessels.

- Automation and smart ship technologies will improve operational efficiency and safety.

- Retrofits will remain essential to meet emission and safety compliance standards.

- Asia-Pacific will strengthen dominance in global shipbuilding and technology integration.

- Naval modernization programs will support investments in advanced military vessels.

- Digital platforms for predictive maintenance and monitoring will gain wider adoption.

- Sustainable ship design and eco-friendly operations will remain a central industry priority.