Market Overview

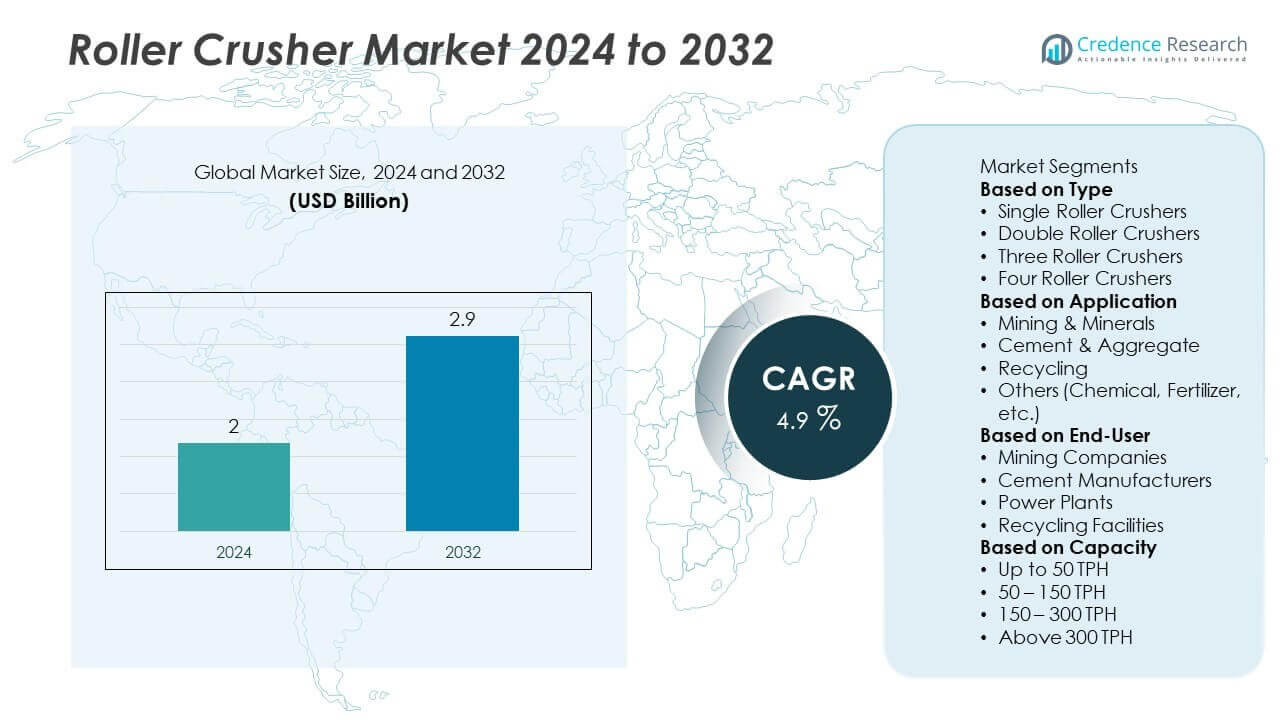

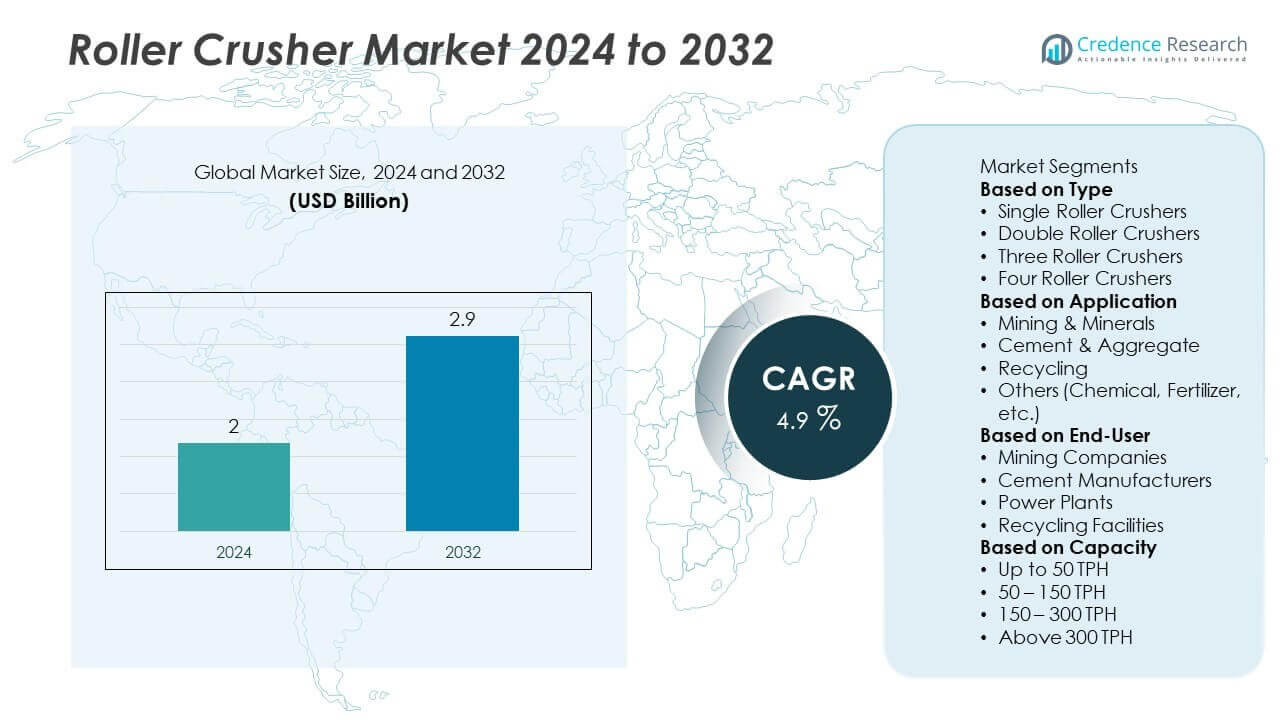

The Roller Crusher Market was valued at USD 2 billion in 2024 and is projected to reach USD 2.9 billion by 2032, registering a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Roller Crusher Market Size 2024 |

USD 2 Billion |

| Roller Crusher Market, CAGR |

4.9% |

| Roller Crusher Market Size 2032 |

USD 2.9 Billion |

The roller crusher market is driven by leading players such as FLSmidth & Co. A/S, Thyssenkrupp AG, McLanahan Corporation, Metso Outotec Corporation, Williams Patent Crusher and Pulverizer Co., Inc., Mechtech Engineers, Techna-Flo Engineering, Shandong Santian Linqu Petroleum Machinery Co., Ltd., CPC Equipments Private Limited, and Baichy Heavy Industrial Machinery Co., Ltd. These companies focus on delivering high-capacity, energy-efficient crushers tailored for mining, cement, and recycling applications. Asia-Pacific leads the market with 34% share, supported by large-scale mining projects and infrastructure growth, followed by North America with 32% share driven by modernization of crushing equipment, while Europe accounts for 27% share backed by strict environmental standards and demand for advanced crushing solutions.

Market Insights

Market Insights

- The roller crusher market was valued at USD 2 billion in 2024 and is projected to reach USD 2.9 billion by 2032, growing at a CAGR of 4.9% during the forecast period.

- Rising demand from mining and mineral processing is the key driver, with the mining & minerals segment holding over 50% share due to increased extraction activities and infrastructure projects.

- Key trends include the adoption of automation-enabled crushers, energy-efficient designs, and integration of smart monitoring systems to reduce downtime and improve operational efficiency.

- The market is competitive, with key players like FLSmidth & Co. A/S, Thyssenkrupp AG, McLanahan Corporation, and Metso Outotec focusing on capacity expansion, product innovation, and regional partnerships.

- Asia-Pacific leads with 34% share, followed by North America with 32% and Europe with 27%, while Latin America and Middle East & Africa collectively contribute 7% share driven by mining investments and construction growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Double roller crushers dominated the roller crusher market in 2024, holding over 45% share due to their efficiency in handling medium-hard materials and ability to produce uniform particle sizes. They are widely used in mining and cement industries for primary and secondary crushing. Their simple design, low maintenance requirements, and high throughput make them the preferred choice for large-scale operations. Single roller crushers serve smaller capacity plants, while three and four roller crushers cater to applications requiring finer output and controlled product size distribution, particularly in chemical and fertilizer processing.

- For instance, FLSmidth’s Double Roll Crusher DRC 20-25, launched in 2024, supports throughput capacities between 4,000 to 6,000 tons per hour and accepts feed sizes up to 400 mm with adjustable crushing gaps between 200 to 400 mm.

By Application

Mining and minerals led the market with over 50% share in 2024, driven by rising demand for processed ores and minerals in metal production and infrastructure projects. Roller crushers are preferred for their ability to handle abrasive materials and deliver consistent performance in harsh mining conditions. Cement and aggregate applications follow, supported by global construction growth. Recycling applications are growing steadily as industries adopt crushers to process slag, glass, and construction waste into reusable materials, contributing to circular economy initiatives and sustainability goals.

- For instance, McLanahan Corporation’s double roll crushers are engineered for high abrasion resistance using replaceable abrasion-resistant steel liners. An optional feature is the use of proprietary tungsten carbide-impregnated teeth, which can increase roll life by three to four times over standard metallurgy.

By End-User

Mining companies accounted for over 40% share of the roller crusher market in 2024, fueled by expanding extraction activities and modernization of crushing equipment. Increased demand for energy-efficient, high-capacity crushers drives adoption among large mining operators. Cement manufacturers follow as key end-users, relying on roller crushers for limestone preparation and clinker crushing. Power plants utilize these crushers for coal size reduction to improve combustion efficiency. Recycling facilities represent a growing end-user group, using roller crushers to reduce waste volume and recover valuable materials from industrial and construction debris.

Key Growth Drivers

Rising Demand from Mining and Mineral Processing

The mining and mineral processing sector is the primary driver, contributing to over 50% of roller crusher installations in 2024. Growing demand for metals and minerals from construction, automotive, and energy industries fuels adoption. Roller crushers are preferred for their ability to handle abrasive ores and deliver consistent particle size reduction. Expansion of mining operations in Asia-Pacific and Africa, coupled with modernization of existing plants, further supports market growth. Companies are investing in energy-efficient crushers to improve productivity and reduce operational costs.

- For instance, thyssenkrupp’s eccentric roll crusher series, which includes the ERC25-25 model, can achieve throughputs of up to 8,000 metric tons per hour, and the technology has been shown to enable significantly lower energy consumption compared to conventional primary crushers. The crushers are designed for the efficient processing of hard ores in large mining operations.

Infrastructure Development and Cement Production Growth

Increasing infrastructure projects worldwide drive demand for cement and aggregates, boosting roller crusher installations. The cement industry relies on double roller crushers for limestone and clinker crushing, holding over 30% share of demand growth. Urbanization, road construction, and housing projects in developing economies are accelerating equipment purchases. Governments are funding large-scale infrastructure development, further increasing the need for efficient crushing solutions. The ability of roller crushers to provide uniform particle size distribution makes them ideal for high-quality cement production.

- For instance, Metso’s HRC™e high-pressure grinding rolls (HPGRs) deployed in North American plants offer hydraulic gap control, with the largest model having a maximum feed size of 120 mm and typical throughput capacities of 4,950–6,930 tons per hour. These crushers are designed for grinding efficiency, with other equipment like jaw crushers used for initial, larger feed crushing in the cement production process.

Focus on Energy Efficiency and Low Maintenance Solutions

Industries are prioritizing energy-efficient crushing solutions to lower operational expenses and comply with sustainability targets. Modern roller crushers feature improved designs that reduce energy consumption by up to 15%, contributing to significant cost savings over their lifecycle. Low maintenance requirements and long service life also make them an attractive choice for continuous operations. Manufacturers are focusing on developing automation-enabled crushers that monitor wear, adjust gap settings, and optimize throughput, reducing downtime and improving overall plant efficiency.

Key Trends & Opportunities

Adoption of Automated and Smart Crushing Systems

Automation is emerging as a key trend, with roller crushers increasingly equipped with real-time monitoring, predictive maintenance, and remote operation features. These smart systems enhance reliability, reduce unplanned downtime, and optimize performance. Adoption is especially strong in large mining and cement plants seeking to boost efficiency and cut labor costs. The trend aligns with Industry 4.0 initiatives and creates opportunities for suppliers offering integrated digital solutions and data analytics to improve throughput and operational decision-making.

- For instance, Williams Patent Crusher’s Impact Dryer Mills incorporate proven technology that simultaneously grinds, dries, and classifies materials in one continuous, automated operation.

Growth of Recycling and Circular Economy Initiatives

The recycling sector presents strong opportunities as industries focus on resource recovery and waste reduction. Roller crushers are used to process construction debris, glass, and slag into reusable aggregates, supporting sustainability goals. Rising regulations promoting recycling and landfill diversion are driving investment in crushing equipment for recycling facilities. This trend benefits manufacturers offering compact, mobile roller crushers that are easy to deploy across different recycling sites and can handle varied feed materials effectively.

- For instance, McLanahan’s Double Roll Crushers, designed for crushing friable materials like glass, are capable of high capacity operation and produce a cubical product with minimal fines, which is essential for creating furnace-ready cullet.

Key Challenges

High Capital Investment and Operating Costs

The initial investment for roller crushers, particularly high-capacity double and four-roller models, is significant and can deter small and mid-sized operators. Ongoing costs for power consumption, wear parts, and skilled maintenance personnel further add to total cost of ownership. This cost challenge is a barrier in developing economies where budget constraints limit modernization of crushing plants despite rising demand for aggregates and minerals.

Competition from Alternative Crushing Technologies

Roller crushers face competition from jaw crushers, cone crushers, and impact crushers that offer higher throughput for certain applications. In industries where very fine output is required, alternative technologies with better precision are preferred. Continuous technological advances in competing equipment, such as hybrid crushers and energy-efficient cone crushers, create pricing pressure and require manufacturers to innovate and differentiate roller crushers with improved performance and cost-efficiency.

Regional Analysis

North America

North America held 32% share in 2024, driven by strong demand from the mining and cement industries in the United States and Canada. Expansion of metal and mineral production, coupled with modernization of crushing equipment, fuels adoption of double and four-roller crushers. The region benefits from a mature infrastructure and high adoption of automated, energy-efficient crushing solutions. The presence of leading equipment manufacturers and technology providers further supports innovation and rapid implementation. Demand is also rising in recycling applications as sustainability regulations encourage the processing of construction waste and slag into reusable aggregates.

Europe

Europe accounted for 27% share in 2024, supported by growing infrastructure development and strict environmental regulations promoting efficient crushing technologies. Major economies such as Germany, France, and the U.K. are investing in advanced roller crushers for cement production and mining operations. The region’s focus on energy-efficient solutions and low-emission equipment drives demand for modern crushers with improved performance and automation features. Recycling is a significant growth area, with increasing use of roller crushers for processing construction and demolition waste. European players are also investing in R&D to develop noise- and dust-controlled crushing systems that meet EU standards.

Asia-Pacific

Asia-Pacific led the global market with 34% share in 2024, making it the fastest-growing region due to rapid industrialization and large-scale mining operations in China, India, and Australia. Rising demand for aggregates and cement from infrastructure and urban development projects drives equipment purchases. Government investments in highways, smart cities, and housing programs fuel steady growth in roller crusher installations. Regional players are focusing on cost-effective, high-capacity crushers to meet local demand and maintain competitive pricing. The region also sees increasing adoption of mobile and modular crushing units, enabling flexibility for mining and construction contractors.

Latin America

Latin America captured 4% share in 2024, with demand primarily from Brazil, Mexico, and Chile. Growth is supported by expanding mining operations for copper, iron ore, and other minerals, driving installations of high-capacity roller crushers. The cement sector is also growing, backed by construction projects and housing development programs. However, slower economic growth and high equipment costs pose adoption challenges for small-scale operators. Opportunities lie in providing cost-effective, low-maintenance crushers that can handle diverse feed materials and operate reliably in remote locations with minimal downtime and reduced energy consumption.

Middle East & Africa

The Middle East & Africa region held 3% share in 2024, with growth concentrated in Gulf nations and South Africa. Roller crushers are widely used in cement manufacturing for large infrastructure projects such as roads, airports, and housing developments. Mining activities in Africa, including gold, platinum, and coal extraction, also drive demand for robust crushing solutions. The region is seeing gradual adoption of automated crushers to improve efficiency in challenging operating environments. Suppliers offering durable, wear-resistant equipment tailored to extreme climates are well-positioned to capture market share in this price-sensitive and growing region.

Market Segmentations:

By Type

- Single Roller Crushers

- Double Roller Crushers

- Three Roller Crushers

- Four Roller Crushers

By Application

- Mining & Minerals

- Cement & Aggregate

- Recycling

- Others (Chemical, Fertilizer, etc.)

By End-User

- Mining Companies

- Cement Manufacturers

- Power Plants

- Recycling Facilities

By Capacity

- Up to 50 TPH

- 50 – 150 TPH

- 150 – 300 TPH

- Above 300 TPH

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the roller crusher market includes major players such as FLSmidth & Co. A/S, Thyssenkrupp AG, McLanahan Corporation, Metso Outotec Corporation, Williams Patent Crusher and Pulverizer Co., Inc., Mechtech Engineers, Techna-Flo Engineering, Shandong Santian Linqu Petroleum Machinery Co., Ltd., CPC Equipments Private Limited, and Baichy Heavy Industrial Machinery Co., Ltd. These companies focus on expanding product portfolios, offering energy-efficient and high-capacity crushers to meet growing demand from mining, cement, and recycling sectors. Strategies include investing in automation-enabled crushers, enhancing wear resistance, and providing customized solutions for specific materials and capacities. Partnerships with mining and construction firms, along with regional expansion through joint ventures and distribution networks, are common approaches to strengthen market presence. Continuous innovation in low-maintenance designs and integration of smart monitoring systems position these players to meet rising requirements for operational efficiency and reduced downtime across global operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FLSmidth & Co. A/S

- Thyssenkrupp AG

- McLanahan Corporation

- Metso Outotec Corporation

- Williams Patent Crusher and Pulverizer Co., Inc.

- Mechtech Engineers

- Techna-Flo Engineering

- Shandong Santian Linqu Petroleum Machinery Co., Ltd.

- CPC Equipments Private Limited

- Baichy Heavy Industrial Machinery Co., Ltd.

Recent Developments

- In January 2025, Mc Lanahan Corporation (USA) launched its EcoRoll™ Series featuring hybrid-electric powered roller crushers designed to reduce energy consumption by up to 25% for mining operations.

- In November 2024, FLSmidth received a major order for two of the world’s largest High Pressure Grinding Rolls (HPGRs) with 3.0 m diameter and 2.0 m width for an iron ore concentrator in India.

- In July 2023, FLSmidth also offers the Strike-Bar Crusher featuring a throughput capacity of up to 2,600 tonnes per hour and size reduction up to 1:40, incorporating wear parts designed to retain up to 50% of their original weight through segmented interchangeable blades, reducing downtime and wear replacement costs.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for roller crushers will grow steadily with rising mining and mineral processing activities.

- Double roller crushers will remain the dominant type, driven by high efficiency and throughput.

- Asia-Pacific will continue to lead growth, supported by infrastructure and construction projects in China and India.

- Automation and smart control integration will become standard features in new crusher installations.

- Energy-efficient and low-maintenance designs will gain preference among mining and cement operators.

- Recycling applications will expand as industries adopt crushers to process construction and demolition waste.

- Partnerships between manufacturers and mining firms will increase to offer customized crushing solutions.

- Technological advancements will enhance wear resistance and extend crusher service life.

- Demand for mobile and modular roller crushers will rise for flexible on-site operations.

- Strict environmental regulations will encourage adoption of noise- and dust-controlled crushing equipment globally.

Market Insights

Market Insights