Market Overview

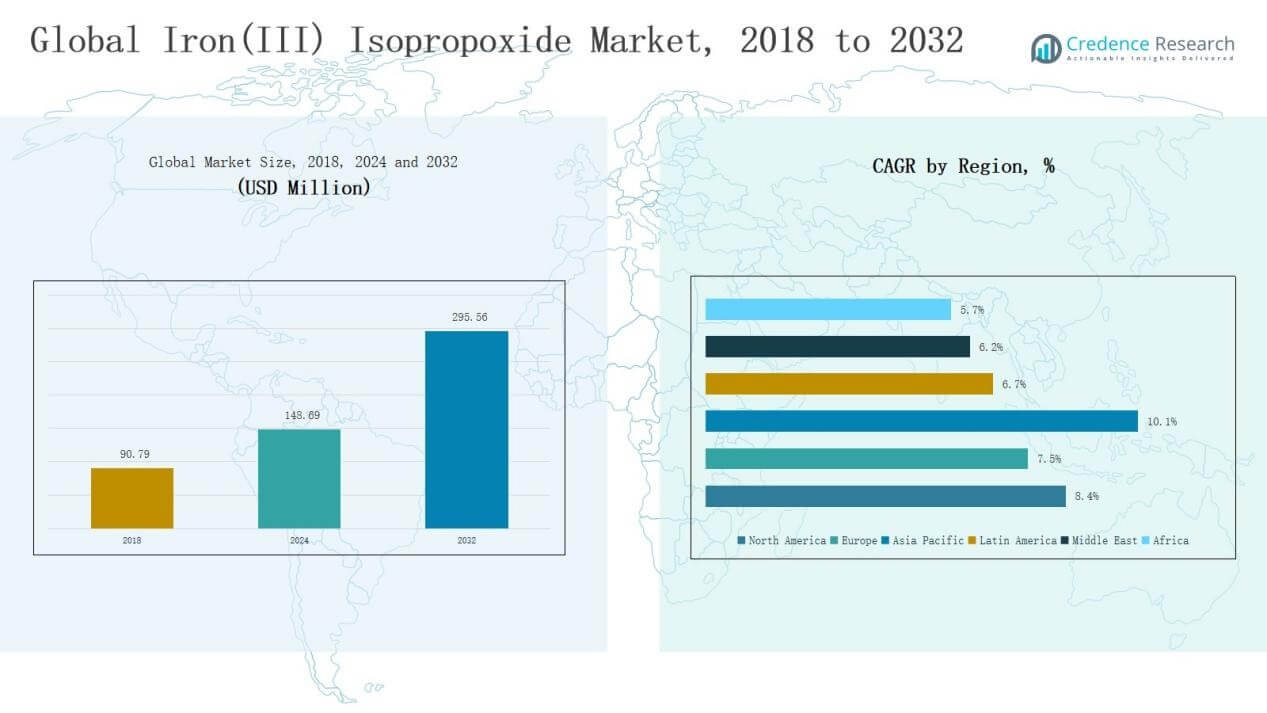

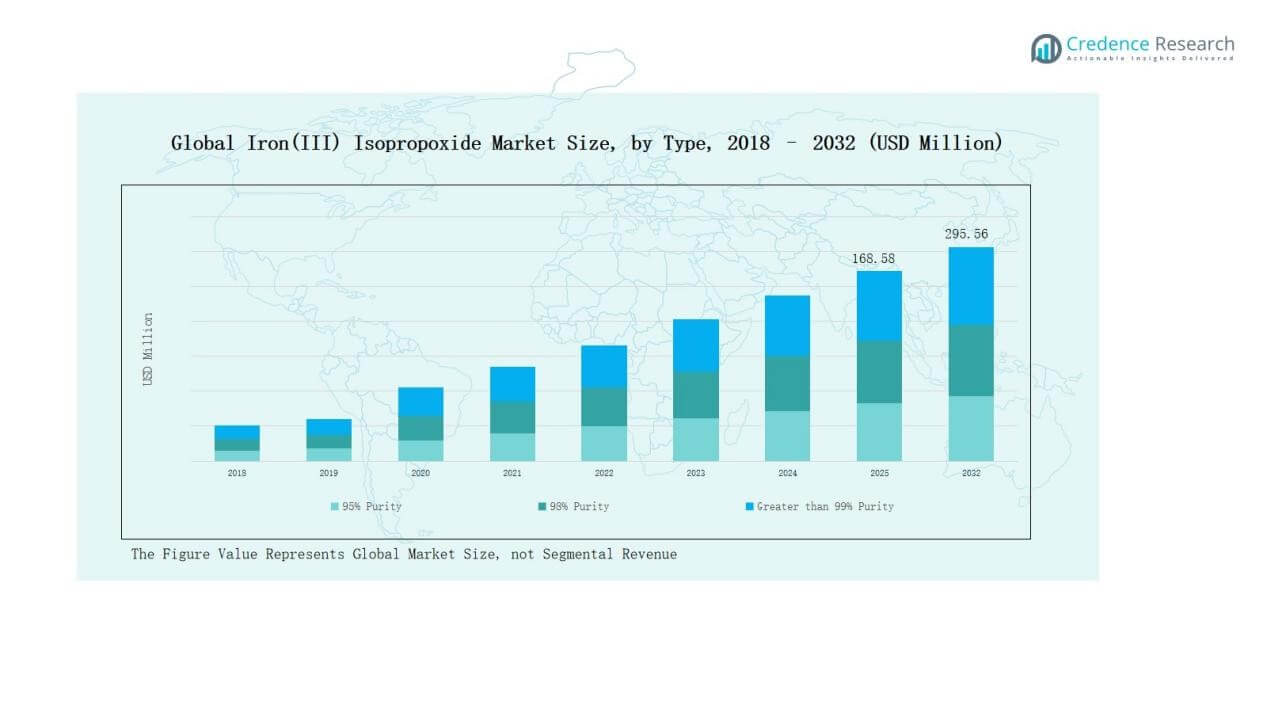

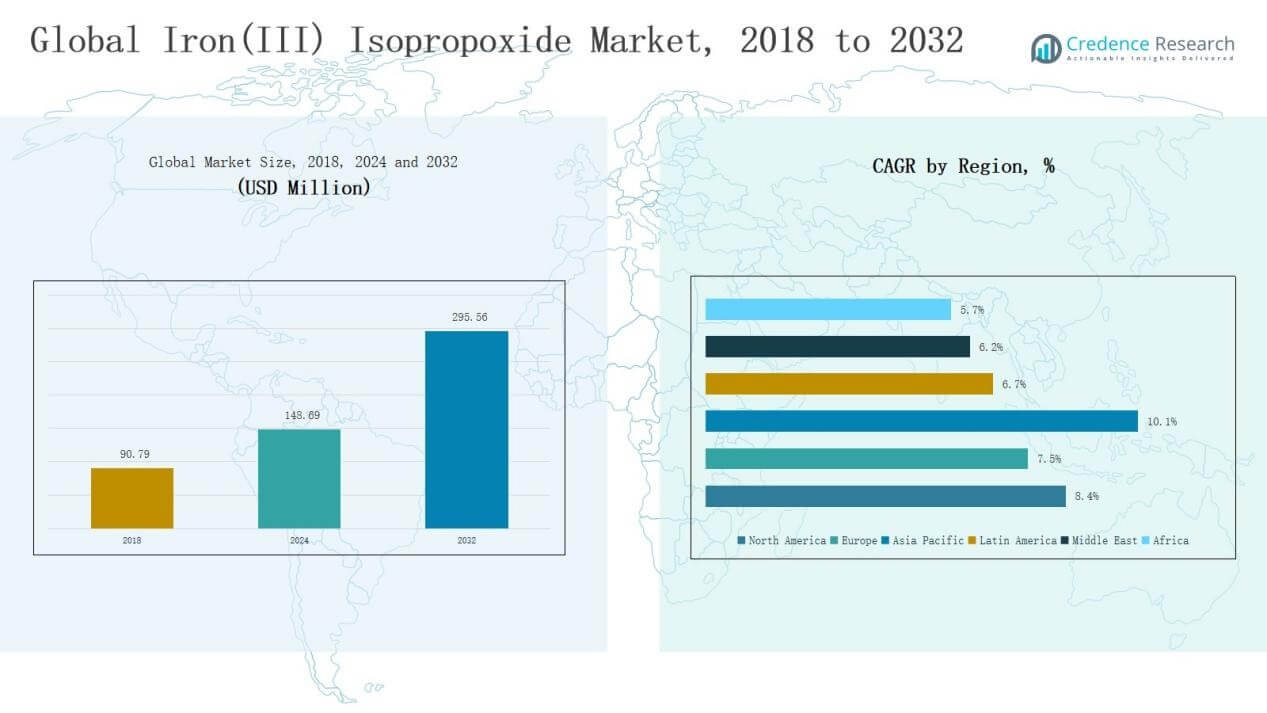

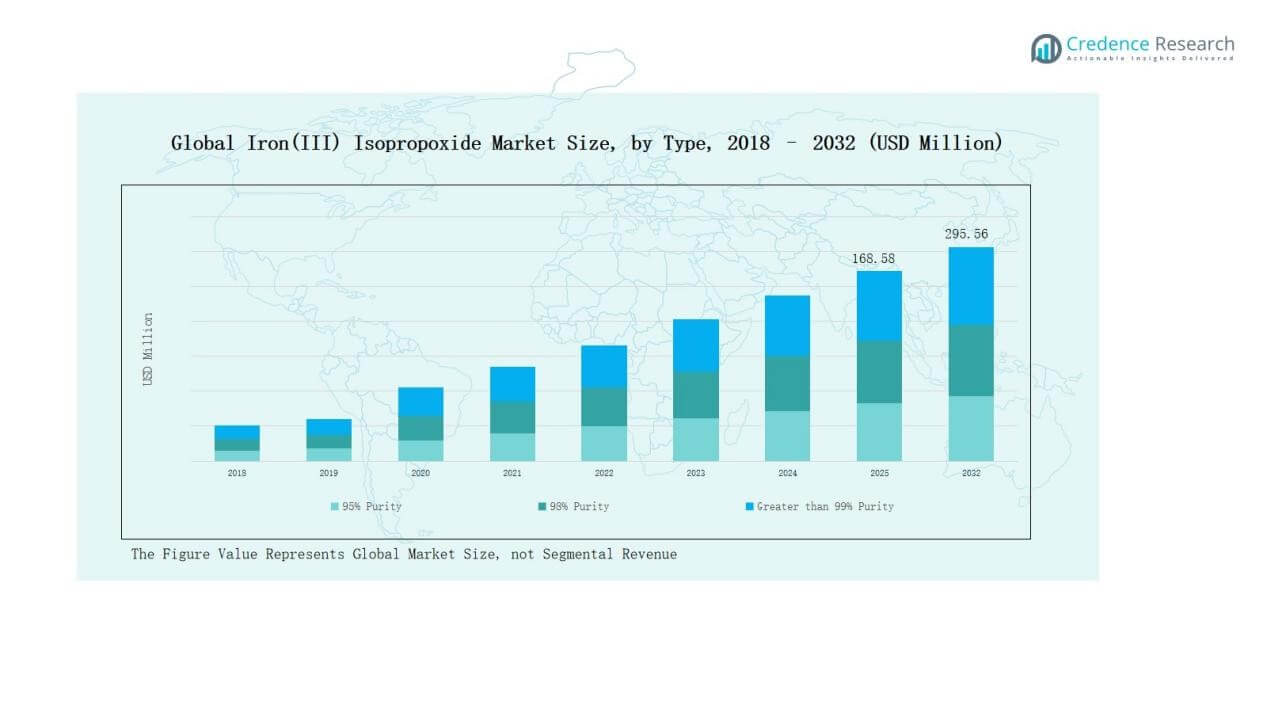

The Iron(III) Isopropoxide Market size was valued at USD 90.79 million in 2018, reached USD 148.69 million in 2024, and is anticipated to reach USD 295.56 million by 2032, growing at a CAGR of 8.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Iron(III) Isopropoxide Market Size 2024 |

USD 148.69 Million |

| Iron(III) Isopropoxide Market, CAGR |

8.35% |

| Iron(III) Isopropoxide Market Size 2032 |

USD 295.56 Million |

The Iron(III) Isopropoxide Market is shaped by the presence of leading players such as American Elements, ABCR GmbH, ALADDIN-E, A2B Chem, Angene International, BOC Sciences, Chemwill Asia, NBInno, Strem Chemicals, and Volatec. These companies focus on expanding high-purity product offerings, strengthening global distribution networks, and advancing purification technologies to meet growing demand from electronics, pharmaceuticals, and specialty chemicals. Strategic collaborations, R&D investments, and regional expansion remain central to their growth strategies. In terms of geography, North America led the global market with a 43.7% share in 2024, supported by robust demand from advanced manufacturing, chemical synthesis, and the electronics industry.

Market Insights

Market Insights

- The Iron(III) Isopropoxide Market grew from USD 90.79 million in 2018 to USD 148.69 million in 2024, and is projected at USD 295.56 million by 2032.

- The greater than 99% purity segment led with a 8% share in 2024, driven by demand from electronics and specialty chemicals requiring ultra-pure precursors for advanced applications.

- By form, the powder segment dominated with a 3% share in 2024, supported by ease of handling, stability, and bulk usage in chemical synthesis and manufacturing.

- By application, the chemical industry segment held the largest share at 6% in 2024, fueled by its use in catalysts, reagents, polymers, coatings, and pharmaceutical R&D.

- North America led with a 43.7% share in 2024, followed by Europe at 26.6% and Asia Pacific at 20.4%, highlighting strong regional demand in advanced industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

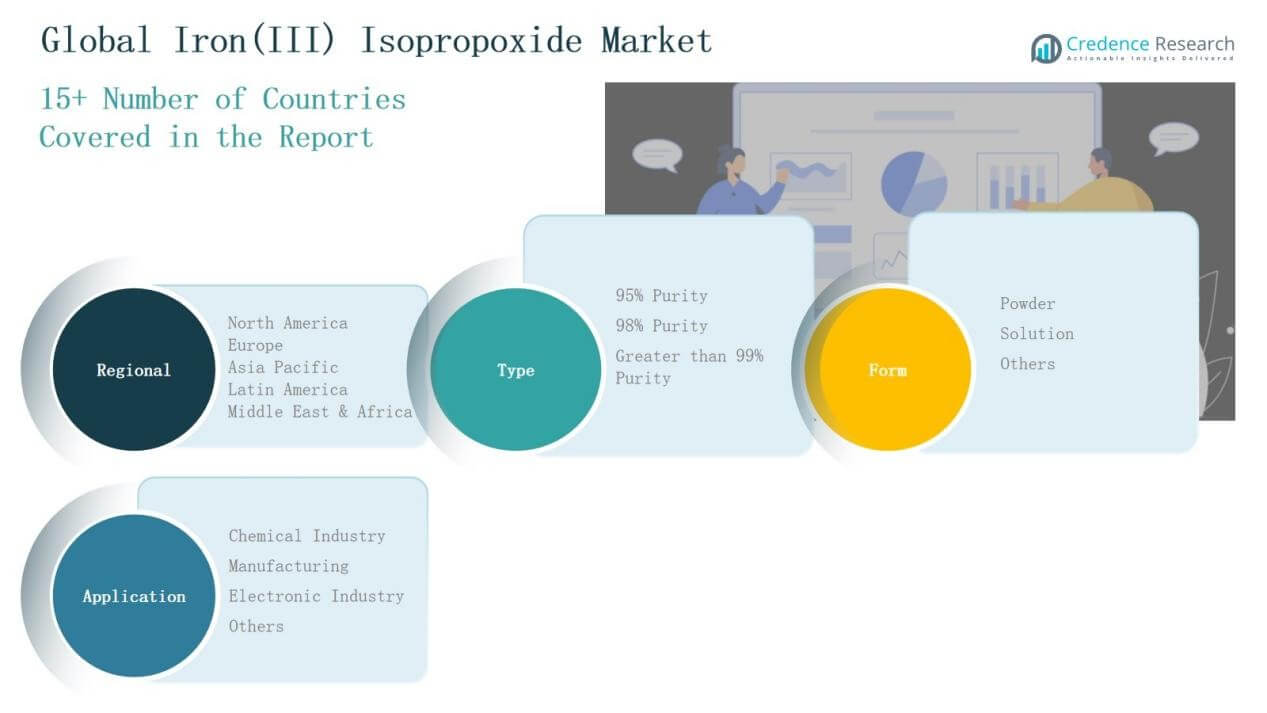

By Type

The greater than 99% purity segment dominated the Iron(III) Isopropoxide Market with a 46.8% share in 2024. This high-grade purity is in strong demand from the electronics and specialty chemical sectors, where consistency and minimal impurities are critical for performance. The rising need for ultra-pure precursors in semiconductor production and advanced material synthesis continues to drive adoption of this segment. Meanwhile, 95% and 98% purity grades find applications in general manufacturing and chemical processes, supporting stable demand across diverse industries.

For instance, Merck KGaA supplies high-purity metal alkoxide precursors for use in atomic layer deposition (ALD) and chemical vapor deposition (CVD) processes in semiconductor fabrication.

By Form

The powder form segment led the market with a 52.3% share in 2024, supported by its ease of handling, stability, and suitability for bulk applications. Powder formulations are widely used in manufacturing and chemical synthesis, where storage and transport efficiency are vital. The solution form, holding a considerable share, is gaining traction in laboratory and high-precision applications due to its enhanced solubility and direct usability. The “others” category, including customized formulations, caters to niche applications in research and specialized industries.

For instance, Evonik Industries supplies specialty powder additives under its AEROSIL® brand, which are commonly used in chemical production and coatings.

By Application

The chemical industry segment accounted for the largest share of 41.6% in 2024, driven by rising use of Iron(III) Isopropoxide in catalysts, reagents, and advanced chemical synthesis. Expanding demand for high-performance chemicals in pharmaceuticals, polymers, and coatings strengthens the dominance of this segment. The electronic industry is emerging as a fast-growing application area, fueled by semiconductor and nanomaterial research. Manufacturing applications remain steady, utilizing the compound for coatings and surface treatments, while other uses include R&D and specialized material development.

Key Growth Drivers

Rising Demand in Advanced Electronics

The increasing use of Iron(III) Isopropoxide as a precursor in semiconductor and nanomaterial fabrication is a key growth driver. Its high-purity variants are essential for thin-film deposition and coating applications, enabling superior performance in microelectronics. With global investment in 5G infrastructure, electric vehicles, and smart devices expanding, the electronics sector continues to push demand for high-quality organometallic compounds. This reliance on Iron(III) Isopropoxide for precision processes underscores its role in advancing next-generation technologies, creating strong and sustainable market growth opportunities.

For instance, methods involving iron(III) isopropoxide enable the deposition of thin iron oxide layers used in magnetic and magneto-optical recording devices.

Expanding Applications in Chemical Synthesis

Iron(III) Isopropoxide is increasingly utilized in catalysts, reagents, and advanced chemical processes, supporting a broad spectrum of industries. Its role in producing polymers, coatings, and specialty chemicals makes it highly attractive to manufacturers seeking efficiency and performance. Pharmaceutical R&D also leverages the compound for novel formulations and material development. As industries intensify efforts to create high-value chemicals, the demand for reliable precursors rises steadily. This expanding application base within chemical synthesis positions Iron(III) Isopropoxide as a versatile compound with long-term market potential.

For instance, Thermo Fisher Scientific offers the compound for laboratory-scale applications in polymer development and specialty chemical synthesis.

Growing Adoption in Industrial Manufacturing

Manufacturing industries are incorporating Iron(III) Isopropoxide for coatings, surface treatments, and corrosion-resistant materials. Its properties enhance material strength, durability, and resistance, which are critical for aerospace, automotive, and construction applications. As global infrastructure projects and industrial modernization accelerate, demand for specialized materials rises correspondingly. The compound’s compatibility with advanced manufacturing processes makes it an important enabler of innovation. This growing adoption in diverse industrial applications continues to strengthen market penetration and reinforces its position as a valuable input in industrial growth.

Key Trends & Opportunities

Key Trends & Opportunities

Shift Toward High-Purity Compounds

A notable trend in the Iron(III) Isopropoxide Market is the rising preference for greater than 99% purity products. This shift reflects increasing reliance on high-purity inputs across electronics, research, and specialty chemicals. Industries are demanding compounds that minimize impurities and deliver consistent results in precision applications. Manufacturers investing in advanced purification technologies stand to gain competitive advantages. The trend toward ultra-pure formulations not only drives product differentiation but also expands opportunities in sectors where quality standards and performance parameters are becoming more stringent.

For instance, American Elements offers Iron(III) Isopropoxide in ultra-high purity grades such as 99.99% and 99.999%, catering to advanced applications in nano-materials and thin films.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific and Latin America offer significant opportunities for Iron(III) Isopropoxide suppliers. Rapid industrialization, expanding electronics manufacturing hubs, and rising investment in chemical processing facilities create strong demand. Countries such as China, India, and Brazil are increasingly focusing on developing domestic chemical and semiconductor industries, which boosts consumption of specialized organometallic compounds. This regional expansion presents opportunities for global players to establish partnerships, expand distribution networks, and localize production. As emerging markets evolve into major demand centers, they will reshape the global market landscape.

For instance, Indian Oil Corporation and Israel-based Phinergy formed a joint venture to manufacture and commercialize Aluminum-Air (Al-Air) battery systems in India. The goal is to boost India’s e-mobility ambitions by developing indigenous batteries using domestically available aluminum and recycling the used metal.

Key Challenges

High Production Costs and Supply Constraints

The production of Iron(III) Isopropoxide involves complex processes and requires advanced purification methods, which elevate costs. Supply chain constraints, particularly for raw materials and specialized equipment, further intensify challenges for producers. Small and medium enterprises face barriers to entry due to capital-intensive requirements. Price volatility and inconsistent supply often impact end-user adoption, particularly in cost-sensitive industries. Overcoming these hurdles requires manufacturers to invest in efficient processes, secure raw material supply chains, and explore strategic collaborations to stabilize production and meet growing market demand.

Stringent Safety and Handling Regulations

Iron(III) Isopropoxide is classified as a reactive and sensitive chemical, requiring stringent storage and handling protocols. Safety concerns associated with flammability, moisture sensitivity, and toxicity often restrict its large-scale adoption. Compliance with global safety regulations, including REACH and OSHA standards, adds complexity for producers and distributors. These requirements lead to increased costs for transportation, training, and protective infrastructure. Companies must implement robust safety management systems to ensure compliance and minimize risks, but regulatory burdens continue to challenge market growth and operational efficiency.

Limited Awareness Among End-Users

Despite its benefits, Iron(III) Isopropoxide remains a relatively specialized compound, with limited awareness among potential industrial users. Many manufacturers continue to rely on traditional reagents or less advanced alternatives due to lack of familiarity or technical expertise. This knowledge gap slows adoption, particularly in developing markets where R&D and specialized applications are still emerging. Market players face the challenge of educating users on its advantages, conducting demonstrations, and highlighting cost-performance benefits. Without greater awareness, market penetration may remain slower than projected across some sectors.

Regional Analysis

North America

North America dominated the Iron(III) Isopropoxide Market with a 43.7% share in 2024, valued at USD 64.93 million, up from USD 40.06 million in 2018. The market is projected to reach USD 129.43 million by 2032, growing at a CAGR of 8.4%. Growth is supported by strong demand from advanced manufacturing, chemical synthesis, and the electronics sector, particularly in the U.S. Expanding investments in R&D and the presence of key producers enhance regional competitiveness. Regulatory standards promoting high-purity chemicals further strengthen adoption, making North America the leading regional contributor to global revenues.

Europe

Europe held a 26.6% market share in 2024, with revenues of USD 39.55 million, rising from USD 25.08 million in 2018. The market is expected to reach USD 73.89 million by 2032, at a CAGR of 7.5%. Growth is driven by widespread applications in specialty chemicals, coatings, and the pharmaceutical sector. Germany, France, and the UK are major contributors, supported by robust industrial bases and research activities. Rising adoption of high-purity compounds in electronics and advanced material development adds to regional demand. However, strict environmental and safety regulations increase compliance costs, slightly moderating growth compared to other regions.

Asia Pacific

Asia Pacific emerged as the fastest-growing region, capturing a 20.4% market share in 2024, valued at USD 30.39 million, up from USD 17.09 million in 2018. The market is forecast to reach USD 68.57 million by 2032, expanding at a CAGR of 10.1%. Rapid industrialization, expanding electronics manufacturing hubs, and increasing demand for specialty chemicals in China, Japan, South Korea, and India drive growth. Local production capacity and rising investments in semiconductor and nanomaterials strengthen adoption. Asia Pacific’s cost advantages and growing R&D infrastructure position it as the most dynamic region in the global market outlook.

Latin America

Latin America accounted for a 4.6% share of the market in 2024, valued at USD 6.92 million, compared to USD 4.28 million in 2018. Revenues are anticipated to reach USD 12.17 million by 2032, registering a CAGR of 6.7%. Brazil and Argentina lead demand, supported by expanding chemical and manufacturing industries. Increasing awareness of advanced materials in coatings, polymers, and niche chemical applications supports regional growth. However, slower technology adoption and economic fluctuations restrict market expansion. Despite these challenges, the region presents opportunities for suppliers targeting untapped markets and local partnerships.

Middle East

The Middle East represented a 2.7% market share in 2024, valued at USD 3.97 million, rising from USD 2.64 million in 2018. It is projected to reach USD 6.71 million by 2032, at a CAGR of 6.2%. Growth is supported by rising investments in industrial and construction chemicals, particularly within the GCC countries. Expanding oil and gas downstream industries also create opportunities for advanced chemical precursors. However, limited local production capacity and reliance on imports constrain market growth. Increasing demand for high-purity materials in research and manufacturing highlights emerging opportunities for international suppliers.

Africa

Africa accounted for a 2.0% share of the market in 2024, with revenues of USD 2.93 million, up from USD 1.64 million in 2018. The market is forecast to reach USD 4.79 million by 2032, growing at a CAGR of 5.7%. South Africa and Egypt are leading contributors, with growing adoption in chemical processing and niche industrial applications. However, limited infrastructure, low awareness, and reliance on imports restrict overall growth. Gradual improvements in manufacturing and rising interest in advanced chemical materials may create long-term opportunities, though Africa remains the smallest regional market globally.

Market Segmentations:

Market Segmentations:

By Type

- 95% Purity

- 98% Purity

- Greater than 99% Purity

By Form

By Application

- Chemical Industry

- Manufacturing

- Electronic Industry

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Iron(III) Isopropoxide Market is moderately consolidated, with a mix of global suppliers and specialized chemical producers competing for market share. Leading players such as American Elements, ABCR GmbH, ALADDIN-E, A2B Chem, Angene International, BOC Sciences, Chemwill Asia, NBInno, Strem Chemicals, and Volatec drive competition through product quality, purity grades, and global distribution capabilities. Companies focus on expanding their high-purity product portfolios to meet growing demand from electronics, pharmaceuticals, and specialty chemical industries. Strategic partnerships, research collaborations, and regional expansion are common approaches to strengthen market presence. Larger firms leverage advanced purification technologies and broad customer bases, while smaller players differentiate by offering customized formulations and flexible supply chains. Increasing emphasis on safety standards, regulatory compliance, and cost optimization also shapes competition. With rising demand for ultra-pure materials in high-tech industries, innovation in production methods and supply chain resilience are becoming critical factors for sustaining competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- American Elements

- ABCR GmbH

- ALADDIN-E

- A2B Chem

- Angene International

- BOC Sciences

- Chemwill Asia

- NBInno

- Strem Chemicals

- Volatec

Recent Developments

- In January 2024, German companies LANXESS and IBU-tec advanced materials announced a research collaboration to develop high-performance iron oxides for lithium iron phosphate (LFP) cathode materials, with the goal of improving LFP battery performance for electric vehicles and energy storage while also establishing a more independent European value chain.

- In July 2024, American Elements was recognized as a preferred supplier of Iron(III) Isopropoxide, offering multiple purity grades including 98%, 99%, 99.99%, and 99.999%, available in commercial and research quantities for immediate delivery.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity grades will rise with growing semiconductor and nanomaterial applications.

- The chemical industry will continue to adopt the compound for advanced synthesis processes.

- Expansion of electronics manufacturing hubs will boost regional consumption in Asia Pacific.

- Manufacturers will invest in improved purification technologies to meet strict quality needs.

- Strategic collaborations and partnerships will strengthen global supply chain resilience.

- Growing use in surface coatings and specialty materials will support industrial applications.

- Emerging markets will open opportunities through industrialization and infrastructure expansion.

- Regulatory compliance and safety standards will shape product handling and adoption.

- Customized formulations will gain traction in research and niche chemical applications.

- Continuous innovation in production methods will enhance competitiveness among key players.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: