Market Overview

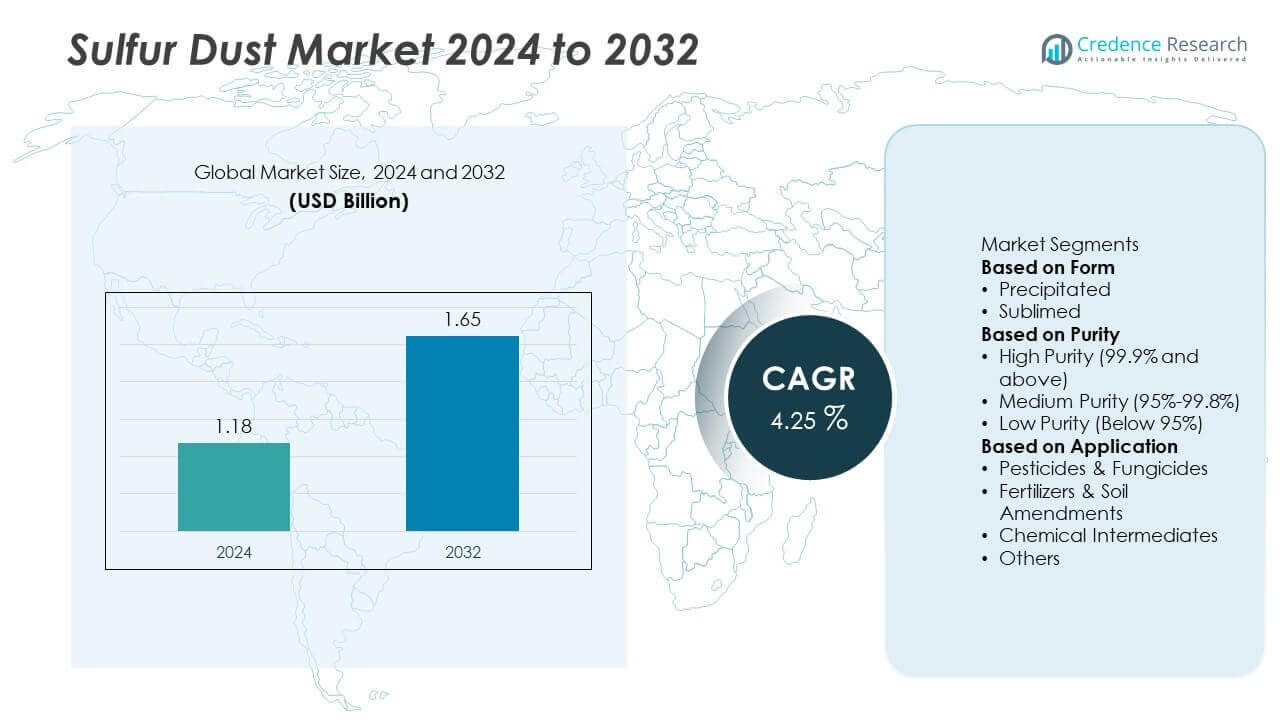

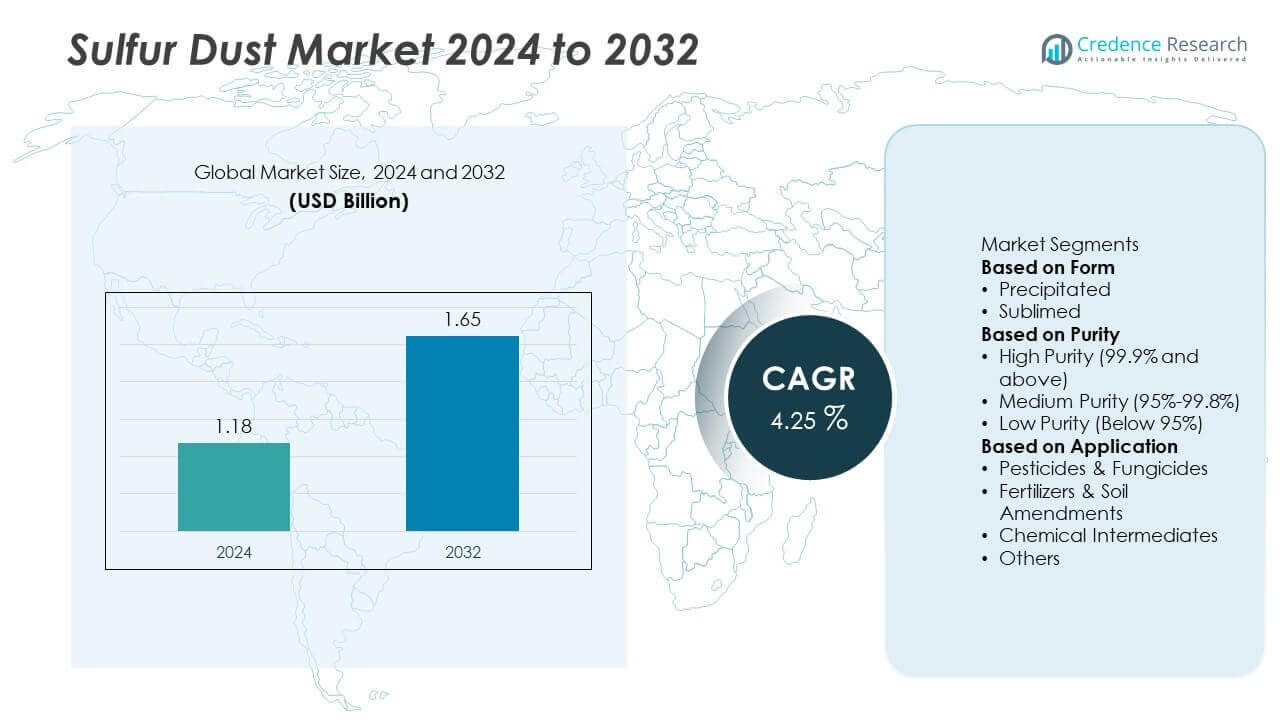

The sulfur dust market was valued at USD 1.18 billion in 2024 and is projected to reach USD 1.65 billion by 2032, growing at a CAGR of 4.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spider Lift Market Size 2024 |

USD 1.18 Billion |

| Spider Lift Market, CAGR |

4.25% |

| Spider Lift Market Size 2032 |

USD 1.65 Billion |

The sulfur dust market is driven by leading players such as Shandong Hubin Rubber Technology Co., Ltd, Jordan Sulfur, Saeed Ghodran Group, Maruti Corporation, Solar Chemferts, SML Limited, American Elements, Georgia Gulf Sulfur Corporation, Jaishil Sulfur and Chemical Industries, and Grupa Azoty. These companies focus on expanding production capacity, offering high-purity grades, and strengthening distribution networks to meet rising demand from agriculture and industrial sectors. North America led the market with over 35% share in 2024, supported by high adoption of sulfur-based pesticides and fertilizers. Asia-Pacific followed with nearly 30% share, driven by expanding crop production and government-backed soil health programs. Europe accounted for around 25%, while Latin America and the Middle East & Africa collectively contributed less than 10%, supported by growing adoption of sustainable farming practices and rising investments in fertilizer application programs across developing economies.

Market Insights

Market Insights

- The sulfur dust market was valued at USD 1.18 billion in 2024 and is projected to reach USD 1.65 billion by 2032, growing at a CAGR of 4.25% during the forecast period.

- Rising demand for crop protection solutions and fertilizers drives market growth, with precipitated sulfur holding over 55% share by form and high-purity sulfur grades contributing nearly 50% share by purity segment.

- Key trends include growing adoption of high-purity grades for agrochemicals and pharmaceuticals and increasing focus on eco-friendly, sustainable farming inputs supported by government initiatives.

- The market is competitive with players such as Shandong Hubin Rubber Technology Co., Ltd, Jordan Sulfur, Saeed Ghodran Group, Maruti Corporation, and Grupa Azoty focusing on production expansion, advanced processing technologies, and long-term supply contracts.

- North America led with 35% share in 2024, followed by Asia-Pacific with 30% and Europe with 25%, while Latin America and Middle East & Africa together accounted for below 10%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Precipitated sulfur dominated the market in 2024, holding over 55% share due to its fine particle size and high reactivity, making it ideal for agricultural applications. Its demand is driven by its superior dispersion in pesticides and fungicides, ensuring effective coverage and pathogen control. Sublimed sulfur accounted for the remaining share, supported by its use in rubber vulcanization and industrial applications where high purity is essential. The growing need for efficient crop protection and compliance with environmental regulations is expected to sustain the dominance of precipitated sulfur during the forecast period.

- For instance, American Elements manufactures a range of high-purity sulfur products, including precipitated and submicron-grade powders. These fine-particle sulfur formulations are used for applications like pesticide manufacturing, where a small, consistent particle diameter is known to improve dispersion and efficacy.

By Purity

High-purity sulfur dust (99.9% and above) led the market with nearly 50% share in 2024, supported by rising adoption in agrochemicals and pharmaceutical-grade intermediates where product quality is critical. Medium-purity sulfur captured around 35%, mainly used in fertilizers and industrial chemicals where ultra-high purity is not required. Low-purity grades represented less than 15%, largely consumed in cost-sensitive applications. The dominance of high-purity sulfur is attributed to increasing demand for high-quality pesticides and stricter residue standards in global agriculture markets, pushing manufacturers toward premium-grade sulfur products.

- For instance, Nippon Chemical Industrial Co., Ltd. supplies high-purity chemicals, including those for the pharmaceutical and semiconductor industries, that meet stringent application standards.

By Application

Pesticides & fungicides remained the leading application segment in 2024, accounting for over 45% of the market share, driven by growing awareness of crop protection and rising global food demand. Sulfur dust is a cost-effective fungicide used against powdery mildew and other fungal diseases in fruits, vegetables, and cereals. Fertilizers & soil amendments followed with nearly 30% share, supported by sulfur’s role as an essential plant nutrient. Chemical intermediates and other uses, including rubber processing and pharmaceuticals, contributed the remaining share, with demand rising in industrial and specialty chemical production.

Key Growth Drivers

Rising Demand for Crop Protection Solutions

The global rise in agricultural production is driving demand for sulfur dust as a cost-effective pesticide and fungicide. Its proven efficacy against fungal diseases like powdery mildew and rust makes it a preferred choice for farmers. Increasing adoption in organic and sustainable farming is boosting consumption, as sulfur is allowed under organic certification standards. Growing global food demand and shrinking arable land further encourage the use of sulfur dust to maximize yields, positioning crop protection as a major growth driver for the market.

- For instance, BASF SE produces a range of fungicides, including sulfur-based formulations like the long-standing Kumulus® DF, that are used for controlling diseases such as powdery mildew on vineyards and other crops.

Expansion of Fertilizer and Soil Amendment Applications

Fertilizers and soil conditioners using sulfur dust accounted for significant growth in 2024. Sulfur is an essential macronutrient for plant growth and is increasingly used to correct sulfur deficiencies in soils worldwide. Rising focus on balanced crop nutrition programs, especially in regions such as Asia-Pacific and Latin America, is driving demand. Regulatory push for higher crop productivity and improved soil health encourages adoption. This is expected to strengthen sulfur dust usage in granulated fertilizers and blended nutrient formulations over the coming years.

- For instance, Grupa Azoty expanded its product portfolio with fertilizers such as POLIFOSKA Multi S, which contains 23% sulfur, and eNpluS, a nitrogen fertilizer with sulfur and calcium derived from anhydrite. They also offer products like Sulphur 90% (Granular) and Salmag® with sulphur.

Increasing Industrial and Chemical Applications

Sulfur dust demand is growing in the chemical sector due to its use as an intermediate for manufacturing sulfites, sulfates, and rubber additives. The chemical industry benefits from sulfur’s low cost and availability, making it a reliable feedstock for industrial processes. Rising demand in pharmaceuticals and personal care applications also supports consumption of high-purity grades. Expansion of industrial production in developing economies is creating opportunities for manufacturers to diversify applications and secure steady supply chains for long-term growth.

Key Trends & Opportunities

Shift Toward High-Purity Sulfur Grades

There is a rising trend toward high-purity sulfur dust (99.9%+) as agricultural, pharmaceutical, and chemical industries demand stricter quality standards. This shift is driven by global residue limits, food safety regulations, and need for higher consistency in formulations. Manufacturers are investing in advanced purification and micronization technologies to meet customer requirements. Premium-grade sulfur dust also opens opportunities for suppliers to target high-value markets such as specialty fertilizers and pharmaceutical intermediates, improving profitability and competitiveness in a price-sensitive industry.

- For instance, companies in the Sichuan region of China, including manufacturers of high-purity materials, are active in expanding production to support technology sectors, with some suppliers in China now offering high-purity sulfur (up to 99.999%) for electronics manufacturing.

Adoption of Sustainable and Eco-Friendly Practices

Sustainable farming and eco-friendly agricultural inputs are key opportunities in the market. Sulfur dust is a naturally occurring mineral and has low environmental impact compared to synthetic pesticides. Increasing government support for integrated pest management (IPM) programs and organic farming certification boosts demand. Companies are innovating dust formulations with better flowability and controlled release, reducing waste and improving field performance. This aligns with global sustainability targets and offers suppliers an opportunity to expand market share among environmentally conscious growers.

- For instance, in 2024, BASF introduced the Aramax Intrinsic brand fungicide, a dual-active product for turf disease control, offering up to 28 days of residual activity on golf courses across the United States. The company also shared results from its global Carbon Field Trials, with findings from Germany and other regions demonstrating the potential for farmers to reduce agricultural greenhouse gas emissions by up to 30%.

Key Challenges

Stringent Regulatory and Safety Requirements

Sulfur dust handling is regulated due to risks of fire, explosion, and inhalation hazards. Compliance with occupational safety standards and transport regulations increases operational costs for producers. Farmers also require training for proper application to avoid phytotoxic effects on crops. These regulatory complexities can delay product approvals and discourage small-scale manufacturers. Market participants must invest in safer packaging, dust suppression technologies, and awareness programs to maintain compliance and ensure safe usage across industries and agricultural sectors.

Price Volatility and Supply Chain Constraints

Sulfur dust prices are influenced by crude oil and natural gas production, as sulfur is a byproduct of refining and gas processing. Any fluctuations in global energy markets can affect raw material availability and pricing. Supply disruptions or export restrictions in major producing regions impact downstream manufacturers, leading to uncertainty in procurement planning. Companies are adopting long-term contracts and backward integration strategies to stabilize supply and manage cost pressures, but volatility remains a key challenge to consistent growth.

Regional Analysis

North America

North America led the sulfur dust market in 2024, capturing over 35% share, driven by strong demand from the agricultural sector in the U.S. and Canada. Widespread adoption of sulfur-based pesticides and fungicides for fruit, vegetable, and cereal production supports growth. Regulatory approval of sulfur as an organic crop protectant encourages farmers to adopt sustainable pest control solutions. Rising use in fertilizers and soil amendments to correct sulfur deficiencies also contributes to market expansion. The presence of well-established chemical manufacturers and efficient supply chains further strengthens the region’s position during the forecast period.

Europe

Europe accounted for around 25% share of the market in 2024, supported by high adoption in viticulture and horticulture. Countries such as France, Spain, and Italy use sulfur dust extensively for controlling powdery mildew in grapes and other high-value crops. Strict regulations favoring environmentally safe pesticides have increased demand for sulfur-based solutions. Growing focus on sustainable agriculture and organic farming certifications also boosts consumption. Fertilizer use is rising in Eastern Europe to improve soil fertility, further driving demand. Investments in micronized sulfur production technologies are enhancing availability across the region and ensuring consistent quality for end-users.

Asia-Pacific

Asia-Pacific held nearly 30% share of the sulfur dust market in 2024 and is projected to be the fastest-growing region. Rising population, increasing food demand, and limited arable land are pushing farmers to adopt crop protection solutions. China and India dominate consumption due to large-scale fruit, vegetable, and cereal cultivation. Government initiatives to promote balanced fertilization programs and reduce crop losses are encouraging adoption. Expanding chemical manufacturing capacity in the region ensures steady supply. Growing awareness of plant nutrient management and adoption of integrated pest management practices will further fuel market growth during the forecast period.

Latin America

Latin America contributed over 6% share in 2024, driven by strong agricultural production in Brazil, Argentina, and Mexico. High demand for sulfur-based fungicides in soybean, coffee, and sugarcane crops is a major growth driver. Rising adoption of fertilizers with added sulfur is improving crop yields and addressing micronutrient deficiencies. Government support for precision farming practices and sustainable agriculture programs further promotes market penetration. Expanding horticulture and export-oriented fruit production also contribute to rising consumption. Investments in storage and distribution infrastructure are improving product availability and reducing seasonal supply gaps across key farming regions.

Middle East & Africa

The Middle East & Africa region accounted for around 4% share in 2024, supported by growing demand for fertilizers and soil amendments in arid farming regions. Sulfur dust is increasingly used to improve soil quality and crop productivity under challenging climatic conditions. Adoption of fungicides is rising in horticulture and greenhouse farming to protect crops from fungal infections. South Africa, Egypt, and Saudi Arabia are key markets driving regional growth. Limited local production capacity presents opportunities for exporters. Ongoing government programs to boost domestic food production and reduce import dependency are expected to stimulate demand further.

Market Segmentations:

By Form

By Purity

- High Purity (99.9% and above)

- Medium Purity (95%-99.8%)

- Low Purity (Below 95%)

By Application

- Pesticides & Fungicides

- Fertilizers & Soil Amendments

- Chemical Intermediates

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sulfur dust market is characterized by the presence of key players such as Shandong Hubin Rubber Technology Co., Ltd, Jordan Sulfur, Saeed Ghodran Group, Maruti Corporation, Solar Chemferts, SML Limited, American Elements, Georgia Gulf Sulfur Corporation, Jaishil Sulfur and Chemical Industries, and Grupa Azoty. These companies focus on enhancing production capacity, securing raw material supply, and offering high-purity sulfur grades to meet the growing demand in agriculture, fertilizers, and industrial applications. Strategic initiatives such as mergers, long-term supply agreements, and regional expansion are common to strengthen their market position. Global players emphasize product quality, consistent particle size, and dust control technologies to cater to high-value markets, while regional manufacturers compete on cost efficiency and localized distribution. Increasing investment in R&D to develop eco-friendly formulations and improve product performance further intensifies competition, making innovation and supply chain reliability key differentiators in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shandong Hubin Rubber Technology Co., Ltd

- Jordan Sulfur

- Saeed Ghodran Group

- Maruti Corporation

- Solar Chemferts

- SML Limited

- American Elements

- Georgia Gulf Sulfur Corporation

- Jaishil Sulfur and Chemical Industries

- Grupa Azoty

Recent Developments

- In August 2025, Grupa Azoty expanded its range of specialized liquid fertilizers combining nitrogen and sulfur in one product.

- In March 2025, Grupa Azoty introduced FOLIRES™, a new granular fertilizer with nitrogen, magnesium, and sulphur (SO₃) aimed at foliar plant nutrition.

- In February 2025, Grupa Azoty began producing a new multi-component fertilizer “POLIFOSKA Multi S” with about 23% sulfur at its Police facility.

Report Coverage

The research report offers an in-depth analysis based on Form, Purity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The sulfur dust market is expected to grow steadily with rising adoption in agriculture.

- Demand for sulfur-based pesticides and fungicides will continue to increase to protect crops.

- Fertilizer applications will expand as farmers focus on balanced nutrient programs.

- High-purity sulfur grades will gain popularity for agrochemical and pharmaceutical uses.

- Technological advancements will improve micronization and dust control for safer handling.

- Sustainability initiatives will boost demand for eco-friendly and organic-approved solutions.

- Asia-Pacific will emerge as the fastest-growing region due to population-driven food demand.

- Strategic partnerships and supply agreements will strengthen global distribution networks.

- Investments in R&D will create innovative formulations with improved efficiency and performance.

- Market competition will intensify as regional players challenge global manufacturers with cost-effective products.

Market Insights

Market Insights