Market Overview:

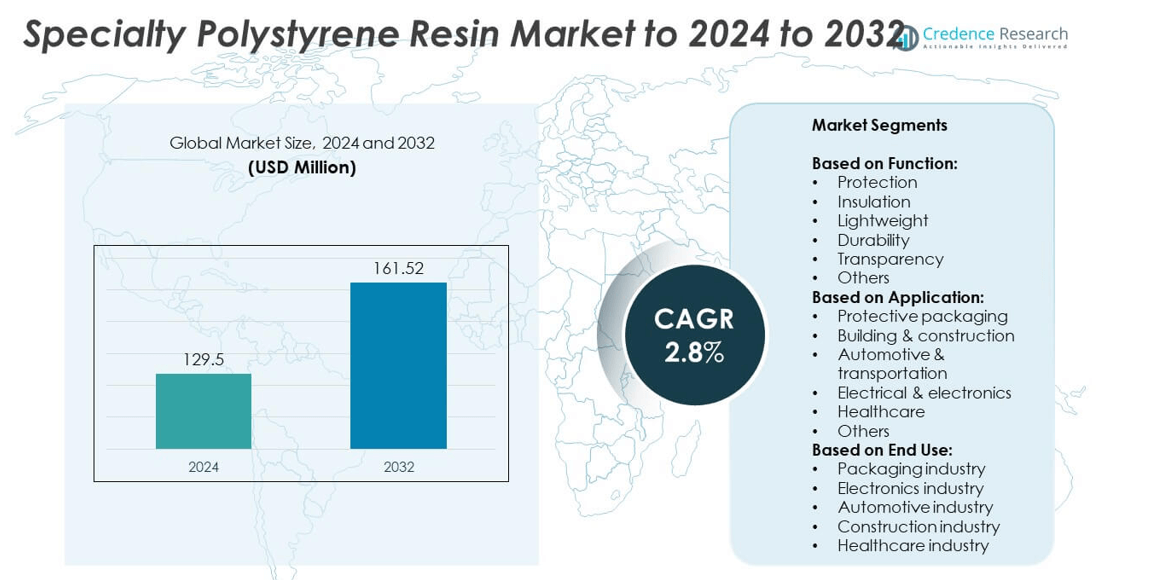

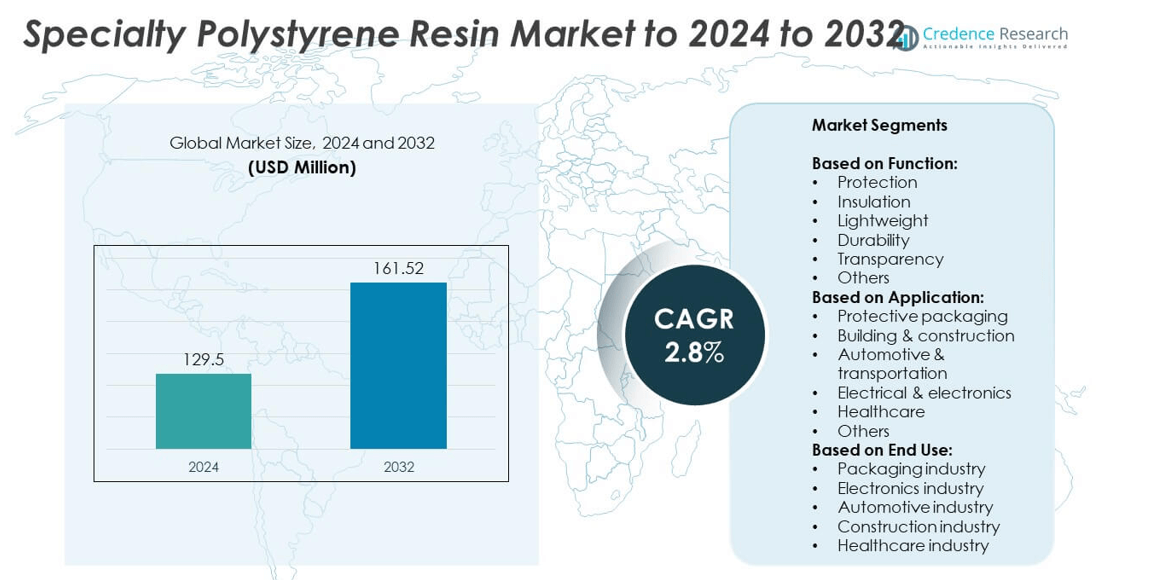

The Specialty Polystyrene Resin Market size was valued at USD 129.5 Million in 2024 and is anticipated to reach USD 161.52 Million by 2032, at a CAGR of 2.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Polystyrene Resin Market Size 2024 |

USD 129.5 Million |

| Specialty Polystyrene Resin Market, CAGR |

2.8% |

| Specialty Polystyrene Resin Market Size 2032 |

USD 161.52 Million |

The specialty polystyrene resin market is driven by major players such as BASF, Versalis, Styron (Dow), Mitsubishi Chemical Corporation, Formosa Plastics Corporation, ExxonMobil, Asahi Kasei, TotalEnergies, Sinopec, Braskem, LG Chem, China Petrochemical Corporation, SABIC, and INEOS Styrolution. These companies compete through innovations in lightweight, durable, and sustainable resin solutions tailored for packaging, construction, automotive, electronics, and healthcare applications. North America emerged as the leading region in 2024, capturing 34% of the global share, supported by strong demand from e-commerce packaging, healthcare infrastructure, and energy-efficient construction projects. Europe followed with 28%, while Asia Pacific accounted for 25%, reflecting rising industrialization and expanding consumer markets.

Market Insights

- The specialty polystyrene resin market was valued at USD 129.5 million in 2024 and is projected to reach USD 161.52 million by 2032, growing at a CAGR of 2.8%.

- Growing demand for protective packaging in e-commerce, along with rising healthcare and construction applications, is driving market expansion.

- Key trends include the shift toward lightweight materials in automotive, adoption of insulation solutions in construction, and increasing focus on recyclable and sustainable resin grades.

- The market is competitive with leading companies investing in innovation, capacity expansion, and sustainable alternatives to address regulatory pressures and customer demand.

- North America led the market with 34% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while Latin America and Middle East & Africa accounted for smaller shares driven by emerging packaging and construction sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Function

The specialty polystyrene resin market by function is led by the protection segment, accounting for over 30% share in 2024. Protection resins are widely adopted in packaging and fragile goods handling due to their shock-absorbing properties. Growing e-commerce sales and global trade expansion drive demand for protection-based resins. Insulation follows closely, supported by applications in building energy efficiency and refrigeration systems. Lightweight and durability functions are gaining traction in automotive manufacturing to reduce vehicle weight. Transparency-based resins remain niche, serving healthcare and electronics applications where clarity is crucial.

- For instance, BASF is adding 50,000 tons/year Neopor® capacity in Ludwigshafen, reaching 250,000 tons/year by early 2027.

By Application

Protective packaging dominated the specialty polystyrene resin market in 2024 with more than 35% market share. Rising online retail, coupled with the global movement of consumer goods, has accelerated the adoption of polystyrene resins in protective packaging solutions. Building and construction applications rank second, supported by thermal insulation and lightweight materials that enhance energy savings. Automotive and transportation industries use specialty resins for lightweight, durable parts, reducing fuel consumption. Electrical and electronics benefit from their insulating properties, while healthcare uses grow in medical packaging. Strong e-commerce penetration is the key growth driver for packaging applications.

- For instance, Sunpor operates EPS facilities capable of 260,000 tons/year granules production.

By End Use

The packaging industry emerged as the dominant end-use sector, capturing nearly 40% of the specialty polystyrene resin market in 2024. This dominance is driven by increased demand for protective and lightweight packaging across consumer goods, electronics, and healthcare products. Electronics industries contribute significantly, with resins used for insulation and transparency in devices. Automotive and construction sectors increasingly adopt these materials for weight reduction and durability. Healthcare applications are expanding, especially in sterile packaging and medical disposables. The growing focus on sustainable packaging and the rise of direct-to-consumer retail models further fuel packaging industry growth.

Market Overview

Rising Demand for Protective Packaging

Protective packaging has become the primary driver of specialty polystyrene resin adoption, holding the largest application share. The rapid rise of e-commerce and global trade is fueling demand for lightweight, shock-absorbing materials to safeguard goods during transit. Specialty polystyrene resins offer high performance at low cost, making them ideal for packaging fragile and consumer products. Increasing online retail penetration, coupled with stringent requirements for safe product delivery, continues to push manufacturers toward advanced protective materials, ensuring steady market growth in this segment.

- For instance, INEOS Styrolution reports StyLight cuts part thickness 50–70%, reducing weight 40–50% versus injection parts.

Expansion in Building and Construction

The construction industry is a major growth driver, supported by rising global infrastructure investments. Specialty polystyrene resins are widely used in insulation, roofing, and structural components, offering thermal efficiency and durability. Growing emphasis on energy-efficient buildings and green construction materials boosts adoption, particularly in regions with strong regulatory support for sustainability. Lightweight properties of these resins reduce overall building loads, improving efficiency in large-scale projects. The push for net-zero construction and urbanization trends further enhance the demand outlook for specialty polystyrene resins in construction applications.

- For instance, CHIMEI lifted total polystyrene capacity to 920,000 tons/year after its 2023 Zhangzhou PS start-up.

Growth in Healthcare and Electronics

Healthcare and electronics applications are key growth contributors, with increasing use of specialty polystyrene resins in medical packaging, diagnostics, and electronic insulation. The healthcare industry relies on these resins for sterile, lightweight, and transparent packaging solutions. In electronics, resins provide durability and insulation for sensitive devices, ensuring safe performance. Rising healthcare spending, coupled with the global surge in consumer electronics production, drives consistent demand. With continuous innovation in medical devices and electronics miniaturization, specialty polystyrene resins play a critical role, supporting advanced manufacturing needs in these fast-growing industries.

Key Trends & Opportunities

Shift Toward Lightweight Materials

Lightweighting has emerged as a strong trend in the specialty polystyrene resin market, especially in automotive and packaging. The push for reducing fuel consumption and improving logistics efficiency makes lightweight materials highly valuable. Automakers are increasingly replacing heavy components with specialty resins to improve performance and reduce emissions. In packaging, lightweight resins reduce transportation costs and enhance sustainability. This shift creates opportunities for resin producers to develop high-strength yet lightweight solutions that meet the performance requirements of diverse end-use industries.

- For instance, FIBRAN’s XPS 500-L board lists CS(10) = 500 kPa compressive strength per EN 13164.

Sustainability and Circular Economy Practices

The adoption of eco-friendly materials is a major opportunity, driven by global sustainability goals. Specialty polystyrene resin manufacturers are investing in recyclable and bio-based alternatives to align with environmental regulations. The circular economy trend is encouraging closed-loop recycling systems, reducing waste and promoting resource efficiency. Companies that integrate sustainability into product development gain a competitive advantage, as industries like packaging and construction prioritize green materials. This trend positions specialty polystyrene resins as vital enablers of sustainable industrial practices, opening long-term opportunities across multiple markets.

- For instance, Sonoco ThermoSafe specifies EPS coolers with 0.75–2.25 in wall options for 24–48+ hour holds.

Key Challenges

Environmental Concerns and Regulations

Environmental issues remain a major challenge for specialty polystyrene resins, with increasing restrictions on plastics usage. Governments and regulatory bodies worldwide are tightening controls on single-use plastics and non-biodegradable packaging materials. Specialty resins, despite their performance advantages, face scrutiny due to waste management challenges. Manufacturers must invest in recycling technologies and sustainable alternatives to maintain market relevance. Failure to address environmental concerns could limit adoption, particularly in regions with strict regulatory frameworks focused on reducing plastic pollution and promoting eco-friendly material substitutes.

Fluctuating Raw Material Prices

Volatility in raw material prices is another key restraint for the specialty polystyrene resin market. Polystyrene production relies heavily on petroleum-based feedstocks, which are subject to unpredictable price swings influenced by global oil markets. Such fluctuations directly impact production costs, affecting profit margins for resin manufacturers. Price instability also creates uncertainty for end-users in packaging, construction, and healthcare sectors, limiting large-scale adoption. Companies must develop cost-efficient production processes and diversify raw material sourcing strategies to mitigate risks from raw material price volatility.

Regional Analysis

North America

North America held the largest share of the specialty polystyrene resin market, accounting for around 34% in 2024. The region’s dominance is driven by strong demand from packaging, healthcare, and construction industries. The U.S. leads the market, supported by advanced healthcare infrastructure and a robust e-commerce sector requiring protective packaging. Canada and Mexico contribute through rising construction projects and automotive manufacturing. The focus on energy-efficient building materials also strengthens resin adoption. Ongoing investment in sustainable packaging solutions and lightweight automotive applications ensures that North America remains a key growth hub during the forecast period.

Europe

Europe captured nearly 28% of the specialty polystyrene resin market share in 2024. The region benefits from high adoption in construction and automotive industries, supported by stringent EU regulations on energy efficiency and sustainable materials. Germany, France, and the UK are major contributors, focusing on insulation and lightweight applications. Growing healthcare spending also drives resin usage in medical packaging. However, environmental restrictions on plastics are pushing manufacturers to adopt recyclable and eco-friendly solutions. The rising focus on circular economy practices positions Europe as a progressive market, with opportunities for innovation in sustainable specialty polystyrene resins.

Asia Pacific

Asia Pacific accounted for approximately 25% of the specialty polystyrene resin market in 2024. Rapid industrialization, growing automotive production, and expanding e-commerce sectors are major demand drivers. China leads the region with large-scale adoption in packaging, construction, and electronics, while India and Southeast Asian countries show strong growth in healthcare and consumer goods packaging. Urbanization and rising disposable incomes further fuel consumption across industries. Although environmental concerns present challenges, government initiatives promoting industrial development and infrastructure growth support steady expansion. Asia Pacific remains one of the fastest-growing regions with significant long-term potential for resin manufacturers.

Latin America

Latin America represented around 7% of the specialty polystyrene resin market share in 2024. The region is seeing increased adoption in packaging and construction, driven by urban development and expanding retail markets. Brazil leads the market with significant demand from the automotive and consumer goods sectors. Mexico also contributes strongly due to its growing manufacturing base. Healthcare applications are gaining attention, supported by rising investment in medical infrastructure. Despite economic fluctuations and regulatory challenges, the region’s demand is projected to grow steadily, particularly as e-commerce penetration and industrial development continue to expand across key markets.

Middle East & Africa

The Middle East & Africa accounted for nearly 6% of the specialty polystyrene resin market in 2024. Growth is primarily supported by construction projects in the Gulf countries and rising packaging needs in Africa. The UAE and Saudi Arabia drive adoption in building insulation and infrastructure development, while South Africa leads demand in healthcare and retail packaging. Limited production capacities and high import dependency remain challenges, but increasing investments in industrial sectors provide opportunities. The push for modern infrastructure and healthcare advancements is expected to gradually boost the market’s presence across the region during the forecast period.

Market Segmentations:

By Function:

- Protection

- Insulation

- Lightweight

- Durability

- Transparency

- Others

By Application:

- Protective packaging

- Building & construction

- Automotive & transportation

- Electrical & electronics

- Healthcare

- Others

By End Use:

- Packaging industry

- Electronics industry

- Automotive industry

- Construction industry

- Healthcare industry

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The specialty polystyrene resin market is shaped by leading companies such as BASF, Versalis, Styron (Dow), Mitsubishi Chemical Corporation, Formosa Plastics Corporation, ExxonMobil, Asahi Kasei, TotalEnergies, Sinopec, Braskem, LG Chem, China Petrochemical Corporation, SABIC, and INEOS Styrolution. These players focus on product innovation, capacity expansion, and sustainable resin development to strengthen their positions. The market is highly competitive, with companies emphasizing recyclable and eco-friendly materials to meet regulatory standards and growing demand for sustainable packaging and construction solutions. Strategic collaborations, regional expansions, and investments in advanced manufacturing technologies are key approaches adopted to maintain market share. Increasing demand from packaging, automotive, and healthcare industries drives competition, while raw material price volatility adds pressure on profitability. Firms are also adopting digital solutions and advanced R&D practices to deliver high-performance resin grades for diverse end-use applications. This competitive environment ensures continuous innovation and positions established players as long-term market leaders.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF

- Versalis

- Styron (Dow)

- Mitsubishi Chemical Corporation

- Formosa Plastics Corporation

- ExxonMobil

- Asahi Kasei

- TotalEnergies

- Sinopec

- Braskem

- LG Chem

- China Petrochemical Corporation

- SABIC

- INEOS Styrolution

Recent Developments

- In 2025, Versalis inaugurated a new plant at its Porto Marghera site. This facility is capable of producing up to 20,000 tonnes per year of recycled crystal and expandable polystyrene from post-consumer waste.

- In 2025, INEOS Styrolution partnered with Unternehmensgruppe Theo Müller to produce yogurt cups from mechanically recycled polystyrene. The project demonstrated the feasibility of using recycled materials in food-grade packaging.

- In 2023, LG Chem held a groundbreaking ceremony for Korea’s first supercritical pyrolysis oil plant and an aerogel plant. This initiative aims to establish a plastic circular economy by converting waste plastics into a raw material for new products.

Report Coverage

The research report offers an in-depth analysis based on Function, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by packaging and e-commerce expansion.

- Construction applications will increase due to demand for energy-efficient insulation materials.

- Automotive adoption will rise as lightweight materials replace traditional components.

- Healthcare use will expand with sterile and transparent packaging requirements.

- Electronics applications will grow with demand for durable and insulating materials.

- Sustainability will shape the market with focus on recyclable and bio-based resins.

- Regulatory frameworks will push manufacturers toward eco-friendly production practices.

- Asia Pacific will emerge as the fastest-growing regional market.

- North America will maintain leadership with strong industrial and healthcare demand.

- Innovation in advanced resin formulations will create new opportunities across industries.