Market Overview

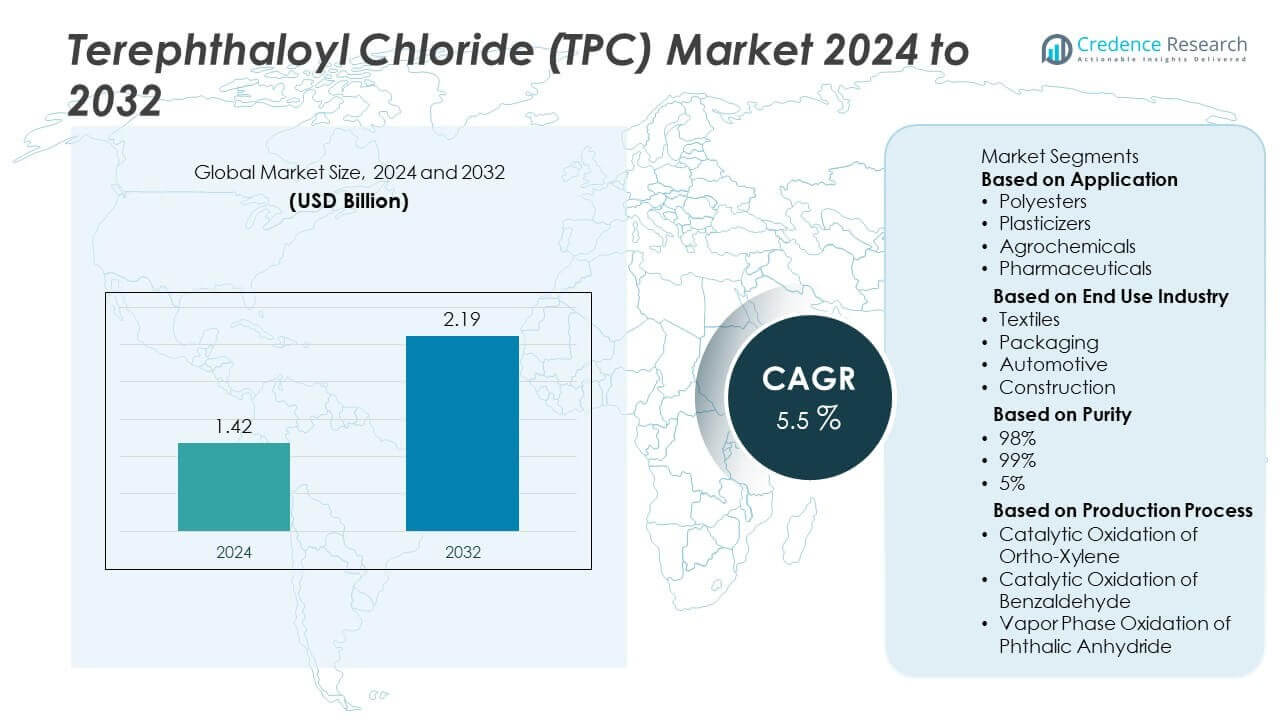

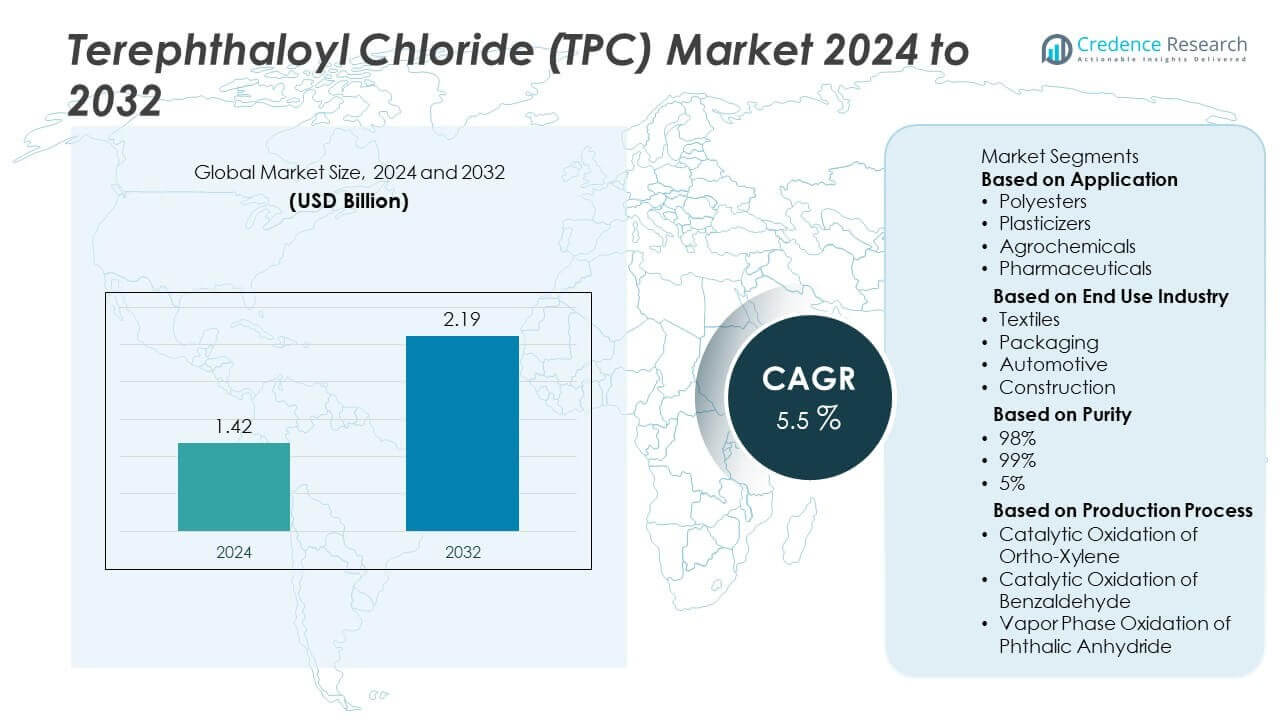

The terephthaloyl chloride (TPC) market was valued at USD 1.42 billion in 2024 and is projected to reach USD 2.19 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Terephthaloyl Chloride (TPC) Market Size 2024 |

USD 1.42 Billion |

| Terephthaloyl Chloride (TPC) Market, CAGR |

5.5% |

| Terephthaloyl Chloride (TPC) Market Size 2032 |

USD 2.19 Billion |

The Terephthaloyl Chloride (TPC) market is driven by major players including DuPont, QDBC, Transpek Industries, TCI Chemicals, Shanong Kaisheng, Yantai Yuxiang, Changzhou Kefeng, Teijin, Sigma Aldrich, and Transpek. These companies focus on expanding production capacity, enhancing purity levels, and innovating cost-efficient manufacturing technologies to serve key sectors like textiles, automotive, and specialty polymers. Asia-Pacific led the market with over 42% share in 2024, supported by strong demand from textile and agrochemical industries in China and India. North America accounted for 28% share, driven by aramid fiber demand in aerospace and defense, while Europe held 20% share, supported by strict environmental regulations and advanced polymer applications.

Market Insights

Market Insights

- The Terephthaloyl Chloride (TPC) market was valued at USD 1.42 billion in 2024 and is projected to reach USD 2.19 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

- Rising demand for aramid fibers and specialty polymers in textiles, automotive, and defense industries is the key driver, with polyesters holding over 45% share as the dominant application segment.

- Trends include increasing adoption of high-purity 99% TPC for advanced polymer production and growing focus on sustainable manufacturing processes to meet global environmental regulations.

- Key players such as DuPont, QDBC, Transpek Industries, Teijin, and Yantai Yuxiang are investing in capacity expansion, R&D, and global supply chain strengthening to meet rising demand and maintain competitiveness.

- Asia-Pacific led the market with 42% share, followed by North America at 28% and Europe at 20%, with the textiles industry contributing nearly 40% of total consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Polyesters dominated the TPC market with over 45% share in 2024, driven by their use in aramid fibers, engineering resins, and specialty polymers. These materials are widely adopted in aerospace, defense, and automotive sectors where high tensile strength and thermal stability are critical. Plasticizers followed as the second-largest segment, supported by demand in flexible PVC and coatings. Agrochemicals and pharmaceuticals contribute smaller shares but are growing steadily due to rising need for crop protection solutions and active pharmaceutical intermediates, expanding TPC’s penetration across end-use sectors.

- For instance, Tasnee, through its diversified businesses in Saudi Arabia, announced in February 2025 that it secured feedstock approval for a new petrochemical complex in Jubail projected to have a production capacity of up to 3.3 million tons.

By End Use Industry

The textiles industry held around 40% share in 2024, making it the leading end-use segment. High-performance fibers such as para-aramids, produced using TPC, are in demand for protective clothing, filtration media, and composites. Automotive applications are gaining traction with TPC-based polymers used in lightweight components and heat-resistant parts. Packaging and construction sectors maintain a steady share, leveraging TPC derivatives for enhanced durability and barrier properties. Growth in industrial safety standards and rising investments in advanced materials are reinforcing the dominance of the textile segment.

- For instance, TPC Group in Houston enhanced its Crude C4 processing capacity to 1.1 billion pounds per year by the end of 2024, supporting increased production of performance polymers utilized in textile fibers for protective and filtration applications as well as automotive lightweight components.

By Purity

TPC with 99% purity captured over 55% share in 2024, preferred for manufacturing aramid fibers, specialty resins, and high-grade coatings where quality consistency is critical. The 98% purity segment accounted for a moderate share, serving applications with less stringent performance requirements, including certain plasticizers and intermediates. The 5% purity segment held the smallest share and is used in limited chemical synthesis applications. The increasing focus on high-performance polymers and demand from advanced industries will continue to boost the consumption of high-purity TPC grades globally.

Market Overview

Key Growth Drivers

Rising Demand for High-Performance Fibers

The growing use of para-aramid fibers in defense, aerospace, and industrial applications is a major driver for the TPC market. These fibers offer exceptional strength, flame resistance, and thermal stability, making them ideal for protective gear, composites, and advanced materials. Increasing investments in lightweight and durable materials to improve fuel efficiency and safety in automotive and aerospace sectors are accelerating TPC consumption. This trend continues to push demand for high-purity TPC as a key raw material for advanced polymer manufacturing worldwide.

- For instance, Sinochem International successfully expanded its para-aramid fiber production capacity to 8,000 tons annually in January 2025, after a 2,500-ton expansion that was expected to be completed in 2024.

Growth in Specialty Polymers and Coatings

The rising adoption of specialty polymers and high-performance coatings across construction, electronics, and industrial applications is boosting TPC demand. Its use as a precursor in polyamide and polyester resins ensures superior mechanical and chemical resistance. Expanding urban infrastructure and the shift toward performance-oriented coatings for corrosion protection are strengthening market growth. The push for higher efficiency materials in electrical and electronic components also supports the growing use of TPC-based polymers, enhancing the market outlook over the forecast period.

- For instance, TPC Group increased its di-isobutylene (DIB) production capacity by 27% since 2023 at its Houston, Texas facility, where it produces precursor chemicals for high-performance coatings, specialty polymers, and lubricant additives.

Expanding Agrochemical and Pharmaceutical Production

The agrochemical and pharmaceutical industries are contributing significantly to TPC market growth due to its role in producing intermediates and active ingredients. Rising demand for crop protection chemicals to enhance agricultural productivity and growing investment in drug discovery are increasing TPC consumption. Emerging economies are witnessing expansions of chemical and pharmaceutical manufacturing capacities, further driving regional demand. The focus on efficient, high-yield synthesis processes is encouraging manufacturers to rely on TPC for precision chemical production.

Key Trends & Opportunities

Miniaturization and Advanced Material Development

Continuous advancements in material science are creating opportunities for new applications of TPC in lightweight composites and electronics. Miniaturization trends in consumer electronics and wearable devices are boosting demand for high-strength, heat-resistant materials made from TPC-derived polymers. This creates opportunities for innovation in coatings, films, and micro-components. Manufacturers investing in R&D for next-generation aramid fibers and engineering plastics are well positioned to capture these emerging opportunities, ensuring long-term market relevance and growth.

- For instance, Aekyung Chemical has been constructing South Korea’s first large-scale TPC production facility with an annual capacity of 15,000 tons, set to commence full-scale mass production in January 2026, enabling supply for advanced aramid fiber development used in microelectronics and lightweight composites.

Sustainability and Green Chemistry Initiatives

The global focus on sustainable production processes is encouraging the development of environmentally friendly synthesis methods for TPC. Manufacturers are exploring process optimization and catalyst improvements to reduce emissions and energy consumption during production. Growing regulatory pressure to minimize hazardous byproducts is pushing adoption of green chemistry solutions. This trend offers opportunities for players to differentiate their offerings through eco-friendly TPC, appealing to industries aiming to meet ESG and sustainability goals while maintaining product performance.

- For instance, Aekyung Chemical’s proprietary ‘light method’ synthesis technology suppresses the generation of pollutants such as sulfur dioxide and hydrogen chloride during TPC production, contributing to a significant reduction in hazardous byproducts at its Ulsan demonstration plant operational since 2020.

Key Challenges

High Production and Compliance Costs

The production of TPC involves complex processes and significant capital investment, which increases overall costs. Compliance with stringent environmental and safety regulations further adds to operational expenses. Smaller manufacturers may face difficulties competing with larger players due to these cost constraints. This factor can slow market penetration, particularly in price-sensitive regions where cost-effective alternatives are preferred.

Supply Chain Volatility and Raw Material Dependence

TPC production relies heavily on raw materials such as p-xylene and phosgene, which are subject to price fluctuations and supply chain disruptions. Geopolitical tensions and logistical challenges can lead to inconsistent supply and increased production costs. Such volatility impacts profit margins and planning for end-users, creating uncertainty in procurement. Diversification of supply sources and strategic partnerships are becoming essential for mitigating risks and ensuring stable market growth.

Regional Analysis

Asia-Pacific

Asia-Pacific led the TPC market with over 42% share in 2024, driven by robust demand from textile manufacturing, agrochemicals, and polymer industries in China, India, and Japan. Expanding industrial production and investments in high-performance fibers for automotive and protective applications are boosting consumption. Growing pharmaceutical and agrochemical production also contribute significantly to demand. Favorable government initiatives supporting domestic chemical manufacturing and increasing exports of aramid fibers strengthen regional dominance. The presence of key players and cost-competitive production capabilities make Asia-Pacific the fastest-growing market during the forecast period.

North America

North America accounted for 28% share in 2024, supported by strong demand from specialty polymer and pharmaceutical sectors. The United States drives most of the regional consumption, with extensive use of TPC in aramid fibers for defense, aerospace, and industrial safety equipment. Growth in R&D activities and high investment in sustainable production technologies are reinforcing market expansion. Rising adoption of TPC in high-performance coatings and packaging solutions is also fueling demand. Stringent regulatory compliance and innovation in green manufacturing processes give North America a competitive edge in high-purity TPC production and advanced applications.

Europe

Europe captured 20% share in 2024, supported by demand from the automotive, construction, and industrial sectors. Countries such as Germany, France, and the UK are focusing on lightweight materials and sustainable polymers, driving TPC consumption. The region’s strong emphasis on recycling and eco-friendly processes is encouraging manufacturers to adopt greener production methods. Growth in aramid fiber applications for protective clothing and filtration media is also contributing to demand. EU regulations promoting energy efficiency and circular economy practices are expected to sustain steady growth for high-purity TPC during the forecast period.

Latin America

Latin America held 6% share in 2024, with Brazil and Mexico leading demand due to expanding chemical manufacturing and rising consumption of agrochemicals. Growing investment in textile production and increasing export of technical fibers are boosting TPC adoption in the region. Industrial growth in automotive and packaging sectors also drives market expansion. However, high raw material costs and limited domestic production capabilities remain challenges. International suppliers are focusing on expanding distribution networks and providing cost-effective solutions to meet the growing demand from regional manufacturers and end-use industries.

Middle East & Africa

The Middle East & Africa accounted for 4% share in 2024, with demand driven by infrastructure development, growing construction activity, and industrial expansion. GCC nations are investing in advanced materials for oil and gas, automotive, and defense sectors, increasing TPC consumption. In Africa, the adoption of TPC is gradually rising in agrochemicals and pharmaceuticals as manufacturing capabilities expand. Limited local production capacity makes the region reliant on imports, but ongoing investment in chemical production facilities is expected to improve supply stability. Market growth is supported by rising focus on self-sufficiency and diversification of industrial output.

Market Segmentations:

By Application

- Polyesters

- Plasticizers

- Agrochemicals

- Pharmaceuticals

By End Use Industry

- Textiles

- Packaging

- Automotive

- Construction

By Purity

By Production Process

- Catalytic Oxidation of Ortho-Xylene

- Catalytic Oxidation of Benzaldehyde

- Vapor Phase Oxidation of Phthalic Anhydride

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Terephthaloyl Chloride (TPC) market is shaped by key players such as DuPont, QDBC, Transpek Industries, TCI Chemicals, Shanong Kaisheng, Yantai Yuxiang, Changzhou Kefeng, Teijin, Sigma Aldrich, and Transpek. These companies focus on expanding production capacity, improving purity levels, and developing cost-efficient manufacturing technologies to meet rising demand from textile, automotive, and specialty polymer sectors. Strategic partnerships and supply agreements with end-use industries help secure long-term contracts and ensure steady revenue streams. Leading players are also investing in sustainable production methods and R&D for high-performance derivatives to comply with global environmental regulations. Additionally, companies are strengthening distribution networks across Asia-Pacific and North America to capture emerging opportunities and reduce supply chain risks. Continuous innovation and capacity expansions remain critical for maintaining competitiveness in a market driven by growing consumption of aramid fibers, agrochemicals, and high-performance coatings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DuPont

- QDBC

- Transpek Industries

- TCI Chemicals

- Shanong Kaisheng

- Yantai Yuxiang

- Changzhou Kefeng

- Teijin

- Sigma Aldrich

- Transpek

Recent Developments

- In June 2025, Premier Graphene, known as Premier Biomedical, partnered with HGI Industrial Technologies SAPI and Nevada Ballistic Armor Corp. to form a multinational joint venture focused on manufacturing advanced body armor for military use. As part of this collaboration, premier graphene and HGI Industrial Technologies had supplied armored plates to a Latin American nation for final testing.

- In May 2025, Transpek Industries reported that it introduced two new acid chlorides (small volume) and is working to introduce a third.

- In May 2024, Outlast Technologies launched a new line of Aersulate aerogels made from aramid fibers, unlocking entirely new application opportunities. These flame-resistant materials were extremely thin and, unlike conventional insulations, remained unaffected by moisture and pressure.

Report Coverage

The research report offers an in-depth analysis based on Application, End Use Industry, Purity, Production Process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for TPC will grow steadily with rising production of aramid fibers and specialty polymers.

- Polyesters will remain the dominant application, driven by increasing use in textiles and packaging.

- Adoption of high-purity 99% TPC will rise for advanced polymer and high-performance coating applications.

- Asia-Pacific will remain the leading region with strong demand from China and India.

- North America will see growth supported by aerospace, defense, and automotive applications.

- Manufacturers will invest in sustainable and eco-friendly production technologies to meet regulations.

- Strategic collaborations and capacity expansions will strengthen supply chain security.

- Growth in agrochemicals and pharmaceuticals will create new demand opportunities for TPC.

- Technological innovation will improve process efficiency and reduce production costs.

- Global players will focus on expanding distribution networks to capture emerging market opportunities.

Market Insights

Market Insights