Market Overview

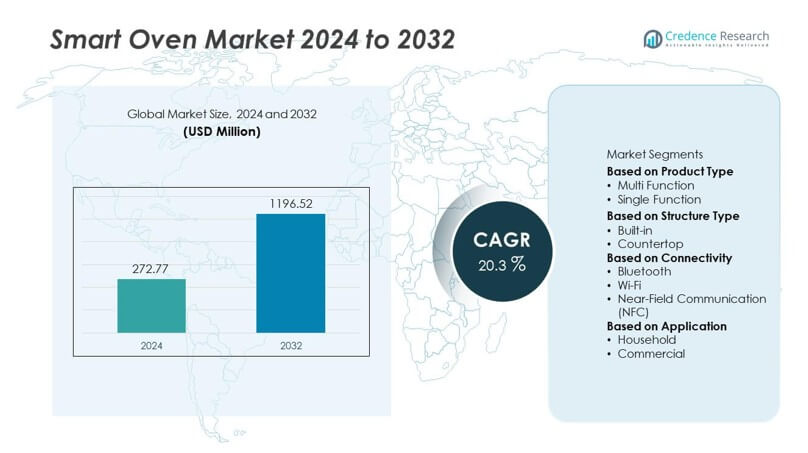

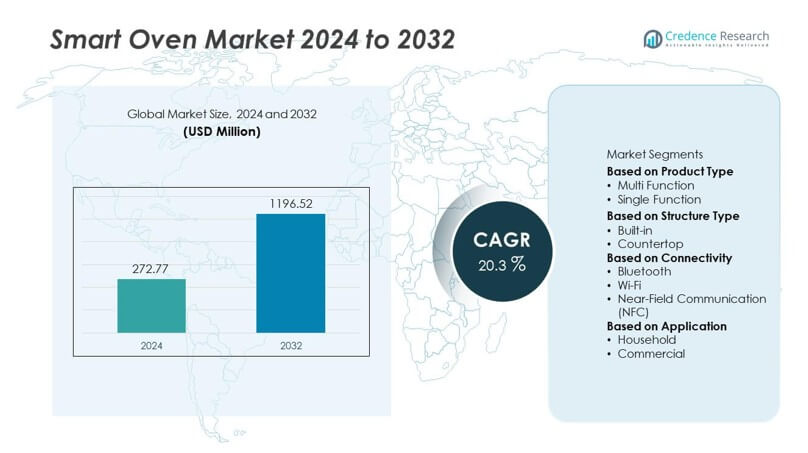

The Smart Oven market was valued at USD 272.77 million in 2024 and is projected to reach USD 1,196.52 million by 2032, expanding at a CAGR of 20.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Oven Market Size 2024 |

USD 272.77 Million |

| Smart Oven Market, CAGR |

20.3% |

| Smart Oven Market Size 2032 |

USD 1,196.52 Million |

The smart oven market is shaped by key players including Breville, KitchenAid, De’Longhi S.p.A., Hamilton Beach, BELLA, Krups, Cuisinart, Kenmore, Black & Decker, and Dualit. These companies compete by offering multifunctional, Wi-Fi-enabled ovens with features such as voice control, preset recipes, and energy-efficient designs. North America led the global market in 2024 with 38% share, supported by advanced smart home adoption and strong consumer purchasing power. Europe followed with 28% share, driven by modular kitchen trends and sustainability regulations, while Asia-Pacific captured 22%, emerging as the fastest-growing region due to rising disposable incomes, urbanization, and expanding smart home ecosystems.

Market Insights

- The smart oven market was valued at USD 272.77 million in 2024 and is projected to reach USD 1,196.52 million by 2032, growing at a CAGR of 20.3% during the forecast period.

- Growth is fueled by rising smart home adoption, demand for multifunctional appliances, and consumer preference for health-oriented cooking features such as air-frying and low-oil recipes.

- Key trends include increasing integration of Wi-Fi connectivity, AI-assisted cooking, and voice assistant compatibility, with multifunctional ovens leading the product type segment at 60% share in 2024.

- The competitive landscape features Breville, KitchenAid, De’Longhi S.p.A., Hamilton Beach, BELLA, Krups, Cuisinart, Kenmore, Black & Decker, and Dualit, focusing on product innovation, affordability, and energy-efficient models.

- Regionally, North America dominated with 38% share in 2024, followed by Europe at 28% and Asia-Pacific at 22%, while Latin America and the Middle East & Africa held smaller shares of 7% and 5% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The multi-function smart oven segment dominated the market in 2024, holding over 60% share. Consumers increasingly prefer versatile ovens capable of baking, grilling, roasting, and air-frying in one unit. Rising urbanization, smaller kitchens, and demand for convenience appliances drive this adoption. Multi-function models also integrate advanced cooking modes with preset recipes, making them more appealing to tech-savvy households. Single-function ovens retain relevance in budget-conscious markets, but their limited features slow growth compared to multifunctional models, which continue to lead global sales momentum.

- For instance, Breville Group launched its Joule Oven Air Fryer Pro, featuring 13 smart cooking functions and using “super convection” airflow to reduce cooking time by up to 30%, which has led to high consumer satisfaction and market presence in North America and Europe.

By Structure Type

Built-in smart ovens accounted for nearly 55% share of the market in 2024, surpassing countertop models. Their dominance stems from rising demand in premium kitchens, integrated modular cooking setups, and home renovations focusing on aesthetics and space optimization. Built-in models also deliver higher energy efficiency and smart connectivity features, appealing to urban consumers. Countertop ovens remain popular in compact households and rental units, but the growing trend of smart home integration sustains the dominance of built-in ovens, particularly across North America and Europe where modern kitchen designs are expanding.

- For instance, Bosch released its Serie 8 built-in smart oven, featuring an intuitive touchscreen interface, intelligent sensor cooking, and an energy consumption as low as 0.69 kWh per cycle on fan-forced convection mode, making it an efficient choice in upscale urban residential projects.

By Connectivity

The Wi-Fi segment led the connectivity category in 2024, capturing more than 65% share. Wi-Fi-enabled smart ovens allow remote operation, real-time recipe updates, and voice assistant integration, which appeal strongly to connected households. Rising smartphone penetration and IoT ecosystem adoption further strengthen this growth. Bluetooth ovens are mainly adopted for short-range control, while NFC-enabled ovens remain niche due to limited device compatibility. The shift toward cloud-based cooking assistance and seamless integration with platforms like Alexa and Google Home reinforces the leadership of Wi-Fi connectivity in shaping future market expansion.

Market Overview

Key Growth Drivers

Rising Smart Home Adoption

Smart ovens benefit from the rapid expansion of smart home ecosystems. In 2024, over 55% of smart appliance sales were linked to connected households, highlighting strong integration demand. Consumers increasingly seek convenience through appliances that connect seamlessly with smartphones, smart speakers, and home hubs. Wi-Fi-enabled ovens allow remote monitoring, energy optimization, and recipe automation. The global rise in IoT penetration, supported by expanding 5G infrastructure, continues to accelerate adoption of smart ovens as central elements of modern kitchens.

- For instance, Whirlpool’s smart ovens in 2024 integrated advanced Wi-Fi connectivity via the Whirlpool app, Google Assistant, or Amazon Alexa, allowing users to preheat the oven, monitor cooking status, and use features like Scan-to-Cook for enhanced convenience and efficiency in connected homes.

Growing Health and Convenience Demand

Health-conscious consumers drive adoption of smart ovens with features like air-frying, low-oil cooking, and preset healthy recipes. In 2024, multifunctional ovens captured over 60% market share, reflecting demand for versatility and wellness-oriented functions. Busy urban lifestyles also fuel preference for quick-cook and one-touch meal preparation. Manufacturers integrating AI-assisted cooking and nutritional guidance enhance appeal among households aiming for healthier, faster food preparation. This trend strongly influences product innovation and sustains growth in both developed and emerging regions.

- For instance, Samsung’s 2024 Bespoke AI™ Oven models include “AI Pro Cooking” that uses an internal camera to recognize food and can optimize cooking settings, while “Slim Fry” technology utilizes warm air circulation and a touch of oil to prepare healthier dishes compared to traditional deep frying.

Expansion in Premium Kitchen Renovations

Rising disposable incomes and home improvement projects significantly boost built-in smart oven sales, which held 55% share in 2024. Consumers increasingly prioritize space efficiency and design aesthetics, choosing premium modular kitchens with integrated appliances. Built-in smart ovens deliver higher energy efficiency and align with sustainability goals, strengthening their market position. Growth in urban housing developments, coupled with rising real estate modernization, ensures continued demand. North America and Europe remain strong markets, while Asia-Pacific sees rapid adoption due to expanding middle-class households.

Key Trends & Opportunities

Integration of AI and Voice Assistants

AI-enabled smart ovens are transforming cooking experiences with real-time adjustments, guided recipes, and predictive maintenance alerts. Voice assistant compatibility with Alexa, Google Home, and Siri enhances usability. In 2024, Wi-Fi connectivity captured 65% share, emphasizing consumer demand for advanced features. This integration creates opportunities for manufacturers to differentiate products with software updates, cloud-based services, and smart kitchen ecosystems. The push toward intelligent automation in households positions AI-driven ovens as a major growth frontier.

- For instance, the June Oven, powered by MediaTek’s i500 AIoT platform, integrates computer vision and voice-assistant support. This enables features like food recognition and automated cooking programs, along with precise temperature control via a built-in thermometer.

Sustainability and Energy Efficiency

Smart ovens increasingly focus on energy-efficient designs and sustainable features. With energy prices rising globally, consumers favor appliances that minimize electricity consumption without compromising performance. Built-in ovens, with 55% share in 2024, are particularly designed with energy optimization in mind. Manufacturers promoting recyclable materials, eco-modes, and compliance with environmental standards like ENERGY STAR create long-term opportunities. This aligns with green building initiatives and regulatory frameworks, ensuring smart ovens are positioned as eco-friendly and future-ready appliances.

- For instance, Rational AG received the 2024 ENERGY STAR Partner of the Year Award for its developments in intelligent cooking equipment, including ovens that reduce energy consumption by up to 15% through adaptive cooking technology and efficient heat retention systems.

Key Challenges

High Initial Cost and Affordability Gap

Smart ovens remain costly compared to traditional models, limiting adoption in price-sensitive regions. Multifunctional models, though preferred, often fall into premium ranges, creating barriers for middle-income households. In 2024, entry-level adoption rates were considerably lower in developing markets, where cost sensitivity is high. Manufacturers face the challenge of balancing advanced features with competitive pricing. Without scalable affordability strategies, mass adoption may remain concentrated in developed economies, slowing global market penetration.

Connectivity and Data Security Concerns

Widespread reliance on Wi-Fi connectivity, which accounts for 65% market share, raises cybersecurity risks. Consumers remain cautious about data privacy, fearing unauthorized access through connected appliances. Inconsistent internet infrastructure in some regions further limits seamless use. Trust issues, if unresolved, could slow adoption of smart ovens in emerging economies. To overcome this, manufacturers must implement stronger encryption, regular software updates, and transparent data policies to ensure consumer confidence in connected kitchen ecosystems.

Regional Analysis

North America

North America held the largest share of the smart oven market in 2024 with 38%. High smart home adoption, advanced IoT infrastructure, and strong consumer purchasing power drive the region’s growth. Built-in multifunctional ovens are particularly popular, supported by premium kitchen renovations and demand for connected appliances. Manufacturers in the U.S. and Canada emphasize Wi-Fi integration and AI-assisted cooking to meet consumer expectations. The presence of leading technology firms and supportive energy efficiency regulations further reinforce the region’s leadership, ensuring North America remains the most influential contributor to overall smart oven adoption through the forecast period.

Europe

Europe accounted for 28% share of the smart oven market in 2024, driven by high penetration of premium kitchen appliances and sustainability-focused regulations. Consumers in countries like Germany, the UK, and France prefer built-in ovens that combine design aesthetics with energy efficiency. Strong demand is linked to modular kitchen trends, government initiatives promoting energy savings, and growing adoption of smart home systems. Leading European appliance manufacturers continue to expand offerings with eco-friendly and connected models. Rising consumer awareness around healthy cooking and multifunctional capabilities sustains steady demand, making Europe the second-largest regional market for smart ovens.

Asia-Pacific

Asia-Pacific represented 22% share of the smart oven market in 2024, emerging as the fastest-growing region. Expanding middle-class households, urbanization, and rising disposable incomes across China, India, and Southeast Asia drive strong adoption. Multifunctional countertop ovens are popular in compact urban kitchens, while built-in models gain momentum in premium housing projects. Increasing smartphone penetration supports Wi-Fi connectivity, which dominates adoption. Local and global brands are actively expanding in the region to meet growing demand. With rapid growth in smart home ecosystems and increasing consumer focus on convenience, Asia-Pacific is expected to outpace other regions in long-term expansion.

Latin America

Latin America held 7% share of the smart oven market in 2024, with growth concentrated in Brazil and Mexico. Rising demand for affordable multifunctional ovens and gradual adoption of smart home devices support market development. Economic constraints limit premium adoption, making countertop ovens more popular compared to built-in models. Growing urban populations and increasing internet connectivity are key enablers of smart oven demand. International brands are expanding distribution channels, while regional players focus on cost-effective models. Although smaller in share, Latin America shows steady growth potential, supported by consumer preference for energy-efficient and versatile kitchen appliances.

Middle East & Africa

The Middle East & Africa region accounted for 5% share of the smart oven market in 2024. Market growth is supported by rising urbanization, expanding modern retail channels, and increased adoption of connected appliances in affluent households. Gulf countries such as the UAE and Saudi Arabia lead demand, driven by high disposable incomes and smart city initiatives. Countertop ovens remain dominant due to affordability, but built-in ovens are gaining traction in premium housing developments. Limited internet infrastructure in some areas poses challenges, yet rising consumer interest in convenience and energy efficiency creates opportunities for gradual market expansion.

Market Segmentations:

By Product Type

- Multi Function

- Single Function

By Structure Type

By Connectivity

- Bluetooth

- Wi-Fi

- Near-Field Communication (NFC)

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the smart oven market features leading players such as Breville, KitchenAid, De’Longhi S.p.A., Hamilton Beach, BELLA, Krups, Cuisinart, Kenmore, Black & Decker, and Dualit. These companies focus on innovation, multifunctionality, and connectivity to strengthen their market presence. Wi-Fi-enabled models, voice assistant compatibility, and AI-driven cooking assistance are central to product development strategies. Premium brands like Breville and De’Longhi S.p.A. emphasize built-in multifunctional ovens tailored for modern kitchens, while mass-market players such as Hamilton Beach and Black & Decker target affordability and countertop convenience. Sustainability also plays a major role, with several manufacturers introducing energy-efficient models and recyclable components. Regional expansion strategies, online retail partnerships, and portfolio diversification further support competitive positioning. As consumer demand shifts toward health-focused, time-saving, and connected cooking solutions, leading players continue to invest in R&D and strategic collaborations, driving strong differentiation and intensifying competition across both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Breville

- KitchenAid

- De’Longhi S.p.A.

- Hamilton Beach

- BELLA

- Krups

- Cuisinart

- Kenmore

- Black & Decker

- Dualit

Recent Developments

- In February 2025, KitchenAid previewed a new appliance collection at KBIS, including a Smart Oven+ with app and attachment support.

- In 2025, KitchenAid’s Smart Oven+ was described as working with the Yummly® app for remote monitoring and recipe guidance.

- In 2025, Breville’s smart ovens use an “Element iQ” system to steer power to heating elements for even cooking.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Structure Type, Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The smart oven market will continue expanding with strong demand for multifunctional appliances.

- Built-in ovens will gain wider adoption due to premium kitchen renovations and modern housing trends.

- Wi-Fi connectivity will remain the dominant standard, supported by rising IoT ecosystem adoption.

- AI-enabled cooking features will grow, offering personalized recipes and predictive maintenance.

- Voice assistant integration will become a key feature to enhance consumer convenience.

- Energy-efficient models will see higher demand as sustainability regulations strengthen globally.

- Asia-Pacific will emerge as the fastest-growing region with rising middle-class adoption.

- Affordability-focused countertop ovens will remain important in price-sensitive markets.

- Competition will intensify as global brands expand alongside regional players in emerging economies.

- Continuous R&D investment will drive innovations in automation, safety, and connected kitchen solutions.