Market Overview

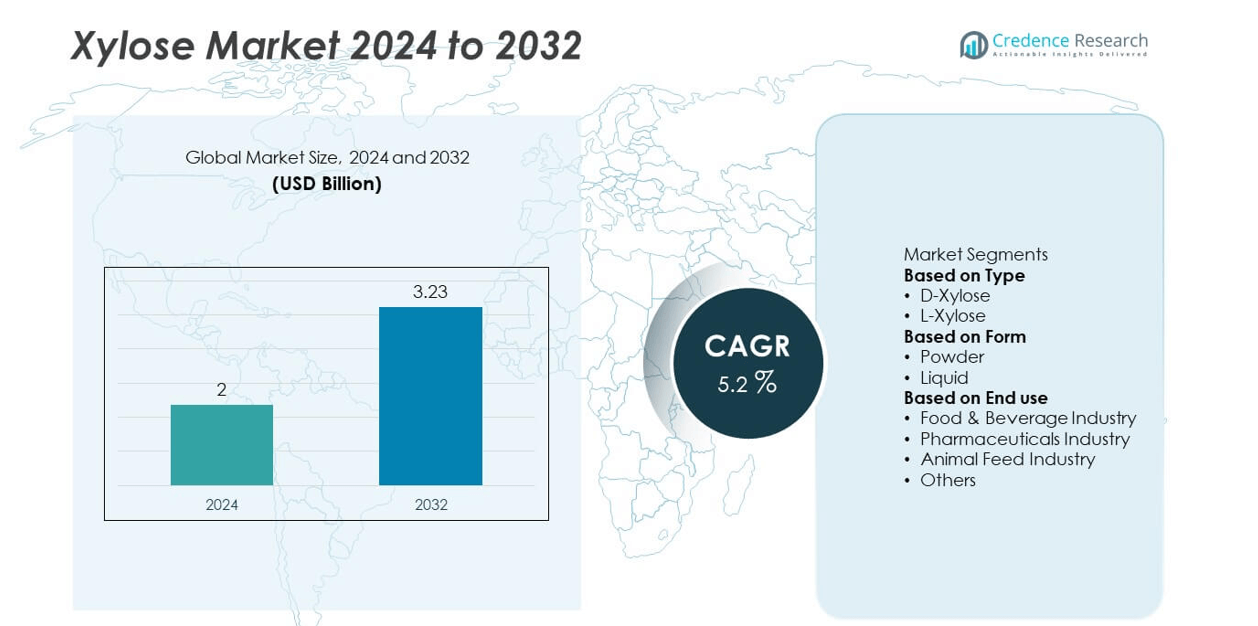

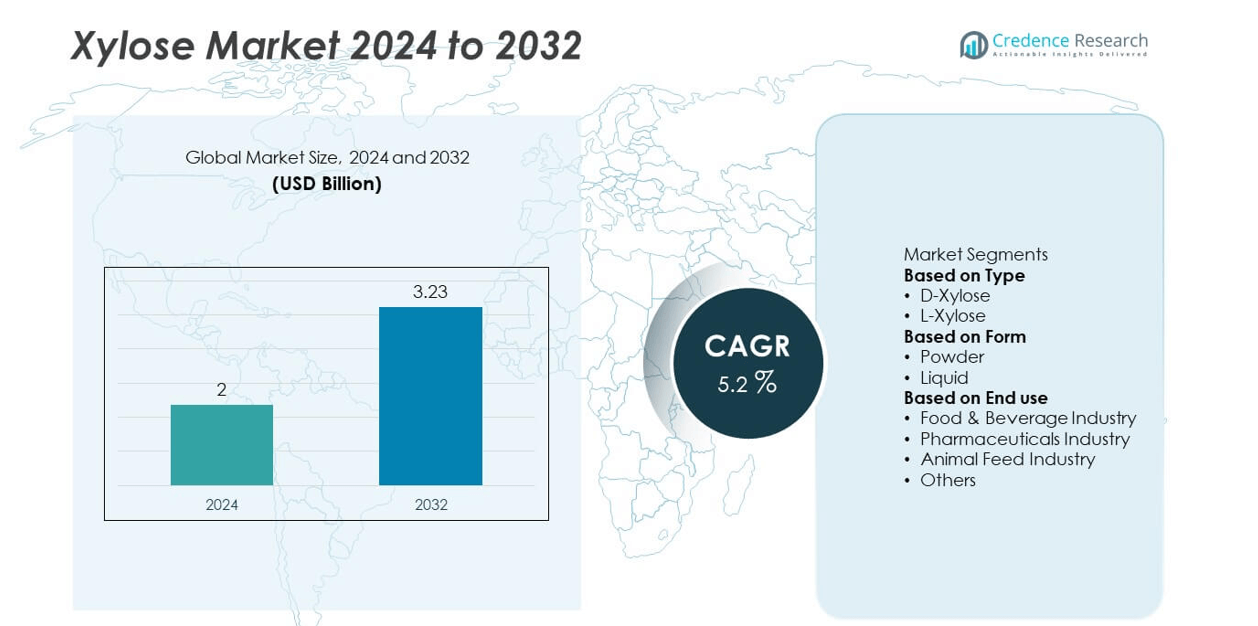

Xylose market size was valued at USD 2 billion in 2024 and is projected to reach USD 3.23 billion by 2032, registering a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Xylose Market Size 2024 |

USD 2 billion |

| Xylose Market, CAGR |

5.2% |

| Xylose Market Size 2032 |

USD 3.23 billion |

The xylose market is driven by leading players such as Sure Chemicals Co. Ltd., Spectrum Chemicals, Penta Manufacturer, Shandong Xieli Bio-tech Co., Ltd., AvanceChem, Ardilla Technologies Limited, International Flavour & Fragrance Limited, Sinofi Ingredients, Central Drug House P, and Healtang Biotech Co. These companies are focused on expanding production, improving biomass-based extraction methods, and supplying high-purity xylose for food, pharmaceutical, and animal feed applications. North America leads the market with 34% share, supported by strong demand for xylitol and functional food products. Asia Pacific follows with 28% share, driven by large-scale production and growing diabetic-friendly food consumption, while Europe holds 26% share, backed by strict sugar reduction regulations and rising nutraceutical adoption.

Market Insights

- The xylose market was valued at USD 2 billion in 2024 and is projected to reach USD 3.23 billion by 2032, growing at a CAGR of 5.2%.

- Rising demand for low-calorie sweeteners and growing xylitol production are major drivers, supported by increasing health awareness and diabetic-friendly food consumption.

- Key trends include adoption of biomass-derived xylose, advancements in biorefinery technologies, and expanding applications in nutraceuticals and functional foods.

- The market is competitive with players such as Sure Chemicals Co. Ltd., Spectrum Chemicals, Shandong Xieli Bio-tech Co., Ltd., AvanceChem, and Sinofi Ingredients focusing on production expansion and cost optimization.

- North America leads with 34% share, followed by Asia Pacific at 28% and Europe at 26%, while D-xylose dominates with over 85% share, driven by its critical role in xylitol manufacturing and applications in food, beverage, and pharmaceutical sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

D-Xylose dominated the xylose market in 2024, accounting for over 85% share due to its widespread use as a key ingredient in xylitol production and as a precursor for various biochemicals. Its natural presence in hemicellulose and easy extraction from hardwoods make it a preferred choice for commercial applications. Demand is driven by its use as a sugar substitute in diabetic-friendly and low-calorie products. L-Xylose held the remaining share and finds niche applications in research and specialty formulations, where its unique stereochemistry supports metabolic and enzymatic studies.

- For instance, one cold caustic extraction process yielded a hemicaustic stream containing greater than 85 wt % xylan content, which was then hydrolysed to produce xylose having 80 wt % or greater purity, without needing additional chromatographic purification.

By Form

Powder form led the xylose market with over 60% share in 2024, supported by its stability, ease of transport, and suitability for bulk applications in food, pharmaceuticals, and animal feed industries. The powder format offers a longer shelf life and easy integration into manufacturing processes. Liquid form accounted for the remaining share, primarily used in applications where solubility and rapid mixing are required. Rising demand for convenience in industrial-scale operations is expected to further support the powder segment’s growth during the forecast period.

- For instance, one study of acidic hydrolysate from pretreated lignocellulose used a liquid solution containing 5 wt % xylose in water, in a continuous counter-current mixer-settler cascade pilot extraction system.

By End Use

The food and beverage industry held the largest share, contributing over 45% of the xylose market in 2024. Its growing use as a sweetener in sugar-free confectionery, bakery products, and beverages is driving demand. Rising health consciousness and preference for low-glycemic sweeteners are key growth drivers. Pharmaceuticals represented a significant share, leveraging xylose for diagnostic tests such as the xylose absorption test. The animal feed industry is also expanding, as xylose is used in additives to improve gut health and nutrient absorption. Other applications, including biofuel production, are gradually emerging as sustainable alternatives gain traction.

Market Overview

Rising Demand for Low-Calorie Sweeteners

Growing health awareness and the rising prevalence of diabetes are fueling demand for sugar substitutes. D-xylose, as a precursor for xylitol production, is witnessing increased consumption in sugar-free confectionery, beverages, and functional foods. Manufacturers are focusing on low-glycemic sweeteners to meet consumer demand for healthier options. The trend toward clean-label and natural ingredients is further boosting xylose adoption. This rising demand is encouraging producers to expand manufacturing capacity and strengthen supply chains, especially in regions with high health-conscious populations such as North America, Europe, and Asia Pacific.

- For instance, YUSWEET Co., Ltd. has an annual D-xylose production capacity of 45,000 metric tons. The company’s products are known for their high purity and are used to supply xylitol manufacturers who cater to the growing market for diabetic-friendly food products.

Expansion in Pharmaceutical Applications

The pharmaceutical industry is driving xylose demand through its use in diagnostic tests like the xylose absorption test, which evaluates intestinal health. Its application as a formulation ingredient in medicinal syrups and tablets is also growing due to its natural origin and safe metabolic profile. Increasing healthcare spending and emphasis on early disease diagnosis are supporting market growth. Drug manufacturers are also exploring xylose for use in controlled-release drug delivery systems, opening new avenues for innovation and product development across major pharmaceutical markets worldwide.

- For instance, Chemos GmbH offers D-(+)-Xylose with a purity of 99% for use in life science applications. The company supplies raw materials for the pharmaceutical industry and has manufacturing capabilities for batch production

Growing Adoption in Animal Feed Industry

Xylose use in animal feed additives is increasing due to its ability to improve gut health and support nutrient absorption. Livestock producers are incorporating xylose-derived additives to enhance feed efficiency and animal performance, reducing overall production costs. Rising meat and dairy consumption globally is driving demand for high-quality feed ingredients. The trend toward antibiotic-free animal nutrition is also pushing adoption of natural, functional additives like xylose. This growing application area is expected to contribute significantly to overall market expansion during the forecast period.

Key Trends & Opportunities

Shift Toward Sustainable Biomass-Derived Production

Manufacturers are focusing on producing xylose from agricultural residues, hardwoods, and other lignocellulosic biomass to reduce costs and improve sustainability. Advancements in biorefinery technologies are enabling efficient extraction of xylose while minimizing waste. This trend supports circular economy initiatives and reduces reliance on synthetic production processes. Increasing demand for bio-based chemicals is creating opportunities for companies investing in green technologies and integrated biorefineries to strengthen their market position and cater to environmentally conscious consumers and industries.

- For instance, an engineered strain of Yarrowia lipolytica produced 12.01 g/L lipids from lignocellulosic hydrolysate using xylose, achieving a yield of 0.16 g lipids per g sugar.

Emergence of Functional and Nutraceutical Applications

Xylose is finding new opportunities in nutraceuticals and functional foods, where it is valued for its prebiotic properties and potential to support gut health. Growing consumer preference for products that provide health benefits beyond basic nutrition is fueling this segment. Food manufacturers are exploring xylose for use in dietary supplements, fortified beverages, and specialized nutrition products. This trend offers significant growth potential, particularly in developed markets where demand for functional ingredients and clean-label products continues to rise.

- For instance, in a human clinical trial, daily intake of 2.8 g/day of xylo-oligosaccharides (XOS) from corn cobs produced a measurable increase in Faecalibacterium species in the stool samples of healthy adults.

Key Challenges

High Production Costs

Xylose production requires energy-intensive extraction and purification processes, making it more expensive compared to conventional sugars. This cost factor limits its adoption in price-sensitive markets and challenges manufacturers to optimize production efficiency. Fluctuations in feedstock availability, such as hardwood or agricultural residues, further add to cost variability. Companies are investing in process innovations to lower operational expenses, but cost competitiveness remains a major restraint for large-scale adoption in low-margin food and beverage applications.

Regulatory and Quality Compliance

Compliance with food safety and pharmaceutical quality standards such as FDA and EFSA regulations is critical in xylose production. Maintaining consistent purity and ensuring absence of contaminants requires significant investment in quality control and monitoring systems. Any deviation can lead to recalls, regulatory penalties, and reputational damage. These challenges pose entry barriers for smaller producers and make it essential for manufacturers to maintain strict adherence to global compliance requirements to retain market credibility and customer trust.

Regional Analysis

North America

North America held 34% share of the xylose market in 2024, driven by strong demand for xylitol production and functional food ingredients. The U.S. leads with significant consumption in sugar-free confectionery, bakery, and beverage segments, supported by a health-conscious population and rising diabetes prevalence. Growth in pharmaceutical applications, including xylose absorption tests, is further contributing to regional demand. Well-established food processing and pharmaceutical industries, combined with regulatory support for low-calorie sweeteners, strengthen market growth. Increasing R&D investments in bio-based xylose production technologies are expected to maintain the region’s leading position during the forecast period.

Europe

Europe accounted for 26% share of the xylose market in 2024, supported by rising demand for natural sweeteners and functional ingredients. Countries like Germany, France, and the UK are major consumers, with strong adoption of xylitol in confectionery and oral care products. Strict EU regulations promoting sugar reduction in food and beverage products drive steady market expansion. Pharmaceutical applications are also significant, as xylose is used in diagnostic tests and specialized formulations. The region benefits from advanced production facilities, continuous innovation in food technology, and growing interest in sustainable, biomass-derived xylose sources.

Asia Pacific

Asia Pacific captured 28% share of the xylose market in 2024, emerging as the fastest-growing region. China leads production with extensive availability of lignocellulosic feedstock, while India and Japan are key consumers in food, beverage, and pharmaceutical applications. Rising disposable incomes, urbanization, and growing demand for diabetic-friendly foods are major drivers. Expansion of xylitol manufacturing facilities and government initiatives supporting bio-based chemical production are strengthening supply chains. Increasing investments in food and beverage innovation and growing awareness of low-calorie sweeteners are expected to boost market growth further across the region during the forecast period.

Latin America

Latin America represented 7% share of the xylose market in 2024, with Brazil and Mexico leading consumption. Demand is fueled by rising adoption of sugar alternatives in beverages and confectionery due to growing health concerns and higher diabetes rates. Expanding food processing industries and a shift toward functional and fortified foods are creating new opportunities. Pharmaceutical demand is also increasing, particularly for diagnostic testing applications. Although production capacity in the region remains limited, international suppliers are strengthening distribution networks to meet growing demand and capture market share in emerging urban centers.

Middle East & Africa

Middle East & Africa accounted for 5% share of the xylose market in 2024, supported by gradual growth in food processing and pharmaceutical sectors. The UAE and South Africa are key markets, with rising consumer preference for sugar-free and functional food products. Growth is driven by increasing health awareness and rising incidence of lifestyle-related diseases, encouraging adoption of low-calorie sweeteners. Limited local production capacity leads to higher reliance on imports, presenting opportunities for global players to establish partnerships. Investment in regional manufacturing and expanding retail channels will support long-term market growth in this region.

Market Segmentations:

By Type

By Form

By End use

- Food & Beverage Industry

- Pharmaceuticals Industry

- Animal Feed Industry

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the xylose market is shaped by key players such as Sure Chemicals Co. Ltd., Spectrum Chemicals, Penta Manufacturer, Shandong Xieli Bio-tech Co., Ltd., AvanceChem, Ardilla Technologies Limited, International Flavour & Fragrance Limited, Sinofi Ingredients, Central Drug House P, and Healtang Biotech Co. These companies focus on expanding production capacity, improving extraction processes, and investing in sustainable biomass-based xylose production. Strategic initiatives include partnerships with food, pharmaceutical, and nutraceutical manufacturers to ensure consistent supply and meet rising demand for low-calorie sweeteners. Players are also enhancing R&D efforts to improve yield efficiency and reduce production costs, making xylose more competitive against traditional sugars. Global suppliers are targeting emerging markets through distribution network expansion and competitive pricing strategies, aiming to capture demand in Asia Pacific and Latin America where consumption of sugar-free and functional food products is increasing rapidly.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sure Chemicals Co. Ltd.

- Spectrum Chemicals

- Penta Manufacturer

- Shandong Xieli Bio-tech Co., Ltd.

- AvanceChem

- Ardilla Technologies Limited

- International Flavour & Fragrance Limited

- Sinofi Ingredients

- Central Drug House P

- Healtang Biotech Co.

Recent Developments

- In 2025, Spectrum Chemical Mfg. Corp. was recognized as a “2025 Top Workplaces Industry winner”

- In 2025, Sure Chemicals Co. Ltd. increased its enzymatic hydrolysis capacity for xylose production with batch yields improving by 18%, enabling higher purity D-xylose (>99%) suitable for pharmaceutical and food-grade uses.

- In 2025, Ardilla Technologies deployed a novel enzymatic hydrolysis process achieving an 85% yield in xylose extraction from lignocellulosic biomass, reducing processing times by 15%, catering to sustainable bio-based material demands.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for low-calorie and diabetic-friendly sweeteners.

- D-xylose will continue dominating production due to its use in xylitol manufacturing.

- Biomass-based and sustainable xylose production methods will gain wider adoption.

- Expanding applications in nutraceuticals and functional foods will boost market opportunities.

- Pharmaceutical demand will rise with increased use in diagnostic tests and drug formulations.

- Asia Pacific will remain a key growth region with expanding manufacturing capacity.

- Technological advancements in extraction and purification will improve yield efficiency and cost competitiveness.

- Strategic collaborations between manufacturers and food producers will strengthen supply chains.

- Growing animal feed applications will create additional revenue streams for producers.

- Competition will drive innovation in process optimization and geographic expansion strategies.