Market Overview

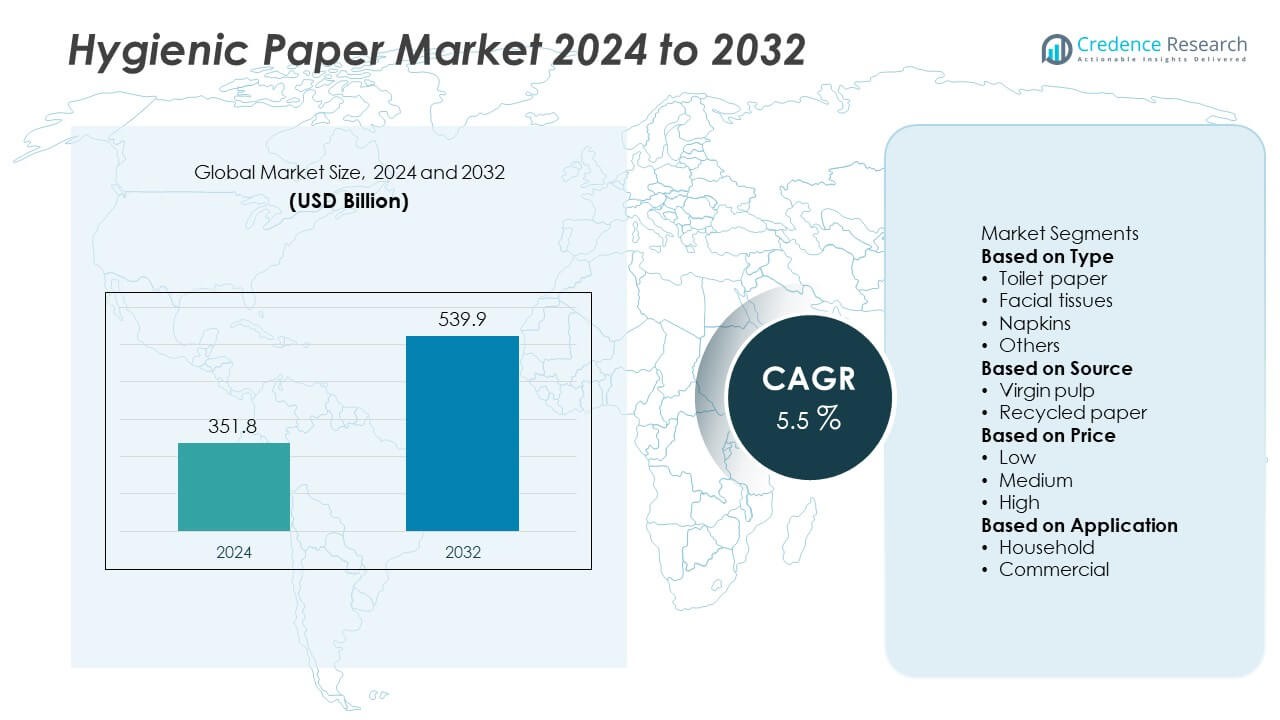

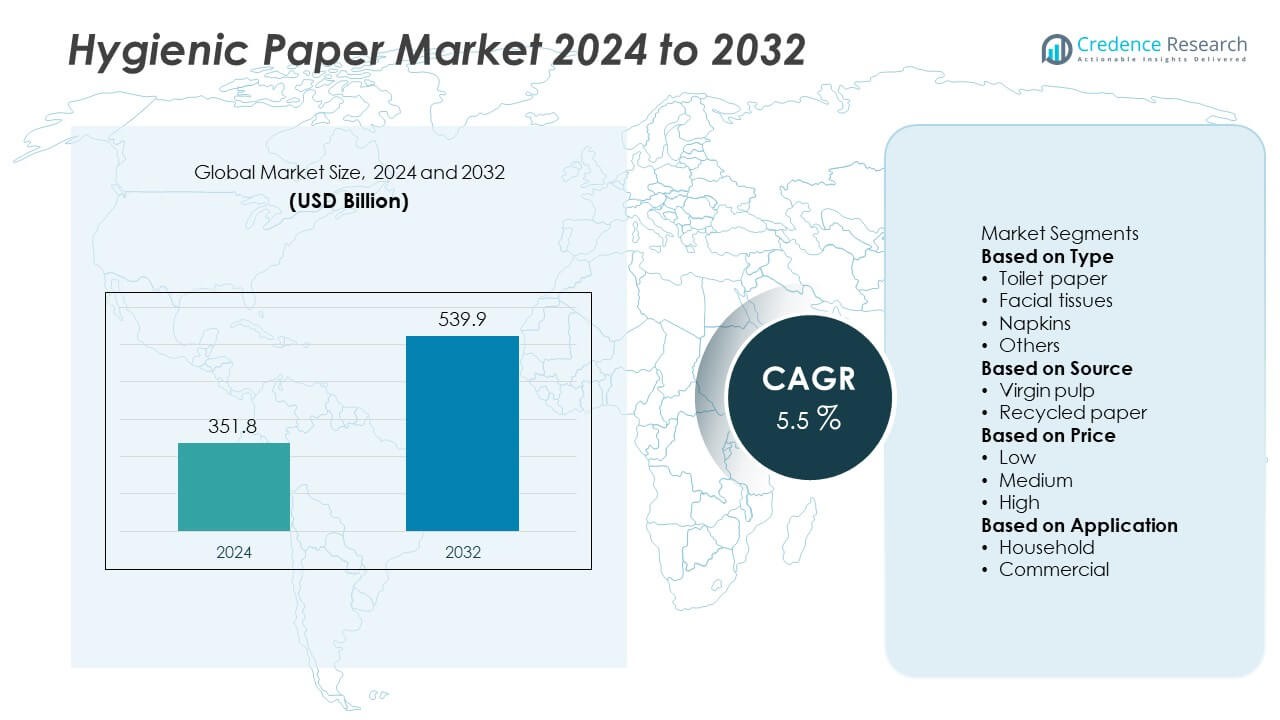

The Hygienic Paper market was valued at USD 351.8 billion in 2024 and is projected to reach USD 539.9 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hygienic Paper Market Size 2024 |

USD 351.8 Billion |

| Hygienic Paper Market, CAGR |

5.5% |

| Hygienic Paper Market Size 2032 |

USD 539.9 Billion |

The hygienic paper market is led by key players including Cascades, Oji, APP, Kimberly-Clark, Mondi, Hengan, Georgia-Pacific, Paperlinx, Nine Dragons Paper, and Essity, all of which emphasize sustainable production, innovation, and strong distribution networks. These companies focus on expanding eco-friendly portfolios with recycled and bamboo-based products to meet rising consumer demand. Regionally, North America held the largest share at 33% in 2024, driven by high per capita consumption and strong retail penetration. Europe followed with 28% share, supported by strict environmental regulations and sustainable product adoption, while Asia-Pacific secured 26% share, emerging as the fastest-growing region due to urbanization, rising incomes, and expanding sanitation awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hygienic Paper market was valued at USD 351.8 billion in 2024 and is projected to reach USD 539.9 billion by 2032, growing at a CAGR of 5.5%.

- Rising hygiene awareness and stricter sanitation standards are driving adoption, with the household segment leading at 55% share in 2024.

- Key trends include increasing demand for eco-friendly, recycled, and bamboo-based paper products, supported by consumer preference for sustainable solutions.

- The market is competitive with players such as Cascades, Oji, APP, Kimberly-Clark, Mondi, Hengan, Georgia-Pacific, Paperlinx, Nine Dragons Paper, and Essity focusing on innovation, sustainability, and distribution expansion.

- Regionally, North America led with 33% share in 2024, followed by Europe at 28% and Asia-Pacific at 26%, while Latin America and the Middle East & Africa together accounted for 13%, showing steady growth through improving sanitation infrastructure and expanding retail networks.

Market Segmentation Analysis:

By Product Type

The toilet paper segment dominated the hygienic paper market with 41% share in 2024. Its leadership is driven by essential daily use and rising consumption across both developed and emerging markets. Increased awareness of hygiene standards, coupled with population growth and improved sanitation infrastructure, has further boosted demand. Facial tissues and paper towels also hold significant shares, supported by consumer preference for convenience and personal hygiene. Napkins and specialty tissues contribute to growth in hospitality and food service. However, toilet paper remains the largest contributor, supported by steady replacement demand and global household penetration.

- For instance, Kimberly-Clark operates numerous facilities in North America that produce toilet paper and other tissue products, distributing a significant volume of these essential goods monthly across commercial and residential channels, making it a leading supplier globally.

By Distribution Channel

Supermarkets and hypermarkets accounted for 46% share of the hygienic paper market in 2024, maintaining dominance due to wide product availability and bulk purchase options. These channels attract a large consumer base by offering discounts and diverse brand selections. Online retail is expanding quickly, fueled by rising e-commerce penetration and doorstep delivery convenience. Convenience stores and specialty outlets also contribute to steady sales. The strong presence of organized retail chains globally ensures consistent supply and accessibility, sustaining supermarkets and hypermarkets as the leading distribution channel for hygienic paper products.

- For instance, Essity AB focuses on profitable growth across its three business areas—Health & Medical, Consumer Goods, and Professional Hygiene—with its total e-commerce sales increasing by 20% in 2022 to reach approximately SEK 23 billion.

By End Use

The household segment held the largest share of 55% in the hygienic paper market in 2024. Rising disposable incomes, urbanization, and growing hygiene awareness drive strong household demand for toilet paper, tissues, and kitchen rolls. Commercial establishments such as offices, restaurants, and healthcare facilities represent the second-largest segment, driven by high consumption in bulk quantities. The hospitality and healthcare sectors further expand demand through strict sanitation standards. While institutional usage continues to grow, households remain the dominant end-use segment due to the daily necessity of hygienic paper products across global markets.

Key Growth Drivers

Rising Hygiene Awareness and Sanitation Standards

Growing awareness of personal hygiene and stricter sanitation practices are key drivers of the hygienic paper market. Governments and health organizations continue to promote hygiene education, encouraging the use of tissues, toilet paper, and paper towels. The COVID-19 pandemic reinforced these habits, resulting in sustained demand. Increasing adoption in emerging economies, where hygiene standards are rapidly improving, further boosts growth. As consumers prioritize cleanliness in both households and public spaces, demand for hygienic paper products continues to expand across all demographic groups.

- For instance, Procter & Gamble reported that organic sales for its Baby, Feminine & Family Care division increased by 1% during the final quarter of the 2025 fiscal year. For the full fiscal year 2025, the division’s organic sales were flat.

Urbanization and Changing Lifestyles

Rapid urbanization and changing consumer lifestyles significantly drive hygienic paper consumption. Rising disposable incomes and busy routines increase reliance on convenience products such as facial tissues and kitchen rolls. Growing penetration of modern retail outlets and online platforms also enhances accessibility. Consumers in urban areas prefer hygienic paper solutions for personal care and household cleaning, supporting steady demand. With expanding middle-class populations in Asia-Pacific and Latin America, lifestyle changes continue to fuel adoption, making hygienic paper an integral part of modern daily life.

- For instance, in India, JK Paper Ltd. announced a strategic corporate restructuring in December 2024 to consolidate its presence in the packaging solutions sector. This initiative, which includes the merger of several packaging subsidiaries into the parent company, aims to streamline operations and tap into the growing demand for packaging boards and corrugated boxes.

Expansion in Healthcare and Hospitality Sectors

The healthcare and hospitality industries contribute significantly to hygienic paper market growth. Hospitals, clinics, and nursing homes rely on tissues, towels, and napkins to maintain strict sanitation standards. Similarly, hotels, restaurants, and catering services demand high volumes of hygienic paper products to meet consumer expectations and regulatory requirements. The rise of medical tourism and global travel further boosts institutional consumption. Continuous expansion of healthcare facilities and hospitality establishments ensures stable, long-term demand, positioning these industries as critical contributors to the overall market’s expansion.

Key Trends & Opportunities

Growth of Sustainable and Eco-Friendly Products

Sustainability has become a central trend, with consumers increasingly preferring eco-friendly hygienic paper made from recycled or bamboo-based fibers. Manufacturers are investing in sustainable raw materials, energy-efficient production processes, and biodegradable packaging. This shift not only meets consumer demand but also aligns with global environmental regulations. Companies that innovate with green products gain a competitive edge, particularly in regions with strong sustainability mandates. The rising preference for eco-conscious products creates long-term opportunities and reshapes the competitive landscape of the hygienic paper industry.

- For instance, Asia Pulp & Paper (APP) has an annual combined pulp, paper, and packaging capacity of over 20 million tons, and claims to meet the growing demand for products like tissue using varied materials.

Rising Penetration of E-Commerce Distribution

E-commerce is rapidly emerging as a key opportunity for hygienic paper manufacturers and retailers. Online platforms allow brands to reach broader consumer bases while offering convenience and competitive pricing. Subscription-based delivery models for household essentials such as toilet paper and tissues are gaining traction, especially in urban markets. The flexibility of online shopping supports premium product sales, including eco-friendly and specialty tissues. With increasing internet penetration and digital adoption worldwide, e-commerce will remain a crucial growth avenue, reshaping distribution strategies in the hygienic paper market.

- For instance, Georgia-Pacific has expanded its e-commerce capabilities, serving both households (B2C) and businesses (B2B) with paper products supported by enhanced digital order fulfillment and supply chain optimization.

Key Challenges

Volatility in Raw Material Costs

Fluctuations in pulp and paper raw material prices pose significant challenges for manufacturers. Rising costs of wood pulp, chemicals, and energy directly impact production expenses, squeezing profit margins. Smaller players struggle to absorb these fluctuations compared to larger competitors with diversified supply chains. Ongoing global supply chain disruptions further add to instability. Addressing this challenge requires investment in alternative raw materials, improved efficiency, and long-term supplier partnerships to ensure consistent pricing and availability of hygienic paper products.

Environmental Regulations and Waste Concerns

The hygienic paper industry faces increasing pressure from environmental regulations and waste management concerns. High water and energy consumption in production, coupled with deforestation, have drawn scrutiny from regulators and environmental groups. Additionally, single-use paper products contribute to waste management challenges. Manufacturers must comply with stricter sustainability standards while maintaining cost competitiveness. This challenge is driving a shift toward recycled materials and eco-friendly alternatives, but adoption remains costly. Balancing regulatory compliance with consumer affordability is a key hurdle for the long-term growth of the hygienic paper market.

Regional Analysis

North America

North America held the largest share of 33% in the hygienic paper market in 2024, driven by high per capita consumption of toilet paper, tissues, and paper towels. The U.S. dominates regional demand, supported by strong consumer hygiene awareness and established distribution networks across retail and e-commerce channels. Canada also contributes significantly, with growing demand for sustainable and eco-friendly paper products. Technological advancements in recycling and production efficiency further support market growth. The region’s strong adoption of premium and specialty hygienic paper ensures North America remains a leading market throughout the forecast period.

Europe

Europe accounted for 28% share of the hygienic paper market in 2024, supported by strict environmental regulations and strong consumer preference for sustainable products. Germany, the UK, and France lead demand, driven by well-established hygiene standards and high consumption in both households and commercial sectors. The European Union’s focus on eco-friendly products has accelerated the shift toward recycled and bamboo-based paper. Expansion in Eastern Europe also adds to growth, supported by rising disposable incomes and improved sanitation infrastructure. The region continues to lead in innovation, sustainability, and product diversification within the hygienic paper industry.

Asia-Pacific

Asia-Pacific captured 26% share of the hygienic paper market in 2024, making it the fastest-growing region. China, India, and Japan dominate demand, fueled by rapid urbanization, rising middle-class populations, and improving sanitation awareness. Government initiatives promoting hygiene and the expansion of modern retail networks support growth. Increasing adoption of toilet paper and tissues in emerging economies further expands the market. The region also benefits from cost-effective manufacturing and the availability of raw materials. With strong demand in both household and commercial sectors, Asia-Pacific remains a critical driver of long-term market expansion.

Latin America

Latin America represented 7% share of the hygienic paper market in 2024, led by Brazil and Mexico. Rising urbanization, expanding retail penetration, and improving hygiene standards are the primary drivers of growth. The household sector dominates consumption, supported by growing middle-class populations and increasing affordability of hygienic paper products. However, economic volatility and inflation in several countries present challenges for consistent demand. Despite these hurdles, rising foreign investments in the paper industry and expansion of e-commerce platforms continue to strengthen the market outlook for hygienic paper across the region.

Middle East & Africa

The Middle East & Africa accounted for 6% share of the hygienic paper market in 2024, with demand concentrated in Gulf nations and South Africa. Increasing urbanization, rising disposable incomes, and growing healthcare infrastructure are key drivers in the region. Demand is strong in both household and institutional sectors, particularly in hospitals and hospitality. However, limited local production and reliance on imports challenge affordability in some countries. Despite these barriers, investments in regional manufacturing capacity and greater awareness of hygiene standards are expected to support steady growth in the hygienic paper market.

Market Segmentations:

By Type

- Toilet paper

- Facial tissues

- Napkins

- Others

By Source

- Virgin pulp

- Recycled paper

By Price

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hygienic paper market is shaped by leading players such as Cascades, Oji, APP, Kimberly-Clark, Mondi, Hengan, Georgia-Pacific, Paperlinx, Nine Dragons Paper, and Essity. These companies compete through product innovation, sustainable manufacturing, and strategic global expansion. Many focus on developing eco-friendly products using recycled fibers and alternative raw materials such as bamboo to meet growing demand for sustainable solutions. Strong distribution networks across supermarkets, hypermarkets, and online platforms help these players maintain dominance in both household and commercial segments. Partnerships, mergers, and acquisitions further strengthen their market presence while expanding product portfolios. Investments in advanced production technologies also enable cost efficiency and improved product quality. Intense competition encourages companies to differentiate through brand recognition, premium product offerings, and compliance with environmental regulations, ensuring they remain competitive in a market driven by rising hygiene awareness and consumer demand for sustainable hygienic paper products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cascades

- Oji

- APP

- Kimberly-Clark

- Mondi

- Hengan

- Georgia-Pacific

- Paperlinx

- Nine Dragons Paper

- Essity

Recent Developments

- In September 2025, Essity expanded its coreless technology to its Lotus Just-1 toilet paper in France.

- In June 2025, Georgia-Pacific (GP PRO) launched new dispensing technologies (e.g. “ECON Mode”) for paper towel dispensers to cut energy use.

- In 2024, Georgia-Pacific recorded production milestones at its Monticello mill, setting new production records in 2024.

- In October 2023, Kimberly-Clark and Essity unveiled new sustainability plans to reduce environmental impact of away-from-home hygiene products.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Price, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising hygiene awareness worldwide.

- Household consumption will continue to dominate overall demand.

- Commercial and healthcare sectors will increase bulk purchases of hygienic paper.

- Sustainable and eco-friendly products will gain stronger consumer preference.

- Recycled and bamboo-based paper will see higher adoption.

- E-commerce platforms will boost online sales and subscription-based models.

- Asia-Pacific will remain the fastest-growing regional market.

- North America and Europe will retain leadership with high per capita usage.

- Product innovation will focus on softness, durability, and eco-certifications.

- Competitive intensity will rise as companies expand global production and distribution.