Market Overview:

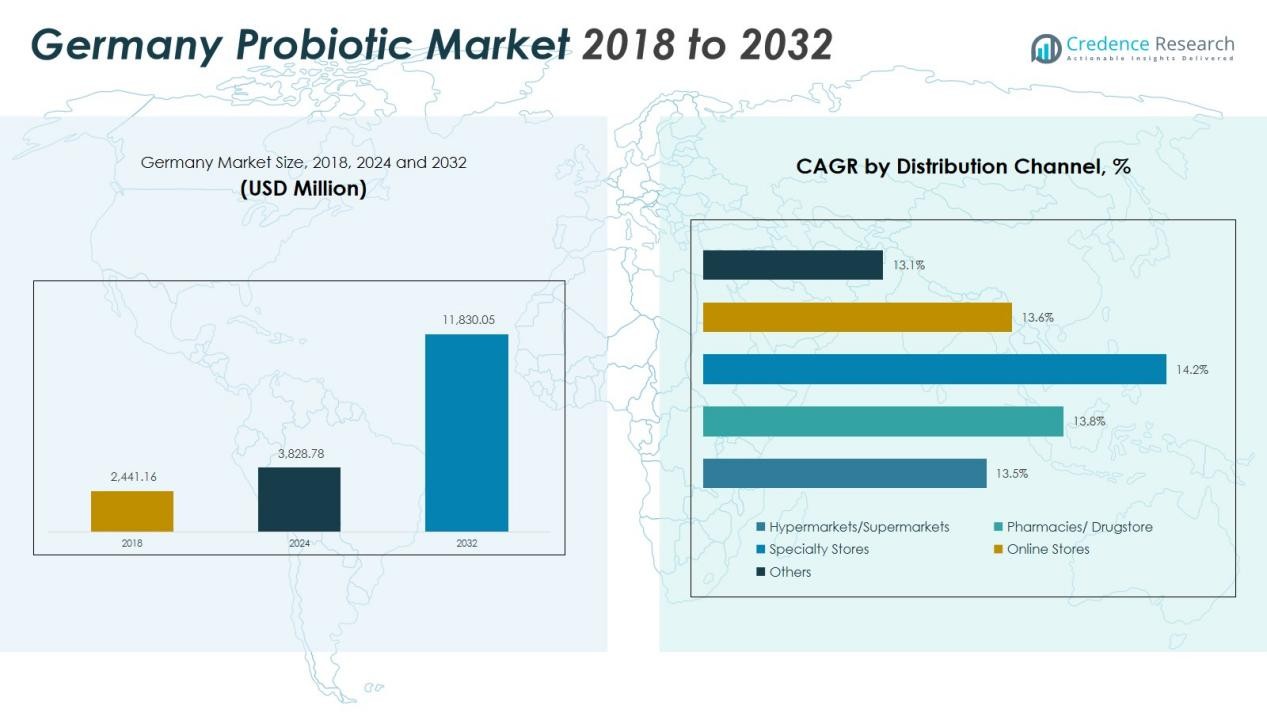

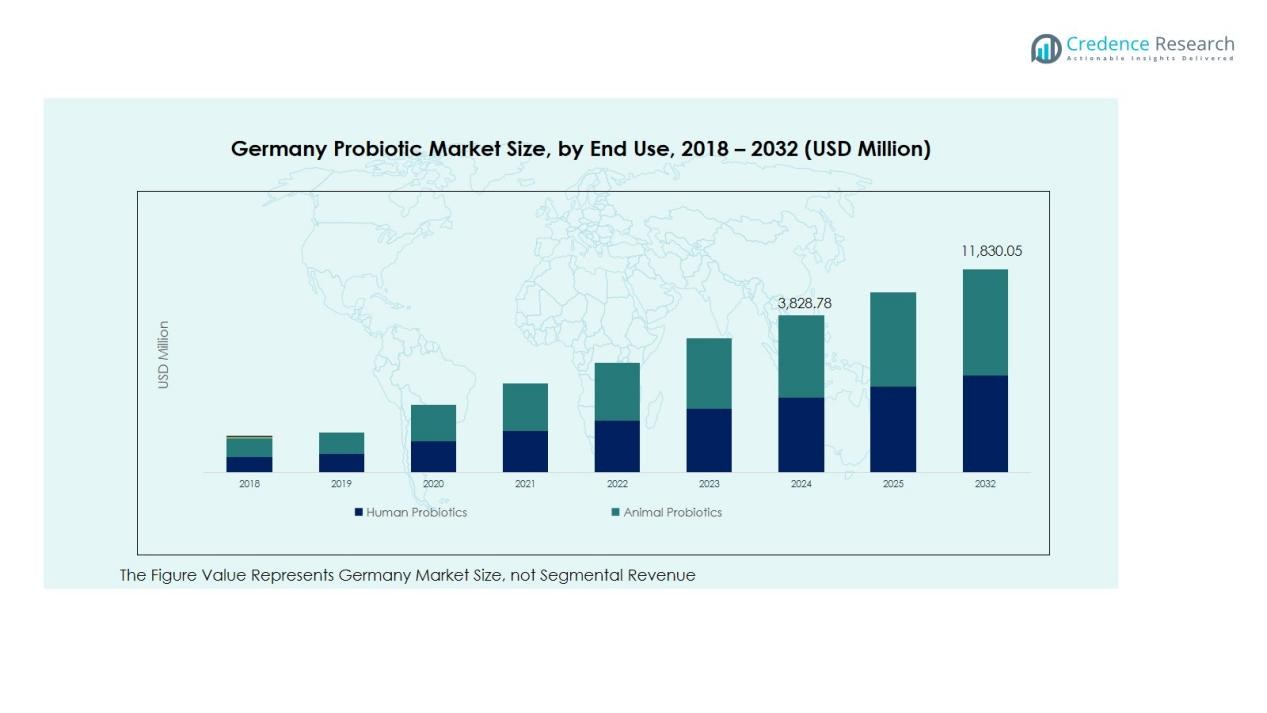

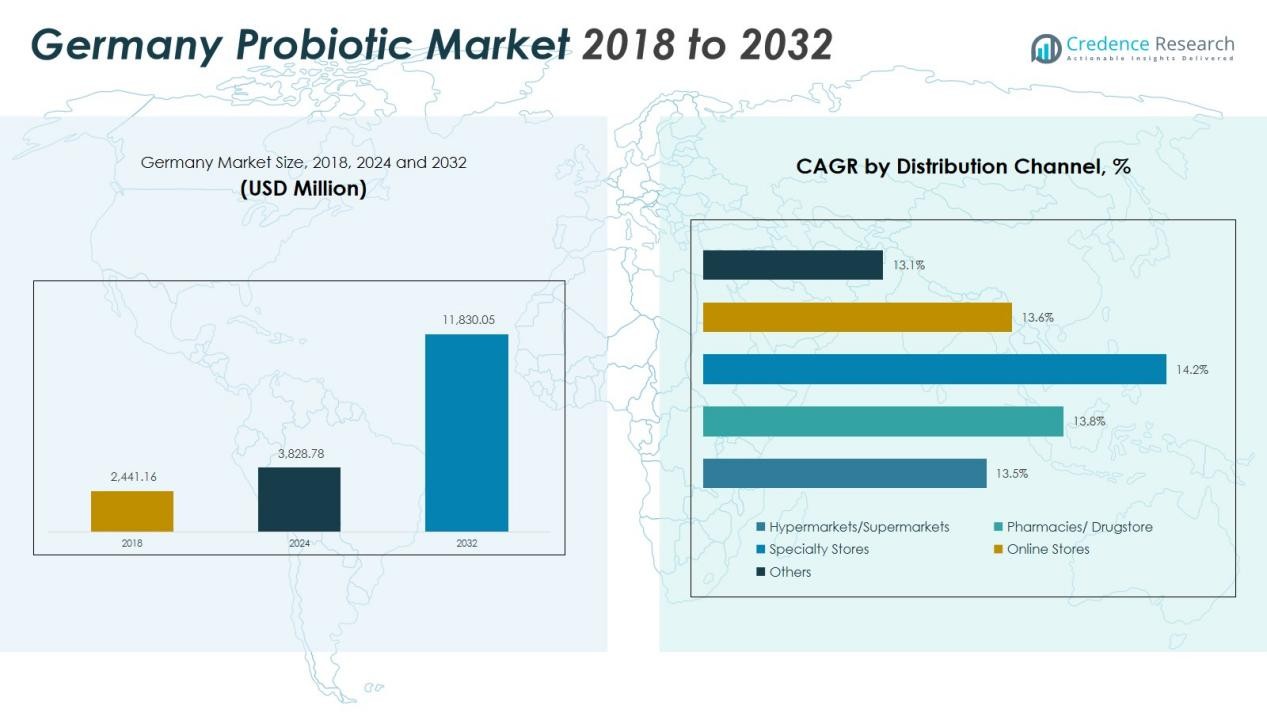

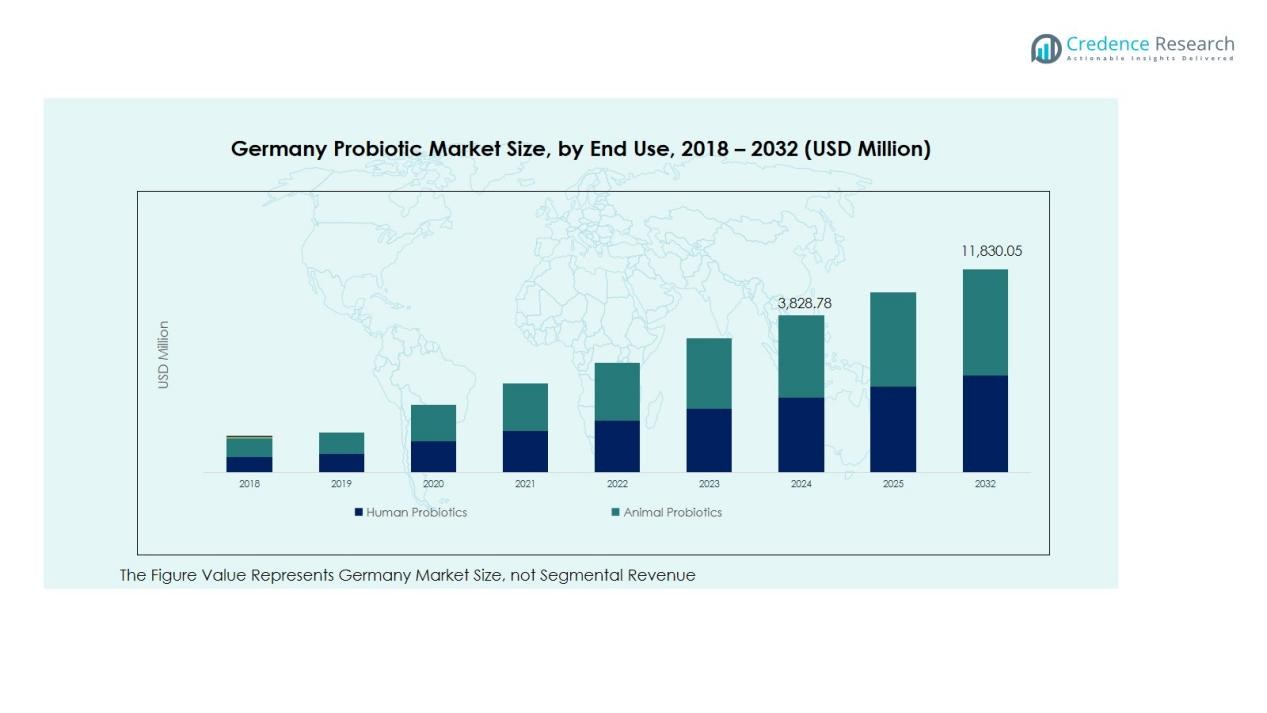

The Germany Probiotic Market size was valued at USD 2,441.16 million in 2018 to USD 3,828.78 million in 2024 and is anticipated to reach USD 11,830.05 million by 2032, at a CAGR of 15.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Probiotic Market Size 2024 |

USD 3,828.78 Million |

| Germany Probiotic Market, CAGR |

15.14% |

| Germany Probiotic Market Size 2032 |

USD 11,830.05 Million |

The market growth is supported by the country’s strong healthcare system and growing inclination toward natural, science-backed ingredients. Increasing preference for multi-strain formulations, enhanced shelf stability, and clinically proven strains are encouraging broader consumer adoption. Expanding collaborations between food manufacturers and biotechnology firms are also driving product innovation and quality assurance, boosting consumer confidence in functional probiotics.

Regionally, Western and Southern Germany dominate the market due to advanced retail infrastructure, higher disposable incomes, and the strong presence of global and domestic brands. Northern Germany shows growing adoption supported by expanding e-commerce networks and awareness campaigns. Meanwhile, Eastern Germany is emerging as a high-growth region, fueled by improving distribution channels and increased demand for non-dairy and plant-based probiotic products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Probiotic Market was valued at USD 2,441.16 million in 2018, reached USD 3,828.78 million in 2024, and is projected to attain USD 11,830.05 million by 2032, growing at a CAGR of 15.14% during 2024–2032.

- Western Germany (38%), Southern Germany (27%), and Northern Germany (22%) hold the largest regional shares, driven by strong retail presence, higher income levels, and high consumer awareness of functional nutrition.

- Eastern Germany (13%) is the fastest-growing region, supported by expanding online channels, government-led nutrition programs, and rising demand for affordable probiotic beverages.

- By Type, probiotic food and beverages dominate with 67% share, led by yogurts, fermented drinks, and plant-based dairy alternatives, while dietary supplements account for 26% of total revenue.

- By Ingredient, bacteria-based probiotics represent 83% of the market, driven by high efficacy and diverse application in human and animal health, while yeast-based strains contribute the remaining 17%

Market Drivers:

Rising Health Awareness and Preventive Nutrition Focus

The Germany Probiotic Market benefits from growing consumer focus on preventive health and digestive wellness. Consumers are actively choosing probiotic-rich foods and supplements to strengthen gut health and immunity. The shift from curative to preventive healthcare aligns with increasing awareness of microbiome balance. It is further supported by government-led nutrition education programs and media coverage promoting healthy lifestyles.

- For instance, Danone’s Activia probiotic yogurt sold in Germany is formulated to deliver at least \(1\times 10^{9}\) CFU of Bifidobacterium animalis DN-173010 per 125 g serving.

Expansion of Functional Food and Beverage Offerings

Strong demand for functional foods drives steady growth in probiotic consumption. Manufacturers are introducing yogurts, fermented drinks, and fortified snacks featuring advanced bacterial strains. The integration of probiotics into daily diets appeals to consumers seeking convenient wellness solutions. It encourages dairy and non-dairy producers to innovate with multi-strain formulations and improved shelf-stable packaging. The trend reinforces the market’s role in everyday nutrition.

- For instance, in August 2025, Danone’s Activia launched its Proactive Yogurt line, reformulated with 25% less sugar and enriched with 10 g of protein and 3 g of prebiotic fiber per serving, each containing billions of live probiotics to support digestive health.

Technological Advancements and Product Innovation

Continuous R&D investment supports innovation across formulation, encapsulation, and strain development. Advanced technologies enhance probiotic viability under varying storage and processing conditions. It enables brands to expand their product range into capsules, gummies, and non-dairy alternatives. German biotech firms collaborate with food manufacturers to develop next-generation probiotics with proven clinical benefits. These innovations strengthen product credibility and market penetration.

Growing E-commerce and Retail Distribution Networks

The expansion of online platforms and organized retail chains increases consumer access to probiotic products. Strong logistics and digital marketing campaigns boost visibility and trust among health-focused consumers. It allows smaller and specialized brands to reach nationwide audiences efficiently. Retailers emphasize premium and science-backed formulations, further diversifying choices. This distribution growth supports consistent revenue generation across major German cities and emerging regions.

Market Trends:

Integration of Probiotics into Everyday Food and Lifestyle Products

The Germany Probiotic Market is witnessing strong integration of probiotics across diverse food and beverage categories. Consumers are adopting probiotic-fortified dairy, juices, and snacks as part of daily nutrition. The market is shifting toward functional products that support digestive, immune, and metabolic health. It benefits from advancements in microencapsulation technology, which enhance strain stability and taste. Leading food companies are investing in multi-strain formulations and plant-based probiotic lines to reach vegan and lactose-intolerant consumers. The growing demand for clean-label and naturally derived ingredients reinforces this transition. Continuous product diversification keeps the category dynamic and consumer engagement high.

- For instance, BRACE GmbH, in collaboration with Vesale Pharma, achieved over 90% encapsulation efficiency using its vibrational nozzle microencapsulation process for Bifidobacterium lactis 300B strains, enhancing survival rates at 40°C for over 30 days—far superior to conventional unencapsulated probiotics.

Growing Role of Digital Marketing and Personalized Wellness Solutions

Personalized nutrition and digital engagement are becoming central to the Germany Probiotic Market. Consumers increasingly seek tailored probiotic solutions that address specific health needs, such as gut balance, skin health, or stress relief. E-commerce and mobile applications enable direct brand communication and education about product benefits. It allows companies to build loyalty through subscription models and personalized wellness recommendations. Social media influencers and healthcare professionals are strengthening consumer trust through science-based messaging. Brands that align digital strategies with consumer wellness goals are achieving stronger retention. This digital shift is defining the next phase of probiotic adoption across Germany’s health-conscious population.

- For instance, BioGaia’s Protectis drops are backed by 270 clinical studies demonstrating targeted gut health benefits.

Market Challenges Analysis:

Regulatory Complexity and Strain Validation Constraints

The Germany Probiotic Market faces challenges from strict regulatory frameworks governing health claims and strain approvals. The European Food Safety Authority (EFSA) enforces rigorous testing before allowing any functional or therapeutic claims. It increases product development costs and limits marketing flexibility for new entrants. Many small manufacturers struggle to validate probiotic efficacy under these standards. Delays in approval processes slow innovation and product launches. The need for scientific substantiation of every strain reduces the speed of commercialization, impacting market expansion.

High Price Sensitivity and Limited Consumer Education

Price competition and uneven awareness about probiotic benefits create barriers for consistent market penetration. Consumers often perceive premium probiotic products as expensive compared to conventional food items. It affects demand in middle-income segments and rural areas with lower health awareness. Misleading product claims by unregulated brands also weaken consumer trust. Limited knowledge about strain specificity and dosage effectiveness reduces willingness to pay for high-quality formulations. This lack of understanding restricts long-term brand loyalty and slows overall market growth across Germany.

Market Opportunities:

Expansion into Personalized and Condition-Specific Formulations

The Germany Probiotic Market presents strong opportunities in personalized nutrition and targeted formulations. Consumers are showing interest in probiotics tailored for digestive balance, immunity, skin health, and mental wellness. It encourages manufacturers to develop strain-specific blends supported by clinical research. Biotechnology firms are exploring genomic tools to match probiotic strains with individual microbiome profiles. This approach supports higher product efficacy and customer loyalty. Expanding personalized solutions through digital platforms and subscription models can strengthen brand differentiation in the market.

Growth Potential in Plant-Based and Non-Dairy Probiotic Products

Rising veganism and lactose intolerance create growth avenues for plant-based probiotic beverages and supplements. The demand for oat, soy, and almond-based probiotic drinks is increasing rapidly. It allows manufacturers to attract younger, health-conscious consumers seeking sustainable options. Collaboration between food technologists and fermentation experts is driving innovation in taste and texture. Retailers are expanding shelf space for dairy-free probiotic ranges to meet this demand. The ongoing shift toward clean-label and environmentally responsible products enhances future market potential in Germany.

Market Segmentation Analysis:

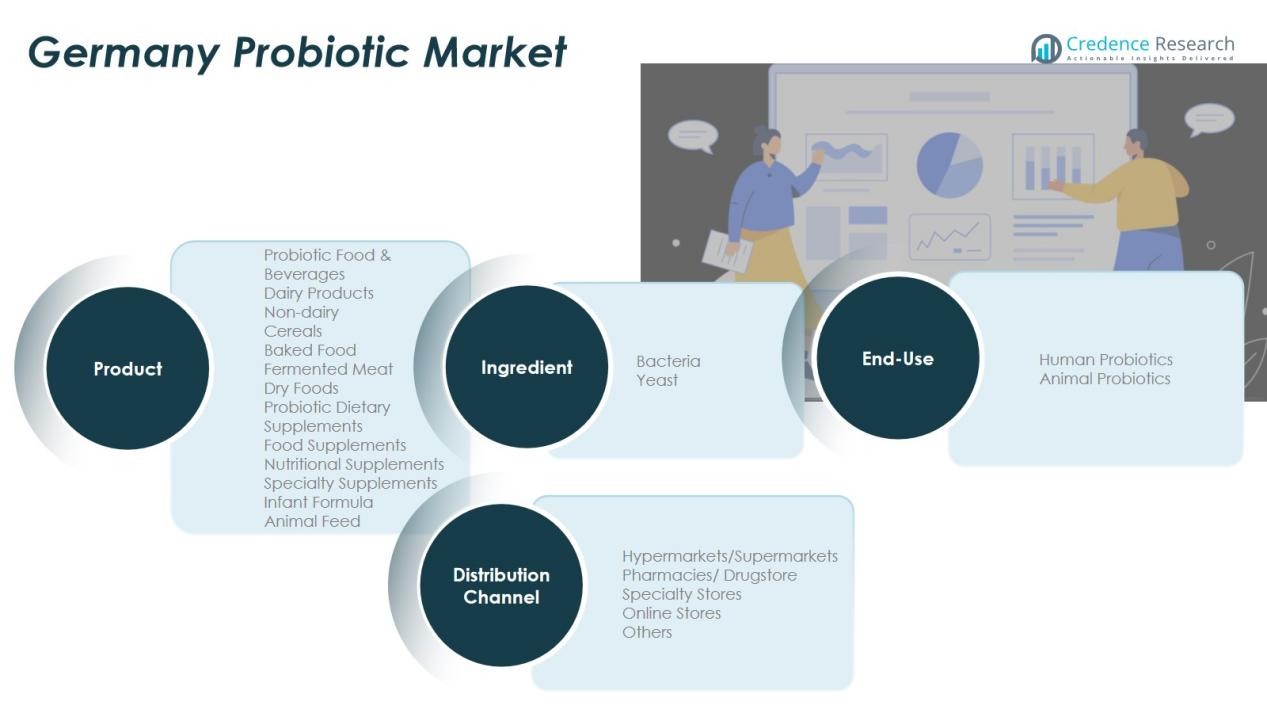

By Type

The Germany Probiotic Market is segmented into probiotic food and beverages, dietary supplements, and animal feed. Probiotic food and beverages dominate due to strong consumption of dairy products, yogurts, and fermented drinks. Non-dairy options such as oat and soy-based beverages are gaining popularity among vegan and lactose-intolerant consumers. Dietary supplements show steady growth, driven by rising awareness of gut health and immune support. It benefits from innovation in capsule, gummy, and powder formats. Animal feed applications are expanding with increased focus on livestock health and productivity.

- For Instance, Oddlygood, a Finnish plant-based company spun off from dairy giant Valio, acquired the British plant-based company Rude Health in October 2024 for an undisclosed sum. Oddlygood anticipated a turnover close to €50 million for 2024 across its Nordic and European operations, a figure that was confirmed in Valio’s financial report in April 2025.

By Ingredient

Bacteria-based probiotics hold the majority share in the market due to their proven efficacy in digestive and immune support. Common strains such as Lactobacillus and Bifidobacterium are widely used in food and supplements. Yeast-based probiotics, primarily Saccharomyces boulardii, are gaining demand for their ability to enhance gut resilience and manage antibiotic-related imbalances. It supports broader diversification within both human and animal probiotic formulations.

- For instance, a 2024 study published in Scientific Reports showed that Saccharomyces boulardii maintained over 10⁶ CFU/mL viability at the end of yogurt shelf life and significantly stimulated lactic acid bacteria growth, confirming its functional strength and beneficial activity in probiotic dairy applications.

By End-Use

Human probiotics lead the Germany Probiotic Market, supported by consumer demand for functional foods and dietary supplements promoting overall wellness. Growing preventive healthcare practices strengthen this segment’s expansion. Animal probiotics are witnessing increased adoption in poultry, swine, and dairy industries. It helps improve feed efficiency, nutrient absorption, and animal immunity. The segment’s steady growth reflects Germany’s focus on sustainable livestock management.

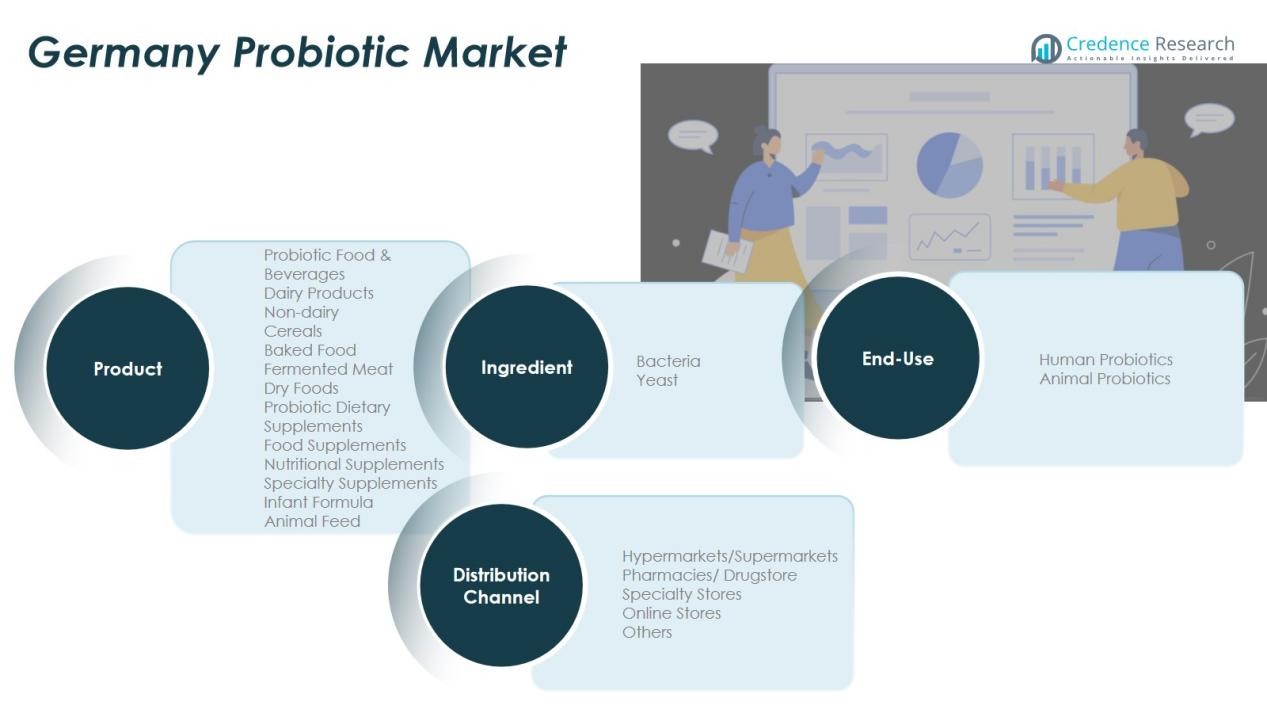

Segmentations:

By Type:

Probiotic Food & Beverages

- Dairy Products

- Non-Dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

By Ingredient:

By End-Use:

- Human Probiotics

- Animal Probiotics

By Distribution Channel:

- Hypermarkets/Supermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Online Stores

- Others

Regional Analysis:

Western and Southern Germany Lead Market Growth

Western and Southern regions dominate the Germany Probiotic Market due to higher consumer awareness and developed retail infrastructure. Cities such as Munich, Frankfurt, and Stuttgart host strong networks of supermarkets and health stores offering probiotic-rich products. It benefits from higher disposable income and preference for preventive healthcare. The presence of major food and pharmaceutical companies drives product innovation and distribution efficiency. Partnerships between retailers and biotechnology firms enhance availability across both urban and suburban markets. The demand for premium probiotic yogurts, drinks, and supplements remains strong in these regions.

Northern Germany Shows Steady Expansion

Northern Germany demonstrates steady market growth supported by expanding e-commerce channels and a health-conscious population. Consumers in Hamburg and Bremen actively purchase probiotics through online wellness platforms and pharmacies. It benefits from the region’s focus on balanced diets and functional food adoption. Local manufacturers are increasing product diversification through non-dairy and fermented beverages. The region also records higher adoption among working professionals seeking convenient probiotic formats such as capsules and sachets. Continuous investments in logistics and digital marketing strengthen its retail performance.

Eastern Germany Emerges as a High-Growth Region

Eastern Germany is emerging as one of the fastest-growing areas for probiotic products. The region experiences rising disposable income and growing penetration of modern retail stores. It benefits from government health initiatives promoting nutrition and digestive wellness. Consumers are gradually shifting toward affordable, quality probiotic brands available through online channels. Domestic producers are expanding presence by offering competitively priced functional foods. This regional diversification supports balanced market expansion across the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Germany Probiotic Market is highly competitive, featuring global and regional players focusing on innovation and product diversification. Major companies such as Danone S.A., Nestlé Germany S.A.S., Lesaffre Group, Lallemand Inc., Chr. Hansen Holding A/S, BioGaia AB, Probi AB, and Valio Ltd. hold strong market positions through extensive product portfolios and advanced research capabilities. It emphasizes strain innovation, clinical validation, and improved shelf stability to meet consumer demand for quality and safety. Companies invest in R&D collaborations and strategic partnerships to strengthen brand presence across retail and online channels. Marketing campaigns highlighting digestive, immune, and overall wellness benefits drive brand recognition and consumer loyalty. The market reflects continuous consolidation through acquisitions, enabling firms to expand regional reach and enhance competitive advantage in the fast-growing probiotic category.

Recent Developments:

- In July, 2025, Danone completed the acquisition of a majority stake in Kate Farms, a U.S.-based plant-based nutrition company, enhancing its specialized nutrition portfolio.

- In October 2025, BioGaia announced the publication of a scientific study on its new patented probiotic strain Lactobacillus reuteri BG-R46® in the journal Beneficial Microbes, highlighting its role in gut and immune health.

Report Coverage:

The research report offers an in-depth analysis based on Type, Ingredient, End-Use and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Germany Probiotic Market will continue expanding with rising consumer focus on preventive and gut health solutions.

- Product innovation will accelerate through development of strain-specific formulations and advanced encapsulation technologies.

- Demand for plant-based and lactose-free probiotic options will grow among vegan and health-conscious consumers.

- Digital health platforms will promote personalized probiotic recommendations based on microbiome analysis.

- Pharmaceutical and nutraceutical collaborations will increase to develop clinically validated probiotic supplements.

- E-commerce and subscription models will strengthen brand loyalty through convenient product access.

- Small and medium manufacturers will enter the market with cost-effective probiotic beverages and snacks.

- Retailers will expand shelf space for functional foods with clean-label and natural claims.

- Education campaigns will improve consumer understanding of strain efficacy and product benefits.

- Germany Probiotic Market will move toward sustainability with eco-friendly packaging and transparent sourcing practices.