Market Overview

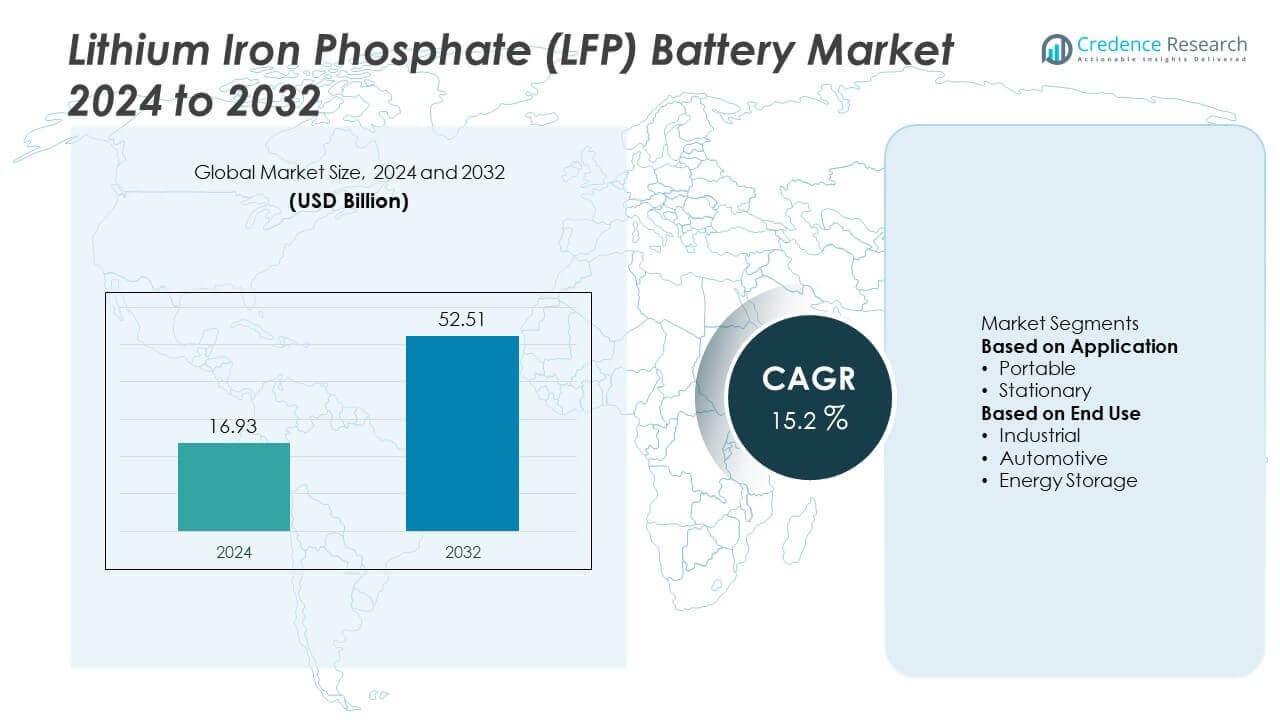

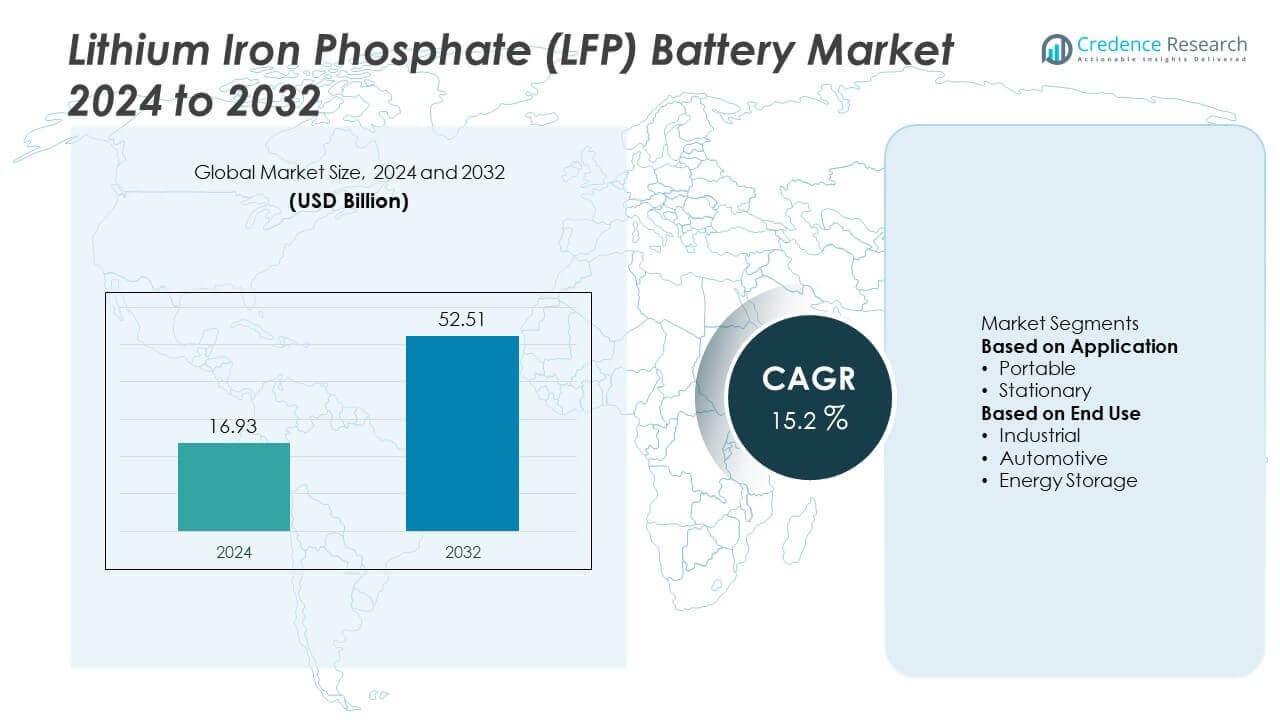

The Lithium Iron Phosphate (LFP) Battery Market was valued at USD 16.93 billion in 2024 and is projected to reach USD 52.51 billion by 2032, expanding at a CAGR of 15.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Iron Phosphate (LFP) Battery Market Size 2024 |

USD 16.93 Billion |

| Lithium Iron Phosphate (LFP) Battery Market, CAGR |

15.2% |

| Lithium Iron Phosphate (LFP) Battery Market Size 2032 |

USD 52.51 Billion |

The lithium iron phosphate (LFP) battery market is led by key players including Energon, Exide Technologies, Contemporary Amperex Technology, Lithiumwerks, A123 Systems, Clarios, Prologium Technology, Ding Tai Battery Company, Duracell, and Koninklijke Philips. These companies focus on expanding production capacity, advancing cycle life, and forming partnerships with automakers and renewable energy developers to strengthen market presence. Asia-Pacific dominated with 47% share in 2024, driven by large-scale EV adoption and renewable integration in China and India. North America accounted for 21%, supported by strong EV policies and storage demand, while Europe held 18%, fueled by emission reduction goals and localized gigafactory investments.

Market Insights

Market Insights

- The lithium iron phosphate (LFP) battery market was valued at USD 16.93 billion in 2024 and is projected to reach USD 52.51 billion by 2032, growing at a CAGR of 15.2%.

- Rising adoption of electric vehicles and renewable energy storage systems is driving strong demand for LFP batteries due to their safety, long cycle life, and cost efficiency.

- Key trends include rapid expansion of grid-scale energy storage projects, localization of supply chains in North America and Europe, and growing use in consumer electronics and industrial applications.

- The market is highly competitive with leading players such as Energon, Exide Technologies, Contemporary Amperex Technology, Lithiumwerks, A123 Systems, Clarios, Prologium Technology, Ding Tai Battery Company, Duracell, and Koninklijke Philips focusing on capacity expansion and innovation.

- Asia-Pacific dominated with 47% share in 2024, followed by North America at 21% and Europe at 18%, while automotive applications held 54% share, leading among end-use segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The application segment of the lithium iron phosphate (LFP) battery market is divided into portable and stationary uses. Stationary applications dominated in 2024, holding over 62% share, driven by rising demand for grid stabilization, backup power, and renewable energy integration. Stationary systems are favored for their long cycle life, thermal stability, and safety, making them suitable for large-scale energy storage projects. The growing installation of renewable power plants and emphasis on reliable grid infrastructure are key factors boosting the stationary segment’s lead in the global market.

- For instance, CATL supplied batteries to integrator FlexGen for a 220 MWh LFP storage project in Texas, which demonstrates the utility-scale deployment of LFP technology.

By End Use

Within end-use categories, the automotive sector held the largest share at 54% in 2024, owing to rapid adoption of electric vehicles. Automakers favor LFP batteries for their cost-effectiveness, long lifespan, and resistance to thermal runaway compared to other chemistries. Leading EV manufacturers increasingly deploy LFP in entry and mid-range models, fueling its dominance. Supportive government incentives, expanding charging infrastructure, and consumer preference for affordable EVs are further strengthening the automotive segment’s position in the market.

- For instance, Gotion High-Tech launched its “Astroinno” LFP battery, which achieved a pack energy density of 190 Wh/kg and a cycle life of 4,000 cycles at room temperature, and is now supplied for several electric vehicle platforms requiring fast charging capability.

Key Growth Drivers

Rising Electric Vehicle Adoption

The rapid adoption of electric vehicles is a primary growth driver for the lithium iron phosphate (LFP) battery market. Automakers are increasingly integrating LFP batteries in mid-range and entry-level EVs due to their safety, durability, and cost advantages over nickel-based chemistries. Strong government incentives and emission reduction policies are accelerating EV demand globally. As consumer preference shifts toward affordable EVs with reliable performance, the automotive sector continues to push large-scale adoption of LFP technology, reinforcing its leading role in the market’s expansion.

- For instance, Tesla equips its standard range models with LFP battery packs that offer a long cycle life of over 2,500 cycles and significantly greater thermal stability than nickel-based chemistries, enabling owners to regularly charge to 100% with a low risk of thermal runaway.

Growing Renewable Energy Integration

The increasing integration of renewable energy into global power grids is boosting demand for energy storage systems. LFP batteries dominate stationary storage due to their long cycle life, safety, and ability to withstand deep discharges. Rising solar and wind installations create a pressing need for efficient storage solutions to address intermittency challenges. Governments and utilities are investing heavily in grid-scale projects and microgrids, where LFP offers cost-effective reliability. This trend ensures consistent demand for LFP batteries in the renewable energy ecosystem.

- For instance, CATL provides LFP-based stationary storage modules engineered for over 6000 charging cycles and continuous operation at up to 55°C, supporting resilient grid performance in large-scale solar farms.

Enhanced Safety and Longer Lifespan

Safety and longevity remain crucial factors driving LFP battery adoption. Compared to other lithium-ion chemistries, LFP provides superior thermal stability, reducing risks of fire or explosion. Its extended lifespan, often exceeding 3,000–5,000 cycles, makes it highly suitable for EVs, residential storage, and industrial backup. Businesses and consumers prioritize low-maintenance solutions with long service life, supporting LFP’s market expansion. The combination of safety and performance ensures continued preference across automotive, energy, and industrial applications, cementing LFP’s competitive advantage in the global battery landscape.

Key Trends & Opportunities

Expansion in Grid-Scale Storage Projects

The deployment of grid-scale energy storage projects is a strong trend shaping the LFP market. Utilities and governments favor LFP batteries for stabilizing renewable energy supply and enhancing grid resilience. Large-scale projects, including solar-plus-storage systems and wind farm storage, are increasing worldwide. This trend creates opportunities for manufacturers to scale production and enhance performance features, such as higher energy density. The growing focus on decarbonization and electrification presents a long-term opportunity for LFP batteries in supporting energy transitions globally.

- For instance, CATL recently introduced a high-capacity LFP energy storage battery with a 587 Ah cell and an energy density of 434 Wh/L, enabling grid-scale systems to achieve over 9 MWh single-unit capacity and maintain zero degradation over five years of continuous use.

Rising Penetration in Consumer Electronics

The market is witnessing increasing use of LFP batteries in portable devices, such as power tools, medical devices, and backup systems. Their safety, affordability, and long cycle life make them ideal for applications demanding reliability. Growing demand for portable electronics in developing regions opens new revenue streams for LFP manufacturers. Opportunities also lie in improving compact designs and boosting energy density for wider consumer adoption. As technology advances, LFP is expected to capture a stronger foothold in the consumer electronics ecosystem.

- For instance, Highstar Battery Technology supplies LFP battery cells for portable backup power, with a typical 100 Ah, 3.2V cell rated for over 3,500 charge-discharge cycles. Multiple cells are assembled into a module to support power outputs up to 3 kW for use in medical and UPS devices.

Global Supply Chain Localization

An emerging trend involves the localization of LFP battery supply chains, particularly in North America and Europe. Governments aim to reduce reliance on Asian imports by supporting local battery manufacturing through subsidies and investments. This shift offers opportunities for regional producers to establish strong market positions. It also drives collaboration between automakers, energy firms, and battery manufacturers to ensure stable supply. Localization enhances competitiveness while aligning with national energy security and sustainability goals, accelerating LFP market penetration worldwide.

Key Challenges

Lower Energy Density Compared to Alternatives

Despite its benefits, LFP batteries face a challenge due to their lower energy density compared to nickel-cobalt chemistries. This limitation affects their adoption in premium EVs, where longer driving range is a priority. While automakers adopt LFP for cost-sensitive models, competition from high-energy alternatives continues. Research and development efforts aim to enhance density while maintaining safety. Until then, the limited energy density of LFP restricts its use in applications demanding compact, high-capacity solutions, creating a significant restraint for broader market penetration.

Raw Material Supply and Cost Volatility

The supply and pricing of raw materials, particularly lithium, pose a challenge to LFP battery producers. Fluctuating costs and regional supply constraints directly impact manufacturing expenses and pricing strategies. The heavy reliance on mining and refining industries adds uncertainty to the value chain. Geopolitical tensions and rising demand across multiple industries further intensify risks. These supply-related challenges may affect profitability for manufacturers and slow adoption in cost-sensitive markets unless mitigated through recycling initiatives and diversified sourcing strategies.

Regional Analysis

North America

North America accounted for 21% share of the lithium iron phosphate (LFP) battery market in 2024. The region’s growth is driven by strong electric vehicle adoption supported by tax credits, emissions regulations, and expansion of charging infrastructure. Energy storage deployment is also accelerating, particularly in the United States, where LFP batteries are favored for grid reliability and renewable integration. Collaborations between automakers and battery manufacturers, alongside rising investments in domestic production facilities, further strengthen the market. The combination of clean energy policies and increasing EV penetration continues to expand LFP adoption across the region.

Europe

Europe held 18% share of the LFP battery market in 2024, supported by stringent environmental regulations and rising EV adoption. Countries such as Germany, France, and the Netherlands lead in vehicle electrification, while regional battery alliances promote domestic production capacity. The European Union’s Green Deal and energy transition goals drive substantial demand for stationary energy storage solutions. Automotive manufacturers are increasingly deploying LFP batteries in mid-range EVs, prioritizing safety and cost benefits. With ongoing investments in local gigafactories, Europe is positioned to reduce reliance on imports and accelerate LFP technology deployment in both automotive and energy storage applications.

Asia-Pacific

Asia-Pacific dominated the global LFP battery market with 47% share in 2024. China remains the largest producer and consumer, fueled by government subsidies, widespread EV adoption, and strong renewable energy integration. Leading battery manufacturers, including CATL and BYD, have expanded production capacity to meet both domestic and international demand. India and Japan are also increasing investments in EV manufacturing and energy storage infrastructure. The region’s established supply chain, cost advantages, and large-scale manufacturing base reinforce its leadership. Continuous government support and expanding export markets ensure Asia-Pacific remains the central hub of LFP battery development and deployment worldwide.

Latin America

Latin America captured 7% share of the LFP battery market in 2024, driven by the growing need for energy storage and electric mobility. Brazil and Mexico lead the regional adoption, supported by renewable energy expansion and pilot EV programs. Governments are promoting investments in solar-plus-storage systems to address grid stability challenges. Industrial applications such as telecom towers and backup power systems further contribute to LFP demand. However, limited manufacturing infrastructure and reliance on imports constrain rapid growth. Rising renewable capacity and gradual EV adoption are expected to create opportunities for LFP battery deployment across the region.

Middle East & Africa

The Middle East & Africa region accounted for 7% share of the LFP battery market in 2024. Market growth is influenced by increasing solar power projects in Gulf countries and off-grid energy storage solutions in Africa. Governments are investing heavily in renewable integration to diversify energy sources, creating opportunities for stationary LFP storage systems. Adoption in electric buses and industrial applications is also expanding, particularly in urban centers. However, high dependency on imports and limited local manufacturing capacity restrict large-scale deployment. Ongoing renewable energy investments are expected to drive consistent demand for LFP batteries in the region.

Market Segmentations:

By Application

By End Use

- Industrial

- Automotive

- Energy Storage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the lithium iron phosphate (LFP) battery market features key players such as Energon, Exide Technologies, Contemporary Amperex Technology, Lithiumwerks, A123 Systems, Clarios, Prologium Technology, Ding Tai Battery Company, Duracell, and Koninklijke Philips. These companies are actively engaged in expanding production capacities, advancing battery technologies, and strengthening supply chains to meet rising global demand. Leading firms like CATL and BYD emphasize large-scale manufacturing and global partnerships, while others focus on specialized applications such as stationary storage or consumer electronics. Strategic alliances with automakers and renewable energy developers play a crucial role in enhancing market presence. Continuous investment in safety, cost optimization, and sustainability initiatives remains central to competitive positioning. Regional players are also emerging, supported by government incentives and local manufacturing projects. The market remains dynamic, with innovation in energy density, cycle life, and eco-friendly solutions driving intense competition among established and emerging manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Energon

- Exide Technologies

- Contemporary Amperex Technology

- Lithiumwerks

- A123 Systems

- Clarios

- Prologium Technology

- Ding Tai Battery Company

- Duracell

- Koninklijke Philips

Recent Developments

- In April 2025, CATL has announced the successful launch of its new generation of sodium-ion batteries, designed to offer a high-energy density and cost-effective solution for electric vehicles (EVs) and energy storage systems.

- In December 2024, Stellantis and CATL’s joint venture effort to build a LFP battery plant in Zaragoza, Spain. The plant is carbon neutral and worth up to USD 4.28 billion. Production is set to begin from the last quarter of 2026 with an overarching aim of supporting the Spanish and EU authorities and attaining a capacity of 50 GWh.

- In September 2024, Hyundai and Kia have announced a collaboration to develop new Lithium Iron Phosphate (LFP) cathode technology aimed at improving the performance and efficiency of their electric vehicle (EV) batteries.

- In March 2024, Nissan has announced the launch of its next-generation battery technology aimed at significantly improving the performance, efficiency, and sustainability of electric vehicles (EVs).

Report Coverage

The research report offers an in-depth analysis based on Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth driven by rising electric vehicle adoption worldwide.

- Demand for stationary energy storage systems will increase with renewable integration projects.

- Automakers will expand use of LFP batteries in mid-range and entry-level EVs.

- Technological advancements will improve energy density and charging efficiency of LFP batteries.

- Governments will support local manufacturing to reduce dependence on Asian imports.

- Safety and long cycle life will remain key advantages over other battery chemistries.

- Industrial applications such as telecom, forklifts, and backup systems will witness steady growth.

- Competition among global and regional players will intensify with new capacity expansions.

- Recycling and circular economy initiatives will shape raw material sourcing strategies.

- Asia-Pacific will maintain leadership, while North America and Europe will expand rapidly with policy support.

Market Insights

Market Insights