Market Overview

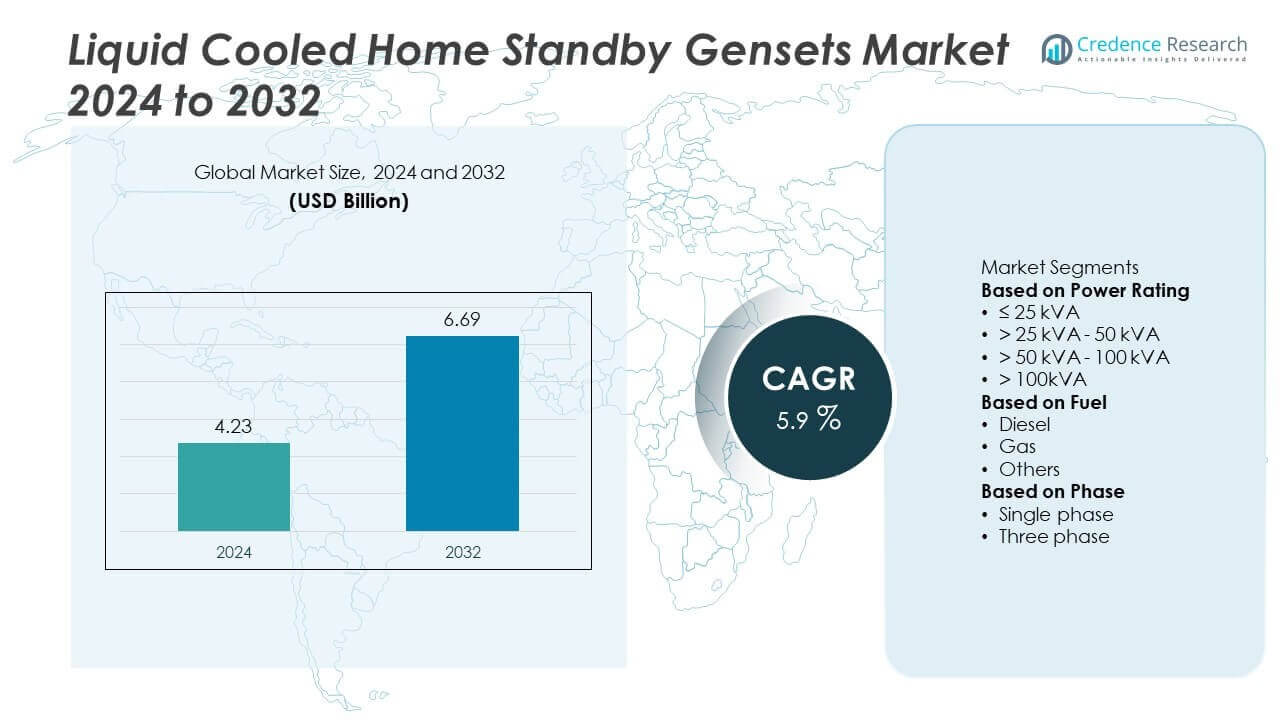

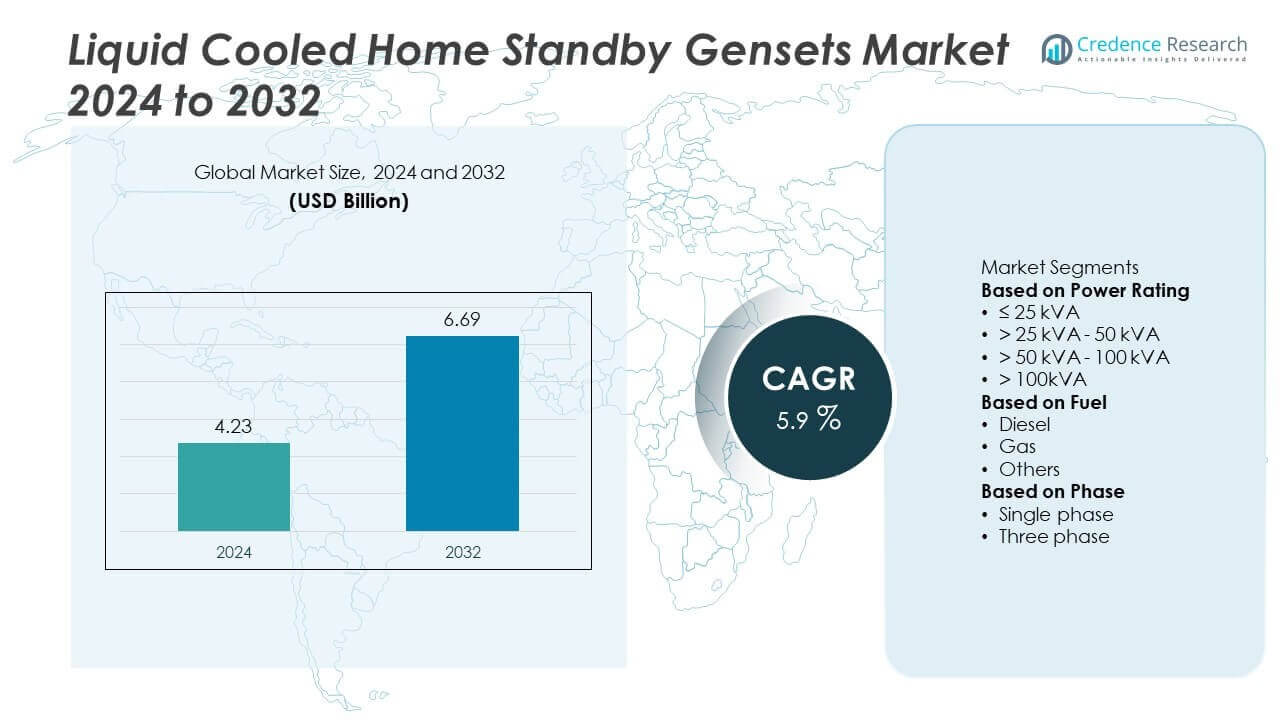

The global Liquid Cooled Home Standby Gensets Market was valued at USD 4.23 billion in 2024. It is projected to reach USD 6.69 billion by 2032, expanding at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Cooled Home Standby Gensets Market Size 2024 |

USD 4.23 Billion |

| Liquid Cooled Home Standby Gensets Market, CAGR |

5.9% |

| Liquid Cooled Home Standby Gensets Market Size 2032 |

USD 6.69 Billion |

The liquid cooled home standby gensets market is led by major players such as Cummins, Kirloskar, Eaton, Briggs & Stratton, Atlas Copco, Ashok Leyland, Generac Power Systems, Mitsubishi Heavy Industries, Multiquip, and Gillette Generators. These companies focus on developing advanced gensets with improved fuel efficiency, smart monitoring systems, and low-emission technologies to cater to residential energy needs. Regionally, North America dominated the market in 2024 with 38% share, driven by frequent outages and strong natural gas infrastructure. Europe followed with 27% share, supported by stricter energy standards and premium housing projects, while Asia Pacific accounted for 24% share, fueled by rapid urbanization, unreliable grids, and rising demand for reliable backup power in metropolitan areas.

Market Insights

Market Insights

- The global liquid cooled home standby gensets market was valued at USD 4.23 billion in 2024 and is projected to reach USD 6.69 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- Key drivers include rising power outages, growing adoption of smart homes, and increasing demand for reliable backup solutions, with the >25 kVA–50 kVA power rating segment holding 37% share in 2024.

- Market trends highlight the shift toward gas-fueled gensets due to cleaner emissions and quieter operation, along with growing integration of IoT-based monitoring systems for performance optimization.

- The market is competitive with players such as Cummins, Generac Power Systems, Mitsubishi Heavy Industries, Briggs & Stratton, and Atlas Copco focusing on innovation, fuel efficiency, and strategic partnerships to expand market presence.

- Regionally, North America led with 38% share, followed by Europe at 27% and Asia Pacific at 24%, while Latin America and the Middle East & Africa held 6% and 5% shares, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The > 25 kVA – 50 kVA segment dominated the liquid cooled home standby gensets market in 2024 with 37% share. This range is widely adopted for residential estates and mid-sized homes that require reliable backup power for essential appliances and HVAC systems. Its balance of affordability, efficiency, and capacity makes it the preferred choice for households facing frequent grid outages. Demand is further supported by rising urbanization and an increasing number of power-dependent smart homes. Larger ratings such as > 100 kVA serve luxury residences but represent a smaller share due to higher costs.

- For instance, the Cummins’ QuietConnect™ Series includes liquid-cooled gensets like the more powerful 40kW (50kVA) RS40, which has a noise level of 63 dB at 7 meters with an optional Sound Level 2 enclosure, and the 30kW (38kVA) RS30, which has an even lower noise rating of 60 dB at 7 meters with the same enclosure, making them both suitable for large homes and estates.

By Fuel

The gas-fueled gensets segment led the market in 2024 with 42% share, driven by its cleaner combustion, lower emissions, and cost advantages compared to diesel. Growing natural gas infrastructure and the availability of pipeline connections in urban and suburban areas enhance adoption. Gas gensets are also favored for their lower maintenance needs and quieter operation, making them suitable for residential environments. Diesel units continue to hold a significant share due to their higher reliability in off-grid or rural regions, while “others,” including hybrid solutions, are gaining traction as sustainability concerns rise.

- For instance, a Generac 48 kW liquid-cooled natural gas genset can deliver reliable standby power, with the manufacturer recommending a comprehensive “Schedule A” maintenance every two years or 200 hours of operation, whichever comes first, to ensure a robust energy backup.

By Phase

The single-phase gensets segment accounted for the largest share in 2024 with 54% of the market, reflecting strong demand from households and smaller residential units. These gensets are cost-effective, easier to install, and sufficient to handle typical home loads such as lighting, heating, and appliances. Growing use in suburban and rural homes further supports their dominance. Three-phase gensets, while holding a smaller share, are gaining traction in larger residences and estates requiring higher load capacity. This segment benefits from increasing adoption in premium housing projects where advanced energy reliability is prioritized.

Key Growth Drivers

Rising Power Outages and Grid Instability

Frequent grid failures and increasing power demand are driving the adoption of liquid cooled home standby gensets. Households are investing in reliable backup power systems to ensure uninterrupted operation of appliances, HVAC units, and security systems. Growing urbanization and the need for continuous power in smart homes further boost demand. Climate-related disruptions such as storms and heatwaves are also increasing outage frequency, supporting market growth. The reliability and longer runtime of liquid cooled gensets make them a preferred choice for residential users.

- For instance, the Briggs & Stratton PowerProtect 48 kVA liquid-cooled genset, when connected to a sufficiently sized external liquid propane (LP) supply or natural gas line, can provide continuous backup during prolonged outages caused by severe weather events.

Increasing Adoption in High-End and Smart Homes

The expansion of premium housing and smart homes is fueling genset demand. Liquid cooled units offer higher power output and quieter operation, making them suitable for large residences with advanced energy needs. Rising adoption of home automation, electric vehicle charging, and energy-intensive appliances requires stable backup solutions. Builders and homeowners are integrating gensets as part of energy security strategies. This trend is particularly strong in urban centers, where high-income households prioritize uninterrupted power supply to maintain comfort and convenience.

- For instance, a specific Generac Protector Series 60 kW liquid-cooled standby generator (Model RG06045ANAX) is capable of supporting whole-house loads, including dual HVAC systems and EV charging stations, and operates at a noise level of 68 dBA during its quiet-test self-mode and 72 dBA under normal load.

Advancements in Fuel Efficiency and Technology

Technological improvements in genset design and fuel efficiency are strengthening market growth. Manufacturers are developing models with lower emissions, improved cooling systems, and digital monitoring features for better control. Integration with smart energy management systems enables users to track performance and reduce operational costs. Hybrid solutions combining gas and renewable energy sources are also gaining attention. These advancements not only enhance reliability but also align gensets with sustainability and efficiency goals, ensuring their long-term role in residential power backup solutions.

Key Trends & Opportunities

Shift Toward Cleaner Fuel Options

Gas-powered gensets are gaining momentum due to their lower emissions and quieter operation compared to diesel. The expansion of natural gas infrastructure in urban and suburban areas is boosting adoption. Homeowners are also turning to hybrid gensets that integrate gas with renewable energy to meet environmental goals. This trend provides significant opportunities for manufacturers to expand eco-friendly product lines and capture environmentally conscious consumer segments.

- For instance, a Kirloskar 40 kVA silent diesel genset is designed to meet CPCB IV+ standards, with emissions limits below CPCB IV+ thresholds and noise levels contained within its acoustic enclosure to be less than 75 dB(A) at 1 meter, which is suitable for commercial and industrial zones.

Integration with Smart Energy Systems

Smart monitoring and IoT-enabled gensets are creating new opportunities in residential markets. Features like remote diagnostics, load management, and predictive maintenance enhance user convenience and system reliability. The ability to integrate gensets with home automation systems ensures seamless power backup during outages. This trend aligns with broader digitalization and smart home adoption, positioning gensets as a critical part of energy security in technologically advanced households.

- For instance, Cummins’ Connect Cloud™ app enables remote monitoring of critical operational parameters, providing maintenance notifications and alerts to minimize unplanned downtime in residential deployments. The system assists in ensuring generator readiness and can be used to track performance data, which helps in efficient maintenance planning and extending service life.

Key Challenges

High Installation and Maintenance Costs

Liquid cooled gensets involve higher upfront installation and maintenance costs compared to air-cooled models. These expenses limit adoption among cost-sensitive households, especially in developing regions. While long-term benefits of durability and efficiency are notable, the initial cost barrier continues to hinder penetration in mid- and low-income residential segments.

Noise and Emission Regulations

Strict residential zoning regulations related to noise and emissions present challenges for genset deployment. Despite being quieter than traditional models, liquid cooled gensets must comply with local laws on permissible noise levels and emissions. Meeting these regulatory standards requires additional design investments, which can increase product costs and impact affordability.

Regional Analysis

North America

North America led the liquid cooled home standby gensets market in 2024 with 38% share. The region benefits from frequent weather-related power outages, aging grid infrastructure, and high adoption of smart homes. The United States dominates demand, with rising installation in large residential properties and luxury housing projects. Canada also contributes significantly, supported by investments in reliable home energy systems. Widespread availability of natural gas infrastructure and strong consumer awareness about uninterrupted power supply drive further growth. North America’s emphasis on energy security ensures continued dominance in the global market.

Europe

Europe accounted for 27% share of the liquid cooled home standby gensets market in 2024. Strong adoption is driven by stringent energy security standards, increasing integration of smart energy systems, and rising reliance on home automation. Countries such as Germany, the United Kingdom, and France are leading demand, particularly in urban regions where large homes and estates require reliable backup power. The growing preference for gas-fueled gensets aligns with the EU’s environmental policies targeting reduced emissions. Advancements in quieter and more efficient genset designs further support residential adoption across Europe’s premium housing segment.

Asia Pacific

Asia Pacific held 24% share of the liquid cooled home standby gensets market in 2024. Rapid urbanization, increasing disposable incomes, and rising construction of high-end residences are fueling demand. China and India lead the market, with growing adoption in metropolitan areas where grid instability is common. Japan also contributes significantly, supported by advanced housing infrastructure and strong demand for reliable backup power systems. Expanding natural gas networks and rising awareness of cleaner energy solutions further drive adoption. The region’s fast-growing residential sector positions Asia Pacific as a key growth hub for genset manufacturers.

Latin America

Latin America represented 6% share of the liquid cooled home standby gensets market in 2024. Demand is supported by frequent power outages and rising energy insecurity across Brazil, Mexico, and Argentina. Residential users are increasingly adopting gensets to maintain uninterrupted power in regions with unreliable grids. Growth is also driven by expanding middle-class households investing in larger residences. However, high costs and limited natural gas infrastructure present adoption barriers. Despite these challenges, government efforts to modernize power systems and growing consumer awareness of reliable backup solutions are expected to support steady market growth.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the liquid cooled home standby gensets market in 2024. Growth is driven by rising demand in Gulf countries such as Saudi Arabia and the United Arab Emirates, where high-end residential projects integrate standby gensets for power reliability. South Africa also contributes due to frequent load-shedding and unstable electricity supply. However, affordability challenges and limited natural gas infrastructure restrict broader adoption. Ongoing housing developments, coupled with investments in smart energy systems, are expected to create new opportunities for genset manufacturers in this region.

Market Segmentations:

By Power Rating

- ≤ 25 kVA

- > 25 kVA – 50 kVA

- > 50 kVA – 100 kVA

- > 100kVA

By Fuel

By Phase

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the liquid cooled home standby gensets market is shaped by leading players including Cummins, Kirloskar, Eaton, Briggs & Stratton, Atlas Copco, Ashok Leyland, Generac Power Systems, Mitsubishi Heavy Industries, Multiquip, and Gillette Generators. These companies compete by offering advanced gensets with higher efficiency, lower emissions, and enhanced durability to meet residential energy security needs. Product portfolios are expanding with gas-fueled and hybrid options as sustainability becomes a priority. Integration of smart monitoring systems and IoT-based diagnostics is a key differentiator, enabling users to track performance and optimize fuel usage. Partnerships with distributors and service providers strengthen after-sales networks, ensuring reliability and customer trust. North America remains the stronghold for many global players, while Asia Pacific presents growing opportunities due to rapid urbanization and grid instability. Intense competition encourages continuous R&D investment, focusing on quieter operation, compact designs, and cost-effectiveness to capture demand across premium and large residential properties.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cummins

- Kirloskar

- Eaton

- Briggs & Stratton

- Atlas Copco

- Ashok Leyland

- Generac Power Systems

- MITSUBISHI HEAVY INDUSTRIES

- Multiquip

- Gillette Generators

Recent Developments

- In January 2025, Generac announced its new home standby generator platform (10–28 kW models) including designs that address liquid cooling in future variants; their L/C unit (XG04045) was among awarded products.

- In 2024, Generac announced that it had received a 2024 GOOD DESIGN Award for the XG04045. The company was recognized for its dedication to design and engineering innovation, which focuses on blending form and function to enhance the user experience.

- In 2024, Cummins expanded its QuietConnect™ home standby liquid-cooled generator line, offering models that maintain sound levels at or below 65 dB in typical operation.

- In 2023, Cummins released its T-030 Liquid-Cooled Generator Sets Application Manual, detailing design specifications such as a DFXX generator emitting 5,530 Btu/min (≈ 5.9 MJ/min) of heat.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Fuel, Phase and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for liquid cooled home standby gensets will rise with increasing power outages worldwide.

- Gas-fueled gensets will gain wider adoption as homeowners shift toward cleaner energy sources.

- Integration of IoT and smart monitoring systems will enhance performance and predictive maintenance.

- Premium housing projects and smart homes will drive higher installation of advanced gensets.

- Hybrid models combining natural gas and renewable energy will emerge as attractive solutions.

- North America will maintain dominance due to grid instability and advanced infrastructure.

- Asia Pacific will record the fastest growth, supported by urbanization and expanding residential demand.

- Europe will strengthen adoption with strict emission regulations and energy efficiency policies.

- High installation and maintenance costs will remain a barrier in cost-sensitive markets.

- Competition will intensify as players focus on innovation, compact designs, and quieter operation.

Market Insights

Market Insights