Market Overview

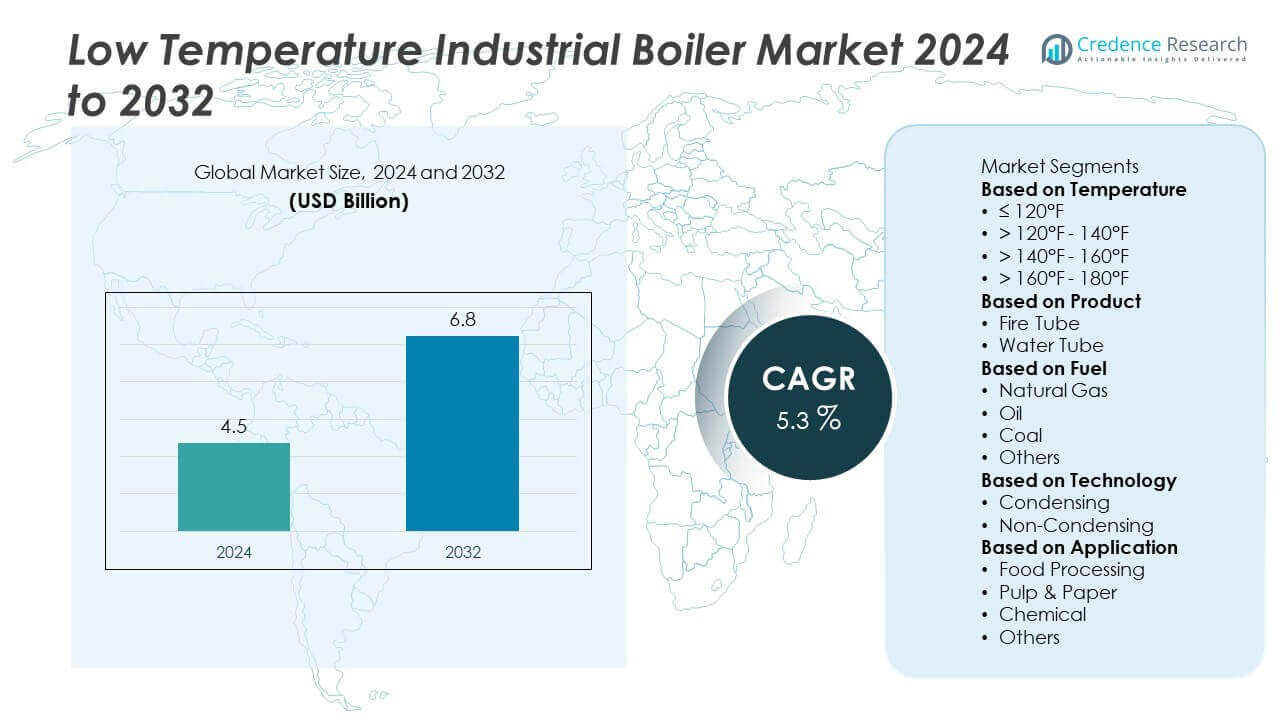

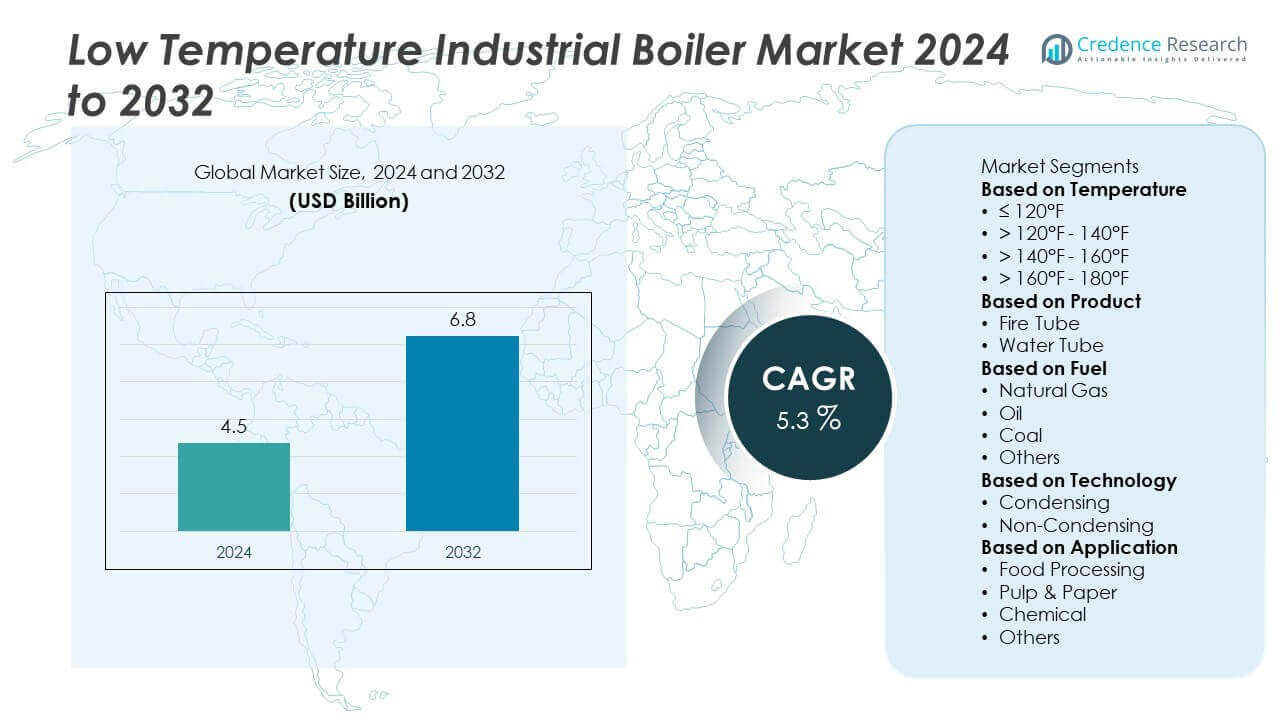

The global Low Temperature Industrial Boiler Market was valued at USD 4.5 billion in 2024. It is projected to reach USD 6.8 billion by 2032, expanding at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Temperature Industrial Boiler Market Size 2024 |

USD 4.5 Billion |

| Low Temperature Industrial Boiler Market, CAGR |

5.3% |

| Low Temperature Industrial Boiler Market Size 2032 |

USD 6.8 Billion |

The low temperature industrial boiler market is led by major players such as Cleaver-Brooks, FERROLI S.p.A, General Electric, Fonderie Sime S.p.A., Doosan Heavy Industries & Construction, Groupe Atlantic, Clayton Industries, FONDITAL S.p.A., Bharat Heavy Electricals Limited, and Babcock and Wilcox Enterprises, Inc. These companies focus on efficiency-driven designs, emission compliance, and integration of advanced monitoring systems to strengthen competitiveness across industries including food processing, chemicals, and textiles. Regionally, North America dominated the market in 2024 with 34% share, supported by strong industrial infrastructure and natural gas adoption. Europe followed with 28% share, driven by strict emission norms and renewable fuel integration, while Asia Pacific accounted for 25% share, propelled by rapid industrialization and expanding manufacturing capacity.

Market Insights

Market Insights

- The global low temperature industrial boiler market was valued at USD 4.5 billion in 2024 and is projected to reach USD 6.8 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

- Key drivers include rising demand from the food and beverage, textile, and chemical sectors, with the >160°F–180°F temperature segment holding 35% share due to its suitability for consistent industrial heating applications.

- Market trends highlight a strong shift toward natural gas and biomass-fueled boilers, supported by energy efficiency initiatives and the integration of smart monitoring technologies for predictive maintenance.

- The market is competitive with leading players such as Cleaver-Brooks, General Electric, Doosan Heavy Industries & Construction, FERROLI S.p.A, and Groupe Atlantic focusing on product innovation, low-emission technologies, and regional expansion strategies.

- Regionally, North America led with 34% share, followed by Europe at 28% and Asia Pacific at 25%, while Latin America and the Middle East & Africa accounted for 7% and 6% shares, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Temperature

The > 160°F – 180°F segment dominated the low temperature industrial boiler market in 2024 with 35% share. This range is widely used in industrial manufacturing, food processing, and chemical plants where consistent medium-to-high heat is required. Demand is driven by its balance between efficiency and operational versatility, making it suitable for multiple industrial processes. The segment also benefits from compliance with stricter emission standards, as manufacturers design boilers that meet energy efficiency norms. Other ranges such as > 140°F – 160°F are growing steadily in applications requiring moderate heating.

- For instance, FERROLI’s Prextherm RSW steel boiler operates efficiently at typical hot water boiler temperatures, with various models in the range handling outputs up to 6,000 kW for large-scale industrial heating.

By Product

The fire tube boilers segment accounted for the largest share in 2024, holding 55% of the market. Their dominance comes from cost efficiency, simple design, and widespread use in small to medium industrial operations. Fire tube boilers are preferred for low-to-medium pressure applications such as textile, food, and paper industries. Easy maintenance and lower installation costs further enhance adoption. Water tube boilers, while holding a smaller share, are gaining traction in industries needing higher efficiency, larger capacity, and faster steam generation for demanding processes.

- For instance, Babcock & Wilcox’s BrightGen™ water tube boiler system can generate over 500,000 pounds of steam per hour at pressures up to 2,400 psi, supporting heavy-duty chemical and refining applications.

By Fuel

The natural gas segment led the market in 2024 with 48% share, driven by its cleaner combustion, lower carbon emissions, and compliance with stringent environmental regulations. Rising global efforts to reduce dependence on coal and oil further support natural gas adoption in industrial boilers. Its cost-effectiveness, operational efficiency, and reliable supply infrastructure in developed economies add to its growth. Oil-fired boilers maintain steady demand in regions lacking natural gas infrastructure, while coal-based systems are declining due to emission concerns. The “others” category, including biomass, is expanding with the push toward renewable energy integration.

Key Growth Drivers

Rising Demand from Food and Beverage Industry

The food and beverage industry is a major driver for low temperature industrial boilers due to their critical role in processing, sterilization, and cleaning applications. The demand is particularly strong in dairy, breweries, and packaged food sectors that require consistent heat at controlled low temperatures. Increasing consumer preference for processed and packaged food globally is boosting production capacities, thereby fueling boiler demand. Energy-efficient models are being adopted to reduce operational costs, making low temperature boilers an essential part of food industry infrastructure.

- For instance, Clayton Industries’ SigmaFire boiler provides steam outputs up to 200 BHP and is widely used in the food and beverage industry, including breweries, to support processes like sterilization.

Stringent Environmental Regulations and Efficiency Needs

Stricter emission norms and efficiency regulations are driving adoption of low temperature industrial boilers across industries. Governments worldwide are pushing industries to replace outdated high-emission systems with eco-friendly and efficient boilers. Natural gas and biomass-fueled systems are seeing higher demand due to their lower environmental footprint. Industries are prioritizing low NOx and CO2 emission technologies to meet compliance while improving operational efficiency. This trend supports investments in advanced low temperature boiler systems that align with sustainability goals.

- For instance, Babcock & Wilcox’s BrightGen hydrogen-compatible boiler system achieves near-zero CO2 emissions while delivering up to 300 MWth of thermal energy, allowing industrial plants to meet EU low-NOx compliance standards.

Expansion of Industrial Manufacturing Sector

Growing industrialization and manufacturing activities worldwide are increasing the need for reliable low-temperature heat solutions. Sectors such as textiles, chemicals, and pulp and paper are adopting low temperature boilers for heating, drying, and process applications. Emerging economies, particularly in Asia Pacific, are witnessing strong infrastructure growth and industrial expansion, boosting demand. The need for flexible, cost-efficient, and scalable heating systems strengthens the role of low temperature boilers. Continuous growth in production output is expected to sustain strong adoption across industrial end-users.

Key Trends & Opportunities

Shift Toward Natural Gas and Renewable Fuels

A major trend is the shift from coal and oil toward natural gas and renewable fuels in low temperature industrial boilers. Natural gas offers cleaner combustion and operational cost benefits, while renewable fuels like biomass align with sustainability and carbon-neutral goals. Industries are increasingly adopting hybrid systems designed for both conventional and renewable fuels to meet long-term energy transition targets. This transition provides opportunities for manufacturers to develop innovative boiler designs that balance performance, efficiency, and compliance with evolving energy policies.

- For instance, Doosan Enerbility, through projects like the Yeongdong Thermal Power Plant Unit 1 conversion, has implemented biomass-fired systems that have significantly reduced CO₂ emissions, with the Yeongdong project alone projected to cut emissions by 860,000 tons annually.

Integration of Smart Monitoring and IoT Solutions

The adoption of IoT-enabled smart boilers is creating new growth opportunities. These systems allow real-time monitoring, predictive maintenance, and energy optimization, reducing downtime and operational costs. Industries with continuous operations, such as chemicals and food processing, benefit from enhanced reliability and efficiency through digitalized boiler systems. Vendors are focusing on integrating advanced control systems and remote diagnostics to provide added value. This trend reflects the broader industrial movement toward digitalization and Industry 4.0, positioning smart low temperature boilers as a strategic investment.

- For instance, Cleaver-Brooks’ Prometha Connected Boiler Solutions platform monitors over 250 data points per boiler in real-time, enabling predictive maintenance that helps extend equipment life and reduce unplanned downtime.

Key Challenges

High Initial Investment and Maintenance Costs

One of the key challenges is the high upfront cost of advanced low temperature industrial boilers. Installation, integration, and compliance with emission norms increase overall expenditure, making it difficult for small and medium industries to adopt. Maintenance and servicing costs also add to the financial burden, particularly in resource-constrained regions. Although long-term savings from energy efficiency are notable, the initial barrier continues to slow adoption among cost-sensitive buyers. Addressing affordability through modular and scalable solutions remains a challenge for manufacturers.

Infrastructure Limitations in Emerging Economies

Infrastructure constraints, particularly limited natural gas networks and inconsistent power supply in developing regions, restrict adoption. Many industries in Latin America, Africa, and parts of Asia still rely on coal or oil-fired boilers due to lack of alternatives. This creates difficulties in transitioning toward cleaner and more efficient low temperature systems. Expanding fuel supply infrastructure and providing cost-effective renewable alternatives will be crucial to overcoming this challenge. Without adequate infrastructure support, market growth in emerging economies will remain below potential.

Regional Analysis

North America

North America accounted for 34% share of the low temperature industrial boiler market in 2024. The region’s dominance is supported by strong industrial infrastructure, high natural gas availability, and strict emission regulations encouraging the adoption of energy-efficient systems. The United States leads with robust demand from the food and beverage, chemical, and paper industries, while Canada contributes with expanding industrial manufacturing and sustainability-focused investments. Technological innovation and integration of smart monitoring solutions are further accelerating adoption. Continued emphasis on efficiency and cleaner fuels positions North America as a leader in this market.

Europe

Europe captured 28% share of the low temperature industrial boiler market in 2024. Demand is driven by stringent EU environmental regulations, which push industries to adopt low-emission and energy-efficient heating solutions. Countries such as Germany, the United Kingdom, and France lead adoption due to well-established manufacturing bases and strong renewable energy integration. Natural gas and biomass-fueled boilers dominate as industries seek to align with decarbonization goals. Continuous advancements in boiler technology, coupled with government incentives for sustainable energy use, are boosting adoption. Europe’s strong regulatory framework ensures steady growth in this sector.

Asia Pacific

Asia Pacific held 25% share of the low temperature industrial boiler market in 2024. The region is experiencing rapid industrialization, especially in China, India, and Southeast Asia, which drives demand in food processing, textiles, and chemicals. Government initiatives to modernize industrial infrastructure and shift toward cleaner fuels further strengthen growth. Rising adoption of natural gas and biomass boilers is observed, although coal remains in use in some areas due to availability. Expanding manufacturing capacity and increasing investments in energy efficiency make Asia Pacific one of the fastest-growing markets for low temperature industrial boilers.

Latin America

Latin America represented 7% share of the low temperature industrial boiler market in 2024. Growth is supported by expanding industrial activities in Brazil, Mexico, and Argentina, particularly in the food processing and chemical sectors. The region is gradually shifting from oil and coal toward natural gas, though infrastructure limitations remain a challenge. Rising energy efficiency standards and investments in cleaner technologies are encouraging adoption. Despite economic constraints in certain countries, the region is expected to witness steady growth as industries modernize production facilities and demand for sustainable heating solutions rises.

Middle East & Africa

The Middle East & Africa accounted for 6% share of the low temperature industrial boiler market in 2024. Growth is driven by rising industrial investments in Gulf countries such as Saudi Arabia and the United Arab Emirates, where modernization projects support adoption of advanced heating systems. South Africa also contributes, with increasing demand from the mining and food processing industries. However, limited natural gas infrastructure and reliance on oil-based systems hinder faster transition. Ongoing industrial diversification efforts and infrastructure expansion are expected to create new opportunities for low temperature boiler adoption in this region.

Market Segmentations:

By Temperature

- ≤ 120°F

- > 120°F – 140°F

- > 140°F – 160°F

- > 160°F – 180°F

By Product

By Fuel

- Natural Gas

- Oil

- Coal

- Others

By Technology

- Condensing

- Non-Condensing

By Application

- Food Processing

- Pulp & Paper

- Chemical

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the low temperature industrial boiler market is shaped by key players including Cleaver-Brooks, FERROLI S.p.A, General Electric, Fonderie Sime S.p.A., Doosan Heavy Industries & Construction, Groupe Atlantic, Clayton Industries, FONDITAL S.p.A., Bharat Heavy Electricals Limited, and Babcock and Wilcox Enterprises, Inc. These companies focus on product innovation, fuel efficiency, and compliance with stringent emission standards to maintain their market positions. Strategies include expanding product portfolios with natural gas and renewable fuel-based boilers, integrating smart monitoring systems, and enhancing service networks to meet diverse industrial needs. Partnerships, acquisitions, and global expansion remain central to strengthening competitiveness. North America and Europe act as strongholds for established players due to strict regulations and advanced manufacturing sectors, while Asia Pacific presents significant growth opportunities driven by rapid industrialization and infrastructure development. Competition is intensifying as manufacturers emphasize sustainability, cost-effectiveness, and technological advancements to cater to industries such as food processing, chemicals, and textiles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cleaver-Brooks

- FERROLI S.p.A

- General Electric

- Fonderie Sime S.p.A.

- Doosan Heavy Industries & Construction

- Groupe Atlantic

- Clayton Industries

- FONDITAL S.p.A.

- Bharat Heavy Electricals Limited

- Babcock and Wilcox Enterprises, Inc.

Recent Developments

- In September 2025, Doosan Enerbility (Doosan group) announced a deal (press release) for a power / boiler systems project.

- In August 2025, Babcock & Wilcox Enterprises reported its Q2 results and highlighted its ongoing combustion and boiler systems work, including low NOx burners.

- In 2025, Cleaver-Brooks enhanced its CBEX-3W firetube boiler with the Prometha® EX technology including an integral burner and economizer.

- In 2025, Fondital promoted its Antea Next boiler designed to run with methane-hydrogen mixtures up to 20%, as part of its next generation heating product line.

Report Coverage

The research report offers an in-depth analysis based on Temperature, Product, Fuel, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient low temperature industrial boilers will continue to rise across industries.

- Natural gas-based boilers will see wider adoption due to cleaner combustion and cost advantages.

- Biomass and renewable fuel integration will expand as industries align with sustainability targets.

- Smart monitoring and IoT-enabled systems will gain traction for predictive maintenance and efficiency.

- The food and beverage industry will remain a key driver for consistent low-temperature heating demand.

- Asia Pacific will record the fastest growth due to rapid industrialization and infrastructure expansion.

- North America and Europe will maintain dominance with strong regulations and advanced industrial bases.

- Manufacturers will invest in compact and modular boiler designs to improve scalability.

- High initial costs and infrastructure limitations will remain major restraints in emerging economies.

- Partnerships, mergers, and acquisitions will intensify competition and strengthen global market presence.

Market Insights

Market Insights