Market Overview

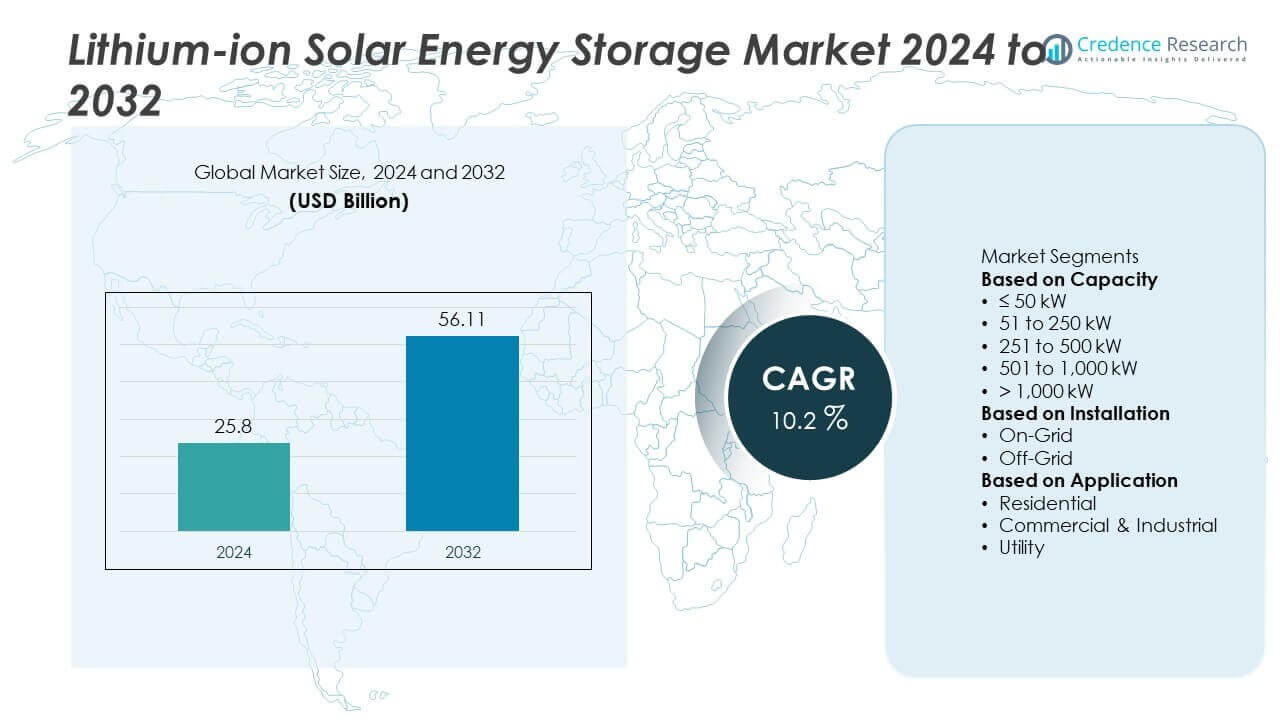

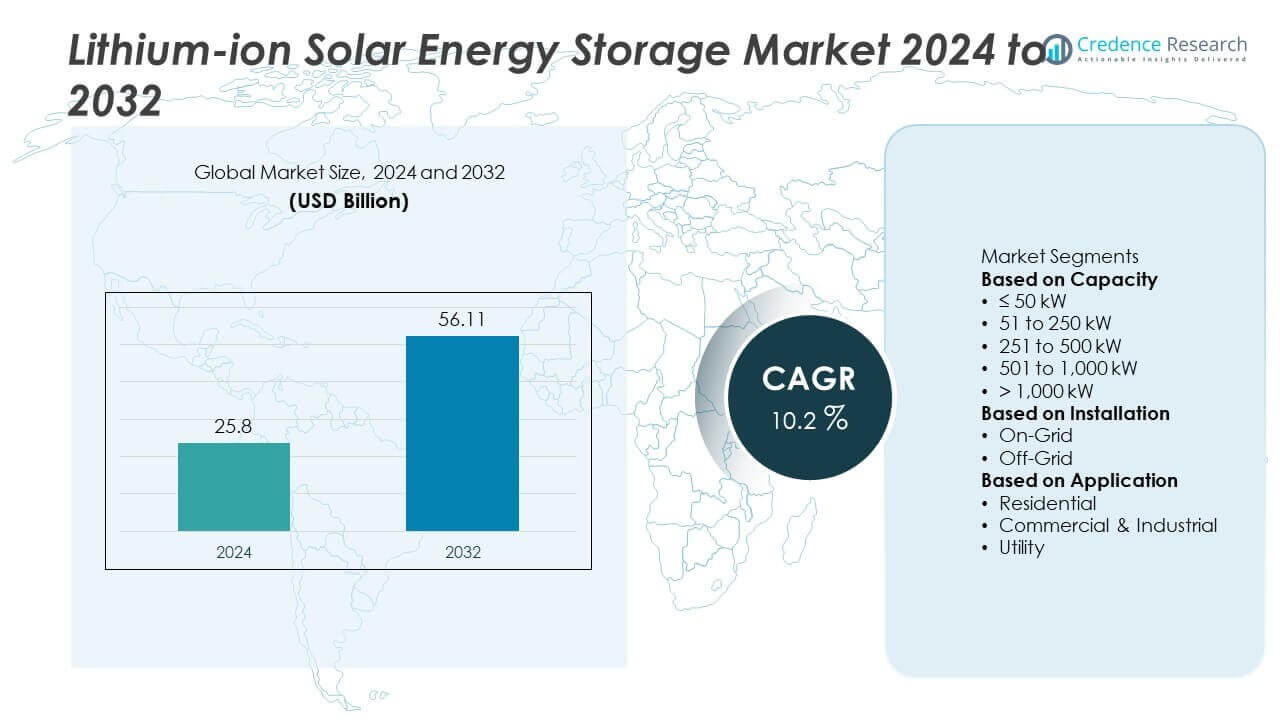

The Lithium-ion Solar Energy Storage Market was valued at USD 25.8 billion in 2024 and is projected to reach USD 56.11 billion by 2032, registering a CAGR of 10.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium-ion Solar Energy Storage Market Size 2024 |

USD 25.8 Billion |

| Lithium-ion Solar Energy Storage Market, CAGR |

10.2% |

| Lithium-ion Solar Energy Storage Market Size 2032 |

USD 56.11 Billion |

The Lithium-ion Solar Energy Storage market is driven by key players including Adara Power, LG Electronics, NextEra Energy, Leclanché SA, Innova Renewables, Saft, ENERSYS, BYD Company, Primus Power, and Maxwell Technologies. These companies focus on enhancing battery efficiency, safety, and scalability to support growing solar adoption across residential, commercial, and utility sectors. North America led the market in 2024 with 36% share, supported by strong renewable investments and advanced grid infrastructure. Europe followed with 28% share, driven by strict decarbonization policies, while Asia Pacific accounted for 24% share, emerging as the fastest-growing region due to large-scale solar deployment and government-backed energy transition initiatives.

Market Insights

Market Insights

- The Lithium-ion Solar Energy Storage market was valued at USD 25.8 billion in 2024 and is projected to reach USD 56.11 billion by 2032, growing at a CAGR of 10.2%.

- Rising renewable integration and supportive government incentives are driving adoption, as lithium-ion storage provides reliable backup, peak load management, and enhanced solar utilization across applications.

- Market trends highlight the expansion of smart grids, rising residential solar adoption, and technological improvements in battery efficiency and safety, boosting long-term demand.

- The competitive landscape includes players such as Adara Power, LG Electronics, NextEra Energy, Leclanché SA, Saft, ENERSYS, BYD Company, Primus Power, Maxwell Technologies, and Innova Renewables, focusing on innovation, large-scale projects, and partnerships.

- Regionally, North America led with 36% share in 2024, followed by Europe at 28% and Asia Pacific at 24%, while the 51 to 250 kW capacity segment held 32% share, reflecting strong demand in commercial and mid-scale projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

In 2024, the 51 to 250 kW segment dominated the Lithium-ion Solar Energy Storage market, holding around 32% share. This range is favored for small to mid-scale projects, balancing cost-efficiency with reliable energy output. Its adoption is strong in commercial facilities, educational institutions, and community-level solar projects. The segment benefits from government incentives and the growing demand for sustainable backup power. As businesses and small industries aim to lower electricity costs and ensure energy reliability, the 51 to 250 kW capacity segment continues to lead market deployment.

- For instance, Tesla’s Powerpack system delivered modular storage units, with the second generation (Powerpack 2) offering capacities such as 200 kWh, 210 kWh for a specific duration, or a 232 kWh version released later, with the Powerpack 2 featuring a newly developed integrated inverter.

By Installation

The On-grid installation segment accounted for the largest share at 68% in 2024. This dominance comes from its ability to provide reliable energy storage while maintaining grid connectivity for stability and power trade. On-grid systems are widely used in urban and industrial setups, where uninterrupted supply is critical. Growing adoption of smart grids and net metering policies also boosts demand. The segment’s strong performance is reinforced by supportive regulations and the rising integration of renewables into existing power infrastructure, making on-grid storage the leading installation type.

- For instance, LG Energy Solution has deployed more than 400 MWh of lithium-ion battery storage solutions integrated with grid systems globally, supporting grid frequency regulation and distributed energy resource management capabilities in urban industrial environments.

By Application

The Utility segment led the market in 2024 with a 47% share, driven by large-scale renewable integration projects. Utilities adopt lithium-ion solar storage to balance load, stabilize grid fluctuations, and enhance renewable energy penetration. Governments and private players invest in large-scale projects to meet clean energy targets, particularly in regions with aggressive decarbonization goals. The scalability and efficiency of lithium-ion batteries make them the preferred choice for grid applications. With rising demand for energy storage to support peak load management, the utility segment remains the largest contributor to market growth.

Key Growth Drivers

Rising Renewable Energy Integration

The increasing penetration of solar power is a major driver for the lithium-ion solar energy storage market. Governments and utilities are investing in large-scale renewable projects to meet clean energy targets. Lithium-ion systems enable efficient storage of excess solar energy, supporting grid stability and reducing reliance on fossil fuels. Their fast response and high energy density make them ideal for balancing demand fluctuations. As solar capacity expands globally, demand for advanced storage technologies will continue to rise, positioning lithium-ion solutions as a core enabler of renewable adoption.

- For instance, Arevon Energy advanced over 3.2 GW of solar-plus-storage projects in 2024, including the landmark Eland project with 758 MW solar power paired with 300 MW/1,200 MWh energy storage, significantly enhancing grid flexibility for tens of thousands of homes across the U.S.

Declining Battery Costs

Continuous technological advancements and economies of scale are driving down lithium-ion battery costs, fueling adoption in solar energy storage. Mass production for electric vehicles has contributed to price reductions, making systems more accessible across residential, commercial, and utility sectors. Lower costs improve return on investment for solar-plus-storage projects, encouraging wider installations. This trend supports the deployment of decentralized power solutions in both developed and emerging markets. The affordability of lithium-ion batteries remains a crucial factor driving the market’s expansion.

- For instance, Tata Power Solar, in addition to its existing 530 MW solar cell and 682 MW module facility in Bengaluru, commenced production in 2024 at a new 4.3 GW solar cell and module plant in Tirunelveli, Tamil Nadu, to support cost-effective, scalable solar energy solutions in India.

Government Policies and Incentives

Supportive government initiatives significantly drive growth in the lithium-ion solar energy storage market. Incentives such as subsidies, tax credits, and net metering policies promote adoption across residential and commercial applications. National targets for renewable integration and decarbonization create strong demand for efficient storage solutions. Additionally, funding for grid modernization projects encourages utilities to integrate lithium-ion systems for enhanced stability and reliability. These favorable policies not only reduce upfront costs but also accelerate investment, making government support a central factor in driving sustained market expansion.

Key Trends & Opportunities

Adoption of Smart Grid and Microgrids

The expansion of smart grids and microgrids creates new opportunities for lithium-ion solar energy storage. Smart grids rely on advanced storage to balance distributed renewable generation, manage peak loads, and ensure grid stability. Microgrids, especially in remote and off-grid regions, increasingly deploy lithium-ion systems for reliable and sustainable power. These applications provide resilience against outages and reduce dependency on diesel generators. As global investment in grid modernization grows, lithium-ion storage will play a central role in enabling flexible, intelligent, and resilient energy infrastructure.

- For instance, in 2024, Schneider Electric launched new all-in-one Battery Energy Storage Systems (BESS) for microgrids and expanded the deployment of its smart grid solutions across various projects globally, integrating renewable energy and improving grid stability

Rising Residential Adoption

Residential applications are emerging as a strong opportunity, supported by the rise of rooftop solar and net metering policies. Homeowners are increasingly adopting lithium-ion storage to reduce electricity bills, ensure backup power, and achieve energy independence. Advancements in compact and scalable systems enhance affordability and convenience for households. With growing awareness of clean energy solutions and government incentives for residential solar adoption, the demand for home-based lithium-ion storage is expected to rise significantly. This trend positions residential adoption as a key growth avenue in the market.

- For instance, as of late 2024, Sonnen had installed over 100,000 energy storage systems cumulatively as part of its global “sonnenCommunity”. The modular nature of these systems allows for a range of capacities, including popular 10 kWh units, which provide backup power and help reduce grid reliance for thousands of households.

Key Challenges

Supply Chain Constraints

The lithium-ion solar energy storage market faces challenges from raw material supply chain constraints. Critical minerals like lithium, cobalt, and nickel face limited availability and volatile pricing, which impacts battery production costs. Geopolitical risks and concentrated mining operations in select regions increase vulnerabilities. Supply chain disruptions can delay projects and raise investment risks. To mitigate these challenges, companies are investing in recycling technologies and alternative chemistries, but dependency on critical minerals remains a barrier to scaling storage solutions.

Safety and Performance Concerns

Safety issues such as thermal runaway, overheating, and fire risks remain significant challenges for lithium-ion storage adoption. These risks create hesitation among utilities and residential users, particularly in high-temperature regions. Additionally, performance degradation over repeated charge-discharge cycles raises concerns about long-term reliability. Addressing these issues requires continuous innovation in battery design, improved cooling systems, and advanced monitoring technologies. Without adequate safety assurances, adoption in critical infrastructure and residential settings may face resistance, slowing overall market penetration despite strong demand.

Regional Analysis

North America

North America led the Lithium-ion Solar Energy Storage market in 2024, holding 36% share. The region’s dominance is supported by strong renewable energy investments, widespread solar adoption, and advanced grid infrastructure. The U.S. spearheads growth with large-scale utility projects and supportive tax credits, while Canada follows with clean energy policies. Growing demand for backup power in residential and commercial sectors further drives adoption. The presence of leading storage technology providers and favorable regulatory frameworks ensures North America maintains its leadership, with continued expansion in both on-grid and off-grid installations.

Europe

Europe accounted for 28% share of the Lithium-ion Solar Energy Storage market in 2024, driven by ambitious decarbonization goals and strict renewable energy targets under the EU Green Deal. Countries like Germany, the UK, and France lead in solar-plus-storage installations, supported by government subsidies and grid modernization programs. The region emphasizes energy independence and resilience, particularly in response to rising energy costs and geopolitical uncertainties. Strong demand from residential and commercial sectors, coupled with integration into smart grids, reinforces Europe’s position as a key market for lithium-ion solar energy storage solutions.

Asia Pacific

Asia Pacific captured 24% share of the Lithium-ion Solar Energy Storage market in 2024, making it the fastest-growing region. Growth is fueled by large-scale solar deployments in China, India, and Japan, supported by government-led renewable energy initiatives. Expanding adoption among SMEs and residential users, along with urban electrification projects, strengthens demand. The region also benefits from the presence of major battery manufacturers, ensuring technological innovation and competitive pricing. Rapid industrialization, increasing electricity demand, and supportive clean energy policies position Asia Pacific as a major hub for future solar energy storage development.

Latin America

Latin America represented 7% share of the Lithium-ion Solar Energy Storage market in 2024, with Brazil and Mexico driving most of the demand. The region is experiencing rising adoption of solar-plus-storage systems to support remote communities, reduce grid instability, and expand renewable energy penetration. Government programs encouraging solar installations, alongside growing commercial investments, are boosting deployment. However, challenges such as high upfront costs and limited financing options constrain broader adoption. Despite these barriers, increasing demand for clean energy independence and off-grid solutions continues to strengthen market opportunities across Latin America.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the Lithium-ion Solar Energy Storage market in 2024. Growth is led by the UAE and Saudi Arabia, which are investing heavily in solar power as part of their energy diversification strategies. Large-scale solar parks, coupled with smart city projects, drive adoption in the region. In Africa, off-grid and rural electrification initiatives fuel demand for solar storage systems, addressing energy access gaps. Although market penetration remains lower compared to other regions, rising infrastructure investment and government-backed renewable programs are expected to accelerate adoption.

Market Segmentations:

By Capacity

- ≤ 50 kW

- 51 to 250 kW

- 251 to 500 kW

- 501 to 1,000 kW

- > 1,000 kW

By Installation

By Application

- Residential

- Commercial & Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Lithium-ion Solar Energy Storage market is shaped by leading players such as Adara Power, LG Electronics, NextEra Energy, Leclanché SA, Innova Renewables, Saft, ENERSYS, BYD Company, Primus Power, and Maxwell Technologies. These companies focus on advancing lithium-ion technology to deliver high-efficiency, durable, and scalable storage solutions. Strategies include investments in large-scale utility projects, partnerships with solar developers, and expansion into residential and commercial segments. Vendors are also enhancing performance through improved battery chemistries, extended lifecycles, and safety innovations. Growing emphasis on integrating storage with smart grids and renewable infrastructure further drives competition. Players actively pursue acquisitions and joint ventures to strengthen global reach, while some invest in recycling and second-life battery programs to address sustainability concerns. With governments pushing renewable energy adoption and energy security, competition intensifies as companies position themselves to meet rising demand across both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Adara Power

- LG Electronics

- NextEra Energy

- Leclanché SA

- Innova Renewables

- Saft

- ENERSYS

- BYD Company

- Primus Power

- Maxwell Technologies

Recent Developments

- In July 2025, LG Energy Solution revealed plans to commercialize lithium metal batteries (for small to large systems) by late 2027, which could disrupt storage markets.

- In June 2025, LG Electronics / LG Energy Solution opened a large factory in Holland, Michigan, to produce lithium iron phosphate (LFP) battery cells for grid-scale storage, with capacity up to 16.5 GWh per year.

- In 2025, NextEra Energy does have a robust backlog and a commitment to developing 36.5 GW to 46.5 GW of such projects over 2024-2027, with 27.7 GW already in its signed contract backlog

- In December 2024, LG Energy Solution Vertech secured a 7.5 GWh integrated energy storage project agreement in the U.S., meeting domestic content requirements.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Installation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing reliance on renewable energy storage solutions.

- Lithium-ion batteries will remain the preferred choice due to high energy density and efficiency.

- Utility-scale projects will drive significant demand as grids integrate more solar capacity.

- Residential adoption will grow with rising rooftop solar installations and net metering policies.

- Advances in battery chemistry will improve safety, lifecycle, and storage performance.

- Recycling and second-life battery programs will gain traction to address sustainability concerns.

- Governments will continue supporting adoption through subsidies, incentives, and decarbonization policies.

- Asia Pacific will emerge as the fastest-growing region with large-scale solar deployment.

- Partnerships between solar developers and battery manufacturers will expand market opportunities.

- Off-grid and microgrid applications will grow in developing regions to improve energy access.

Market Insights

Market Insights