Market Overview

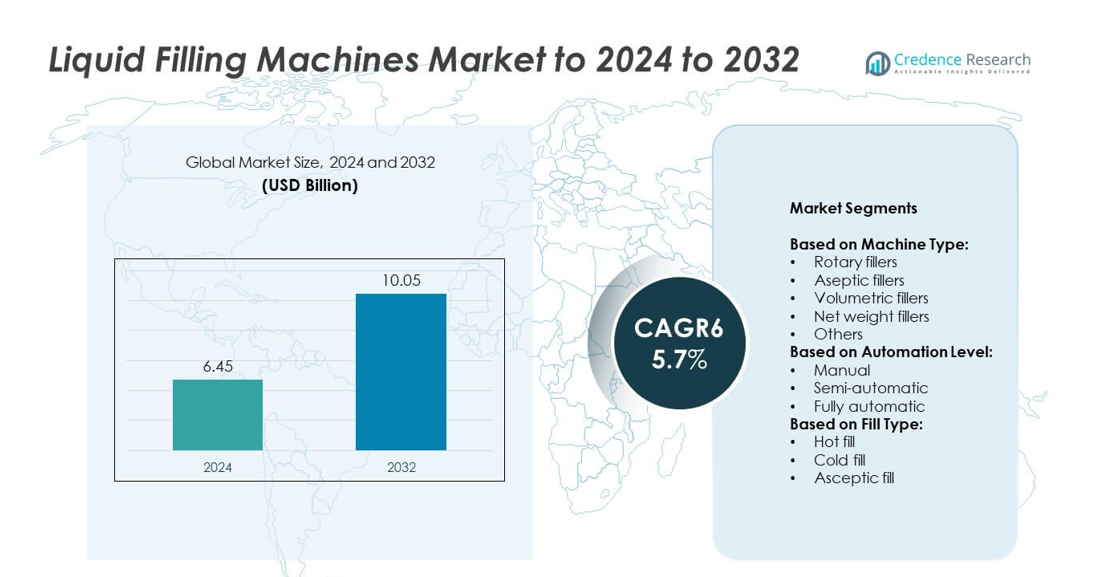

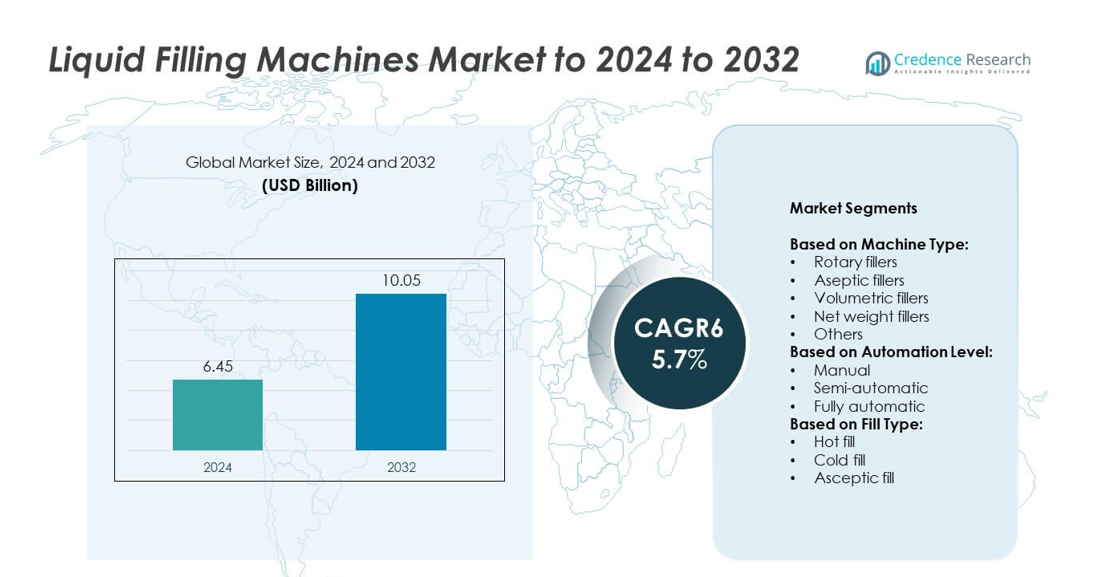

The Liquid Filling Machines Market size was valued at USD 6.45 billion in 2024 and is anticipated to reach USD 10.05 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Filling Machines Market Size 2024 |

USD 6.45 billion |

| Liquid Filling Machines Market, CAGR |

5.7% |

| Liquid Filling Machines Market Size 2032 |

USD 10.05 billion |

The liquid filling machines market is shaped by leading players such as Krones, GEA Group, Tetra Pak International, KHS, Sidel Group, Coesia, ProMach, Serac Group, Ronchi Mario, Trepko Group, Weightpack, Inline Filling Systems, JBT Corporation, and E-PAK Machinery. These companies focus on automation, aseptic technologies, and energy-efficient solutions to strengthen their positions in global markets. Asia Pacific emerged as the dominant region, holding 32% of the market share in 2024, driven by rapid industrialization and strong demand from food, beverage, and pharmaceutical sectors. North America followed with 28%, supported by advanced automation adoption, while Europe contributed 25% through stringent regulatory standards and technological expertise.

Market Insights

- The liquid filling machines market was valued at USD 6.45 billion in 2024 and is projected to reach USD 10.05 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

- Rising demand from food and beverage industries, coupled with growth in pharmaceuticals, is driving adoption of automated and aseptic filling technologies across global markets.

- Market trends highlight a shift toward fully automatic machines, integration of IoT and Industry 4.0, and development of sustainable, energy-efficient solutions catering to environmental standards.

- The competitive landscape is defined by global players focusing on innovation, mergers, and partnerships, aiming to expand portfolios and strengthen positions across packaging and healthcare industries.

- Asia Pacific leads with 32% market share in 2024, followed by North America at 28% and Europe at 25%, while Latin America holds 8% and the Middle East and Africa account for 7%, showcasing balanced but region-specific growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Machine Type

Rotary fillers dominated the liquid filling machines market in 2024, accounting for nearly 35% share. Their popularity stems from high-speed operations, precision filling, and adaptability across industries such as food, beverage, and pharmaceuticals. Aseptic fillers are growing steadily due to increasing demand for sterile packaging in dairy and healthcare sectors. Volumetric and net weight fillers are preferred for cost efficiency and accurate dosing, particularly in chemicals and cosmetics. The dominance of rotary fillers is driven by automation compatibility, reduced downtime, and ability to handle varied container sizes efficiently.

- For instance, a Krones brochure mentions outputs of up to 78,000 containers per hour for other Modulfill models, and describes a Modulfill VFS-C reaching 72,000 containers per hour for CSD.

By Automation Level

Fully automatic machines held the largest share of more than 55% in 2024, reflecting rising adoption of Industry 4.0 practices. These systems are widely used in large-scale beverage and pharmaceutical plants for faster throughput and minimal human error. Semi-automatic fillers remain significant in mid-sized enterprises, offering a balance of efficiency and affordability. Manual machines are gradually declining but remain viable for small businesses and niche production lines. The dominance of fully automatic fillers is fueled by labor cost reduction, productivity enhancement, and consistent demand from high-volume packaging operations.

- For instance, Filamatic DAB-5 achieves up to 70 bottles/minute with two nozzles.

By Fill Type

Hot fill technology led the market in 2024 with approximately 40% share, widely applied in juices, sauces, and ready-to-drink beverages requiring microbial stability. Cold fill systems are gaining traction in bottled water and carbonated soft drinks due to energy efficiency and cost savings. Aseptic fill continues to expand rapidly in pharmaceuticals and dairy products, ensuring sterility and longer shelf life. The dominance of hot fill is supported by strong demand for packaged foods and beverages in emerging markets, coupled with technological improvements in sealing and contamination prevention.

Key Growth Drivers

Rising Demand from Food and Beverage Industry

The food and beverage sector is the largest consumer of liquid filling machines, driving substantial market growth. Increasing consumption of packaged drinks, sauces, and dairy products fuels higher adoption of efficient fillers. Manufacturers prefer advanced rotary and hot fill systems for speed, hygiene, and extended shelf life. The rising trend of ready-to-drink beverages, coupled with urban lifestyle shifts, further strengthens demand. This segment remains the key growth driver as global beverage brands invest in modern, automated filling lines to scale production and ensure consistent quality.

- For instance, Nestlé plans to boost cereal beverage production by ~15 % at its Avanca plant via a €30 million machinery upgrade.

Advancements in Automation and Industry 4.0

The integration of automation, robotics, and smart monitoring systems enhances efficiency in liquid filling operations. Fully automatic machines dominate due to their capability to reduce human error and optimize production cycles. Industry 4.0 features like IoT-enabled sensors and predictive maintenance are increasingly deployed to improve uptime. The need for scalability in large production facilities boosts demand for advanced filling lines. This driver is critical as manufacturers aim to achieve cost savings, higher productivity, and real-time quality monitoring, pushing automation as a central growth enabler in the market.

- For instance, SIG’s CFA 812 filling machine at a Nestlé plant achieved 94 % technical line efficiency with <0.2 % average loss.

Expansion of Pharmaceutical and Healthcare Applications

Pharmaceuticals and healthcare are adopting aseptic fillers at a rapid pace to ensure sterility and precision. Growth in liquid drugs, vaccines, and nutraceuticals has created strong demand for advanced filling machines. Compliance with stringent regulations encourages companies to invest in high-quality, contamination-free systems. The pandemic accelerated these investments, particularly in sterile packaging solutions. This expansion is a key growth driver, as manufacturers focus on safety, traceability, and efficiency. Long-term growth is expected as biologics, intravenous solutions, and nutraceutical products continue to see rising global consumption.

Key Trends and Opportunities

Shift Toward Sustainable and Energy-Efficient Solutions

Sustainability is a major trend shaping the liquid filling machines market, with manufacturers investing in energy-efficient and eco-friendly systems. Companies are adopting machines that minimize water use, reduce power consumption, and support recyclable packaging materials. This aligns with global initiatives on carbon neutrality and circular economy practices. Opportunities are rising for suppliers who innovate with green technologies and low-waste processes. The focus on sustainability presents strong growth potential, making it a key trend and opportunity that appeals to environmentally conscious brands and regulatory bodies worldwide.

- For instance, SIG’s alu-free barrier packs are compatible with high-speed filling lines capable of producing up to 15,000 packs per hour for multi-serve formats. A May 2025 press release from SIG noted that since 2023, over 300 million single-serve alu-free full-barrier packs had been sold in China.

Rising Demand for Customization and Flexible Filling Systems

Manufacturers increasingly demand flexible liquid filling machines capable of handling multiple container shapes and sizes. The growing variety of consumer products, from premium beverages to personal care items, drives this trend. Machines with modular designs and quick-change features gain preference for enhancing operational agility. This creates opportunities for equipment makers offering highly adaptable solutions. The trend highlights an industry shift toward versatile filling technologies, catering to frequent product launches and diversified portfolios. Such flexibility forms a key trend and opportunity, particularly for competitive consumer-driven markets.

- For instance, Romaco’s Oftalmica reaches 12,000 bottles/hour with up to 8 dosing pumps and plug-and-play format parts.

Key Challenges

High Initial Investment and Maintenance Costs

One of the key challenges for the liquid filling machines market is the significant upfront investment required. Fully automatic and aseptic filling systems involve high purchase costs, installation expenses, and ongoing maintenance needs. Small and medium-scale manufacturers often hesitate to adopt advanced machines due to these financial constraints. Additionally, specialized technicians are required for servicing and upkeep, adding to operational costs. This challenge restrains adoption among cost-sensitive businesses, particularly in emerging markets, and slows down market penetration despite the efficiency benefits of modern filling systems.

Stringent Regulatory Compliance and Operational Complexity

Compliance with strict hygiene, safety, and packaging standards poses another key challenge for manufacturers. In sectors like pharmaceuticals and food, companies must meet global regulations such as FDA, GMP, and EU directives. Operating advanced aseptic systems also requires skilled labor, extensive training, and careful monitoring, which complicates adoption. The complexity of handling sterile environments can slow production and increase error risks if not managed properly. These regulatory and operational hurdles limit the pace of adoption, particularly for small enterprises lacking resources to invest in compliance-ready technologies.

Regional Analysis

North America

North America accounted for 28% of the liquid filling machines market share in 2024, driven by strong demand from the food, beverage, and pharmaceutical industries. The United States leads regional adoption, supported by high investments in automation and advanced packaging technologies. Regulatory requirements for safety and hygiene further push companies toward aseptic and fully automatic fillers. Growing demand for ready-to-drink beverages and personalized healthcare products also contributes to steady growth. The region’s mature industrial base, combined with ongoing technological innovation, ensures sustained adoption of high-speed, energy-efficient filling systems across multiple industries.

Europe

Europe held 25% of the global market share in 2024, supported by robust pharmaceutical, food, and dairy industries. Germany, France, and Italy remain key contributors, driven by advanced packaging machinery expertise and high-quality standards. Stringent EU regulations on safety and environmental sustainability encourage adoption of aseptic and eco-friendly filling technologies. Demand for automation and flexible filling solutions continues to rise, especially in beverage and cosmetics segments. With strong focus on efficiency and compliance, Europe maintains a leading role in the adoption of advanced liquid filling systems, ensuring consistent market growth through modernization.

Asia Pacific

Asia Pacific dominated the market with 32% share in 2024, making it the largest regional market. Rapid industrialization, expanding food and beverage consumption, and growing pharmaceutical production drive strong demand. China and India lead regional adoption due to large-scale manufacturing, while Japan and South Korea invest in advanced technologies. Rising disposable incomes and increasing consumption of packaged products fuel long-term growth. Additionally, government support for automation in manufacturing boosts adoption of fully automatic machines. Asia Pacific’s cost advantages, coupled with growing end-user industries, position the region as the primary growth hub in this market.

Latin America

Latin America captured 8% of the liquid filling machines market share in 2024, driven mainly by Brazil and Mexico. Rising demand for packaged beverages, cosmetics, and pharmaceuticals supports steady adoption of advanced filling technologies. However, the region faces challenges such as fluctuating economic conditions and limited automation investments. Despite these hurdles, multinational food and beverage companies continue to expand operations, creating opportunities for machine suppliers. Growing middle-class consumption and urbanization trends further support demand. Latin America’s gradual move toward semi-automatic and fully automatic fillers reflects an ongoing modernization of packaging infrastructure in key industries.

Middle East and Africa

The Middle East and Africa accounted for 7% of the global market share in 2024, reflecting emerging opportunities. Demand is supported by growing food and beverage processing industries, particularly in the Gulf countries and South Africa. Expanding pharmaceutical investments in sterile packaging also contribute to regional growth. However, limited local manufacturing capacity and high import dependency slow adoption of advanced systems. The region shows rising interest in automation to improve efficiency and hygiene standards. With increasing urbanization and consumer demand for packaged goods, MEA presents gradual but promising growth opportunities for liquid filling machines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Machine Type:

- Rotary fillers

- Aseptic fillers

- Volumetric fillers

- Net weight fillers

- Others

By Automation Level:

- Manual

- Semi-automatic

- Fully automatic

By Fill Type:

- Hot fill

- Cold fill

- Asceptic fill

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Inline Filling Systems, Ronchi Mario, Coesia, Serac Group, JBT Corporation, E-PAK Machinery, KHS, Weightpack, Sidel Group, Krones, ProMach, Tetra Pak International, Trepko Group, and GEA Group are among the prominent players shaping the competitive landscape of the liquid filling machines market. The market is highly competitive, with companies focusing on automation, precision, and efficiency to strengthen their market positions. Advanced technologies, including IoT-enabled monitoring, aseptic filling, and energy-efficient systems, are increasingly integrated into product portfolios to meet evolving industry standards. Strategic initiatives such as mergers, acquisitions, and partnerships with beverage, food, and pharmaceutical manufacturers are common, enabling suppliers to expand global reach and address specialized customer requirements. Continuous investment in research and development remains a central strategy, particularly to enhance flexibility, improve hygiene compliance, and reduce operating costs. Intense rivalry among established manufacturers ensures ongoing innovation, while growing demand from emerging markets creates opportunities for expansion and competitive differentiation.

Key Player Analysis

- Inline Filling Systems

- Ronchi Mario

- Coesia

- Serac Group

- JBT Corporation

- E-PAK Machinery

- KHS

- Weightpack

- Sidel Group

- Krones

- ProMach

- Tetra Pak International

- Trepko Group

- GEA Group

Recent Developments

- In 2025, Sidel Delivered three new high-speed aseptic complete lines to Chinese beverage company CR Beverage to boost production of sensitive products and meet market demand.

- In 2025, Krones AG Introduced Ingeniq, a data-based and fully automated line system for filling still water into PET containers.

- In 2023, Tetra Pak Collaborated with Lactogal to launch an aseptic carton with a paper-based barrier, replacing the traditional aluminum layer

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Automation Level, Fill Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with expanding applications in food, beverage, and pharmaceuticals.

- Fully automatic machines will lead adoption as industries prioritize speed and accuracy.

- Aseptic filling solutions will gain traction due to stricter hygiene and safety regulations.

- Demand for sustainable and energy-efficient technologies will influence machine design and innovation.

- Asia Pacific will remain the largest regional market, supported by manufacturing and consumption growth.

- Flexible and modular filling systems will see higher demand for diverse packaging needs.

- Integration of digital technologies like IoT and AI will improve operational efficiency.

- Emerging economies will increasingly adopt semi-automatic machines to modernize production processes.

- Strategic collaborations and partnerships will expand the global footprint of key manufacturers.

- High costs and regulatory pressures will challenge adoption but drive further innovation.