Market Overview

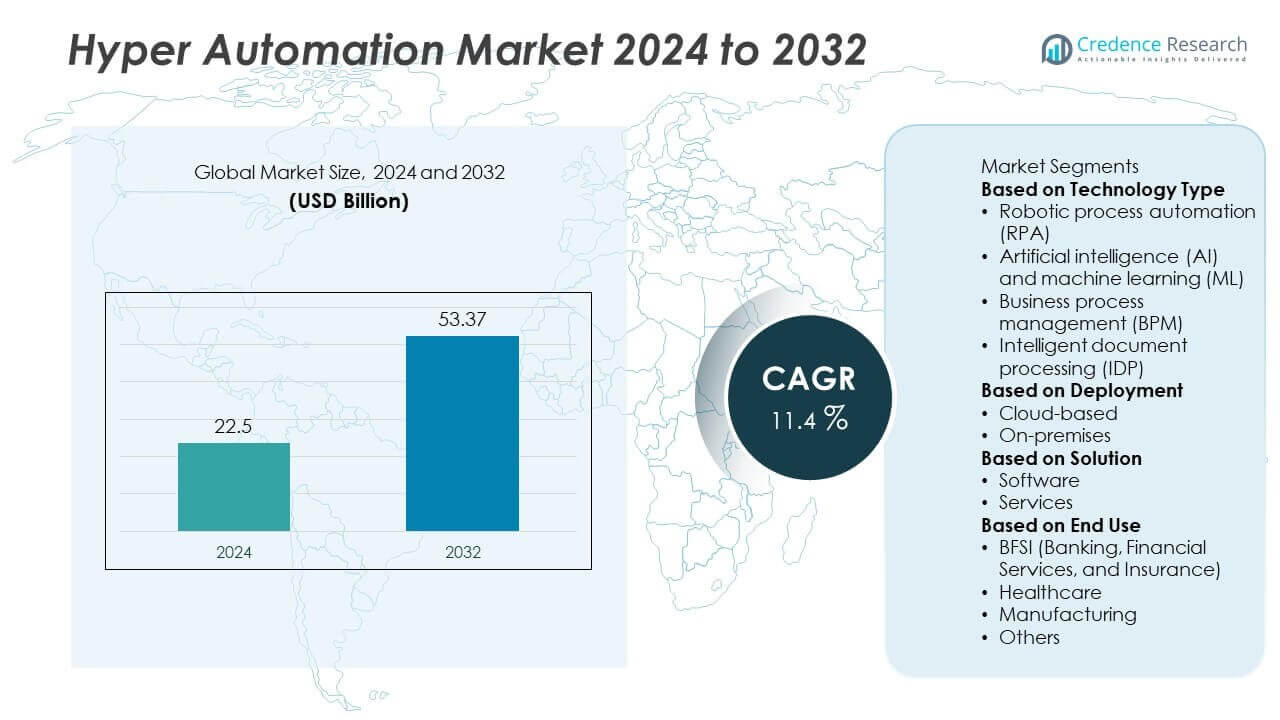

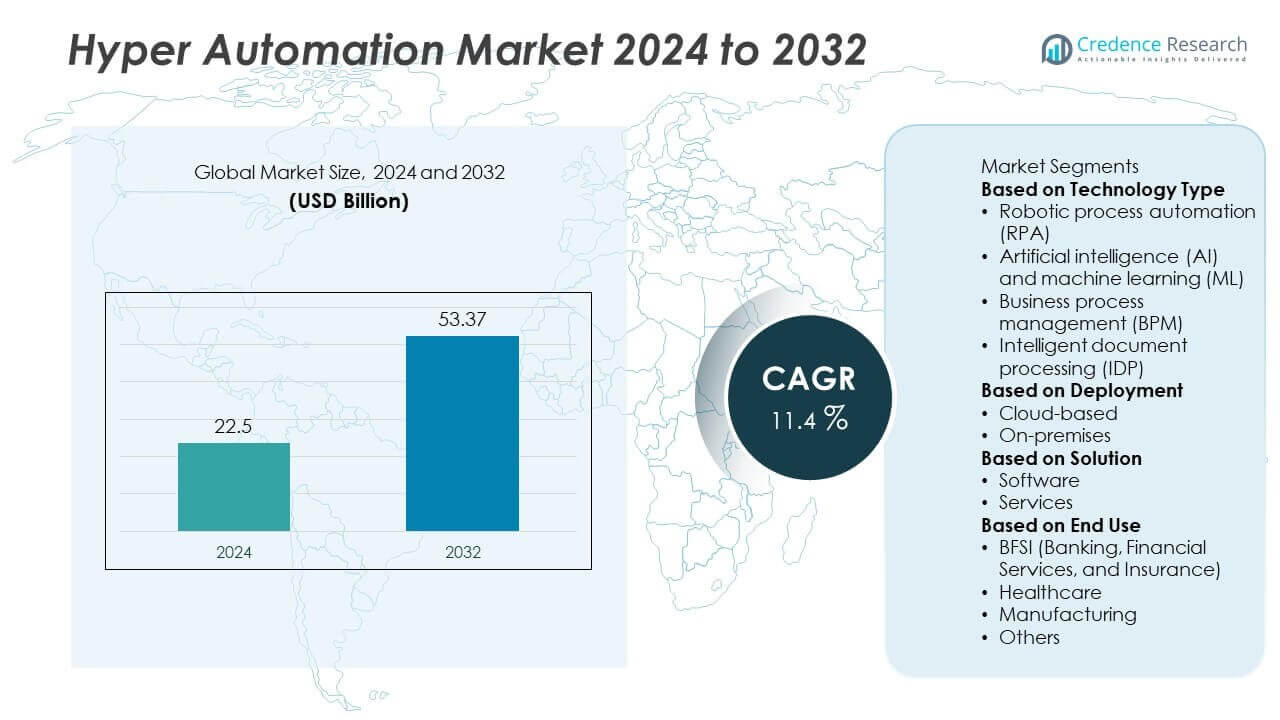

The Hyper Automation Market was valued at USD 22.5 billion in 2024 and is projected to reach USD 53.37 billion by 2032, expanding at a CAGR of 11.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hyper Automation Market Size 2024 |

USD 22.5 Billion |

| Hyper Automation Market, CAGR |

11.4% |

| Hyper Automation Market Size 2032 |

USD 53.37 Billion |

The hyper automation market is driven by top players including UiPath, Oracle, TCS, ServiceNow, Microsoft Corporation, Honeywell International, SAP SE, WorkFusion, Google, and Automation Anywhere. These companies lead through AI-powered platforms, robotic process automation (RPA), and cloud-based solutions that support enterprise-wide digital transformation. They focus on strengthening product portfolios, investing in innovation, and forming strategic partnerships across key industries such as banking, healthcare, and manufacturing. Regionally, North America held the largest share at 36% in 2024, followed by Europe with 28% share, while Asia-Pacific captured 25% share, emerging as the fastest-growing market due to rapid industrial and digital advancements.

Market Insights

Market Insights

- The hyper automation market was valued at USD 22.5 billion in 2024 and is projected to reach USD 53.37 billion by 2032, expanding at a CAGR of 11.4% during the forecast period.

- Rising demand for operational efficiency and regulatory compliance drives adoption, with robotic process automation (RPA) leading by holding 38% share in 2024.

- Key trends include growing integration of AI and intelligent document processing (IDP), alongside rapid adoption of cloud-based platforms, which accounted for 62% share in deployment.

- The market is highly competitive with major players such as UiPath, Microsoft, Oracle, SAP SE, ServiceNow, Google, Honeywell International, Automation Anywhere, WorkFusion, and TCS, focusing on innovation and global expansion.

- Regionally, North America led with 36% share, followed by Europe at 28%, while Asia-Pacific accounted for 25% share and is expected to record the fastest growth, with Latin America and Middle East & Africa holding 6% and 5% shares respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology Type

Robotic process automation (RPA) dominated the hyper automation market in 2024, holding 38% share. Its leadership is driven by widespread adoption in banking, financial services, insurance, and healthcare sectors for automating repetitive tasks and reducing manual errors. Enterprises increasingly deploy RPA to enhance workforce productivity and improve compliance with minimal cost. The integration of RPA with artificial intelligence and machine learning further enhances decision-making and scalability. As organizations prioritize digital transformation and cost efficiency, RPA continues to remain the most adopted technology within hyper automation solutions.

- For instance, Automation Anywhere’s AI-powered automation platform serves thousands of companies globally, and some customers have reported transformative results through specific deployments, including a global healthcare leader that saved millions and a customer that achieved over 150,000 hours in annual savings.

By Deployment

Cloud-based deployment led the hyper automation market in 2024, accounting for 62% share. The growth is supported by flexible scalability, lower upfront costs, and easy integration with enterprise systems. Organizations across industries favor cloud-based solutions for faster deployment and real-time access, especially in distributed work environments. Strong demand from small and medium-sized enterprises (SMEs) accelerates adoption due to affordability and minimal infrastructure needs. Vendors are also offering AI-powered cloud automation platforms, enhancing analytics and monitoring capabilities. Cloud-based deployment continues to outpace on-premises adoption, reinforcing its dominance in hyper automation strategies.

- For instance, UiPath’s Automation Cloud, leveraging the company’s platform, supports its base of over 10,800 customers as of July 31, 2025, enabling them to remotely manage their robotic workforce and automate processes at scale.

By Solution

Software solutions captured the largest share of the hyper automation market in 2024, representing 57% share. The dominance comes from high enterprise spending on automation platforms, RPA tools, AI frameworks, and BPM software. Businesses adopt software-driven solutions to streamline workflows, enhance customer engagement, and improve operational agility. The rise of AI-powered automation suites further drives growth, enabling end-to-end process integration. While services such as consulting, implementation, and training are expanding, software remains the backbone of digital transformation initiatives, ensuring scalability and advanced functionality across industries.

Key Growth Drivers

Rising Demand for Operational Efficiency

Organizations worldwide are adopting hyper automation to reduce manual intervention, eliminate inefficiencies, and improve productivity. Automating repetitive and rule-based processes helps businesses cut costs while enhancing accuracy and compliance. Industries such as banking, healthcare, and retail rely on automation to handle large volumes of data-driven tasks. The growing need for real-time decision-making further strengthens the adoption of AI- and RPA-driven platforms. As enterprises focus on lean operations and scalability, hyper automation becomes a core strategy for driving sustainable efficiency and competitiveness in dynamic markets.

- For instance, UiPath has enabled clients across multiple industries to automate tasks, with some users reporting reductions in manual process durations and improvements in compliance accuracy through detailed audit trails and consistent execution.

Expansion of Digital Transformation Initiatives

Digital transformation strategies across industries are accelerating the demand for hyper automation solutions. Enterprises are increasingly integrating robotic process automation (RPA), business process management (BPM), and AI to modernize legacy systems. Governments and enterprises are investing in automation to optimize citizen services, supply chains, and enterprise workflows. Cloud adoption further boosts integration, enabling enterprises to deploy scalable solutions at lower costs. With digital-first business models becoming essential, hyper automation acts as a key enabler of innovation, customer satisfaction, and long-term growth.

- For instance, Automation Anywhere’s platform supports thousands of enterprise customers globally, leveraging cloud and AI-integrated workflows to automate hundreds of millions of tasks annually and deliver improved operational agility.

Growing Adoption of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) integration significantly enhance hyper automation capabilities by enabling predictive analytics, intelligent decision-making, and adaptive learning. AI-powered systems process unstructured data, automate complex workflows, and improve customer engagement through personalized experiences. Enterprises are embedding AI in automation platforms to analyze vast datasets and uncover actionable insights. This integration empowers businesses to shift from simple task automation to end-to-end process optimization. The rise in AI investments across sectors such as finance, manufacturing, and healthcare further drives demand, making AI-ML a central growth driver.

Key Trends and Opportunities

Cloud-Powered Automation Platforms

The growing adoption of cloud-based hyper automation solutions creates new opportunities for scalability and cost efficiency. Enterprises benefit from faster deployment, real-time analytics, and seamless integration across global operations. Small and medium-sized enterprises (SMEs) prefer cloud deployment due to lower infrastructure investments. Vendors are increasingly offering AI-powered automation suites as Software-as-a-Service (SaaS), supporting hybrid work environments and distributed teams. This trend enables enterprises to modernize their workflows and achieve agility. Cloud platforms thus remain a critical driver for expanding automation adoption across industries.

- For instance, Hyperglance provides automated cloud security and compliance across multi-cloud environments, continuously checking against 200+ customizable rules. It also includes automated remediation actions and real-time visualization of your cloud architecture to help identify security risks.

Integration of Intelligent Document Processing

Intelligent document processing (IDP) is emerging as a transformative opportunity in hyper automation, addressing the challenge of unstructured data. Organizations use IDP to digitize, classify, and extract insights from large volumes of documents in sectors like banking, insurance, and healthcare. The growing reliance on automation for regulatory compliance and risk management further supports IDP adoption. Enhanced accuracy in data capture, combined with AI-driven analysis, enables enterprises to improve customer service and decision-making. As digital documentation grows, IDP integration within hyper automation platforms is gaining significant traction.

- For instance, Microsoft Power Automate integrates AI Builder to process documents, and customers have reported significant increases in speed and accuracy for tasks in financial services and healthcare, thereby accelerating workflows while minimizing manual review cycles.

Key Challenges

High Implementation Costs and Complexity

Despite its benefits, hyper automation requires significant upfront investment in software, integration, and workforce training. Smaller enterprises often find it difficult to allocate resources for advanced automation platforms. Complex deployment processes and the need for skilled professionals further increase costs. These barriers limit widespread adoption, especially in cost-sensitive industries and emerging markets. Without affordable and simplified solutions, hyper automation adoption may remain concentrated among large enterprises with stronger digital budgets.

Data Security and Compliance Concerns

Automation platforms handle sensitive enterprise and customer data, raising challenges related to data privacy, cybersecurity, and regulatory compliance. Industries such as banking and healthcare face heightened risks due to strict data protection mandates. Any breach or non-compliance can lead to significant financial and reputational losses. Enterprises adopting cloud-based hyper automation must ensure robust encryption, access controls, and regulatory adherence. Addressing these concerns is critical, as data security risks could slow adoption and hinder trust in large-scale automation deployments.

Regional Analysis

North America

North America held 36% share of the hyper automation market in 2024, making it the largest regional contributor. The region benefits from strong adoption of robotic process automation (RPA), AI, and cloud technologies across industries such as BFSI, healthcare, and manufacturing. Large enterprises lead investments to enhance productivity, reduce costs, and comply with regulatory standards. The presence of major technology vendors and advanced IT infrastructure strengthens market expansion. Additionally, the growing need for real-time analytics and digital workforce integration continues to drive adoption, positioning North America as a dominant force in hyper automation growth.

Europe

Europe accounted for 28% share of the hyper automation market in 2024, supported by rapid digital transformation initiatives and strict regulatory frameworks. Countries such as Germany, the United Kingdom, and France are key adopters, driven by Industry 4.0 strategies and smart manufacturing practices. Enterprises emphasize process optimization and compliance, fueling demand for AI-powered automation and intelligent document processing. Government-backed funding programs for digital innovation further support adoption across sectors. The region’s strong focus on sustainability and operational resilience enhances the role of hyper automation, making Europe a significant contributor to the global market landscape.

Asia-Pacific

Asia-Pacific captured 25% share of the hyper automation market in 2024 and is projected to witness the fastest growth through 2032. China, India, Japan, and South Korea are leading adopters due to rapid industrialization, expanding IT services, and large-scale automation initiatives. Enterprises in the region are deploying cloud-based solutions to support scalability and cost-effectiveness. Rising demand from banking, telecom, and retail industries strengthens adoption. Government-led digital economy programs, particularly in India and Southeast Asia, provide further momentum. Asia-Pacific’s growing enterprise automation ecosystem and expanding talent pool make it a high-growth region in the global hyper automation market.

Latin America

Latin America represented 6% share of the hyper automation market in 2024, with Brazil and Mexico emerging as the largest adopters. The region is experiencing growing interest in robotic process automation and cloud-based solutions, driven by cost optimization needs in banking, healthcare, and retail sectors. While adoption remains moderate compared to advanced regions, SMEs are increasingly leveraging automation for operational agility. Limited budgets and infrastructure challenges restrict faster growth, but expanding investments from global vendors create opportunities. Government-led digital transformation initiatives and the rise of fintech ecosystems will further contribute to the market’s steady expansion.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the hyper automation market in 2024, with adoption primarily concentrated in Gulf countries and South Africa. The demand is driven by modernization of public services, banking operations, and large-scale industrial projects. Governments are increasingly investing in AI and automation technologies to support smart city and digital economy initiatives. Enterprises adopt cloud-based hyper automation to overcome infrastructure limitations and reduce costs. However, challenges such as skill shortages and cybersecurity risks limit widespread adoption. Despite these barriers, rising digital transformation agendas will drive gradual market penetration in the region.

Market Segmentations:

By Technology Type

- Robotic process automation (RPA)

- Artificial intelligence (AI) and machine learning (ML)

- Business process management (BPM)

- Intelligent document processing (IDP)

By Deployment

By Solution

By End Use

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hyper automation market includes leading players such as UiPath, Oracle, TCS, ServiceNow, Microsoft Corporation, Honeywell International, SAP SE, WorkFusion, Google, and Automation Anywhere. These companies compete by offering advanced automation platforms that integrate robotic process automation (RPA), artificial intelligence (AI), business process management (BPM), and intelligent document processing (IDP). Their strategies focus on expanding cloud-based offerings, developing end-to-end automation suites, and enhancing integration with enterprise applications. Partnerships with industries such as BFSI, healthcare, and manufacturing strengthen market reach. Vendors also invest heavily in AI-driven analytics and machine learning to improve decision-making and scalability. Competitive intensity is further fueled by acquisitions and collaborations aimed at strengthening portfolios. With enterprises prioritizing digital transformation and efficiency, market players emphasize innovation, customer-centric services, and global expansion to maintain leadership in this fast-evolving automation landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- UiPath

- Oracle

- TCS

- ServiceNow

- Microsoft Corporation

- Honeywell International

- SAP SE

- WorkFusion

- Google

- Automation Anywhere

Recent Developments

- In September 2025, UiPath was named a Leader in Gartner’s inaugural Magic Quadrant for Intelligent Document Processing.

- In September 2025, Oracle added 13 new AI agents in Fusion HCM to automate HR workflows.

- In June 2025, UiPath and Deloitte announced agentic automation migration support for SAP S/4HANA.

- In February 2025, Oracle introduced “Robots” feature in Oracle Integration to support UI-based automation.

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Deployment, Solution, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as enterprises accelerate digital transformation strategies.

- Robotic process automation will remain a core driver of adoption across industries.

- Artificial intelligence and machine learning integration will enhance decision-making and analytics.

- Cloud-based hyper automation platforms will continue to dominate deployments.

- Intelligent document processing will gain traction as enterprises manage unstructured data.

- BFSI and healthcare sectors will lead demand due to compliance and efficiency needs.

- Asia-Pacific will record the fastest growth with large-scale automation initiatives.

- North America will maintain leadership supported by strong technology investments.

- Competitive intensity will increase as vendors focus on mergers, acquisitions, and partnerships.

- Sustainability and workforce optimization will shape future automation strategies globally.

Market Insights

Market Insights