Market Overview

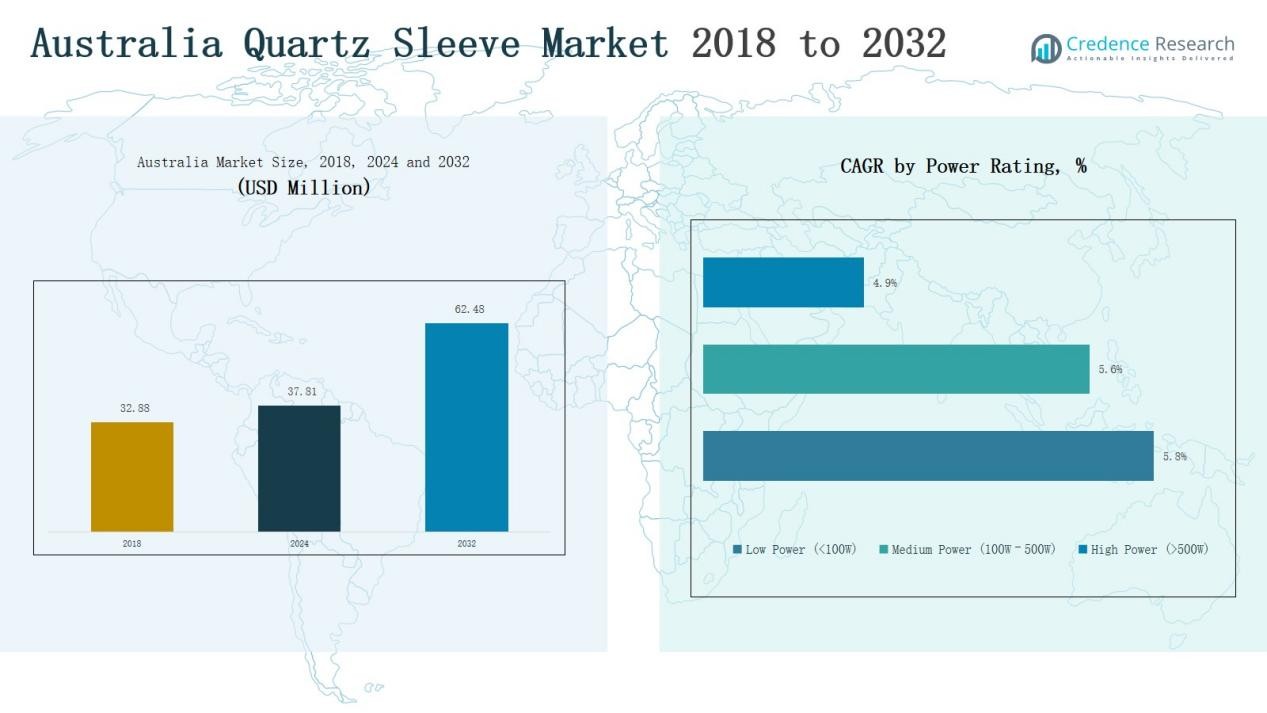

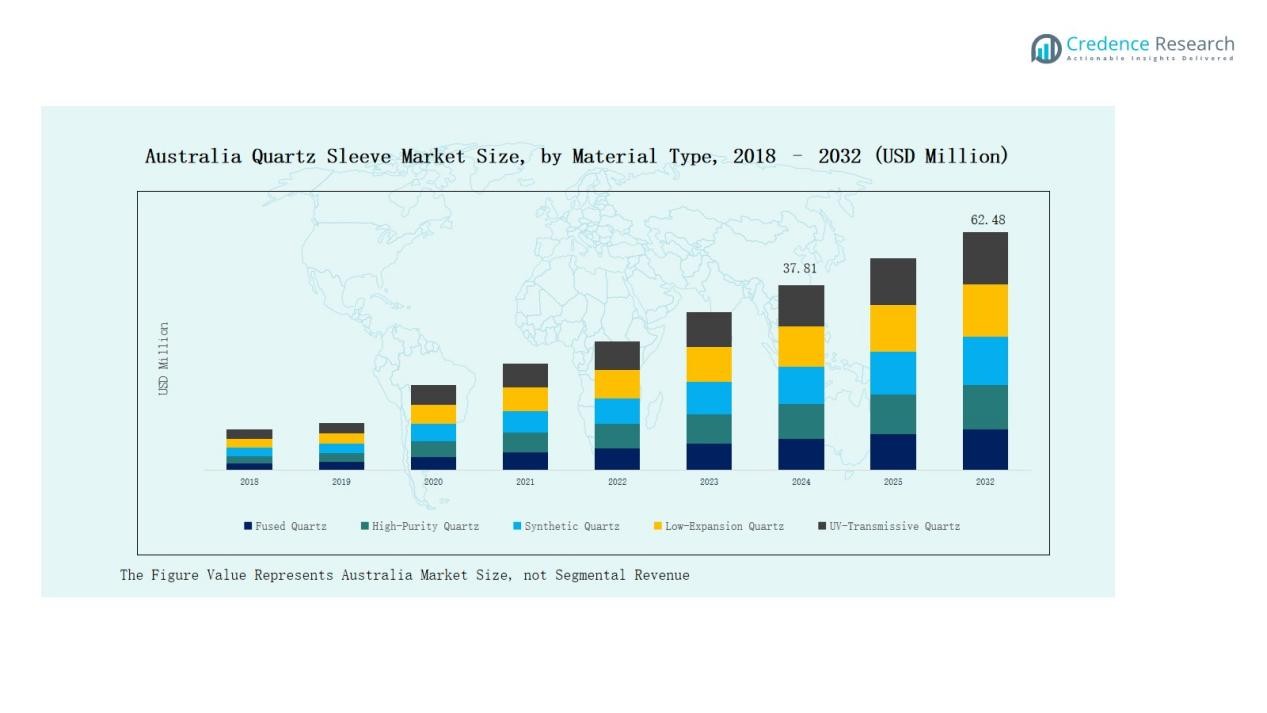

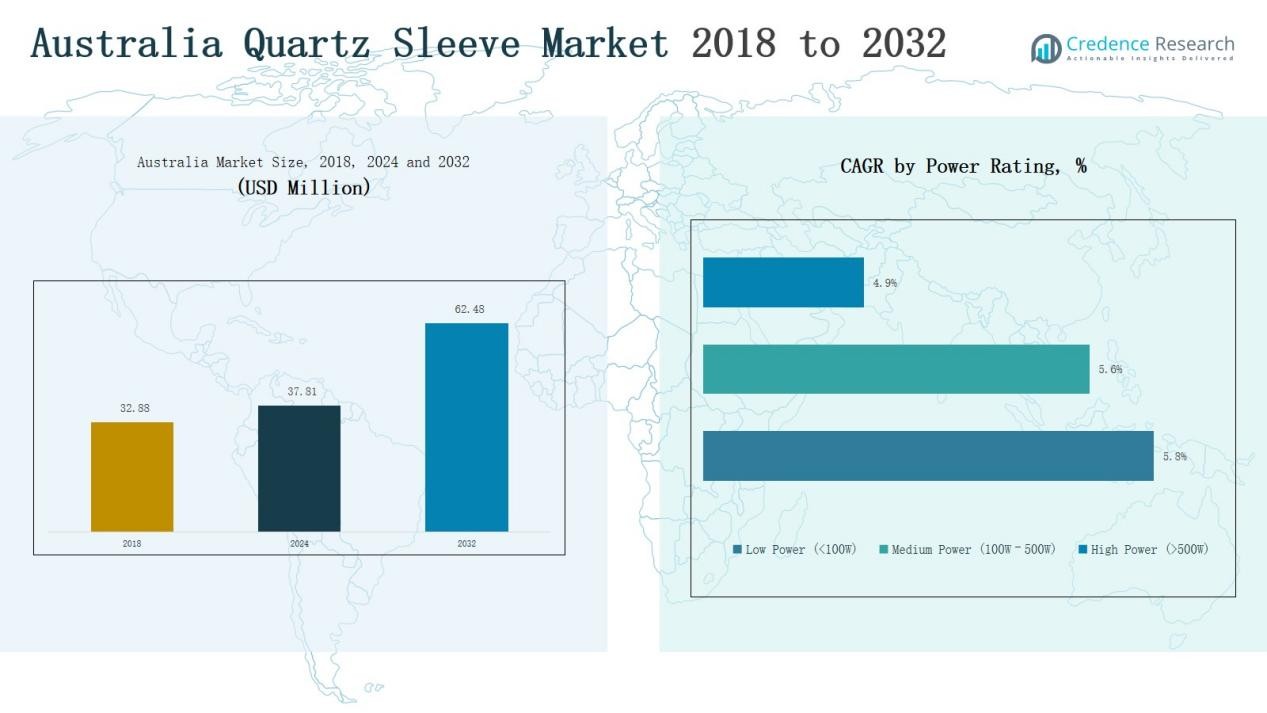

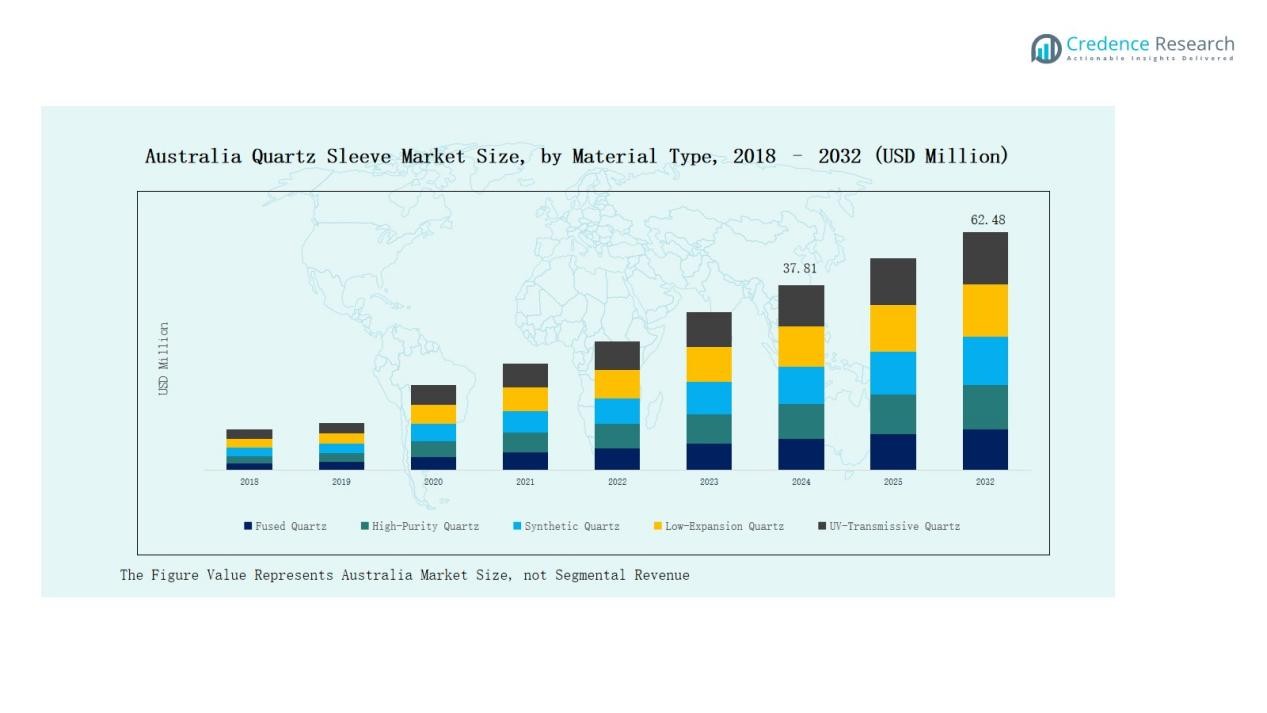

The Australia Quartz Sleeve Market size was valued at USD 32.88 million in 2018, reached USD 37.81 million in 2024, and is anticipated to reach USD 62.48 million by 2032, at a CAGR of 6.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Quartz Sleeve Market Size 2024 |

USD 37.81 Million |

| Australia Quartz Sleeve Market, CAGR |

6.48% |

| Australia Quartz Sleeve Market Size 2032 |

USD 62.48 Million |

The Australia Quartz Sleeve Market features a competitive landscape led by domestic suppliers and specialized distributors focusing on water, air, and surface disinfection applications. Key players include The Spa Co Australia, Clarence Water Filters Australia, ASC Water Tanks, CRH Australia, LabFriend Australia, ProSciTech, Fine Pebble Aquarium, and Glass Bongs Australia. These companies strengthen their positions through product customization, strong distribution networks, and aftermarket support across residential, commercial, and industrial sectors. Regionally, New South Wales emerged as the leader in 2024 with a 32% market share, supported by extensive municipal water treatment projects, advanced healthcare infrastructure, and strong demand from food and beverage industries. This leadership highlights the state’s pivotal role in driving nationwide adoption of quartz sleeve solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The Australia Quartz Sleeve Market grew from USD 32.88 million in 2018 to USD 37.81 million in 2024 and is expected to reach USD 62.48 million by 2032 at a CAGR of 6.48%.

- Fused quartz led the material type segment with 34.5% share in 2024, supported by superior UV transmission and durability, while high-purity quartz gained traction in semiconductor and pharmaceutical applications.

- UV water disinfection dominated applications with 39.2% share in 2024, driven by strict regulations and municipal investments, while UV air disinfection gained demand in healthcare and hospitality sectors.

- Water treatment was the largest end-user segment with 36.8% share in 2024, supported by infrastructure upgrades, while food and beverage and pharmaceutical sectors ensured steady adoption for contamination-free environments.

- New South Wales led regionally with 32% share in 2024, followed by Victoria at 25%, reflecting strong municipal, healthcare, and industrial investments supporting quartz sleeve adoption across Australia.

Market Segment Insights

By Material Type

The Australia Quartz Sleeve Market by material type is led by fused quartz, which accounted for 34.5% share in 2024. Its dominance is supported by excellent UV transmission, high thermal resistance, and suitability for long-term use in disinfection systems. High-purity quartz follows closely, driven by demand from semiconductor and pharmaceutical applications. Synthetic and low-expansion quartz show steady uptake in specialized processes, while UV-transmissive quartz finds rising adoption in advanced water and air purification systems.

- For instance, Heraeus Conamic expanded its fused silica portfolio to support UV-C disinfection systems, enhancing penetration into water treatment applications.

By Application

Within applications, UV water disinfection dominated the market with a 39.2% share in 2024. The growth stems from strict water quality regulations, rising municipal treatment investments, and strong adoption across residential and commercial sectors. UV air disinfection ranked second, benefiting from rising demand in healthcare and hospitality settings post-pandemic. Surface disinfection and chemical processing applications contribute steady growth, supported by industrial safety requirements and precision manufacturing. Niche applications under “others” include aquaculture and laboratory use cases.

- For instance, Xylem launched its Wedeco UV systems for municipal water utilities in Europe, designed to meet the stringent EU Drinking Water Directive requirements.

By End-User

The end-user landscape is led by water treatment, which captured 36.8% share in 2024. Adoption is driven by Australia’s increasing focus on sustainable water infrastructure and compliance with sanitation standards. The food and beverage industry represents the second-largest segment, benefiting from the need for contamination-free production lines. Pharmaceuticals and semiconductor industries are also significant consumers due to their demand for sterile environments. Oil and gas operators leverage quartz sleeves for specialized disinfection needs, while “others” include laboratories and aquaculture.

Key Growth Drivers

Rising Demand for UV Disinfection

Australia’s growing focus on public health and sanitation is a major growth driver for quartz sleeves. Municipal water treatment facilities increasingly adopt UV-based disinfection systems to meet strict government standards. Expanding applications in residential and commercial water systems further strengthen demand. Rising awareness about chemical-free disinfection methods positions quartz sleeves as a reliable solution. This trend ensures steady revenue growth, especially in urban regions where water quality compliance is critical.

- For instance, Melbourne Water commissioned the Winneke Water Treatment Plant UV upgrade, integrating advanced medium-pressure UV systems to enhance compliance with Australian Drinking Water Guidelines.

Expansion of Semiconductor and Electronics Sector

The semiconductor and electronics industry in Australia has created strong demand for high-purity quartz sleeves. These sleeves are essential for processes requiring UV transparency, high durability, and contamination-free environments. As advanced electronics manufacturing gains momentum, the need for precision-engineered quartz materials continues to rise. Investments in research laboratories and electronics R&D facilities support long-term demand. High-purity and synthetic quartz materials are particularly favored due to their performance advantages in critical semiconductor production.

- For instance, Ultra HPQ operates a hydrothermal quartz deposit in Queensland, producing high-purity quartz sand and powders essential to the semiconductor wafer production process.

Stringent Environmental and Safety Regulations

Government regulations promoting sustainable practices strongly support the adoption of quartz sleeves. Industries are shifting toward UV disinfection as an eco-friendly alternative to chemical methods. Stricter safety standards in food, beverage, and pharmaceutical industries reinforce this transition. Regulations mandate the use of contamination-free and energy-efficient technologies, driving quartz sleeve demand. This regulatory push creates consistent market opportunities across industrial and municipal end-users. The focus on long-term environmental protection ensures that quartz sleeves remain central to disinfection infrastructure.

Key Trends & Opportunities

Integration with Smart UV Systems

Technological advancement is driving the integration of quartz sleeves with smart UV disinfection systems. These systems feature sensors, automation, and IoT capabilities to optimize performance. In Australia, the rising adoption of smart water treatment solutions in commercial and residential sectors supports this trend. Quartz sleeves benefit as essential components of these advanced systems, ensuring durability and efficiency. The shift toward digital water management creates new opportunities for manufacturers to deliver compatible, high-performance quartz solutions.

- For instance, Crystal Clear™ quartz sleeves are designed to protect UV lamps from dust and temperature variations, ensuring high germicidal UV output in water and air disinfection systems.

Growth in Healthcare and Pharmaceutical Applications

Healthcare and pharmaceutical industries in Australia present rising opportunities for quartz sleeves. Hospitals and laboratories increasingly deploy UV-based air and surface disinfection to prevent infections and maintain sterile environments. Pharmaceuticals require high-purity environments where UV disinfection plays a vital role. The demand for quartz sleeves is expanding in these segments, fueled by post-pandemic hygiene awareness and strict compliance standards. This creates a robust opportunity for suppliers to diversify into medical-grade quartz sleeve applications.

- For instance, Silanna UV in Brisbane launched its NozzleShield UV Water Dispenser Disinfection technology in early 2025, demonstrating 99.9% to 99.99% reduction of harmful bacteria like E. coli and S. aureus, critical for maintaining sterile environments in hospitals and labs.

Key Challenges

High Production and Material Costs

Quartz sleeve production requires advanced processing and high-purity raw materials, leading to elevated costs. Manufacturers face challenges in balancing quality with affordability. The high costs often deter smaller buyers, limiting adoption in cost-sensitive applications. Import dependency for specialized quartz materials also adds to expenses. These factors restrict market expansion among price-conscious end-users and require companies to explore cost optimization and localized sourcing strategies to remain competitive.

Competition from Alternative Technologies

Alternative disinfection technologies such as advanced filtration systems and chemical-based treatments pose challenges for quartz sleeve adoption. Many industries, particularly in rural and small-scale settings, still rely on chlorine-based disinfection due to lower costs. Competing technologies that claim equal efficiency at reduced expenses limit quartz sleeve penetration. Overcoming this challenge requires educating customers about the long-term benefits of quartz sleeves, including eco-friendliness and durability, compared to short-term savings offered by substitutes.

Limited Awareness in Emerging Applications

Despite their advantages, quartz sleeves face limited awareness in emerging applications such as aquaculture, niche laboratories, and small commercial setups. Many end-users lack technical knowledge about UV disinfection benefits and the role of quartz sleeves. This knowledge gap slows adoption outside traditional markets like water treatment. Building awareness through training, demonstrations, and partnerships with equipment providers is essential. Addressing this challenge could unlock new customer segments and diversify market growth opportunities in Australia.

Regional Analysis

New South Wales

New South Wales held the largest share of the Australia Quartz Sleeve Market with 32% in 2024. Strong demand comes from municipal water treatment projects and growing healthcare infrastructure. Sydney’s urban expansion has increased investments in UV water and air disinfection systems. The food and beverage industry further supports adoption due to high regulatory compliance requirements. With leading distributors based in the region, product accessibility remains high. It continues to be a central hub for both residential and industrial end-users.

Victoria

Victoria accounted for 25% share in 2024, driven by Melbourne’s industrial base and healthcare sector. The region emphasizes sustainable water treatment technologies, pushing UV disinfection systems adoption. Food and pharmaceutical industries contribute to consistent demand, supported by quality and safety standards. Quartz sleeves are also used in semiconductor R&D projects, enhancing the segment’s strength. Strong logistics and manufacturing clusters ensure easy supply for end-users. It is emerging as a strategic growth area for technology-focused applications.

Queensland

Queensland represented 18% of the market share in 2024, led by growing applications in water treatment and aquaculture. The region’s climate-driven water quality challenges have encouraged wider use of UV disinfection. Demand from the oil and gas industry strengthens uptake in specialized applications. Brisbane and coastal cities are key contributors due to urban expansion and regulatory compliance. Local distributors cater to both industrial and residential segments effectively. It remains a steadily growing region with broad end-user diversity.

Western Australia

Western Australia captured 15% share in 2024, supported by strong demand from mining and oil and gas sectors. The state prioritizes safe water systems in remote industrial operations, creating opportunities for quartz sleeves. UV disinfection has become essential in large-scale resource projects to maintain water quality standards. Perth also drives residential and healthcare applications, strengthening regional demand. Import reliance is higher compared to eastern states, influencing supply dynamics. It continues to expand steadily in specialized industries.

Rest of Australia

The rest of Australia held 10% share in 2024, driven by niche applications in smaller states and territories. Adoption in academic research institutions and laboratories is rising. UV air and surface disinfection systems are increasingly used in regional hospitals. Residential uptake remains limited but shows gradual improvement with e-commerce distribution. These markets provide incremental growth opportunities for suppliers. It adds complementary demand to the major states, sustaining nationwide expansion of quartz sleeve usage.

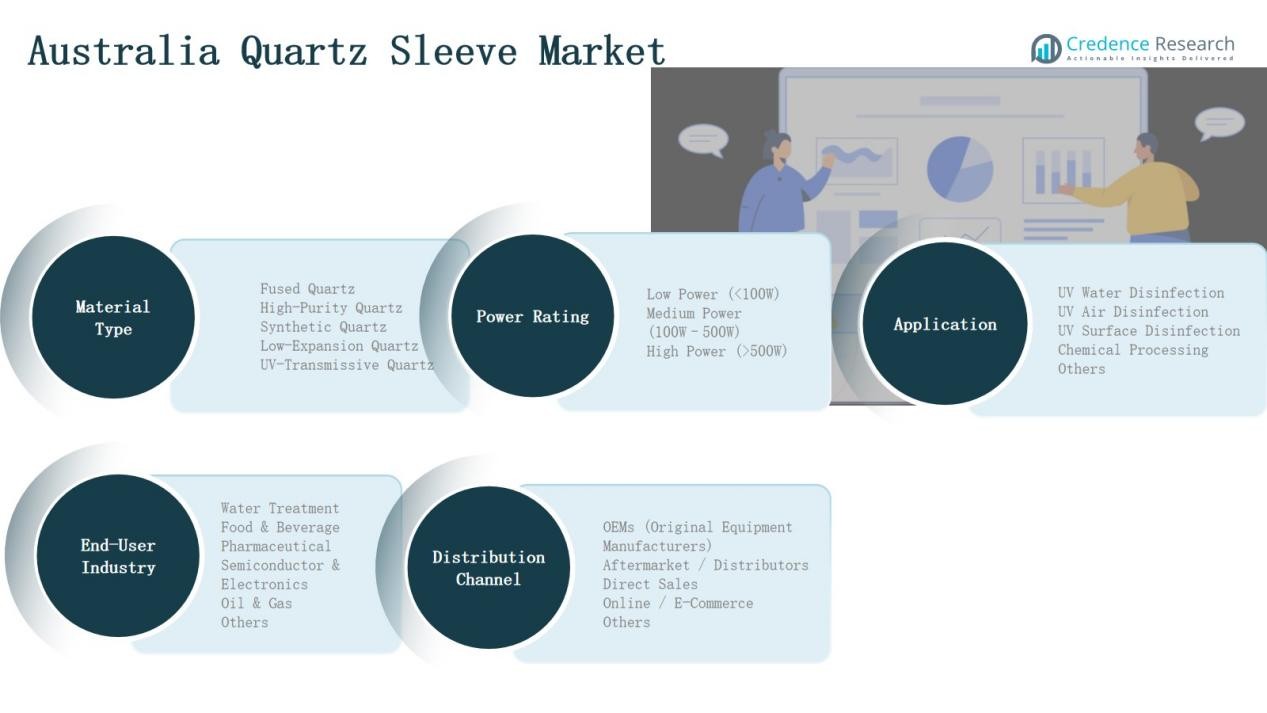

Market Segmentations:

By Material Type

- Fused Quartz

- High-Purity Quartz

- Synthetic Quartz

- Low-Expansion Quartz

- UV-Transmissive Quartz

By Application

- UV Water Disinfection

- UV Air Disinfection

- UV Surface Disinfection

- Chemical Processing

- Others

By End-User

- Water Treatment

- Food & Beverage

- Pharmaceutical

- Semiconductor & Electronics

- Oil & Gas

- Others

By Power Rating

- Low Power (<100W)

- Medium Power (100W–500W)

- High Power (>500W)

By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Aftermarket / Distributors

- Direct Sales

- Online / E-Commerce

- Others

By Region

- New SouthWales

- Victoria

- Queensland

- Western Australia

- Rest of Australia

Competitive Landscape

The Australia Quartz Sleeve Market is moderately fragmented, with a mix of domestic suppliers and specialized distributors catering to diverse applications. Key players such as The Spa Co Australia, Clarence Water Filters Australia, and ASC Water Tanks hold strong positions by offering customized quartz sleeve solutions for water and air disinfection systems. Companies like CRH Australia, LabFriend Australia, and ProSciTech expand their presence through laboratory and industrial supply channels, while Fine Pebble Aquarium and Glass Bongs Australia serve niche consumer and hobbyist markets. Competition is shaped by product quality, durability, UV transmission efficiency, and reliable supply networks. Local players focus on cost competitiveness and tailored solutions, while international partnerships bring advanced materials and technology into the market. Recent strategies emphasize expanding e-commerce distribution, strengthening aftermarket support, and diversifying into pharmaceutical and semiconductor applications. This dynamic environment encourages continuous product innovation and fosters regional growth opportunities across multiple end-user industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In June 2025, UV-Guard Australia announced availability of OEM and replacement quartz sleeves in the domestic market.

- In January 2024, Excelitas acquired Noblelight to strengthen its UV and specialty lighting portfolio.

- In May 2023, Xylem completed the acquisition of Evoqua Water Technologies to expand its UV disinfection and water treatment capabilities.

- In February 2025, Veralto entered an agreement to purchase AQUAFIDES, a UV treatment systems maker.

Report Coverage

The research report offers an in-depth analysis based on Material Type,Application, End User, Power Rating, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for UV water disinfection systems will continue to expand across municipal projects.

- Healthcare and pharmaceutical industries will increase adoption of UV air and surface disinfection.

- Semiconductor and electronics sectors will drive higher demand for high-purity quartz sleeves.

- E-commerce channels will strengthen accessibility for residential and small commercial buyers.

- OEM collaborations will enhance product integration in advanced UV disinfection systems.

- Mining and oil and gas industries will create steady demand for durable quartz sleeves.

- Government regulations will continue to push adoption of eco-friendly disinfection technologies.

- Local manufacturers will invest in cost-efficient production to reduce import dependency.

- Research institutions and laboratories will expand niche applications for synthetic quartz.

- Rising awareness of chemical-free sanitation will support long-term market penetration.