Market Overview

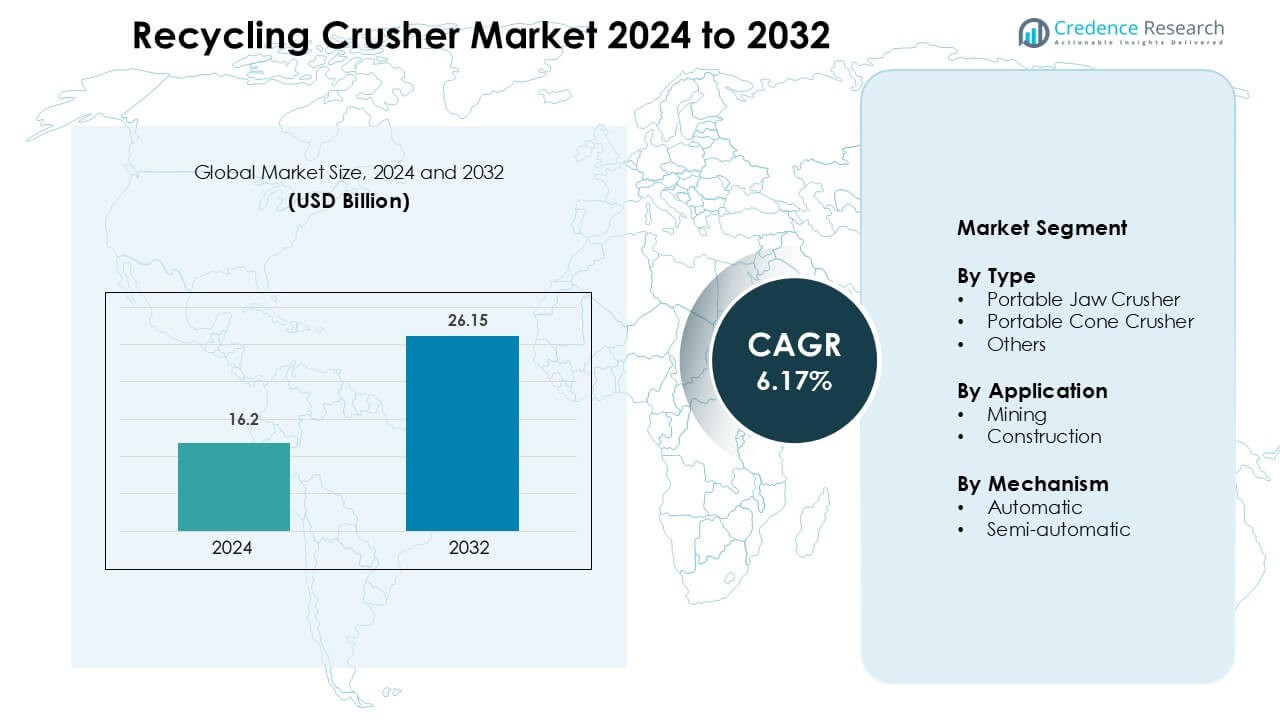

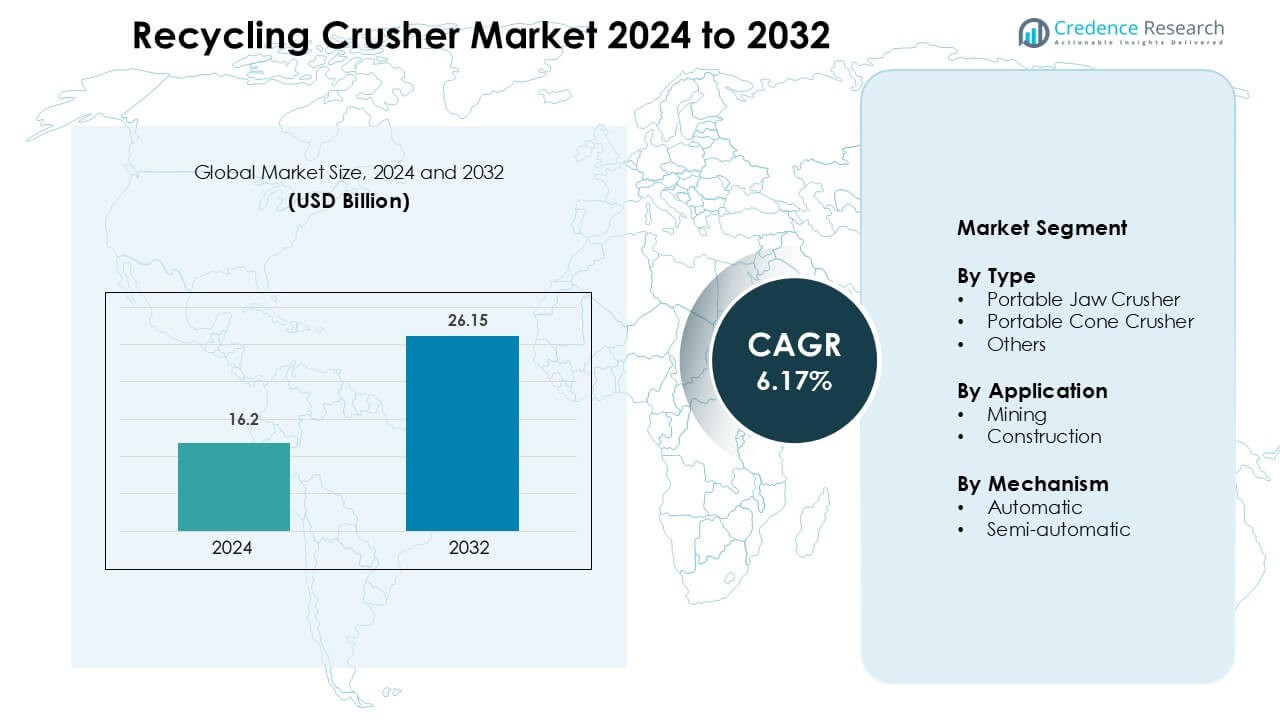

Recycling Crusher Market was valued at USD 16.2 billion in 2024 and is anticipated to reach USD 26.15 billion by 2032, growing at a CAGR of 6.17 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recycling Crusher Market Size 2024 |

USD 16.2 Billion |

| Recycling Crusher Market, CAGR |

6.17 % |

| Recycling Crusher Market Size 2032 |

USD 26.15 Billion |

North America leads the Recycling Crusher Market with 32% share, supported by strict landfill regulations and strong adoption of mobile crushing units across construction and demolition projects. Major companies such as Terex Corporation, Wastequip, Tomra Systems ASA, Sesotec GmbH, and Vecoplan AG compete through automated controls, hybrid engines, and low-emission designs. Dover Corporation (Marathon Equipment) and SSI Shredding Systems Inc expand their presence through rental fleets and service contracts, making advanced crushers accessible to small contractors. Eldan Recycling A/S and Levstal Group focus on versatile machines that handle mixed waste streams, while Machines Industries Inc strengthens its position in North America with compact, fuel-efficient models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Recycling Crusher Market was valued at USD 16.2 billion in 2024 and is projected to reach USD 26.15 billion by 2032, at a CAGR of 6.17%.

- A major growth driver is rising construction and demolition waste, pushing contractors to adopt portable crushers to cut hauling cost and support recycled aggregate production, especially in roadbuilding and commercial projects.

- Key trends include hybrid and electric crushers, telematics integration, and automated controls that boost productivity, while rental models expand access for small and mid-size companies.

- Competitive activity remains strong, with companies focusing on compact designs, dust-controlled systems, and service contracts, although high capital investment and maintenance cost limit adoption among smaller players.

- North America leads with 32% share, followed by Europe at 29%, while portable jaw crushers hold 41% share as the dominant type due to high crushing efficiency and lower operating cost.

Market Segmentation Analysis:

By Type

Portable jaw crushers hold 41% share and lead the market. Contractors prefer these units due to high crushing force, lower maintenance, and faster relocation between sites. These systems handle mixed demolition debris and reinforced concrete with ease, making them ideal for recycling yards. Portable cone crushers gain traction in asphalt and aggregate recycling where a finer output is needed. The “others” category includes impact crushers, which support glass, brick, and ceramic waste. Growth comes from rising demolition activity, strict waste diversion policies, and the push for compact, fuel-efficient equipment.

- For instance, the Metso Lokotrack LT106 jaw crusher delivers a feed opening of 1,060 x 700 mm and a capacity reaching 500 tons per hour.

By Application

Construction applications account for 57% share, driven by strict building waste disposal laws and the shift toward recycled aggregates. The segment benefits from public infrastructure upgrades and urban redevelopment projects that generate large debris volumes. Builders adopt mobile crushers to reduce hauling cost and meet green building norms. Mining uses these machines for overburden processing and heap-leach preparation, but demand remains smaller due to fixed crushing plants on most mining sites. The expansion of sustainable construction materials supports long-term growth for the construction segment.

- For instance, the Terex Finlay J-1175 jaw crusher supports aggregate processing with a feed size of 700 mm and delivers outputs as fine as 40 mm, helping miners repurpose waste rock for haul road construction.

By Mechanism

Automatic crushers dominate with 62% share due to advanced telematics, hydraulic controls, and real-time performance monitoring. These features reduce manpower needs, speed up set-up, and ensure consistent product size. Semi-automatic units remain popular in small contractors and rental fleets because of lower upfront cost. Automatic machines gain favor in recycling plants that operate continuous shifts and demand precise output. Rising labor shortages and the need for remote diagnostics strengthen the shift toward automated systems across North America and Europe.

Key Growth Drivers

Rising Construction and Demolition Waste Volumes

Growing infrastructure development, housing expansion, and old structure demolition create large waste streams that need safe disposal. Landfill restrictions and lack of urban dumping space encourage builders to process debris onsite. Mobile recycling crushers reduce transportation cost, convert concrete and asphalt into reusable aggregates, and support circular construction practices. Governments promote recycled aggregates for road base layers, non-structural concrete, and landscaping. Contractors adopt crushers to meet green building standards, reduce raw material dependence, and comply with waste diversion mandates. Public infrastructure upgrades, bridge replacements, and smart city projects further raise the demand for rapid debris handling. Contractors benefit from lower fuel usage, faster project turnaround, and reduced landfill charges. These factors make recycling crushing an essential part of modern construction management.

- For instance, the Komatsu BR580JG-1 mobile jaw crusher uses a 262 kW engine and delivers a crushing capacity of up to 460 tons per hour, enabling contractors to recycle reinforced concrete directly on congested urban projects.

Growing Environmental Regulations and Sustainability Mandates

Environmental regulators enforce strict limits on landfill usage, dust emissions, and improper disposal of recyclable debris. Many regions impose higher landfill fees and mandate minimum recycling rates for construction waste. Recycling crushers help companies comply with these rules by processing concrete, asphalt, stone, and bricks into usable products. Municipalities encourage recycled aggregate use in road resurfacing and municipal repairs. Large construction firms adopt onsite crushing fleets to improve their sustainability score and win green-certified contracts. Rapid growth of eco-friendly projects and carbon-neutral buildings motivates contractors to reduce virgin material consumption. Corporate ESG commitments further push builders to add recycling equipment to reduce environmental impact. These regulations secure long-term demand for mobile and stationary crushers.

- For instance, the Sandvik QI442 impact crusher integrates a 328 kW engine and produces end products as fine as 25 mm while using an onboard double-deck pre-screen to reduce dust generation and improve material separation during recycling.

Cost Savings and Operational Efficiency for Contractors

Onsite crushing lowers transportation cost since debris does not need to be hauled to distant disposal sites. Recycled aggregates produced onsite replace new quarry materials, helping contractors save on procurement. Mobile crushers also speed up site clearance, reduce downtime, and allow flexible movement between projects. Rental fleets make equipment accessible to small contractors, while automated control systems reduce labor needs. Fuel-efficient engines, hybrid power units, and remote monitoring systems improve operating economics. Companies gain long-term savings through reduced tipping fees and improved logistics management. In competitive construction markets, cost-efficient waste processing becomes a strategic advantage. These financial benefits drive wider adoption across roadworks, commercial building projects, and urban redevelopment.

Key Trends & Opportunities

Adoption of Electric and Hybrid Crushers

Manufacturers introduce hybrid and fully electric crushers to reduce fuel usage and emissions. These machines operate with lower noise, meet strict urban construction regulations, and reduce operating cost. Hybrid systems switch between diesel and battery power to run in low-emission zones. This trend creates opportunities in residential redevelopment, city center projects, and indoor demolition sites where noise limits matter. Solar-assisted charging, regenerative braking, and energy-efficient motors improve productivity. Rental companies expand fleets of green crushers as clients seek sustainable solutions. Countries with net-zero goals and green procurement policies accelerate the shift toward electric crushing units. This trend aligns with broader electrification in construction equipment markets.

- For instance, the Metso Lokotrack® LT120E uses a 310-kW electric motor and can be powered directly from an external grid connection, eliminating diesel consumption during continuous operation.

Integration of Smart Telematics and Remote Monitoring

Modern crushers feature GPS tracking, engine diagnostics, hydraulic pressure monitoring, and automated feed control. Fleet managers use digital dashboards to optimize fuel consumption, schedule maintenance, and track performance. Remote troubleshooting reduces downtime and lowers service costs. Analytics predict component failures and ensure consistent product size. Smart control improves safety by reducing manual adjustments. Automated systems support small crews and mitigate skilled labor shortages. These features drive demand from large contractors and recycling firms operating multiple job sites. Digitalization becomes a key selling point for new crushers, strengthening supplier revenues from software and service contracts.

- For instance, the Powerscreen Pulse telematics platform monitors engine load, fuel rate, crushing hours, and location data in real time, while delivering automated alerts for hydraulic pressure fluctuations and service intervals.

Key Challenges

High Capital Investment and Maintenance Cost

Recycling crushers require heavy upfront investment, which limits adoption among small contractors. High wear-and-tear from abrasive materials increases maintenance needs for hammers, jaws, and conveyor components. Engine parts, hydraulics, and screens demand periodic servicing. In many developing regions, access to spare parts and trained technicians remains limited, causing long downtime. Rental solutions solve this issue, but not all regions have mature rental fleets. Tight budget construction projects may delay machinery upgrades. These factors slow market penetration, especially in small and mid-size businesses.

Operational and Noise Restrictions in Urban Areas

Many cities enforce strict noise limits and air quality rules for demolition activities. Traditional diesel-powered crushers face complaints related to dust, vibration, and excessive sound. Urban job sites often have space constraints, limiting movement of large machines. Permits take longer due to safety clearances and environmental checks. Contractors need dust suppression systems, low-noise engines, and compact units to meet regulations. This raises equipment cost and design complexity. While electric crushers address some of these issues, they are still expensive and not widely available. This challenge affects deployment in densely populated zones and slows market expansion.

Regional Analysis

North America

North America holds 32% share, driven by strong emphasis on sustainable construction and strict landfill regulations. Large infrastructure upgrades and highway rehabilitation projects generate high debris volumes that require onsite crushing. Contractors adopt portable crushers to cut transport cost and meet green procurement rules. The United States leads adoption due to municipal recycling mandates and mature rental fleets that support small and mid-size builders. Canada follows with rising investment in urban redevelopment and road maintenance. Technological features such as hybrid engines and telematics strengthen equipment preference, while government incentives for recycled aggregates support long-term market growth.

Europe

Europe accounts for 29% share, led by advanced waste management laws and high recycling targets for construction materials. Countries like Germany, the U.K., and the Netherlands enforce strict bans on illegal dumping and promote recycled aggregates in pavements and non-structural concrete. Portable crushers see strong deployment in city projects where space is limited and transport cost remains high. The region benefits from electric and low-noise models suited for urban zones. Equipment upgrades, circular economy policies, and carbon reduction frameworks create steady demand. Public infrastructure renovation projects further support recycling crusher installations across EU member states.

Asia-Pacific

Asia-Pacific commands 26% share, driven by large-scale construction, rising urbanization, and highway expansion projects. China and India produce high volumes of demolition waste and adopt crushers to reduce raw material dependency. Growing investment in smart cities, industrial parks, and metro rail projects increases demand for onsite crushing. Rental options expand access for smaller contractors, while government pushes for waste recycling gain momentum. Japan and South Korea adopt advanced hybrid and automated crushers for urban demolition. Rapid infrastructure growth and environmental compliance will make this region a major long-term growth engine for the industry.

Latin America

Latin America holds 7% share, supported by increasing adoption in roadworks, mining cleanup, and redevelopment projects. Brazil and Mexico lead demand due to construction growth and higher cost of transporting debris to landfills. Recycling crushers help contractors reuse concrete and asphalt in public works, reducing procurement cost. Awareness of eco-friendly materials grows, but adoption is slower due to capital constraints and limited rental availability. Government programs for infrastructure modernization create new opportunities, while mining-focused nations use crushers to handle overburden and site restoration. Market penetration remains gradual but promising with ongoing urban development.

Middle East & Africa

Middle East & Africa represent 6% share, with rising demand in large construction, mining, and industrial projects. The UAE and Saudi Arabia adopt crushers to support urban expansion, road networks, and demolition waste recycling in megacity projects. Africa shows traction in mining rehabilitation and quarry operations, where mobile crushers reduce material hauling cost. Limited recycling regulations and budget constraints slow adoption in smaller markets. However, infrastructure investments, cement plant expansions, and sustainability initiatives create future opportunities. Growing interest in mobile and hybrid units supports gradual market development across the region.

Market Segmentations:

By Type

- Portable Jaw Crusher

- Portable Cone Crusher

- Others

By Application

By Mechanism

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the recycling crusher market features global manufacturers offering portable, compact, and high-capacity units for construction, demolition, and industrial waste processing. Companies focus on hybrid power systems, automated controls, and telematics to reduce fuel use and improve output quality. Many firms expand rental fleets to attract small and mid-size contractors who avoid high upfront costs. Partnerships with recycling plants and construction service providers strengthen market reach. Leading players launch low-noise and dust-controlled models to meet strict urban regulations. Strategic moves include product upgrades, mergers to access new technologies, and geographic expansion into fast-growing Asian and Latin American markets. Training and aftermarket services support customer retention and maximize machine uptime.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Machines Industries Inc (Canada)

- Terex Corporation (U.S.)

- Sesotec GmbH (Germany)

- Wastequip (U.S.)

- Levstal Group (Estonia)

- Tomra Systems ASA (Norway)

- Dover Corporation (Marathon Equipment) (U.S.)

- Eldan Recycling A/S (Denmark)

- SSI Shredding Systems Inc (U.S.)

- Vecoplan AG (Germany)

Recent Developments

- In October 2025, Terex brand EvoQuip launched Bison 220 and 220R compact jaw crushers. These target quarrying, demolition, and recycling applications.

- In September 2025, Sesotec introduced the PURIFIER PERFORMER sorting system at K 2025. Dual-sided viewing improves detection on opaque plastic flakes.

- In May 2025, Machinex Industries Inc. launched Gateway, a service and maintenance platform. The tool streamlines parts quotes and upkeep for recycling plants.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Mechanism and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as cities enforce strict recycling rules for construction and demolition waste.

- Portable and compact crushers will gain more adoption in urban redevelopment projects.

- Electric and hybrid-powered crushers will expand due to low-emission operating requirements.

- Automation, telematics, and remote monitoring will become standard features across new machines.

- Rental fleets will grow as small contractors prefer flexible, low-investment access to equipment.

- Recycled aggregates will see higher use in road resurfacing, pipeline bedding, and landscaping.

- Manufacturers will focus on dust suppression and low-noise designs for city-center projects.

- Expansion in Asia-Pacific will accelerate due to rapid infrastructure development and landfill pressure.

- Service and maintenance contracts will become a major revenue source for suppliers.

- Recycling plants will integrate high-capacity crushers to support circular construction and material reuse.