Market Overview:

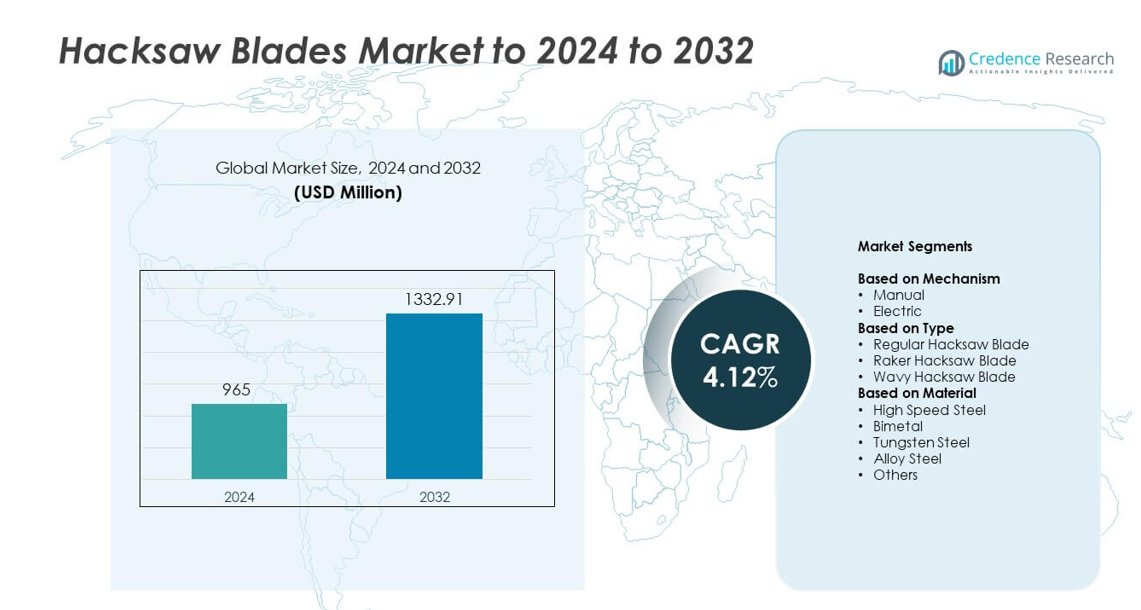

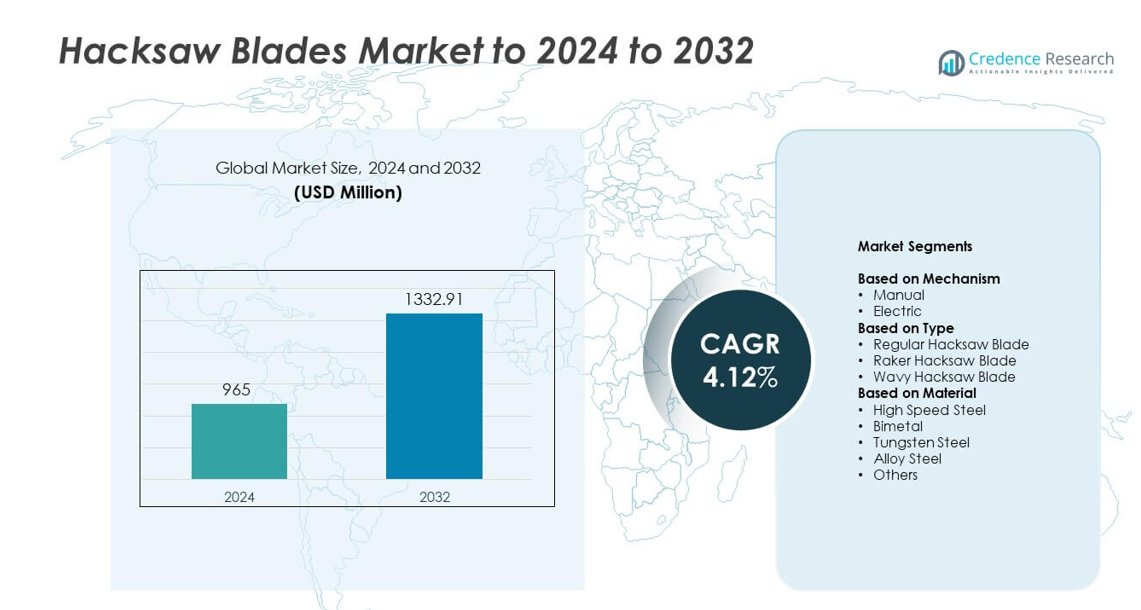

Hacksaw Blades Market size was valued at USD 965 million in 2024 and is anticipated to reach USD 1332.91 million by 2032, at a CAGR of 4.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hacksaw Blades Market Size 2024 |

USD 965 million |

| Hacksaw Blades Market, CAGR |

4.12% |

| Hacksaw Blades Market Size 2032 |

USD 1332.91 million |

The Hacksaw Blades Market includes leading players such as Fein, CooperTools, Starret, Dewalt, Lenox, Black Hawk Industries, Techtronic Industries Co., Ltd., Snap-on Tools Company LLC, Stanley, Robert Bosch GmbH, Bipico Industries Pvt. Ltd., TTI Group, Apex Tool Group LLC, Disston, and Klein Tools. These companies compete through durable materials, advanced tooth designs, and strong distribution channels across industrial and household sectors. Asia Pacific leads the market with a 34% share due to rapid industrialization and construction growth. North America follows with 32% share, driven by high tool adoption in fabrication, plumbing, and DIY activities. Europe holds 27% share supported by strong manufacturing and maintenance demand.

Market Insights

- The Hacksaw Blades Market reached USD 965 million in 2024 and USD 1332.91million in 2032 and will grow at a CAGR of 4.12% through 2032.

- Rising demand from metal fabrication and construction drives steady adoption, with manual mechanisms holding 62% share and bimetal materials leading with 52% share due to durability and long service life.

- Key trends include the shift toward premium blades with stronger tooth designs, higher flexibility, and coated surfaces that improve cutting accuracy and reduce breakage across industrial applications.

- The market remains competitive as global brands focus on innovation and stronger distribution networks, while low-cost manufacturers create price pressure in developing regions.

- Asia Pacific leads with 34% share due to rapid industrial growth, followed by North America at 32% and Europe at 27%, while Latin America and Middle East and Africa collectively contribute the remaining share through expanding repair, maintenance, and small-scale fabrication activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Mechanism

The Hacksaw Blades Market by mechanism is led by the manual segment, holding about 62% share in 2024. Manual hacksaw blades dominate due to high use in metal workshops, plumbing tasks, and household repair work where portability and low operating cost matter. Strong demand from small fabrication units and maintenance teams supports market strength, while electric hacksaw blades grow steadily as industries shift toward powered cutting tools. Manual blades remain preferred for precise control, easy replacement, and lower tool investment, which continues to drive adoption across developing regions.

- For instance, Bahco (SNA Europe) confirms that its ERGO 325 hacksaw frame can apply a blade-tension force of more than 1000 N (Newtons), which is approximately 100 kg (specifically 100 kiloponds or kP), enabling very stable and accurate cutting for manual operations in fabrication and plumbing tasks.

By Type

The type segment is dominated by regular hacksaw blades, which account for nearly 48% share in 2024. Regular blades lead because they deliver smooth cutting performance on metals, plastics, and light construction materials. Their wide use in automotive repair, DIY activities, and general metalworking supports strong demand. Raker and wavy blades gain traction for heavy-duty and vibration-free cutting applications, but regular blades stay ahead due to lower cost and broad compatibility with standard frames. Consistent use across commercial workshops keeps this segment at the forefront.

- For instance, the Stanley FatMax Hacksaw frame provides a spring-loaded, adjustable blade tension of up to 150 kg.

By Material

The material segment is led by bimetal hacksaw blades, which command around 52% share in 2024. Bimetal blades dominate because they provide high flexibility, longer tool life, and strong resistance to tooth breakage compared to high-speed steel or alloy steel blades. Their industrial preference grows with rising metal fabrication and construction activity where durability matters. Tungsten steel and high-speed steel blades serve niche high-strength cutting needs, but bimetal blades maintain leadership due to superior endurance and cost-effective performance across medium to heavy cutting tasks.

Key Growth Drivers

Rising Demand from Metalworking and Fabrication

Metalworking and fabrication remain major growth drivers as workshops, construction sites, and repair units increase the use of hacksaw blades for cutting metal pipes, bars, and structural components. Growing industrial expansion in automotive, machinery, and infrastructure projects boosts consumption. The need for precise, low-cost cutting tools strengthens demand across small and medium enterprises. Manual and bimetal blades gain wider adoption due to durability and versatility, which supports steady market expansion across both developed and emerging economies.

- For instance, Fischer Group states that its advanced precision tube-processing lines operate at high operational speeds, with speeds of up to 120 m/min being achievable in specific applications and for certain materials.

Expansion of DIY and Home Improvement Activities

The rise in home renovation, repair tasks, and do-it-yourself culture drives strong demand for accessible cutting tools, including hacksaw blades. Consumers prefer blades that offer ease of use, portability, and compatibility with basic toolkits. Growth in online retail supports wider product availability, while awareness of affordable metal and plastic cutting solutions increases household adoption. This trend amplifies sales of manual and regular hacksaw blades, which remain the preferred choice for basic domestic applications.

- For instance, Bosch Power Tools reported sales revenue of €5.6 billion in 2023, reflecting a decline in a challenging market, rather than a specific increase in unit volume.

Growing Use of Durable and High-Performance Materials

4Industries increasingly adopt durable materials such as bimetal and tungsten steel blades that provide longer life, reduced breakage, and efficient cutting in demanding environments. This shift supports market growth as sectors like construction, plumbing, and manufacturing prioritize tools that lower downtime and improve performance. High-resistance blades help meet rising expectations for productivity and quality. The push for tougher materials strengthens the premium blade category and boosts replacement rates across industrial settings.

Key Trends and Opportunities

Rising Preference for Bimetal Blades in Industrial Applications

Industrial buyers continue shifting toward bimetal hacksaw blades due to superior flexibility, enhanced tooth strength, and extended operational life. This trend presents strong opportunities for manufacturers to expand premium offerings tailored to heavy-duty cutting. Growth in fabrication, automotive repair, and construction increases the need for high-reliability tools. The move toward efficient material removal and reduced breakage positions bimetal products as the most attractive category, creating space for product differentiation and performance-focused innovation.

- For instance, the Starrett Intenss® bi-metal blade series is made with an M42 high-speed steel cutting edge welded to a fatigue-resistant alloy steel backing.

Growth of E-Commerce Distribution Channels

Online platforms create major opportunities by increasing product visibility and enabling faster access for small workshops, technicians, and DIY users. E-commerce supports brand comparison, customer reviews, and bulk purchase options, encouraging wider adoption of advanced blade types. Manufacturers gain opportunities to expand global reach without heavy distribution costs. The shift toward digital buying behavior also helps promote specialty blades and combo packs, strengthening market penetration among new customer groups.

- For instance, W.W. Grainger reports that in its Endless Assortment segment, Zoro.com offers access to more than 12 million products and MonotaRO.com offers more than 22 million products through their online platforms, by the year 2023.

Adoption of Ergonomic and Precision-Focused Blade Designs

Advancements in blade geometry, tooth configuration, and coating technology open new opportunities for precision cutting across industries. Manufacturers focus on ergonomic designs that reduce user fatigue and improve handling accuracy, especially during repetitive tasks. Improved heat resistance and anti-fracture technologies enhance cutting performance on hard metals. These innovations attract users seeking safer and more efficient solutions, supporting long-term market growth through performance-driven product upgrades.

Key Challenges

Intense Competition from Low-Cost Manufacturers

Increasing availability of low-priced hacksaw blades, particularly from mass-production regions, creates strong price pressure for established brands. Budget blades attract buyers in cost-sensitive markets, reducing margins for premium manufacturers. The challenge intensifies as small suppliers offer generic products with wide distribution reach. This situation makes brand differentiation and quality assurance harder, compelling industry players to focus on innovation, durability enhancements, and strategic pricing to stay competitive.

Shift Toward Power Tools Reducing Manual Blade Usage

The growing adoption of electric cutting tools, including reciprocating saws and angle grinders, limits demand for manual hacksaw blades in some applications. Industrial and professional users prefer powered tools for speed and efficiency, reducing reliance on traditional blades. This shift challenges market growth, especially in sectors where mechanized cutting becomes standard. Manufacturers address this issue by improving manual blade durability and targeting markets where cost, precision, or portability maintain relevance.

Regional Analysis

North America

North America holds about 32% share of the Hacksaw Blades Market in 2024, supported by strong demand from construction, metal fabrication, plumbing services, and home improvement activities. The region benefits from high adoption of bimetal and high-speed steel blades due to their durability and efficiency in industrial tasks. Growth in DIY culture and steady expansion of maintenance services further reinforce product use across residential and commercial sectors. The presence of established tool brands and advanced distribution channels supports stable market penetration across the United States and Canada.

Europe

Europe accounts for nearly 27% share of the Hacksaw Blades Market, driven by strong manufacturing activity, rising repair and maintenance operations, and strict quality standards. The region sees high adoption of premium bimetal and alloy steel blades used in automotive workshops, engineering facilities, and industrial plants. Expanding infrastructure upgrades across Germany, the United Kingdom, France, and Italy continue to support market demand. Increasing focus on precision cutting solutions and workplace safety drives preference for durable blade materials. Well-developed retail and online channels enhance product accessibility across the region.

Asia Pacific

Asia Pacific leads with about 34% share of the Hacksaw Blades Market, making it the largest regional contributor. Rapid industrialization, expanding construction activity, and strong growth in metalworking industries across China, India, and Southeast Asia support rising consumption. Demand for cost-effective manual blades remains high, while adoption of bimetal variants increases in heavy-use environments. Growing small manufacturing units and repair workshops fuel continuous blade replacement cycles. The surge in home improvement trends and the rise of e-commerce platforms further expand access to a wide range of cutting tools.

Latin America

Latin America holds around 4% share of the Hacksaw Blades Market, driven by growing construction activity and rising use of cutting tools in automotive repair and small manufacturing units. Countries such as Brazil, Mexico, and Argentina show steady demand for manual and affordable blade types. Increasing urban development and infrastructure maintenance create opportunities for durable blade materials. Market growth is supported by expanding retail distribution, although price sensitivity remains a challenge. Adoption of premium bimetal blades grows gradually as industrial sectors modernize operations across key economies in the region.

Middle East and Africa

Middle East and Africa represent nearly 3% share of the Hacksaw Blades Market, with demand influenced by construction growth, oil and gas maintenance operations, and rising metal fabrication tasks. Countries like the United Arab Emirates, Saudi Arabia, and South Africa drive steady consumption through ongoing infrastructure investments. Manual blades remain widely used due to cost advantages, while industrial users increasingly shift toward higher-strength materials. The region benefits from improving distribution networks and rising adoption of repair and refurbishment services, supporting moderate but consistent market expansion.

Market Segmentations:

By Mechanism

By Type

- Regular Hacksaw Blade

- Raker Hacksaw Blade

- Wavy Hacksaw Blade

By Material

- High Speed Steel

- Bimetal

- Tungsten Steel

- Alloy Steel

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hacksaw Blades Market features key players such as Fein, CooperTools, Starret, Dewalt, Lenox, Black Hawk Industries, Techtronic Industries Co., Ltd., Snap-on Tools Company LLC, Stanley, Robert Bosch GmbH, Bipico Industries Pvt. Ltd., TTI Group, Apex Tool Group LLC, Disston, and Klein Tools. The competitive landscape remains defined by product durability, material innovation, and strong performance across industrial and household applications. Manufacturers focus on enhancing blade strength, improving tooth geometry, and offering long-life bimetal products to maintain customer loyalty. Companies invest in expanding distribution networks through hardware stores, industrial suppliers, and digital platforms to strengthen global reach. Premium brands emphasize precision cutting solutions, while cost-focused producers target price-sensitive markets with basic yet reliable options. Continuous technological advancements, including heat-resistant coatings and flexible blade designs, help companies differentiate products in a crowded market. The sector’s competition will continue to intensify as global infrastructure growth and metalworking activity increase demand across end-user categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fein

- CooperTools

- Starret

- Dewalt

- Lenox

- Black Hawk Industries

- Techtronic Industries Co., Ltd.

- Snap-on Tools Company LLC

- Stanley

- Robert Bosch GmbH

- Bipico Industries Pvt. Ltd.

- TTI Group

- Apex Tool Group LLC

- Disston

- Klein Tools

Recent Developments

- In 2025, Lenox has continued to promote its T2™ Technology bi-metal hacksaw blades, which deliver up to 100% longer blade life compared to previous generations.

- In 2024, Makita USA continued to expand its 40V max XGT® System, introducing new tools and blades optimized for cordless operation across various industrial applications.

- In 2023, Stanley FATMAX Double Edge Pull Saw Replacement Blade was an existing product available as part of Stanley’s professional line of hand tools for use with the Stanley FATMAX Double Edge Pull Saw.

Report Coverage

The research report offers an in-depth analysis based on Mechanism, Type, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for durable bimetal blades across industrial applications.

- Manual hacksaw blades will remain relevant due to strong use in repair and maintenance work.

- Growth in construction and metal fabrication will support steady blade consumption.

- DIY activities and home improvement trends will drive higher sales of regular blades.

- Manufacturers will focus on precision tooth designs and enhanced heat-resistant coatings.

- E-commerce platforms will expand product reach and boost sales in emerging regions.

- Industrial users will prefer long-life blades to reduce downtime and replacement frequency.

- Increased adoption of ergonomically designed blades will improve cutting efficiency.

- Competition will intensify as low-cost manufacturers expand global distribution networks.

- Product innovation will center on stronger materials and improved performance for heavy-duty cutting.