Market Overview

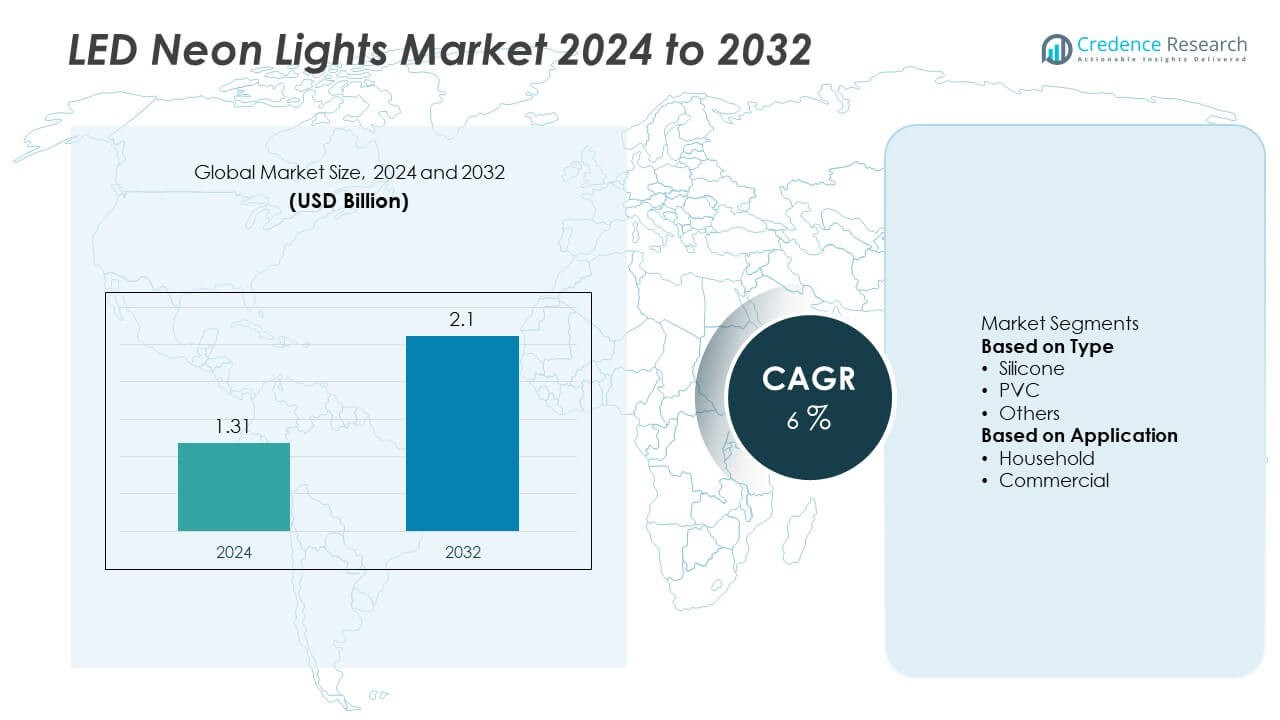

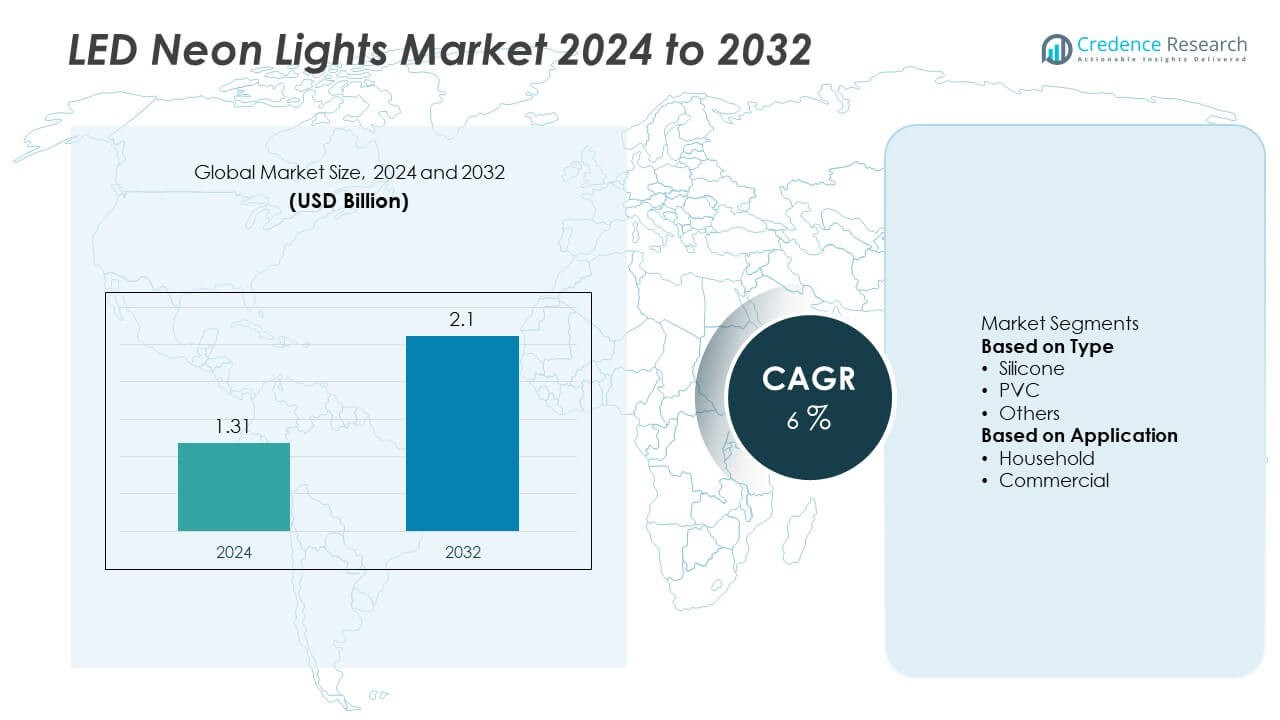

LED Neon Lights market size was valued at USD 1.31 billion in 2024 and is anticipated to reach USD 2.1 billion by 2032, growing at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Neon Lights Market Size 2024 |

USD 1.31 Billion |

| LED Neon Lights Market, CAGR |

6% |

| LED Neon Lights Market Size 2032 |

USD 2.1 Billion |

The LED neon lights market is shaped by top players including INCISEON, GE Lighting, Best Buy Neon Signs, Signify Holding, and Elemental LED Inc. These companies drive competition through innovations in flexible silicone-based designs, smart lighting integration, and energy-efficient solutions tailored for both commercial and residential use. Regionally, Asia-Pacific led the market with 34% share in 2024, supported by rapid urbanization, retail growth, and large-scale infrastructure projects. North America followed with 31% share, driven by strong demand in advertising, entertainment, and residential décor, while Europe accounted for 27% share, supported by sustainability-focused initiatives and advanced architectural applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The LED neon lights market was valued at USD 1.31 billion in 2024 and is expected to reach USD 2.1 billion by 2032, growing at a CAGR of 6% during the forecast period.

- Commercial applications held more than 60% share in 2024, driven by strong demand for signage, advertising, and architectural lighting in retail, hospitality, and entertainment sectors.

- A key trend is the rising adoption of silicone-based LED neon lights, which captured over 55% share, supported by flexibility, durability, and suitability for outdoor and decorative installations.

- The market is highly competitive with companies such as INCISEON, GE Lighting, Best Buy Neon Signs, Signify Holding, and Elemental LED Inc. focusing on energy-efficient designs, smart lighting integration, and customized solutions.

- Asia-Pacific leads with 34% share, followed by North America at 31% and Europe at 27%, while Latin America and the Middle East & Africa collectively accounted for under 10% share in 2024.

Market Segmentation Analysis:

By Type

Silicone-based LED neon lights dominated the market in 2024, capturing over 55% share. Their dominance is supported by superior flexibility, weather resistance, and durability compared to PVC variants. Silicone’s ability to maintain performance under high temperatures and UV exposure makes it highly suitable for outdoor and architectural lighting applications. PVC lights follow with notable demand due to their cost-effectiveness and ease of installation, particularly in indoor decorative use. However, the long service life and premium quality of silicone products position them as the preferred choice in both commercial and residential projects.

- For instance, Signify’s FlexCove Neon Indoor series is built with silicone extrusion, rated for 30,000 operating hours at L70, supports bending radii as small as 50 mm, and withstands operating temperatures from –20 °C to 45 °C, demonstrating the material’s durability in architectural installations.

By Application

The commercial segment led the LED neon lights market in 2024, accounting for more than 60% share. Rising use in advertising, signage, retail, and hospitality sectors fuels this dominance, as businesses increasingly adopt vibrant and energy-efficient neon alternatives for branding and aesthetic appeal. Their long lifespan, low maintenance, and superior brightness make LED neon lights ideal for continuous commercial use. The household segment is growing steadily, driven by rising interest in home décor, ambient lighting, and smart interior design, but remains secondary to large-scale commercial demand.

- For instance, Elemental LED’s Diode LED NEON BLAZE product line is specified for commercial signage and can be field-cut with certain models. The product line includes options with uniform Zero Line Diffusion® and an IP65 rating for wet location use.

Key Growth Drivers

Rising Adoption in Commercial Signage and Advertising

The rapid expansion of retail, hospitality, and entertainment sectors is fueling demand for LED neon lights in signage and advertising. Businesses prefer LED neon solutions for their brightness, energy efficiency, and customizable designs that enhance visibility and brand appeal. Unlike traditional glass neon, LED variants offer lower power consumption and reduced maintenance costs, making them ideal for long-term installations. As companies invest in visually appealing marketing tools, the need for flexible, durable, and vibrant LED neon lighting continues to drive strong market growth across global commercial hubs.

- For instance, the GE Lighting Tetra Contour LED system has a rated life of 50,000 hours, and certain generations and colors support bending radii suitable for complex commercial logos and outdoor advertising displays.

Increasing Popularity in Residential and Decorative Applications

Growing consumer interest in interior aesthetics and personalized décor is boosting the use of LED neon lights in households. Their availability in a wide range of colors, shapes, and designs supports ambient lighting in living spaces, bedrooms, and home events. Rising adoption of smart lighting technologies further integrates LED neon products into modern homes. The flexibility and safety of silicone and PVC-based variants add to their appeal in residential applications. This rising trend in lifestyle-driven home improvement projects continues to strengthen market demand on a global scale.

- For instance, INCISEON’s patented LED neon solution operates at 12V DC, reproduces the glow and 360° light distribution of high voltage neon with superior technology, and offers a safer, more energy-efficient alternative for customized installations.

Energy Efficiency and Sustainability Advantages

The energy-saving benefits of LED neon lights are a major growth driver. Compared to conventional glass neon, LED options consume significantly less electricity while offering longer operational life. This aligns with global sustainability goals and government regulations promoting low-energy lighting solutions. Their reduced heat output and eco-friendly materials make them safer and more sustainable, appealing to both commercial and residential users. As industries and consumers prioritize energy efficiency and carbon footprint reduction, LED neon lights emerge as a preferred alternative, supporting long-term adoption across diverse applications.

Key Trends & Opportunities

Shift Toward Flexible and Customizable Designs

The market is witnessing a trend toward highly flexible and customizable LED neon lights, enabling unique shapes, patterns, and lettering for branding and decoration. Silicone-based variants, known for durability and adaptability, are increasingly favored in outdoor signage and architectural lighting. Growing demand for personalized solutions in events, interior design, and retail spaces creates opportunities for manufacturers offering tailored products. The ability to design cost-effective, creative, and durable neon alternatives is opening new revenue streams, particularly in the premium lighting segment across both developed and emerging markets.

- For instance, Diode LED’s NEON BLAZE silicone series offers cut points every 2 inches and supports a tight bend radius, enabling highly customized shapes for architectural and retail signage projects. Certain versions of the top-bending series can produce up to 219 lumens per foot.

Integration with Smart Lighting Systems

An emerging opportunity lies in integrating LED neon lights with smart lighting platforms. Compatibility with IoT and app-based controls allows users to adjust colors, brightness, and patterns remotely, enhancing functionality. This trend is gaining traction in both residential and commercial spaces, driven by rising adoption of smart homes and connected infrastructure. Businesses also benefit from programmable lighting for dynamic displays and advertisements. As smart lighting ecosystems expand globally, the integration of LED neon lights into these networks creates significant growth potential, supporting enhanced customer engagement and innovative applications.

- For instance, Signify’s Philips Hue Play Gradient Lightstrip integrates with the Hue app, delivers up to 1,800 lumens, supports 16 million color combinations, and connects via Bluetooth and Zigbee, demonstrating how LED neon-style products are embedded into smart lighting ecosystems.

Key Challenges

High Initial Installation Costs

Despite offering long-term savings, LED neon lights face resistance due to their high upfront costs compared to traditional alternatives. Price-sensitive markets, especially in developing regions, often prefer cheaper conventional lighting options. The premium associated with silicone-based products further limits adoption among small businesses and households with budget constraints. Manufacturers face the challenge of balancing quality with affordability to broaden accessibility. Without cost optimization, the higher initial investment remains a barrier to widespread adoption, slowing growth potential in certain customer segments.

Competition from Low-Cost Alternatives

LED neon lights face strong competition from traditional glass neon, LED strip lights, and other low-cost decorative lighting solutions. In commercial signage, cheaper alternatives can deliver acceptable results, reducing reliance on advanced LED neon systems. The presence of numerous local suppliers offering cost-effective products intensifies competitive pressure. Quality differences between premium and low-cost variants also create customer hesitation. To overcome this challenge, manufacturers must emphasize durability, energy efficiency, and design flexibility while also expanding affordable product lines. Without clear differentiation, competition from substitutes could restrict long-term market expansion.

Regional Analysis

North America

North America held over 31% share of the LED neon lights market in 2024, driven by strong adoption across commercial signage, architectural lighting, and residential décor. The United States leads regional demand, supported by widespread use in retail, hospitality, and entertainment industries where brand visibility and energy efficiency are critical. The rise of smart lighting solutions further enhances adoption in modern homes and businesses. Investments in infrastructure modernization and commercial expansions continue to boost demand. With a preference for durable, customizable silicone-based products, North America remains one of the most dynamic markets for LED neon lights.

Europe

Europe accounted for more than 27% share of the LED neon lights market in 2024, supported by strong presence in advertising, events, and automotive applications. Countries such as Germany, France, and the UK drive demand with growing investments in LED signage for retail and public spaces. The region’s sustainability focus also supports the shift from traditional glass neon to energy-efficient LED alternatives. Increasing use in decorative home lighting and city beautification projects further accelerates growth. With high preference for flexible, eco-friendly materials, Europe is expected to maintain steady market expansion supported by innovation in smart lighting technologies.

Asia-Pacific

Asia-Pacific dominated the LED neon lights market in 2024 with more than 34% share, making it the largest regional contributor. Rapid urbanization, infrastructure development, and booming retail sectors in China, India, and Southeast Asia are major growth drivers. Expanding consumer electronics markets also support decorative LED neon usage in events and households. Cost advantages in manufacturing strengthen regional supply chains, particularly for PVC-based variants. Meanwhile, rising disposable incomes and growing adoption of premium silicone products support diversification. With continued industrial and urban expansion, Asia-Pacific remains the fastest-growing regional market for LED neon lights across both commercial and residential sectors.

Latin America

Latin America captured over 5% share of the LED neon lights market in 2024, supported by increasing investments in retail signage, hospitality, and entertainment venues across Brazil and Mexico. Growing urbanization and rising interest in decorative lighting solutions are driving adoption among households. However, higher upfront costs and limited availability of premium silicone-based products restrict faster penetration. Local manufacturers and distributors focusing on affordable PVC-based solutions have gained traction in cost-sensitive markets. Despite challenges, steady urban development and rising use of LED neon lights in branding and advertising campaigns support moderate but consistent growth in the region.

Middle East & Africa

The Middle East & Africa accounted for nearly 3% share of the LED neon lights market in 2024. Growth is fueled by expanding retail, hospitality, and infrastructure projects in Gulf nations, where energy-efficient lighting is increasingly adopted. LED neon lights are also used in decorative and entertainment sectors, particularly in urban hubs such as Dubai and Riyadh. In Africa, adoption remains limited to urban centers due to cost constraints and lower awareness compared to traditional lighting. However, demand for durable and customizable lighting solutions is gradually increasing, creating long-term opportunities as infrastructure investment and urban development progress.

Market Segmentations:

By Type

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the LED neon lights market features key players such as INCISEON, GE Lighting, Best Buy Neon Signs, Signify Holding, and Elemental LED Inc. These companies compete by focusing on product innovation, energy efficiency, and customized lighting solutions for both commercial and residential applications. Leading manufacturers are emphasizing durable silicone-based designs and smart lighting integration to strengthen their portfolios. GE Lighting and Signify Holding leverage global distribution networks to expand market reach, while Elemental LED Inc. focuses on high-performance, flexible products tailored for architectural and decorative use. Best Buy Neon Signs and INCISEON cater to signage and branding solutions, addressing the growing demand from retail and hospitality sectors. The market remains highly competitive, with strategies centered on sustainability, expanding digital lighting capabilities, and enhancing customer engagement. Continuous investments in R&D and regional expansion are helping players maintain strong positions in this rapidly growing sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INCISEON

- GE Lighting

- Best Buy Neon Signs

- Signify Holding

- Elemental LED Inc.

- Best Buy Neon Signs

- INCISEON

- Elemental LED Inc.

- GE Lighting

- Signify Holding

Recent Developments

- In September 2025, Elemental LED’s Diode LED brand announced a 20% price cut on its LED tape light products to stimulate demand amid industry challenges.

- In 2025, Elemental LED expanded its manufacturing in Reno, Nevada, to begin producing customized Light Guide Panels (LGPs) under the Diode LED brand.

- In August 2024, Signify released its FlexCove Neon Indoor strip lights with a lifetime rating of 30,000 hours at L70 and full bending flexibility (able to follow curves).

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increasing adoption in commercial signage and advertising.

- Silicone-based LED neon lights will continue to dominate due to durability and flexibility.

- PVC-based products will maintain demand in cost-sensitive indoor decorative applications.

- Household adoption will rise as consumers seek modern, aesthetic, and energy-efficient décor solutions.

- Asia-Pacific will remain the largest market, supported by rapid urbanization and infrastructure expansion.

- North America will sustain growth with strong demand from retail, hospitality, and entertainment sectors.

- Europe will expand through sustainability-focused projects and advanced architectural lighting.

- Smart lighting integration will open new opportunities for connected and programmable LED neon products.

- Manufacturers will focus on recyclable and eco-friendly materials to align with global sustainability goals.

- Competition will intensify as global and regional players expand portfolios with customized designs.