Market Overview:

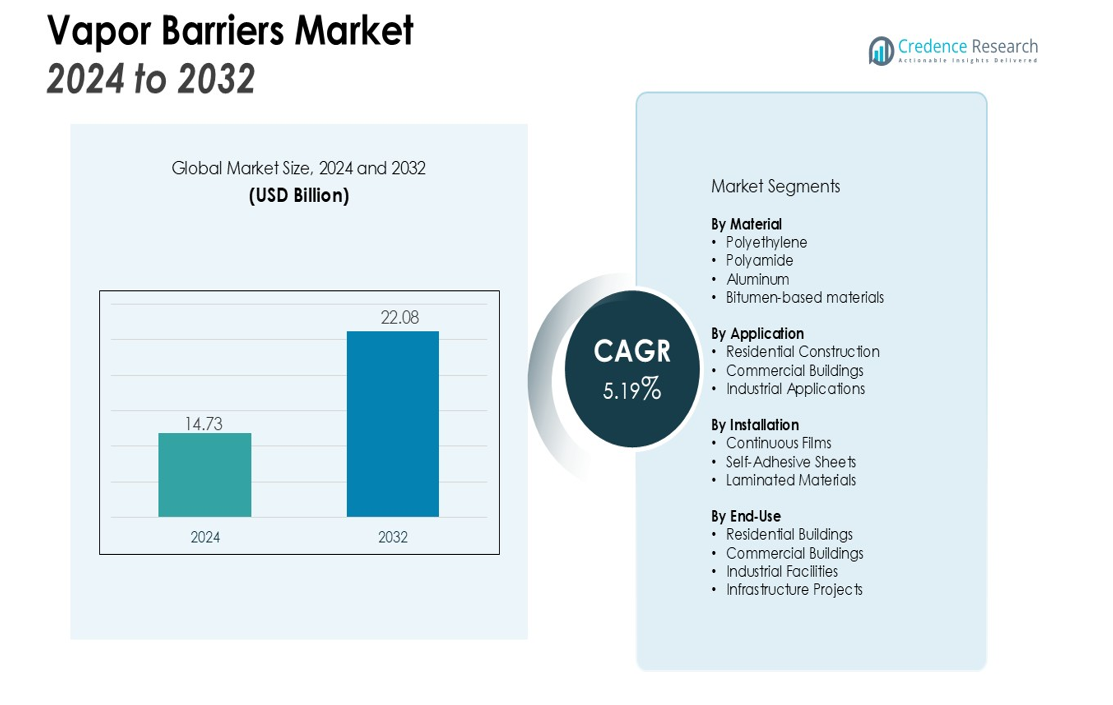

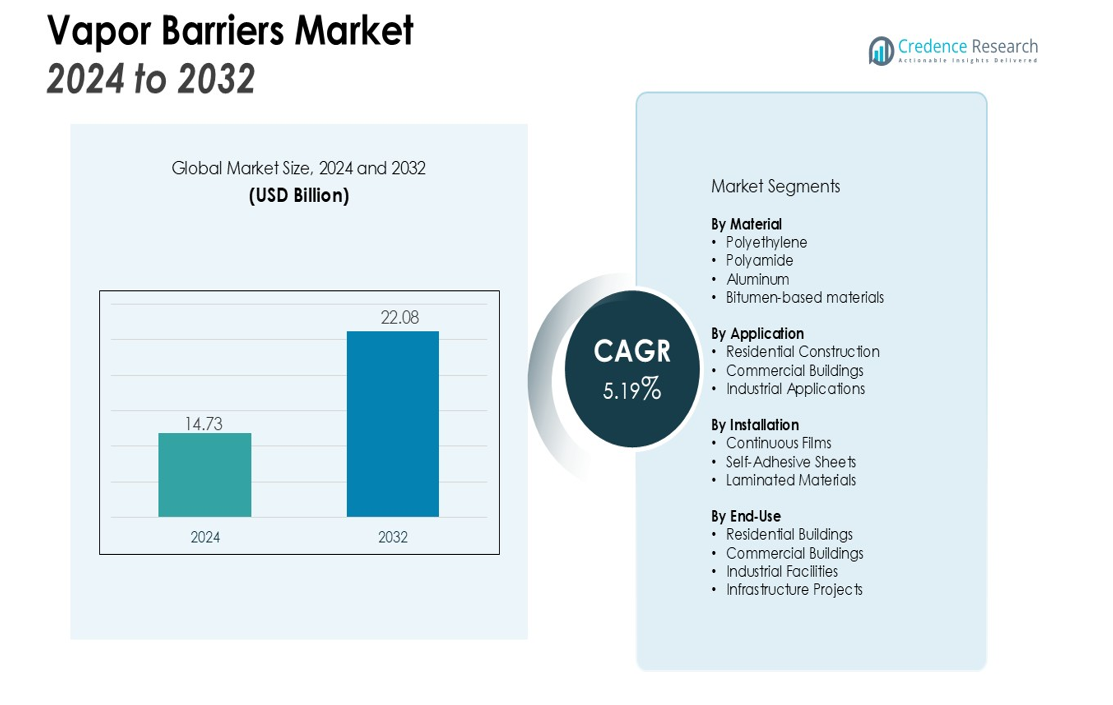

The Vapor Barriers Market size was valued at USD 14.73 billion in 2024 and is anticipated to reach USD 22.08 billion by 2032, at a CAGR of 5.19% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vapor Barriers Market Size 2024 |

USD 14.73 billion |

| Vapor Barriers Market, CAGR |

5.19% |

| Vapor Barriers Market Size 2032 |

USD 22.08 billion |

Key drivers of the market include rapid urbanization, stringent building codes, and the growing adoption of green building technologies. The demand for vapor barriers is particularly heightened in regions with fluctuating climates, where controlling moisture can significantly impact energy consumption and building longevity. The increasing construction activities, especially in residential and commercial sectors, are further accelerating the demand for these products. Additionally, innovations in vapor barrier materials, such as the development of eco-friendly and high-performance barriers, are likely to drive future market growth.

Regionally, North America leads the market, accounting for a substantial share due to stringent building regulations and a well-established construction industry. Europe follows closely, with growing demand driven by sustainability trends and energy-efficient construction. The Asia Pacific region is expected to witness the fastest growth, fueled by booming construction activities in countries like China and India.

Market Insights:

- The global vapor barriers market was valued at USD 14.73 billion in 2024 and is expected to reach USD 22.08 billion by 2032, with a CAGR of 5.19% during the forecast period.

- Growing demand for energy-efficient construction materials is a major driver, as vapor barriers help prevent moisture buildup, improving insulation efficiency and reducing heating and cooling energy requirements.

- Stringent building codes and regulations, particularly in regions with fluctuating climates, mandate the use of vapor barriers in construction projects to enhance energy efficiency and building durability.

- Sustainability trends are accelerating the adoption of vapor barriers, as they contribute to eco-friendly, energy-efficient buildings and support green certifications like LEED.

- Rapid urbanization and the expanding construction industry, particularly in emerging economies like China, India, and the Middle East, are increasing the demand for vapor barriers in both residential and commercial sectors.

- The high initial installation costs of vapor barriers, particularly those made from advanced materials, remain a challenge for smaller construction projects, potentially hindering broader market adoption.

- Regional differences in market adoption and regulatory compliance, particularly in areas with milder climates, affect the uniform growth of the market, creating challenges for manufacturers to expand globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Energy-Efficient Construction Materials

The growing demand for energy-efficient construction materials is a significant driver of the vapor barriers market. As energy costs rise and sustainability becomes a priority, there is a stronger focus on improving building insulation and reducing energy loss. Vapor barriers play a crucial role in this by preventing moisture buildup, which can lead to mold and reduce the overall efficiency of insulation. As a result, more buildings are incorporating these barriers to enhance thermal performance and decrease heating and cooling energy requirements.

- For instance, Dow’s DEFENDAIR™ 200 is a one-component, water-based silicone coating that cures to form a flexible, breathable membrane, enhancing the building envelope’s energy efficiency.

Strict Building Codes and Regulations

Stringent building codes and regulations are another key driver of the vapor barriers market. Governments across regions are enforcing tighter standards for energy conservation, moisture control, and building durability. Vapor barriers are now often a mandatory inclusion in construction projects to comply with these regulations. This is particularly evident in regions with fluctuating weather conditions, where proper moisture management is critical to maintaining the structural integrity and longevity of buildings.

Rising Focus on Sustainable and Green Building Technologies

Sustainability trends in construction are accelerating the adoption of vapor barriers. The global shift toward eco-friendly and sustainable building practices has increased demand for materials that improve a structure’s environmental footprint. Vapor barriers, being integral to energy-efficient construction, align well with the growing emphasis on green buildings. They help in reducing moisture-related damage, promoting better air quality, and improving overall indoor comfort, making them essential for green building certifications such as LEED.

- For instance, DuPont’s Tyvek® CommercialWrap® D provides superior weather protection for sustainable projects and can withstand up to 270 days of UV exposure during construction without damage.

Rapid Urbanization and Expanding Construction Activities

Rapid urbanization and the expanding construction industry in emerging economies are fueling the demand for vapor barriers. Countries in Asia Pacific and the Middle East are witnessing a construction boom, driven by increasing population growth and urban development. Vapor barriers are increasingly used in both residential and commercial sectors to prevent moisture-related damage, particularly in high-humidity regions. As the construction market continues to grow, so does the need for moisture protection and energy-efficient building solutions.Top of Form

Market Trends:

Growing Preference for Eco-Friendly and Sustainable Vapor Barriers

The trend toward eco-friendly and sustainable construction materials is gaining momentum, which is influencing the vapor barriers market. Manufacturers are increasingly developing barriers using recyclable materials, reducing their environmental impact. This trend aligns with the rising demand for green buildings and the growing importance of LEED certifications. Consumers and construction companies are opting for vapor barriers made from low-impact materials like biodegradable plastics and natural fibers, contributing to the overall sustainability of building projects. These products not only offer enhanced performance in terms of moisture control but also meet the growing demand for environmentally responsible materials. As energy-efficient construction practices evolve, the focus on sustainability in vapor barriers is expected to continue shaping the market.

- For instance, Kuraray offers EVAL™ EVOH, a high-performance oxygen barrier where a 1-millimeter layer provides the same gas barrier performance as a 10-meter-thick wall of LDPE, enabling resource-saving packaging structures.

Advancements in Vapor Barrier Technology and Performance

Technological advancements in vapor barrier materials are improving performance and expanding their application in construction. Innovations in vapor barrier films and coatings are enhancing their ability to control moisture and improve energy efficiency. Manufacturers are also focusing on improving the durability and ease of installation of these barriers, making them more effective and cost-efficient. New multi-layered designs and vapor barrier systems are offering better protection against moisture penetration, particularly in challenging climates. The continued development of high-performance vapor barriers is driving the demand for these products, especially in regions with extreme weather conditions. These technological improvements are expected to play a key role in the market’s expansion and meet evolving industry standards.

- For instance, Toyo Seikan Group’s MiraNeo® Ultra Moisture Barrier Film provides a significant technological advantage by achieving a water vapor transmission rate (WVTR) as low as 10⁻⁶ g/m² per day, one of the highest levels of moisture barrier performance available.

Market Challenges Analysis:

High Initial Installation Costs and Maintenance

One of the primary challenges facing the vapor barriers market is the high initial cost of installation. These barriers, especially those with advanced materials or multi-layer designs, can significantly increase construction budgets. The need for skilled labor and specialized installation techniques further elevates these costs. Despite long-term energy savings and improved building durability, the upfront investment can be a barrier for many small and mid-sized construction projects. This financial challenge often delays the adoption of vapor barriers in cost-sensitive markets, hindering broader market growth.

Regional Variations in Market Adoption and Regulatory Compliance

Another challenge is the variation in market adoption and regulatory requirements across regions. While some regions have stringent building codes that mandate the use of vapor barriers, others have less rigorous regulations, leading to slower adoption. In areas with milder climates, the perceived need for vapor barriers is lower, which limits their implementation. Furthermore, regional differences in material availability and the cost of specialized products can impact the market’s uniform growth. These disparities can create obstacles for manufacturers aiming to expand their presence in diverse global markets.

Market Opportunities:

Increasing Demand for Energy-Efficient and Green Building Solutions

The growing emphasis on energy-efficient and sustainable building practices presents a significant opportunity for the vapor barriers market. With global construction trends shifting towards green buildings, there is a heightened demand for materials that contribute to energy conservation and improved indoor air quality. Vapor barriers play a crucial role in enhancing the energy efficiency of buildings by preventing moisture accumulation that can damage insulation and increase heating and cooling costs. This rising demand for eco-friendly construction solutions positions vapor barriers as a key component in the development of sustainable, high-performance buildings, particularly in markets focusing on achieving green certifications.

Expansion in Emerging Economies and Urbanization

Emerging economies, particularly in Asia Pacific and the Middle East, represent a substantial growth opportunity for the vapor barriers market. Rapid urbanization and increasing construction activities in these regions are driving the need for efficient moisture control systems in residential and commercial buildings. As infrastructure development accelerates in countries like China, India, and the UAE, the demand for vapor barriers to ensure building durability and energy efficiency is expected to grow. This trend, combined with the increasing adoption of building regulations that prioritize moisture management, will open up new markets and foster innovation in vapor barrier technologies to meet the specific needs of these regions.

Market Segmentation Analysis:

By Material

Vapor barriers are available in various materials, including polyethylene, polyamide, aluminum, and bitumen-based options. Polyethylene dominates the market due to its cost-effectiveness, ease of installation, and reliable moisture resistance. Aluminum vapor barriers are preferred in high-performance applications due to their superior durability and high moisture resistance. Polyamide-based barriers are gaining traction in the market for their lightweight properties and flexibility. The choice of material depends on the specific needs of the construction project, including environmental conditions, insulation requirements, and budget.

- For instance, W. R. MEADOWS’ AIR-SHIELD Aluminum Sheet Membrane is a self-adhering barrier that is nominally 40 mils thick and demonstrates excellent durability with a puncture resistance of 88 lbf.

By Application

Vapor barriers are primarily used in residential, commercial, and industrial applications. In residential construction, they are used in walls, roofs, and floors to protect against moisture buildup, which can lead to mold and structural damage. Commercial buildings, especially those in regions with high humidity, rely on vapor barriers to maintain the integrity of insulation and improve energy efficiency. In industrial applications, vapor barriers are crucial for protecting machinery and equipment from moisture that can cause rust and corrosion. The demand for vapor barriers in these applications is driven by the growing emphasis on building durability and energy efficiency.

- For instance, Cortec’s CorroLogic Tube Strips, powered by Nano VpCI, are designed to protect the interior of pipes and tubes from corrosion and are available on a 500-foot roll.

By Installation

Vapor barriers are typically installed in three ways: as continuous films, self-adhesive sheets, or laminated materials. Continuous film barriers are commonly used for larger surface areas, providing seamless protection against moisture. Self-adhesive sheets offer ease of installation and are often used in areas with complex structures. Laminated materials are used for added strength and durability, especially in commercial and industrial applications where high performance is required. The method of installation varies depending on the specific requirements of the building project and the desired level of moisture protection.

Segmentations:

By Material

- Polyethylene

- Polyamide

- Aluminum

- Bitumen-based materials

By Application

- Residential Construction

- Commercial Buildings

- Industrial Applications

By Installation

- Continuous Films

- Self-Adhesive Sheets

- Laminated Materials

By End-Use

- Residential Buildings

- Commercial Buildings

- Industrial Facilities

- Infrastructure Projects

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Leading Market with Strong Regulatory Support

North America holds the largest share of the vapor barriers market at 35%. Strict building codes and high demand for energy-efficient materials in the U.S. and Canada drive the market’s dominance. The region’s regulations require the use of vapor barriers in both residential and commercial buildings to ensure energy efficiency and moisture control. The focus on green building initiatives, supported by government incentives, further accelerates the demand for vapor barriers. As the demand for sustainable infrastructure rises, vapor barriers play a critical role in meeting both performance and environmental standards.

Europe: Rapid Expansion with Emphasis on Sustainability

Europe holds a significant share of the market at 28%. The region’s commitment to sustainability and energy-efficient construction fuels the demand for vapor barriers. Stringent energy efficiency regulations, along with an increasing focus on eco-friendly building practices, support market growth. Countries like Germany, France, and the UK are adopting green building technologies, and vapor barriers are key to meeting these standards. Innovations in barrier materials, including recyclable and biodegradable options, also contribute to the region’s market expansion, aligning with Europe’s push toward sustainable construction practices.

Asia Pacific and Middle East: Emerging Markets with Rapid Growth

Asia Pacific and the Middle East account for 32% of the vapor barriers market, with rapid urbanization driving demand. Countries like China and India are witnessing significant construction growth, increasing the need for efficient moisture control solutions. The Middle East, with its focus on smart cities and sustainable buildings, also presents a growing market for vapor barriers. As infrastructure projects expand in these regions, vapor barriers are increasingly recognized for their role in enhancing building durability and reducing energy consumption. This growth trend is expected to continue as construction activities accelerate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- GCP Applied Technologies

- Sika

- BASF

- Carlisle Companies

- GAF Materials Corporation

- Soprema Group

- CertainTeed Corporation

- Honeywell

- Johns Manville

- Dow Chemical Company

- DuPont de Nemours

- Firestone Building Products

Competitive Analysis:

The vapor barriers market is highly competitive, with several leading players dominating the landscape. Key companies include Dow, 3M, Berry Global, and Covestro, all of which offer a wide range of vapor barrier solutions across various materials and applications. These companies focus on product innovation, sustainability, and expanding their global reach to maintain market leadership. Dow and 3M, for instance, offer advanced polyethylene and aluminum-based vapor barriers known for their durability and moisture resistance. Smaller players are focusing on niche applications, such as eco-friendly and high-performance materials, to differentiate themselves in the market. The increasing demand for energy-efficient and sustainable building materials is pushing competitors to develop cost-effective and high-quality vapor barriers. Market players are also expanding their distribution networks and forging strategic partnerships with construction firms to increase their market share and meet the rising demand for moisture control solutions in the construction sector.

Recent Developments:

- In September 2025, BASF introduced its SYNSPIRE® G1-110 catalyst, a new product designed to increase steam efficiency and lower CO2 emissions during industrial processes.

- In January 2025, CertainTeed’sd’s RenuCore™ division entered into a partnership with Mark II Transfer Station LLC, licensing its technology to recycle asphalt shingles into materials for high-performance pavement.

- In September 2025, DuPont announced its intention to acquire a reverse osmosis manufacturing plant in China to grow its FilmTec™ production capabilities in the country.

Report Coverage:

The research report offers an in-depth analysis based on Material, Application, Installation, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for vapor barriers will continue to rise as energy efficiency and sustainability remain central to global construction trends.

- Innovation in material technology will lead to the development of more eco-friendly and durable vapor barriers, catering to green building standards.

- Increased construction activities in emerging economies, particularly in Asia Pacific and the Middle East, will significantly boost market growth.

- Stringent building codes and regulations across regions will enforce the use of vapor barriers, particularly in regions with fluctuating climates.

- Vapor barriers will become more integral to residential and commercial construction projects focused on improving building longevity and reducing energy consumption.

- The growth of the smart city initiatives will increase the need for high-performance vapor barriers to ensure the structural integrity of buildings.

- Ongoing advancements in manufacturing processes will drive the availability of cost-effective vapor barrier solutions for diverse construction applications.

- The market will see a growing preference for self-adhesive and laminated vapor barriers due to their ease of installation and enhanced performance.

- New market entrants will focus on developing specialized vapor barriers tailored to specific industry needs, further diversifying product offerings.

- Increased awareness of moisture control’s impact on indoor air quality and health will strengthen the demand for vapor barriers in both residential and commercial sectors.