Market Overview

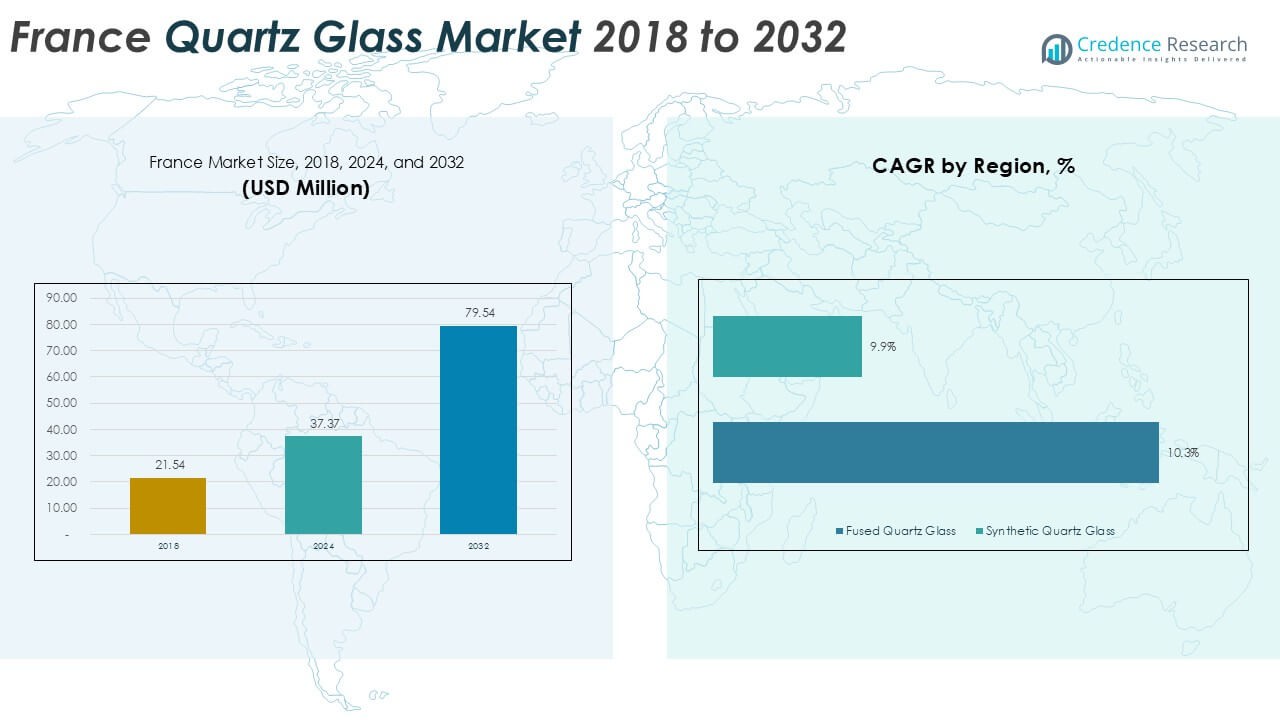

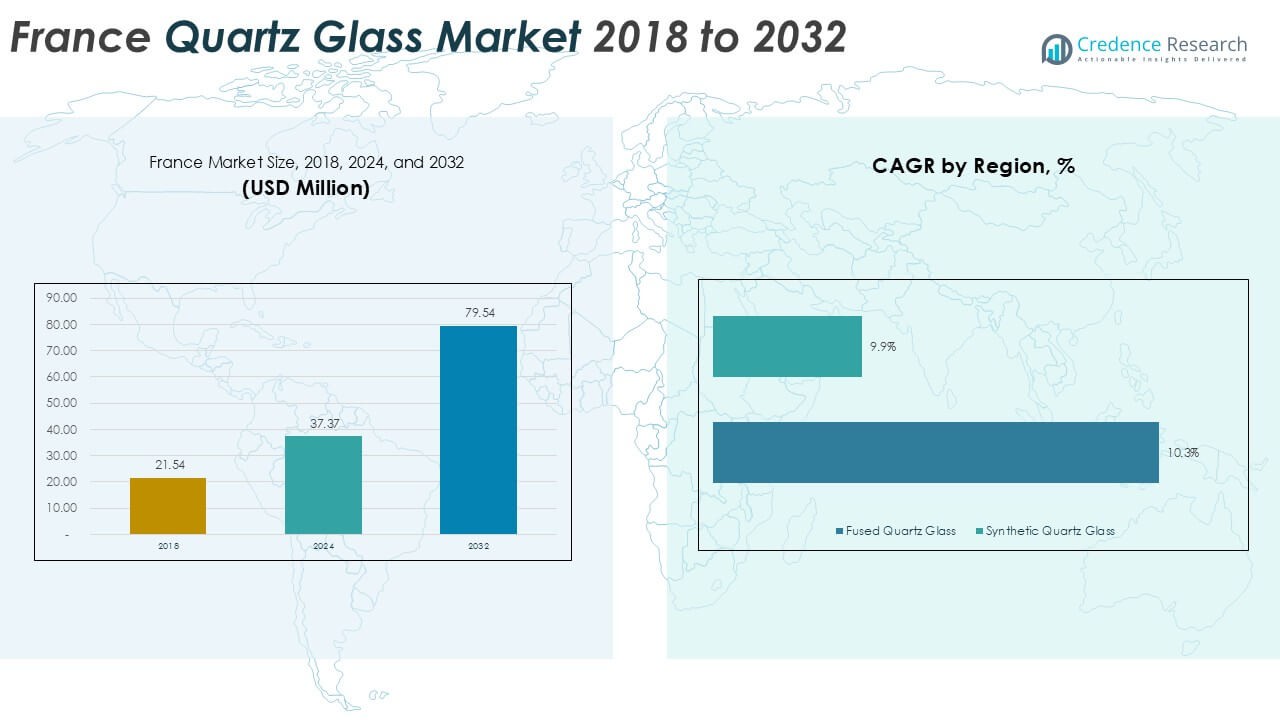

France Quartz Glass market size was valued at USD 21.54 million in 2018, grew to USD 37.37 million in 2024, and is anticipated to reach USD 79.54 million by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Glass Market Size 2024 |

USD 37.37 Million |

| France Quartz Glass Market, CAGR |

9.9% |

| France Quartz Glass Market Size 2032 |

USD 79.54 Million |

The France quartz glass market is led by prominent players such as Saint-Gobain S.A., Heraeus Holding, QSIL, WONIK Group, and Verresatine, alongside specialized suppliers like Quartz Solutions, Raesch Quarz, Swift Glass, and Sandfire Scientific. These companies collectively drive innovation in fused and synthetic quartz for semiconductors, solar energy, optics, and laboratory applications. Competitive strategies focus on expanding high-purity product lines, securing supply contracts, and investing in R&D to support advanced electronics and renewable energy growth. Regionally, Northern France accounted for the largest share at 30% in 2024, driven by semiconductor clusters, strong research institutions, and robust industrial activity. Eastern and Southern France followed with 25% each, supported by cross-border trade, photonics, and solar farms, while Western France held the remaining 20%, benefiting from aerospace and optoelectronics hubs. This balanced regional distribution highlights strong nationwide demand anchored by high-tech and renewable energy applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France quartz glass market was valued at USD 37.37 million in 2024 and is projected to reach USD 79.54 million by 2032, growing at a CAGR of 9.9%.

- Growth is driven by rising demand from the semiconductor and electronics sector, which accounted for over 45% of total applications in 2024, supported by EU initiatives to strengthen chip manufacturing.

- A major trend is the shift toward synthetic quartz glass, offering ultra-high purity for photonics, medical, and advanced electronics, creating high-value opportunities despite higher production costs.

- The market is moderately consolidated, with top players including Saint-Gobain S.A., Heraeus Holding, QSIL, WONIK Group, and Verresatine, focusing on R&D and capacity expansion to maintain competitive advantage.

- Regionally, Northern France led with 30% share in 2024 due to strong semiconductor clusters, followed by Eastern and Southern France at 25% each, while Western France contributed 20% with growth supported by aerospace and optoelectronics.

Market Segmentation Analysis:

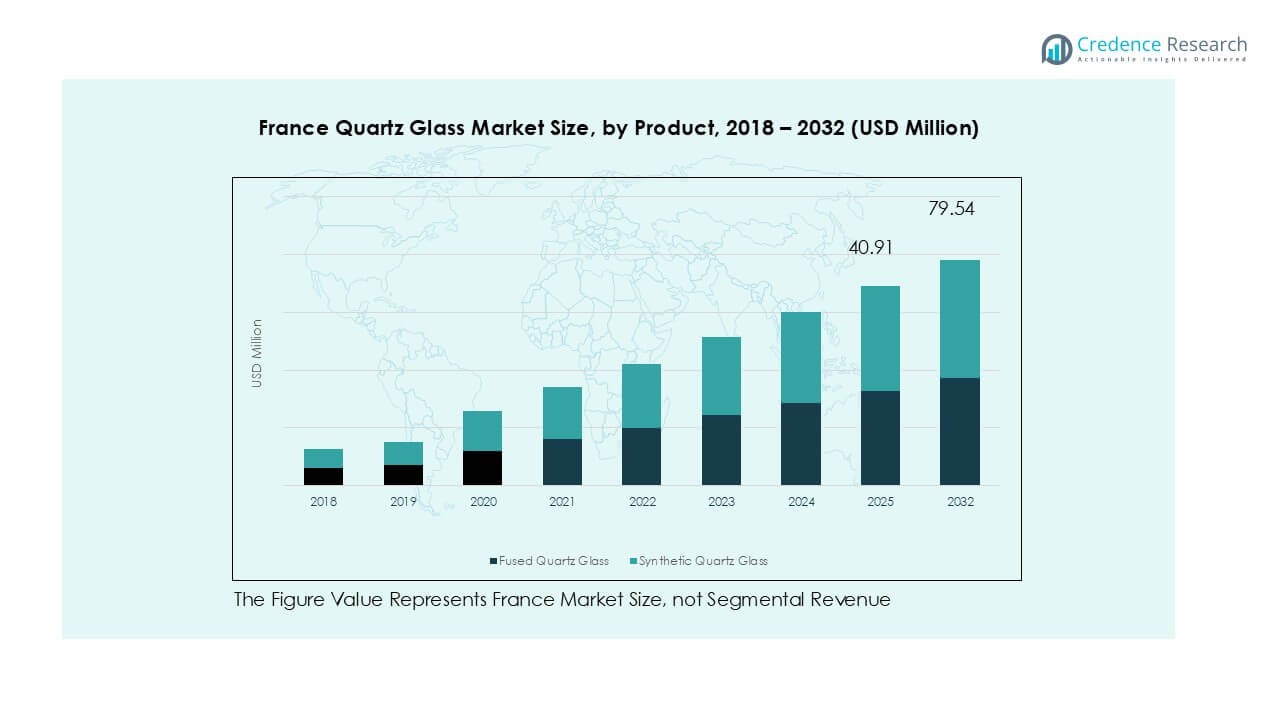

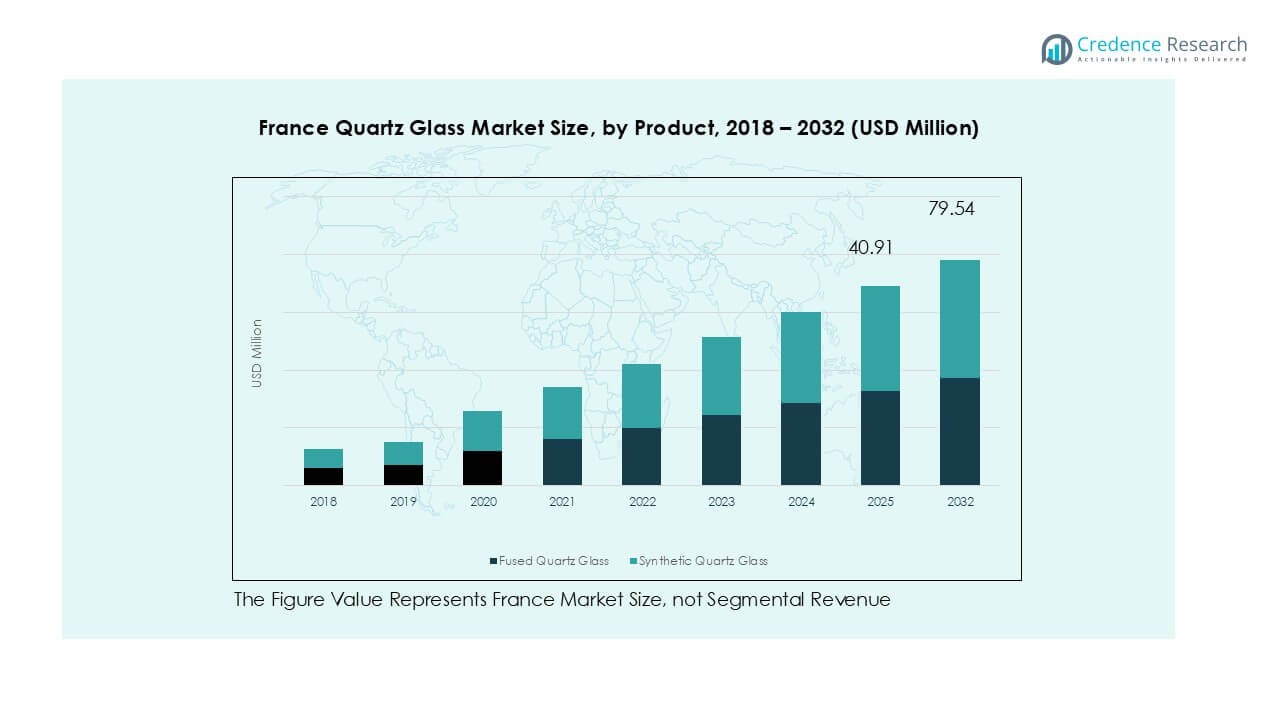

By Product

The fused quartz glass segment dominated the France quartz glass market in 2024, holding over 60% share. Its leadership stems from broad use in semiconductor wafers, optical fibers, and high-temperature applications where thermal stability and purity are critical. Demand is reinforced by France’s growing semiconductor and electronics industry, which relies heavily on fused quartz for precision processing. Synthetic quartz glass, though gaining traction for advanced optics and high-end electronics, remains a smaller share due to its higher production costs and specialized applications compared to fused quartz glass.

- For instance, Corning provides its EXTREME ULE® (Ultra-Low Expansion) glass for use in photomask substrates, a critical component for patterning the most complex, high-density chips. The exceptionally high thermal stability and dimensional uniformity of EXTREME ULE glass help ensure manufacturing consistency, which in turn supports high-throughput wafer processing.

By Application

The semiconductors and electronics segment accounted for the largest share of the France quartz glass market in 2024, exceeding 45% of total demand. Growth is driven by rising investment in microelectronics, lithography, and silicon wafer manufacturing, where quartz glass enables high precision and contamination-free processing. France’s increasing focus on strengthening its semiconductor supply chain under EU initiatives further supports demand. Solar energy, optics, and medical uses are expanding steadily, but electronics remain the primary growth driver due to consistent technological upgrades and large-scale production needs.

- For instance, in ASML’s Extreme Ultraviolet (EUV) lithography tools, the reflective photomasks are constructed on a substrate made from a low thermal expansion material (LTEM). The flatness specifications are significantly more complex and stringent than a simple ≤ 15 nm figure, requiring extremely smooth surfaces measured over specific, smaller quality areas to minimize image placement errors and ensure pattern fidelity.

By Form

Quartz tubes emerged as the dominant form in 2024, capturing nearly 40% share of the France quartz glass market. Their wide use in semiconductor manufacturing, solar energy equipment, and laboratory instruments underpins this dominance. Tubes provide high thermal resistance, excellent transparency, and dimensional stability, making them indispensable for chemical processing and microelectronics. Quartz rods and plates/sheets hold growing demand, particularly in optics and photonics, yet their contribution is smaller compared to tubes. Continuous innovation in thin-walled quartz tubes for efficient processing further consolidates their market leadership in the country.

Key Growth Drivers

Expanding Semiconductor Manufacturing Base

France’s quartz glass market benefits significantly from the expanding semiconductor industry, which requires high-purity quartz products for wafer fabrication, lithography, and etching processes. Quartz glass provides superior thermal stability, transparency, and chemical resistance, enabling contamination-free environments essential for chip production. The French government’s focus on strengthening domestic semiconductor capacity, aligned with the EU’s €43 billion Chips Act, is accelerating investments in fabrication plants. With leading European and global chipmakers boosting production, demand for fused quartz tubes, plates, and rods continues to rise. This growth is further supported by technological miniaturization and advanced microelectronics, which require precision materials for consistent performance.

- For instance, at GlobalFoundries’ Fab 1 in Dresden, maintaining an exceptionally low level of metal and other impurities is crucial for maximizing the yield of 300mm wafers. Wafers are processed in specialized equipment like diffusion furnaces that often use high-purity quartz tubes, which must be scrupulously maintained to prevent contamination.

Rising Solar Energy Installations

The growth of solar energy installations in France is another strong driver for the quartz glass market. Quartz glass is a critical material in photovoltaic (PV) manufacturing, particularly in solar cells, ingot production, and encapsulation processes. France aims to double its solar energy capacity to over 100 GW by 2050 as part of its renewable transition plan, creating consistent demand for quartz components in solar modules. High durability and superior light transmission make quartz indispensable for PV applications. As the country expands utility-scale solar farms and rooftop installations, quartz glass demand is set to increase further, supported by EU decarbonization policies and incentives for renewable adoption.

- For instance, in the production of monocrystalline silicon ingots, quartz crucibles by companies like Saint-Gobain must withstand continuous use at 1420 °C for over 6000 hours before replacement.

Advancements in Optics and Photonics

Optics and photonics industries in France are driving additional growth opportunities for quartz glass. Quartz is widely used in high-performance optical lenses, laser systems, and precision instruments due to its exceptional clarity and UV transmission properties. France’s strong presence in aerospace, defense, and research institutions supports innovation in advanced optics, where quartz glass enables accurate measurements and stable performance under extreme conditions. Growing demand for photonics in telecommunications and medical diagnostics also boosts usage. With rising investment in R&D and collaboration between universities and technology firms, quartz glass adoption in advanced optics and photonics applications is expanding steadily, positioning this sector as a key growth pillar.

Key Trends & Opportunities

Shift Toward Synthetic Quartz Glass

A major trend shaping the France quartz glass market is the growing adoption of synthetic quartz glass. Unlike fused quartz, synthetic quartz offers ultra-high purity and superior homogeneity, making it ideal for advanced photonics, medical imaging, and semiconductor lithography. Although production costs remain higher, rising demand for defect-free materials in nanotechnology and next-generation electronics is creating strong opportunities. France’s research hubs and collaborations with EU partners are fostering innovation in synthetic quartz development, positioning it as a premium growth segment. Companies focusing on scaling synthetic quartz output stand to gain a competitive advantage in niche but high-value applications.

- For instance, synthetic quartz used in UV optics often maintains impurity levels below 20 ppm for metal contaminants, enabling stable deep-UV transmission.

Opportunities in Medical and Laboratory Applications

Medical and laboratory applications represent a growing opportunity for quartz glass adoption in France. The material’s chemical inertness, sterilization compatibility, and optical clarity make it highly suitable for diagnostic equipment, laboratory consumables, and pharmaceutical research tools. Increasing demand for precision instruments in life sciences and biotechnology is boosting quartz usage in cuvettes, crucibles, and optical components. France’s emphasis on strengthening its healthcare infrastructure and expanding research capabilities further accelerates adoption. This segment offers high-margin opportunities, as specialized medical devices often require advanced quartz solutions that can withstand both extreme conditions and stringent regulatory standards.

- For instance, synthetic quartz cuvettes used in UV spectrophotometers often specify surface flatness better than λ/10 (for λ = 633 nm) to reduce optical error.

Key Challenges

High Production and Processing Costs

The production of quartz glass is energy-intensive and costly, presenting a significant challenge to the France market. Achieving high-purity quartz requires advanced processing techniques and specialized equipment, driving up operational expenses. Fluctuating raw material prices and rising energy costs in Europe further amplify this challenge. For small and mid-sized manufacturers, competing with large global suppliers becomes difficult due to limited economies of scale. These high costs often translate into higher product prices, limiting adoption in cost-sensitive industries. Overcoming this challenge requires innovation in cost-effective production methods and increased efficiency in processing technologies.

Competition from Alternative Materials

Another key challenge is the growing competition from alternative materials such as borosilicate glass, sapphire, and advanced ceramics. These materials offer durability, heat resistance, and in some cases, lower costs, making them attractive substitutes in specific applications. For instance, borosilicate is widely used in laboratory and medical devices due to its affordability and performance. This substitution risk poses limitations on quartz glass demand in lower-end segments. To address this, manufacturers must differentiate through product innovation, superior quality, and expanding into high-value sectors like semiconductors, photonics, and solar energy, where quartz glass maintains clear performance advantages.

Regional Analysis

Northern France

Northern France commands about 30 % share of the national quartz glass market. This region hosts major industrial hubs, especially around Paris, Lille, and Normandy. High demand emerges from semiconductor, electronics, and optics firms located here. Proximity to ports and logistics routes helps reduce transport cost for quartz components. The concentration of R&D centers and universities further supports uptake of advanced quartz variants. Growth in Northern France is driven by both domestic consumption and exports to neighboring European markets.

Eastern France

Eastern France accounts for nearly 25 % of France’s quartz glass demand. Regions like Grand Est and Bourgogne-Franche-Comté host glassmakers, precision optics, and electronics clusters. The presence of cross-border trade with Germany, Switzerland, and Luxembourg raises demand for high-performance quartz products. The strong industrial base and investments in semiconductor fabs in the Rhine corridor amplify consumption. Eastern France’s share is bolstered by specialization in high-purity and synthetic quartz production tailored for advanced photonics.

Western France

Western France captures about 20 % of the quartz glass market. Key contributors include the Pays de la Loire and Nouvelle-Aquitaine regions, benefiting from coastal access for raw material imports and exports. Aerospace, electronics, and solar component manufacturing in western clusters drive local quartz demand. This region also benefits from favorable logistics, with ports facilitating supply chain connectivity. Investment in clean-energy and optoelectronics facilities along the Atlantic coast boosts growth in quartz consumption.

Southern France

Southern France holds roughly 25 % of the French quartz glass market. The Occitanie and Provence-Alpes-Côte d’Azur areas include photonics, solar, and scientific research clusters. Solar farms in the south intensify demand for quartz in PV manufacturing. Optics and photonics research centers (e.g. in Marseille, Montpellier) also push demand. The region’s strong academic-industry collaboration supports uptake of synthetic quartz variants. Proximity to Mediterranean ports further reduces transport costs for bulk shipments.

Market Segmentations:

By Product

- Fused Quartz Glass

- Synthetic Quartz Glass

By Application

- Semiconductors & Electronics

- Solar Energy

- Optics & Photonics

- Medical & Laboratory

- Others

By Form

- Quartz Tubes

- Quartz Rods

- Quartz Plates/Sheets

- Others

By Geography

- Northern France

- Eastern France

- Western France

- Southern France

Competitive Landscape

The France quartz glass market is moderately consolidated, with global leaders and regional specialists competing across key application sectors. Saint-Gobain S.A., Heraeus Holding, and QSIL dominate through strong product portfolios, advanced manufacturing capabilities, and established supply chains. Domestic players such as Verresatine and Quartz Solutions strengthen the local ecosystem with tailored products for electronics, solar, and photonics. International suppliers including WONIK Group, Raesch Quarz, and Swift Glass add competitive intensity by offering high-purity and synthetic quartz solutions for semiconductor and laboratory use. Companies are increasingly focused on R&D partnerships, capacity expansion, and vertical integration to secure long-term contracts with semiconductor and solar energy manufacturers. Product differentiation remains central to competition, particularly in applications requiring superior thermal resistance, transparency, and defect-free performance. The competitive environment is shaped by innovation, regulatory compliance, and the ability to deliver high-quality quartz at scale while meeting the rising demand from France’s semiconductor and renewable energy industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Verresatine

- Saint-Gobain S.A.

- Heraeus Holding

- Quartz Solutions

- Precision Electronic Glass

- WONIK Group

- Raesch Quarz

- QSIL

- Swift Glass

- Sandfire Scientific

- Other Key Players

Recent Developments

- In July 2025, QSIL inaugurated (opened) an expansion building at its ceramics site in Auma-Weidatal for the metallization process. While this is not directly quartz glass, it is part of its high-performance materials / production footprint.

- In March 2025, Heraeus (Heraeus Covantics) launches a new quartz manufacturing plant in Shenyang, China.The facility cost is ~600 million yuan (≈ USD 83.6 million). It focuses on high-purity and ultra-high-purity synthetic quartz products.

- In January 2025, Heraeus Covantics is formed (reorganization). Heraeus combined its high-performance materials units, Heraeus Conamic and Heraeus Comvance, into a new operating company under the name.

- In December 2024 / January 2025, QSIL GmbH Quarzschmelze Ilmenau is acquired by SCHOTT AG. Effective early 2025, SCHOTT acquired the quartz glass production facility in Ilmenau, Germany, including about 275 employees. The acquisition is seen as strategic for SCHOTT to bolster its semiconductor materials portfolio and ensure supply chain resilience.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand from semiconductors and electronics.

- Solar energy applications will boost adoption of quartz glass in photovoltaic manufacturing.

- Synthetic quartz glass will gain traction due to high purity and defect-free performance.

- Optics and photonics industries will drive innovation in advanced quartz applications.

- Medical and laboratory uses will rise with growing life sciences research in France.

- Companies will focus on R&D to develop cost-efficient and high-performance quartz products.

- Regional demand will stay strong in Northern France, supported by industrial clusters.

- Trade integration with neighboring EU countries will enhance export opportunities.

- Competition will intensify as international players expand presence in France.

- Sustainability and renewable energy policies will continue to shape long-term growth.