Market Overview

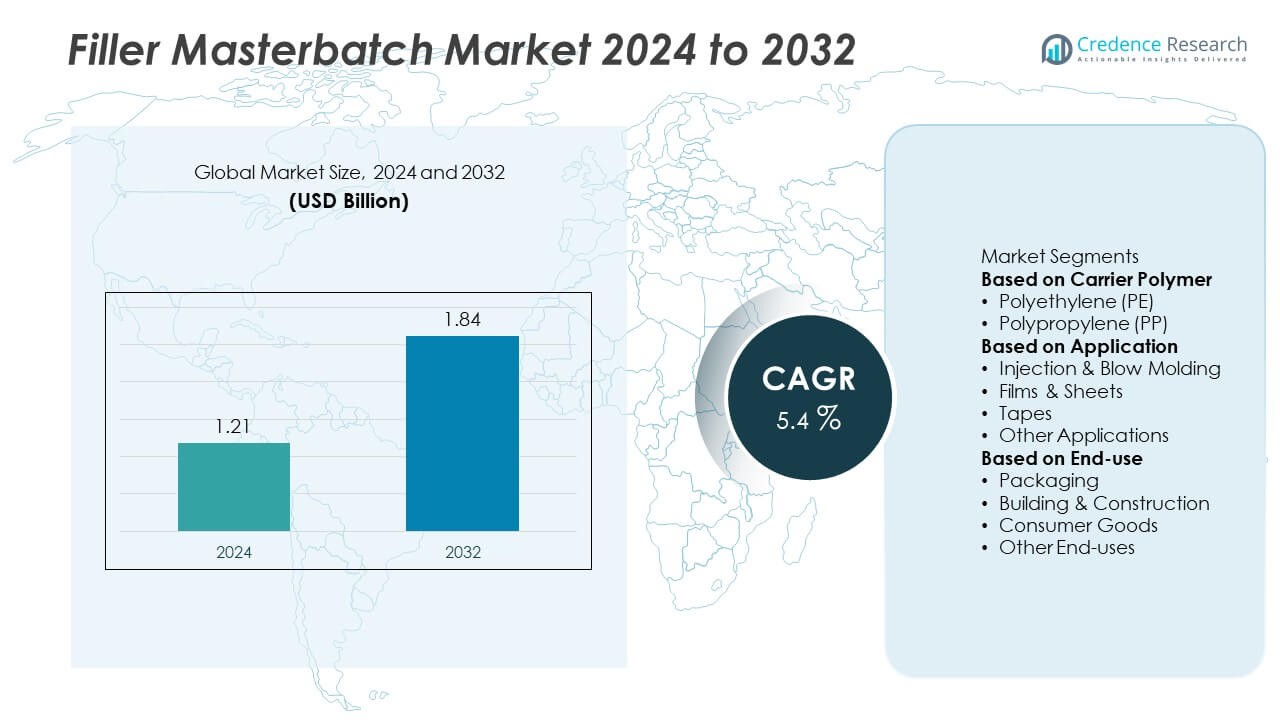

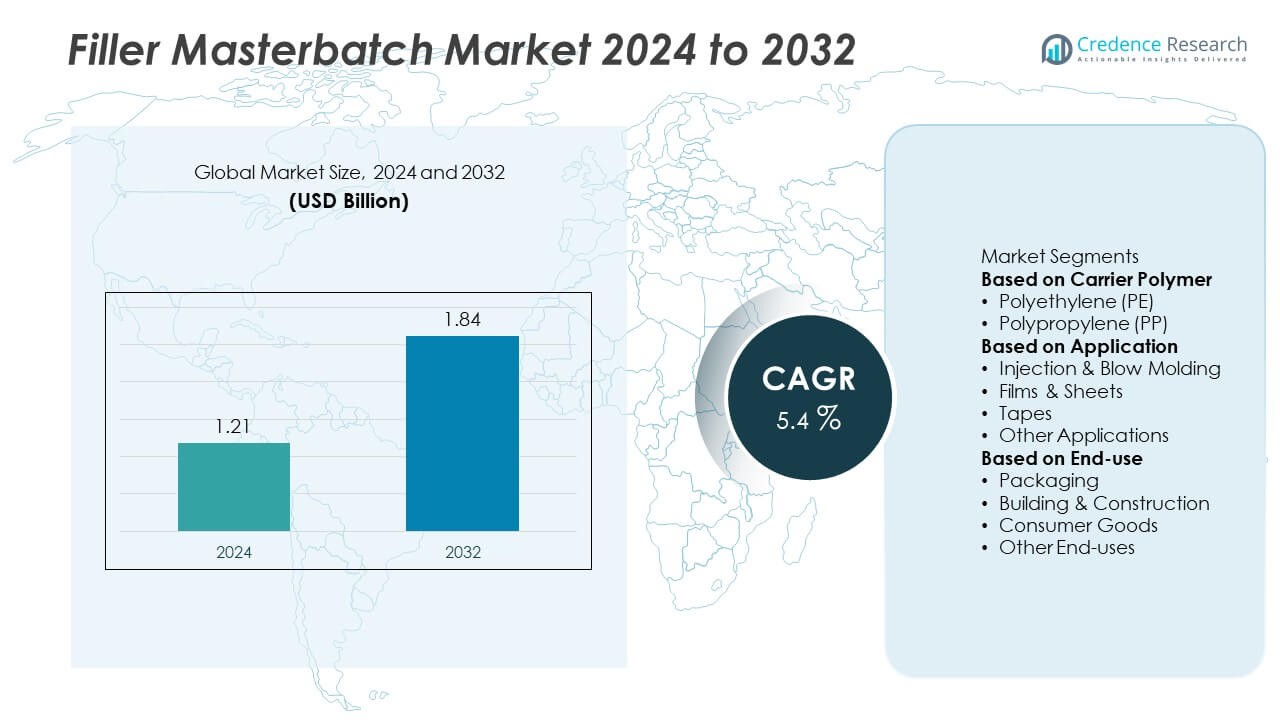

The Filler Masterbatch market was valued at USD 1.21 billion in 2024 and is projected to reach USD 1.84 billion by 2032, growing at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Filler Masterbatch Market Size 2024 |

USD 1.21 Billion |

| Filler Masterbatch Market, CAGR |

5.4% |

| Filler Masterbatch Market Size 2032 |

USD 1.84 Billion |

The Filler Masterbatch market is led by prominent players such as An Tien Industries, Eco Green Plastic JSC, A DONG Plastic Joint Stock Company (ADC Plastic JSC), Vina Color (Vietnam Colour Trading and Manufacturing Co., LTD.), Megaplast, PMJ Joint Stock Company, US Masterbatch JSC, Pha Le Plastics Manufacturing, Vinares, and PHU LAM Import Export Company Limited. These companies focus on innovation in calcium carbonate-based masterbatches, improved polymer compatibility, and cost-effective production. Asia-Pacific dominated the global market with a 41.6% share in 2024, driven by strong demand from the packaging and construction sectors in China, India, and Vietnam. The region’s rapid industrialization and growing plastic processing capacity further solidify its leadership in global filler masterbatch production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Filler Masterbatch market was valued at USD 1.21 billion in 2024 and is projected to reach USD 1.84 billion by 2032, expanding at a CAGR of 5.4% during the forecast period.

- Rising demand from the packaging and construction industries is driving market growth due to the cost-effectiveness and strength-enhancing properties of filler masterbatches.

- Growing adoption of sustainable, calcium carbonate, and talc-based masterbatches is shaping market trends, improving material performance and reducing environmental impact.

- Key players such as An Tien Industries, Eco Green Plastic JSC, and ADC Plastic JSC are focusing on product innovation, energy-efficient manufacturing, and partnerships to expand global presence.

- Asia-Pacific led with a 41.6% share, followed by Europe (25.3%) and North America (20.8%), while polypropylene-based masterbatches held a 53.2% share and films and sheets applications accounted for 48.5% of total market revenue in 2024.

Market Segmentation Analysis:

By Carrier Polymer

Polypropylene (PP) dominated the Filler Masterbatch market in 2024 with a 53.2% share, owing to its extensive use in packaging films, woven sacks, and injection-molded components. Its superior mechanical strength, chemical resistance, and cost-effectiveness make it the preferred carrier polymer across multiple industries. Polyethylene (PE) follows closely, driven by its growing use in film extrusion and flexible packaging. The high compatibility of PP with calcium carbonate and talc fillers, combined with its ability to maintain product durability at reduced resin content, continues to strengthen its dominance in global production.

- For instance, Megaplast introduced its PP-based filler masterbatch model W202A, designed for high-speed woven bag production lines operating at 450 m/min. The formulation improved tensile strength and reduced resin usage by 12 kg per ton of product, optimizing production efficiency and mechanical stability across export markets.

By Application

Films and sheets accounted for the largest 48.5% share in 2024, driven by rising demand in packaging, agriculture, and industrial sectors. Filler masterbatches are widely used in film extrusion to reduce production costs and improve opacity, stiffness, and surface finish. Injection and blow molding applications follow, with growing use in rigid containers and consumer products. The increasing use of filler masterbatches in multilayer film production for food and industrial packaging continues to support segment growth, especially across Asia-Pacific and Europe.

- For instance, US Masterbatch JSC supplies CaCO₃-based filler masterbatch for agricultural and packaging films, a product which helps manufacturers reduce production costs and lessen the reliance on virgin polymer resin while potentially enhancing properties like stiffness and printability.

By End-use

The packaging sector held a 45.7% share in 2024, emerging as the leading end-use segment in the Filler Masterbatch market. Strong demand from flexible packaging, woven bags, and laminated films drives growth. Cost efficiency, lightweight properties, and improved printability make filler masterbatches vital for packaging film manufacturers. The building and construction sector also contributes significantly, with applications in pipes, profiles, and sheets for infrastructure projects. Continuous demand from consumer goods manufacturing further strengthens market penetration, supported by rapid industrialization and expansion of the plastic processing industry worldwide.

Key Growth Drivers

Rising Demand from the Packaging Industry

The growing packaging sector is the primary driver of the filler masterbatch market, supported by increasing consumption of flexible and rigid packaging materials. Manufacturers use filler masterbatches to lower polymer usage while maintaining product strength and printability. Expanding e-commerce and food packaging applications are also fueling large-scale adoption. As global packaging producers seek cost-effective and sustainable solutions, calcium carbonate-based masterbatches are becoming increasingly popular for enhancing film quality and reducing raw material costs.

- For instance, An Tien Industries JSC sourced calcium carbonate powder from its Mong Son and Luc Yen quarries, enabling its filler masterbatch to be used in thin-film packaging extrusion applications.

Expansion of Construction and Infrastructure Projects

The rise in construction and infrastructure activities is significantly driving demand for filler masterbatches used in pipes, cables, and plastic panels. Their ability to improve thermal stability and dimensional strength makes them ideal for building materials. Rapid urbanization in developing economies is boosting plastic use in construction, particularly in Asia-Pacific. Growing investment in housing, public utilities, and industrial infrastructure continues to create steady demand for durable, lightweight, and cost-efficient polymer products incorporating filler masterbatches.

- For instance, A DONG Plastic Joint Stock Company (ADC Plastic) brought its new factory in Yên Mỹ, Hưng Yên into full operation with a capacity of about 460,000 tons/year and a total area of 15,000 m².

Cost Efficiency and Improved Material Performance

Filler masterbatches enable manufacturers to reduce production costs without compromising mechanical properties. They enhance stiffness, printability, and processing speed in various polymer applications. Producers are increasingly integrating high-quality mineral fillers such as calcium carbonate and talc to optimize resin consumption and surface finish. The ability of filler masterbatches to maintain aesthetic and structural integrity while lowering manufacturing expenses is a key factor driving their widespread adoption across packaging, textiles, and construction industries.

Key Trends & Opportunities

Shift Toward Sustainable and Bio-Based Solutions

Manufacturers are developing eco-friendly filler masterbatches that combine mineral fillers with biodegradable or recycled polymers. This trend is gaining traction due to rising regulatory pressure and growing awareness of environmental sustainability. Companies are focusing on reducing carbon footprints by using renewable calcium carbonate sources and energy-efficient compounding processes. The move toward circular economy models is also creating opportunities for innovation in bio-based filler masterbatches designed for packaging and consumer product applications.

- For instance, Vina Color (Vietnam Colour Trading & Manufacturing Co., LTD) produces a filler masterbatch suitable for film applications for consumer packaging, which typically contains a 70% to 80% calcium carbonate loading to help reduce production costs and improve properties such as heat resistance, stiffness, and printability.

Increasing Adoption in Film and Sheet Extrusion Applications

The growing use of filler masterbatches in film extrusion is a major market trend, driven by the demand for high-performance packaging materials. These masterbatches enhance opacity, thickness uniformity, and processing efficiency, allowing manufacturers to achieve cost savings while maintaining film strength. With the expansion of the agricultural and industrial film sectors, producers are investing in advanced dispersion technologies and customized filler grades to improve consistency and product quality across large-scale film production lines.

- For instance, Pha Le Plastics Manufacturing & Technology Joint Stock Company leveraged its in-house CaCO₃ quarry and installed a production line with 450,000 ton/year capacity producing filler masterbatch for film extrusion, supplying thin-gauge polyethylene films at line speeds above 350 m/min while maintaining flatness and printability.

Key Challenges

Fluctuating Raw Material Prices

Price volatility of polymer resins and mineral fillers such as calcium carbonate and talc remains a key challenge for manufacturers. Variations in global crude oil prices directly impact polymer costs, affecting overall profitability. Inconsistent raw material quality and supply chain disruptions can further strain production efficiency. To mitigate this, companies are focusing on long-term supplier partnerships, recycling initiatives, and process optimization to stabilize costs and maintain consistent product performance across different applications.

Environmental Regulations and Plastic Waste Concerns

Stringent environmental regulations regarding plastic waste management and non-biodegradable materials pose challenges for filler masterbatch producers. Governments worldwide are promoting sustainable packaging alternatives and limiting single-use plastics. Manufacturers must adapt by developing recyclable and compostable filler masterbatches that meet new compliance standards. Continuous innovation and investment in sustainable compounding technologies are crucial to ensure long-term growth and maintain competitiveness in an increasingly eco-conscious global market.

Regional Analysis

Asia-Pacific

Asia-Pacific dominated the Filler Masterbatch market in 2024 with a 41.6% share, driven by strong demand from packaging, construction, and consumer goods industries. China and India lead regional growth due to large-scale polymer production and expansion in plastic film manufacturing. Rapid urbanization and rising disposable incomes have boosted consumption of cost-effective plastic products. Increasing investments in industrial infrastructure and packaging exports further strengthen market development. Local manufacturers are also focusing on high filler-content and calcium carbonate masterbatches to meet the growing need for durable and affordable plastic materials.

Europe

Europe held a 25.3% share in 2024, supported by growing demand for sustainable and high-performance plastics. The region’s well-established packaging and automotive industries are major consumers of filler masterbatches. Countries such as Germany, Italy, and France emphasize eco-friendly product development and strict recycling mandates, which promote the use of mineral-based fillers. European manufacturers are increasingly adopting energy-efficient compounding processes and bio-based polymer blends. The shift toward lightweight components and reduced material waste continues to fuel innovation and steady growth within the regional filler masterbatch market.

North America

North America accounted for a 20.8% share in 2024, driven by advanced plastic processing technologies and high demand for functional materials in packaging and construction. The United States leads the region due to its strong industrial base and focus on product innovation. Expanding applications in automotive interiors, consumer packaging, and extrusion films continue to support steady market growth. Increasing adoption of sustainable compounding materials and the presence of key masterbatch producers are fostering competitiveness. Regulatory emphasis on recyclability and cost-efficient formulations further strengthens market penetration across multiple end-use industries.

Latin America

Latin America captured a 7.1% share in 2024, fueled by increasing consumption of low-cost plastics in packaging and construction. Brazil and Mexico dominate the regional market due to expanding manufacturing capabilities and infrastructure projects. The use of filler masterbatches in films, pipes, and molded products continues to rise as manufacturers focus on cost reduction. Economic recovery and industrial growth are encouraging local production expansion. However, dependency on imported raw materials remains a challenge, pushing producers to explore local sourcing and regional partnerships for sustained growth in coming years.

Middle East & Africa

The Middle East & Africa region held a 5.2% share in 2024, driven by growth in construction, packaging, and industrial manufacturing sectors. Countries such as Saudi Arabia, the UAE, and South Africa are increasing plastic production capacity to support domestic and export demand. Rising urban development and packaging consumption in FMCG products further boost market opportunities. The abundance of petrochemical resources supports stable polymer supply, promoting masterbatch production. Although limited by lower adoption of advanced processing technologies, growing investments in polymer manufacturing are expected to enhance regional competitiveness.

Market Segmentations:

By Carrier Polymer

- Polyethylene (PE)

- Polypropylene (PP)

By Application

- Injection & Blow Molding

- Films & Sheets

- Tapes

- Other Applications

By End-use

- Packaging

- Building & Construction

- Consumer Goods

- Other End-uses

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Filler Masterbatch market features key players such as An Tien Industries, Eco Green Plastic JSC, A DONG Plastic Joint Stock Company (ADC Plastic JSC), Vina Color (Vietnam Colour Trading and Manufacturing Co., LTD.), Megaplast, PMJ Joint Stock Company, US Masterbatch JSC, Pha Le Plastics Manufacturing, Vinares, and PHU LAM Import Export Company Limited. These companies focus on expanding production capacity, improving filler dispersion technologies, and developing high-performance calcium carbonate and talc-based masterbatches. Market leaders are investing in research to enhance polymer compatibility and reduce environmental impact through sustainable formulations. Strategic partnerships with packaging and construction manufacturers are helping strengthen regional distribution networks. The industry is witnessing growing competition among local and international players, emphasizing quality consistency, cost efficiency, and eco-friendly compounding solutions to meet the evolving needs of the global plastic manufacturing sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- An Tien Industries

- Eco Green Plastic JSC

- A DONG Plastic Joint Stock Company (ADC Plastic JSC)

- Vina Color (Vietnam Colour Trading and Manufacturing Co., LTD.)

- Megaplast

- PMJ Joint Stock Company

- US Masterbatch JSC

- Pha Le Plastics Manufacturing

- Vinares

- PHU LAM Import Export Company Limited

Recent Developments

- In October 2025, US Masterbatch showcased its “Innovation for Sustainable Future” filler masterbatch and bio-compound portfolio at K 2025 in Düsseldorf.

- In October 2025, Mega Plast presented a technical case study at K 2025 wherein their W202A filler masterbatch enabled a Colombian PP woven-bag customer to maintain 450–550 m/min line speeds and increase filler loading, boosting efficiency.

- In June 2025, US Masterbatch JSC highlighted Vietnam’s emergence as a leading filler masterbatch export hub, supplying to over 80 countries with advanced CaCO₃ filler masterbatch and aligned capacity improvements.

- In January 2024, US Masterbatch JSC inaugurated its third plastic additive factory at its Hoa Binh branch.

Report Coverage

The research report offers an in-depth analysis based on Carrier Polymer, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will continue to grow due to rising plastic consumption in packaging and construction.

- Calcium carbonate-based masterbatches will dominate because of their cost-effectiveness and availability.

- Polypropylene and polyethylene carriers will remain preferred materials in film and molding applications.

- Manufacturers will invest in sustainable and bio-based filler solutions to meet environmental goals.

- Automation and advanced dispersion technologies will improve production efficiency and product consistency.

- Asia-Pacific will maintain market leadership, supported by industrial growth in China, India, and Vietnam.

- Europe will see strong adoption of eco-friendly and recyclable filler formulations.

- Partnerships and mergers will increase as companies expand capacity and distribution networks.

- R&D will focus on high filler-loading capabilities and improved mechanical performance.

- Growing demand for lightweight and durable plastics will drive continuous innovation in filler masterbatch formulations.