Market Overview

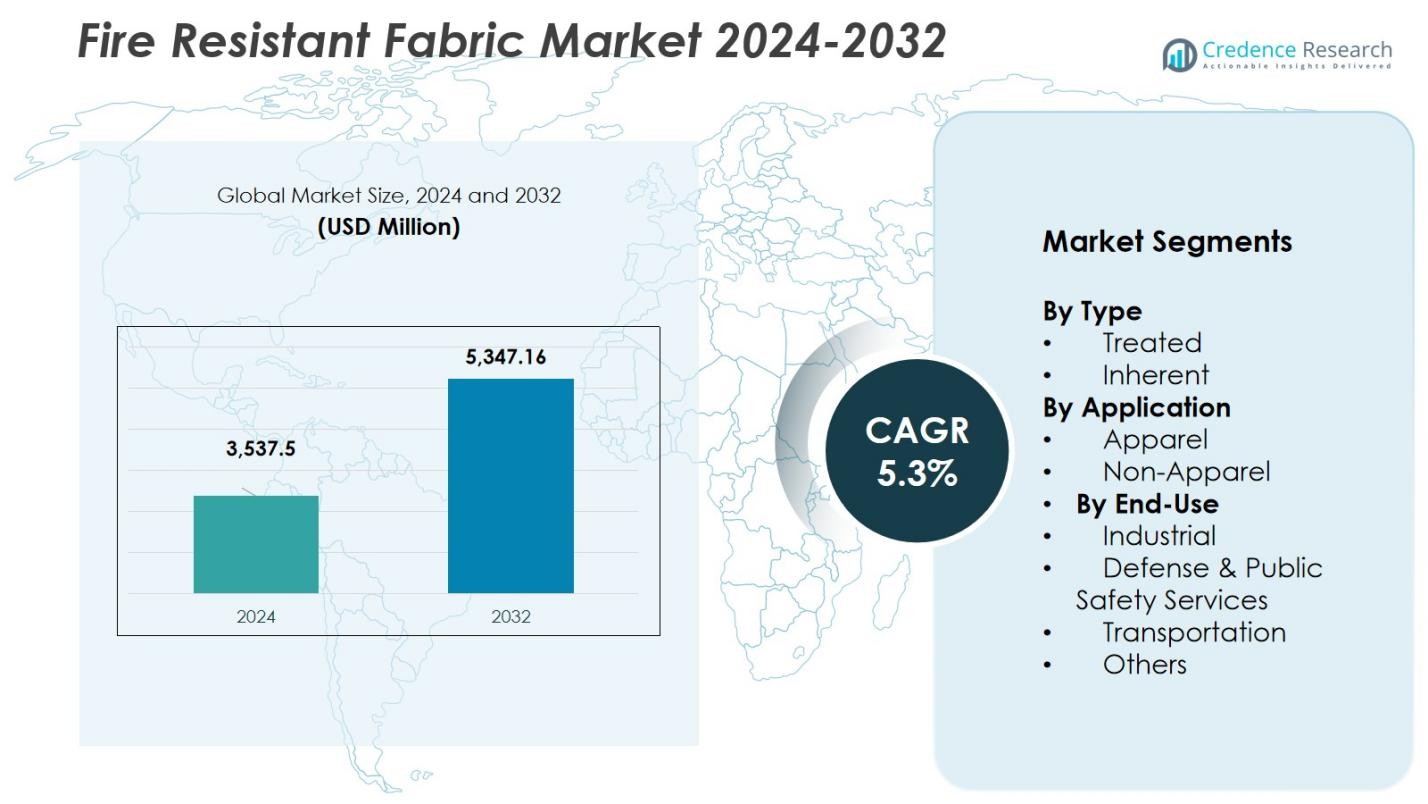

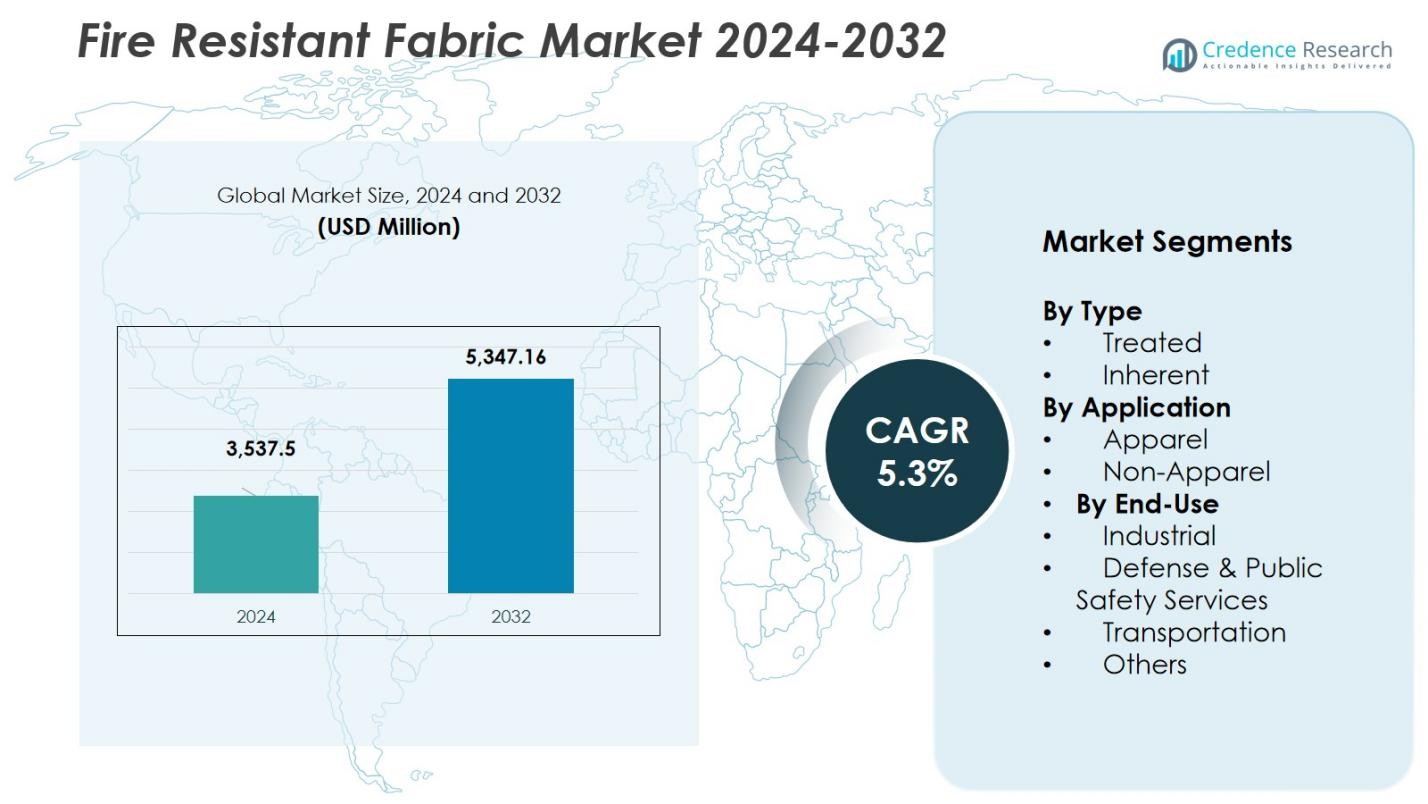

The fire resistant fabric market size was valued at USD 3,537.5 million in 2024 and is anticipated to reach USD 5,347.16 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fire Resistant Fabric Market Size 2024 |

USD 3,537.5 Million |

| Fire Resistant Fabric Market, CAGR |

5.3% |

| Fire Resistant Fabric Market Size 2032 |

USD 5,347.16 Million |

Fire Resistant Fabric Market is shaped by the presence of leading players such as DuPont de Nemours, Lenzing AG, Teijin Ltd., TenCate Protective Fabrics, Solvay S.A., Kaneka Corporation, Milliken & Company, W. L. Gore & Associates, Indorama Ventures Fibers Germany, and Taiwan K.K. Corporation. These companies strengthen the market through advancements in inherent and treated fire-resistant technologies, wide product portfolios, and strong partnerships across industrial and defense sectors. Regionally, North America leads the market with 35% share, driven by strict safety regulations, high industrial adoption, and continuous investment in advanced protective fabric solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The fire resistant fabric market was valued at USD 3,537.5 million in 2024 and is projected to reach USD 5,347.16 million by 2032, expanding at a CAGR of 5.3%.

- Market growth is driven by stringent workplace safety regulations and rising adoption of flame-resistant apparel across oil & gas, manufacturing, defense, and public safety sectors.

- Key trends include increasing demand for inherent fire-resistant fabrics, integration of smart textile technologies, and a growing shift toward lightweight and sustainable material solutions.

- Major players such as DuPont, Lenzing, Teijin, TenCate Protective Fabrics, Milliken, Solvay, and W. L. Gore strengthen the market through advanced R&D, strategic collaborations, and diversified product portfolios.

- North America leads with 35% share, followed by Asia-Pacific at 30% and Europe at 28%, while segment-wise the treated fabric category accounts for 60% share and apparel applications hold 65%, supported by industrial dominance at 40%.

Market Segmentation Analysis:

By Type

The treated segment dominated the fire-resistant fabric market in 2024, accounting for around 60% of total share. Its leadership stems from cost-effectiveness, easy availability, and wide adoption across industrial protective clothing where performance and budget balance are essential. Treated fabrics gain flame-resistant properties through chemical application, enabling manufacturers to tailor protection levels to different hazards. Demand continues to grow as industries strengthen safety protocols and adopt standardized protective gear. Meanwhile, inherent fabrics, holding the remaining market share, are gaining traction for high-performance applications requiring longer-lasting flame resistance.

- For instance, Suzhou Kylin Textile Technology produces treated flame-retardant textiles widely used in protective workwear and home textiles.

By Application

Apparel emerged as the leading application segment, representing approximately 65% of market share in 2024. Growth is primarily driven by rising use of flame-resistant clothing in oil & gas, manufacturing, utilities, and emergency response sectors. Increasing regulatory enforcement and employer emphasis on worker safety fuel strong adoption of protective coveralls, jackets, and gloves. Non-apparel applications such as curtains, upholstery, and insulation comprise the remaining share and continue to expand as public infrastructure and transportation systems integrate flame-retardant materials for enhanced fire-safety compliance.

- For instance, Companies like DuPont provide innovative flame-resistant apparel such as Nomex suits that protect workers in hazardous environments, including firefighting and electrical utilities.

By End-Use

The industrial segment held the largest share of the market in 2024, capturing around 40% of overall demand. Its dominance is supported by stringent workplace safety standards and the high-risk nature of operations in oil & gas, chemical processing, construction, and electrical utilities. Employers increasingly adopt flame-resistant fabrics to reduce fire-related accidents and ensure regulatory compliance. Defense and public safety services form the second-largest segment, followed by transportation and others, where increased investment in protective gear and fire-safe materials supports steady market expansion.

Key Growth Drivers

Stringent Workplace Safety Regulations

Global enforcement of workplace safety standards continues to drive strong demand for fire-resistant fabrics across high-risk industries. Regulatory agencies require employers to equip workers with certified protective apparel to reduce fire and thermal hazards. These mandates are particularly strict in oil & gas, utilities, manufacturing, and chemical processing, where exposure risks remain high. As governments update compliance frameworks and companies prioritize employee protection, adoption of advanced flame-resistant clothing and materials accelerates. This regulatory pressure remains one of the most influential growth catalysts in the market.

- For instance, NFPA 2112 sets rigorous requirements for flame-resistant clothing used in industrial settings, ensuring critical protection from flash fires.

Expansion of High-Risk Industrial Sectors

Rapid expansion in industries such as oil & gas, power generation, metallurgy, and transportation significantly boosts the need for fire-resistant fabrics. Increasing energy production, infrastructure development, and industrial automation elevate the likelihood of fire and thermal incidents, prompting companies to invest in durable, certified protective materials. Growth in developing economies further strengthens demand as new manufacturing hubs implement modern safety protocols. This industrial expansion creates sustained opportunities for fabric manufacturers offering high-performance, compliant fire-resistant solutions.

- For instance, Companies like DuPont and TenCate are supplying advanced fire-resistant fabrics to meet the stringent safety and regulatory requirements associated with these industries.

Rising Adoption in Defense and Emergency Services

Growing investment in defense modernization and public safety services has intensified demand for flame-resistant materials used in military uniforms, firefighting suits, and tactical gear. Governments worldwide continue to upgrade protective equipment to meet evolving battlefield and emergency response threats. Advancements in lightweight, breathable, and high-durability fabrics enhance user comfort and mobility, making them more suitable for demanding missions. This emphasis on improved protection and performance keeps defense and emergency services a rapidly expanding driver for the fire-resistant fabric market.

Key Trends & Opportunities

Shift Toward High-Performance Inherent Fabrics

A notable trend in the market is the growing preference for inherent fire-resistant fabrics, which naturally possess flame-retardant properties without chemical treatment. Industries increasingly value their long-term durability, wash resistance, and enhanced thermal stability. Technological advancements enabling lighter, stronger, and more comfortable inherent fibers have broadened applications, especially in defense and specialty industrial operations. As sustainability gains importance, inherent fabrics present an opportunity for manufacturers to differentiate through longer life cycles and reduced chemical usage.

- For instance, companies like TenCate have developed inherently flame-resistant fabrics such as Tecasafe Plus, offering durability and wash resistance that outperform treated fabrics, making them ideal for defense and specialty industries.

Integration of Smart and Multifunctional Textiles

The market is witnessing rising interest in smart fire-resistant textiles that combine thermal protection with added functionalities such as moisture management, heat sensing, and antimicrobial properties. Innovations in fiber technology and wearable systems create new opportunities in advanced firefighting gear, industrial uniforms, and military clothing. Incorporating sensors and conductive materials enhances situational awareness and safety, making protective fabrics more adaptable for hazardous environments. This convergence of protection and technology opens high-value growth avenues for fabric producers.

- For instance, TenCate Protective Fabrics launched Tecasafe 360+, an inherently flame-resistant stretch fabric that marries safety with comfort and flexibility, meeting the evolving demands of modern workers.

Key Challenges

High Production Costs and Pricing Pressure

The manufacturing of high-performance fire-resistant fabrics requires specialized raw materials, complex production processes, and stringent quality certifications, all of which increase costs. Many end-users, particularly in developing regions, remain cost-sensitive, leading to preference for lower-priced alternatives. Additionally, fluctuations in raw material prices and competitive pricing pressure from local manufacturers affect profitability. These cost-related barriers limit adoption among smaller industrial operators and challenge manufacturers to balance performance, compliance, and affordability.

Limited Awareness and Inconsistent Compliance

In several emerging markets, awareness of proper fire-resistant standards and the importance of certified protective gear remains limited. Small and medium-sized industries often underestimate fire hazards or delay safety investments due to budget constraints. Inconsistent enforcement of regulations further slows market penetration for high-quality fire-resistant fabrics. These gaps in safety culture and regulatory compliance restrict widespread adoption, requiring extensive training, awareness programs, and collaboration between industry stakeholders to overcome.

Regional Analysis

North America

North America held 35% market share in the fire-resistant fabric market, driven by stringent workplace safety regulations and strong adoption across oil & gas, industrial manufacturing, and emergency services. The U.S. leads consumption due to robust regulatory enforcement and continuous upgrades in protective apparel for firefighting and defense applications. Technological advancements and high investment in PPE innovation further strengthen the region’s position. Growing emphasis on industrial risk mitigation and expansion of energy infrastructure continue to support steady demand, making North America a mature yet consistently growing market for advanced fire-resistant fabrics.

Europe

Europe accounted for 28% of the market share, supported by strict safety compliance standards and widespread adoption across industrial, transportation, and defense sectors. Countries such as Germany, France, and the U.K. drive consumption due to strong manufacturing bases and high investment in worker protection. The region’s emphasis on sustainable and inherently flame-resistant fabrics is shaping product innovation and material selection. Growing demand from automotive and aerospace industries further reinforces market expansion. Continued regulatory alignment under EU directives ensures sustained adoption and stable long-term growth prospects for fire-resistant fabric manufacturers.

Asia-Pacific

The Asia-Pacific region captured 30% of the market share, emerging as the fastest-growing market due to rapid industrialization, expanding manufacturing hubs, and rising safety awareness. China, India, Japan, and Southeast Asia contribute significantly as industries strengthen occupational safety compliance. Increasing demand from oil & gas, chemicals, and transportation sectors boosts fabric consumption, while growing defense modernization programs accelerate adoption of high-performance flame-resistant materials. The region’s large workforce, infrastructure development, and expanding industrial footprint continue to create substantial opportunities for global and regional fabric producers.

Latin America

Latin America represented 4% market share, supported by gradual improvements in workplace safety practices and rising adoption of protective apparel in oil & gas, mining, and manufacturing sectors. Brazil and Mexico lead regional demand as companies modernize operations and comply with stricter safety guidelines. Although budget constraints and inconsistent enforcement limit broader penetration, increasing industrial investments and multinational presence encourage higher uptake. Growing awareness of fire risks and the expansion of energy and mining projects are expected to sustain moderate but steady market growth in the region.

Middle East & Africa

The Middle East & Africa held 3% of the market share, driven primarily by the region’s extensive oil & gas operations and growing industrial safety initiatives. Countries such as Saudi Arabia, the UAE, and South Africa show rising demand for flame-resistant fabrics as companies adopt international safety standards. The region continues to invest in energy, construction, and mining projects, supporting increased usage of protective clothing. While market maturity remains lower than other regions, the adoption of high-performance fire-resistant materials is expanding as industrial operations diversify and safety compliance strengthens.

Market Segmentations:

By Type

By Application

By End-Use

- Industrial

- Defense & Public Safety Services

- Transportation

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fire-resistant fabric market is characterized by the presence of major players such as DuPont de Nemours, Lenzing AG, Teijin Ltd., TenCate Protective Fabrics, Solvay S.A., Kaneka Corporation, Milliken & Company, W. L. Gore & Associates, Indorama Ventures Fibers Germany, and Taiwan K.K. Corporation. These companies compete by focusing on technology innovation, material performance, regulatory compliance, and long-term durability. The market is moderately consolidated, with established players leveraging strong R&D capabilities to develop advanced inherent and treated fire-resistant fabrics tailored for industrial, defense, and transportation applications. Strategic partnerships with PPE manufacturers, investments in sustainable fiber technologies, and expansion into emerging markets further strengthen competitive positioning. Additionally, companies are prioritizing lightweight, breathable, and multifunctional fabric solutions to meet rising demand for comfort and improved protection. As safety regulations intensify, manufacturers continue to enhance product quality while optimizing cost efficiency to maintain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, PBI Performance Products, Inc. and TenCate Protective Fabrics entered into a partnership to introduce PBI Peak5, an ultra-lightweight, fire-resistant outer-shell fabric engineered specifically for firefighter protection.

- In May 2024, Milliken & Company collaborated with NASA to develop and manufacture a flame-resistant intimate-apparel fabric for use in upcoming Artemis space missions.

- In May 2023, Indorama Ventures Public Company Limited rebranded Trevira GmbH as Indorama Ventures Fibers Germany GmbH as part of its global brand-alignment strategy to unify its corporate identity across 147 sites in 35 countries.

- In February 2022, DuPont Personal Protection, a division of DuPont de Nemours, Inc., partnered with Bulwark, the world’s largest flame-resistant apparel brand, to strengthen offerings in the flame-resistant clothing market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as global industries strengthen workplace safety compliance.

- Demand for inherent fire-resistant fabrics will increase due to their durability and long-term performance benefits.

- Adoption of advanced protective clothing will rise in oil & gas, utilities, and chemical processing sectors.

- Defense modernization programs will fuel higher use of high-performance flame-resistant materials.

- Integration of smart and multifunctional textile technologies will create new innovation opportunities.

- Sustainability initiatives will drive development of eco-friendly and chemical-free fire-resistant fibers.

- Emerging economies will contribute significantly as industrialization and safety awareness expand.

- Manufacturers will focus on lightweight, comfortable, and high-mobility fabric solutions.

- Strategic partnerships between fabric producers and PPE manufacturers will strengthen supply capabilities.

- Market competition will intensify as global players expand product portfolios and regional presence.