Market Overview:

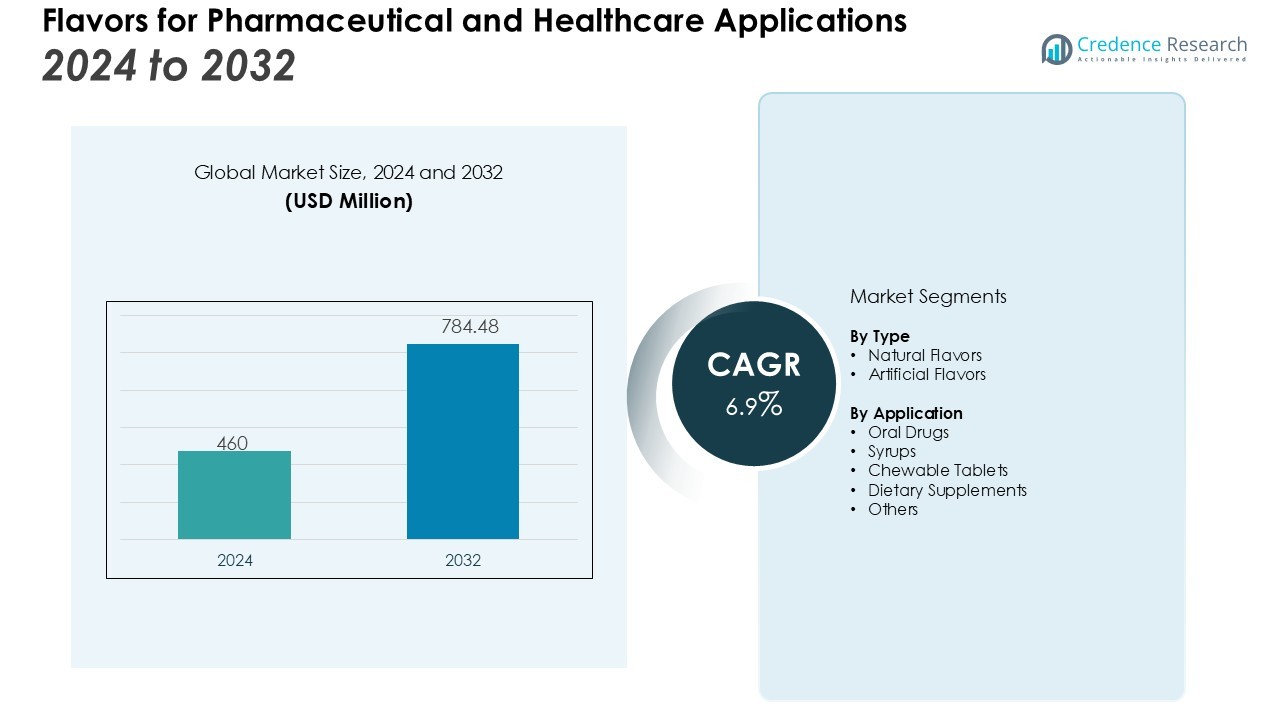

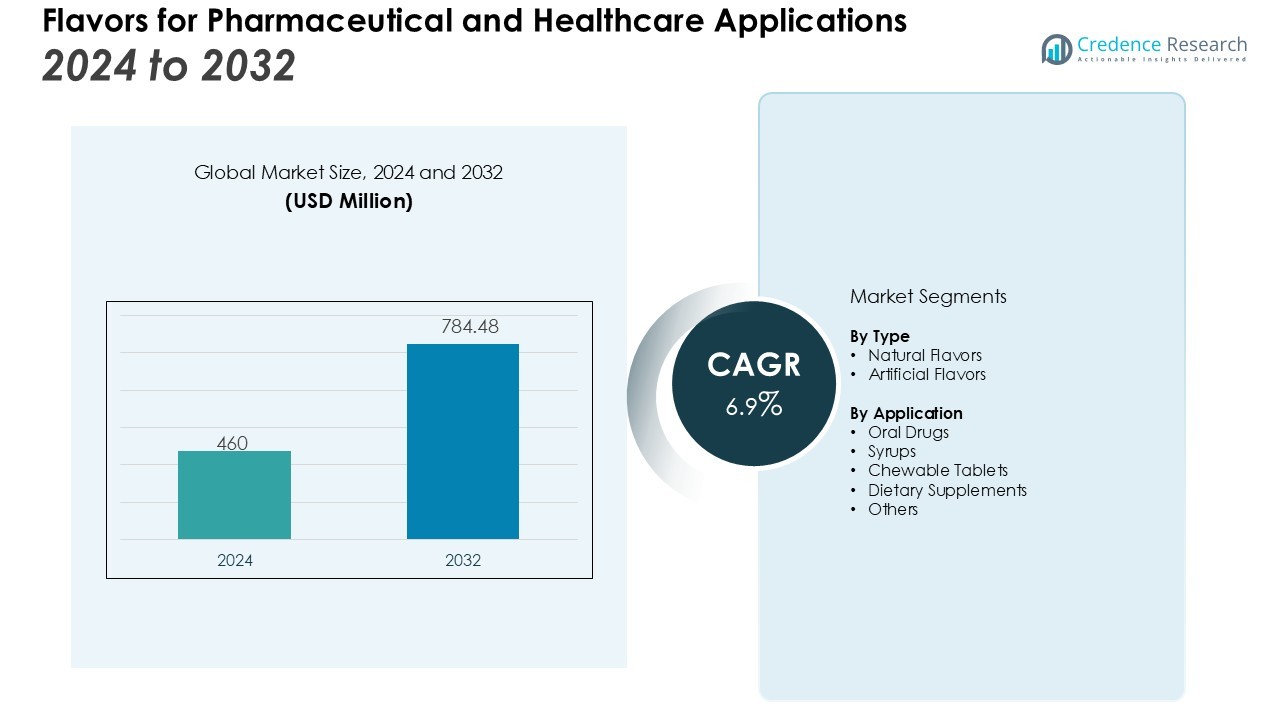

The Flavors for Pharmaceutical and Healthcare Applications Market size was valued at USD 460 million in 2024 and is anticipated to reach USD 784.48 million by 2032, at a CAGR of 6.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flavors for Pharmaceutical and Healthcare Applications Market Size 2024 |

USD 460 Million |

| Flavors for Pharmaceutical and Healthcare Applications Market, CAGR |

6.9% |

| Flavors for Pharmaceutical and Healthcare Applications Market Size 2032 |

USD 784.48 Million |

The market is primarily driven by rising consumer demand for palatable and easy-to-consume formulations. Pharmaceutical companies are incorporating natural and sugar-free flavors to improve compliance while addressing health concerns such as diabetes and obesity. Increasing investments in functional healthcare products, nutraceuticals, and dietary supplements further contribute to flavor adoption. Partnerships between flavor houses and drug manufacturers enhance formulation innovations, while regulatory support for patient-friendly medicines fosters product development.

Regionally, North America leads the global market, supported by advanced pharmaceutical research and high healthcare expenditure. Europe follows closely, driven by strong adoption of nutraceuticals and compliance-focused medicines. Asia-Pacific is witnessing rapid growth due to increasing demand for pediatric and over-the-counter medicines in emerging economies like China and India. Rising urbanization and healthcare access strengthen market expansion across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Flavors for Pharmaceutical and Healthcare Applications Market was valued at USD 460 million in 2024 and is expected to reach USD 784.48 million by 2032, growing at a CAGR of 6.9% during the forecast period.

- Rising demand for patient-centric formulations drives adoption of flavors in syrups, chewable tablets, and oral medications to improve treatment adherence among pediatric and geriatric populations.

- Expanding nutraceutical and dietary supplement industries fuel demand for natural and sugar-free flavors, particularly in vitamins, functional beverages, and over-the-counter products.

- Growing focus on natural, clean-label flavor solutions supports product differentiation and strengthens trust among health-conscious consumers seeking safe alternatives to artificial additives.

- Regulatory complexities and high compliance costs remain a challenge, as global variations in approval standards and frequent updates slow down product launches and innovation.

- North America leads with 38% share, supported by advanced healthcare infrastructure, strong R&D investments, and regulatory support for safe flavor integration.

- Asia-Pacific holds 24% share and shows the fastest growth, driven by expanding healthcare access, high demand for pediatric medicines, and strong uptake of nutraceuticals in China and India.

Market Drivers:

Rising Demand for Patient-Centric Drug Formulations

The Flavors for Pharmaceutical and Healthcare Applications Market is driven by the growing need for patient-friendly drug formulations. Flavor incorporation in oral medications, syrups, and chewable tablets improves compliance, especially in pediatric and geriatric groups. It helps reduce aversion to bitter or unpleasant tastes, improving treatment outcomes. Healthcare providers increasingly recommend flavored alternatives to enhance adherence across multiple therapeutic areas.

Growing Popularity of Nutraceuticals and Dietary Supplements

A significant driver is the rapid expansion of the nutraceutical and dietary supplement industry. Consumers seek health-supportive products with appealing taste profiles, pushing manufacturers to integrate natural and sugar-free flavors. It allows companies to expand product acceptance in vitamins, functional beverages, and over-the-counter supplements. Rising preventive healthcare awareness further accelerates the demand for flavor innovations.

Advancements in Natural and Clean-Label Flavor Solutions

Shifting consumer preference toward clean-label products has increased demand for natural flavors in pharmaceutical and healthcare applications. Manufacturers invest in botanical extracts, fruit-based essences, and non-artificial sweeteners to align with global health regulations. It supports product differentiation while addressing concerns about chemical additives. This trend strengthens trust between pharmaceutical companies and health-conscious consumers.

- For instance, Coca-Cola and Purecircle collaborated to advance clean-label sweetener options by developing a new stevia-based drink, their joint research, which altered the taste profile to better mimic sucrose, was protected by the filing of at least 1 patent for the innovative process.

Strong Collaborations Between Flavor Houses and Pharma Companies

Strategic partnerships between global flavor houses and pharmaceutical manufacturers represent another strong market driver. Joint efforts focus on creating innovative solutions that balance efficacy with taste improvement. It allows faster development of flavored drug delivery systems and patient-centric healthcare products. Collaborative research accelerates regulatory approvals and supports long-term growth opportunities in diverse markets.

- For instance, FlavorSum has built a stronger platform for collaboration by successfully integrating 4 complementary flavor companies.

Market Trends:

Increasing Shift Toward Natural, Sugar-Free, and Functional Flavor Solutions

The Flavors for Pharmaceutical and Healthcare Applications Market is witnessing a strong shift toward natural and sugar-free formulations that meet both health and taste expectations. Rising prevalence of lifestyle-related diseases such as diabetes and obesity has encouraged manufacturers to avoid synthetic sweeteners and high-sugar content. It is driving innovation in plant-based extracts, fruit essences, and herbal blends that align with clean-label demands. Healthcare and nutraceutical brands are investing in flavor technologies that enhance product acceptance while meeting regulatory requirements on safety and transparency. Functional flavoring, which incorporates therapeutic or wellness-enhancing elements, is gaining traction across oral medicines, syrups, and chewable formats. This trend reflects consumer demand for holistic health solutions that combine efficacy with taste appeal.

- For instance, biotechnology firm Conagen successfully scaled up production of the natural protein sweetener thaumatin II, which is approximately 3,000 times sweeter than sugar on a weight basis, offering a potent alternative for sugar reduction in various products.

Integration of Advanced Flavor Technologies for Enhanced Drug Delivery

Technological advancements in flavor encapsulation and controlled release are shaping the next phase of product development. The Flavors for Pharmaceutical and Healthcare Applications Market benefits from microencapsulation techniques that improve stability, mask bitterness, and ensure consistent flavor delivery over time. It enhances patient adherence by making both prescription and over-the-counter medicines more palatable. Pharma companies are exploring advanced delivery systems that pair taste masking with improved bioavailability, enabling dual benefits of efficacy and user acceptance. Collaboration between pharmaceutical manufacturers and global flavor houses is strengthening this innovation pipeline. Emerging markets are also adopting these solutions rapidly, driven by high demand for pediatric formulations and growing investments in healthcare infrastructure. These trends highlight the industry’s focus on innovation and patient-centered outcomes.

- For instance, a 2021 study demonstrated how Direct Powder Extrusion 3D printing of the drug praziquantel resulted in a greater than four-fold increase in the drug’s release compared to its pure form, significantly improving its formulation for pediatric patients.

Market Challenges Analysis:

Regulatory Complexities and Compliance Barriers

The Flavors for Pharmaceutical and Healthcare Applications Market faces significant challenges due to stringent regulatory frameworks. Flavor ingredients must meet strict safety standards and undergo extensive testing before approval. It creates longer development timelines and increases compliance costs for manufacturers. Differences in regulatory requirements across regions further complicate product launches for global players. Frequent updates to guidelines on artificial sweeteners, natural extracts, and allergen declarations demand continuous reformulation. These factors slow down innovation and limit flexibility for pharmaceutical companies seeking faster market entry.

High Costs of Natural Ingredients and Technical Limitations

Rising demand for natural and clean-label flavors has increased reliance on costly raw materials, creating pricing pressures for producers. It forces companies to balance consumer preferences with cost efficiency, which can restrict large-scale adoption. Technical challenges in flavor stability, especially in heat-sensitive or long-shelf-life pharmaceutical products, further complicate formulation. Taste masking remains a hurdle in highly bitter drug compounds where traditional flavoring techniques show limited effectiveness. Supply chain volatility in botanical and fruit-based extracts also impacts consistent availability. These challenges highlight the need for advanced technologies and sustainable sourcing strategies to support market growth.

Market Opportunities:

Expansion in Pediatric and Geriatric Medicine Segments

The Flavors for Pharmaceutical and Healthcare Applications Market holds strong opportunities in pediatric and geriatric medicine segments where taste plays a critical role in compliance. Rising demand for flavored syrups, chewable tablets, and dissolvable strips creates space for innovative formulations. It supports better adherence to treatment in children and older adults, reducing therapy dropouts. Growing healthcare investments and specialized drug delivery systems enhance the scope for flavor customization. Companies that provide targeted solutions with natural and safe flavoring agents are expected to capture significant market share. This expansion strengthens the role of flavors in patient-centric healthcare.

Growth Potential in Emerging Markets and Nutraceuticals

Emerging economies with expanding healthcare access and rising disposable incomes present major growth prospects for the market. The Flavors for Pharmaceutical and Healthcare Applications Market is benefiting from increasing demand for nutraceuticals, functional supplements, and over-the-counter products. It creates strong opportunities for flavor houses to partner with regional pharmaceutical manufacturers. Demand for herbal, fruit-based, and sugar-free flavors is high in these markets due to health-conscious consumer behavior. Advancements in encapsulation and delivery technologies further expand the use of flavors in diverse formulations. These opportunities highlight the market’s potential for sustainable growth across both developed and developing regions.

Market Segmentation Analysis:

By Type

The Flavors for Pharmaceutical and Healthcare Applications Market is segmented into natural flavors and artificial flavors. Natural flavors lead the market as demand for clean-label and safe ingredients grows steadily. It is driven by rising preference for herbal extracts, fruit essences, and sugar-free formulations that address health issues such as diabetes and obesity. Artificial flavors remain relevant where cost efficiency and product stability are critical. Pharmaceutical companies adopt a balanced approach, combining both flavor types to meet compliance standards and consumer needs. This balance ensures broader acceptance across diverse therapeutic and supplement categories.

- For instance, Symrise advanced its natural taste solutions by establishing 1 dedicated Protein Center of Excellence in Germany to develop new taste-balancing technologies for products with diverse plant-based proteins.

By Application

The market is segmented into oral drugs, syrups, chewable tablets, dietary supplements, and other healthcare formulations. Oral drugs represent a major share due to the need to mask bitterness in capsules and tablets. It strengthens patient compliance across multiple age groups. Syrups and chewable tablets hold strong appeal in pediatric and geriatric populations, where palatability directly impacts adherence. Dietary supplements are another fast-growing application, supported by preventive healthcare trends and consumer focus on functional wellness. These applications highlight flavors as a critical component in improving acceptability, effectiveness, and long-term use of pharmaceutical and healthcare products.

- For instance, SPI Pharma’s Actimask® acetaminophen formulation features taste-masked particles with a mean particle size of 380 micrometers, designed to improve mouthfeel and medication adherence.

Segmentations:

By Type

- Natural Flavors

- Artificial Flavors

By Application

- Oral Drugs

- Syrups

- Chewable Tablets

- Dietary Supplements

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Strong Adoption Driven by Advanced Healthcare and R&D Investments

North America accounts for 38% share of the Flavors for Pharmaceutical and Healthcare Applications Market, making it the leading region. Its dominance is supported by advanced healthcare infrastructure and high investment in pharmaceutical research. The region’s focus on patient-centric formulations supports strong adoption of flavor-enhanced drugs and supplements. It benefits from established collaborations between pharmaceutical manufacturers and leading flavor houses, which accelerate product innovation. Growing preference for natural and sugar-free flavors aligns with rising health awareness among consumers. Regulatory support for safe and compliant flavor integration further strengthens regional leadership.

Europe: Emphasis on Clean-Label and Nutraceutical Growth

Europe holds 28% share of the Flavors for Pharmaceutical and Healthcare Applications Market, positioning it as a key region. Strict safety regulations and preference for herbal and botanical extracts drive adoption of natural flavor solutions. It fosters innovation in sustainable formulations, particularly in nutraceuticals and dietary supplements. Rising adoption of flavored pediatric medicines further strengthens growth across the region. Strong presence of multinational pharmaceutical companies creates opportunities for collaborations with flavor suppliers. Europe continues to balance regulatory demands with innovation-led expansion.

Asia-Pacific: Rapid Expansion in Emerging Healthcare Markets

Asia-Pacific represents 24% share of the Flavors for Pharmaceutical and Healthcare Applications Market, making it the fastest-growing region. Expanding healthcare access and rising consumer spending drive strong demand for flavored healthcare products. It is further supported by high adoption of pediatric formulations and functional supplements in countries like China and India. Local pharmaceutical manufacturers invest in flavor technologies to improve treatment adherence and expand product reach. Partnerships between global flavor houses and regional drug producers accelerate innovation in cost-effective formulations. Asia-Pacific continues to present long-term growth opportunities and expanding market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Wild Flavors & Specialty Ingredients

- Quest Nutra Pharma

- Keva Flavours

- Mane SA

- Firmenich

- Gold Coast Ingredients

- International Flavours & Fragrances (IFF)

- Symrise AG

- Prinova Nagasa Group

- Taste Master Flavors

- Concept Flavors & Fragrances

- Carmi Flavors & Fragrances

Competitive Analysis:

The Flavors for Pharmaceutical and Healthcare Applications Market features strong competition among global and regional players focused on innovation, compliance, and product differentiation. Leading companies emphasize natural and sugar-free flavor development to align with clean-label trends and regulatory standards. It is driven by strategic partnerships between flavor houses and pharmaceutical manufacturers, enabling advanced solutions that enhance patient compliance. Multinational firms invest heavily in research and development, particularly in encapsulation and taste-masking technologies, to strengthen their portfolios. Regional players compete by offering cost-effective and tailored solutions for nutraceuticals and over-the-counter medicines. The market also reflects increasing consolidation through collaborations and acquisitions, helping companies expand distribution and accelerate product launches across emerging economies. Competitive intensity remains high as firms prioritize sustainable sourcing, technological advancements, and targeted innovation to secure long-term growth.

Recent Developments:

- In August 2025, IFF entered into a partnership with Reservas Votorantim to create its first-of-its-kind forest laboratory for sustainable innovation in fragrances and cosmetic ingredients.

- In March 2025, Symrise launched the Mindera® product platform, a 100% plant-based technology for the natural protection of cosmetic products.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Flavors for Pharmaceutical and Healthcare Applications Market will expand with growing demand for patient-friendly drug formulations.

- Rising use of natural, botanical, and sugar-free flavors will strengthen consumer trust in healthcare products.

- Increasing focus on pediatric and geriatric medicines will create wider opportunities for flavor innovation.

- Nutraceuticals and functional supplements will drive significant adoption of advanced flavor solutions.

- Encapsulation and taste-masking technologies will play a central role in improving flavor stability and product performance.

- Collaborations between pharmaceutical manufacturers and global flavor houses will accelerate innovation pipelines.

- Emerging economies will see faster adoption due to rising healthcare spending and access to affordable medicines.

- Regulatory alignment across regions will encourage faster product approvals and consistent flavor use in drug formulations.

- Sustainable sourcing of raw materials and eco-friendly production methods will become key competitive differentiators.

- Expansion of over-the-counter and preventive healthcare products will further increase the relevance of flavors in long-term growth strategies.