Market overview

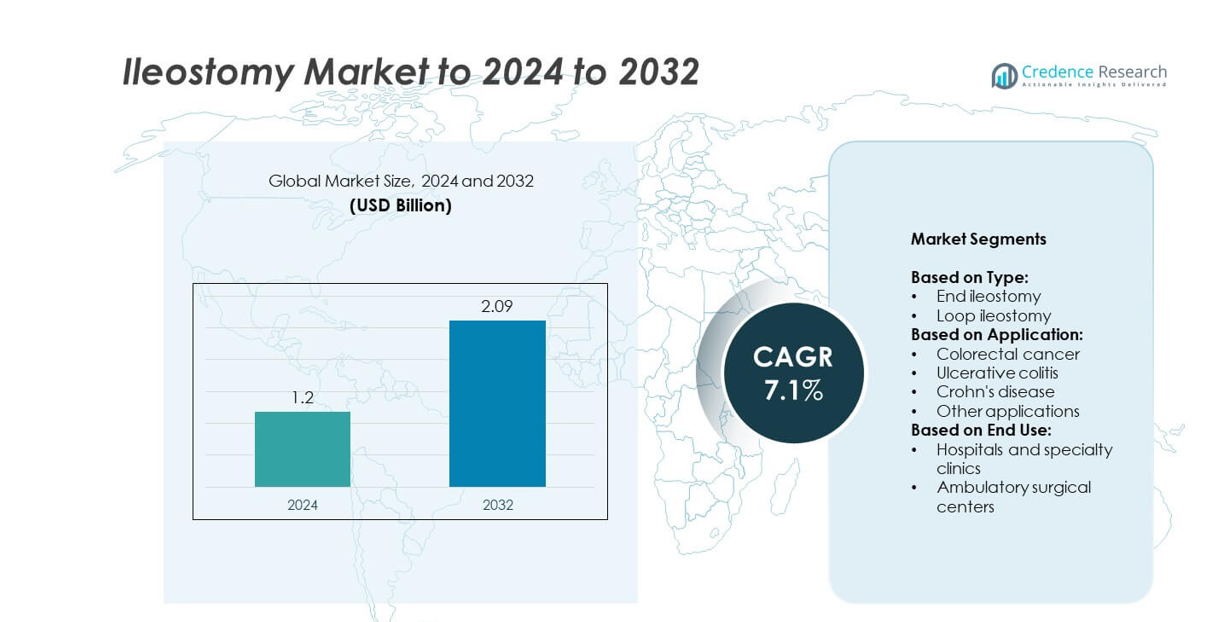

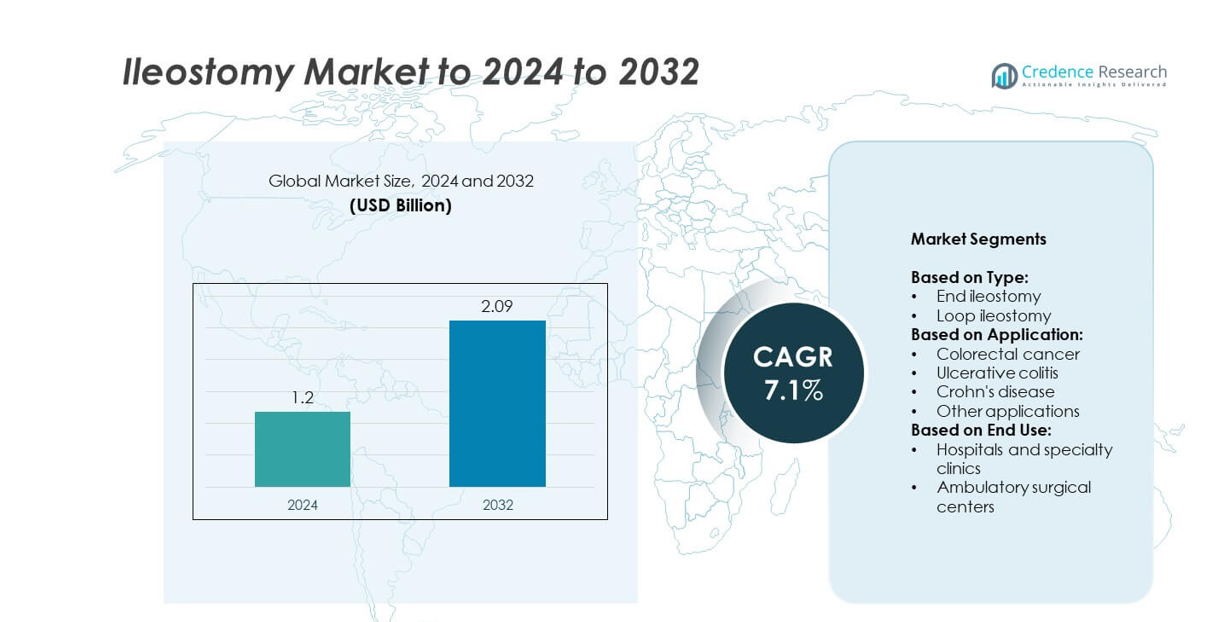

The Ileostomy Market size was valued at USD 1.2 billion in 2024 and is anticipated to reach USD 2.09 billion by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ileostomy Market Size 2024 |

USD 1.2 billion |

| Ileostomy Market, CAGR |

7.1% |

| Ileostomy Market Size 2032 |

USD 2.09 billion |

The ileostomy market is led by major players such as Coloplast, ConvaTec Group, B. Braun, Hollister, Smith & Nephew, Torbot Group, and Salts Healthcare, which focus on innovation in pouching systems, skin barriers, and patient-centric care solutions. These companies strengthen their positions through strategic collaborations, product advancements, and strong global distribution networks. Regionally, North America emerged as the dominant market in 2024 with a 38% share, supported by advanced healthcare infrastructure, high procedure volumes, and favorable reimbursement frameworks. Europe followed with a 30% share, driven by strong healthcare systems and supportive patient networks, while Asia Pacific accounted for 20%, positioning itself as the fastest-growing region due to rising colorectal cancer cases and expanding healthcare access.

Market Insights

- The ileostomy market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.09 billion by 2032, growing at a CAGR of 7.1%.

- Rising prevalence of colorectal cancer and inflammatory bowel diseases, coupled with increasing surgical interventions, is fueling market demand, with end ileostomy accounting for over 55% of the share in 2024.

- Growing adoption of advanced pouching systems, digital health integration, and minimally invasive surgical techniques are shaping market trends, improving patient comfort and compliance.

- The competitive landscape is defined by global players focusing on innovation, expanding distribution networks, and strategic collaborations with healthcare providers to strengthen their market presence.

- North America led with 38% share in 2024, followed by Europe at 30% and Asia Pacific at 20%, while Latin America and Middle East & Africa held smaller shares of 7% and 5% respectively, reflecting diverse growth patterns across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The end ileostomy segment dominated the ileostomy market in 2024, accounting for over 55% of the total share. Its prevalence is linked to its use in permanent diversion surgeries, particularly among patients with advanced colorectal cancer and severe ulcerative colitis. The segment benefits from rising surgical interventions, growing awareness of stoma care, and advanced pouching systems that improve patient outcomes. Loop ileostomy, while used for temporary diversion, shows steady growth due to increasing adoption in staged surgeries, especially in younger patients with Crohn’s disease and complex bowel disorders.

- For instance, Coloplast reports holding a 35–40% share of the global ostomy care market and strategically notes China as one of the largest ostomy care markets by number of users.

By Application

Colorectal cancer emerged as the leading application, representing nearly 50% of the ileostomy market share in 2024. The dominance stems from the global increase in colorectal cancer cases, with higher surgical interventions requiring ileostomy procedures. Rising cancer screening programs, coupled with improved survival rates, drive demand for effective postoperative care, boosting adoption. Ulcerative colitis and Crohn’s disease also contribute significantly, fueled by growing incidence of inflammatory bowel diseases. Other applications, including trauma and congenital anomalies, represent a smaller share but remain relevant in specialized surgical contexts.

- For instance, Exact Sciences says Cologuard has detected over 623,000 cancers and precancers in 10 years, supporting more surgical referrals.

By End Use

Hospitals and specialty clinics held the largest share, capturing about 65% of the ileostomy market in 2024. This dominance is driven by the high patient inflow, availability of advanced surgical infrastructure, and skilled professionals managing complex stoma surgeries. Rising hospital-based colorectal cancer procedures and expanding specialized gastroenterology units further support this growth. Ambulatory surgical centers, though holding a smaller share, are witnessing rapid growth due to shorter recovery times, cost-effectiveness, and increasing preference for outpatient care settings, especially in developed regions with strong healthcare infrastructure.

Key Growth Drivers

Rising Prevalence of Colorectal Cancer and IBD

The growing incidence of colorectal cancer and inflammatory bowel diseases (IBD), including ulcerative colitis and Crohn’s disease, is a major growth driver for the ileostomy market. With colorectal cancer ranking among the leading causes of cancer-related deaths worldwide, surgical interventions requiring ileostomy procedures are rising steadily. Increasing awareness, early screening programs, and improved diagnostic rates are further accelerating procedure volumes. This segment’s dominance directly supports market expansion, as patients undergoing resection or bowel diversion require long-term stoma management solutions.

- For instance, a randomized controlled trial among endoscopists-in-training demonstrated that Olympus ENDO-AID CADe increased the overall adenoma detection rate from 44.5% to 57.5%, supporting more timely interventions.

Advancements in Stoma Care Products

Continuous innovations in ostomy bags, skin barriers, and pouching systems are driving higher adoption rates. New-generation products offer enhanced comfort, leak prevention, and longer wear time, which significantly improve patient quality of life. Companies are focusing on ergonomic designs and advanced adhesives, addressing key concerns of irritation and infection. Digital stoma monitoring tools are also emerging, helping clinicians and patients track skin health and output more effectively. These technological improvements strengthen patient confidence and increase compliance, fueling market growth.

- For instance, in 2019, Welland Medical added equipment forecast to produce an additional 4 million pouches per year, expanding its manufacturing capacity for ostomy systems.

Expansion of Specialized Healthcare Infrastructure

The rapid growth of hospitals and specialty clinics with advanced colorectal surgical units is another key driver. Increasing investments in surgical facilities and specialized training for stoma care nurses have improved treatment quality and accessibility. Governments and healthcare providers in both developed and emerging markets are expanding colorectal cancer care programs, which raises procedure volumes. In addition, insurance coverage for surgical interventions and ostomy supplies in several countries is reducing financial barriers, thereby boosting demand for ileostomy products globally.

Key Trends & Opportunities

Shift Toward Outpatient and Ambulatory Settings

Ambulatory surgical centers are emerging as a fast-growing setting for ileostomy procedures. Shorter recovery times, reduced hospitalization costs, and improvements in minimally invasive surgical techniques are driving this trend. Patients increasingly prefer outpatient care due to convenience, while healthcare systems benefit from reduced burden on hospitals. This shift creates opportunities for product manufacturers to adapt devices and supplies specifically for fast-discharge models. The growing focus on cost-effective and patient-centric care further strengthens this opportunity across both developed and emerging healthcare markets.

- For instance, According to a record on the Global Database for SALTS HEALTHCARE LIMITED, the company employed 623 people as of December 31, 2023.

Integration of Digital Health Solutions

Digital technologies are reshaping stoma care by enabling remote monitoring and patient education. Mobile apps, wearable sensors, and telehealth consultations are increasingly used to track stoma function, pouch output, and skin conditions. These solutions enhance early intervention, reduce complications, and improve overall patient outcomes. Manufacturers that integrate digital health tools with ostomy devices gain a competitive edge, as demand for personalized and technology-driven healthcare grows. This trend aligns with broader healthcare digitalization, opening new opportunities in patient engagement and long-term care management.

- For instance, 11 Health’s hospital app connects up to 20 patients to one tablet for live ostomy output monitoring and alerts.

Key Challenges

High Cost of Ostomy Supplies and Procedures

The cost burden of ileostomy surgery and long-term ostomy care products remains a key challenge. Premium stoma appliances, pouching systems, and accessories often carry high prices, limiting accessibility in low- and middle-income countries. Patients face significant financial strain due to the recurring expense of ostomy supplies, even in developed markets with partial reimbursement. This economic barrier can lead to underutilization or extended use of products, increasing risks of leakage, infection, and reduced quality of life. Addressing affordability is crucial for broader adoption.

Psychological and Social Barriers for Patients

Patients undergoing ileostomy often face stigma, lifestyle adjustments, and psychological distress, which hinder adoption of stoma care solutions. Concerns related to body image, odor, leakage, and intimacy challenges can negatively impact mental health and quality of life. Limited access to stoma care counseling and inadequate patient support programs in many regions intensify these issues. Manufacturers and healthcare providers must work toward awareness programs, support networks, and patient education to reduce stigma and improve acceptance of ileostomy solutions.

Regional Analysis

North America

North America held the largest share of the ileostomy market in 2024, accounting for nearly 38%. The region’s dominance is supported by a high prevalence of colorectal cancer and inflammatory bowel diseases, coupled with advanced healthcare infrastructure. Strong reimbursement frameworks and the presence of major industry players further drive adoption of innovative stoma care products. Increasing patient awareness, access to specialized stoma care nurses, and widespread acceptance of advanced pouching systems also contribute to market leadership. Growth in ambulatory surgical centers adds momentum, ensuring North America remains the key revenue contributor during the forecast period.

Europe

Europe accounted for around 30% of the ileostomy market share in 2024, driven by robust healthcare systems and rising colorectal cancer incidence across the region. Countries like Germany, the UK, and France lead adoption due to advanced colorectal surgery capabilities and widespread availability of ostomy care services. Expanding government initiatives and patient support networks further enhance product accessibility. Favorable reimbursement policies and the strong presence of stoma care associations support sustained growth. Continuous product innovations tailored for patient comfort strengthen Europe’s position as the second-largest market, with steady demand from both hospitals and community-based care centers.

Asia Pacific

Asia Pacific represented approximately 20% of the ileostomy market share in 2024, emerging as the fastest-growing region. Rising incidence of colorectal cancer and inflammatory bowel diseases, coupled with expanding healthcare infrastructure, are fueling market growth. Countries like China, Japan, and India are driving demand through increased surgical volumes and government-backed healthcare initiatives. Growing awareness campaigns, expanding access to affordable ostomy supplies, and rapid development of specialty clinics also contribute. Although reimbursement coverage remains limited in some nations, improving healthcare spending and strong urban demand position Asia Pacific as a key growth engine in the coming years.

Latin America

Latin America accounted for nearly 7% of the ileostomy market share in 2024. Brazil and Mexico are the leading contributors, supported by improving surgical infrastructure and rising cancer care programs. Increased awareness of inflammatory bowel diseases and gradual improvements in healthcare access are driving demand for stoma care products. However, challenges such as limited reimbursement and cost barriers hinder wider adoption. The region is witnessing growing collaborations with global manufacturers to improve supply chains and expand product reach. As healthcare systems modernize, Latin America is expected to experience moderate but steady growth in the forecast period.

Middle East and Africa

The Middle East and Africa held a market share of about 5% in the ileostomy market in 2024. Growth is driven by expanding cancer treatment facilities and gradual improvements in healthcare investments across Gulf countries and South Africa. Rising cases of colorectal cancer and inflammatory bowel diseases are generating demand, but affordability challenges remain a major restraint. Limited patient awareness and low availability of advanced stoma care products restrict adoption. International healthcare collaborations and non-profit initiatives are playing a vital role in bridging gaps. While growth is slower, the region presents long-term potential with ongoing healthcare reforms.

Market Segmentations:

By Type:

- End ileostomy

- Loop ileostomy

By Application:

- Colorectal cancer

- Ulcerative colitis

- Crohn’s disease

- Other applications

By End Use:

- Hospitals and specialty clinics

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ileostomy market is shaped by leading players such as Torbot Group, Coloplast, Safe n Simple, Flexicare, Hollister, Alcare, Welland Medical, ConvaTec Group, Nu-Hope Labs, Smith & Nephew, Marlen Manufacturing, Salts Healthcare, B. Braun, Cymed Micro Skin, and Perma-Type. The market is characterized by continuous innovation in stoma care technologies, with companies focusing on advanced pouching systems, skin-friendly adhesives, and leak-proof designs to enhance patient comfort. Strategic collaborations with healthcare providers and investments in digital health solutions are driving adoption across developed and emerging markets. Firms are also expanding product accessibility through partnerships with distributors, online platforms, and hospital networks. Increasing attention to affordability and customized care solutions is strengthening competitiveness, while global players are leveraging strong brand presence and extensive product portfolios to maintain leadership. Rising demand for minimally invasive procedures and growing awareness programs will continue to shape competitive dynamics in the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Torbot Group

- Coloplast

- Safe n Simple

- Flexicare

- Hollister

- Alcare

- Welland Medical

- ConvaTec Group

- Nu-Hope Labs

- Smith & Nephew

- Marlen Manufacturing

- Salts Healthcare

- Braun

- Cymed Micro Skin

- Perma-Type

Recent Developments

- In 2024, Coloplast indeed launched Heylo, a digital leakage notification system designed to reduce the burden of leakage for ostomy users by providing early leakage warnings

- In 2024, ConvaTec launched its Esteem Body™ with Leak Defense™, a one-piece soft convex ostomy system designed for a secure fit on various body and stoma types to prevent leakage

- In 2024, Hollister was granted a patent for a new ostomy appliance system that incorporates thermal sensors for leak detection.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ileostomy market will expand steadily, supported by rising colorectal cancer and IBD cases.

- Hospitals and specialty clinics will remain the dominant end-use segment.

- Ambulatory surgical centers will grow rapidly due to demand for outpatient care.

- End ileostomy will continue holding the largest share among procedure types.

- Colorectal cancer will remain the leading application driving surgical interventions.

- Technological advancements in pouching systems will improve patient adoption.

- Digital health integration will strengthen remote monitoring and personalized care.

- North America will sustain leadership, while Asia Pacific will grow fastest.

- High treatment costs will challenge adoption in low-income regions.

- Patient awareness programs will play a critical role in reducing stigma.