Market overview

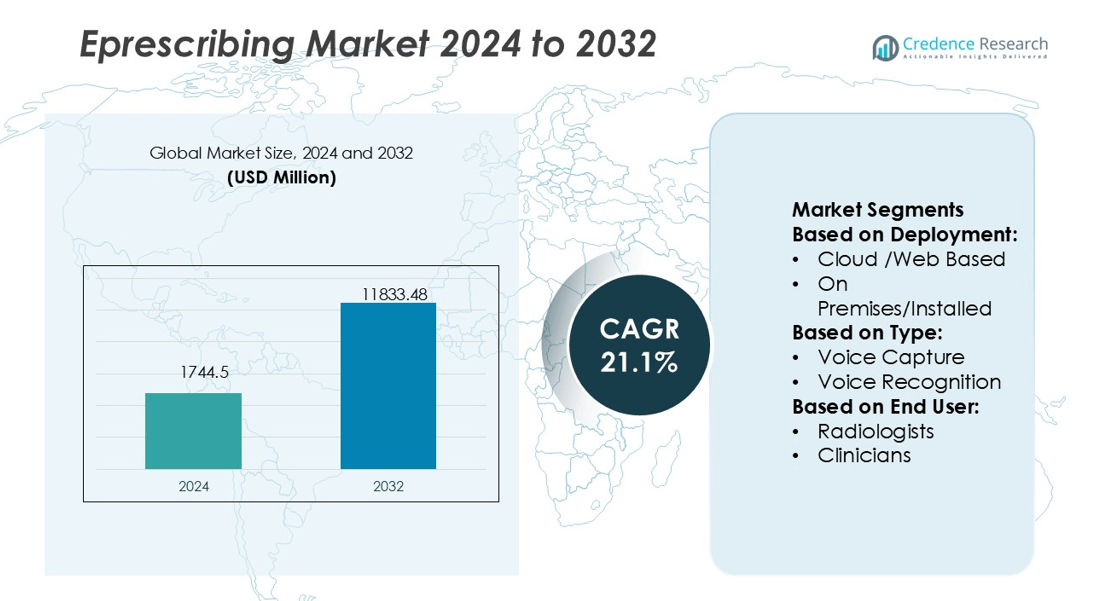

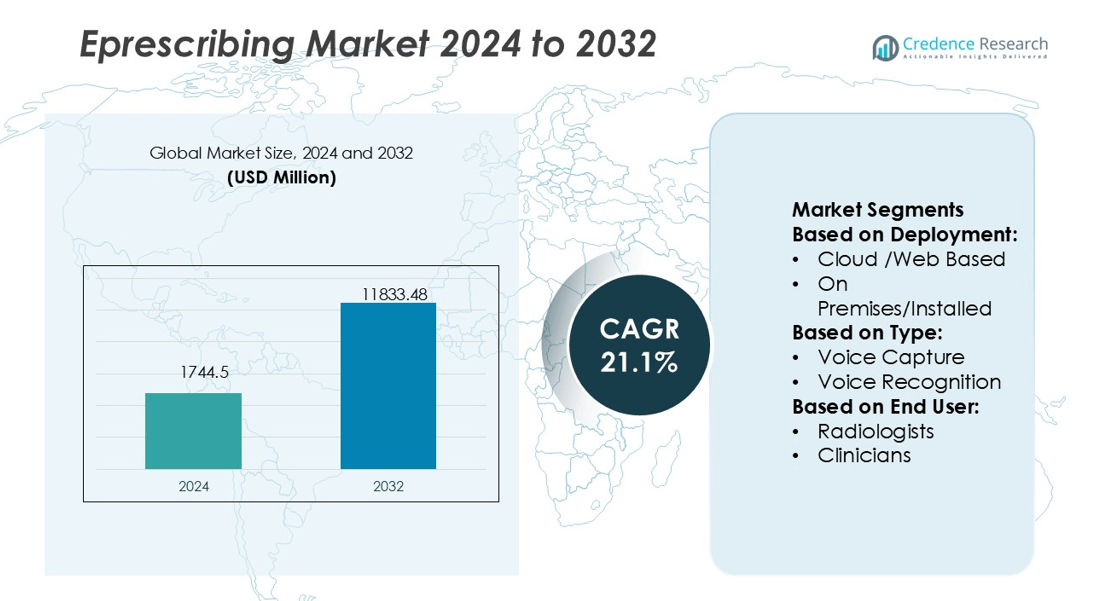

Eprescribing Market size was valued USD 1744.5 million in 2024 and is anticipated to reach USD 11833.48 million by 2032, at a CAGR of 21.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Eprescribing Market Size 2024 |

USD 1744.5 million |

| Eprescribing Market, CAGR |

21.1% |

| Eprescribing Market Size 2032 |

USD 11833.48 million |

The Eprescribing Market is driven by leading players such as Cerner Corporation (Oracle), Epic Systems Corporation, Allscripts Healthcare, LLC, McKesson Corporation, Surescripts, Athenahealth, DrFirst, NXGN Management, LLC, Change Healthcare, and Practice Fusion, Inc. These companies strengthen their positions through advanced cloud-based platforms, AI-enabled solutions, and strong integration with electronic health records and pharmacy networks. Strategic partnerships with healthcare providers and payers enhance adoption, while investments in security and interoperability improve trust and efficiency. North America leads the global market with a 42% share in 2025, supported by regulatory mandates, robust healthcare IT infrastructure, and widespread telehealth adoption.

Market Insights

- The Eprescribing Market size was valued at USD 1744.5 million in 2024 and is projected to reach USD 11833.48 million by 2032, growing at a CAGR of 21.1% during the forecast period.

- Market growth is driven by regulatory mandates, rising demand for digital healthcare, and reduced prescription errors through advanced cloud-based and AI-enabled platforms.

- Key players focus on competitive strategies including product innovation, interoperability, and partnerships with providers and pharmacies, strengthening their presence in the global market.

- High implementation costs and data security concerns remain significant restraints, particularly for small and mid-sized healthcare facilities in developing regions.

- North America leads with a 42% share in 2025, followed by Europe at 29% and Asia-Pacific at 19%, while the cloud-based segment holds the largest deployment share due to scalability and cost efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

The cloud/web-based segment dominates the Eprescribing Market with over 65% share in 2025. Its leadership stems from scalability, lower upfront costs, and real-time access to prescriptions. Hospitals and clinics prefer cloud deployment for ease of integration with electronic health records and better interoperability across systems. Continuous government support for digital health initiatives further strengthens adoption. On-premises deployment remains relevant among large institutions seeking enhanced data control and security. However, the shift toward digital transformation continues to make cloud/web-based platforms the clear growth driver.

- For instance, Surescripts’ network handled more than 27.2 billion patient clinical and benefit information transactions and maintained an exceptionally high uptime, demonstrating the high performance and reliability of its cloud infrastructure.

By Type

Voice recognition leads the Eprescribing Market by type, accounting for 58% share in 2025. This dominance is driven by advancements in natural language processing that enhance prescription accuracy and reduce manual entry. Clinicians increasingly favor voice recognition for its efficiency in reducing administrative time and improving workflow. Voice capture holds a smaller share, often used in settings requiring simple recording functions. Growth in AI-enabled platforms continues to improve accuracy and compliance, making voice recognition the preferred technology among healthcare professionals.

- For instance, Iteris’ Vantage Apex hybrid sensor monitors vehicle presence up to 600 feet downstream of the stop bar. Software accounts for strong demand through traffic management platforms and cloud-based analytics, while services like installation and maintenance ensure system integration and lifecycle support.

By End-user

Clinicians hold the largest share of the Eprescribing Market by end-user, representing 47% in 2025. Their dominance is driven by widespread adoption in outpatient and primary care settings, where digital prescriptions improve patient safety and reduce errors. Surgeons and radiologists are adopting gradually, supported by integration with imaging and surgical planning systems. Other users, including pharmacists, also benefit from enhanced connectivity with healthcare networks. Rising demand for efficiency, compliance with regulatory frameworks, and reduced paperwork drive clinicians’ leading role, making them the primary growth contributors within this segment.

Key Growth Drivers

Rising Government Support for Digital Healthcare

Government initiatives promoting electronic health records and e-prescribing systems are a major growth driver. Policies aimed at reducing prescription errors, improving patient safety, and enhancing interoperability fuel adoption. Financial incentives and mandatory compliance requirements encourage healthcare providers to implement advanced e-prescribing platforms. Supportive regulations across developed and emerging economies strengthen market expansion. These measures not only accelerate digital transformation but also create a foundation for long-term growth in the Eprescribing Market, ensuring sustained demand across healthcare systems.

- For instance, a recent research paper describes a distributed acoustic sensor approach using fiber optics in ITS applications—achieving 92% vehicle classification accuracy and 92–97% accuracy in occupancy detection under controlled conditions.

Increasing Focus on Patient Safety and Error Reduction

Growing concerns over medication errors are driving adoption of e-prescribing solutions. Automated systems reduce transcription mistakes, ensure accurate dosage, and enhance compliance with drug formularies. Clinicians benefit from integrated clinical decision support, which alerts them about drug interactions and allergies. This improves patient outcomes while lowering liability risks for healthcare institutions. Rising awareness among providers and patients regarding safety measures continues to accelerate deployment. The Eprescribing Market thrives as accuracy and reliability become core requirements in modern healthcare delivery.

- For instance, Econolite has deployed over 160,000 traffic controllers across more than 60,000 intersections globally. Its newly introduced EPIQ RADAR™ detection solution offers a 110-degree field of view, covers up to 900 feet, and can track 128 objects from 512 detections, integrating lane-by-lane classification and ETA computation.

Expansion of Telehealth and Remote Care Services

The rapid rise of telehealth is significantly boosting demand for e-prescribing platforms. Virtual consultations require seamless prescription management, making digital solutions a natural fit. Cloud-based platforms allow physicians to issue prescriptions remotely while ensuring secure communication with pharmacies. Integration with telemedicine applications strengthens accessibility and patient convenience. The increasing prevalence of chronic diseases also supports the need for remote prescription renewals. This shift toward digital-first healthcare delivery positions the Eprescribing Market as a critical enabler of future healthcare ecosystems.

Key Trends & Opportunities

Adoption of AI-Enabled Voice Recognition

The integration of artificial intelligence and natural language processing is transforming e-prescribing. AI-enabled voice recognition improves accuracy and reduces the administrative burden on clinicians. These solutions allow faster prescription creation, saving time while ensuring compliance with clinical guidelines. Healthcare providers adopting these technologies gain efficiency and enhanced patient interaction. As AI continues to advance, opportunities arise for vendors to deliver intelligent, user-friendly platforms. This trend strengthens the market’s growth potential by aligning with the industry’s demand for automation and efficiency.

- For instance, DHL partnered with Daimler and Hylane to rent 30 Mercedes-Benz eActros 600 electric trucks, transitioning its heavy transport operations toward zero-emission freight.

Growing Integration with Pharmacy and Insurance Networks

E-prescribing platforms are increasingly linked with pharmacies, payers, and supply chain systems. This integration enhances real-time drug availability checks, formulary compliance, and cost transparency for patients. Seamless connectivity reduces delays in medication access and improves adherence rates. For insurers, it lowers costs by minimizing prescription duplication and fraud. Vendors offering platforms with strong interoperability gain competitive advantage. Expanding these connections presents an opportunity for market growth, making integrated e-prescribing solutions an essential part of value-based healthcare delivery.

- For instance, F. Hoffmann-La Roche Ltd launched the VENTANA DP 600 slide scanner for digital pathology. This scanner provides enhanced patient care with precision diagnostics.

Key Challenges

Data Security and Privacy Concerns

E-prescribing involves sensitive patient and prescription information, raising significant data security challenges. Healthcare organizations must comply with strict regulations such as HIPAA and GDPR. Any breach can lead to financial penalties, reputational damage, and loss of trust among patients. Rising cases of cyberattacks on healthcare systems further intensify concerns. Ensuring robust encryption, secure data storage, and regular audits is critical. These requirements increase operational costs, creating a barrier for smaller providers and slowing adoption of e-prescribing platforms in some regions.

High Implementation and Integration Costs

Despite long-term benefits, the initial cost of implementing e-prescribing systems remains high. Small and mid-sized healthcare facilities often struggle with investments in software, training, and integration with legacy systems. Maintenance and upgrade expenses further add to financial pressure. Lack of technical expertise among providers can also delay deployment. These challenges hinder widespread adoption, particularly in resource-constrained settings. Vendors focusing on affordable cloud-based solutions and flexible pricing models may overcome this barrier and drive broader acceptance of e-prescribing technology.

Regional Analysis

North America

North America dominates the Eprescribing Market with a 42% share in 2025. Growth is driven by widespread adoption of electronic health records, strong regulatory mandates, and significant government incentives supporting digital healthcare infrastructure. The U.S. leads the region, benefiting from advanced healthcare IT systems and established telehealth networks. Canada is also expanding rapidly, with increased investments in digital health platforms and interoperability projects. Strong collaboration between providers, payers, and pharmacies continues to strengthen adoption. The region’s mature healthcare ecosystem ensures that North America remains the leading contributor to global e-prescribing revenues.

Europe

Europe holds a 29% share of the global Eprescribing Market in 2025, supported by strict regulatory frameworks and strong emphasis on patient safety. Countries such as Germany, the U.K., and France are leading adopters due to national healthcare digitalization programs and e-health mandates. Interoperability initiatives within the European Union further accelerate integration across healthcare systems and pharmacies. Rising demand for reducing medication errors and improving clinical efficiency also supports expansion. The region’s focus on cross-border e-health initiatives ensures continued growth, making Europe a strong hub for standardized and secure e-prescribing adoption.

Asia-Pacific

Asia-Pacific accounts for 19% of the global Eprescribing Market in 2025, driven by rapid digital transformation in healthcare and growing telemedicine adoption. China, India, Japan, and Australia are key contributors, supported by government-led e-health initiatives and rising demand for efficient prescription management. Increasing healthcare investments, expanding urban populations, and the adoption of AI-driven solutions further strengthen the region’s growth. Cloud-based platforms are particularly gaining traction due to cost-effectiveness and scalability. While infrastructure gaps remain in some countries, the region’s high-growth potential makes Asia-Pacific the fastest-expanding market for e-prescribing solutions.

Latin America

Latin America represents 6% of the Eprescribing Market in 2025, with Brazil and Mexico as leading contributors. Market growth is supported by healthcare modernization initiatives and government programs to improve electronic health record adoption. The region faces challenges such as uneven infrastructure and limited budgets among smaller healthcare providers. However, increasing telemedicine adoption and private sector investments are creating new opportunities. Demand for affordable cloud-based solutions is growing, enabling wider penetration across hospitals and clinics. Despite current limitations, Latin America shows steady progress in expanding e-prescribing adoption across its healthcare landscape.

Middle East & Africa

The Middle East & Africa region holds a 4% share of the Eprescribing Market in 2025, reflecting gradual adoption across developing healthcare systems. The UAE, Saudi Arabia, and South Africa lead the region due to strong investments in digital health infrastructure and government-backed initiatives. Expansion of private healthcare networks and telehealth services further supports growth. However, limited interoperability and data security concerns continue to restrain adoption in several countries. Ongoing modernization efforts and regional partnerships are expected to strengthen adoption, positioning the Middle East & Africa as an emerging but promising market for e-prescribing solutions.

Market Segmentations:

By Deployment:

- Cloud /Web Based

- On Premises/Installed

By Type:

- Voice Capture

- Voice Recognition

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Eprescribing Market features strong competition among leading players including NXGN Management, LLC, Surescripts, Epic Systems Corporation, McKesson Corporation, Cerner Corporation (Oracle), Practice Fusion, Inc., DrFirst, Allscripts Healthcare, LLC, Change Healthcare, and Athenahealth. The Eprescribing Market is characterized by high competition, driven by innovation, regulatory compliance, and integration with broader healthcare IT systems. Companies focus on delivering platforms that reduce prescription errors, enhance interoperability, and support real-time communication with pharmacies and payers. Advancements in cloud-based deployment, AI-enabled voice recognition, and clinical decision support tools are shaping differentiation among solutions. Strategic collaborations with healthcare providers and insurers strengthen adoption rates, while expansion into emerging markets fuels future opportunities. Continuous investment in technology and adherence to data security standards remain critical to maintaining competitive advantage in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, McKesson Corporation agreed to buy an 80% stake in PRISM Vision Holdings for strengthening its specialty-care and analytics portfolio.

- In January 2025, Leica Biosystems enhanced its Aperio GT 450 digital pathology scanner by introducing features such as DICOM-compatible files with 20x/40x magnification, Z-Stacking, Manual Scan, Extended Focus, and Default Calibration.

- In February 2024, F. Hoffmann-La Roche Ltd announced a partnership with PathAI to develop artificial intelligence (AI) digital pathology algorithms for Roche’s Tissue Diagnostics business.

- In November 2023, PharmaNest Inc., Alimentiv Inc., and AcelaBio Inc. collaborated to revolutionize precision medicine and AI-based digital pathology for MASH (metabolic dysfunction associated steatohepatitis)/NASH (nonalcoholic steatohepatitis) clinical trials

Report Coverage

The research report offers an in-depth analysis based on Deployment, Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Eprescribing Market will see stronger adoption through government mandates and healthcare digitalization policies.

- Cloud-based platforms will continue to lead due to scalability and cost efficiency.

- AI-driven voice recognition will improve accuracy and reduce clinician workload.

- Integration with telehealth services will expand, supporting remote care and prescription renewals.

- Interoperability with pharmacy and insurance networks will strengthen cost transparency and drug availability.

- Data security solutions will advance to address rising cyber threats in healthcare.

- Emerging markets will witness faster adoption driven by healthcare modernization.

- Clinical decision support integration will enhance patient safety and reduce prescription errors.

- Strategic partnerships among providers, payers, and IT vendors will expand solution reach.

- Continuous innovation in digital health ecosystems will shape long-term growth and competitiveness.