Market overview

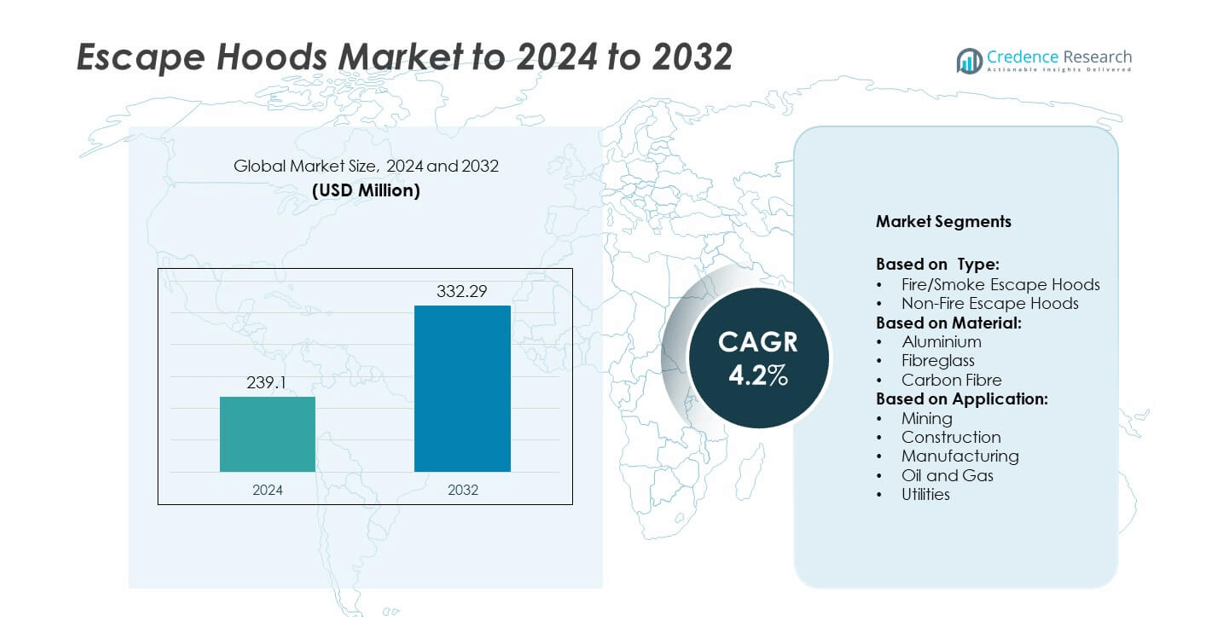

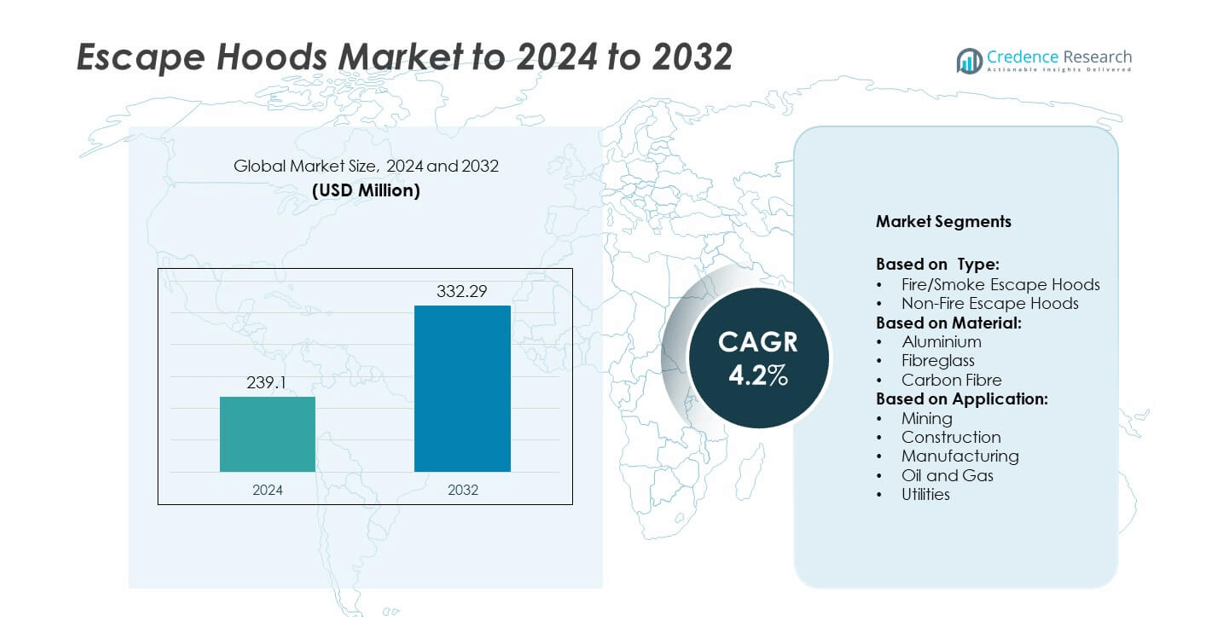

Escape Hoods Market size was valued USD 239.1 Million in 2024 and is anticipated to reach USD 332.29 Million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Escape Hoods Market Size 2024 |

USD 239.1 Million |

| Escape Hoods Market, CAGR |

4.2% |

| Escape Hoods Market Size 2032 |

USD 332.29 Million |

The escape hoods market is shaped by leading players such as Avon Protection, 3M, Dräger, Honeywell, MSA, KimberlyClark, Bullard, Survivair, Uvex, Interspiro, Scott, BW Technologies, GVS, RiteHite, Bacharach, and Calibro. These companies focus on innovation, compliance with safety regulations, and strategic partnerships to strengthen their global footprint. Product advancements in lightweight materials, integrated filtration, and enhanced wearer comfort drive their competitiveness. Regionally, North America led the market in 2024 with a 34% share, supported by strict safety regulations and high industrial adoption, positioning it as the dominant contributor to overall market revenue.

Market Insights

- The escape hoods market size was USD 239.1 million in 2024 and will reach USD 332.29 million by 2032, growing at a CAGR of 4.2%.

- Rising fire incidents and stringent workplace safety regulations in oil and gas, mining, and manufacturing industries are driving adoption of escape hoods.

- Trends such as the use of fibreglass for cost-effective protection and the growing preference for fire/smoke escape hoods strengthen segment leadership.

- The market is competitive with global players investing in advanced materials, technology integration, and partnerships to expand their presence.

- North America held 34% share in 2024, Europe followed with 27%, Asia Pacific captured 24%, while Latin America and Middle East & Africa accounted for 8% and 7% respectively, with oil and gas as the leading application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The fire/smoke escape hoods segment held the largest market share in 2024, driven by rising fire safety regulations and mandatory compliance in industrial and commercial spaces. These hoods offer protection against toxic gases, smoke, and carbon monoxide during emergencies, making them essential in high-risk environments. Non-fire escape hoods continue to gain traction in specialized areas like chemical handling and laboratory settings. However, the dominance of fire/smoke escape hoods is strengthened by frequent fire incidents and stricter occupational safety standards, reinforcing their demand across construction, utilities, and manufacturing industries.

- For instance, Dräger’s safety division reported €1,407.3 million net sales in 2023 from its segment, which includes products such as fixed and mobile gas detection systems, respiratory protection, and professional diving gear, reflecting demand across various industrial and public safety applications.

By Material

Fibreglass accounted for the leading market share in 2024 due to its lightweight structure, heat resistance, and cost-effectiveness. It is widely preferred in manufacturing and oil and gas sectors where durability and thermal protection are critical. Aluminium-based escape hoods are also popular for their reflective properties and portability but face limitations in extreme heat conditions. Carbon fibre is emerging as a premium choice with strong mechanical strength and enhanced protection features. Nonetheless, fibreglass remains dominant as industries prioritize a balance between affordability, thermal shielding, and user comfort.

- For instance, the Dräger PARAT® 7520 escape hood weighs 770 g and uses an ABEK CO P3 combination filter to protect against a wide range of toxic industrial and fire-related gases, vapors, and particles.

By Application

The oil and gas segment emerged as the dominant application area in 2024, holding the highest market share. This is attributed to the sector’s high exposure to toxic gas leaks, explosions, and fire hazards, which mandate the use of reliable emergency respiratory protection. Mining also represents a significant segment due to the prevalence of underground fires and hazardous gas emissions. Construction and utilities continue to adopt escape hoods to comply with stringent workplace safety standards. The oil and gas industry’s critical safety needs and large workforce presence make it the key driver for market growth.

Key Growth Drivers

Stringent Workplace Safety Regulations

The growing enforcement of occupational safety standards is the primary growth driver for the escape hoods market. Industries such as oil and gas, mining, and manufacturing face strict regulations that mandate emergency protective equipment for workers exposed to fire, smoke, and toxic gases. Increasing workplace inspections and safety audits are compelling companies to adopt certified escape hoods to avoid penalties and ensure worker protection. This regulatory push is significantly boosting market penetration, particularly in regions with strong industrial compliance frameworks.

- For instance, Honeywell offers the ER5000 escape breathing apparatus with 5- and 10-minute air supply versions—used in petrochemical plants for emergency egress.

Rising Fire Incidents in Industrial and Commercial Spaces

The increasing number of fire-related accidents across industrial facilities, commercial establishments, and urban infrastructure is driving demand for escape hoods. Fire and smoke escape hoods are increasingly viewed as essential safety equipment to protect individuals during emergencies. Growing awareness among employers and households about the importance of personal fire protection equipment is also contributing to wider adoption. As urbanization accelerates and fire risks become more frequent, the need for rapid evacuation solutions remains a strong growth catalyst for the market.

- For instance, Demand increases where fire and smoke risks are high. Honeywell’s ER2000CBRN escape hood provides at least 30 minutes of protection in hazardous chemical or fire environments.

Expansion in Oil and Gas and Mining Sectors

High-risk industries such as oil and gas and mining serve as major end-users of escape hoods. These sectors involve hazardous environments with potential for toxic gas leaks, explosions, and underground fires, creating consistent demand for advanced respiratory protection. Employers in these sectors are investing in high-performance hoods to safeguard workers and meet safety compliance. The rising global energy demand and mining expansion projects are further driving procurement. This sector’s reliance on protective gear establishes it as a critical driver shaping the future growth of the market.

Key Trends & Opportunities

Adoption of Advanced Materials

The integration of advanced materials such as carbon fibre and lightweight composites is a key trend in the escape hoods market. These materials enhance durability, reduce weight, and provide higher resistance against heat and toxic gases. Manufacturers are focusing on improving wearer comfort while ensuring maximum protection. This material innovation creates opportunities for premium product offerings, particularly in high-risk industries where performance and reliability are prioritized. The shift towards advanced materials positions the market for sustained growth through product differentiation.

- For instance, Dräger’s PARAT 5510 fire escape hood, uses a self-extinguishing fabric that is tested for flame resistance at 800 °C.

Technological Integration in Safety Equipment

The incorporation of digital monitoring and smart features is opening new opportunities in the market. Some manufacturers are developing escape hoods with integrated sensors that detect harmful gases or provide real-time usage alerts. This enhances safety standards and ensures quick response during emergencies. Growing demand for connected safety equipment in industrial settings is driving innovation. The trend reflects a broader industry movement toward smart protective devices, offering manufacturers a chance to capture niche markets with advanced, technology-driven products.

- For instance, MSA Safety’s S-CAP Fire Escape Hood uses a multi-purpose filter rated for a minimum of 15 minutes of service time.

Key Challenges

High Product Costs

One of the major challenges in the escape hoods market is the high cost of advanced protective hoods. Premium products made with carbon fibre or integrated sensors are expensive, limiting adoption among small and medium-sized enterprises. Budget constraints in developing regions also restrict procurement, despite rising safety awareness. Manufacturers face the challenge of balancing affordability with advanced features to make products accessible to wider markets. Addressing cost barriers remains a critical issue to support broader global adoption.

Limited Awareness in Developing Regions

Low awareness about the importance of escape hoods continues to hinder market growth in developing countries. Many small businesses and unregulated industries do not prioritize investments in personal safety equipment, leaving workers vulnerable in hazardous environments. Lack of training and insufficient safety culture further exacerbate the issue. While multinational companies follow strict safety standards, regional players often lag. Overcoming this awareness gap requires education, training programs, and government initiatives to emphasize workplace safety and the role of protective gear.

Regional Analysis

North America

North America held the largest share of the escape hoods market in 2024, accounting for 34%. The region’s dominance is driven by strict workplace safety regulations, advanced industrial infrastructure, and frequent adoption of fire and smoke protection equipment. The oil and gas, construction, and manufacturing sectors play a crucial role in boosting demand. Additionally, increasing fire-related incidents in urban and industrial spaces reinforce the need for high-quality protective hoods. Strong regulatory compliance, combined with high investment in advanced safety equipment, ensures the region remains the leading contributor to market revenue during the forecast period.

Europe

Europe accounted for 27% of the escape hoods market in 2024, supported by robust industrial safety standards and strict government regulations. The region has strong adoption in sectors like utilities, manufacturing, and mining, where employee safety is a top priority. Countries such as Germany, the UK, and France lead in demand, driven by high awareness and enforcement of safety protocols. The presence of established manufacturers and continuous innovation in material technology further strengthens the regional market. Increased emphasis on occupational safety and compliance with EU directives ensures Europe remains a significant growth region.

Asia Pacific

Asia Pacific held 24% of the escape hoods market share in 2024, driven by rapid industrialization and expansion of high-risk industries. The oil and gas, mining, and construction sectors contribute heavily to demand, particularly in China, India, and Australia. Rising urbanization and infrastructure growth also boost adoption across commercial and industrial facilities. However, varying levels of regulatory enforcement across countries create uneven growth. Despite this, the increasing focus on worker safety and growing awareness of protective equipment in industrial operations position Asia Pacific as one of the fastest-growing regional markets during the forecast period.

Latin America

Latin America captured 8% of the escape hoods market in 2024, primarily supported by the oil and gas and mining sectors. Countries such as Brazil and Mexico are major demand contributors due to their large industrial and energy bases. Safety concerns in underground mining operations and increased awareness about fire-related hazards are fostering adoption. However, limited investment in advanced protective equipment and weaker regulatory enforcement compared to developed regions act as constraints. Nonetheless, gradual improvements in workplace safety standards and growing industrial development offer potential for steady market expansion across the region.

Middle East and Africa

The Middle East and Africa represented 7% of the escape hoods market share in 2024, supported by significant demand from oil and gas operations and large-scale industrial projects. Countries like Saudi Arabia, UAE, and South Africa are key contributors, where occupational safety standards are gradually improving. The high prevalence of hazardous environments in energy extraction and refining industries drives consistent use of escape hoods. However, adoption remains uneven due to cost challenges and lack of awareness in certain areas. With ongoing investments in industrial safety and infrastructure, the region shows potential for stable long-term growth.

Market Segmentations:

By Type:

- Fire/Smoke Escape Hoods

- Non-Fire Escape Hoods

By Material:

- Aluminium

- Fibreglass

- Carbon Fibre

By Application:

- Mining

- Construction

- Manufacturing

- Oil and Gas

- Utilities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Avon Protection, Survivair, Bullard, Uvex, KimberlyClark, 3M, Dräger, Interspiro, BW Technologies, GVS, Scott, Honeywell, MSA, Calibro, Bacharach, and RiteHite are the prominent players shaping the competitive landscape of the escape hoods market. The market is characterized by intense competition with companies focusing on innovation, compliance with stringent safety standards, and expanding their product portfolios. Leading firms invest in advanced materials, lightweight designs, and integrated features to improve safety and comfort. Strategic initiatives such as mergers, acquisitions, and partnerships strengthen global presence and distribution networks. Many players are targeting industrial end-users in oil and gas, mining, and utilities to capitalize on rising safety requirements. Emphasis on research and development, along with growing adoption of technology-driven products, ensures sustained competitive positioning. Furthermore, efforts to address cost challenges and expand awareness in developing regions highlight the long-term strategies companies adopt to secure market share and maintain leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Avon Protection

- Survivair

- Bullard

- Uvex

- KimberlyClark

- 3M

- Dräger

- Interspiro

- BW Technologies

- GVS

- Scott

- Honeywell

- MSA

- Calibro

- Bacharach

- RiteHite

Recent Developments

- In 2025, GVS promoted its Z-Link respirator hood as a comfort-focused solution for powered air-purifying respirators (PAPRs), highlighting its ergonomic, lightweight design inspired by motorcycle helmets

- In 2023, Dräger’s PARAT escape hoods, including the PARAT 4700, were available in the market, focusing on user safety and ease of donning. The PARAT 4720 model was also available.

- In 2023, Bullard continued to promote its existing respiratory protection systems, such as the EVA Powered Air-Purifying Respirator (PAPR)

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The escape hoods market will expand steadily, driven by stricter workplace safety regulations.

- Fire and smoke escape hoods will remain the dominant type across industries.

- Fibreglass will continue leading the material segment due to its balance of cost and performance.

- Oil and gas will sustain the largest application share owing to high safety risks.

- Asia Pacific will emerge as the fastest-growing region with rising industrialization.

- Advanced materials like carbon fibre will create opportunities for premium product adoption.

- Technological integration such as gas detection sensors will enhance product demand.

- Growing awareness campaigns will drive adoption in developing economies.

- High costs will challenge penetration among small and medium enterprises.

- Increasing mining and infrastructure projects worldwide will create long-term growth opportunities.