Market Overview

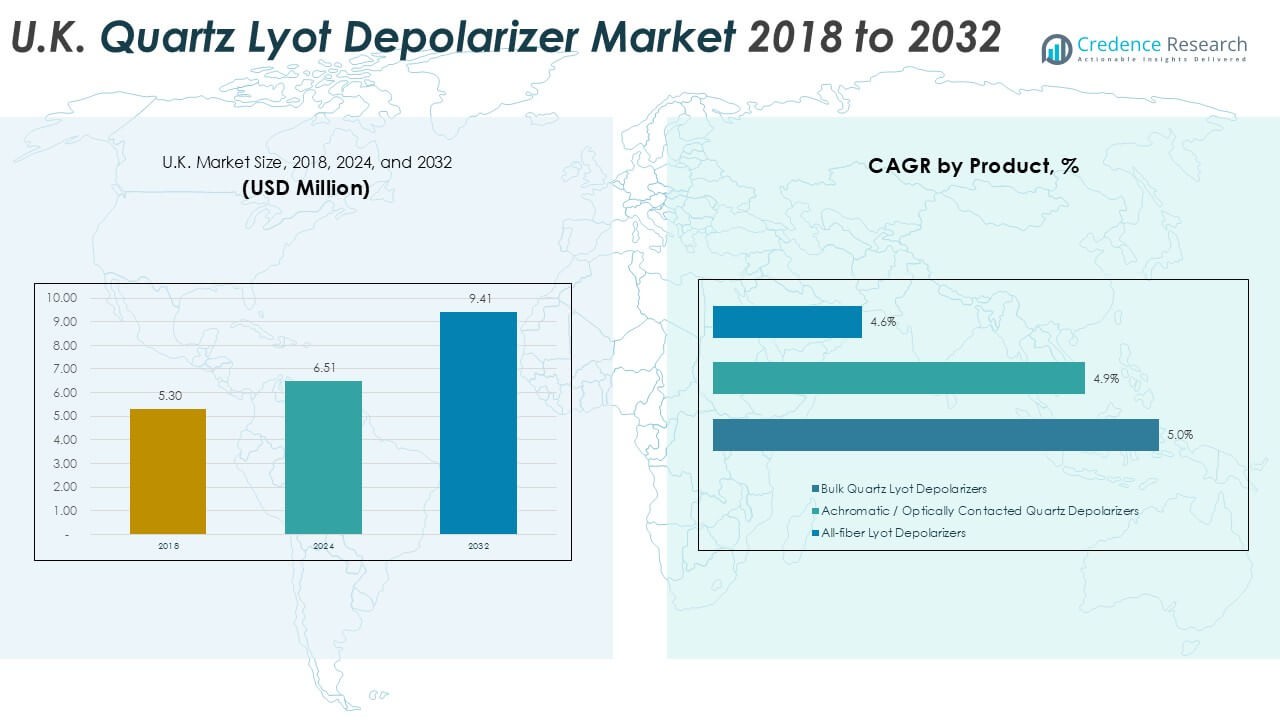

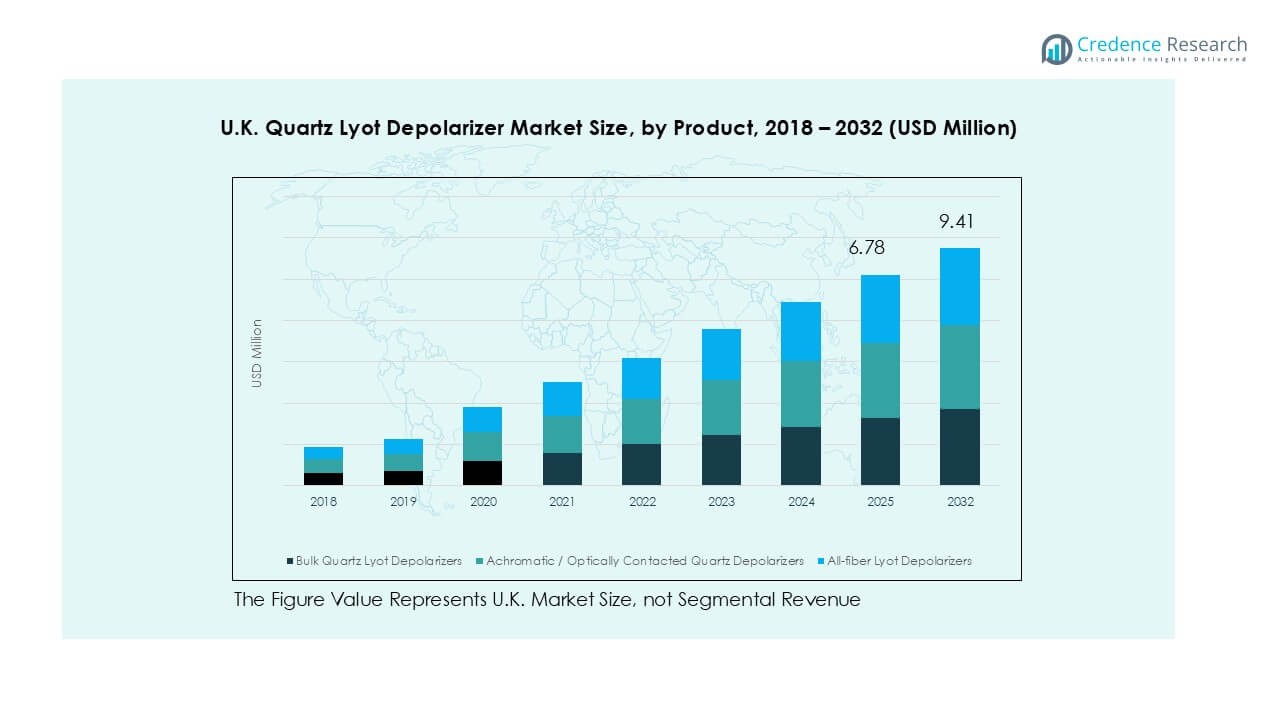

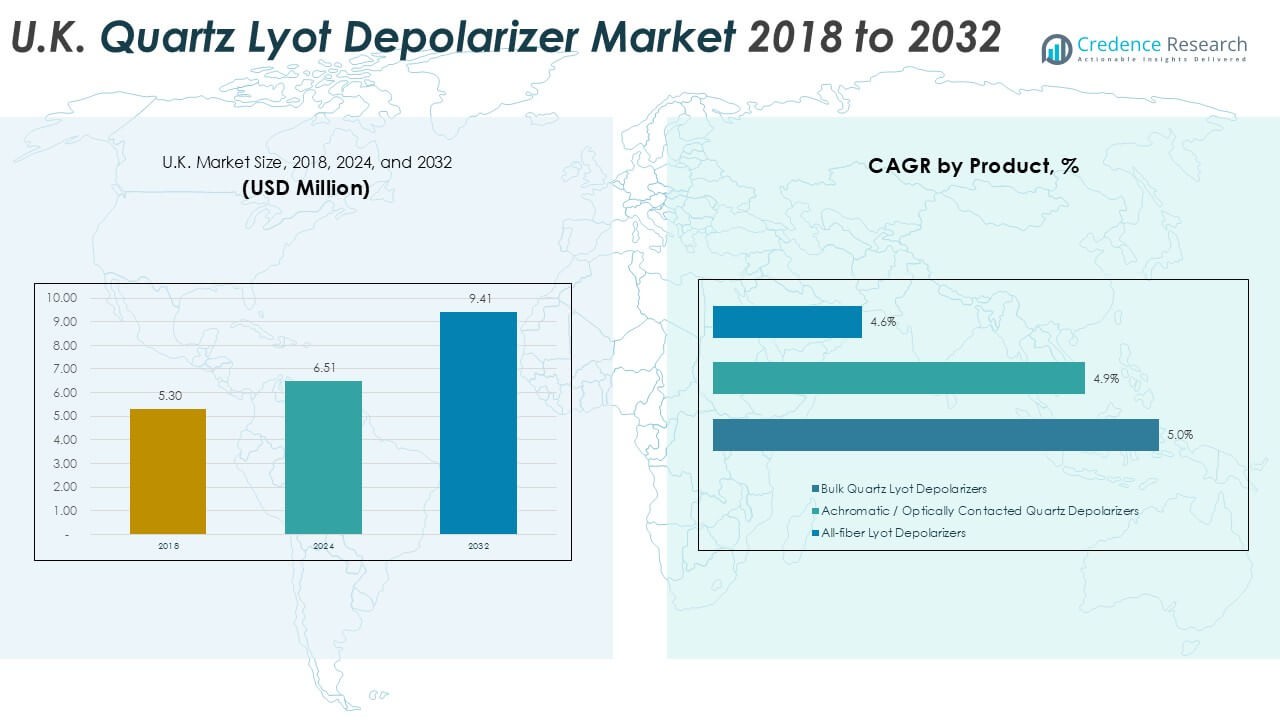

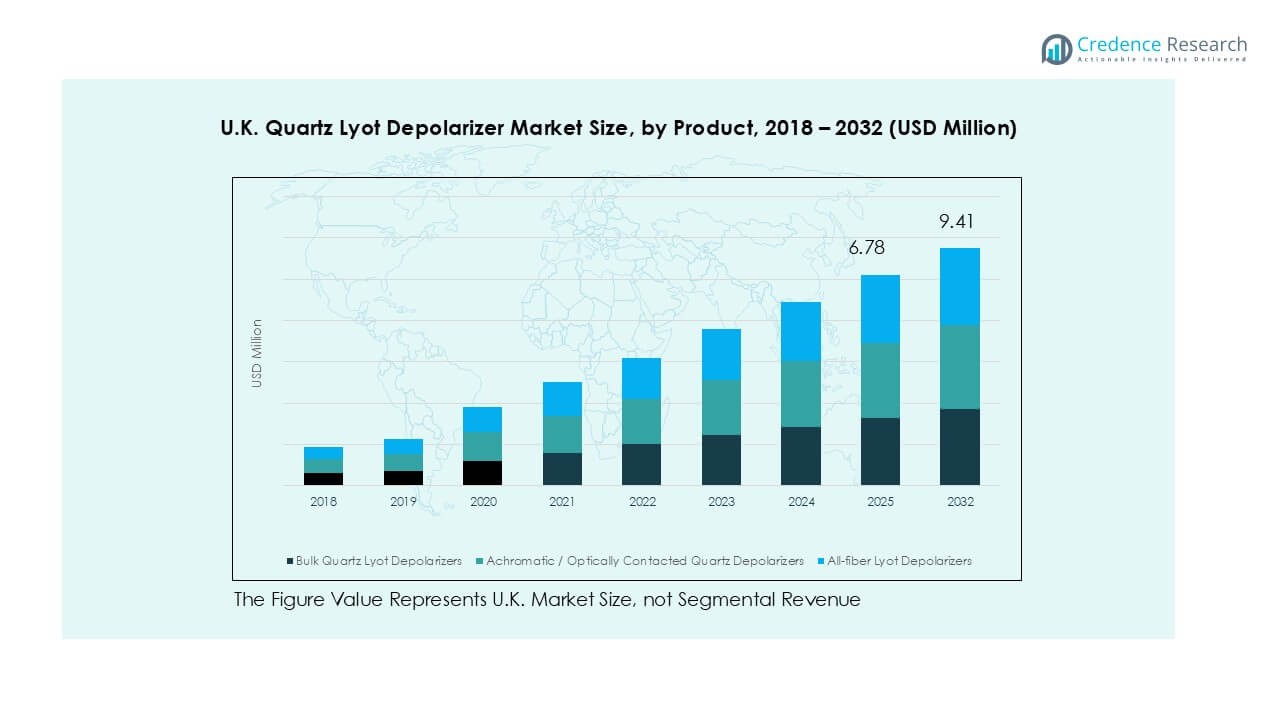

The UK Quartz Lyot depolarizer market size was valued at USD 5.30 million in 2018 and reached USD 6.51 million in 2024. It is anticipated to reach USD 9.41 million by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Quartz Lyot Depolarizer Market Size 2024 |

USD 6.51 Million |

| UK Quartz Lyot Depolarizer Market, CAGR |

5.3% |

| UK Quartz Lyot Depolarizer Market Size 2032 |

USD 9.41 Million |

The UK Quartz Lyot depolarizer market is shaped by leading companies such as Thorlabs, Jenoptik AG, Excelitas Technologies, Edmund Optics, Tower Optical, Foctek Photonics, and Leysop Ltd, which compete through product innovation, wavelength range expansion, and integration support for OEMs. Thorlabs and Edmund Optics maintain strong presence through broad catalogs and reliable UK distribution, while Leysop Ltd specializes in bespoke designs for research applications. Regionally, England, including Greater London and the South East, dominates with a 45% market share, supported by major research hubs and telecom infrastructure. Scotland and Northern England follow with around 20%, driven by university research and industrial demand, while Wales, the West Midlands, and Northern Ireland contribute smaller but steadily growing shares.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Quartz Lyot depolarizer market was valued at USD 6.51 million in 2024 and is projected to reach USD 9.41 million by 2032, growing at a CAGR of 5.3%.

- Rising adoption in spectroscopy and imaging drives demand, supported by academic research and pharmaceutical R&D requiring precise depolarization across UV–visible wavelengths.

- Market trends highlight increasing use of achromatic and broadband depolarizers, as well as growing opportunities in telecom and fiber-optic networks through all-fiber designs.

- Competitive landscape features key players such as Thorlabs, Jenoptik, Excelitas Technologies, Edmund Optics, Tower Optical, and Leysop, focusing on customization, wavelength coverage, and OEM integration.

- England leads with 45% share, driven by major research hubs and telecom nodes, followed by Scotland & Northern England at 20%, Wales & West Midlands at 15%, and Northern Ireland & East Midlands with 20%. By product, bulk quartz depolarizers dominate due to higher reliability in scientific and industrial laser systems.

Market Segmentation Analysis

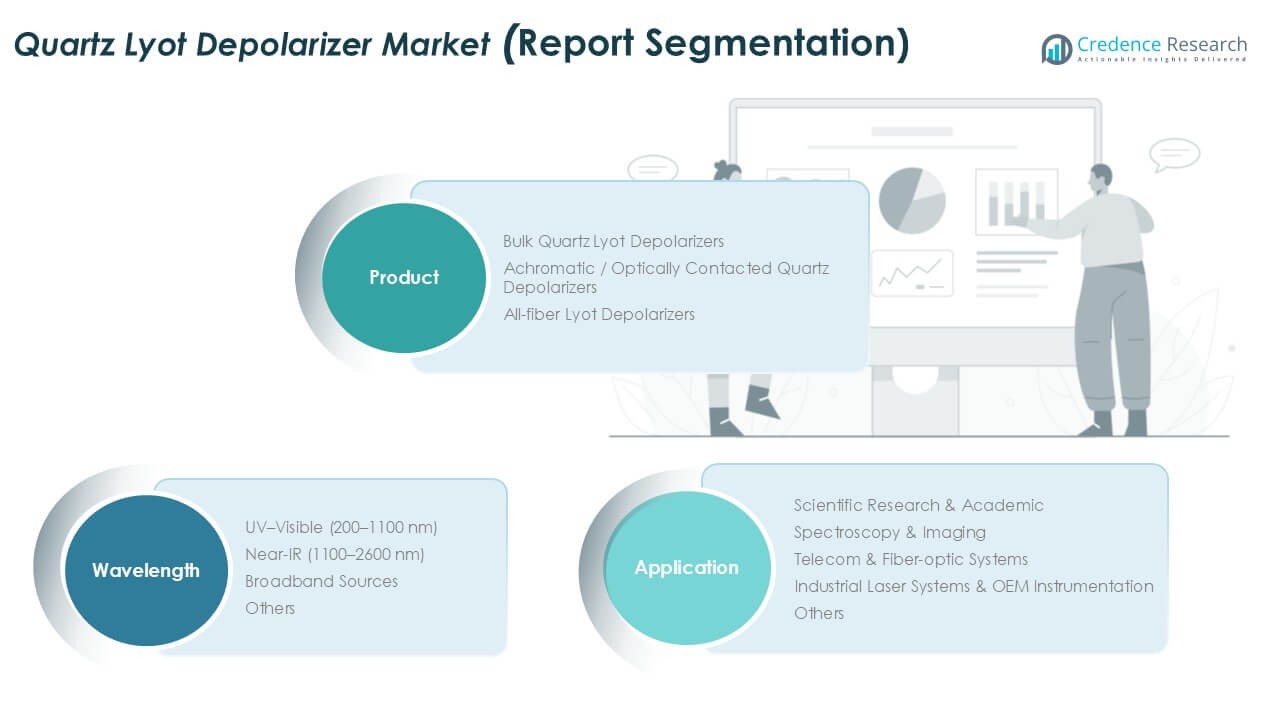

By Product

In the UK Quartz Lyot depolarizer market, Bulk Quartz Lyot Depolarizers accounted for the largest share in 2024, supported by their proven reliability in high-precision optical applications. Their ability to handle higher power levels and deliver stable depolarization makes them the preferred choice across laboratories and instrumentation manufacturers. Achromatic or optically contacted quartz depolarizers are gaining ground due to their versatility in broadband optical systems, while all-fiber Lyot depolarizers find niche adoption in telecom and fiber-optic networks. Demand growth is driven by increasing integration of quartz-based depolarizers into spectroscopy and industrial laser systems.

- For instance, Edmund Optics supplies quartz depolarizers and other optical components for applications such as laboratory spectroscopy and OEM laser systems. The company has a global presence, including operations in Europe and the UK, which are significant markets for these technologies.

By Application

The Spectroscopy & Imaging segment dominated the UK market in 2024, representing the largest share due to extensive use in advanced research labs, pharmaceutical R&D, and material characterization facilities. High accuracy in reducing polarization-related errors makes quartz depolarizers critical in spectroscopic applications. Scientific research and academic institutions continue to expand adoption as funding for optical experiments grows, while telecom and fiber-optic systems are emerging as secondary growth areas. Industrial laser systems and OEM instrumentation also contribute to steady demand, reflecting rising automation and precision engineering requirements across industries.

- For instance, in 2023, Horiba, a global manufacturer of scientific instruments, provided spectroscopy systems and components to various markets, including universities and pharmaceutical companies. Its activities included the acquisition of Process Instruments to expand its Raman spectroscopy offerings.

By Wavelength

Within wavelength segments, UV–Visible (200–1100 nm) held the largest market share in 2024, supported by its widespread use in spectroscopy, microscopy, and imaging applications. The ability of quartz Lyot depolarizers to perform effectively in UV–visible ranges makes them indispensable in scientific and biomedical research. Near-IR depolarizers are gaining traction for telecom and fiber-optic systems, while broadband sources address multi-wavelength optical platforms. The market growth is reinforced by demand from laboratories and OEMs requiring high-performance depolarizers across different wavelengths, with UV–visible continuing to drive the dominant share in research and industrial usage.

Key Growth Drivers

Rising Demand in Spectroscopy and Imaging

Spectroscopy and imaging applications represent one of the strongest growth drivers for the UK Quartz Lyot depolarizer market. Research institutions, pharmaceutical companies, and academic laboratories rely heavily on depolarizers to minimize polarization artifacts and improve measurement accuracy. With the UK expanding its investment in optical instrumentation for materials science, life sciences, and chemical analysis, quartz Lyot depolarizers are witnessing significant uptake. Their stability in UV–visible wavelengths further enhances their role in advanced microscopy and high-precision imaging systems. The rising use of spectroscopy in biotechnology, nanotechnology, and quality assurance testing ensures sustained demand, positioning spectroscopy and imaging as a primary adoption area.

- For instance, in 2023, Oxford Instruments saw significant revenue growth, driven by strong demand across key segments including materials analysis, semiconductors, and healthcare & life sciences.

Integration into Telecom and Fiber-optic Networks

The growing expansion of fiber-optic networks across the UK has made telecom applications a vital driver for quartz Lyot depolarizer adoption. These devices improve signal quality by reducing polarization-dependent losses, which is critical for ensuring consistent optical transmission. With the UK government pushing investments in high-speed broadband and next-generation telecom infrastructure, demand for advanced depolarizers is steadily rising. All-fiber Lyot depolarizers, in particular, are gaining momentum due to their compatibility with modern fiber-optic systems. This integration not only supports telecom efficiency but also helps meet the rising data transmission needs of industries, research centers, and smart city projects, strengthening the market outlook.

- For instance, in 2023, BT’s infrastructure division, Openreach, added around 4 million premises to its full-fibre network, contributing to its long-term goal of 25 million by the end of 2026.

Expanding Industrial Laser Systems and OEM Applications

Industrial laser systems and OEM instrumentation are contributing significantly to market growth, as depolarizers ensure consistent beam quality and measurement accuracy. Manufacturers in the UK are increasingly adopting quartz Lyot depolarizers to meet the demand for automation, precision engineering, and laser-based material processing. OEMs integrate depolarizers into optical instruments for aerospace, defense, and industrial testing, fueling consistent market opportunities. With industries prioritizing enhanced optical performance in manufacturing and testing environments, bulk quartz depolarizers dominate due to their higher power handling capabilities. This rising industrial adoption reflects a strong market pull from sectors aiming to achieve higher efficiency, accuracy, and reliability in their processes.

Key Trends & Opportunities

Shift Toward Broadband and Achromatic Depolarizers

A major trend in the UK Quartz Lyot depolarizer market is the shift toward broadband and achromatic depolarizers, which provide flexibility across multiple wavelength ranges. These products are especially useful in multi-wavelength laser systems, advanced spectroscopy setups, and optical test equipment where high versatility is required. As industries move toward integrated optical platforms that span UV–visible, near-IR, and broadband sources, the demand for achromatic solutions is expected to grow. Companies developing compact and robust broadband depolarizers stand to capture new opportunities in academic research, imaging, and telecom testing, making this segment an important driver for innovation and differentiation.

- For instance, as a brand of MKS Instruments, Newport manufactures a range of optical components, including depolarizers, for various industrial and scientific applications.

Growing Applications in Life Sciences and Biophotonics

The growing importance of life sciences and biophotonics is creating new opportunities for quartz Lyot depolarizers in the UK. Biophotonics research relies on accurate optical measurements to study cells, tissues, and molecular structures. Depolarizers help minimize polarization distortions, improving imaging resolution and measurement reliability in fluorescence microscopy, endoscopy, and biomedical spectroscopy. With UK-based research centers and biotech firms increasing investments in advanced optical systems, demand is set to accelerate. This creates a strong growth pathway for manufacturers offering UV–visible depolarizers tailored for biophotonics, supporting the market’s expansion into healthcare-focused applications alongside traditional industrial and telecom domains.

Key Challenges

High Manufacturing Complexity and Cost

One of the key challenges facing the UK Quartz Lyot depolarizer market is the high cost and complexity of manufacturing. Producing bulk quartz depolarizers requires precision cutting, alignment, and polishing, which significantly raises production costs. Achromatic depolarizers add further complexity, as they demand advanced bonding techniques to handle broadband wavelength ranges. These costs often limit adoption among smaller research labs and budget-constrained institutions. Additionally, OEMs may opt for lower-cost alternatives when performance tolerances allow. Overcoming this challenge will require innovations in cost-efficient production processes and partnerships to streamline supply chains while maintaining high optical quality standards.

Competition from Alternative Depolarization Technologies

The market also faces competition from alternative depolarization technologies such as polymer-based depolarizers and liquid crystal solutions. These alternatives offer cost advantages and, in some cases, simpler integration into compact optical devices. For specific low-power or narrowband applications, they provide sufficient performance, reducing the reliance on quartz-based solutions. As optical device manufacturers explore alternatives to reduce costs, quartz Lyot depolarizers face challenges in maintaining their market share. The UK market’s sustained growth will depend on highlighting quartz’s superior durability, wavelength stability, and high-power handling, while differentiating from competing technologies through innovation and application-specific performance.

Regional Analysis

England

England dominates the UK quartz Lyot depolarizer market, with roughly 45% share in 2024. Major research institutes, photonics firms, and telecom nodes concentrate in Cambridge, Oxford, London, and the South East. These clusters drive demand in spectroscopy, imaging, and fiber-optic systems. Manufacturers often locate in or near these hubs to reduce logistics costs and tap into engineering talent. The density of universities and industrial optics users further reinforces England as the core region for sales, service, and innovation in depolarizer deployment.

Scotland & Northern England

Scotland and Northern England together hold around 20% share of the UK market. Aberdeen, Glasgow, Manchester, and Newcastle host research labs and laser companies serving energy, defense, and industrial markets. The presence of advanced materials research centers in Edinburgh and Glasgow boosts adoption for customized depolarizers. This region also sees spillover demand from England-based OEMs, benefiting local distributors and service clusters. Moderate infrastructure and academic strength support consistent growth in depolarizer usage.

Wales & West Midlands

Wales and the West Midlands contribute an estimated 15% share of the UK quartz Lyot depolarizer market. Key application sectors here include industrial laser systems, OEM instrumentation, and automotive testing laboratories. Birmingham, Cardiff, and surrounding towns host precision engineering and optics equipment firms. These firms often act as secondary buyers or integrators, purchasing depolarizers in bulk or via regional distributors. While not as concentrated as England, this region shows steady demand tied to industrial and manufacturing activity.

Northern Ireland, East Midlands & Other Regions

Northern Ireland, the East Midlands, and less dense regions combined account for about 20% share. Although demand is lower per capita, aerospace, defense contractors, and regional universities provide niche usage. Belfast, Derby, and Nottingham house optical labs and instrumentation firms. These areas often rely on national distributors or remote servicing of components. Growth in renewable energy, defense optics, and regional R&D funding may help expand depolarizer demand here in coming years.

Market Segmentations

By Product

- Bulk Quartz Lyot Depolarizers

- Achromatic / Optically Contacted Quartz Depolarizers

- All-fiber Lyot Depolarizers

By Application

- Scientific Research & Academic

- Spectroscopy & Imaging

- Telecom & Fiber-optic Systems

- Industrial Laser Systems & OEM Instrumentation

- Others

By Wavelength

- UV–Visible (200–1100 nm)

- Near-IR (1100–2600 nm)

- Broadband Sources

- Others

By Geography

- England (including Greater London & South East)

- Scotland & Northern England

- Wales & West Midlands

- Northern Ireland, East Midlands & Other Regions

Competitive Landscape

The UK Quartz Lyot depolarizer market is moderately concentrated, with global and niche players competing on precision, wavelength coverage, and delivery reliability. Thorlabs, Jenoptik, Edmund Optics, and Excelitas leverage broad catalogs, UK distribution, and custom engineering support. Leysop and Tower Optical compete through bespoke builds, tight tolerances, and fast prototype cycles for spectroscopy and imaging labs. Foctek Photonics, Hunan Dayoptics, OptoSigma, and Enlumen expand share via value pricing, OEM-focused batches, and ISO-certified quality controls. Achromatic and broadband solutions remain key differentiators, while all-fiber designs win telecom and fiber-optic testing accounts. Partnerships with UK universities and integrators strengthen application support and accelerate design-in decisions. Lead-time management, coating durability, and power-handling guarantees drive vendor selection criteria. Midsize OEMs favor suppliers offering documentation depth, metrology traceability, and consistent lot-to-lot performance. M&A activity and line extensions target gaps in UV–visible and near-IR ranges, reinforcing cross-sell potential across research, industrial laser systems, and instrumentation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leysop Ltd

- Thorlabs, Inc.

- Tower Optical Corporation

- Jenoptik AG

- Excelitas Technologies Corp.

- Foctek Photonics, Inc.

- Hunan Dayoptics, Inc.

- OptoSigma Corporation

- Edmund Optics India Private Limited

- Fujian Enlumen Tech Co., Ltd.

- Other Key Players

Recent Developments

- In 2023, Thorlabs launched a new generation of integrated depolarizers focused on improving efficiency and reducing device size.

- In 2023, OptoSigma released a smaller, more compact version of its popular depolarizer model.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Wavelength and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by rising adoption in spectroscopy and imaging applications.

- Demand for UV–visible wavelength depolarizers will remain strong in research and life sciences.

- All-fiber depolarizers will gain traction with the growth of telecom and fiber-optic networks.

- Achromatic and broadband solutions will see higher adoption due to multi-wavelength applications.

- Industrial laser systems will continue to integrate depolarizers for precision and quality assurance.

- OEM partnerships will strengthen as manufacturers seek customized and compact designs.

- Academic and scientific institutions will drive consistent demand for advanced optical components.

- Competition will intensify, with players focusing on wavelength range, power handling, and delivery speed.

- Regional demand in England will dominate, while Scotland and Northern Ireland will grow steadily.

- Innovation in low-cost manufacturing will be critical to overcome pricing and adoption barriers.