Market Overview

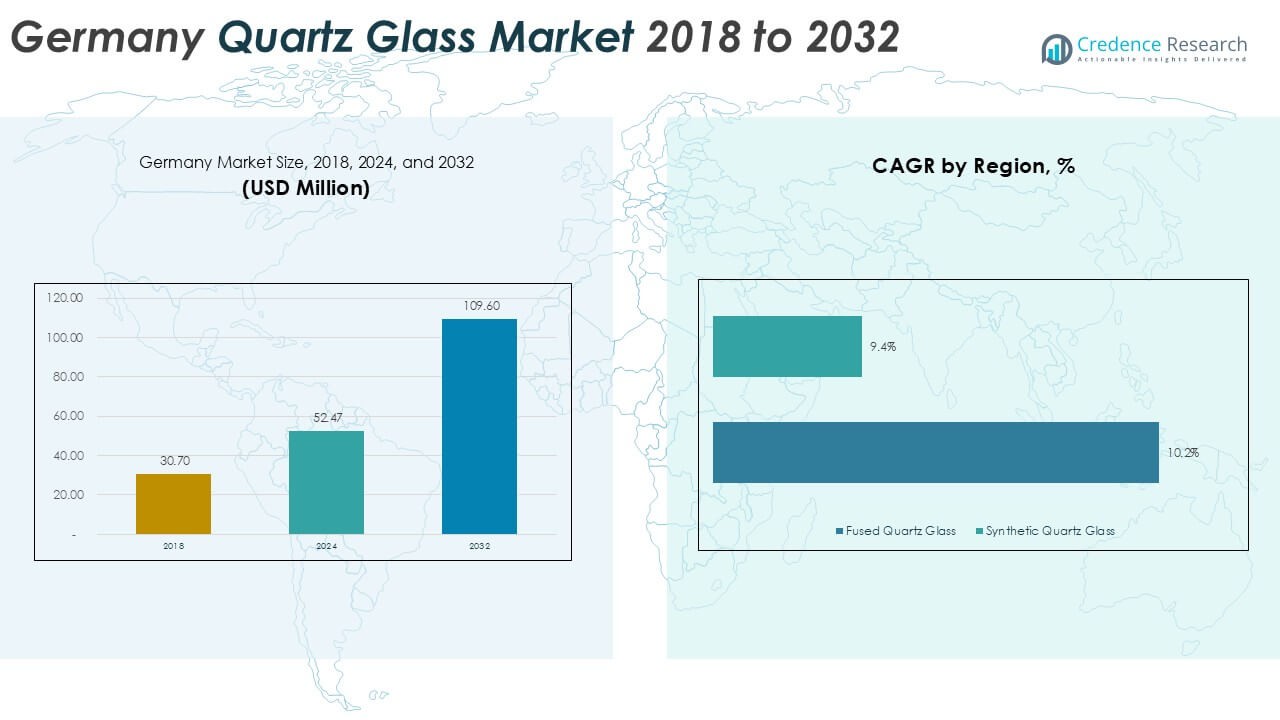

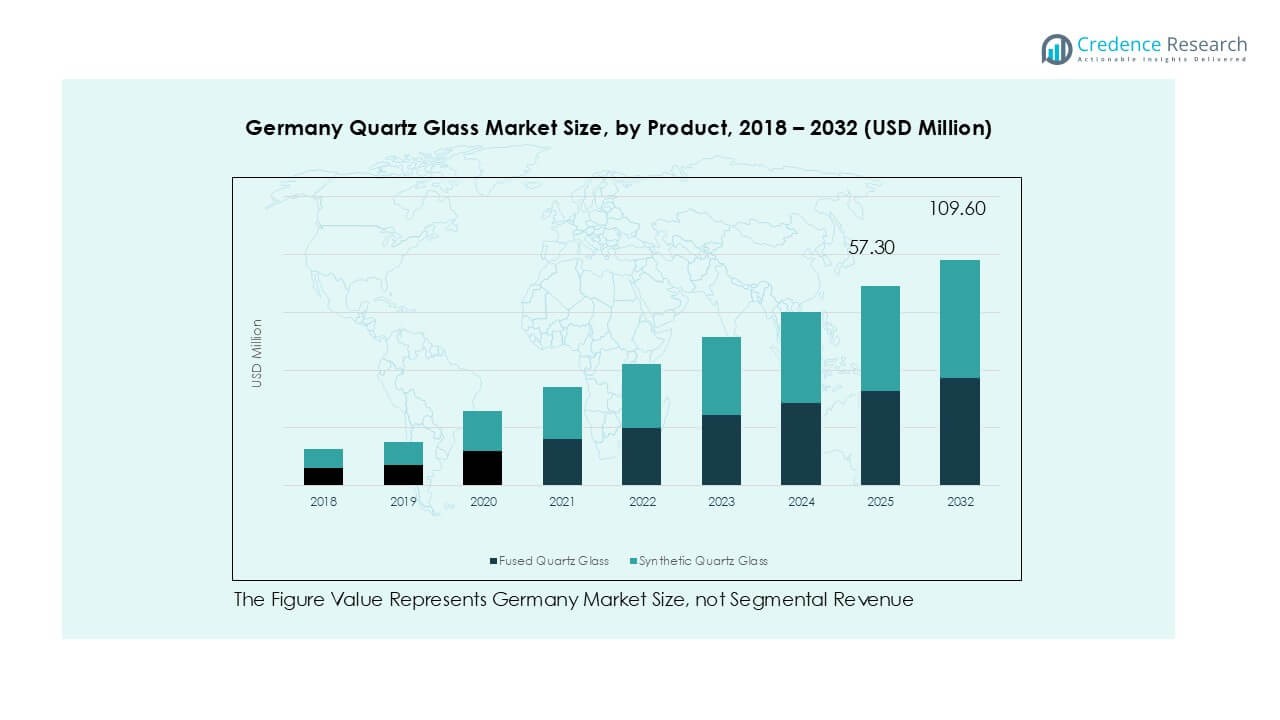

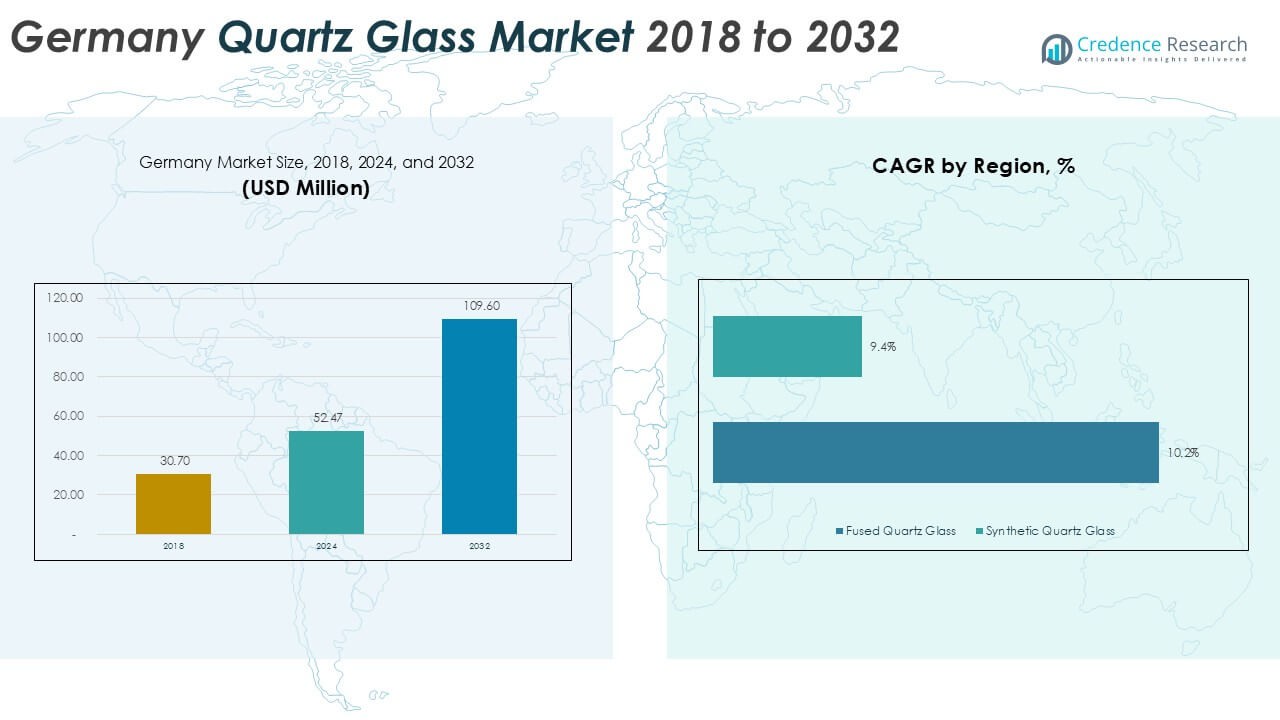

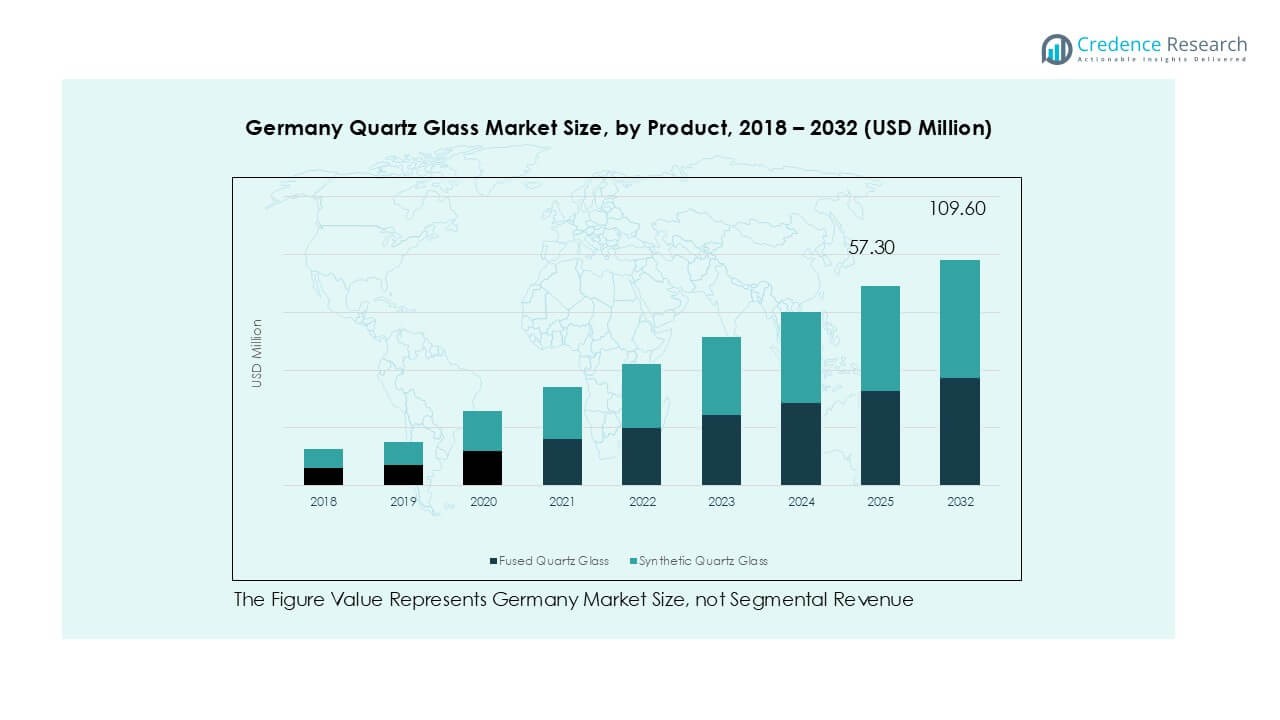

Germany Quartz Glass market size was valued at USD 30.70 million in 2018, expanded to USD 52.47 million in 2024, and is anticipated to reach USD 109.60 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Quartz Glass Market Size 2024 |

USD 52.47 Million |

| Germany Quartz Glass Market, CAGR |

9.5% |

| Germany Quartz Glass Market Size 2032 |

USD 109.60 Million |

The Germany quartz glass market is shaped by major players including Saint-Gobain S.A., Heraeus Holding, QSIL, proQuarz GmbH, and Raesch Quarz, alongside international participants such as WONIK Group, Swift Glass, and Sandfire Scientific. These companies compete through product innovation, high-purity offerings, and expansion into advanced applications like semiconductor lithography, solar wafer processing, and photonics. Regionally, Southern Germany led the market in 2024 with 34% share, supported by strong semiconductor and optics clusters, followed by Western Germany at 27% with its robust chemical and solar industries. Eastern Germany contributed 21% due to its photonics specialization, while Northern Germany accounted for 18%, driven by healthcare and laboratory demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany quartz glass market was valued at USD 52.47 million in 2024 and is projected to reach USD 109.60 million by 2032, expanding at a CAGR of 9.5% during the forecast period.

- Market growth is fueled by rising semiconductor demand, where fused quartz glass held over 62% share, supported by its critical role in wafer processing and photolithography applications.

- A key trend is the shift toward synthetic quartz glass for EUV lithography and advanced medical instruments, creating opportunities in high-purity and high-value segments.

- The competitive landscape is led by Saint-Gobain S.A., Heraeus Holding, QSIL, proQuarz GmbH, and Raesch Quarz, with strong R&D investments and focus on optics, solar energy, and electronics sectors.

- Regionally, Southern Germany led with 34% share, followed by Western Germany at 27%, Eastern Germany at 21%, and Northern Germany at 18%, each driven by distinct industrial clusters.

Market Segmentation Analysis:

By Product

Fused quartz glass dominated the Germany market in 2024, accounting for more than 62% share. Its leadership stems from high purity, thermal resistance, and optical transmission that make it vital in semiconductors and high-performance optics. Rising demand from electronics manufacturing and photolithography equipment has further supported its adoption. Synthetic quartz glass, while growing, is mainly used in specialized optics and high-end laboratory instruments. The continued expansion of the semiconductor sector in Germany underpins fused quartz glass as the leading product type.

- For instance, Heraeus, headquartered in Hanau, produces fused quartz tubes with dimensional tolerances of ±0.02 mm, widely supplied to semiconductor diffusion furnace manufacturers in Germany.

By Application

Semiconductors & electronics represented the largest application segment in 2024 with around 48% share. Germany’s strong base in chip manufacturing and advanced electronics drives this dominance, as quartz glass is essential for wafer processing, diffusion furnaces, and photomasks. Solar energy applications are expanding steadily, supported by government targets for renewable energy capacity. Optics & photonics also hold a notable share due to Germany’s leadership in laser technologies and precision optics. However, semiconductors remain the key driver, reinforced by rising investments in EU chip resilience programs.

- For instance, Infineon Technologies’ Dresden fab relies on fused quartz components in etching chambers and wafer carriers to support 300 mm production.

By Form

Quartz tubes accounted for the dominant form segment in 2024 with a share of 46%. Their widespread use in semiconductor fabrication, UV lamps, and laboratory heating systems supports strong adoption. Quartz rods and plates also contribute meaningfully, particularly in optical components and research applications. Growing demand for efficient UV disinfection systems has further reinforced the role of quartz tubes. Germany’s emphasis on advanced electronics and healthcare technology continues to position quartz tubes as the primary form in the quartz glass market.

Key Growth Drivers

Expansion of Semiconductor and Electronics Industry

Germany’s quartz glass market benefits strongly from the expanding semiconductor and electronics sector. Quartz glass is critical for wafer processing, diffusion furnaces, and photolithography systems due to its high thermal resistance and purity. Germany plays a central role in the European Union’s semiconductor strategy, supported by the European Chips Act, which is driving large-scale investments in chip production capacity. The need for high-purity fused quartz components in photomasks and etching equipment is growing in parallel with demand for advanced integrated circuits. With semiconductor companies setting up new fabs and research hubs, the requirement for quartz tubes, rods, and plates continues to rise. This direct linkage between quartz glass adoption and semiconductor capacity expansion secures a strong and long-term driver for market growth.

- For instance, Intel announced a €30 billion investment in its new Magdeburg fab, which will require high-purity fused quartz tubes and plates for 300 mm wafer diffusion and etching equipment.

Rising Solar Energy Deployment

The push toward renewable energy sources has created strong demand for quartz glass in solar energy applications. Quartz glass is extensively used in photovoltaic manufacturing for crucibles, tubes, and protective covers, which enable reliable and efficient solar cell production. Germany has one of the largest solar energy markets in Europe, with government targets aimed at scaling renewable energy capacity to meet climate neutrality by 2045. This commitment to green energy is accelerating solar panel installations and supporting domestic production of solar technologies. Quartz glass’s durability and resistance to extreme thermal conditions make it an indispensable material in solar wafer processing and module assembly. With solar capacity expansion continuing across both utility-scale projects and residential rooftops, the solar energy sector represents a consistent driver of quartz glass demand in Germany.

- For instance, Germany installed 14.6 GW of new solar capacity in 2023, requiring thousands of quartz crucibles for monocrystalline silicon ingot pulling.

Advancements in Optics and Photonics

Germany is a global leader in optics and photonics, creating a strong growth base for the quartz glass industry. Quartz glass is essential for producing lenses, prisms, windows, and laser components that require high transmission, chemical stability, and minimal thermal expansion. The country’s established photonics clusters, such as those in Jena and Berlin, focus on R&D in laser systems, precision instruments, and optical fibers. Increasing adoption of high-powered lasers for industrial cutting, medical diagnostics, and telecommunications is expanding quartz glass requirements. Furthermore, the demand for high-quality optical materials has grown with the rise of autonomous vehicles, AR/VR devices, and next-generation communication technologies. This technological leadership, coupled with continuous investment in photonics research, reinforces optics as a pivotal driver sustaining Germany’s quartz glass market growth.

Key Trends & Opportunities

Shift Toward Synthetic Quartz Glass for High-Tech Applications

While fused quartz glass dominates, synthetic quartz glass is gaining traction due to its superior transmission and minimal impurities. Its adoption is particularly increasing in high-end optics, semiconductor lithography, and advanced medical instruments. German research institutions and companies are focusing on producing ultra-pure synthetic quartz for EUV lithography, which is crucial for next-generation chips. This shift offers opportunities for manufacturers to expand into niche high-value markets, leveraging synthetic quartz to serve precision optics, aerospace sensors, and quantum technology applications.

- For instance, Heraeus in Hanau manufactures high-purity synthetic quartz glass, like its HSQ grades, which have very low OH content but typically no lower than 1 ppm, with some electrically fused products achieving less than 30 ppm. This material is not used for the final optics in EUV lithography, as EUV light at 13.5 nm is absorbed by all solids, including quartz glass.

Opportunities from Healthcare and Laboratory Expansion

Germany’s growing healthcare infrastructure and laboratory research sectors provide opportunities for quartz glass adoption. Medical devices, diagnostic tools, and laboratory instruments increasingly rely on quartz due to its biocompatibility, chemical resistance, and high transparency. Rising demand for quartz cuvettes, capillaries, and spectroscopic instruments has been driven by biotechnology research, pharmaceutical production, and clinical diagnostics. With healthcare digitization and increased R&D funding, manufacturers of quartz glass components can capitalize on supplying advanced instruments to laboratories and medical facilities.

Key Challenges

High Production Costs and Energy Intensity

Quartz glass manufacturing is capital and energy intensive, which creates a significant challenge for producers in Germany. The material requires extremely high melting temperatures and specialized processing, increasing operational costs. Additionally, energy price volatility in Europe, particularly after the regional energy crisis, has raised production expenses. These high costs limit competitiveness against suppliers in regions with lower energy prices. Manufacturers must invest in energy-efficient technologies and process optimization to maintain margins, but these improvements often require heavy capital expenditure.

Raw Material Supply Constraints

The availability of high-purity silica sand, the core raw material for quartz glass, poses another challenge for Germany’s market. Only a limited number of global suppliers provide the purity required for advanced semiconductor and optical applications. Dependence on imports exposes manufacturers to supply chain disruptions, pricing fluctuations, and geopolitical risks. Any shortage in raw material supply directly impacts quartz glass production and delays deliveries for critical end-use industries like semiconductors and solar energy. Ensuring raw material security and diversifying sourcing strategies remain pressing challenges for the industry.

Regional Analysis

Southern Germany

Southern Germany accounted for the largest share of the quartz glass market in 2024, representing 34% of total revenue. The dominance stems from the strong semiconductor and electronics clusters in Bavaria and Baden-Württemberg, where companies and research hubs drive demand for high-purity fused quartz. The region also benefits from significant investments in photonics and solar technologies, supported by industrial innovation policies. With Munich serving as a hub for microelectronics and precision optics, Southern Germany continues to lead market adoption. The strong presence of manufacturing facilities reinforces its role as the top contributor.

Western Germany

Western Germany held 27% of the market share in 2024, making it the second-largest region. This share is supported by the concentration of chemical industries, solar energy projects, and advanced laboratories across North Rhine-Westphalia and surrounding areas. The presence of large-scale research universities and technology clusters also boosts demand for quartz components in laboratory and photonics applications. The strong industrial base ensures consistent usage in both fused and synthetic quartz glass products. Western Germany’s position is further reinforced by its focus on renewable energy deployment, which directly drives quartz glass adoption in solar wafer processing.

Eastern Germany

Eastern Germany represented 21% of the market in 2024, driven primarily by its specialization in optics and photonics. The Jena region, known as a leading European photonics cluster, houses numerous companies producing high-precision optical instruments and lasers that rely heavily on quartz glass. The expansion of research in quantum optics and high-powered laser systems has further strengthened demand. Eastern Germany also benefits from renewable energy adoption, with solar energy research and projects contributing to quartz usage. Its long-standing history in precision optics ensures steady market presence, though it remains smaller compared to southern and western regions.

Northern Germany

Northern Germany accounted for the remaining 18% share of the quartz glass market in 2024. The region’s demand comes mainly from healthcare, laboratory equipment, and maritime industries requiring specialized quartz components. Hamburg and Bremen serve as key hubs for medical technology, while universities across Schleswig-Holstein contribute to laboratory research needs. While smaller in scale, Northern Germany shows steady growth, supported by increasing investments in healthcare infrastructure and advanced diagnostics. The presence of renewable energy initiatives, particularly offshore wind projects, indirectly supports quartz glass usage in related instrumentation, positioning the region as a steadily expanding market.

Market Segmentations:

By Product

- Fused Quartz Glass

- Synthetic Quartz Glass

By Application

- Semiconductors & Electronics

- Solar Energy

- Optics & Photonics

- Medical & Laboratory

- Others

By Form

- Quartz Tubes

- Quartz Rods

- Quartz Plates/Sheets

- Others

By Geography

- Southern Germany

- Western Germany

- Eastern Germany

- Northern Germany

Competitive Landscape

The competitive landscape of the Germany quartz glass market is marked by the presence of established global players and specialized domestic producers. Companies such as Saint-Gobain S.A., Heraeus Holding, and QSIL maintain strong positions through advanced product portfolios and wide application coverage in semiconductors, solar, and optics. Local firms like proQuarz GmbH and Raesch Quarz focus on high-purity fused quartz, catering to both industrial and laboratory requirements. International participants including WONIK Group, Swift Glass, and Sandfire Scientific strengthen market competition with imports and technology collaborations. The landscape is characterized by R&D investments, product differentiation, and strategic expansions into high-growth sectors such as semiconductor lithography and solar energy, ensuring steady rivalry and innovation-driven competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- proQuarz GmbH

- Saint-Gobain S.A.

- Heraeus Holding

- Quartz Solutions

- Precision Electronic Glass

- WONIK Group

- Raesch Quarz

- QSIL

- SUNG RIM Germany GmbH

- Swift Glass

- Sandfire Scientific

- Other Key Players

Recent Developments

- In July 2025, QSIL inaugurated (opened) an expansion building at its ceramics site in Auma-Weidatal for the metallization process. While this is not directly quartz glass, it is part of its high-performance materials / production footprint.

- In March 2025, Heraeus (Heraeus Covantics) launches a new quartz manufacturing plant in Shenyang, China.The facility cost is ~600 million yuan (≈ USD 83.6 million). It focuses on high-purity and ultra-high-purity synthetic quartz products.

- In January 2025, Heraeus Covantics is formed (reorganization). Heraeus combined its high-performance materials units, Heraeus Conamic and Heraeus Comvance, into a new operating company under the name.

- In December 2024 / January 2025, QSIL GmbH Quarzschmelze Ilmenau is acquired by SCHOTT AG. Effective early 2025, SCHOTT acquired the quartz glass production facility in Ilmenau, Germany, including about 275 employees. The acquisition is seen as strategic for SCHOTT to bolster its semiconductor materials portfolio and ensure supply chain resilience.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Germany quartz glass market will expand steadily with rising semiconductor fabrication demand.

- Fused quartz glass will remain the dominant product due to high purity and thermal resistance.

- Synthetic quartz glass will gain traction in advanced optics and EUV lithography applications.

- Growth in solar energy deployment will drive demand for quartz crucibles and tubes.

- Optics and photonics research hubs in Jena and Berlin will strengthen market adoption.

- Healthcare and laboratory expansion will create new opportunities for quartz-based instruments.

- Companies will increase R&D spending to develop ultra-pure and high-performance quartz products.

- High production costs and energy dependence will push innovation in efficiency and recycling.

- Regional dominance will continue from Southern Germany, supported by semiconductor and electronics clusters.

- International collaborations and supply chain diversification will play a key role in long-term growth.