Market Overview

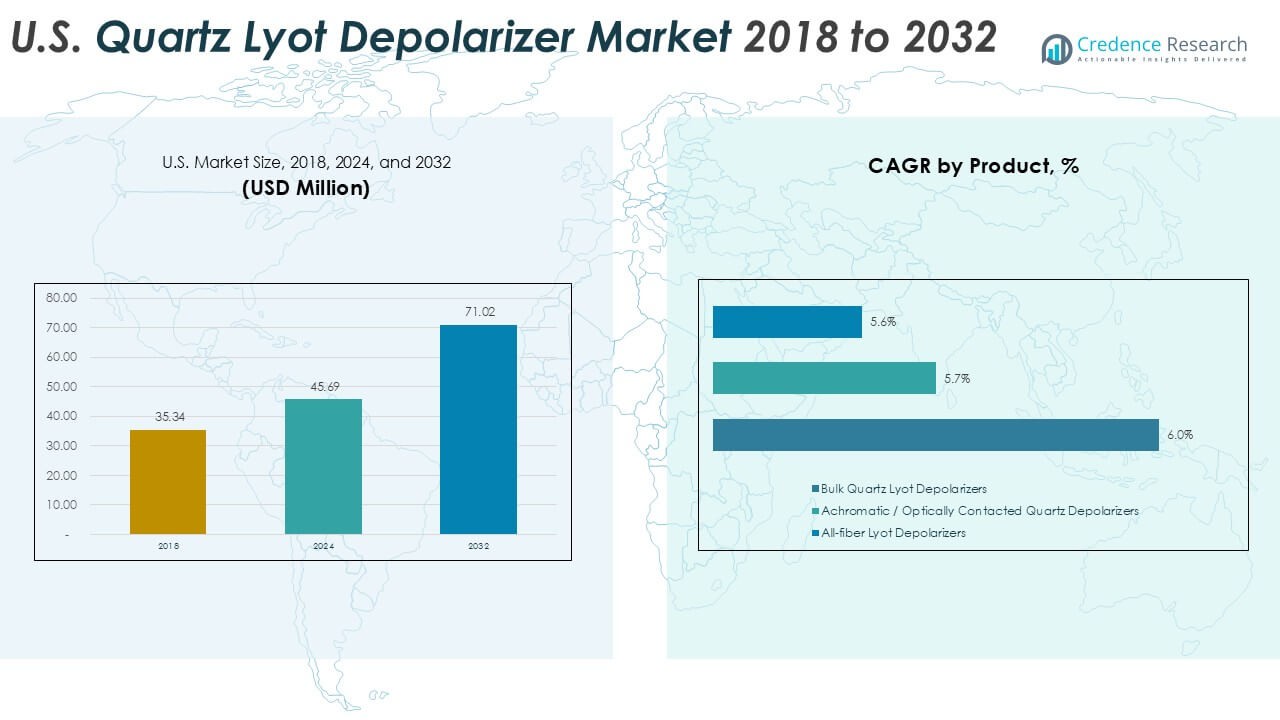

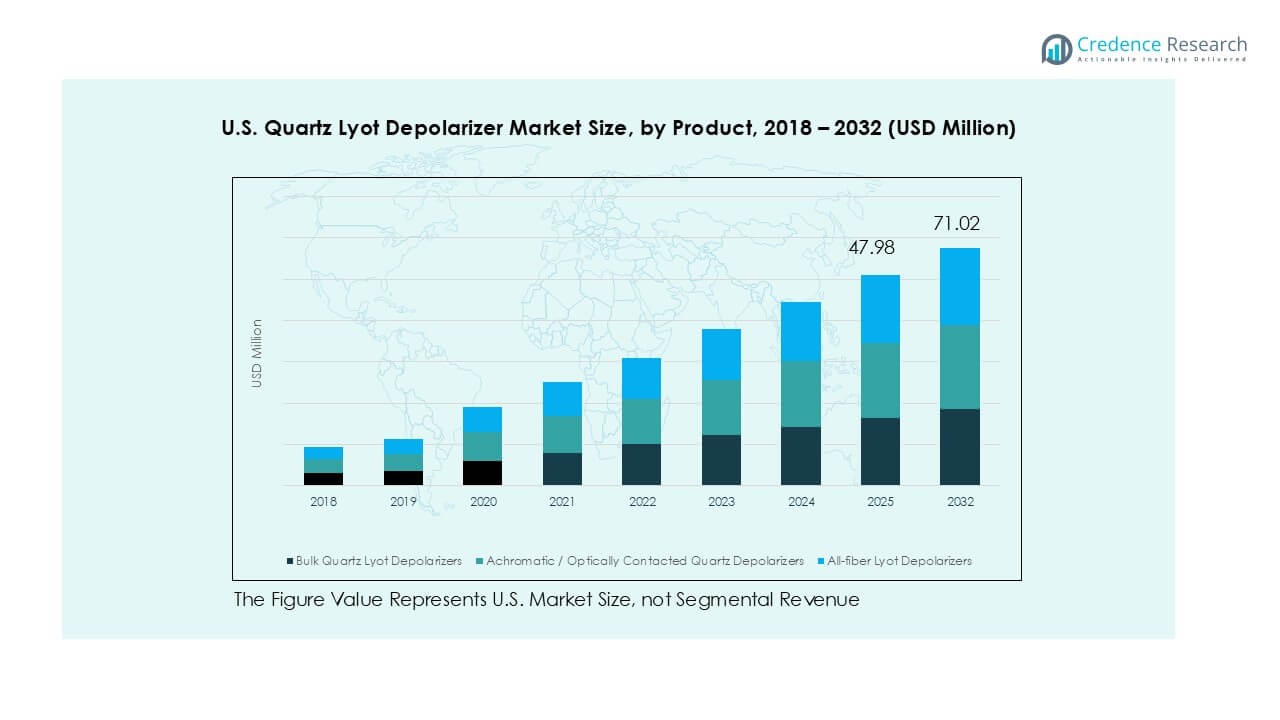

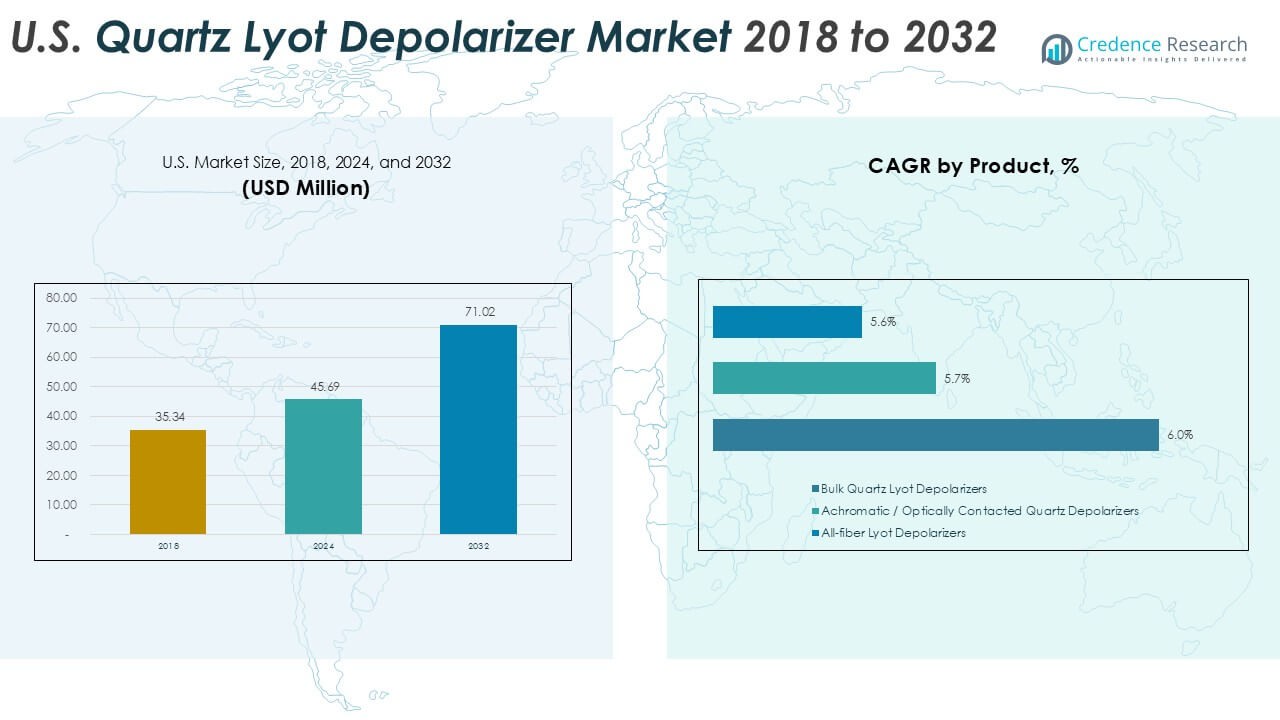

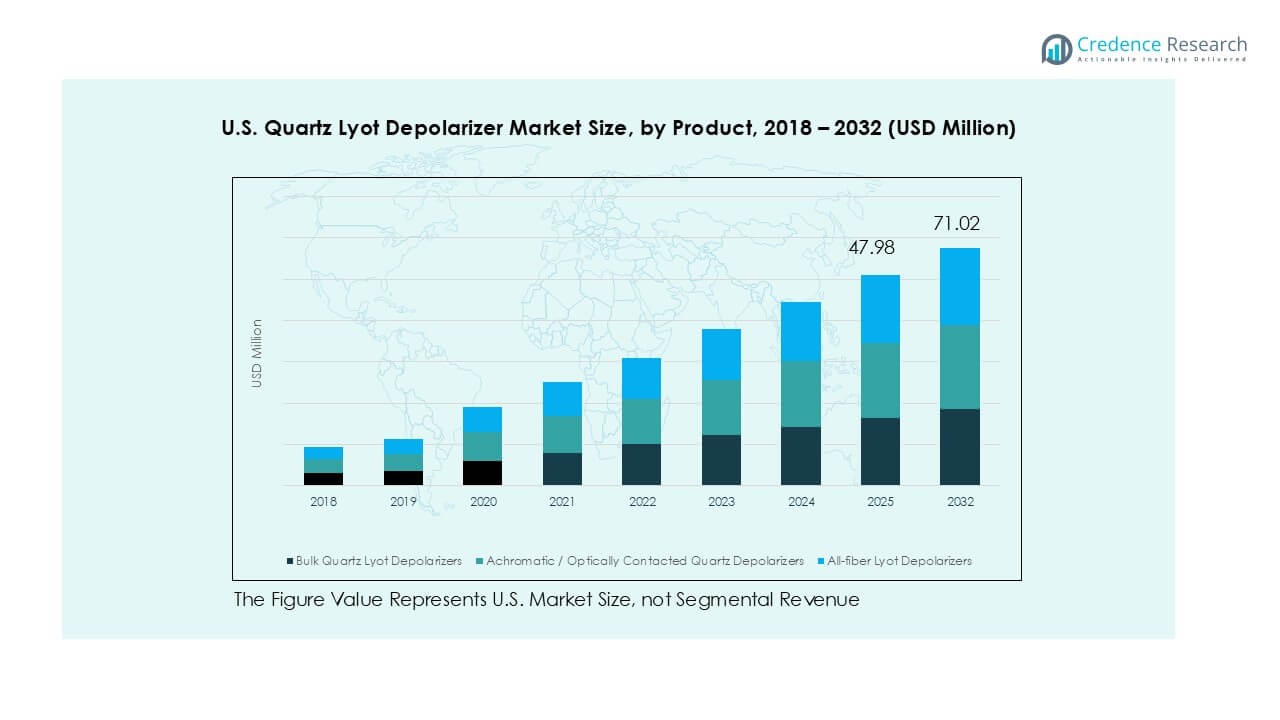

The U.S. Quartz Lyot Depolarizer Market size was valued at USD 35.34 million in 2018 and reached USD 45.69 million in 2024. It is anticipated to reach USD 71.02 million by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Lyot Depolarizer Market Size 2024 |

USD 45.69 Million |

| U.S. Quartz Lyot Depolarizer Market, CAGR |

5.6% |

| U.S. Quartz Lyot Depolarizer Market Size 2032 |

USD 71.02 Million |

The U.S. Quartz Lyot depolarizer market is led by prominent players including Newport Corporation, Thorlabs, Jenoptik AG, Edmund Optics, and Excelitas Technologies Corp., alongside specialized manufacturers such as Tower Optical Corporation, Foctek Photonics, and Hunan Dayoptics. These companies strengthen their positions through advanced depolarizer portfolios, OEM partnerships, and strong supply networks supporting telecom, spectroscopy, and industrial laser applications. Regionally, the Northeast dominated with 34% market share in 2024, driven by research institutions and biotech hubs, while the West followed with 25%, supported by California’s telecom and photonics ecosystem. The Midwest accounted for 22% on the back of industrial laser adoption, and the South held 19%, supported by defense and aerospace demand. Together, these competitive players and region-specific strengths underscore the dynamic growth and innovation shaping the U.S. Quartz Lyot depolarizer market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Quartz Lyot depolarizer market was valued at USD 45.69 million in 2024 and is projected to reach USD 71.02 million by 2032, expanding at a CAGR of 5.6%.

- Growth is fueled by rising adoption in telecom and fiber-optic systems, where demand for reliable polarization control in high-speed networks drives large-scale deployment.

- A key trend is the shift toward all-fiber depolarizers, aligning with the miniaturization of optical systems and increased use in photonic integrated circuits and broadband testing.

- The competitive landscape is led by Newport Corporation, Thorlabs, Jenoptik AG, Edmund Optics, and Excelitas Technologies Corp., with niche contributions from Tower Optical and Foctek Photonics offering customized solutions.

- Northeast led with 34% share in 2024, followed by the West with 25%, Midwest with 22%, and South with 19%. By product, bulk quartz depolarizers dominated, while telecom and fiber-optic systems led by application.

Market Segmentation Analysis:

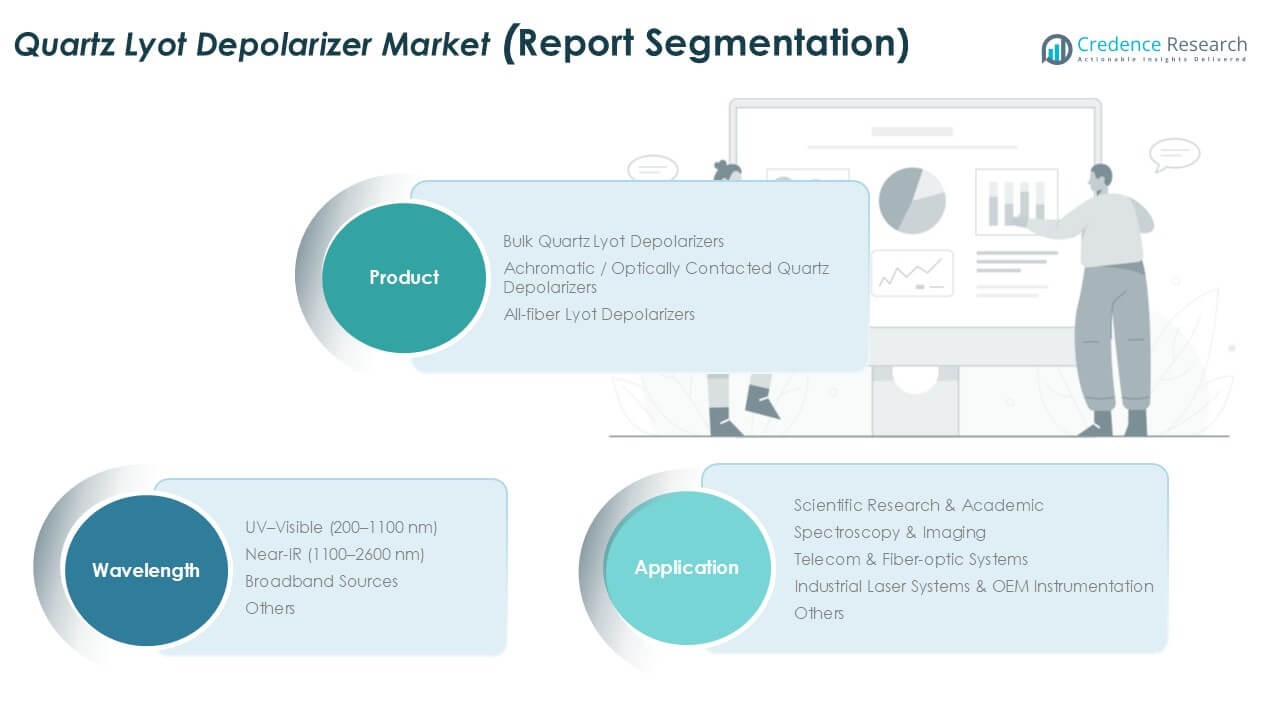

By Product

Bulk Quartz Lyot Depolarizers accounted for the largest share of the U.S. market in 2024, driven by their high reliability and widespread use in precision optical systems. Their robustness and cost-effectiveness make them the preferred choice for research and industrial applications requiring consistent polarization control. Achromatic or optically contacted quartz depolarizers are gaining demand in advanced instrumentation due to their superior wavelength stability. Meanwhile, all-fiber Lyot depolarizers are expanding steadily, supported by increasing deployment in fiber-optic communication systems that require compact and integration-friendly solutions.

- For instance, Thorlabs is a respected manufacturer of precision polarization solutions, including various depolarizers such as bulk quartz-wedge and advanced liquid crystal polymer (LCP) models, which it supplies to research labs and industrial OEMs.

By Application

Telecom and fiber-optic systems represented the leading application segment, holding the dominant market share in 2024. Growth is supported by rising investments in high-speed networks and demand for low-loss optical components. Scientific research and academic applications also contribute significantly, driven by university laboratories and R&D institutions adopting Lyot depolarizers for optical experiments. Spectroscopy and imaging use is expanding with increased adoption in biomedical and analytical instruments. Industrial laser systems and OEM instrumentation are steadily growing, as manufacturers integrate depolarizers to enhance beam quality and performance in advanced optical devices.

- For instance, Corning delivered more than 130 million kilometers of optical fiber in 2023, with U.S. telecom operators leveraging advanced optical network components to minimize polarization issues and ensure stable signal transmission for 5G and data center networks.

By Wavelength

The UV–Visible (200–1100 nm) wavelength range dominated the market in 2024, supported by strong adoption in spectroscopy, microscopy, and optical imaging applications. These depolarizers are favored for their precision performance in life sciences and research. The Near-IR (1100–2600 nm) segment is growing due to rising usage in telecom and fiber-optic systems, where infrared light transmission is critical. Broadband sources are increasingly applied in optical testing and calibration, enabling wide operational versatility. Other wavelength categories maintain niche demand, primarily in specialized optical experiments and industrial instrumentation that require tailored polarization solutions.

Key Growth Drivers

Rising Demand from Telecom and Fiber-Optic Systems

The rapid expansion of fiber-optic networks across the U.S. is driving the adoption of Quartz Lyot depolarizers, particularly in high-capacity telecom infrastructure. These depolarizers play a critical role in reducing polarization-related signal distortion, thereby ensuring faster and more reliable data transmission. With increasing investment in 5G networks and data centers, telecom operators are adopting advanced depolarization solutions to enhance bandwidth efficiency. Fiber-to-the-home (FTTH) deployments and upgrades in metro and long-haul networks are further fueling demand. As operators prioritize low-loss, high-stability optical components, Quartz Lyot depolarizers are becoming essential in ensuring performance standards. This makes the telecom segment one of the strongest contributors to overall market growth.

- For instance, in 2025, the company deployed over 2.2 million new intercity fiber miles and is on track to reach a total of 16.6 million intercity fiber miles by the end of the year. Lumen also expanded its 400G backbone to cover more than 100,000 route miles and has not officially announced the use of specific components such as Lyot depolarizers.

Expanding Applications in Spectroscopy and Imaging

Quartz Lyot depolarizers are witnessing rising adoption in spectroscopy and imaging applications used across healthcare, life sciences, and material analysis. These instruments require stable polarization control to deliver accurate imaging and spectral data, particularly in high-precision research. In medical diagnostics and pharmaceutical research, depolarizers are integrated into advanced spectroscopic tools for disease detection, drug development, and biomolecular imaging. Academic and research institutions across the U.S. are also fueling demand, with federal funding supporting next-generation optical instrumentation. Additionally, industrial laboratories are incorporating depolarizers into advanced imaging systems for materials testing and quality assurance. This growing focus on precision and reproducibility across applications reinforces the need for reliable Quartz Lyot depolarizers, strengthening the market outlook in high-value research-driven sectors.

- For instance, Horiba Scientific supplies spectroscopic systems to U.S. universities and pharmaceutical companies for research in biomedical imaging and material science.

Industrial Laser Systems and OEM Instrumentation Growth

The integration of Quartz Lyot depolarizers into industrial laser systems and OEM instrumentation is becoming a major growth driver. Industries such as aerospace, defense, semiconductor manufacturing, and precision engineering rely on advanced laser systems for cutting, welding, and microfabrication. In these high-performance applications, polarization stability directly impacts output quality and efficiency. Depolarizers help achieve uniform beam profiles and stable laser performance, meeting the demand for precision. OEMs are increasingly embedding depolarizers in optical instruments, boosting long-term market opportunities. The U.S. industrial landscape’s push toward automation, high-precision manufacturing, and advanced material processing further increases the role of depolarizers. As industries scale adoption of photonics-based processes, Quartz Lyot depolarizers will remain central to ensuring system reliability and operational excellence.

Key Trends & Opportunities

Shift Toward All-Fiber Depolarizers

A key trend shaping the U.S. market is the growing preference for all-fiber Lyot depolarizers. These compact, integration-friendly devices align with the miniaturization of optical systems and the ongoing shift toward fiber-based architectures in telecom and research applications. Their ability to integrate seamlessly into fiber-optic circuits reduces system complexity while maintaining efficiency. This trend is also fueled by rising interest in photonic integrated circuits (PICs), which demand compact polarization management solutions. As telecom, spectroscopy, and sensing industries push toward more scalable and portable optical platforms, all-fiber depolarizers present significant growth opportunities.

- For instance, in 2023, the U.S. telecom and photonics sectors saw high demand for such components, supported by the expansion of advanced fiber networks.

Opportunities in Broadband Optical Sources

The growing use of broadband optical sources across telecom testing, medical imaging, and industrial instrumentation creates opportunities for Quartz Lyot depolarizers. These devices ensure uniform depolarization over wide wavelength ranges, making them ideal for testing and calibration environments. In biomedical optics, broadband depolarizers support advanced imaging techniques such as optical coherence tomography (OCT). Similarly, industrial testing labs increasingly integrate broadband depolarizers into precision measurement systems. The trend toward multifunctional optical sources across multiple industries highlights a strong opportunity for depolarizer manufacturers to provide tailored, high-performance solutions.

Key Challenges

High Manufacturing Complexity and Costs

One of the main challenges in the U.S. Quartz Lyot depolarizer market is the complexity of precision quartz fabrication. These devices require exact crystal orientation and optical finishing, which adds to production time and cost. The dependence on specialized materials and manufacturing expertise limits scalability and creates higher price points compared to alternative polarization control devices. Smaller OEMs and cost-sensitive users may hesitate to adopt quartz-based solutions, slowing market penetration. Addressing this challenge requires advances in cost-efficient production methods and improved material sourcing strategies.

Competition from Alternative Polarization Technologies

The availability of alternative polarization control technologies poses another challenge for Quartz Lyot depolarizer adoption. Devices such as waveplates, polarization scramblers, and liquid crystal-based depolarizers are gaining ground due to lower costs and ease of integration. For telecom and laser applications, these alternatives sometimes provide sufficient performance at reduced expense. This competitive pressure forces quartz depolarizer manufacturers to focus on performance differentiation and advanced product design. Unless suppliers highlight unique advantages such as broadband coverage, long-term stability, and precision performance, quartz depolarizers risk losing market share to emerging polarization solutions.

Regional Analysis

Northeast

The Northeast held the largest share of the U.S. Quartz Lyot depolarizer market in 2024, accounting for 34%. Strong demand stems from leading research universities, national laboratories, and biotech companies concentrated in states such as Massachusetts and New York. These institutions drive adoption for spectroscopy, imaging, and scientific research applications requiring high-precision polarization control. Federal funding for R&D and advanced photonics initiatives in the Boston–Cambridge and New York hubs further supports growth. In addition, growing investments in telecom infrastructure and data centers in the region add momentum to quartz depolarizer deployment, reinforcing its leadership position.

Midwest

The Midwest captured 22% of the market share in 2024, supported by its strong industrial and manufacturing base. States such as Illinois, Michigan, and Ohio are key contributors, with demand largely driven by integration into industrial laser systems and OEM instrumentation. The presence of automotive and precision engineering industries accelerates adoption of depolarizers for material processing and advanced manufacturing. University research programs in optics and photonics also sustain steady growth in academic applications. As industrial automation expands across the region, the Midwest is expected to remain a strong adopter of quartz depolarizers, with increasing opportunities in industrial laser integration.

South

The South accounted for 19% of the U.S. Quartz Lyot depolarizer market in 2024, driven by telecom infrastructure expansion and defense-related applications. States such as Texas, Virginia, and Florida host major fiber-optic networks, aerospace contractors, and defense research facilities, all of which integrate quartz depolarizers into advanced optical systems. The presence of NASA facilities and military research labs further boosts adoption for high-precision instrumentation. Additionally, growing medical research hubs in Texas are driving use in spectroscopy and biomedical imaging. With increasing investments in defense modernization and healthcare R&D, the South remains a steadily expanding regional market.

West

The West region represented 25% of the market share in 2024, supported by California’s dominance in technology, telecom, and photonics research. Silicon Valley and surrounding innovation clusters lead adoption in fiber-optic systems, broadband testing, and integrated photonic circuits. Strong research institutions such as Stanford and Caltech contribute to demand in spectroscopy, imaging, and academic programs. Industrial laser use in semiconductor manufacturing and aerospace applications in California and Washington also fuels adoption. With ongoing growth in broadband networks and photonic startups, the West continues to strengthen its position as a critical growth hub for Quartz Lyot depolarizers.

Market Segmentations:

By Product

- Bulk Quartz Lyot Depolarizers

- Achromatic / Optically Contacted Quartz Depolarizers

- All-fiber Lyot Depolarizers

By Application

- Scientific Research & Academic

- Spectroscopy & Imaging

- Telecom & Fiber-optic Systems

- Industrial Laser Systems & OEM Instrumentation

- Others

By Wavelength

- UV–Visible (200–1100 nm)

- Near-IR (1100–2600 nm)

- Broadband Sources

- Others

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Quartz Lyot depolarizer market is highly competitive, with a mix of global optics manufacturers and specialized regional suppliers shaping the landscape. Leading companies such as Newport Corporation, Thorlabs, Jenoptik AG, and Edmund Optics maintain strong market positions through wide product portfolios and established distribution networks. Their focus on innovation in broadband and fiber-based depolarizers has strengthened customer adoption in telecom, spectroscopy, and industrial applications. Smaller firms like Tower Optical Corporation and Foctek Photonics compete by offering niche, customized depolarizer solutions that address specific research and industrial needs. Partnerships with OEMs and research institutions remain a key growth strategy, as suppliers seek to integrate depolarizers into advanced optical systems. Price competitiveness, high product reliability, and precision engineering continue to define market positioning. The competitive environment is further characterized by ongoing product development, mergers, and regional expansions, as companies aim to capture a larger share of the fast-evolving U.S. photonics market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Newport Corporation

- Thorlabs, Inc.

- Tower Optical Corporation

- Jenoptik AG

- Excelitas Technologies Corp.

- Foctek Photonics, Inc.

- Hunan Dayoptics, Inc.

- OptoSigma Corporation

- Edmund Optics India Private Limited

- Fujian Enlumen Tech Co., Ltd.

- Other Key Players

Recent Developments

- In 2023, Thorlabs launched a new generation of integrated depolarizers focused on improving efficiency and reducing device size.

- In 2023, OptoSigma released a smaller, more compact version of its popular depolarizer model.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Wavelength and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing adoption in telecom and fiber-optic systems.

- Demand from spectroscopy and imaging applications will continue to strengthen in research and healthcare.

- Industrial laser systems will drive consistent usage in precision engineering and manufacturing sectors.

- All-fiber depolarizers will gain momentum as integration-friendly solutions for advanced optical networks.

- Broadband depolarizers will see rising demand in testing, calibration, and biomedical imaging.

- Regional growth will remain strong in the Northeast and West due to innovation hubs.

- OEM partnerships will increase as manufacturers embed depolarizers in advanced instruments.

- Competition will intensify with more players offering customized and broadband solutions.

- High-precision research funding will sustain adoption across universities and national labs.

- Long-term opportunities will emerge from photonics integration in defense, aerospace, and semiconductor industries.