Market overview

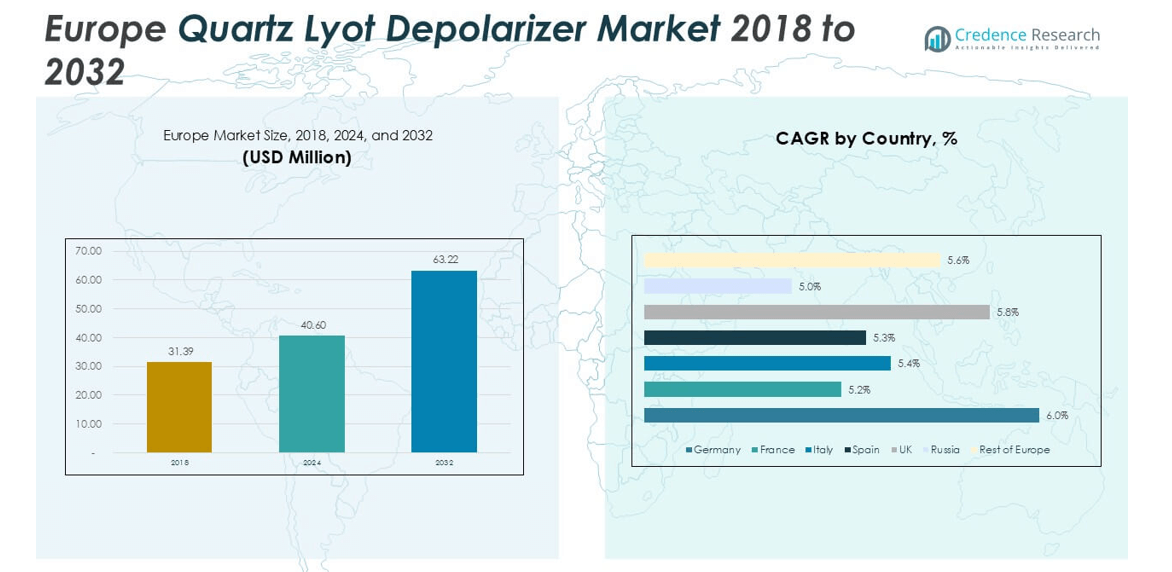

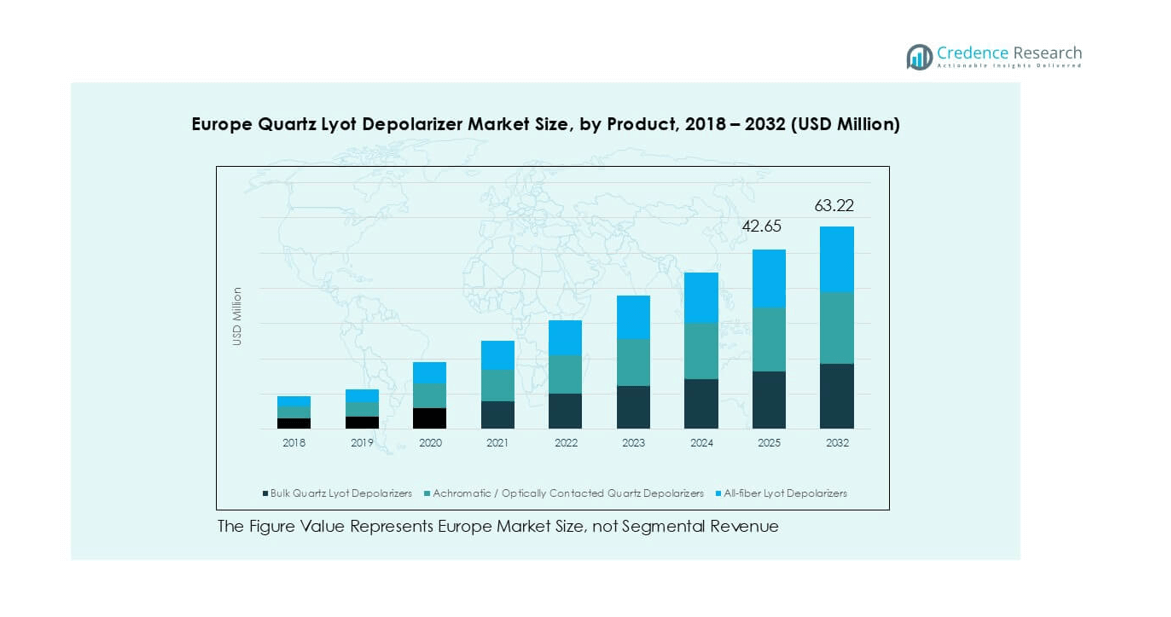

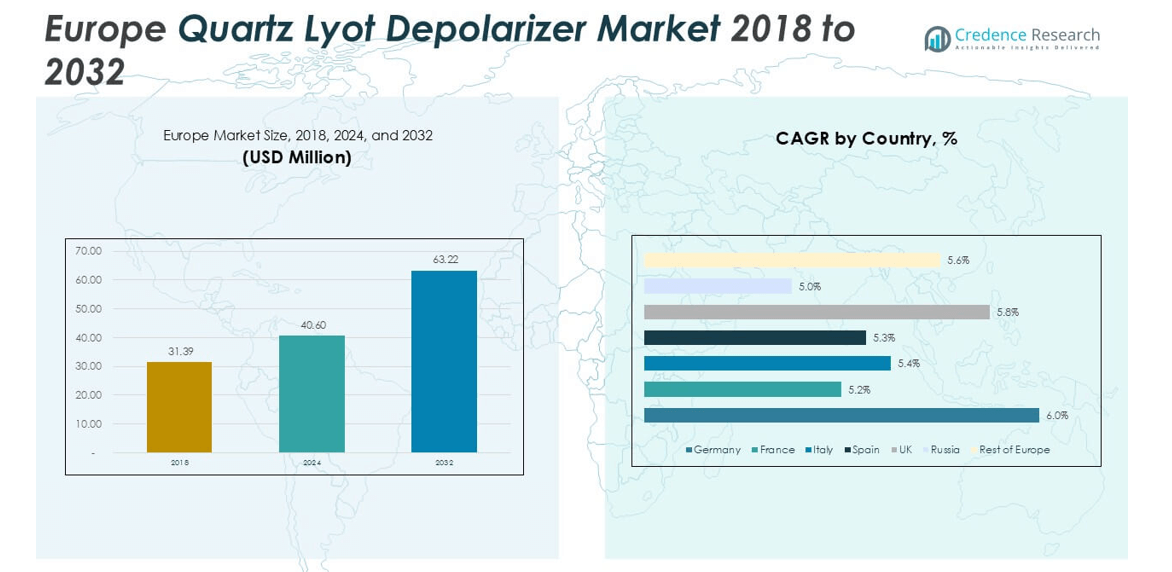

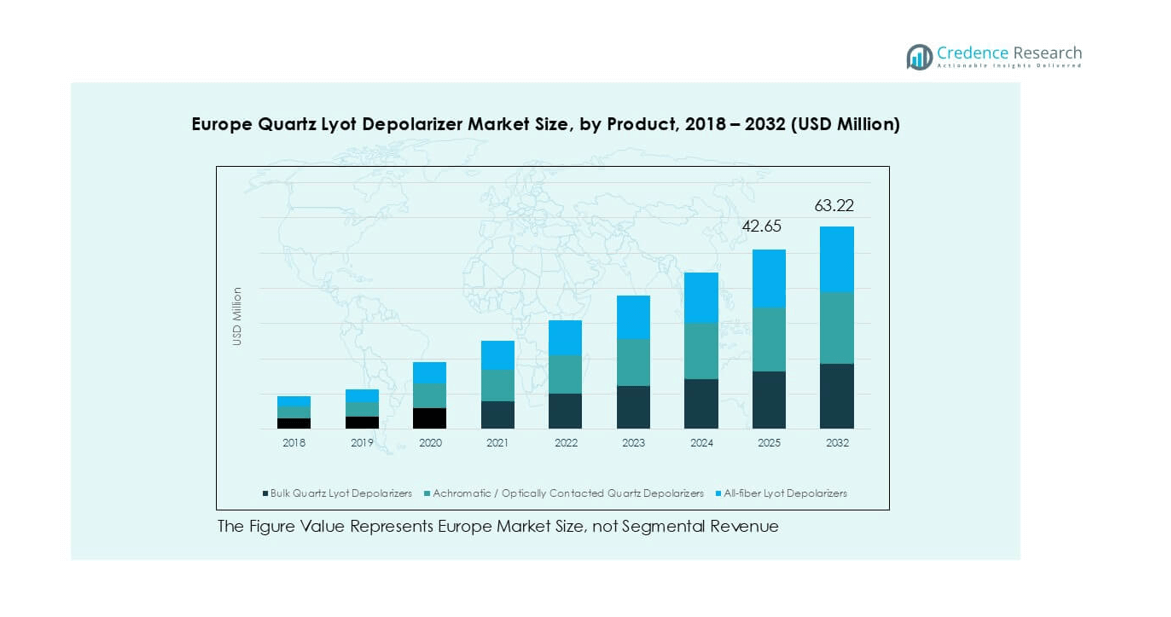

Europe Quartz Lyot Depolarizer market size was valued at USD 31.39 million in 2018, reaching USD 40.60 million in 2024, and is anticipated to reach USD 63.22 million by 2032, at a CAGR of 5.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Lyot Depolarizer Market Size 2024 |

USD 40.60 million |

| Europe Quartz Lyot Depolarizer Market, CAGR |

5.69% |

| Europe Quartz Lyot Depolarizer Market Size 2032 |

USD 63.22 million |

The Europe Quartz Lyot Depolarizer market is led by established players including B. Halle, Thorlabs, Jenoptik AG, Tower Optical Corporation, and Excelitas Technologies Corp., supported by regional suppliers such as Edmund Optics India Private Limited, Foctek Photonics, and OptoSigma Corporation. These companies compete on advanced product portfolios, covering bulk, achromatic, and all-fiber depolarizers for telecom, spectroscopy, and industrial laser applications. Geographically, Germany accounted for the largest share at 28% in 2024, driven by strong adoption in industrial laser systems and academic research. The United Kingdom followed with 19%, supported by optical research centers and telecom modernization, while France contributed 16%, with growing demand in spectroscopy and biomedical imaging. This concentration of market activity in Western Europe underscores the region’s leadership in advanced optics and industrial applications.

Market Insights

- The Europe Quartz Lyot Depolarizer market was valued at USD 40.60 million in 2024 and is projected to reach USD 63.22 million by 2032, registering a CAGR of 5.69% during the forecast period.

- Growth is driven by expanding fiber-optic communication networks, where polarization control is essential for maintaining signal stability in high-capacity systems. Strong demand also comes from spectroscopy and imaging in academic and research institutions.

- A notable trend is the rising adoption of broadband and achromatic depolarizers, particularly in precision spectroscopy, biomedical imaging, and advanced laser applications. This shift reflects Europe’s focus on innovation in optical technologies.

- The market is moderately consolidated with leading players such as B. Halle, Thorlabs, Jenoptik AG, and Tower Optical Corporation. Competition is shaped by wavelength coverage, customization, and cost-effective solutions for both research and industrial users.

- Regionally, Germany led with 28% share in 2024, followed by the UK at 19% and France at 16%. Bulk Quartz Lyot depolarizers remained the dominant product segment with over 45% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Bulk Quartz Lyot Depolarizers held the dominant share in 2024, accounting for over 45% of the Europe market. Their leadership stems from broad adoption in research laboratories and fiber-optic systems, where they ensure cost-effective polarization management with stable performance. Achromatic or optically contacted depolarizers are gaining traction for precision applications in spectroscopy and imaging, while all-fiber Lyot depolarizers are expanding due to telecom and fiber-optic network upgrades. The rise in industrial use cases and strong demand from OEM instrumentation manufacturers further drives bulk depolarizer adoption across Europe.

- For instance, Depolarizers are used to scramble the polarization of light and are commonly deployed in optical systems to reduce polarization-dependent loss (PDL), making their use in telecom and imaging systems a standard application. G&H also specifically mentions producing components for the telecom and imaging sectors.

By Application

Telecom and fiber-optic systems represented the leading application segment in 2024, holding nearly 40% share of the regional market. High reliance on polarization control for signal integrity in dense optical networks drives this dominance. Scientific research and academic institutions remain strong users, particularly for laser optics experiments, while spectroscopy and imaging applications expand due to increased adoption in medical and material analysis. Industrial laser systems and OEM instrumentation also show steady growth, supported by manufacturing automation and precision testing across European industries.

- For instance, Thorlabs offers various depolarization solutions, including off-the-shelf and custom components, that are used in applications like dense wavelength division multiplexing (DWDM) systems.

By Wavelength

The UV–Visible (200–1100 nm) segment accounted for the largest market share in 2024, representing over 50% of demand in Europe. These depolarizers are widely applied in spectroscopy, biomedical imaging, and material sciences, where accuracy in short-wavelength measurements is essential. Near-IR (1100–2600 nm) follows closely, driven by applications in fiber-optic systems and telecom networks, while broadband sources are increasingly used in industrial laser instrumentation. Rising deployment of UV–Visible depolarizers in research universities and advanced imaging centers strengthens the segment’s dominance across the regional market.

Key Growth Drivers

Rising Demand in Fiber-Optic Communication Systems

The growing expansion of fiber-optic communication networks across Europe is a major driver for the Quartz Lyot depolarizer market. Telecom operators are increasingly upgrading to high-capacity optical systems where polarization control is essential to minimize signal distortion. The rollout of 5G and next-generation broadband infrastructure has accelerated the use of depolarizers in maintaining stable optical transmission, particularly for dense wavelength division multiplexing (DWDM) systems. Countries like Germany, France, and the UK are investing heavily in telecom infrastructure modernization, further increasing demand. Bulk Quartz Lyot depolarizers dominate this segment due to their stability and cost efficiency, while all-fiber depolarizers are gaining traction in compact systems. As Europe transitions toward high-speed digital connectivity, the need for reliable polarization management continues to reinforce market growth, making fiber-optic adoption one of the most influential drivers.

- For instance, German fiber expansion projects, Nokia has provided advanced networking equipment to telecommunications companies like Deutsche Glasfaser and Deutsche Telekom. This includes modern DWDM systems that are capable of exceeding 400 Gbps per channel and incorporate standard components for polarization management.

Increasing Use in Spectroscopy and Imaging Applications

Spectroscopy and imaging applications form another strong growth driver, fueled by demand from research institutions, universities, and industrial laboratories in Europe. Quartz Lyot depolarizers are widely applied in UV–Visible and near-infrared spectroscopy, where accurate polarization control improves measurement reliability and imaging quality. They are extensively used in biomedical research, material characterization, and environmental analysis across Europe’s advanced academic and scientific hubs. Healthcare research facilities, especially in France and Switzerland, rely on these depolarizers for molecular imaging and diagnostics, while Germany and the UK see strong adoption in industrial material analysis. The rise of precision imaging in pharmaceuticals and biotechnology also contributes to increased market demand. With European governments continuing to fund R&D in advanced optics and spectroscopy, this application area provides steady market expansion, particularly for achromatic and broadband depolarizers designed for high-accuracy measurements.

- For instance, Horiba Scientific supplies a wide range of advanced spectroscopic systems, including spectrofluorometers like the Fluorolog-QM, that can cover a broad spectral range (e.g., 180 nm to 5,500 nm) and be configured with accessories like polarizers.

Adoption in Industrial Laser Systems and OEM Instrumentation

The integration of Quartz Lyot depolarizers in industrial laser systems and OEM instrumentation is a significant growth driver. Europe’s manufacturing and automotive industries increasingly rely on laser-based technologies for cutting, welding, and material processing, where polarization management ensures higher accuracy and efficiency. Depolarizers are used in OEM optical instrumentation for measurement systems, quality inspection, and semiconductor processing equipment. Germany, as a leader in industrial automation and precision engineering, drives high demand for depolarizers in advanced laser systems. Meanwhile, Italy and Spain also contribute through strong adoption in automotive and aerospace manufacturing lines. OEMs prefer bulk depolarizers for their cost-effectiveness and robustness, while all-fiber types gain traction in compact instrumentation. The rise of Industry 4.0 and digital manufacturing initiatives across Europe strengthens this driver, as precision optics and laser technologies become critical in advanced production environments.

Key Trends & Opportunities

Shift Toward Broadband and Achromatic Depolarizers

A key trend in the Europe Quartz Lyot depolarizer market is the growing demand for broadband and achromatic depolarizers, particularly for research and spectroscopy applications. Traditional bulk depolarizers remain dominant, but laboratories and imaging centers increasingly prefer achromatic solutions that offer stable polarization across a wider wavelength range. This trend is supported by advancements in material science and nanofabrication that enable high-performance optical components. Achromatic depolarizers find strong adoption in precision spectroscopy, microscopy, and astronomy, where consistent optical performance is essential. Research hubs in France and Germany are spearheading investments into advanced optical instruments, creating opportunities for suppliers offering broadband depolarizers with high customization. The ability to operate across UV–Visible, near-IR, and broadband sources makes achromatic depolarizers a strategic growth area for companies targeting scientific research and industrial R&D facilities across Europe.

- For instance, Edmund Optics offers achromatic depolarizers with wavelength coverage from 400–700 nm and clear apertures up to 12.5 mm, widely adopted in spectroscopy and laser microscopy setups across European research labs.

Opportunities in Fiber-Optic and Telecom Modernization

The modernization of Europe’s telecom infrastructure creates significant opportunities for Quartz Lyot depolarizer adoption. With rising data traffic and broadband penetration, European operators continue to upgrade long-haul and metro fiber networks to handle higher capacity. Depolarizers play a crucial role in stabilizing signals in optical transmission systems, particularly in DWDM and coherent communication systems. This trend is accelerated by the expansion of 5G networks and future 6G trials, which demand ultra-reliable and high-speed optical backbone systems. Countries such as the UK and France are heavily investing in fiber-to-the-home (FTTH) deployments, while Eastern European nations are catching up with infrastructure upgrades. This environment creates growth opportunities for all-fiber depolarizers that provide compact, efficient, and cost-effective solutions for telecom equipment manufacturers and service providers. The ongoing digitalization of European economies ensures sustained demand for depolarizers in this sector.

Key Challenges

High Cost of Precision Optical Components

One of the key challenges facing the Europe Quartz Lyot depolarizer market is the high cost of production and procurement. Quartz depolarizers require high-grade materials and complex manufacturing processes to maintain optical accuracy and stability across different wavelengths. Achromatic and broadband depolarizers, in particular, involve advanced fabrication techniques, which increase costs significantly compared to traditional bulk depolarizers. This limits adoption in price-sensitive sectors and smaller research labs that cannot afford premium instruments. For telecom operators and OEMs, cost pressures remain a barrier, especially when scaling optical systems across large networks. Manufacturers face the challenge of balancing quality, precision, and affordability to compete in Europe’s highly competitive optics market.

Competition from Alternative Polarization Technologies

Another challenge for the Quartz Lyot depolarizer market is competition from alternative polarization control technologies. Devices such as fiber-based polarization scramblers, polarization-maintaining fibers, and liquid crystal polarization controllers offer cost-effective or application-specific solutions. These alternatives are increasingly used in telecom systems and certain laser-based applications, reducing the reliance on Quartz Lyot depolarizers. Furthermore, as nanophotonic and integrated optics technologies advance, compact polarization management solutions are entering the market, especially in miniaturized instrumentation. This competition puts pressure on depolarizer manufacturers to innovate and differentiate their products through better performance, broader wavelength coverage, or integrated solutions. Without continuous product innovation, Quartz Lyot depolarizers risk losing market share in fast-evolving European optical markets.

Regional Analysis

Germany

Germany accounted for the largest share of the Europe Quartz Lyot Depolarizer market in 2024, representing nearly 28% of the regional revenue. Strong demand comes from industrial laser systems, automotive manufacturing, and research institutions, particularly in Berlin and Munich. German universities and R&D hubs drive adoption in spectroscopy and imaging, while the country’s leadership in telecom and Industry 4.0 manufacturing further strengthens demand. Local OEMs prefer bulk depolarizers for cost efficiency, but achromatic types are gaining traction in advanced optics. Germany’s robust industrial base makes it a consistent growth leader in this market.

United Kingdom

The United Kingdom held around 19% share of the Europe market in 2024, supported by its strong telecom sector and research institutions. London and Cambridge host leading optical research centers that drive adoption in spectroscopy and imaging. Fiber-optic upgrades across the UK’s broadband and 5G infrastructure have increased reliance on depolarizers in telecom systems. Universities also integrate depolarizers into advanced imaging systems, fueling demand for achromatic and broadband types. Industrial laser adoption in aerospace and defense applications adds to growth, positioning the UK as a key innovation-driven market within Europe.

France

France contributed close to 16% of the Europe Quartz Lyot Depolarizer market in 2024, led by applications in biomedical imaging and spectroscopy. Paris and Lyon host strong research networks where UV–Visible depolarizers are widely used. The French telecom industry’s investment in optical networks also boosts adoption in fiber-optic systems. Bulk depolarizers remain dominant due to broad availability, but research labs increasingly prefer achromatic and broadband options for precision work. France’s strength in pharmaceuticals and biotechnology further drives demand, making it an important market for advanced depolarizer suppliers.

Italy

Italy represented about 10% of the European Quartz Lyot Depolarizer market in 2024, with growth concentrated in industrial laser applications. The country’s strong automotive and aerospace sectors rely on depolarizers to enhance precision in cutting and welding systems. Universities in Milan and Rome also contribute demand through spectroscopy and research programs. Telecom modernization adds another layer of adoption, particularly in metropolitan regions. Bulk depolarizers dominate due to industrial usage, while all-fiber types gain traction in compact OEM instrumentation. Italy’s industrial focus positions it as a steadily growing market in Europe.

Spain

Spain accounted for nearly 8% of the Europe market in 2024, driven by industrial and academic adoption. Universities and research institutions in Madrid and Barcelona play a central role in spectroscopy and imaging applications. The expansion of fiber-optic infrastructure supports demand in telecom systems, while industrial laser integration in manufacturing further fuels growth. Bulk depolarizers hold the largest share, but broadband depolarizers are increasingly adopted in advanced optical research. Spain’s rising investments in R&D and manufacturing modernization continue to sustain its role as a mid-sized but expanding market.

Russia

Russia held close to 7% share of the European market in 2024, supported by demand in telecom networks and industrial laser systems. Universities and state-funded research institutions remain key buyers, applying depolarizers in spectroscopy and imaging. Moscow and St. Petersburg lead the country’s adoption due to their concentration of industrial and academic infrastructure. Telecom modernization projects add further opportunities, though economic volatility limits rapid expansion. Bulk Quartz Lyot depolarizers dominate usage due to cost advantages, but achromatic variants see limited growth in high-precision research facilities.

Rest of Europe

The Rest of Europe collectively contributed around 12% of the regional Quartz Lyot Depolarizer market in 2024. Countries such as the Netherlands, Switzerland, and Scandinavia show strong research-driven adoption in spectroscopy and imaging applications. Switzerland leads in biomedical optics, while the Netherlands invests in telecom infrastructure upgrades, boosting depolarizer demand. Smaller Eastern European markets are emerging, driven by modernization in fiber-optic networks and industrial manufacturing. Bulk depolarizers remain the most widely adopted across these nations, but specialized research hubs in Switzerland and the Netherlands create demand for achromatic and broadband depolarizers.

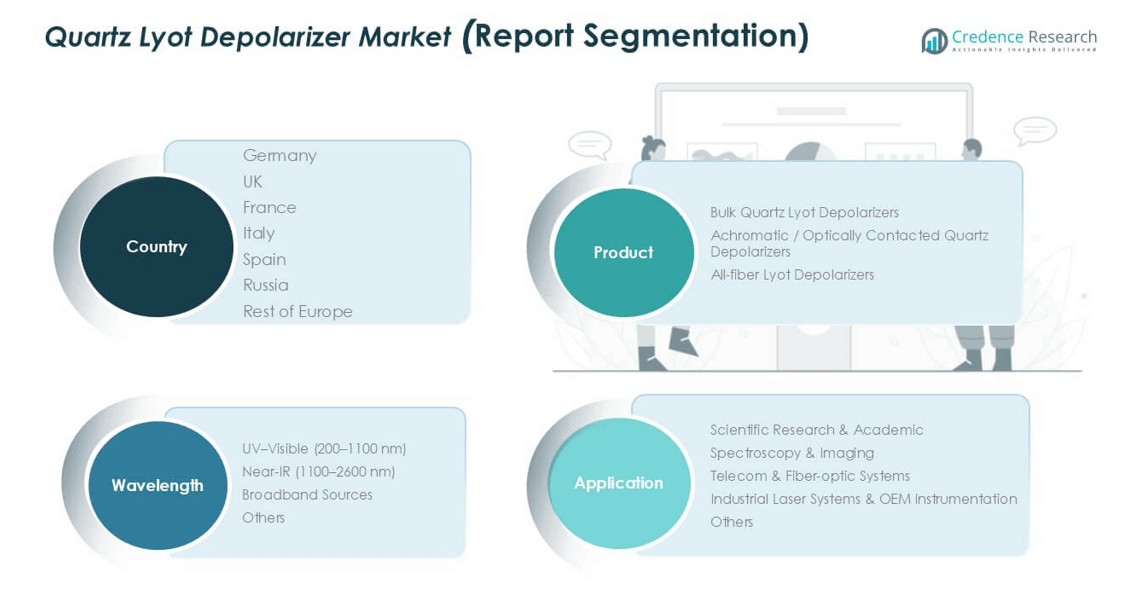

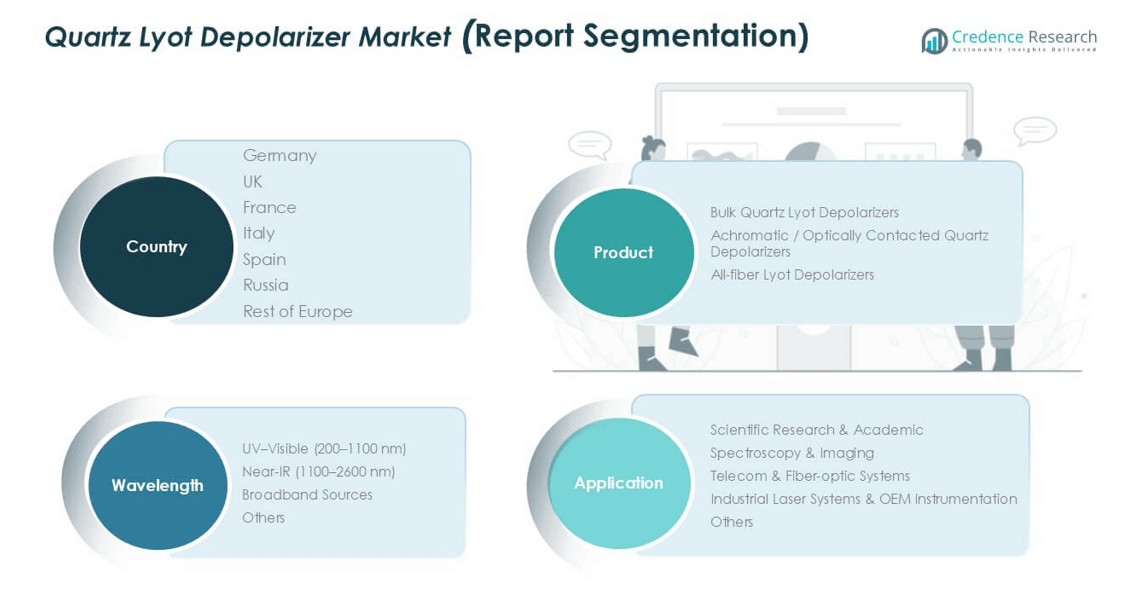

Market Segmentations:

By Product

- Bulk Quartz Lyot Depolarizers

- Achromatic / Optically Contacted Quartz Depolarizers

- All-fiber Lyot Depolarizers

By Application

- Scientific Research & Academic

- Spectroscopy & Imaging

- Telecom & Fiber-optic Systems

- Industrial Laser Systems & OEM Instrumentation

- Others

By Wavelength

- UV–Visible (200–1100 nm)

- Near-IR (1100–2600 nm)

- Broadband Sources

- Others

By Geography

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Quartz Lyot Depolarizer market is moderately consolidated, with several established optical component manufacturers and specialized suppliers shaping competition. Companies such as B. Halle, Thorlabs, Jenoptik AG, and Tower Optical Corporation hold strong positions through diverse product portfolios that address bulk, achromatic, and all-fiber depolarizer needs. Regional players like Edmund Optics India Private Limited and Hunan Dayoptics support demand with cost-effective solutions, while global firms such as Excelitas Technologies expand through strategic acquisitions and partnerships in Europe. Competition centers on technological innovation, wavelength coverage, and customization for research and industrial applications. Rising demand from fiber-optic networks and spectroscopy research fosters opportunities for broadband and achromatic depolarizer suppliers. Meanwhile, niche companies like OptoSigma and Foctek Photonics compete by offering specialized solutions for academic and OEM applications. With increasing R&D investments across Europe, the competitive landscape is marked by innovation-driven differentiation and growing partnerships between optical firms and research institutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- B. Halle

- Thorlabs, Inc.

- Tower Optical Corporation

- Jenoptik AG

- Excelitas Technologies Corp.

- Foctek Photonics, Inc.

- Hunan Dayoptics, Inc.

- OptoSigma Corporation

- Edmund Optics India Private Limited

- Fujian Enlumen Tech Co., Ltd.

- Other Key Players

Recent Developments

- In 2023, Thorlabs launched a new generation of integrated depolarizers focused on improving efficiency and reducing device size.

- In 2023, OptoSigma released a smaller, more compact version of its popular depolarizer model.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Wavelength and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising adoption in fiber-optic communication systems.

- Bulk Quartz Lyot depolarizers will remain the most widely used product category.

- Achromatic depolarizers will see faster growth due to demand in precision spectroscopy and imaging.

- All-fiber depolarizers will gain traction with telecom modernization and compact instrumentation.

- Germany will continue leading the regional market supported by industrial and research applications.

- The UK and France will strengthen positions through advanced optical research and telecom upgrades.

- Industrial laser applications will drive demand across automotive, aerospace, and manufacturing industries.

- Research institutions and universities will remain key buyers for spectroscopy and imaging systems.

- Market competition will focus on wavelength coverage, product customization, and technological innovation.

- Integration of depolarizers in OEM optical instruments will create new opportunities for suppliers.